Содержание

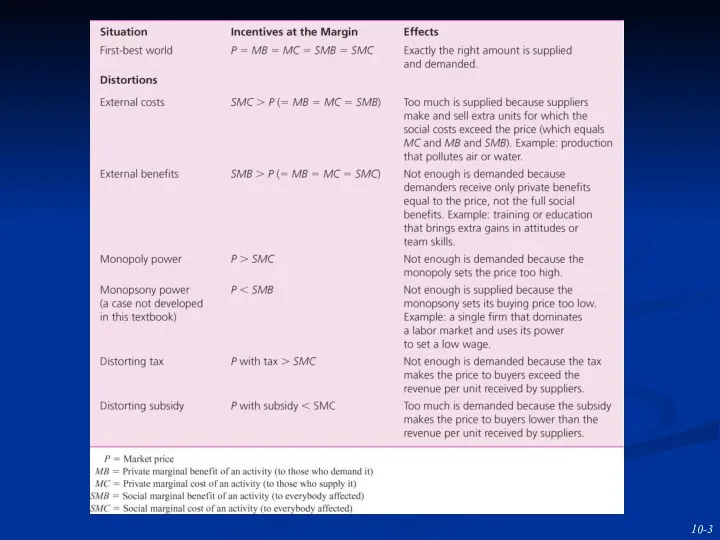

- 2. 1. The first best world (ideal) and the second best world In the ideal world P=MB=MC=SMB=SMC

- 4. 2. Specificity Rule If an externality is present, government policy should intervene as directly as possible

- 5. 3.Promoting domestic production or employment A barrier against imports can be better than doing nothing in

- 6. 3.Promoting domestic production or employment Also, workers can carry new skills and attitudes to when they

- 7. 3.Promoting domestic production or employment Consider a small country where there are positive spillovers in the

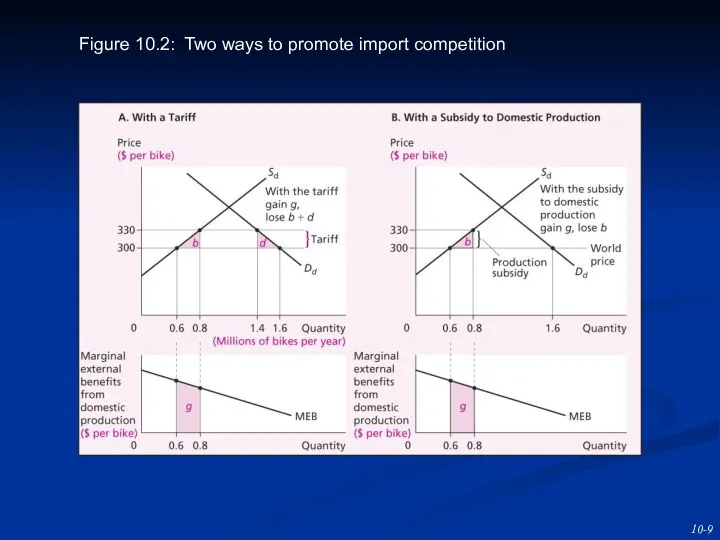

- 8. 3.Promoting domestic production or employment Instead of a tariff, domestic production could be encouraged by rewarding

- 9. Figure 10.2: Two ways to promote import competition

- 10. 4.The infant industry argument Temporary tariff is justified because it cuts down on imports while the

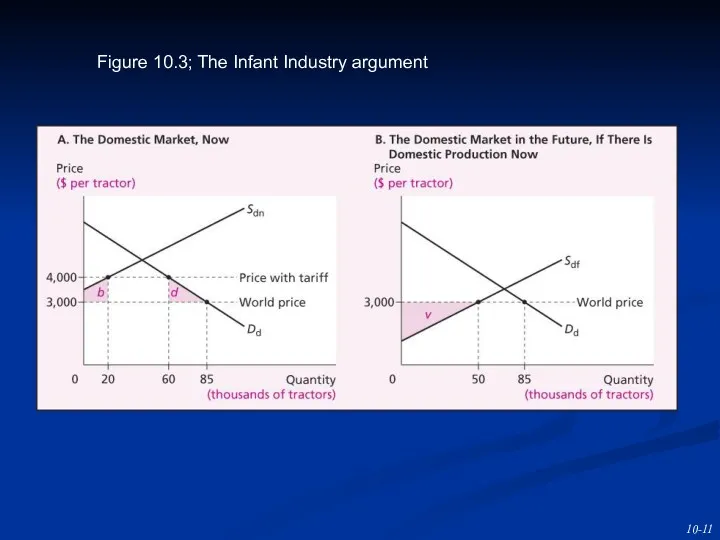

- 11. Figure 10.3; The Infant Industry argument

- 12. 4.The infant industry argument Consider the following example (Figure 10.3.) Initially there is no domestic production

- 13. 4.The infant industry argument As firms produce tractors, they find ways of lowering their costs, shifting

- 14. 4.The infant industry argument Why should the government get involved? Why not rely on the market?

- 15. 4.The infant industry argument In conclusion: There can be a case for government intervention A tariff

- 16. 5.The dying industry argument Similar to the infant industry argument in that protection against imports might

- 17. 5.The dying industry argument If the problem is a mismatch of worker skills and available jobs,

- 18. 5.National Defense A country must have access to products to maintain the national defense, especially because

- 19. 6.Other arguments for protection The developing country public revenue National pride Income redistribution

- 21. Скачать презентацию

Новинка – силовой трансформатор ТМГ-3150кВА

Новинка – силовой трансформатор ТМГ-3150кВА Управління маркетингом

Управління маркетингом Препараты ВИК МДЖ для сети клиник ЦЕНТР

Препараты ВИК МДЖ для сети клиник ЦЕНТР Специальное предложение для риэлторов

Специальное предложение для риэлторов Понятие маркетинга. История и эволюция маркетинга. Поведение покупателей на рынке. Сегментация рынка

Понятие маркетинга. История и эволюция маркетинга. Поведение покупателей на рынке. Сегментация рынка Вопросы учета, аудита и налогообложения предприятий розничной торговли на примере ООО Компьютеры

Вопросы учета, аудита и налогообложения предприятий розничной торговли на примере ООО Компьютеры Бизнес-план открытия кафе правильного питания Fast Green

Бизнес-план открытия кафе правильного питания Fast Green Improve grinding efficiency

Improve grinding efficiency Как улучшить гостеприимство в нашем кинотеатре

Как улучшить гостеприимство в нашем кинотеатре Презентация объекта ЖК Павшинская пойма город Красногорск

Презентация объекта ЖК Павшинская пойма город Красногорск Свадьба 2016

Свадьба 2016 Інновація як об’єкт маркетингу

Інновація як об’єкт маркетингу План продвижения интернет-магазина

План продвижения интернет-магазина Аналіз подання реклами у друкованих виданнях

Аналіз подання реклами у друкованих виданнях Стратегическое планирование

Стратегическое планирование Введение в продажи для сотрудников Якобс Дау Эгбертс. Шаги активных продаж

Введение в продажи для сотрудников Якобс Дау Эгбертс. Шаги активных продаж Конкурентоспособность фирм на исследуемом рынке (на примере рекламного агентства ИП Корытникова С.С.)

Конкурентоспособность фирм на исследуемом рынке (на примере рекламного агентства ИП Корытникова С.С.) ООО ЧИКА. Каталог продукции

ООО ЧИКА. Каталог продукции Какие бизнес-модели работают в интернете и как применить их для своего бизнеса

Какие бизнес-модели работают в интернете и как применить их для своего бизнеса Салон красоты Грация и Эстетика

Салон красоты Грация и Эстетика Новітні інструменти маркетингових комунікацій

Новітні інструменти маркетингових комунікацій Отдых в Египте

Отдых в Египте Ежедневник сотрудника филиала ВТБ МС-3

Ежедневник сотрудника филиала ВТБ МС-3 Zveropolis. American computer-animated comedy-adventure

Zveropolis. American computer-animated comedy-adventure Коммерческое предложение компании Аlles

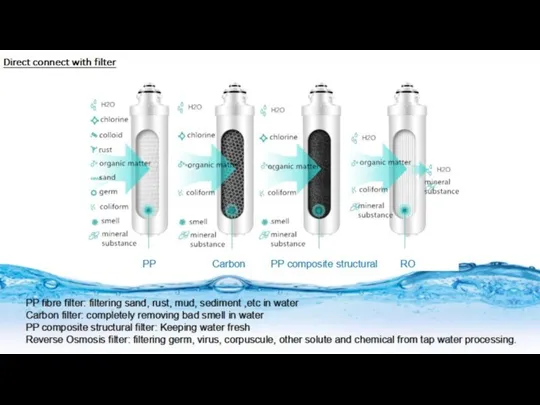

Коммерческое предложение компании Аlles Hot, normal and cold water

Hot, normal and cold water Аппараты по продаже воды alivewater.ru. Компания Живая вода

Аппараты по продаже воды alivewater.ru. Компания Живая вода Маркетинговый подход к принятию управленческих решений. Портфельные стратегии и стратегии роста

Маркетинговый подход к принятию управленческих решений. Портфельные стратегии и стратегии роста