Содержание

- 2. How are you feeling today? ⓘ Start presenting to display the poll results on this slide.

- 3. What will we cover today? Why to carry out qualitative research? Examples of qualitative research Structuring

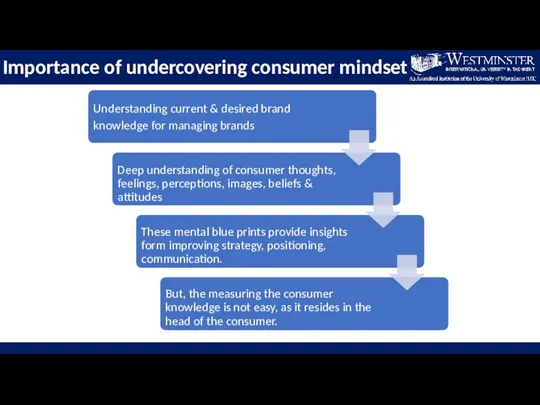

- 4. Importance of undercovering consumer mindset Understanding current & desired brand knowledge for managing brands Deep understanding

- 6. Why to carry out qualitative research? Understand consumer motives Aim to explore Test new ideas and

- 7. Qualitative research techniques

- 8. Qualitative research techniques Source: brandautopsy.com Ernest Dichter (1907-1991) is best known as a marketing researcher who

- 9. Qualitative research impact

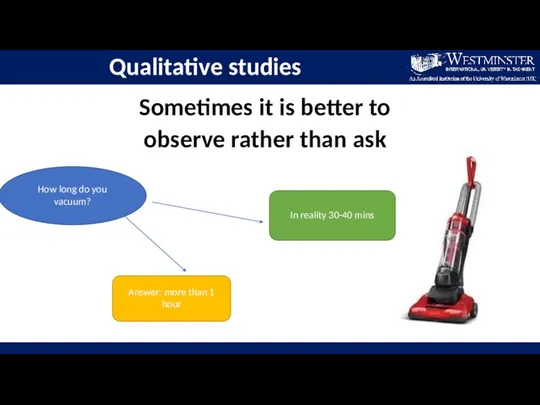

- 10. Sometimes it is better to observe rather than ask How long do you vacuum? Answer: more

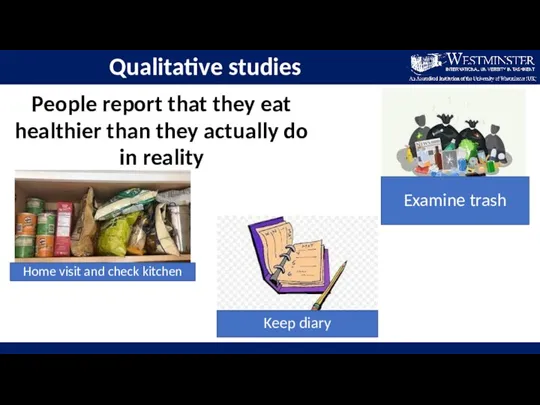

- 11. People report that they eat healthier than they actually do in reality Examine trash Home visit

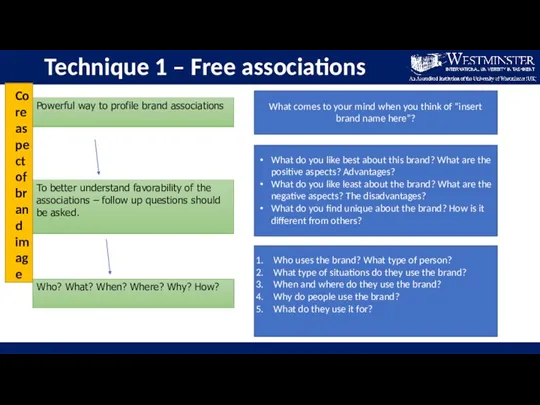

- 12. Technique 1 – Free associations What comes to your mind when you think of “insert brand

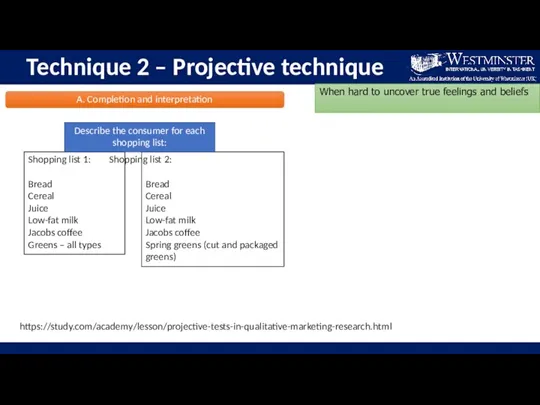

- 13. Technique 2 – Projective technique When hard to uncover true feelings and beliefs https://study.com/academy/lesson/projective-tests-in-qualitative-marketing-research.html Bread Cereal

- 14. Technique 2 – Projective technique https://study.com/academy/lesson/projective-tests-in-qualitative-marketing-research.html What is he saying? Thinking? Feel out the bubbles A.

- 15. What he is saying? or thinking? ⓘ Start presenting to display the poll results on this

- 16. Technique 3 – Zaltman metaphor elicitation technique “Olson Zaltman: Intro to ZMET.” YouTube, uploaded by Olson

- 17. Technique 3 – Zaltman metaphor elicitation technique Describe each picture Triad task to identify common concepts

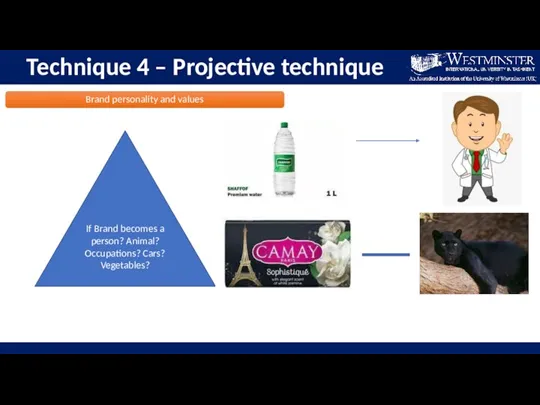

- 18. Technique 4 – Projective technique Brand personality and values If Brand becomes a person? Animal? Occupations?

- 19. If WIUT becomes an animal, what animal would it be? ⓘ Start presenting to display the

- 20. Examples of qualitative studies The most popular type of research to gather customer insight into current

- 21. Sunsilk case Why it is not selling?

- 22. Sunsilk is a global hair care brand that helps young women (18-30) to stay on top

- 23. To understand how consumers perceive product, price, place, promotion strategy of Sunsilk. To understand Sunsilk’s perception

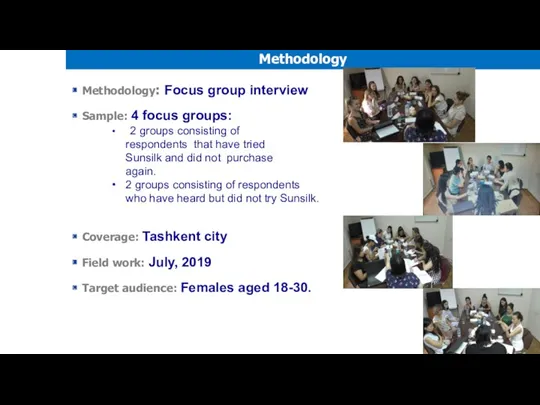

- 24. Methodology: Focus group interview Sample: 4 focus groups: 2 groups consisting of respondents that have tried

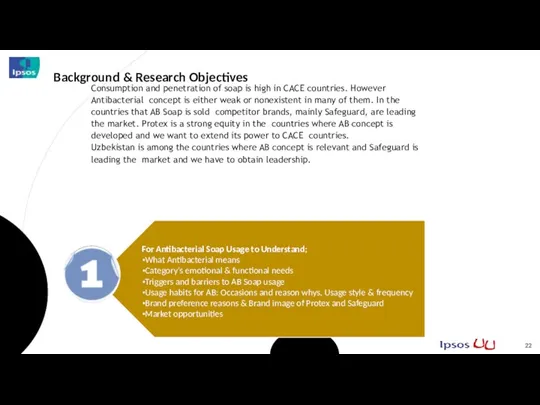

- 25. Protex case Identify barriers and consumer attitude

- 26. Background & Research Objectives Consumption and penetration of soap is high in CACE countries. However Antibacterial

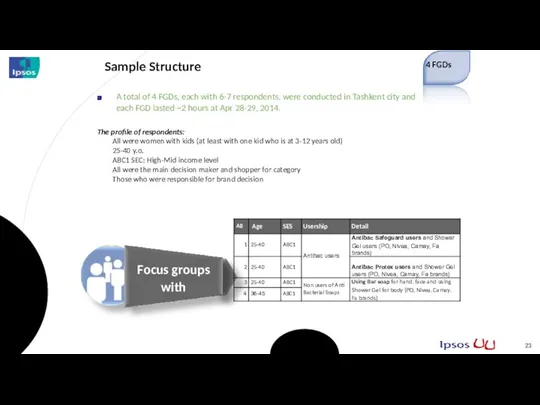

- 27. 23 A total of 4 FGDs, each with 6-7 respondents, were conducted in Tashkent city and

- 28. Examples of qualitative studies The most popular type of research to gather customer insight into current

- 29. Ucell case How to improve our service for B2B clients?

- 30. Ucell case How to improve our service for B2B clients? 1. Perception and definition of quality

- 31. Study behavior of each B2B segment Identify needs and wants of each B2B segment Identify key

- 32. Methodology: In depth-interview (face-to-face) Quantity of respondents : 100 Coverage: Tashkent, Angren, Djizak, Andijan, Namangan, Fergana,

- 33. Ethics compliance: Introduce yourself Thank respondent for their time and valued opinions. Explain the research aims.

- 34. Attributes that are important for the interviewer: "Open-minded. Judgment or criticism can act as barriers to

- 35. References and Reading Strategic brand management: Building, measuring and managing brand equity by Kevin Lane Keller

- 36. Managing brands Lecture 3 – Conducting qualitative research By Zamira Ataniyazova Part 2

- 37. What will we cover today? Qualitative research step by step process: 1.Defining objectives 2.Gathering a list

- 38. Examples of qualitative studies The most popular type of research to gather customer insight into current

- 39. Defining objectives Justify why focus group not other research types like survey, phone interview, diary, observation,

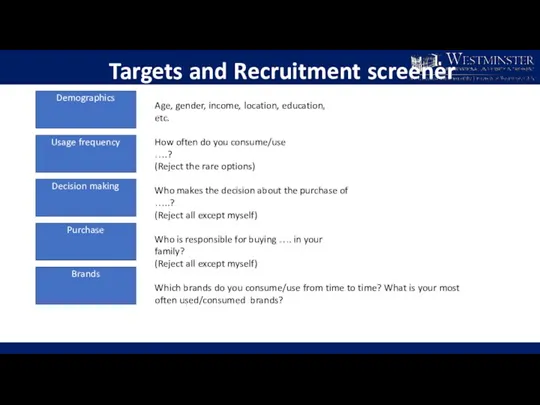

- 40. Targets and Recruitment screener Demographics Usage frequency Decision making Purchase Brands Age, gender, income, location, education,

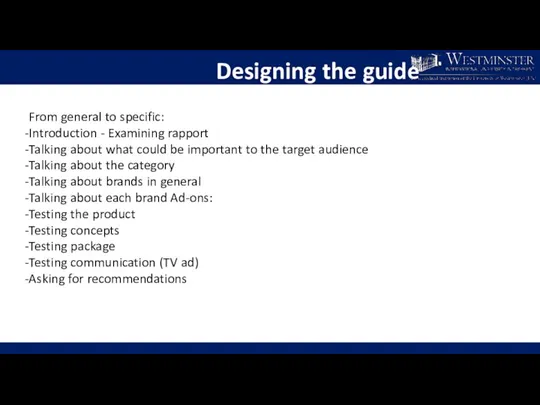

- 41. Designing the guide From general to specific: Introduction - Examining rapport Talking about what could be

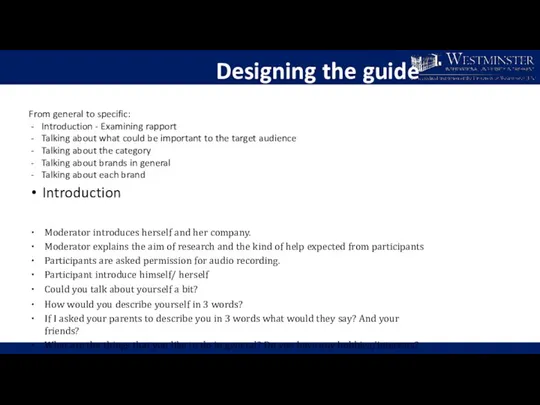

- 42. Designing the guide From general to specific: Introduction - Examining rapport Talking about what could be

- 43. Designing the questions - Practical demonstration of a sample focus group – please read the sample

- 44. Designing the questions Focus group guide example 1 – Diaper category Study objectives: To understand Uzbek

- 45. Designing the questions 1) Focus group guide example 2 – Beverages Study objectives: Understanding target groups’

- 46. Fieldwork – moderating focus group “Moderating focus groups.” YouTube, uploaded by Richard Krueger, 28 July 2015,

- 47. Analyzing and Reporting Analyze data by coding Report - practical demonstration – explain by words (word

- 48. Ethics compliance: Introduce yourself Thank respondent for their time and valued opinions. Explain the research aims.

- 50. Скачать презентацию

Медиапланирование в издательстве. Анализ эффективности интернет-рекламы. Веб-аналитика

Медиапланирование в издательстве. Анализ эффективности интернет-рекламы. Веб-аналитика Парфюм-маркет. Продукты питания и товары повседневного спроса

Парфюм-маркет. Продукты питания и товары повседневного спроса Дерево и смола. Уникальность вашего интерьера

Дерево и смола. Уникальность вашего интерьера Welcome to our school website

Welcome to our school website Разработка фирменного стиля для магазина продуктов Фортуна

Разработка фирменного стиля для магазина продуктов Фортуна Комплекс маркетинга. Элементы маркетинга

Комплекс маркетинга. Элементы маркетинга Консалтинговое агентство Точка Роста

Консалтинговое агентство Точка Роста Методы маркетинговых исследований

Методы маркетинговых исследований Бриф на цветокоррекцию и ретушь

Бриф на цветокоррекцию и ретушь Добавка для дизельного топлива СтопРасход, уменьшающая расход на 10 и более %

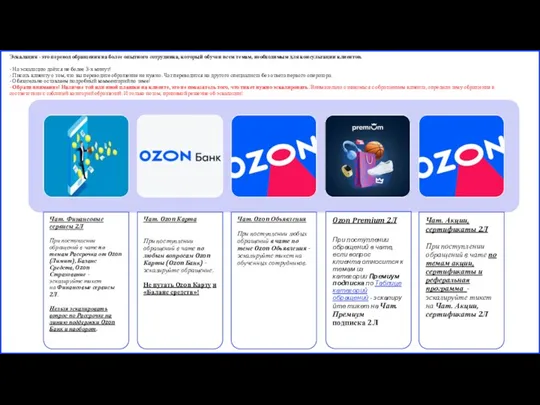

Добавка для дизельного топлива СтопРасход, уменьшающая расход на 10 и более % Эскалация

Эскалация Анализ существующего положения в магазине потребительской кооперации

Анализ существующего положения в магазине потребительской кооперации Рынок лидогенерации. Интернет-рынок в России. Понятия и термины СРА-рекламы. Процедура по работе с партнерской сетью

Рынок лидогенерации. Интернет-рынок в России. Понятия и термины СРА-рекламы. Процедура по работе с партнерской сетью Компания Dreamhouse

Компания Dreamhouse Суть бизнеса Орифлэйм

Суть бизнеса Орифлэйм Nubrella

Nubrella ООО НПО Ка-технологии. Создание инновационных радаров VI поколения

ООО НПО Ка-технологии. Создание инновационных радаров VI поколения Система управления рекламного агентства Аврора

Система управления рекламного агентства Аврора М2М-менеджер. Удаленное управление М2М SIM-картами

М2М-менеджер. Удаленное управление М2М SIM-картами Управление маркетингом рекламного агентства

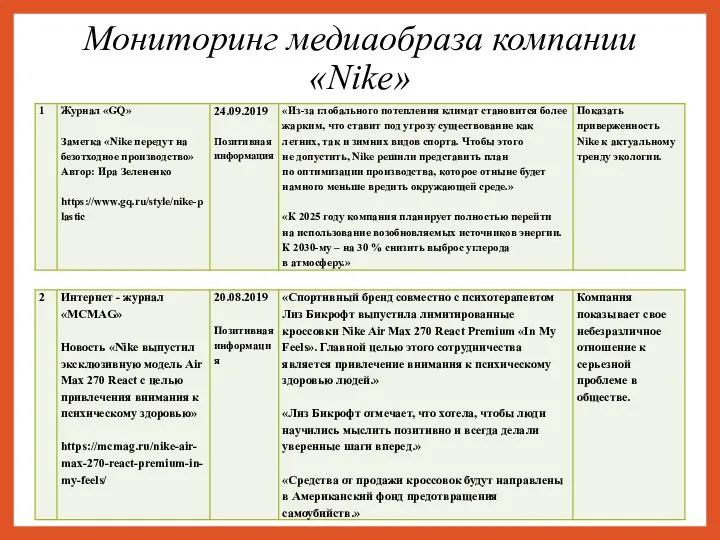

Управление маркетингом рекламного агентства Мониторинг медиаобраза компании Nike

Мониторинг медиаобраза компании Nike Анимационная новогодняя программа для взрослых Крысиный бум

Анимационная новогодняя программа для взрослых Крысиный бум Арт-кондитерская Happy Time

Арт-кондитерская Happy Time Auchan InExtenso. Bébé Conf Boy Saison S23

Auchan InExtenso. Bébé Conf Boy Saison S23 Бренд BioMax. Обновления

Бренд BioMax. Обновления Торгово-развлекательный центр в г. Липецк. Проект

Торгово-развлекательный центр в г. Липецк. Проект Бизнес-план КЖПГ-авто

Бизнес-план КЖПГ-авто Организация свадьбы

Организация свадьбы