Содержание

- 2. Satisfying vs optimal Simple rules are often far more robust than complicated ”optimal” alternatives Rules of

- 3. Simplicity in portfolio theory “One should always divide his wealth into three parts: a third in

- 4. Steps of strategy evaluation Formally define rules for decision-making Collect data and clean it Simulate trading

- 5. Decision-making rules Distribute your initial capital equally between N stocks Wait☺ Example: Initial capital: $1000 10

- 6. Not so simple in fact How to choose N stocks (assets) to invest in? Infinite possible

- 7. Universe of securities We will look at largest US companies by market capitalization Capitalization = Number

- 8. Data collection We need daily close prices for all Russell 1000 components Yahoo! Finance is one

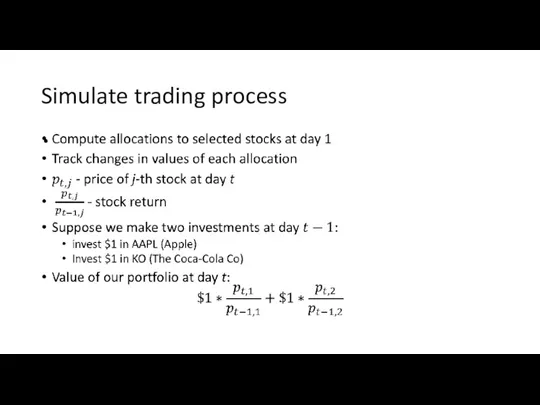

- 9. Simulate trading process

- 10. Compare result with the benchmark

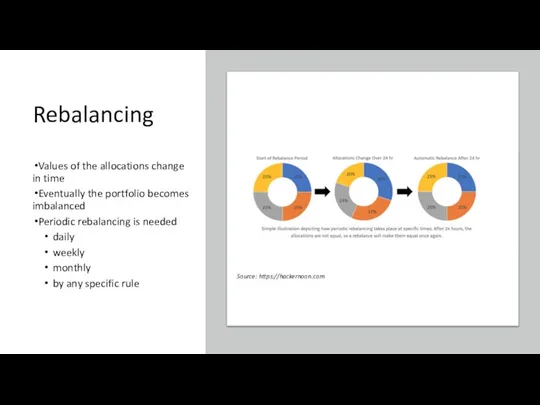

- 11. Rebalancing Values of the allocations change in time Eventually the portfolio becomes imbalanced Periodic rebalancing is

- 13. Скачать презентацию

ПрезентацияМужские архетипы

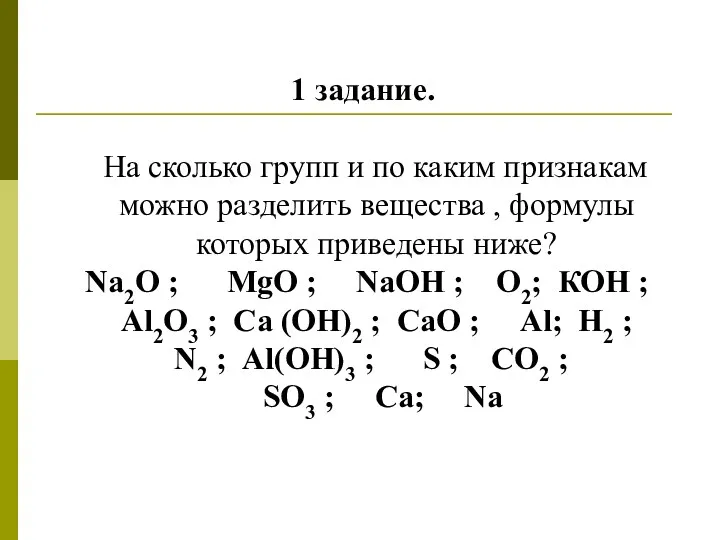

ПрезентацияМужские архетипы презентация к уроку Основания 8 класс

презентация к уроку Основания 8 класс Разделы науки о языке

Разделы науки о языке Новое царство

Новое царство Растения в интерьере жилого дома

Растения в интерьере жилого дома Р. Сеф Весёлые стихи, 3класс

Р. Сеф Весёлые стихи, 3класс презентация группового занятия по патриотическому воспитанию

презентация группового занятия по патриотическому воспитанию Программа кормления животных ветеринарных врачей на территории дилера ИП Коробов

Программа кормления животных ветеринарных врачей на территории дилера ИП Коробов Информация для родителей. Критические периоды в развитии речевой функции у детей.

Информация для родителей. Критические периоды в развитии речевой функции у детей. Алгоритм сочинения загадок по опорным таблицам

Алгоритм сочинения загадок по опорным таблицам Презентация по химии для 9 класса по теме: Органические вещества.

Презентация по химии для 9 класса по теме: Органические вещества. Бойове застосування КЗА 86Ж6. Алгоритми обробки радiолокацiйної iнформацiї, виявлення та захоплення цiлей. (Тема 8.4)

Бойове застосування КЗА 86Ж6. Алгоритми обробки радiолокацiйної iнформацiї, виявлення та захоплення цiлей. (Тема 8.4) Презентация к статье Образовательное путешествие. Новые возможности

Презентация к статье Образовательное путешествие. Новые возможности Экологические проблемы Берингова моря

Экологические проблемы Берингова моря Портфолио педагога дополнительного образования (Презентация)

Портфолио педагога дополнительного образования (Презентация) Мастер-класс Народная кукла Кувадка

Мастер-класс Народная кукла Кувадка Сумматоры. Виды

Сумматоры. Виды DSM Food Specialties

DSM Food Specialties Wodospady iguazú - park narodowy Аrgentyny i Вrazylii

Wodospady iguazú - park narodowy Аrgentyny i Вrazylii 20230916_videoprezentatsiya_k_obobshchayushchemu_uroku_po_prirodovedeniyu_dlya_6_kl

20230916_videoprezentatsiya_k_obobshchayushchemu_uroku_po_prirodovedeniyu_dlya_6_kl Презентация. Климат Австралии, 7 класс.

Презентация. Климат Австралии, 7 класс. Устный счёт

Устный счёт Мастер - класс по фелтингу Осенние листья

Мастер - класс по фелтингу Осенние листья Мы - граждане России

Мы - граждане России Презентация Весёлый гномик

Презентация Весёлый гномик Устройство и эксплуатация солнечных батарей

Устройство и эксплуатация солнечных батарей Поэтапное рисование кошки

Поэтапное рисование кошки Кузнецкая крепость Диск

Кузнецкая крепость Диск