Содержание

- 2. ASSOCIATION COUNCIL DECISION OF 6 MARCH 1995 CONCERNING THE COMPLETION OF THE CUSTOMS UNION The decision

- 3. Turkey dismantled all customs taxes and quantitative restrictions regarding the industrial products originating in the EU

- 4. -This decision provides for an effective cooperation in the following areas: standardisation, calibration, quality, accreditation, testing

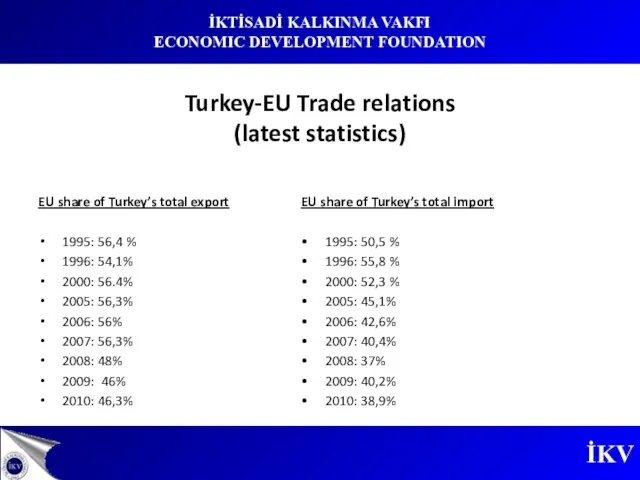

- 7. Turkey-EU Trade relations (latest statistics) EU share of Turkey’s total export 1995: 56,4 % 1996: 54,1%

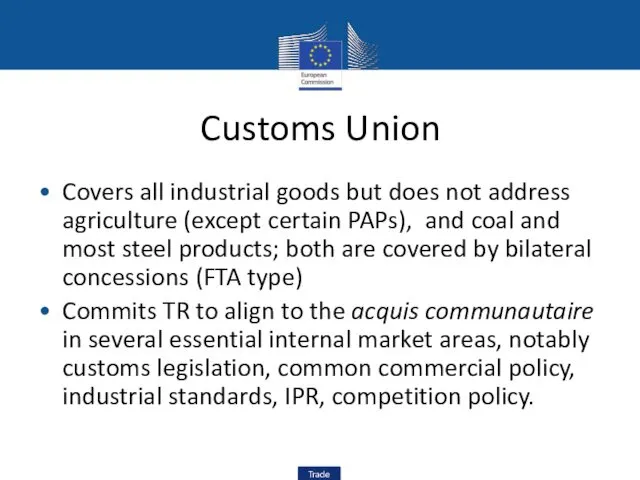

- 8. Customs Union Covers all industrial goods but does not address agriculture (except certain PAPs), and coal

- 9. Benefits of the Customs Union Turkey has benefited from an “early” legislative alignment process before its

- 10. Benefits of the Customs Union (cont'd) Customs Union: driving force for trade liberalisation and integration into

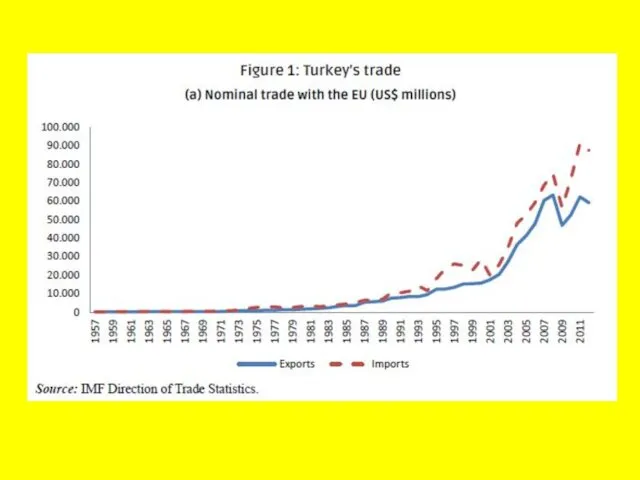

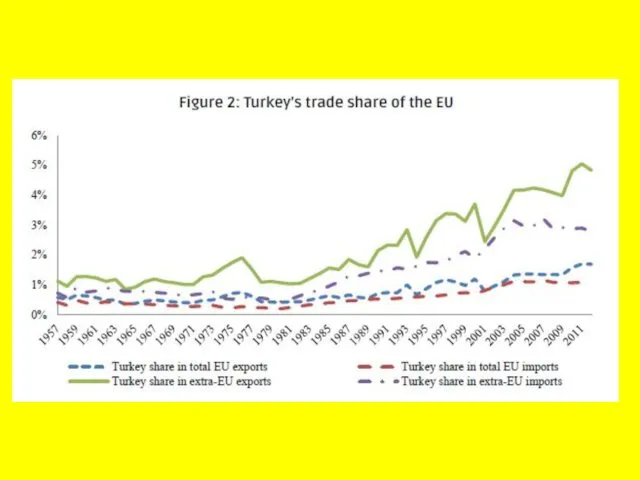

- 11. Increased trade and investment relations Since 1996, trade between the EU and Turkey has increased more

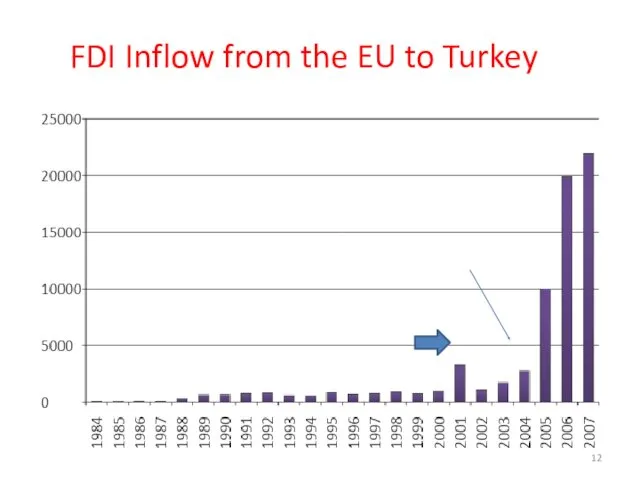

- 12. FDI Inflow from the EU to Turkey

- 13. -In pursuance of Decision No. 1/95, Turkey passed new laws in the following areas: a) In

- 14. AGRICULTURE EXCLUEDED! -The customs union arrangement only comprises industrial products and processed agricultural products. In the

- 15. Customs Union -Financial provisions: According to Decision No. 1/95, Turkey will receive a total of 2,4

- 16. CCT Compliance Customs union arrangement also requires Turkey to adapt itself to the common customs tariffs

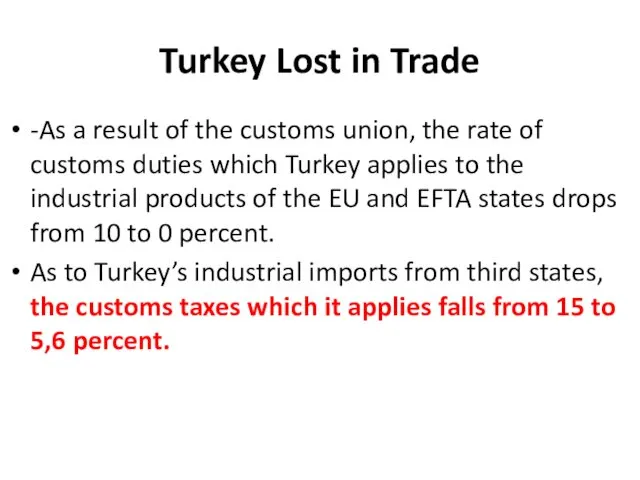

- 17. Turkey Lost in Trade -As a result of the customs union, the rate of customs duties

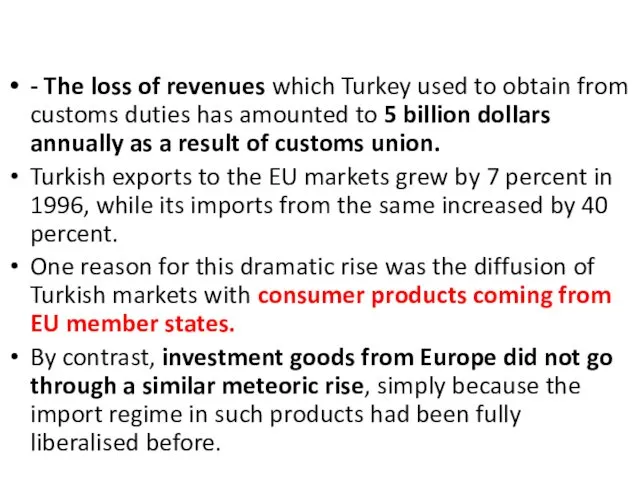

- 18. - The loss of revenues which Turkey used to obtain from customs duties has amounted to

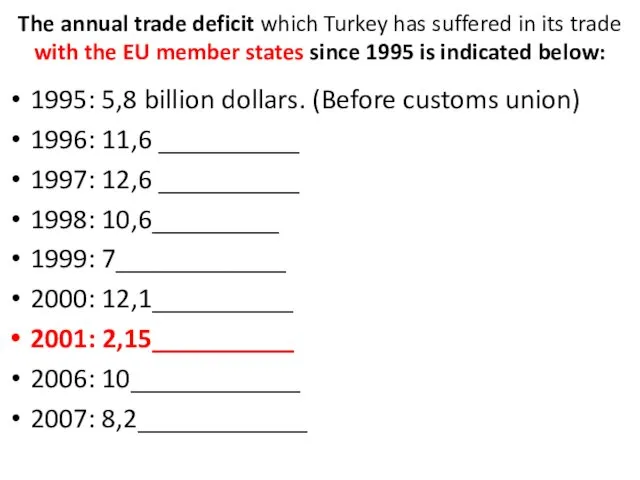

- 19. The annual trade deficit which Turkey has suffered in its trade with the EU member states

- 21. Скачать презентацию

Политическая сфера. Политика и власть

Политическая сфера. Политика и власть Система управления в Древней Греции

Система управления в Древней Греции Владимир Иванович Дегтярёв. Жизнь, посвященная Донбассу

Владимир Иванович Дегтярёв. Жизнь, посвященная Донбассу Пропаганда как технология политического манипулирования

Пропаганда как технология политического манипулирования The split of Sudan. The role of the oil extraction and transit

The split of Sudan. The role of the oil extraction and transit Қоғамның саяси жүйесі

Қоғамның саяси жүйесі Найбільш впливові світові та регіональні міжнародні організації

Найбільш впливові світові та регіональні міжнародні організації Образование как одна из главных составляющих национальной безопасности государства

Образование как одна из главных составляющих национальной безопасности государства Политические партии и движения

Политические партии и движения Политическая жизнь современного общества. Политический конфликт

Политическая жизнь современного общества. Политический конфликт Повторительно - обобщающий урок. 11 класс. Политология (вопросы для повторения)

Повторительно - обобщающий урок. 11 класс. Политология (вопросы для повторения) Організація Рада Європи

Організація Рада Європи Политические режимы

Политические режимы Политика. Субъекты

Политика. Субъекты Социология политики

Социология политики America's political system

America's political system Международный конфликт как явление мировой политики

Международный конфликт как явление мировой политики Политика и власть

Политика и власть Сфера политики и социального управления

Сфера политики и социального управления Политические элиты. Политическое лидерство (тема 6)

Политические элиты. Политическое лидерство (тема 6) Этнический лоббизм

Этнический лоббизм Власть как явление общественной жизни

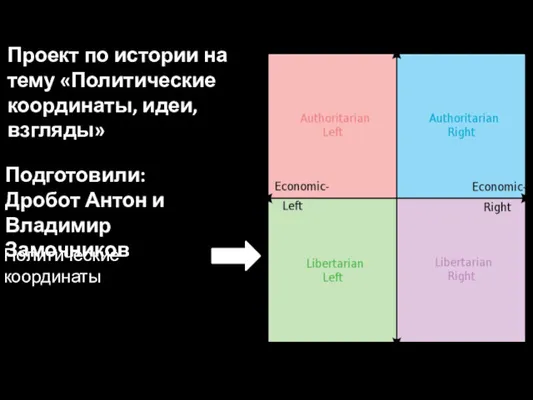

Власть как явление общественной жизни Политические координаты, идеи, взгляды

Политические координаты, идеи, взгляды Содружество Независимых Государств

Содружество Независимых Государств Международная деятельность Вооруженных Сил Российской Федерации

Международная деятельность Вооруженных Сил Российской Федерации Владимир Владимирович Путин

Владимир Владимирович Путин Авраам Линкольн

Авраам Линкольн Россия и США. Российско-американские отношения при Дональде Трампе

Россия и США. Российско-американские отношения при Дональде Трампе