Слайд 2

State Owned Enterprises (SOE): When and Where SOEs Emerge?

In countries with

market failure

In emerging economies shifting to market economy

Justified by better allocation of resources in places where there are no signs of healthy competition

In other developed countries SOEs exist to provide the most vital to state services: road and bridge construction/maintenance, education, national security, energy/gas, airlines, etc.

SOEs traditionally are criticized for a number of reasons:

Слайд 3

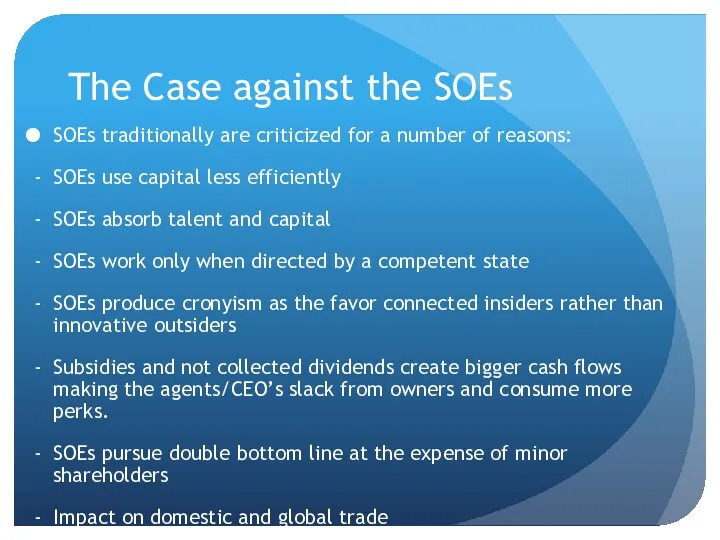

The Case against the SOEs

SOEs traditionally are criticized for a number

of reasons:

SOEs use capital less efficiently

SOEs absorb talent and capital

SOEs work only when directed by a competent state

SOEs produce cronyism as the favor connected insiders rather than innovative outsiders

Subsidies and not collected dividends create bigger cash flows making the agents/CEO’s slack from owners and consume more perks.

SOEs pursue double bottom line at the expense of minor shareholders

Impact on domestic and global trade

Слайд 4

The Case for SOEs

Per Pargendler et al. the mixed SOEs provide

for a better platform for investments where markets fail.

They argue that combination of government regulation from the standpoint of SOE owner and private ownership go well together complementing each other and provide for more efficiency

Слайд 5

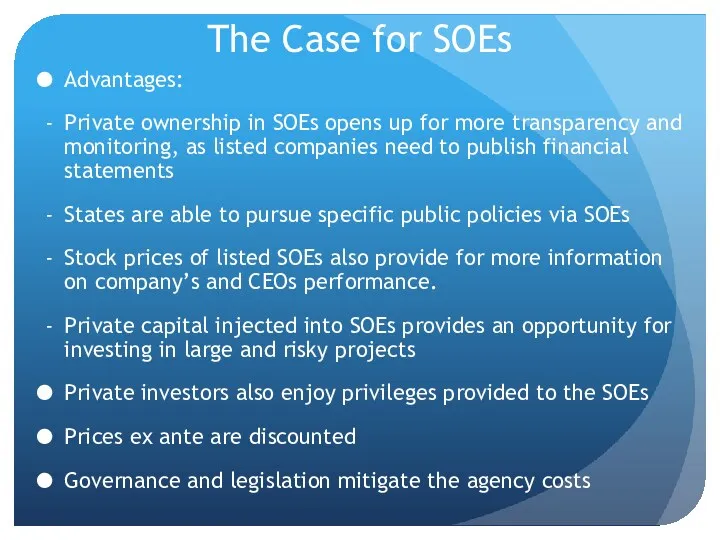

The Case for SOEs

Advantages:

Private ownership in SOEs opens up for more

transparency and monitoring, as listed companies need to publish financial statements

States are able to pursue specific public policies via SOEs

Stock prices of listed SOEs also provide for more information on company’s and CEOs performance.

Private capital injected into SOEs provides an opportunity for investing in large and risky projects

Private investors also enjoy privileges provided to the SOEs

Prices ex ante are discounted

Governance and legislation mitigate the agency costs

Слайд 6

Controversies about SOEs

Debate on short-termism v long-term horizons

Which ones would be

long-term oriented, listed or non listed SOEs?

Per scholars, the ultimate owners of the SOEs are the citizenry of the state. Do you agree? Then what is wrong with the model?

Слайд 7

Comparison of Pemex, Petrobras and Statoil

Which of the three have better

governance structure?

What are the criteria to judge?

Which one has the biggest return?

Which of those have better firm valuation?

Does politics play role in SOEs?

Is political interference a positive or negative element?

Слайд 8

SOEs in China

What is the ownership structure in most of the

Chinese business groups?

How did that develop into current situation?

What is the role of the SASAC?

What is the main criticism of the authors Milhaupt and Zheng?

Dividends

Exec Compensation

Failure to implement public policies

Influences on corporations it owns via regualtion

Слайд 9

Privately Owned Enterprises (POEs) in China

Incumbents vs. Captors

How would you describe

the state capture of POEs?

What are the main criteria for capturing?

What are the ways of capture?

Connections (personal, professional, etc.)

Corruption

Economic growth (!!!!)

What is the role of the local leaders in economy there? Would it be appropriate for Armenia?

Слайд 10

SOEs in China and around the Globe

What were the reasons for

the short-lived success?

Did the Chinese leadership’s anti-corruption reform affect Chinese outbound investments? Why?

Why do the reporters criticize the SOEs and how they explain the recent falling out of rankings of the SOEs that had topped the rankings a decade ago?

Do you agree that the SOEs should go public? How much? In all industries?

Модель учителя, как управляющего учебно-познавательной деятельностью учащихся

Модель учителя, как управляющего учебно-познавательной деятельностью учащихся Мотивация персонала

Мотивация персонала Методи дослiдження поведiнки споживачiв

Методи дослiдження поведiнки споживачiв Экономика туризма

Экономика туризма Стратегическое управление на предприятии малого и среднего бизнеса

Стратегическое управление на предприятии малого и среднего бизнеса Аттестация персонала

Аттестация персонала Мотивация и аттестация продавца в магазине Франчайзи

Мотивация и аттестация продавца в магазине Франчайзи Склад как элемент логистической системы (на примере ОАО Метро кэш энд керри)

Склад как элемент логистической системы (на примере ОАО Метро кэш энд керри) Транспортно-экспедиционное обслуживание при международных автомобильных перевозках

Транспортно-экспедиционное обслуживание при международных автомобильных перевозках Менеджмент, как вид человеческой деятельности

Менеджмент, как вид человеческой деятельности Объект знаний – связующее звено между двумя подходами знание как поток и знание как продукт

Объект знаний – связующее звено между двумя подходами знание как поток и знание как продукт Системный подход к развитию персонала в социальной сфере. (Тема 12)

Системный подход к развитию персонала в социальной сфере. (Тема 12) Internal control and deontology - Chapter 6 C. Sales

Internal control and deontology - Chapter 6 C. Sales Контроль та методи оцінки якості продукції

Контроль та методи оцінки якості продукції Психологические и функциональные роли в команде (тема 4)

Психологические и функциональные роли в команде (тема 4) Менеджмент безопасности

Менеджмент безопасности Модели управления запасами

Модели управления запасами Тест по менеджменту

Тест по менеджменту Техника SMART. Целеполагание

Техника SMART. Целеполагание Эволюция предприятия

Эволюция предприятия Современное делопроизводство. Документационное обеспечение управления

Современное делопроизводство. Документационное обеспечение управления Басқару шешімдерін қабылдау

Басқару шешімдерін қабылдау Менеджмент түсінігі

Менеджмент түсінігі Food and Beverage Division

Food and Beverage Division Совершенствование организации перевозки асфальта транспортными средствами ОАО ТАТК

Совершенствование организации перевозки асфальта транспортными средствами ОАО ТАТК Процессный подход в управлении

Процессный подход в управлении Внедрение инструментов комплаенс-контроля в практику управления рисками на предприятии

Внедрение инструментов комплаенс-контроля в практику управления рисками на предприятии Факторы эффективности менеджмента. Управленческую деятельность эффективна

Факторы эффективности менеджмента. Управленческую деятельность эффективна