Содержание

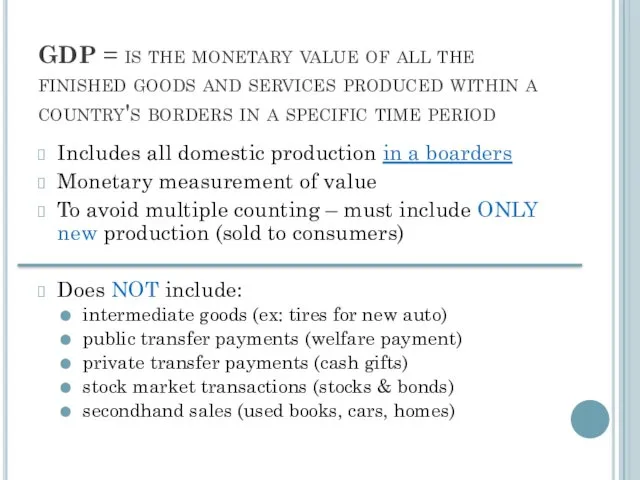

- 2. GDP = is the monetary value of all the finished goods and services produced within a

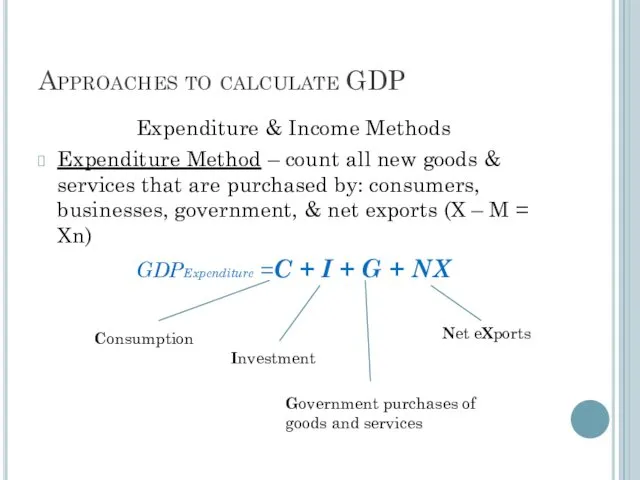

- 3. Approaches to calculate GDP Expenditure & Income Methods Expenditure Method – count all new goods &

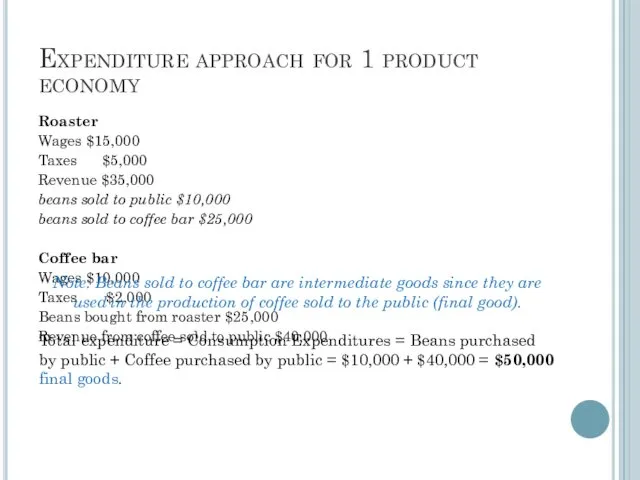

- 12. Expenditure approach for 1 product economy Roaster Wages $15,000 Taxes $5,000 Revenue $35,000 beans sold to

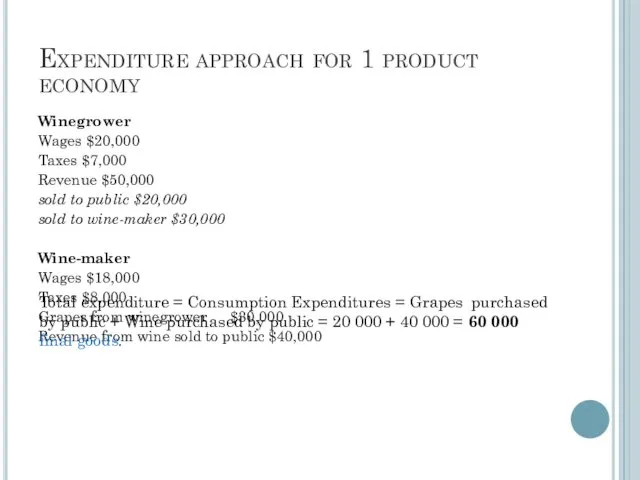

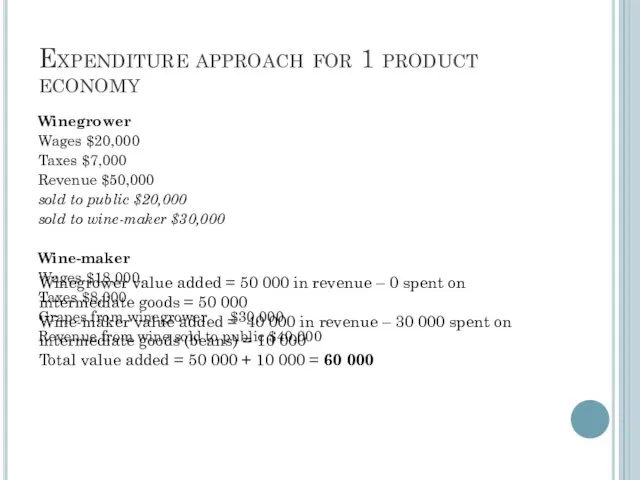

- 13. Expenditure approach for 1 product economy Winegrower Wages $20,000 Taxes $7,000 Revenue $50,000 sold to public

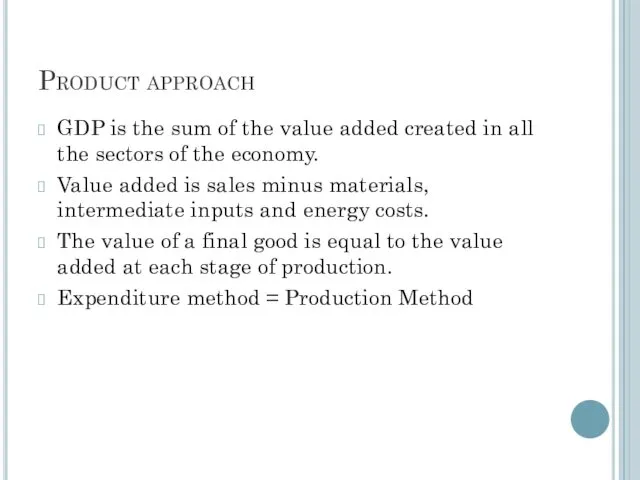

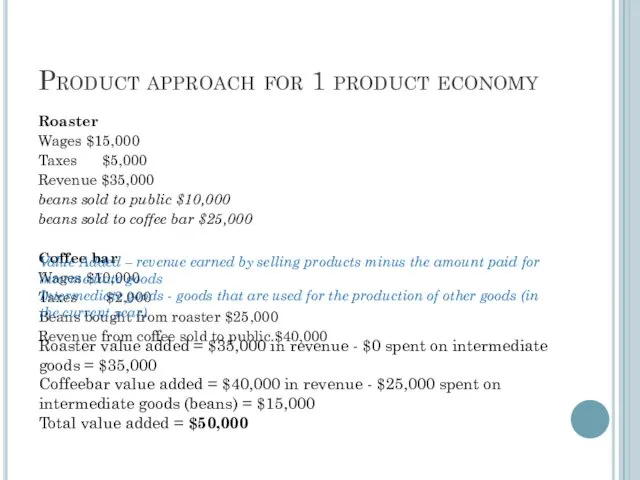

- 14. Product approach GDP is the sum of the value added created in all the sectors of

- 15. Product approach for 1 product economy Roaster Wages $15,000 Taxes $5,000 Revenue $35,000 beans sold to

- 16. Expenditure approach for 1 product economy Winegrower Wages $20,000 Taxes $7,000 Revenue $50,000 sold to public

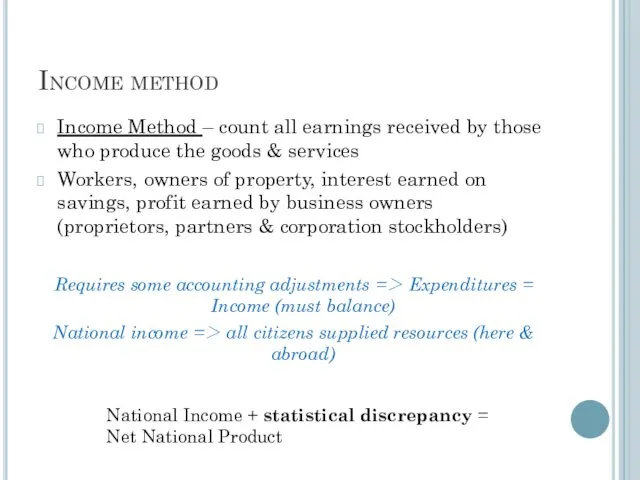

- 17. Income method Income Method – count all earnings received by those who produce the goods &

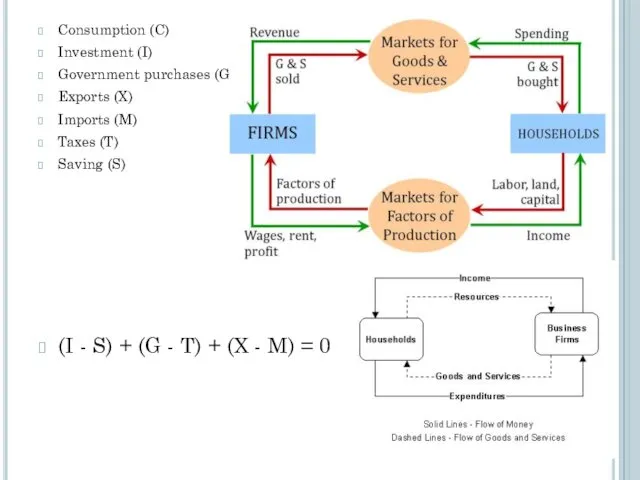

- 18. Consumption (C) Investment (I) Government purchases (G) Exports (X) Imports (M) Taxes (T) Saving (S) (I

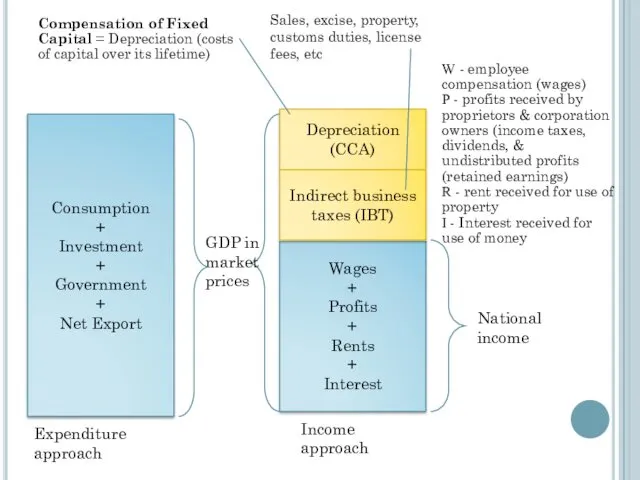

- 19. Consumption + Investment + Government + Net Export Wages + Profits + Rents + Interest Depreciation

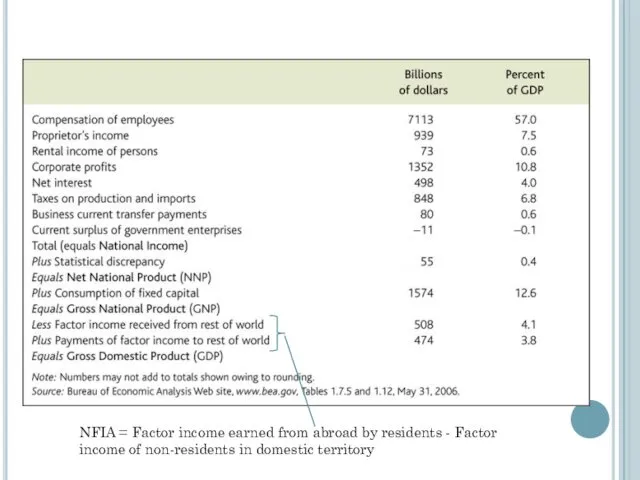

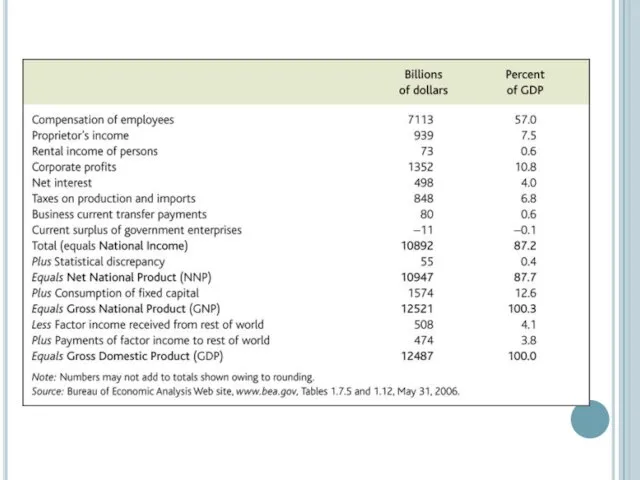

- 20. NFIA = Factor income earned from abroad by residents - Factor income of non-residents in domestic

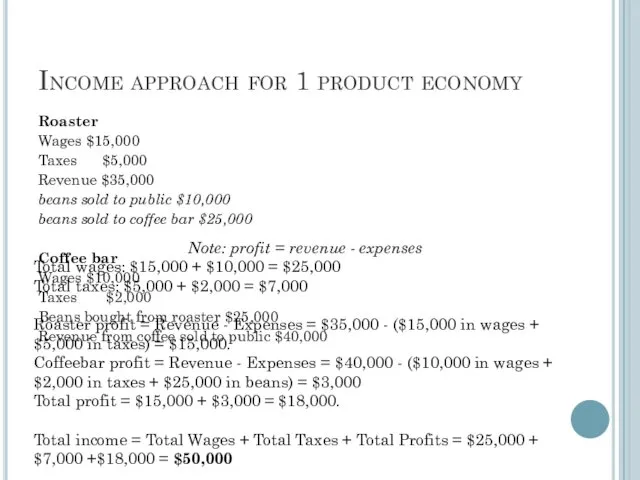

- 22. Income approach for 1 product economy Roaster Wages $15,000 Taxes $5,000 Revenue $35,000 beans sold to

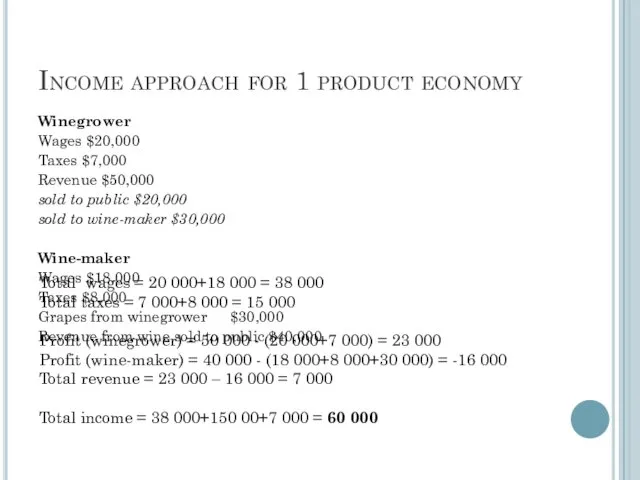

- 23. Income approach for 1 product economy Winegrower Wages $20,000 Taxes $7,000 Revenue $50,000 sold to public

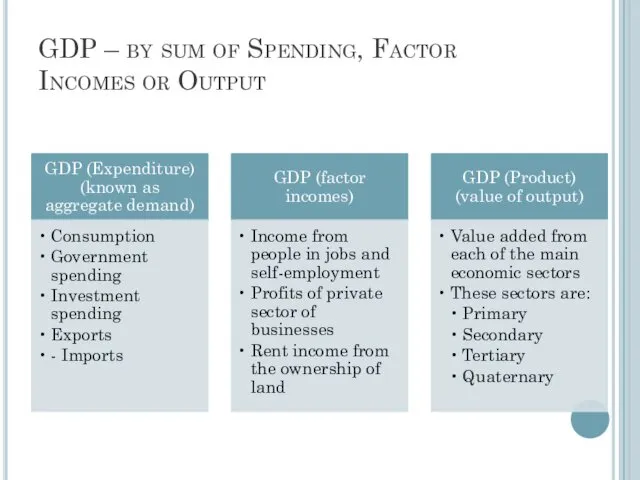

- 24. GDP – by sum of Spending, Factor Incomes or Output

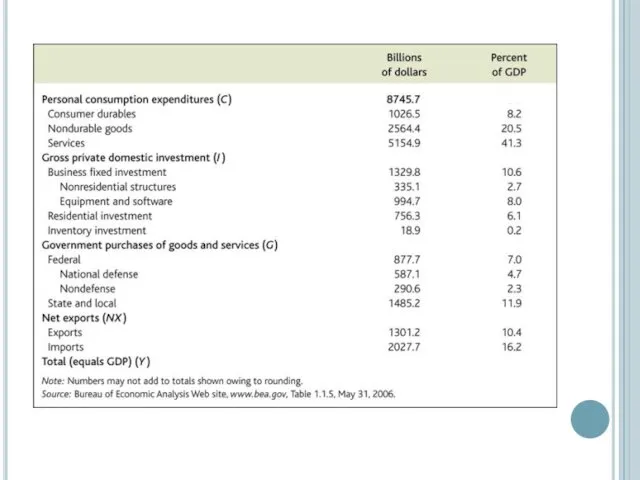

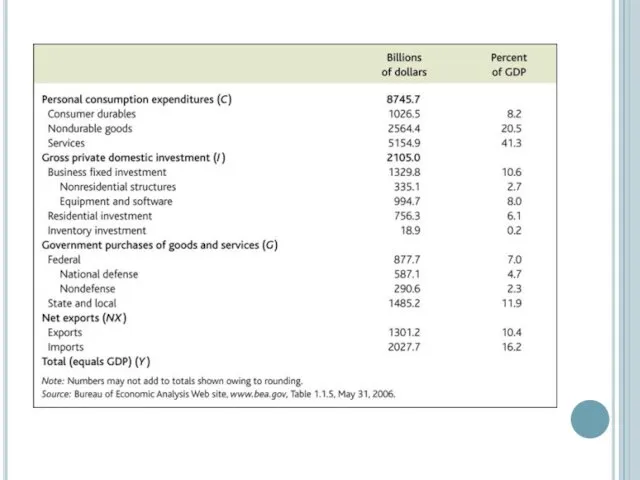

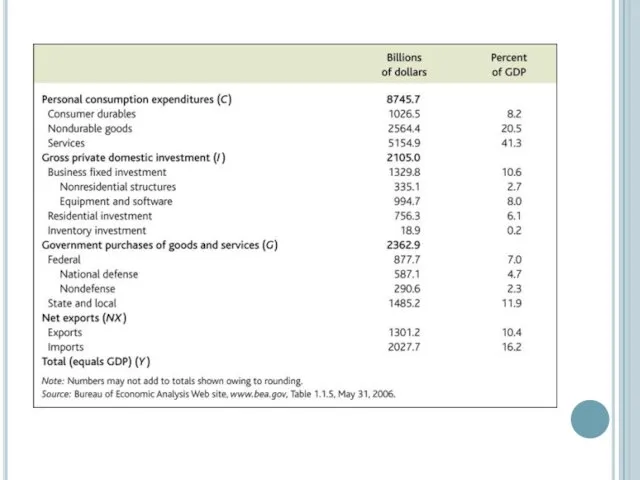

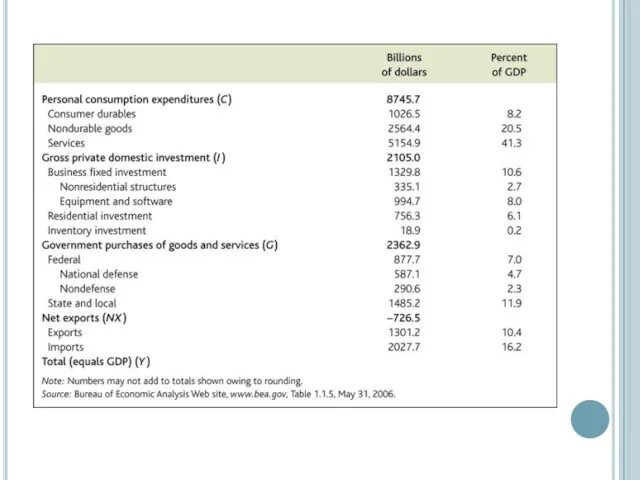

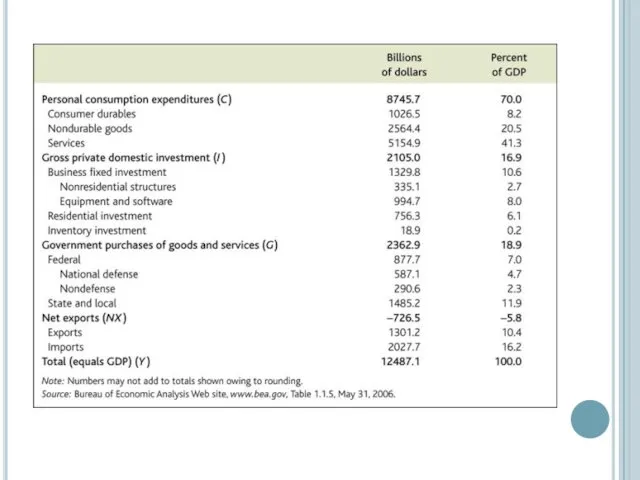

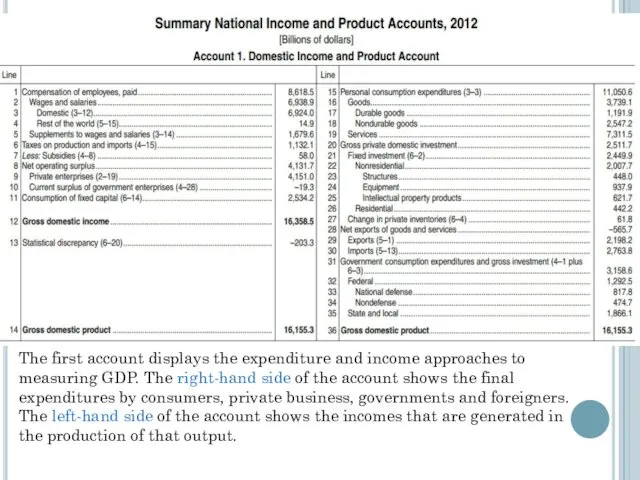

- 25. The first account displays the expenditure and income approaches to measuring GDP. The right-hand side of

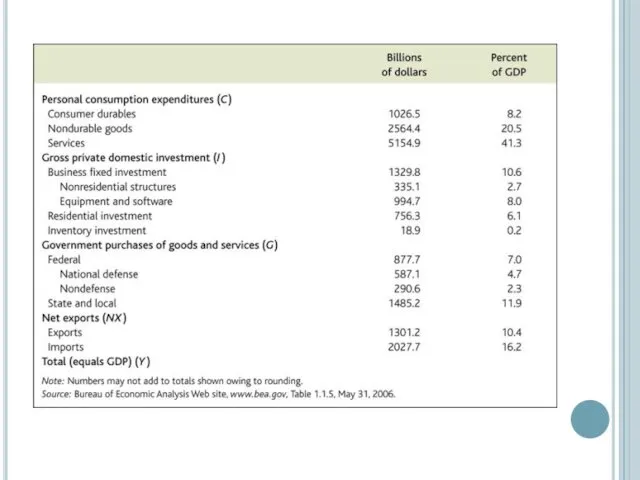

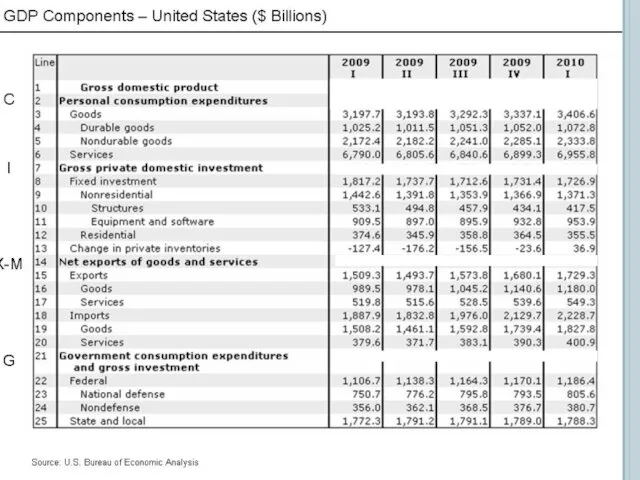

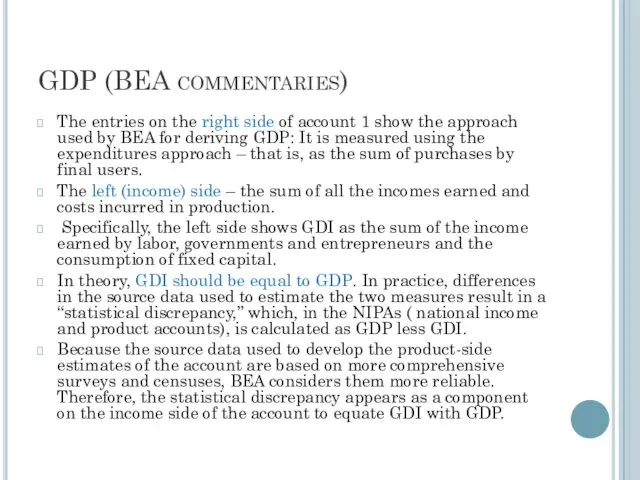

- 26. GDP (BEA commentaries) The entries on the right side of account 1 show the approach used

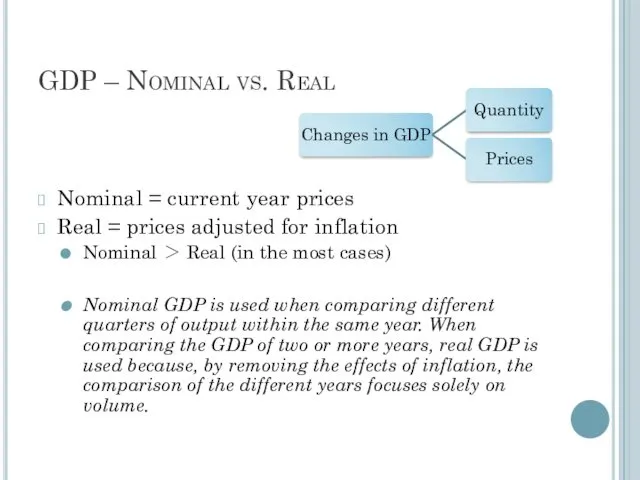

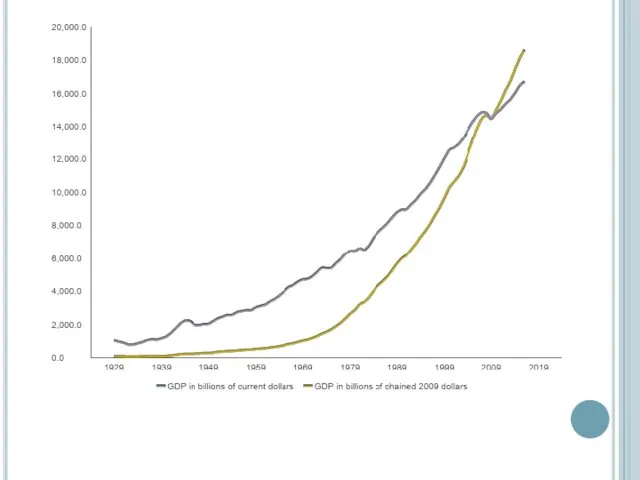

- 28. GDP – Nominal vs. Real Nominal = current year prices Real = prices adjusted for inflation

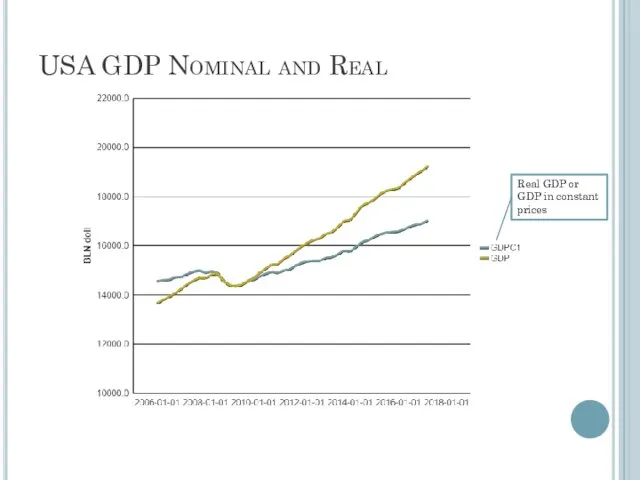

- 29. USA GDP Nominal and Real Real GDP or GDP in constant prices

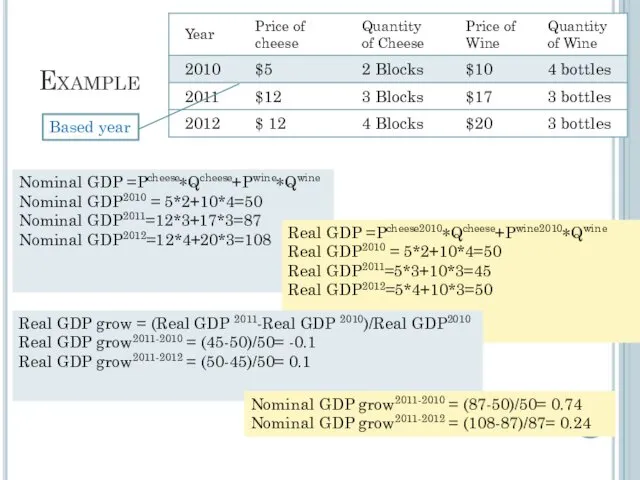

- 31. Example Nominal GDP =Pcheese∗QCheese+Pcheese∗QCheese Nominal GDP =Pcheese∗Qcheese+Pwine∗Qwine Nominal GDP2010 = 5*2+10*4=50 Nominal GDP2011=12*3+17*3=87 Nominal GDP2012=12*4+20*3=108 Real

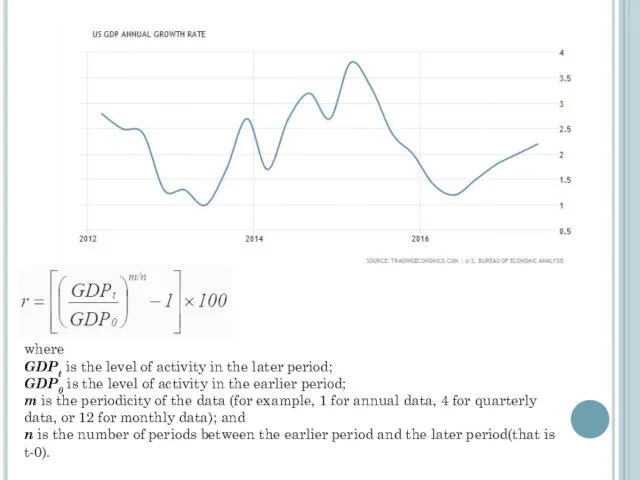

- 32. where GDPt is the level of activity in the later period; GDP0 is the level of

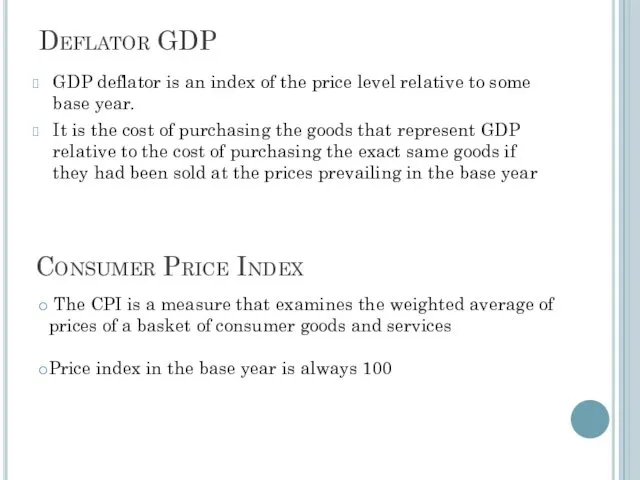

- 33. Deflator GDP GDP deflator is an index of the price level relative to some base year.

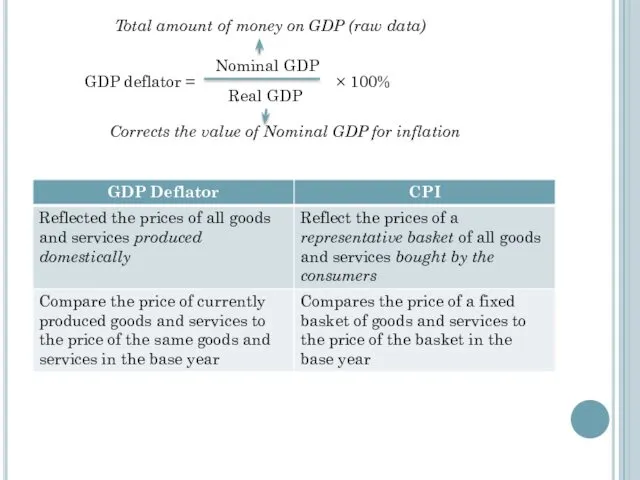

- 34. GDP deflator = Nominal GDP Real GDP × 100% Total amount of money on GDP (raw

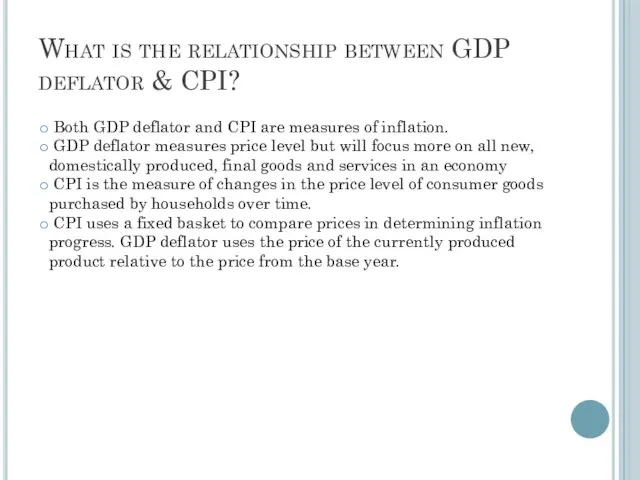

- 35. What is the relationship between GDP deflator & CPI? Both GDP deflator and CPI are measures

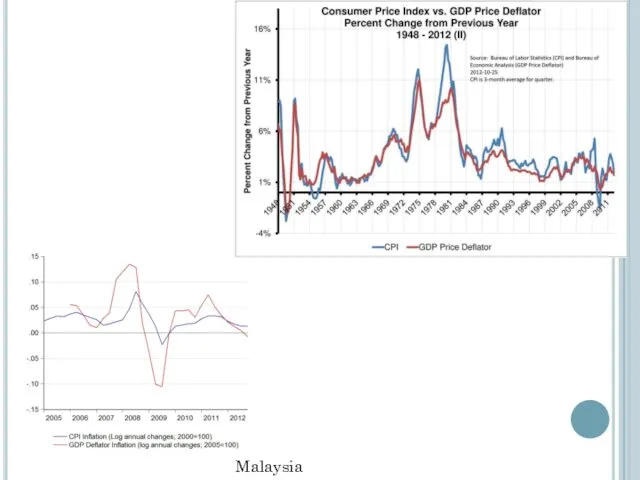

- 36. Malaysia

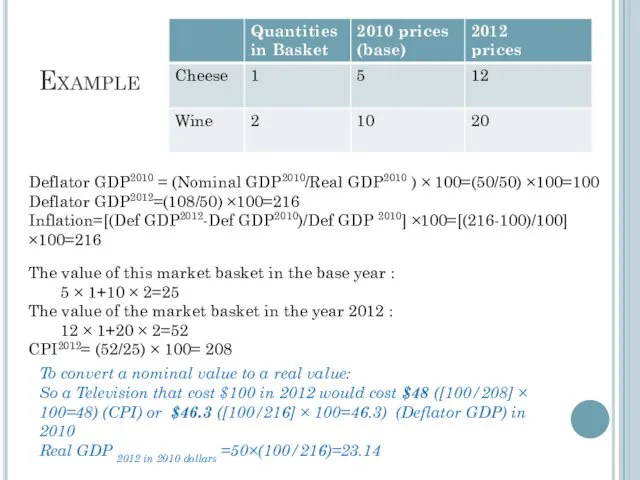

- 37. Example The value of this market basket in the base year : 5 × 1+10 ×

- 39. Скачать презентацию

Решение экономических задач. Семейный бюджет

Решение экономических задач. Семейный бюджет Место и роль эконометрики в экономической науке и практике

Место и роль эконометрики в экономической науке и практике Світовий ринок товарів та послуг

Світовий ринок товарів та послуг Продовольственная безопасность

Продовольственная безопасность Нетарифные барьеры. Экспортные субсидии. Свободная торговля. Всемирная торговая организация (ВТО). Россия и ВТО

Нетарифные барьеры. Экспортные субсидии. Свободная торговля. Всемирная торговая организация (ВТО). Россия и ВТО Организация деятельности центрального банка Российской Федерации в 1945-1990 годы. (Лекция 5)

Организация деятельности центрального банка Российской Федерации в 1945-1990 годы. (Лекция 5) Economic growth

Economic growth Теория производства

Теория производства Медициналық қызметтер нарығындағы бәсекелестің типтері

Медициналық қызметтер нарығындағы бәсекелестің типтері Национальная экономика, содержание, структура и измерение параметров

Национальная экономика, содержание, структура и измерение параметров Результаты и эффективность деятельности предприятия

Результаты и эффективность деятельности предприятия Система планирования деятельности предприятия

Система планирования деятельности предприятия Руководство Фраскати

Руководство Фраскати Промышленная политика Республики Корея

Промышленная политика Республики Корея Глобализация мировой экономики и её последствия

Глобализация мировой экономики и её последствия Экономические системы. Рыночная система хозяйствования

Экономические системы. Рыночная система хозяйствования Предпринимательский всеобуч

Предпринимательский всеобуч Контрольный тест. 7 класс

Контрольный тест. 7 класс Исследовательский проект Разумная экономия энергии

Исследовательский проект Разумная экономия энергии Государственные расходы и налоги. Деньги и их функции. (Тема 11)

Государственные расходы и налоги. Деньги и их функции. (Тема 11) Экономический анализ как наука

Экономический анализ как наука Экономика общественного сектора

Экономика общественного сектора Бәсеке. Бәсекенің түрлері

Бәсеке. Бәсекенің түрлері Трудовые ресурсы предприятия: основные понятия, структура, показатели

Трудовые ресурсы предприятия: основные понятия, структура, показатели Рынки факторов производства и формирование факторных доходов. (Тема 7)

Рынки факторов производства и формирование факторных доходов. (Тема 7) Налоговая система

Налоговая система Инвестиционно-инновационная активность (привлекательнось) региона РФ. Астраханская область

Инвестиционно-инновационная активность (привлекательнось) региона РФ. Астраханская область Нарушения макроэкономического равновесия: инфляция и безработица. (Тема 3)

Нарушения макроэкономического равновесия: инфляция и безработица. (Тема 3)