Слайд 2

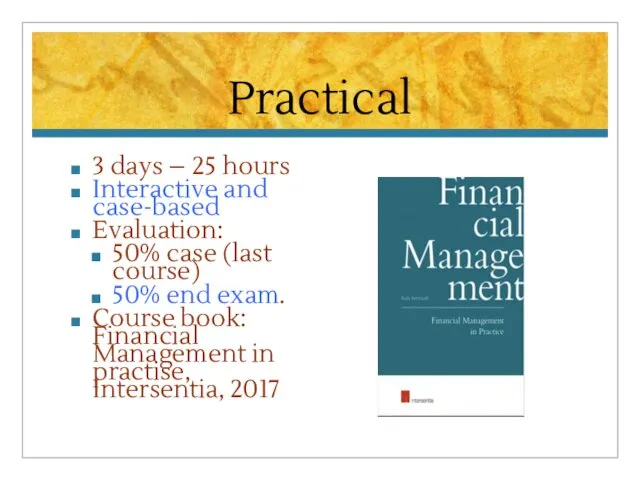

Practical

3 days – 25 hours

Interactive and case-based

Evaluation:

50% case (last course)

50%

end exam.

Course book: Financial Management in practise, Intersentia, 2017

Слайд 3

module :Stratégies et financement

des entreprises en Europe

Слайд 4

Content

Basis concepts Financial Management

Investment analysis

Credits

Value of a company

Venture capital

Business angels (crowdfunding,

lovemoney, BA)

Reality cases

Wrap-up

Слайд 5

Definitions

Financial Management:

“Increase the value of the company for the shareholders”

“Shareholders

value approach”

Corporate governance

Слайд 6

Importance of financial management

Two main reasons for bankrupcy:

Management

Financing

Major obstacle growth:

Lack

of financing

CEO versus CFO

Слайд 7

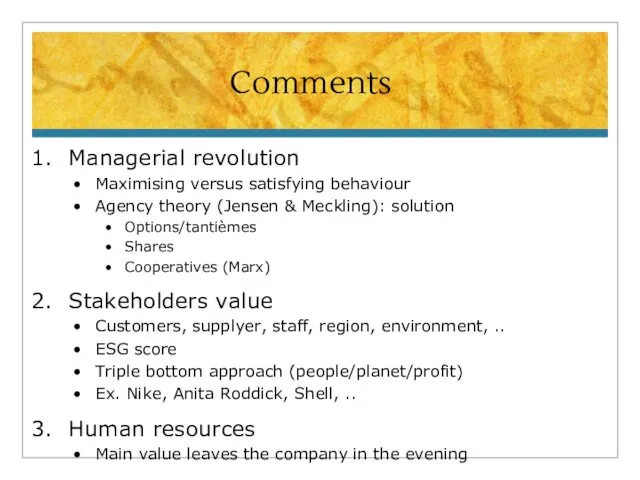

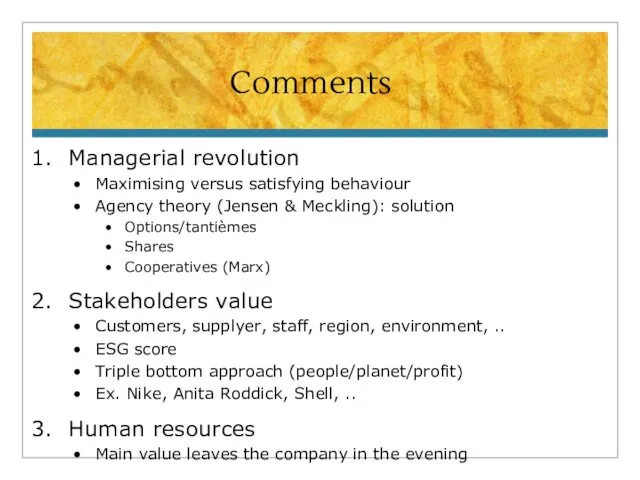

Comments

Managerial revolution

Maximising versus satisfying behaviour

Agency theory (Jensen & Meckling): solution

Options/tantièmes

Shares

Cooperatives (Marx)

Stakeholders

value

Customers, supplyer, staff, region, environment, ..

ESG score

Triple bottom approach (people/planet/profit)

Ex. Nike, Anita Roddick, Shell, ..

Human resources

Main value leaves the company in the evening

Слайд 8

Слайд 9

“Not all companies are the same”

Слайд 10

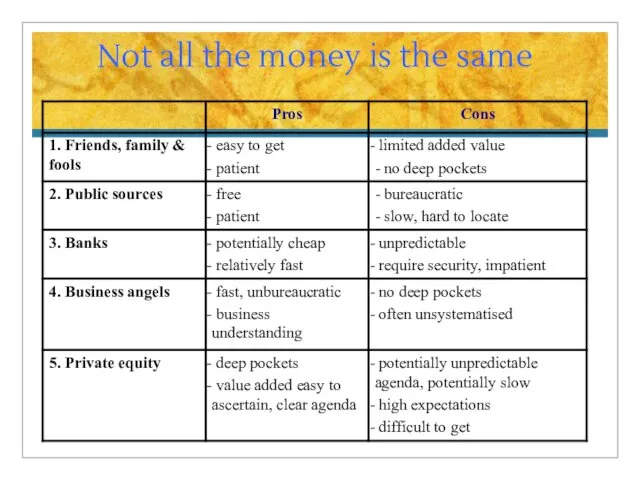

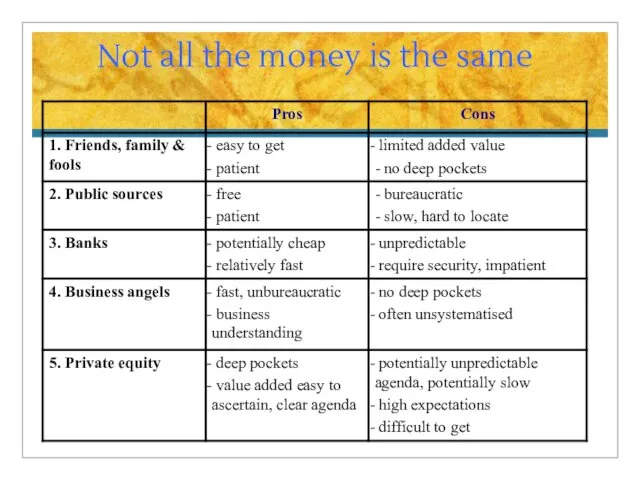

Not all the money is the same

Слайд 11

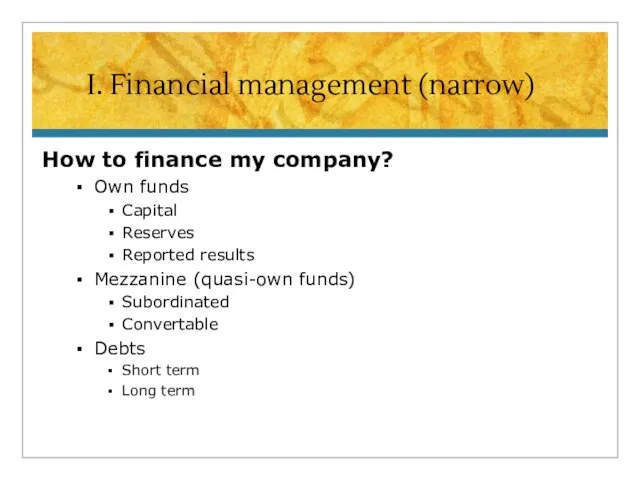

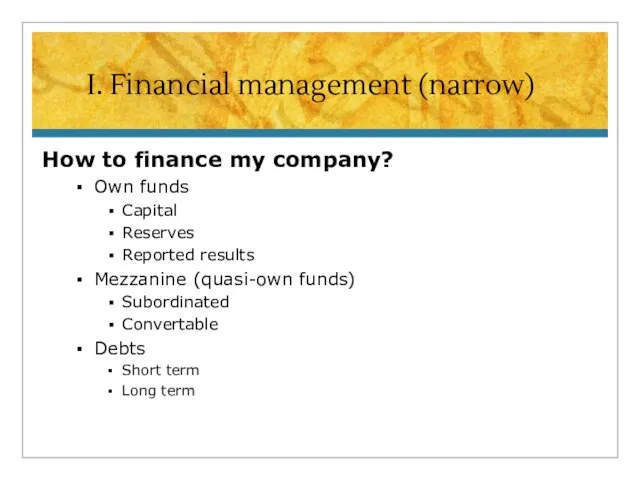

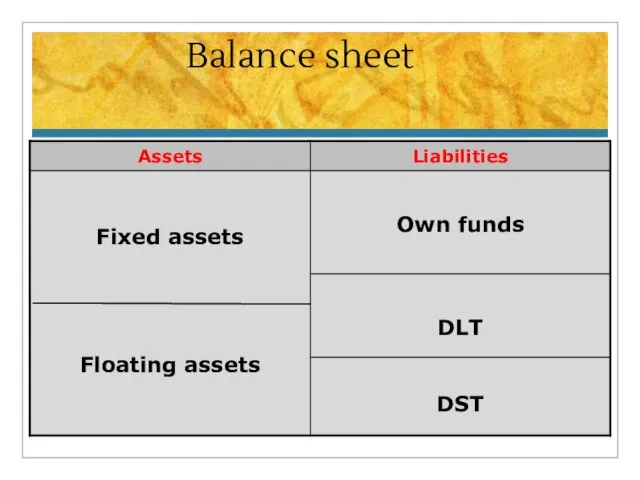

I. Financial management (narrow)

How to finance my company?

Own funds

Capital

Reserves

Reported results

Mezzanine (quasi-own

funds)

Subordinated

Convertable

Debts

Short term

Long term

Слайд 12

Слайд 13

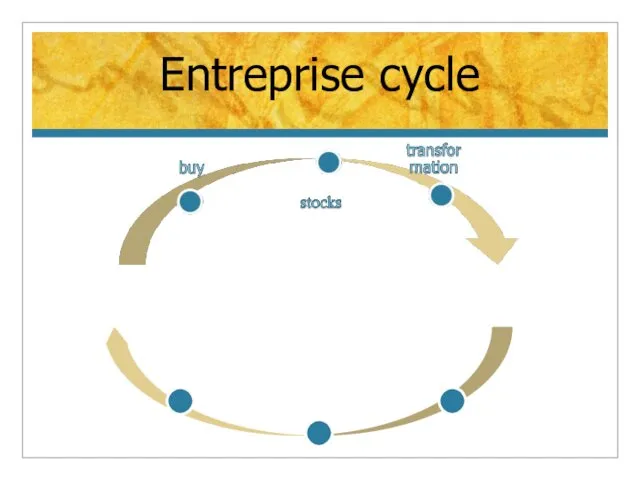

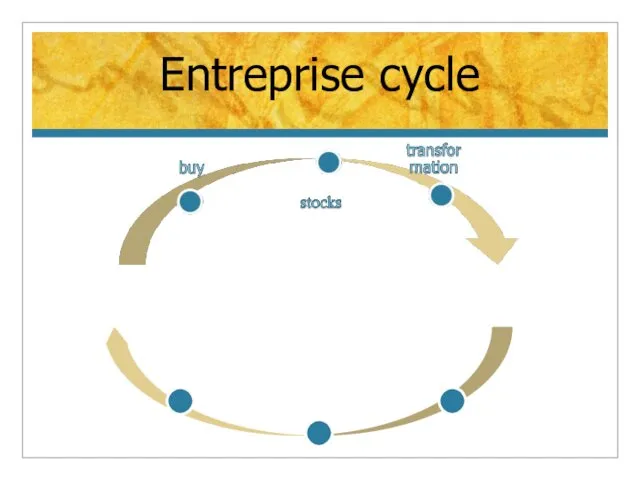

Entreprise cycle

sales

INVOICE

TURNOVER

RECIEVABLES

Слайд 14

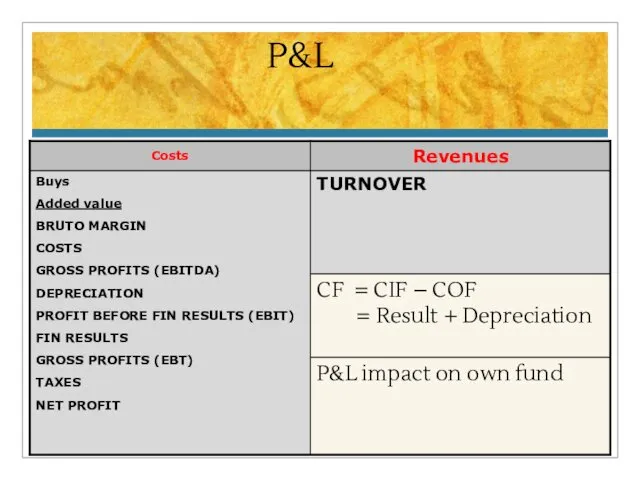

Слайд 15

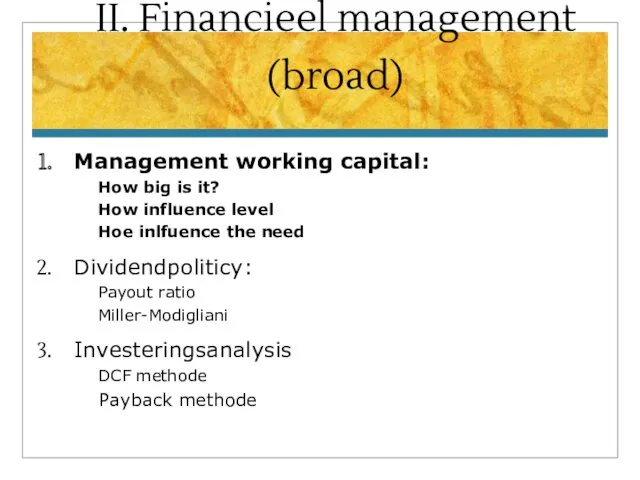

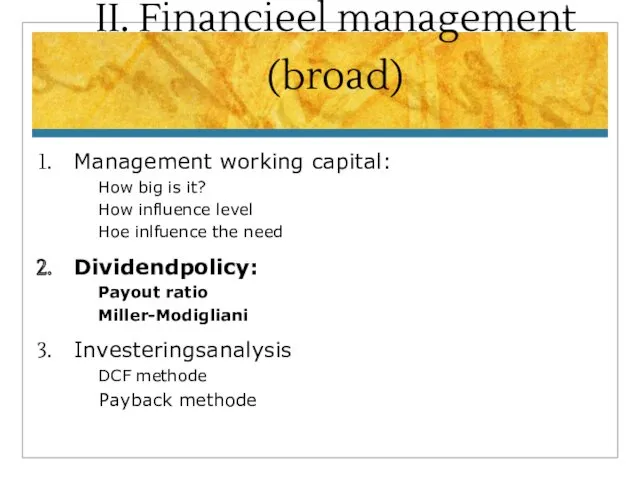

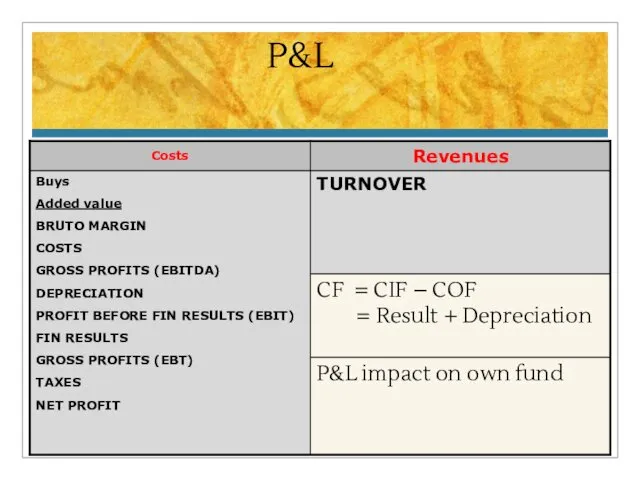

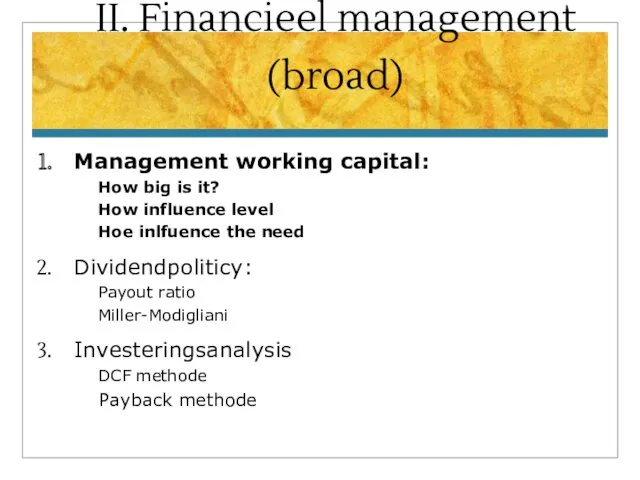

II. Financieel management (broad)

Management working capital:

How big is it?

How influence level

Hoe

inlfuence the need

Dividendpoliticy:

Payout ratio

Miller-Modigliani

Investeringsanalysis

DCF methode

Payback methode

Слайд 16

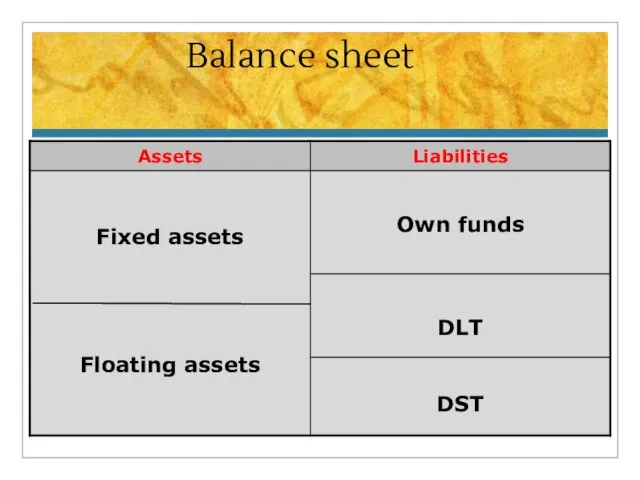

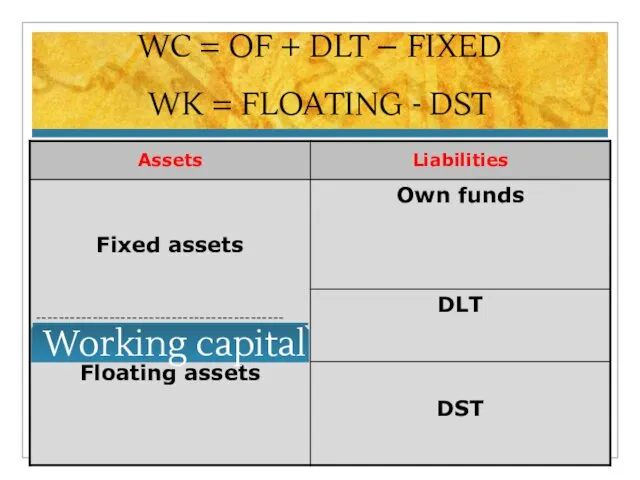

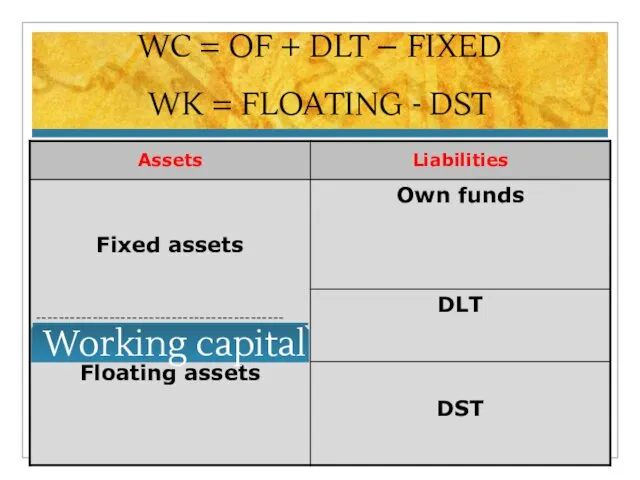

WC = OF + DLT – FIXED

WK = FLOATING - DST

Слайд 17

Financial plan

Means are bigger than needs

Objective: determine financing modalities

Case: CVBA

Lakatos (p. 62)

Make exercises 1 & 2!

Слайд 18

Bankrupcy prediction Models

DEFAULT RATE

Alarm levels

Altman

Multiple regression-analysis

Слайд 19

Слайд 20

II. Financieel management (broad)

Management working capital:

How big is it?

How influence level

Hoe

inlfuence the need

Dividendpolicy:

Payout ratio

Miller-Modigliani

Investeringsanalysis

DCF methode

Payback methode

Слайд 21

II. Financial managemant

Dividendpolitiek:Payout ratio

Three theories:

Letzenburger-Ramaswany: paying div. Increases taxes

Gordon: “bird

in the hand”

Miller-Modigliani:

Value of the company = f(profit capacity)

= f(investment policy)

Not dividend policy of financing policy

comments:

Fiscality

Perfect financial markets

Инструменты предпринимателя

Инструменты предпринимателя Методология и методы исследования в менеджменте

Методология и методы исследования в менеджменте Ситуационные факторы проектирования организации

Ситуационные факторы проектирования организации Результативность государственного управления, подходы к определению

Результативность государственного управления, подходы к определению Значение управления персоналом в управлении современным предприятием. Факторы, обусловившие возрастание роли человека

Значение управления персоналом в управлении современным предприятием. Факторы, обусловившие возрастание роли человека Сущность управленческого труда

Сущность управленческого труда 3 еркіндік дәрежелі дельта-роботты жобалау және басқару

3 еркіндік дәрежелі дельта-роботты жобалау және басқару ВКР: Анализ и оценка конкурентных преимуществ фирмы

ВКР: Анализ и оценка конкурентных преимуществ фирмы Руководитель как организатор системы управления персоналом государственной службы

Руководитель как организатор системы управления персоналом государственной службы Правила ведения беседы

Правила ведения беседы Команда лидера. Мотивация других

Команда лидера. Мотивация других Технология метода проектов

Технология метода проектов Основные понятия в области научно-исследовательских работ. Лекция 1

Основные понятия в области научно-исследовательских работ. Лекция 1 Диаграммы деятельности

Диаграммы деятельности Бизнес-планирование в ИС Project Expert

Бизнес-планирование в ИС Project Expert Управление временем. Тайм-менеджмент. Основы

Управление временем. Тайм-менеджмент. Основы Система менеджмента безопасности. Анализ опасностей

Система менеджмента безопасности. Анализ опасностей Процесс управленческого консультирования

Процесс управленческого консультирования Управление качеством в проекте

Управление качеством в проекте Евент-менеджмент

Евент-менеджмент Проектное управление

Проектное управление Управление конфликтом в организации. Содержание, уровни, стратегии и стили

Управление конфликтом в организации. Содержание, уровни, стратегии и стили Формирование и развитие системы мотивации и стимулирования трудовой деятельности

Формирование и развитие системы мотивации и стимулирования трудовой деятельности Метод мозгового штурма

Метод мозгового штурма Основы профессиональной этики

Основы профессиональной этики Эффективность использования всех ресурсов агропромышленного предприятия

Эффективность использования всех ресурсов агропромышленного предприятия Corporate Governance. State Owned Enterprises

Corporate Governance. State Owned Enterprises Организационные структуры управления

Организационные структуры управления