Содержание

- 2. Class #13 – CCP Risk Management 1 Clearinghouses and Central Counterparties 2 Central Counterparty Risk Management

- 3. Class #13 – CCP Risk Management 1 Clearinghouses and Central Counterparties 2 Central Counterparty Risk Management

- 4. Clearinghouses and Central Counterparties “We allow the City to sleep at night.” “Post-trade clearing and settlement

- 5. Clearinghouses and Central Counterparties Increasing Interest in Central Counterparties After the 2007/2008 Crisis Successfully Managed to

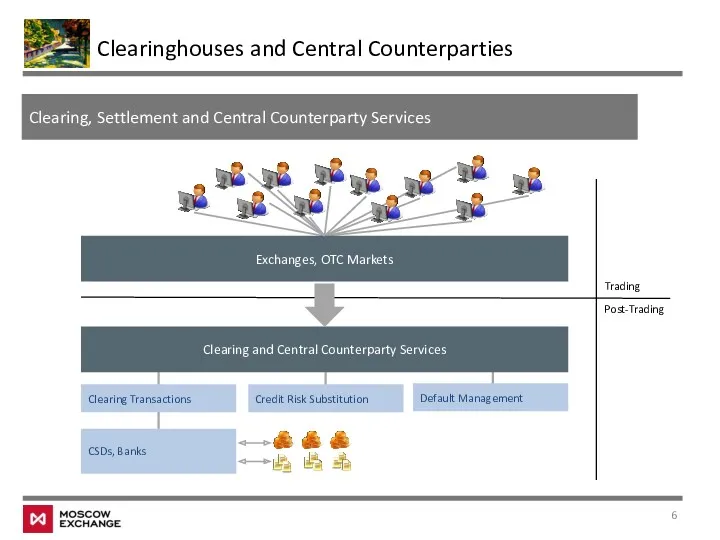

- 6. Clearinghouses and Central Counterparties Clearing, Settlement and Central Counterparty Services Clearing and Central Counterparty Services Credit

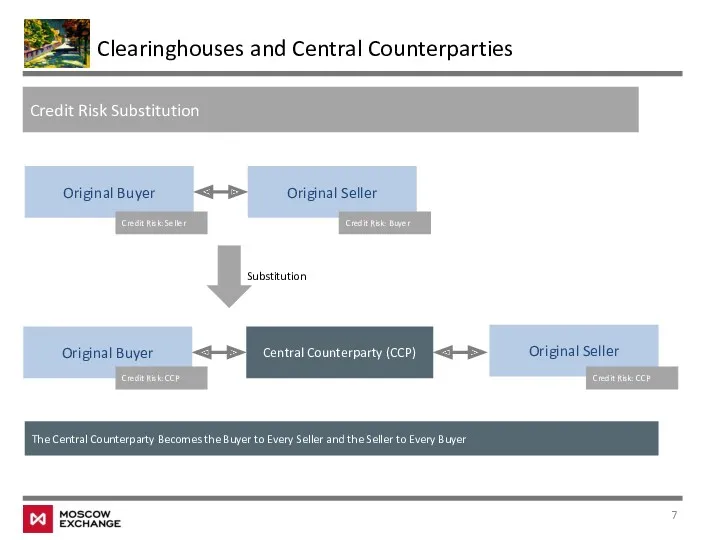

- 7. Clearinghouses and Central Counterparties Credit Risk Substitution Central Counterparty (CCP) Original Buyer Original Seller Original Buyer

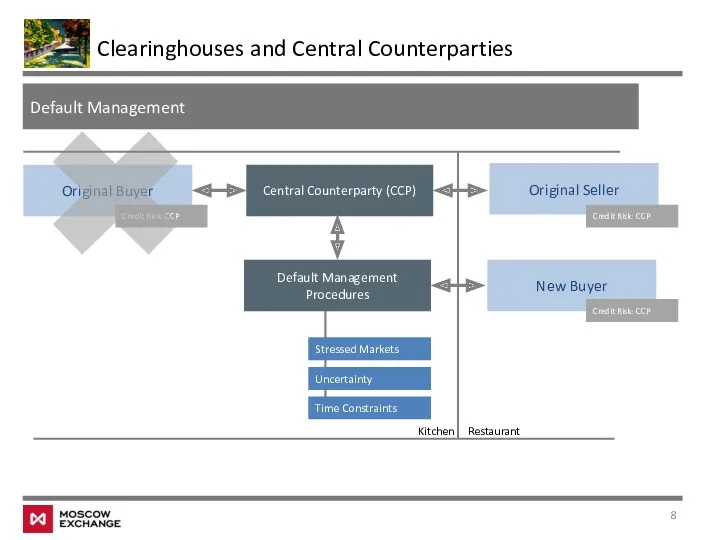

- 8. Clearinghouses and Central Counterparties Default Management Central Counterparty (CCP) Original Buyer Original Seller Credit Risk: CCP

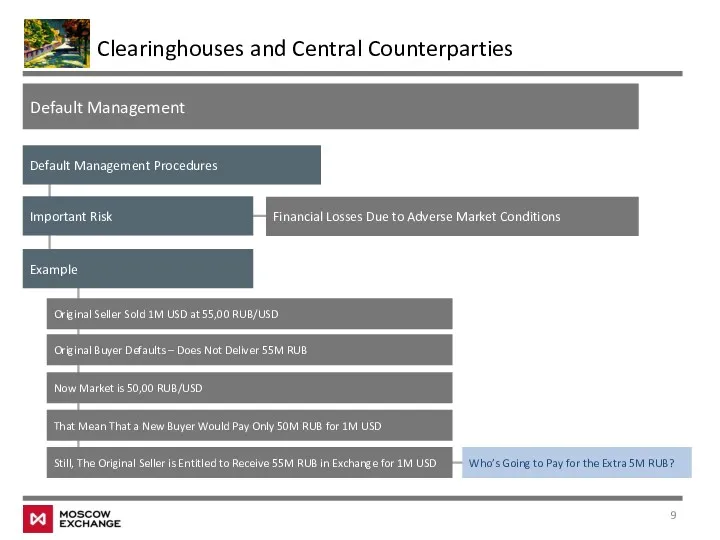

- 9. Clearinghouses and Central Counterparties Default Management Default Management Procedures Important Risk Financial Losses Due to Adverse

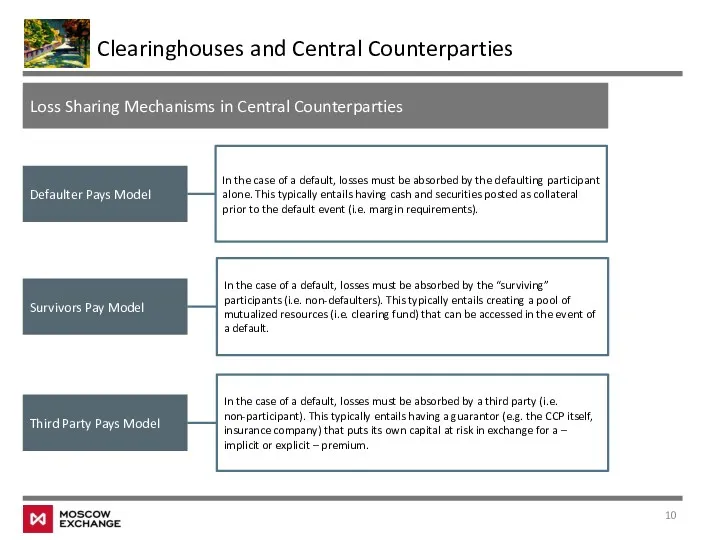

- 10. Clearinghouses and Central Counterparties Loss Sharing Mechanisms in Central Counterparties Survivors Pay Model Defaulter Pays Model

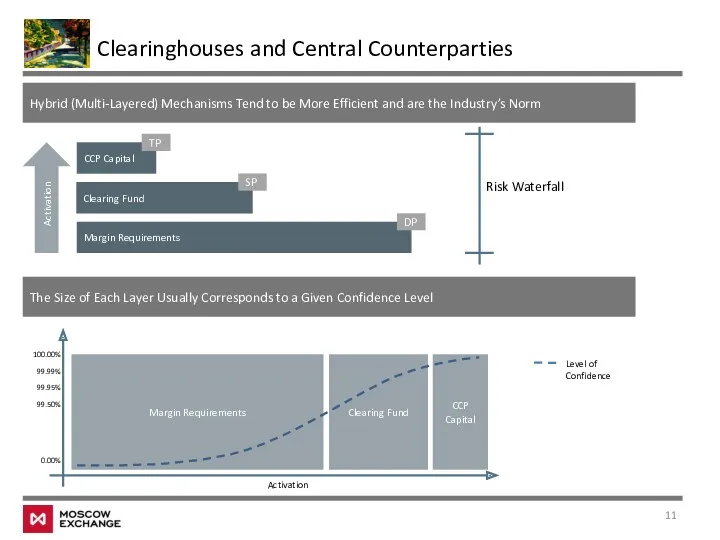

- 11. Clearinghouses and Central Counterparties Hybrid (Multi-Layered) Mechanisms Tend to be More Efficient and are the Industry’s

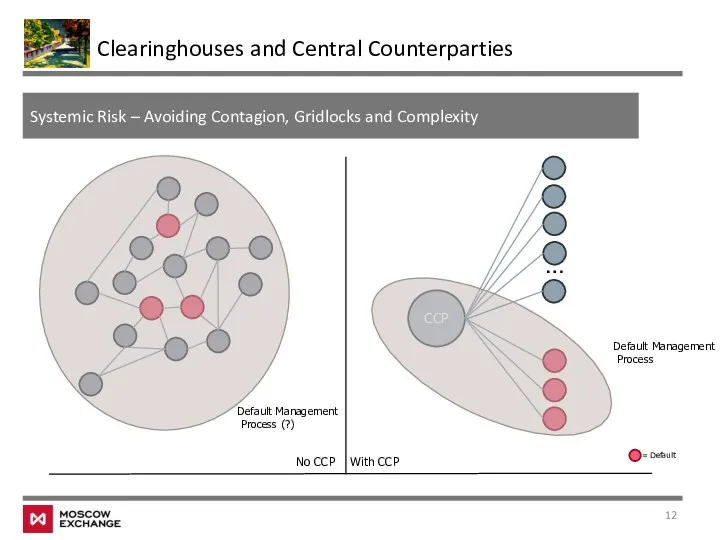

- 12. Clearinghouses and Central Counterparties Systemic Risk – Avoiding Contagion, Gridlocks and Complexity CCP … No CCP

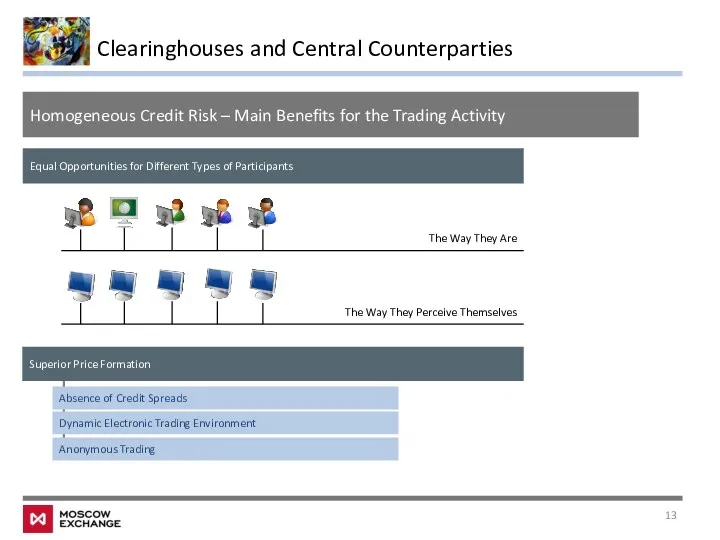

- 13. Clearinghouses and Central Counterparties Homogeneous Credit Risk – Main Benefits for the Trading Activity Equal Opportunities

- 14. Class #13 – CCP Risk Management 1 Clearinghouses and Central Counterparties 2 Central Counterparty Risk Management

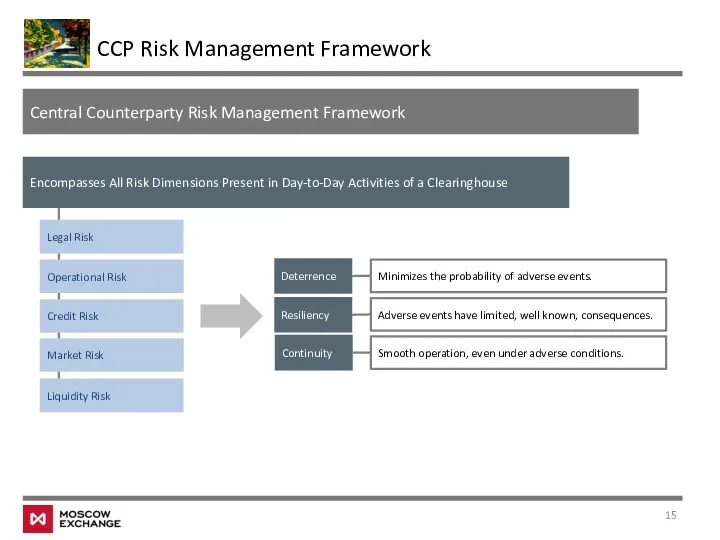

- 15. CCP Risk Management Framework Central Counterparty Risk Management Framework Encompasses All Risk Dimensions Present in Day-to-Day

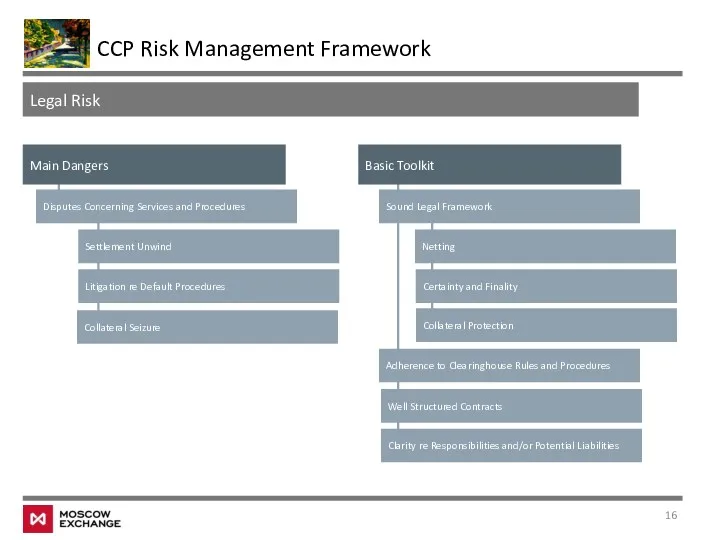

- 16. CCP Risk Management Framework Legal Risk Main Dangers Sound Legal Framework Basic Toolkit Netting Certainty and

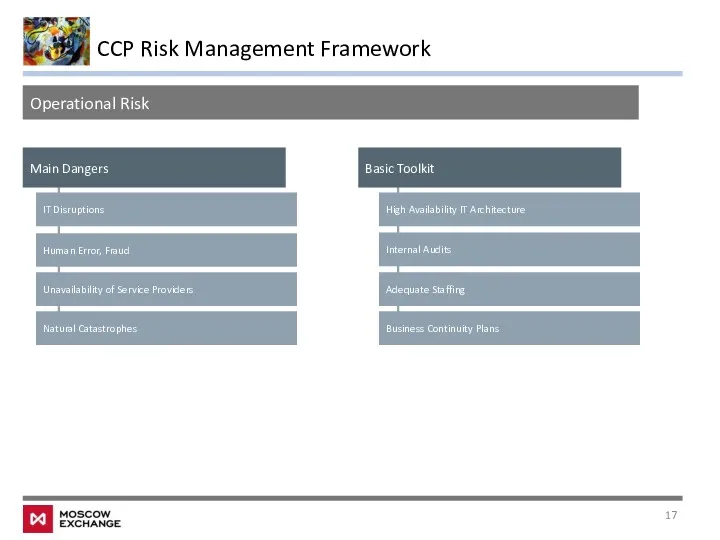

- 17. CCP Risk Management Framework Operational Risk Main Dangers High Availability IT Architecture Basic Toolkit IT Disruptions

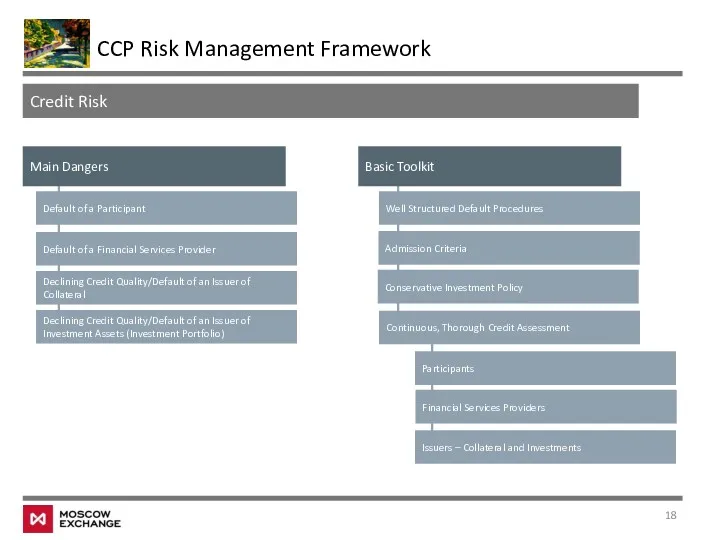

- 18. CCP Risk Management Framework Credit Risk Main Dangers Well Structured Default Procedures Basic Toolkit Default of

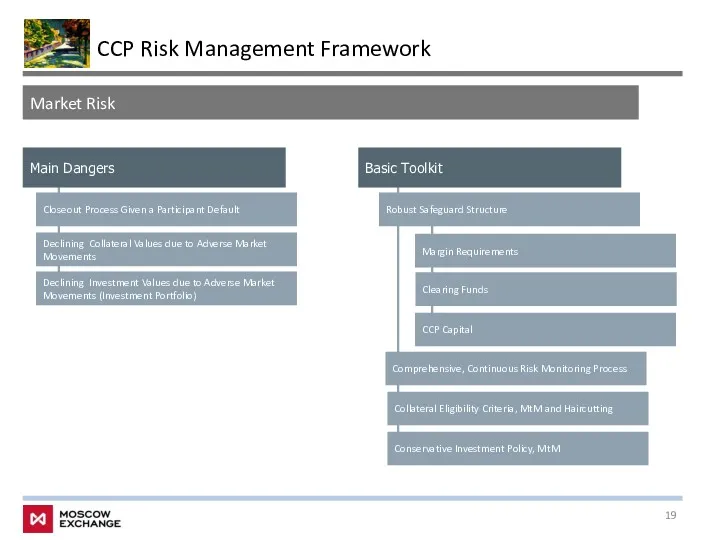

- 19. CCP Risk Management Framework Market Risk Main Dangers Robust Safeguard Structure Basic Toolkit Closeout Process Given

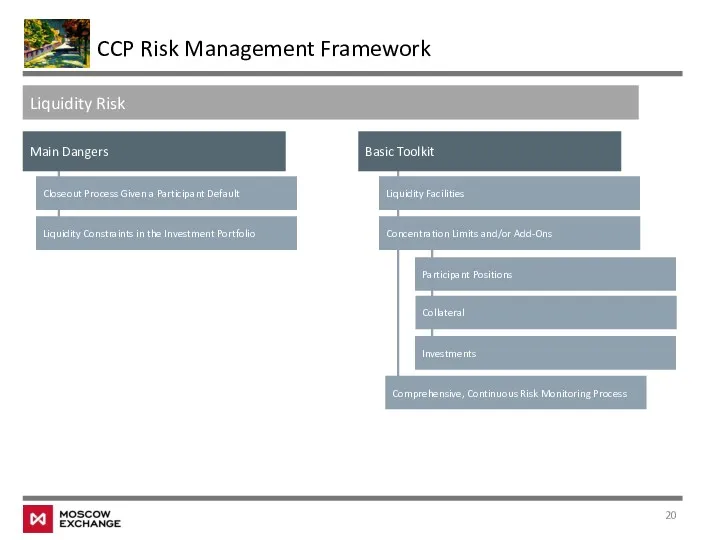

- 20. CCP Risk Management Framework Main Dangers Liquidity Facilities Basic Toolkit Closeout Process Given a Participant Default

- 21. Class #13 – CCP Risk Management 1 Clearinghouses and Central Counterparties 2 Central Counterparty Risk Management

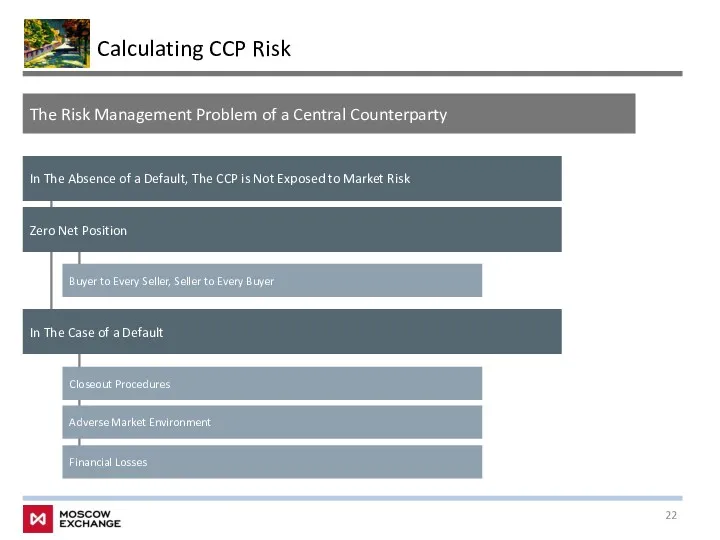

- 22. Calculating CCP Risk The Risk Management Problem of a Central Counterparty Buyer to Every Seller, Seller

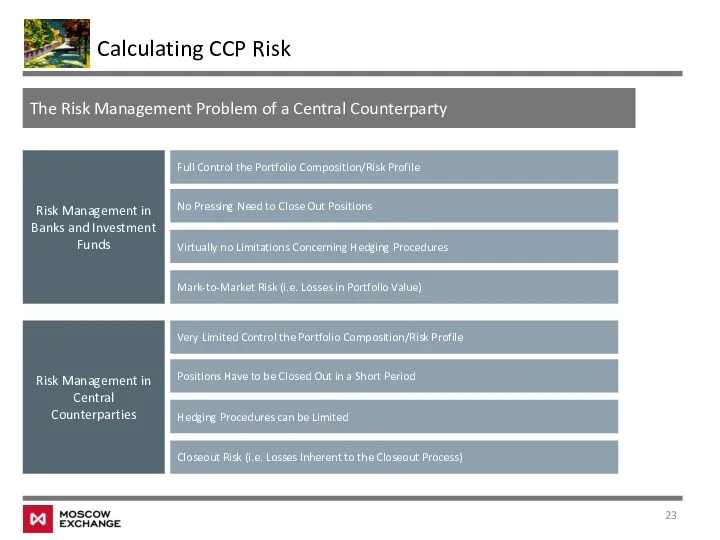

- 23. Calculating CCP Risk The Risk Management Problem of a Central Counterparty Risk Management in Banks and

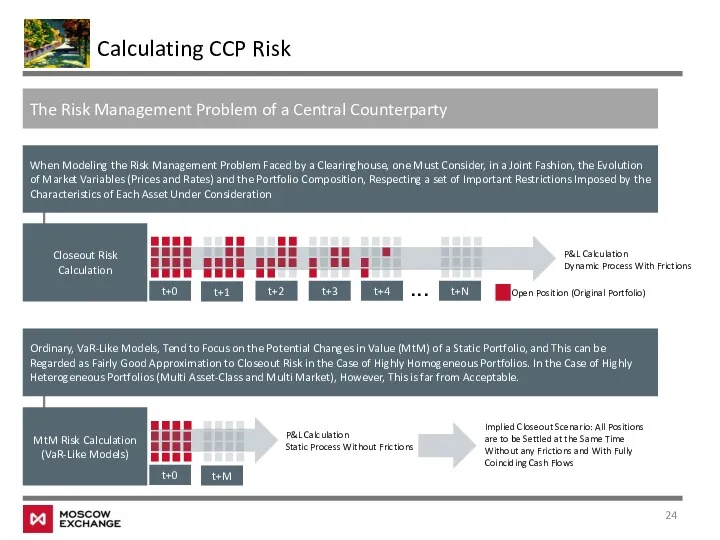

- 24. Calculating CCP Risk The Risk Management Problem of a Central Counterparty When Modeling the Risk Management

- 25. Class #13 – CCP Risk Management 1 Clearinghouses and Central Counterparties 2 Central Counterparty Risk Management

- 26. Annex Useful References Principles for Financial Market Infrastructures, CPMI-IOSCO, (2012); Modelling Risk in Central Counterparty Clearing

- 28. Скачать презентацию

Транспортная логистика

Транспортная логистика Time management

Time management Инновационный процесс

Инновационный процесс Организация ремонтного хозяйства

Организация ремонтного хозяйства 1С:Медицина.Поликлиника. Автоматизация основных процессов и ведение электронных медицинских карт в медицинских организациях

1С:Медицина.Поликлиника. Автоматизация основных процессов и ведение электронных медицинских карт в медицинских организациях Turistik deneyim

Turistik deneyim Инновационный менеджмент в управлении персоналом. HR-брендинг

Инновационный менеджмент в управлении персоналом. HR-брендинг Виды управления в менеджменте гостеприимства

Виды управления в менеджменте гостеприимства Отечественный и зарубежный опыт социологии управления

Отечественный и зарубежный опыт социологии управления Формирование бюджетных данных в программной системе 1C:Управление производственным предприятием

Формирование бюджетных данных в программной системе 1C:Управление производственным предприятием Психологическое сопровождение организации Арбат-фитнес

Психологическое сопровождение организации Арбат-фитнес Контроль как функция менеджмента

Контроль как функция менеджмента Международные стандарты серии ИСО 9000 по управлению качеством и обеспечению качества

Международные стандарты серии ИСО 9000 по управлению качеством и обеспечению качества Внутренняя структура организации

Внутренняя структура организации Оптимизация стимулирования вовлеченности персонала, как способ повышения эффективности в АЦ Британия

Оптимизация стимулирования вовлеченности персонала, как способ повышения эффективности в АЦ Британия Сектор обслуживания дебетовых карт

Сектор обслуживания дебетовых карт Профессиональная этика и деловой этикет

Профессиональная этика и деловой этикет Разработка системы мотивации и стимулирования сотрудников на примере агентства недвижимости

Разработка системы мотивации и стимулирования сотрудников на примере агентства недвижимости Общие и конкретные функции управления. Планирование и целеполагание. (Темы 3.1 и 3.2)

Общие и конкретные функции управления. Планирование и целеполагание. (Темы 3.1 и 3.2) Аттестация персонала

Аттестация персонала Медицинские и фармацевтические товары и их потребительские свойства. Основы товароведческого анализа

Медицинские и фармацевтические товары и их потребительские свойства. Основы товароведческого анализа Стратегическое планирование в международном менеджменте

Стратегическое планирование в международном менеджменте Корпоративный кодекс

Корпоративный кодекс Организация как объект управления. Система управления: понятие, составляющие элементы

Организация как объект управления. Система управления: понятие, составляющие элементы Основы управления трудовыми ресурсами строительной организации

Основы управления трудовыми ресурсами строительной организации Совершенствование организации труда персонала (на примере ООО Макдоналдс)

Совершенствование организации труда персонала (на примере ООО Макдоналдс) Basic Elements of Lean Production. Benefits of Lean Production. Implementing Lean Production. Lean Services

Basic Elements of Lean Production. Benefits of Lean Production. Implementing Lean Production. Lean Services Процессы управления проектом. Процессы УП в строительстве. Раздел 4

Процессы управления проектом. Процессы УП в строительстве. Раздел 4