Содержание

- 2. Gross Domestic Product

- 3. Measuring a Nation’s Income Microeconomics – the study of how individual households and firms make decisions

- 4. Measuring a Nation’s Income Macroeconomics answers questions like the following: Why is average income high in

- 5. The Economy’s Income and Expenditure When judging whether the economy is doing well or poorly, it

- 6. The Measurement of Gross Domestic Product Gross Domestic Product (GDP) – a measure of the income

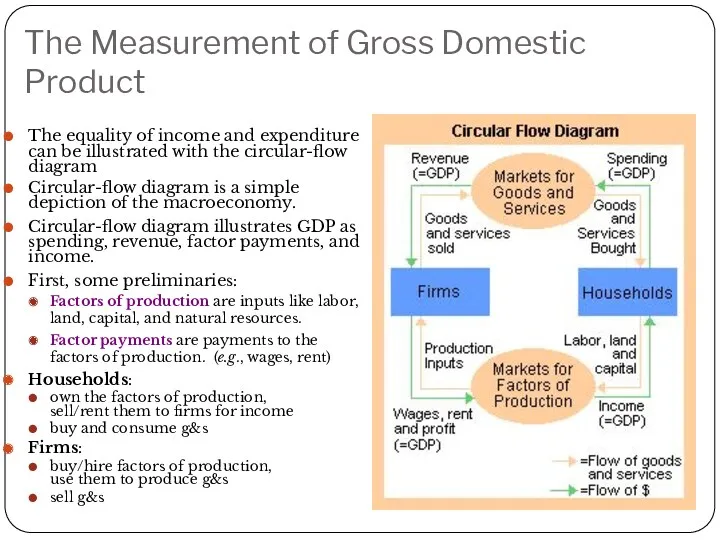

- 7. The Measurement of Gross Domestic Product The equality of income and expenditure can be illustrated with

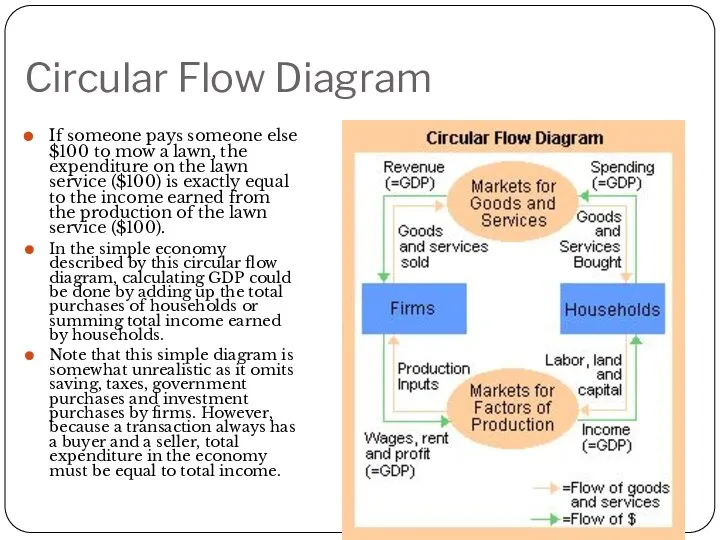

- 8. Circular Flow Diagram If someone pays someone else $100 to mow a lawn, the expenditure on

- 9. Circular Flow - Leakages Leakage is the non-consumption uses of income, including saving, taxes, and imports.

- 10. The Measurement of Gross Domestic Product Definition: GDP is the market value of all final goods

- 11. The Measurement of Gross Domestic Product “Of All Final …” It records only the value of

- 12. The Measurement of Gross Domestic Product “Goods and Services…” It includes both tangible goods (food, clothing,

- 13. The Measurement of Gross Domestic Product “In a Given Period of Time…” It measures the value

- 14. What is not Counted in GDP? GDP includes all items produced in the economy and sold

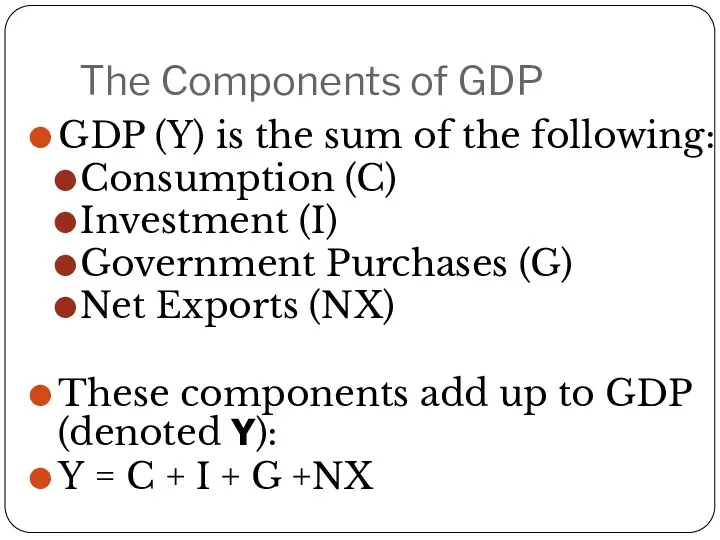

- 15. The Components of GDP GDP (Y) is the sum of the following: Consumption (C) Investment (I)

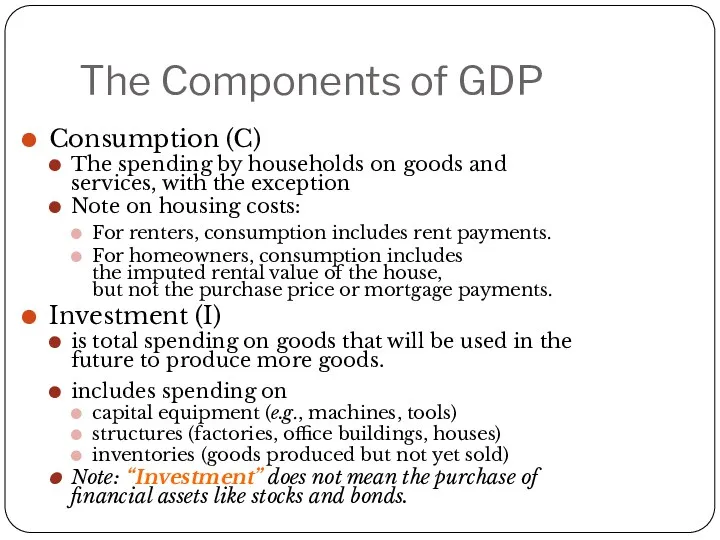

- 16. The Components of GDP Consumption (C) The spending by households on goods and services, with the

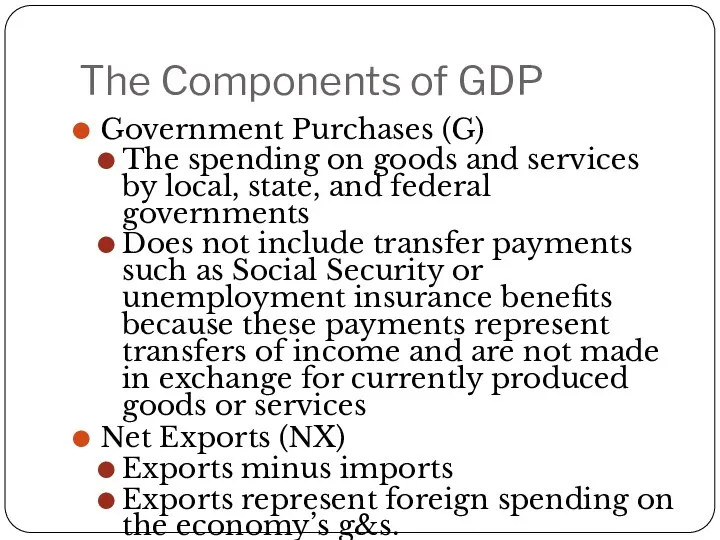

- 17. The Components of GDP Government Purchases (G) The spending on goods and services by local, state,

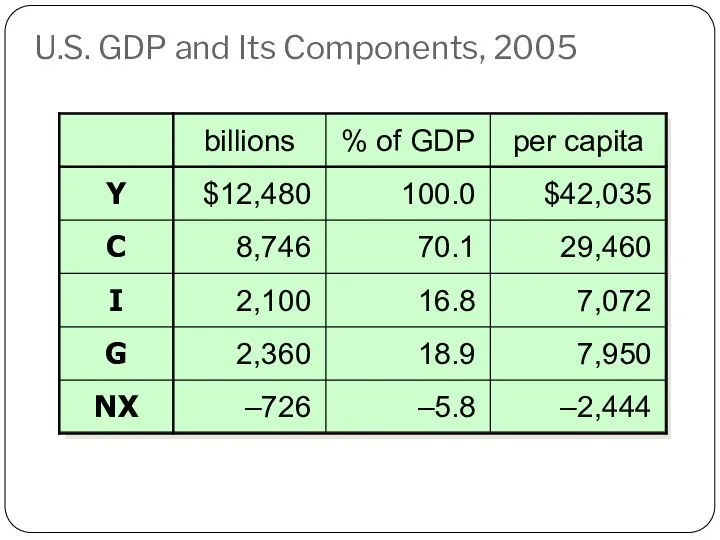

- 18. U.S. GDP and Its Components, 2005

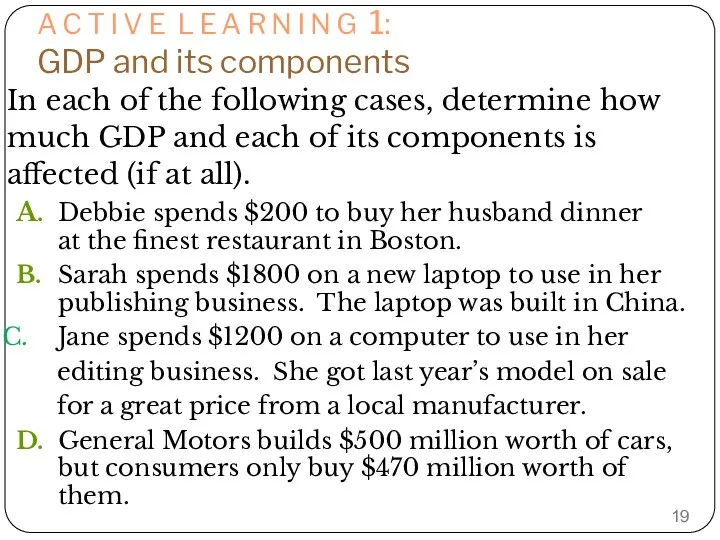

- 19. A C T I V E L E A R N I N G 1: GDP

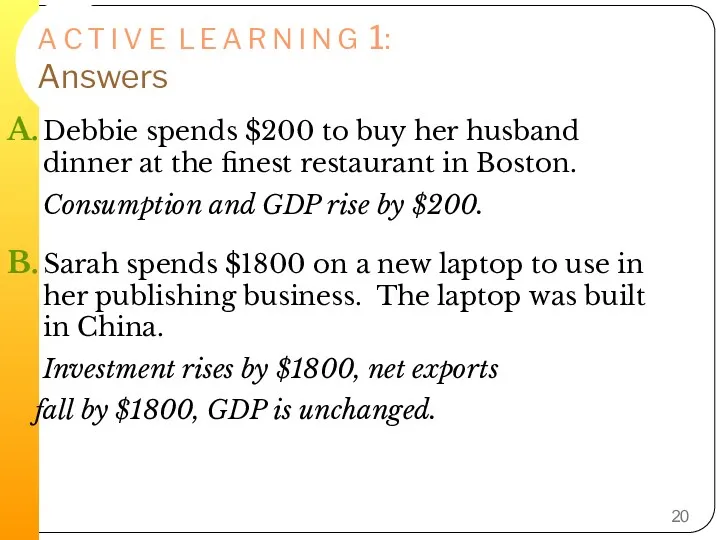

- 20. A C T I V E L E A R N I N G 1: Answers

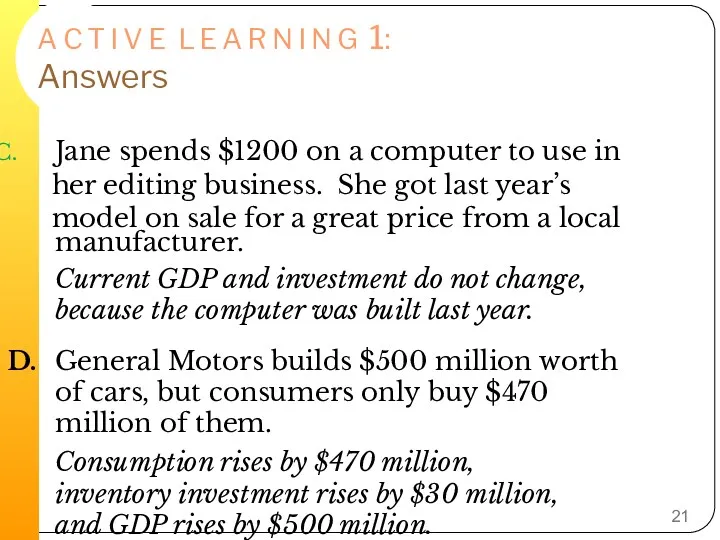

- 21. A C T I V E L E A R N I N G 1: Answers

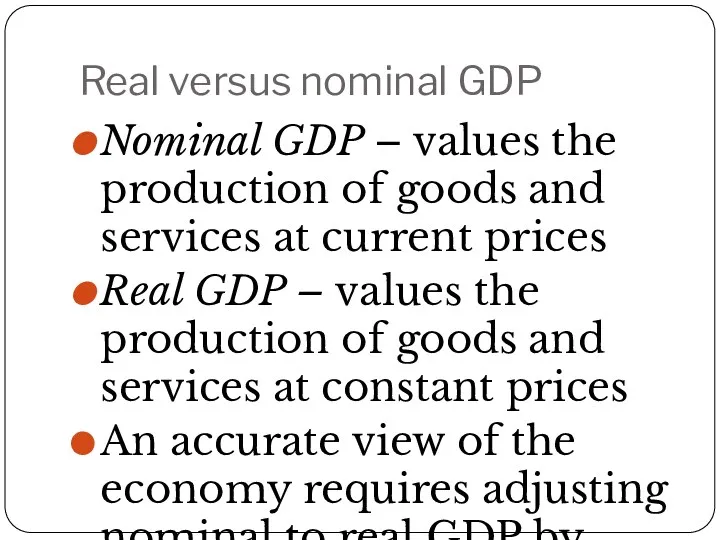

- 22. Real versus nominal GDP Nominal GDP – values the production of goods and services at current

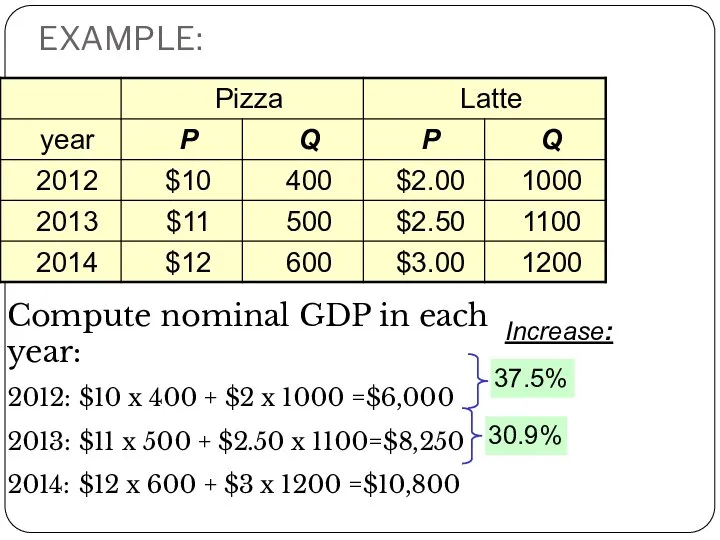

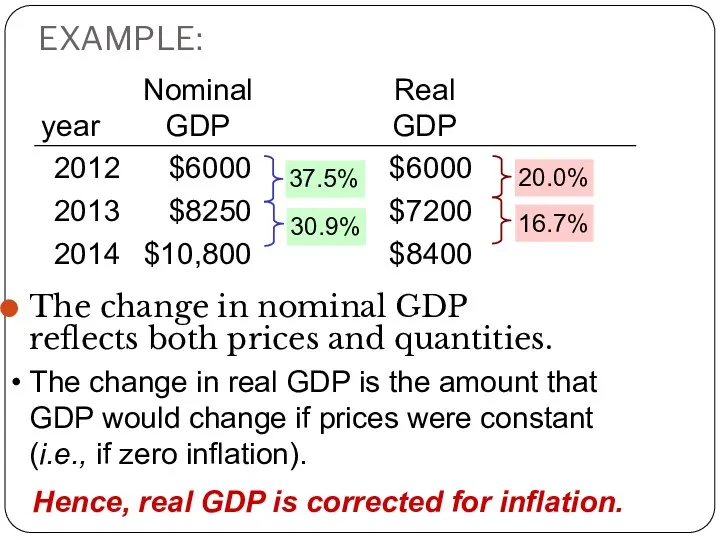

- 23. EXAMPLE: Compute nominal GDP in each year: 2012: $10 x 400 + $2 x 1000 =$6,000

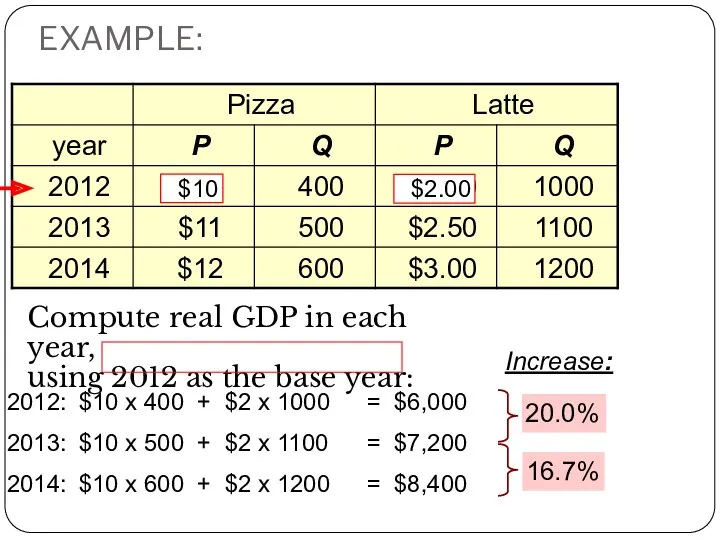

- 24. EXAMPLE: Compute real GDP in each year, using 2012 as the base year: Increase: 2012: $10

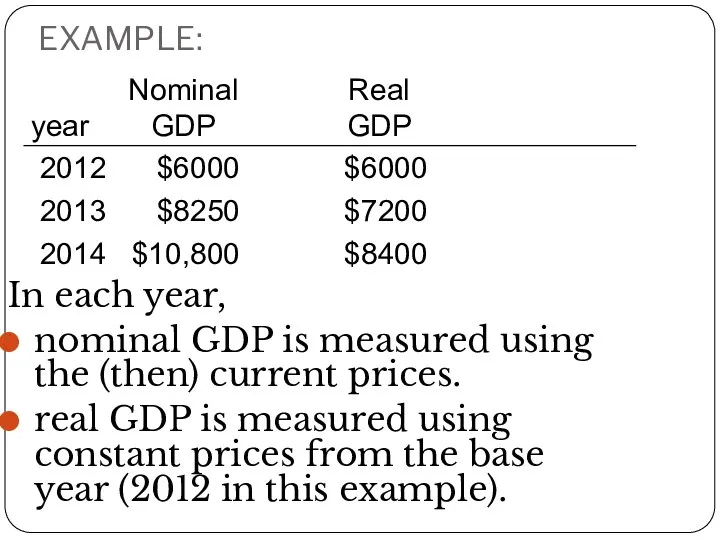

- 25. EXAMPLE: In each year, nominal GDP is measured using the (then) current prices. real GDP is

- 26. EXAMPLE: The change in nominal GDP reflects both prices and quantities. The change in real GDP

- 27. Nominal and Real GDP in the U.S., 1965-2005 Real GDP (base year 2000) Nominal GDP

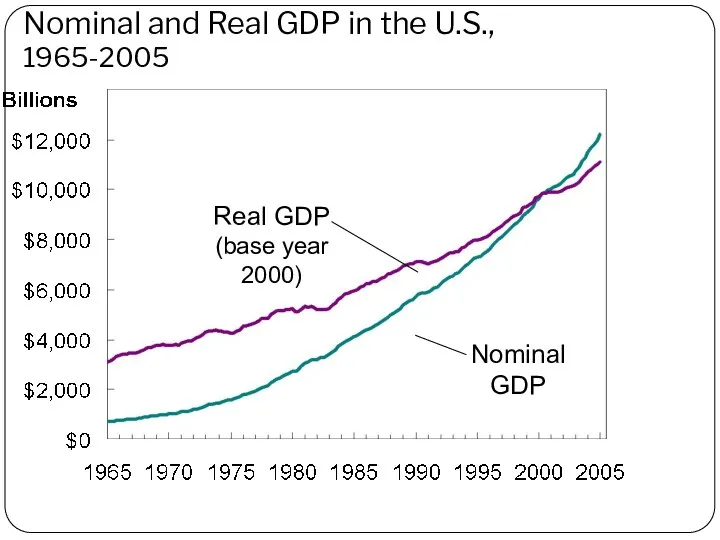

- 28. The GDP Deflator The GDP Deflator is a measure of the price level calculated as the

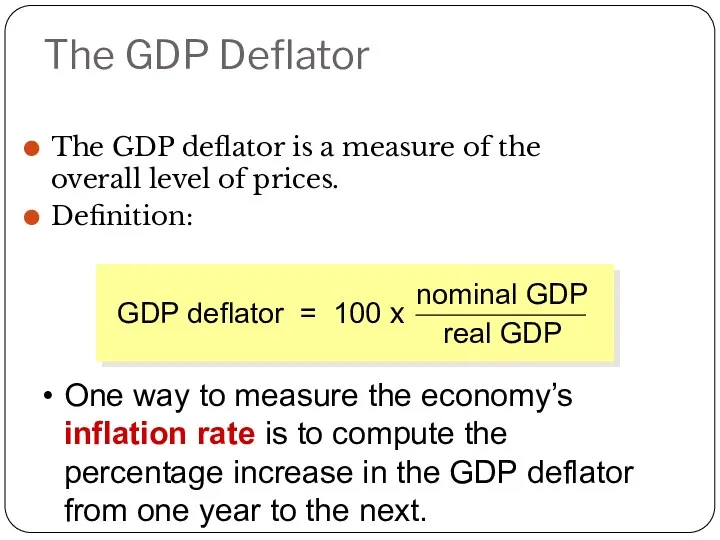

- 29. The GDP Deflator The GDP deflator is a measure of the overall level of prices. Definition:

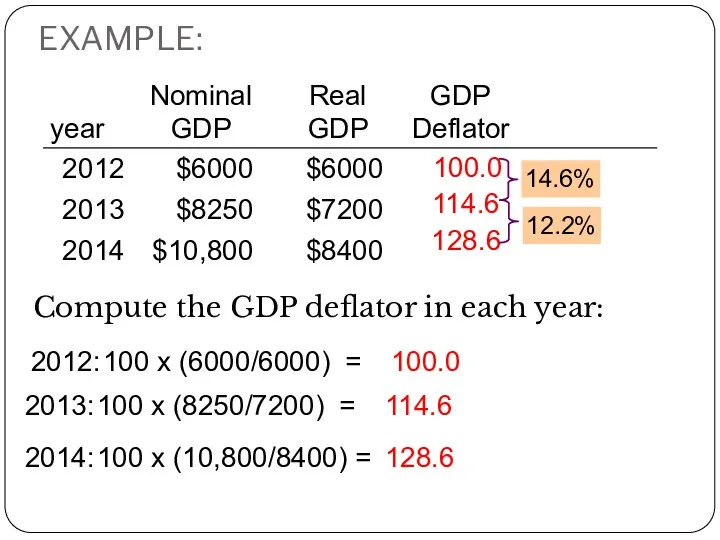

- 30. EXAMPLE: Compute the GDP deflator in each year:

- 31. The GDP Deflator Converting Nominal GDP to Real GDP Nominal GDP is converted to real GDP

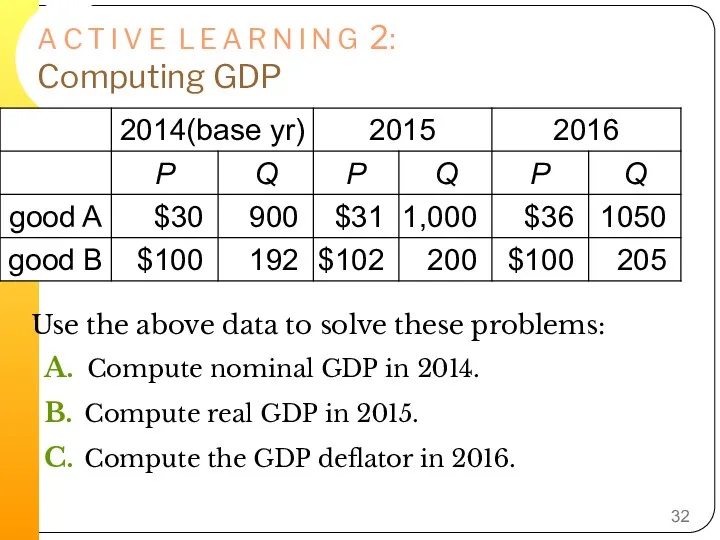

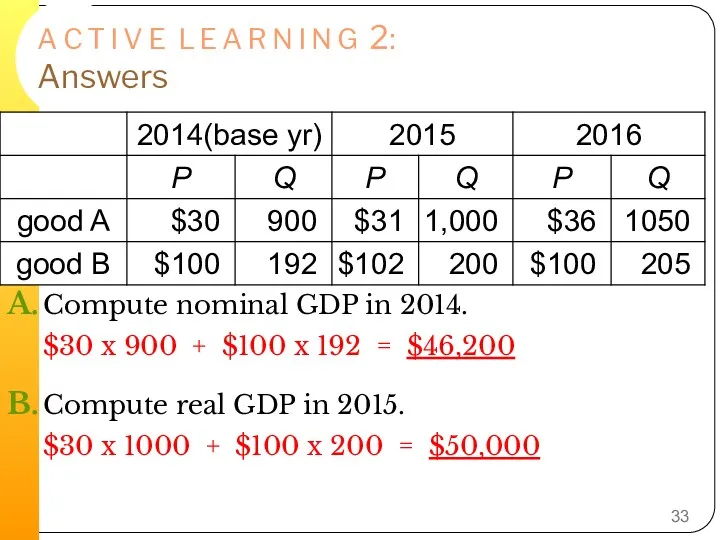

- 32. A C T I V E L E A R N I N G 2: Computing

- 33. A C T I V E L E A R N I N G 2: Answers

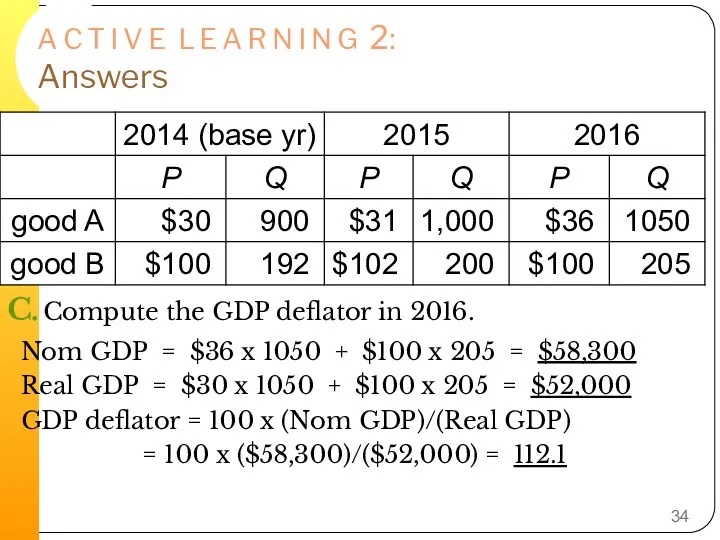

- 34. A C T I V E L E A R N I N G 2: Answers

- 35. GDP and Economic Well-being GDP is the best single measure of the economic well-being of a

- 36. GDP and Economic Well-Being Some things that contribute to well-being are not included in GDP The

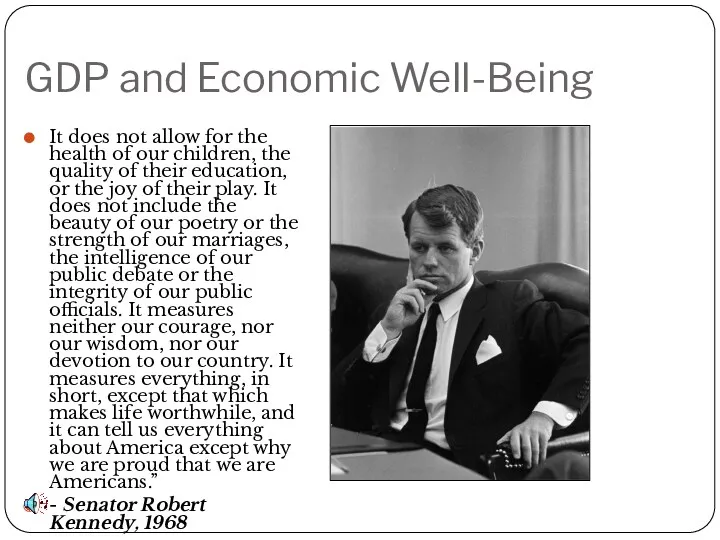

- 37. GDP and Economic Well-Being It does not allow for the health of our children, the quality

- 38. Then Why Do We Care About GDP? Having a large GDP enables a country to afford

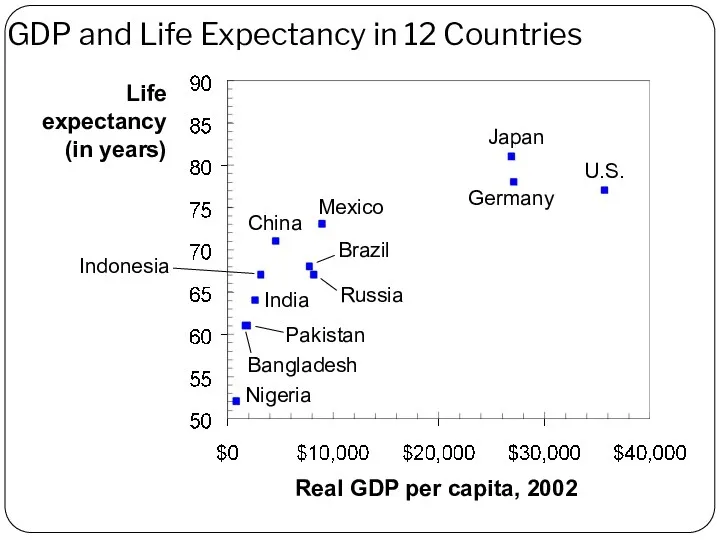

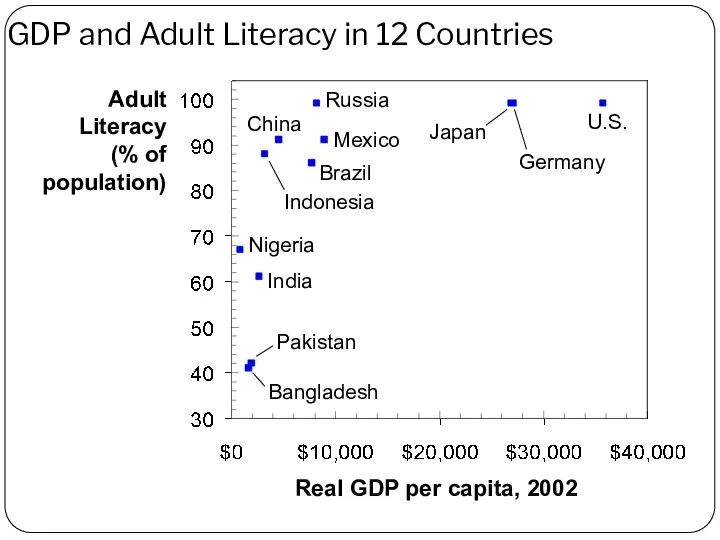

- 39. GDP and Life Expectancy in 12 Countries Life expectancy (in years) Real GDP per capita, 2002

- 40. GDP and Adult Literacy in 12 Countries Adult Literacy (% of population) Real GDP per capita,

- 41. Gross National Product (GNP) GNP is the total income earned by a nation’s permanent residents. Differs

- 42. Other Measures of Income Net national product (NNP) – is the total income earned by a

- 43. Other Measures of Income An economy in 2008 produced $500 billion worth of final goods and

- 44. Other Measures of Income National Income – the total income earned by a nation’s residents in

- 45. Income Approach GDP can also be calculated through three different income approaches: aggregate, national, and personal.

- 46. Production Approach The production approach is the total production of all firms or industries in the

- 47. Unemployment and its Natural Rate

- 48. Unemployment can be divided into two categories The economy’s natural rate of unemployment refers to the

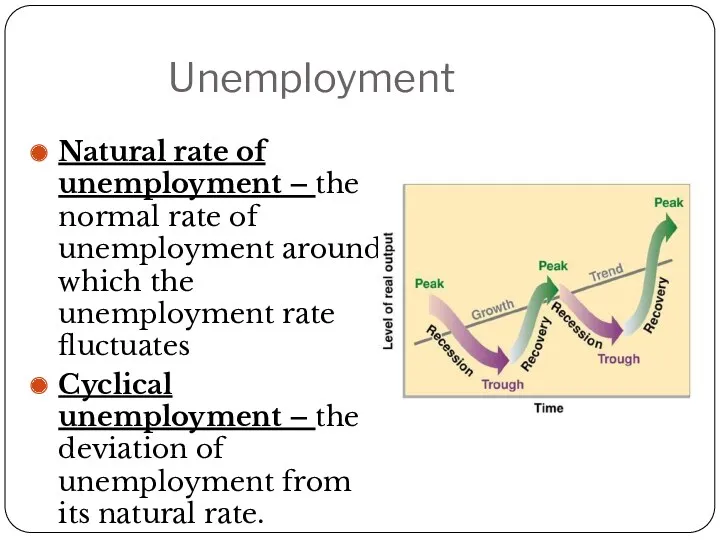

- 49. Identify Unemployment How is Unemployment Measured? The Bureau of Labor Statistics (BLS) surveys 60,000 households every

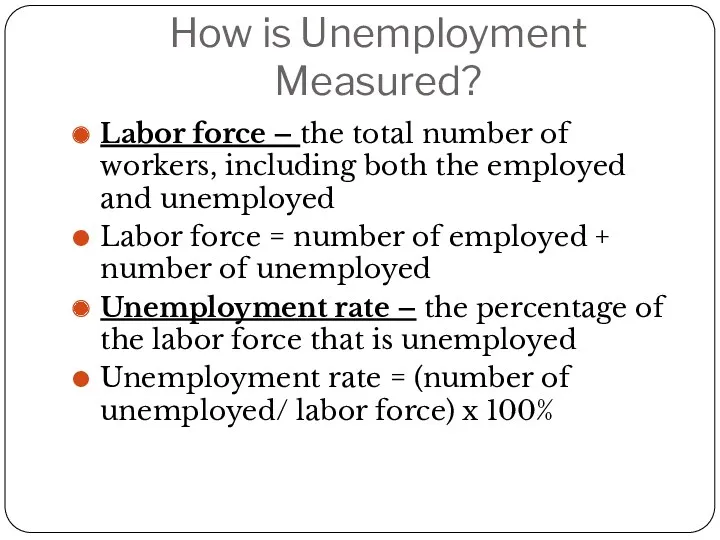

- 50. How is Unemployment Measured? Labor force – the total number of workers, including both the employed

- 51. How is Unemployment Measured? Labor – force participation rate – the percentage of the adult population

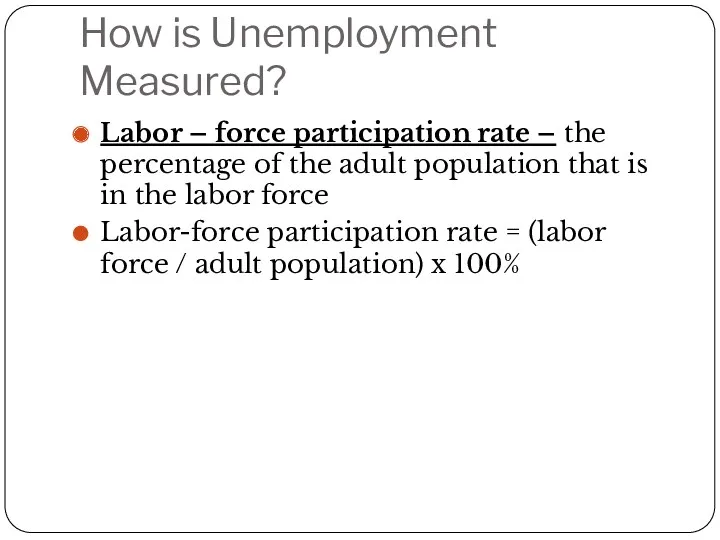

- 52. How is Unemployment Measured? Example: data from 2001. In that year, there were 135.1 million employed

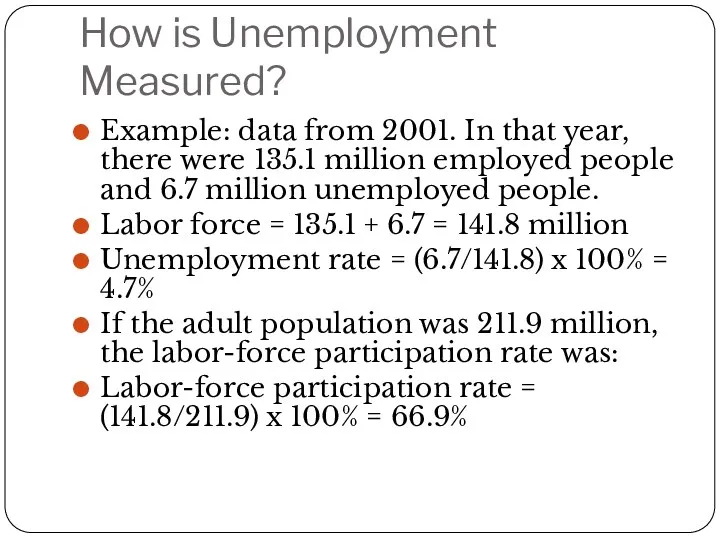

- 53. A C T I V E L E A R N I N G 1: Calculate

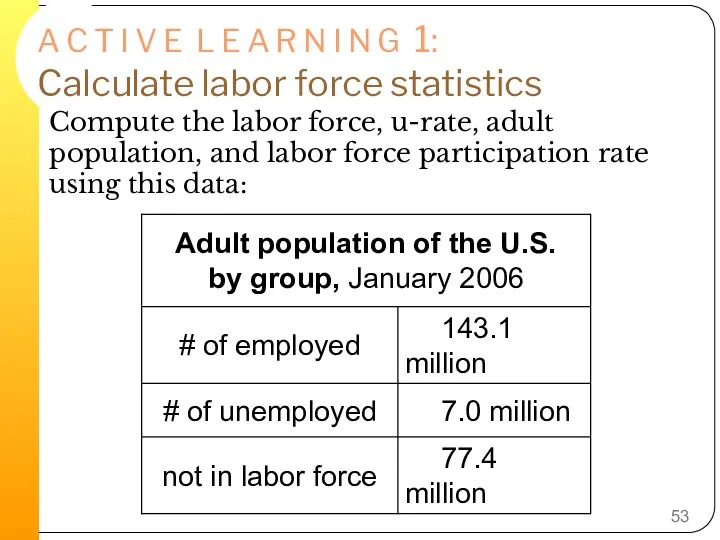

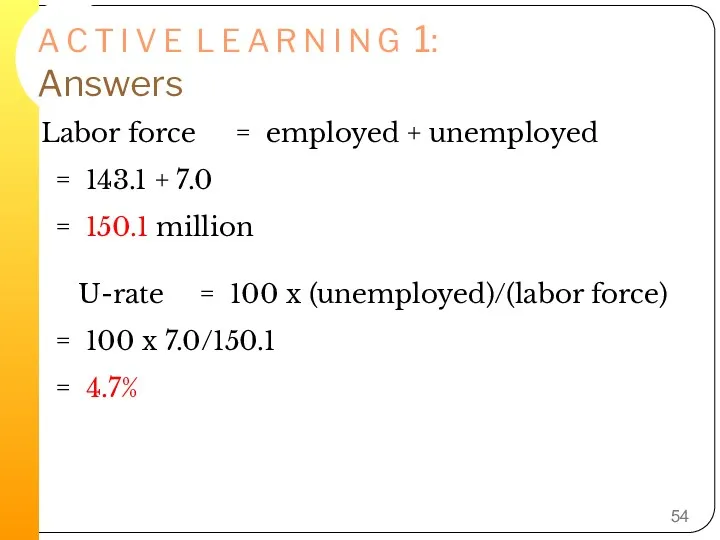

- 54. A C T I V E L E A R N I N G 1: Answers

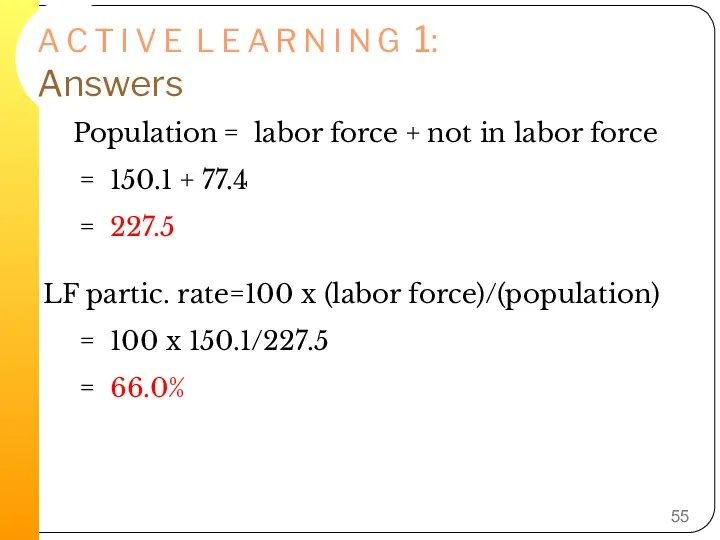

- 55. A C T I V E L E A R N I N G 1: Answers

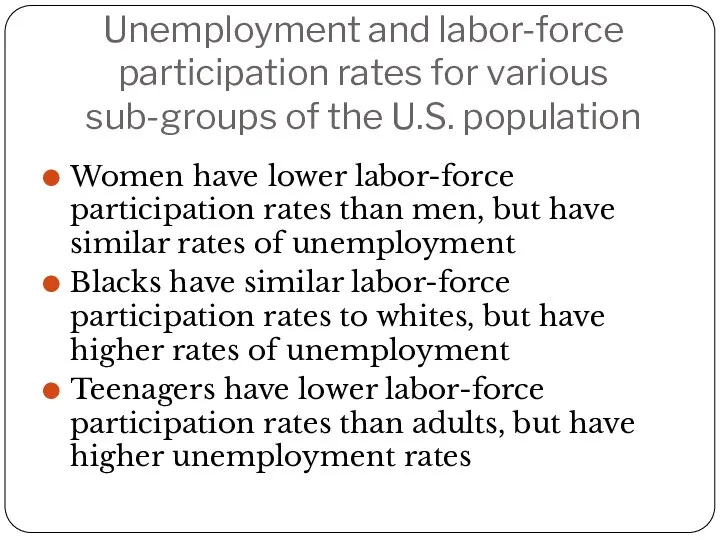

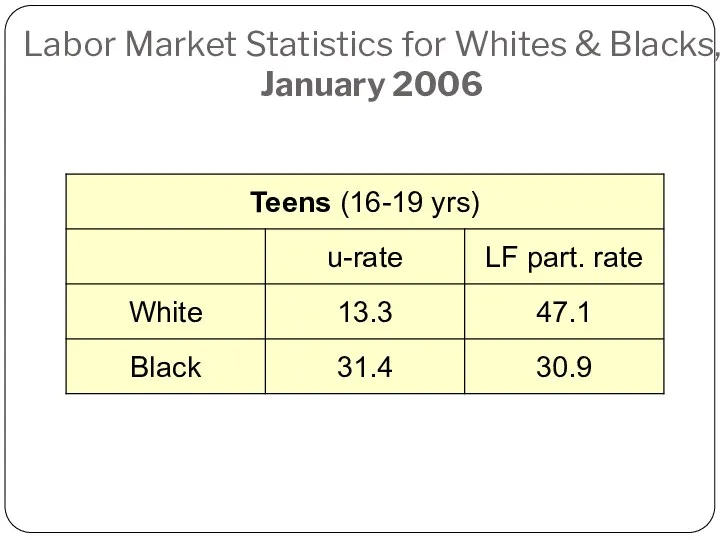

- 56. Unemployment and labor-force participation rates for various sub-groups of the U.S. population Women have lower labor-force

- 57. Labor Market Statistics for Whites & Blacks, January 2006

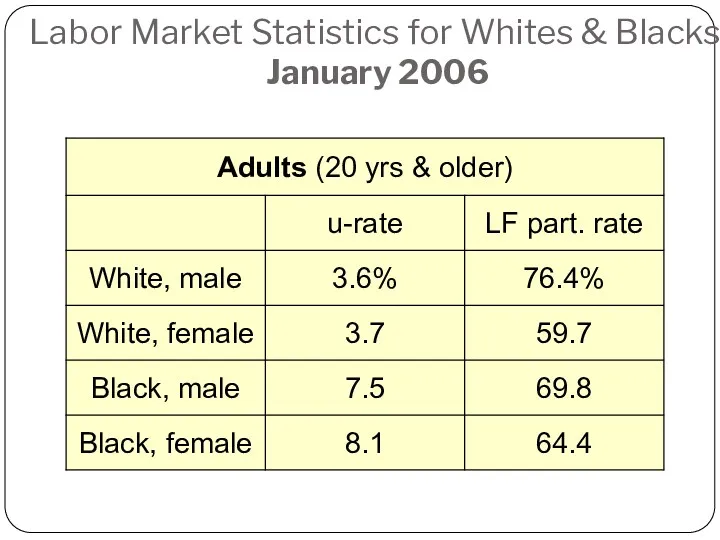

- 58. Labor Market Statistics for Whites & Blacks, January 2006

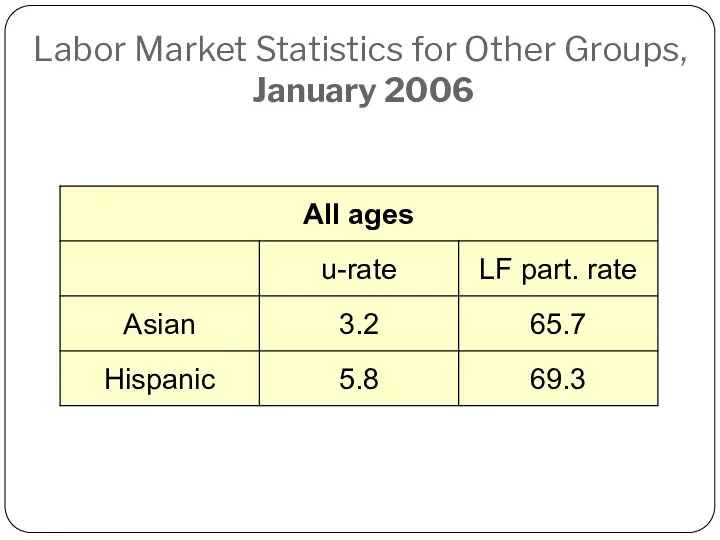

- 59. Labor Market Statistics for Other Groups, January 2006

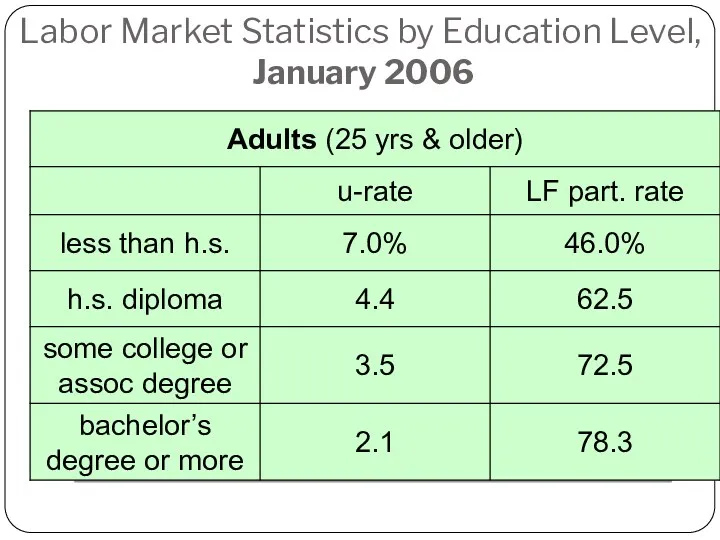

- 60. Labor Market Statistics by Education Level, January 2006

- 62. Unemployment Natural rate of unemployment – the normal rate of unemployment around which the unemployment rate

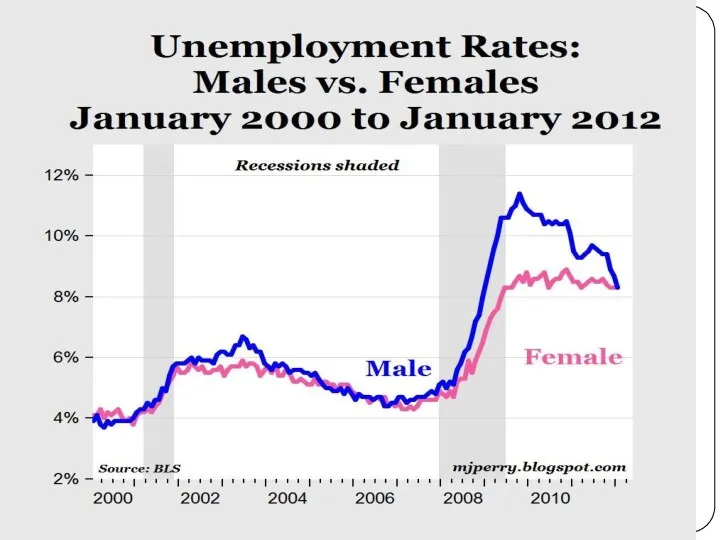

- 63. Case Study: Labor-Force Participation of Men and Women in the U.S. economy There has been a

- 64. Does the Unemployment Rate Measure What We Want It To? Measuring the unemployment rate is not

- 65. Does the Unemployment Rate Measure What We Want It To? There may be individuals who are

- 66. How Long are the Unemployed without work? Another important variable that policymakers may be concerned with

- 67. Why are there always People Unemployed? In an ideal labor market, wages would adjust so that

- 68. Types of Unemployment Frictional unemployment – unemployment that results because it takes time for workers to

- 69. Types of Unemployment Seasonal unemployment – the unemployment that arises because of seasonal weather patterns. Seasonal

- 70. Job Search Job search – the process by which workers find appropriate jobs given their tastes

- 71. Why some Frictional Unemployment is Inevitable? Frictional unemployment often occurs because of a change in the

- 72. Public Policy and Job Search Government programs can help to reduce the amount of frictional unemployment

- 73. Unemployment Insurance Unemployment insurance – a government program that partially protects workers’ incomes when they become

- 74. In the News: German Unemployment Unemployment benefits are much more generous in Germany than they are

- 75. Minimum-Wage Laws Unemployment can also occur because of minimum-wage laws The minimum wage is a price

- 76. Minimum-Wage Laws Anytime a wage is kept above the equilibrium level for any reason, the result

- 77. Unions and Collective Bargaining Union – a worker association that bargains with employers over wages and

- 78. The Economics of Union Collective bargaining – the process by which unions and firms agree on

- 79. The Economics of Unions This implies that unions raise the wage above the equilibrium wage, resulting

- 80. Are Unions Good or Bad for the Economy? Critics of unions argue that unions are a

- 81. The Theory of Efficiency Wages Efficiency wages – above-equilibrium wages paid by firms in order to

- 82. There are several reasons why a firm may pay efficiency wages. Worker Health Better paid workers

- 83. There are several reasons why a firm may pay efficiency wages. Worker Effort Again, if a

- 84. Case Study: Henry Ford and the Very Generous $5-A-Day Wage Henry Ford used a high wage

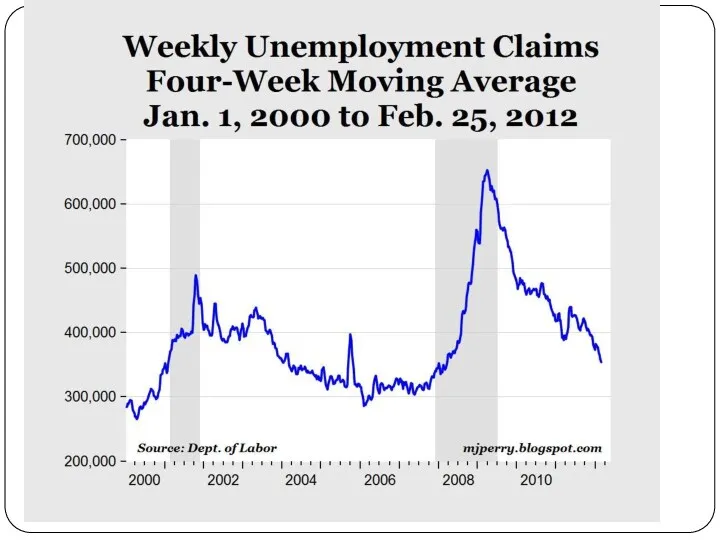

- 85. Unemployment High rates of unemployment can cause a personal loss of self-confidence, crime, the breakup of

- 87. Inflation and CPI

- 88. Consumer Price Index Consumer Price Index – (CPI) measure of the overall cost of the goods

- 89. How the Consumer Price Index is calculated 1) Fix the basket The Bureau of Labor Statistics

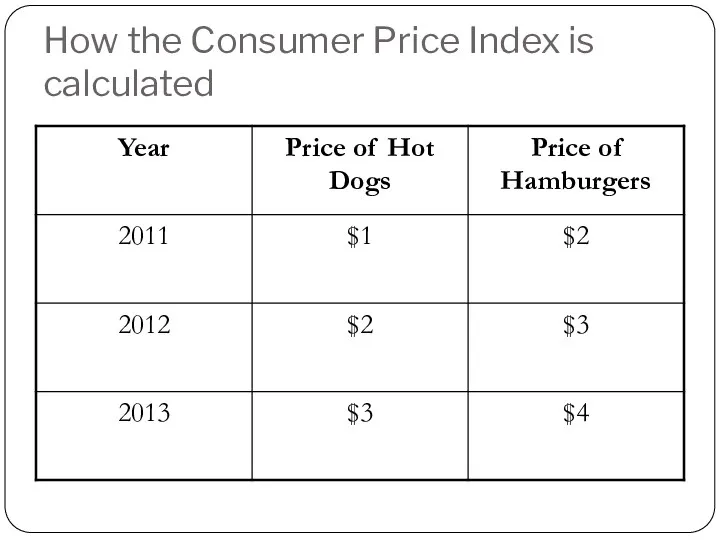

- 90. How the Consumer Price Index is calculated

- 91. How the Consumer Price Index is calculated 3) Compute the basket’s cost By keeping the basket

- 92. How the Consumer Price Index is calculated 4) Choose a base year and compute the index.

- 93. How the Consumer Price Index is calculated 5) Compute the inflation rate Inflation rate: the percentage

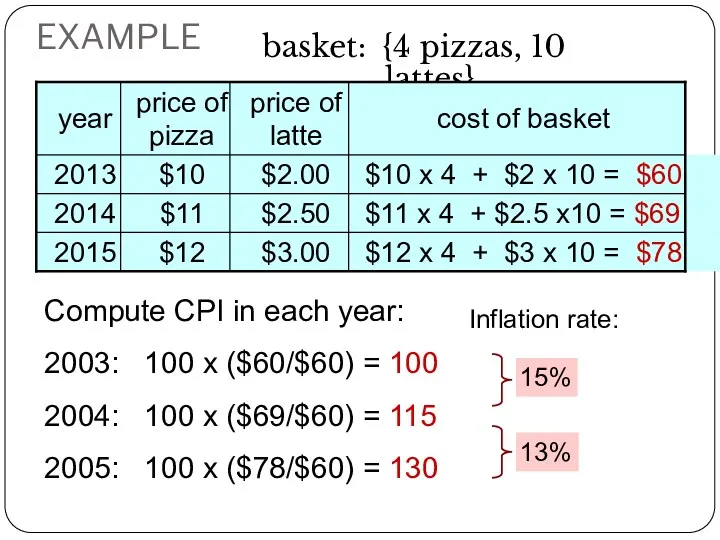

- 94. EXAMPLE basket: {4 pizzas, 10 lattes} $12 x 4 + $3 x 10 = $78 $11

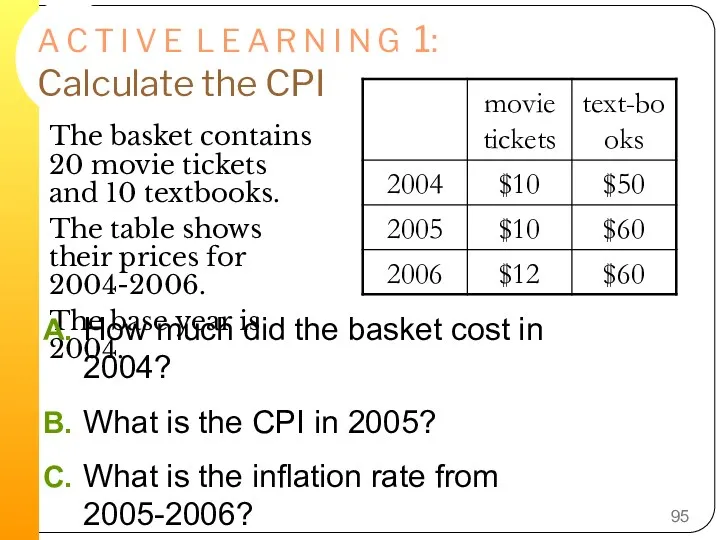

- 95. A C T I V E L E A R N I N G 1: Calculate

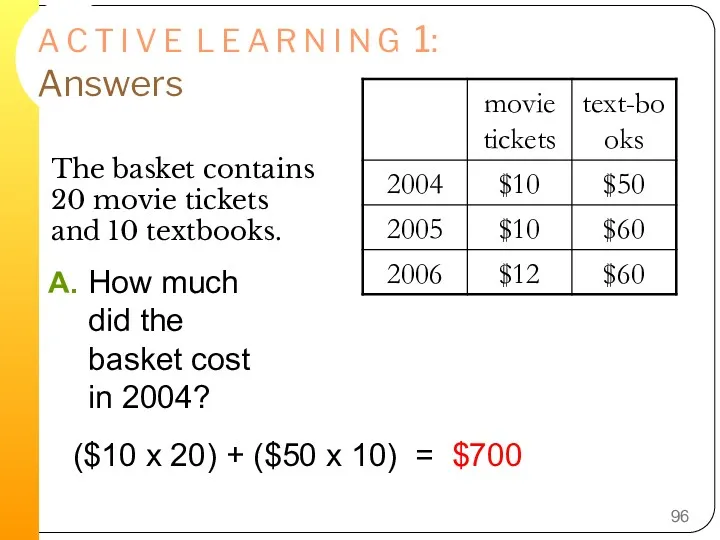

- 96. A C T I V E L E A R N I N G 1: Answers

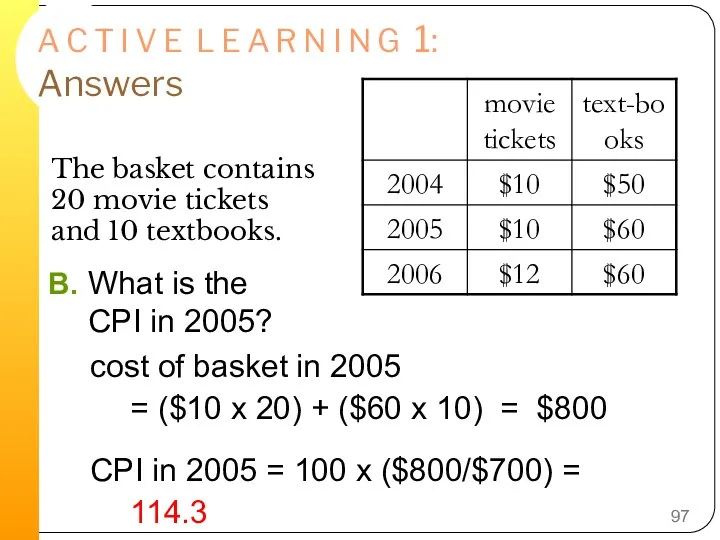

- 97. A C T I V E L E A R N I N G 1: Answers

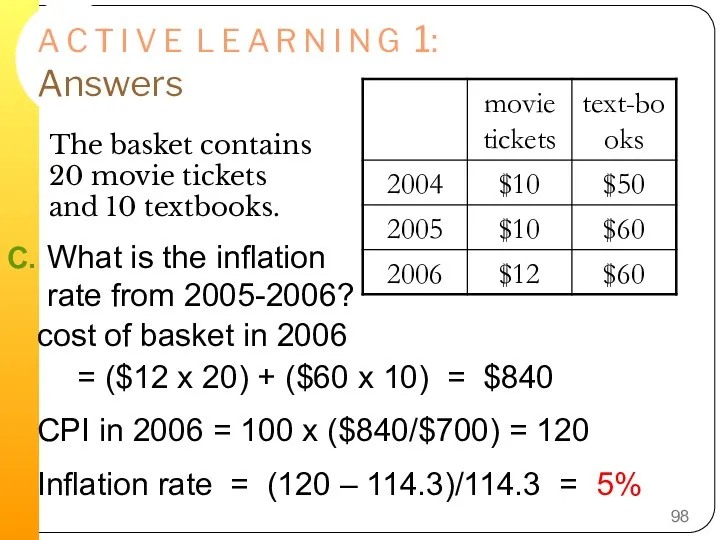

- 98. A C T I V E L E A R N I N G 1: Answers

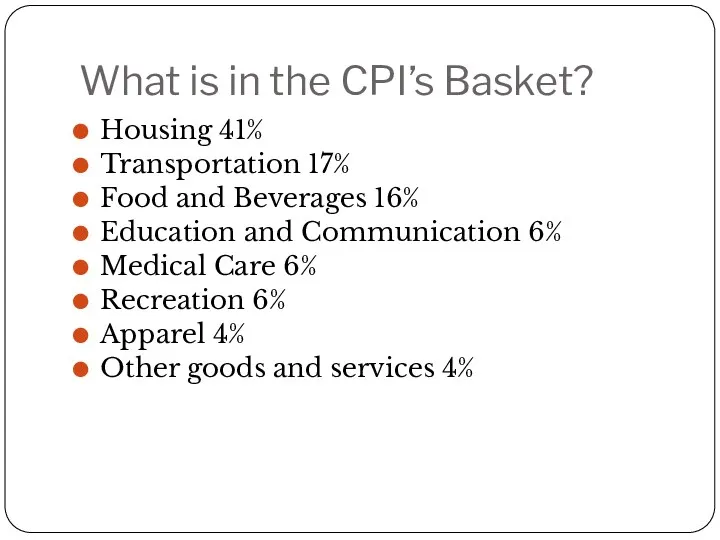

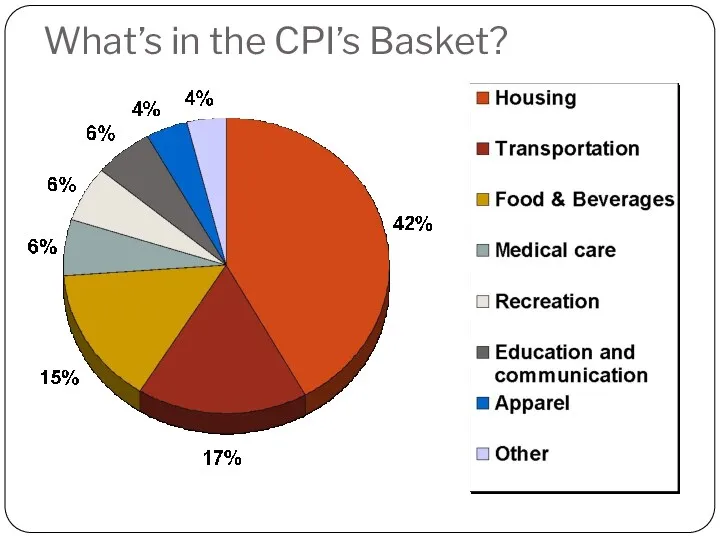

- 99. What is in the CPI’s Basket? Housing 41% Transportation 17% Food and Beverages 16% Education and

- 100. What’s in the CPI’s Basket?

- 101. In the News: Shopping for the CPI There are approximately 300 employees of the Bureau of

- 102. The Producer Price Index Producer Price Index – a measure of the cost of a basket

- 103. Problems in Measuring the Cost of Living Substitution Bias When the price of one good changes,

- 104. Problems in Measuring the Cost of Living Introduction of New Goods When a new good is

- 105. Problems in Measuring the Cost of Living Unmeasured Quality Change If the quality of a good

- 106. Problems in Measuring the Cost of Living The size of these problems is also difficult to

- 107. The GDP Deflator versus the Consumer Price Index The GDP Deflator reflects the prices of all

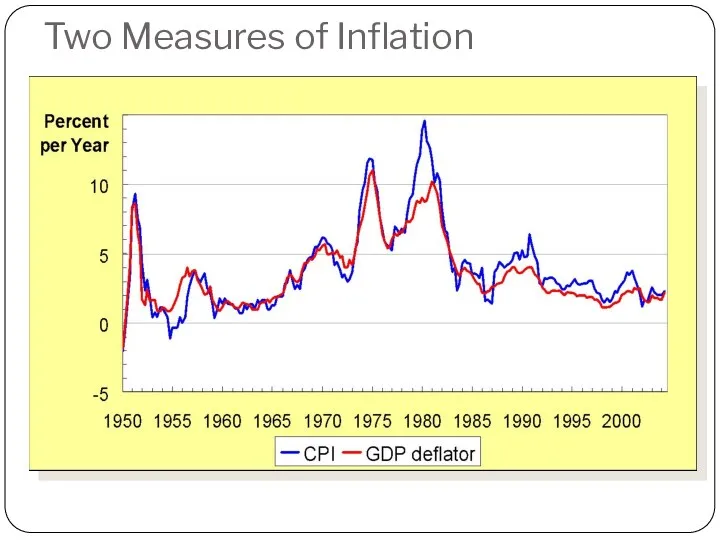

- 108. Two Measures of Inflation

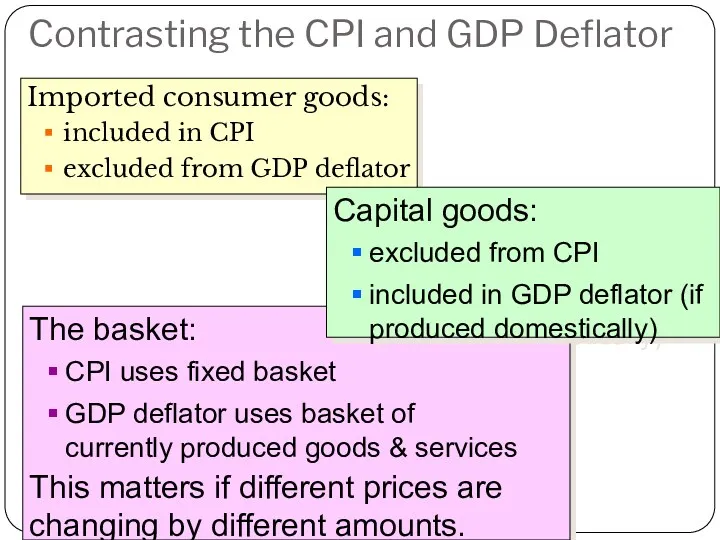

- 109. Contrasting the CPI and GDP Deflator Imported consumer goods: included in CPI excluded from GDP deflator

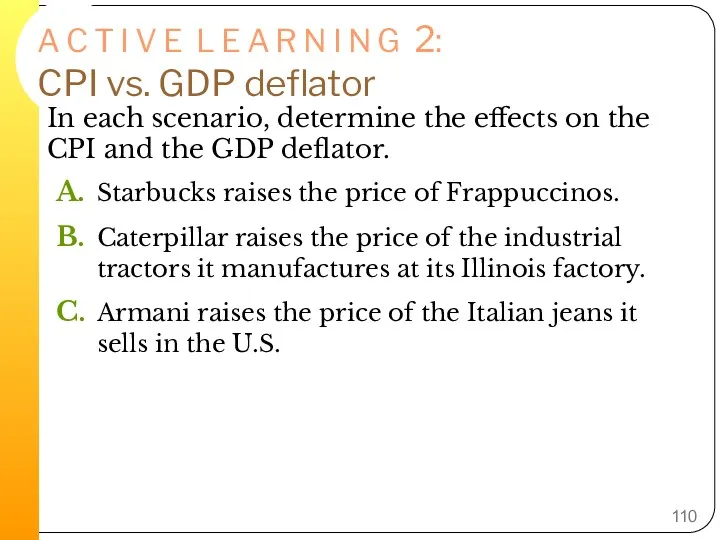

- 110. A C T I V E L E A R N I N G 2: CPI

- 111. A C T I V E L E A R N I N G 2: Answers

- 112. Correcting Economic Variables for the Effects of Inflation Inflation makes it harder to compare dollar amounts

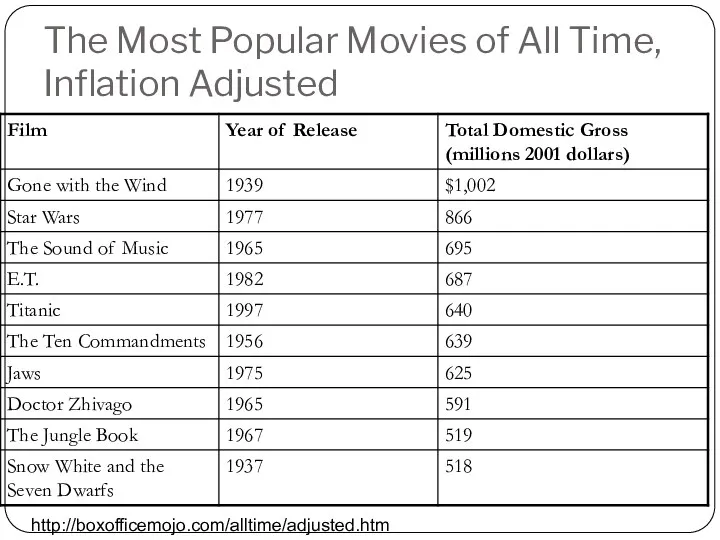

- 113. Mr. Index Goes to Hollywood Reports of box office success are often made in terms of

- 114. The Most Popular Movies of All Time, Inflation Adjusted http://boxofficemojo.com/alltime/adjusted.htm

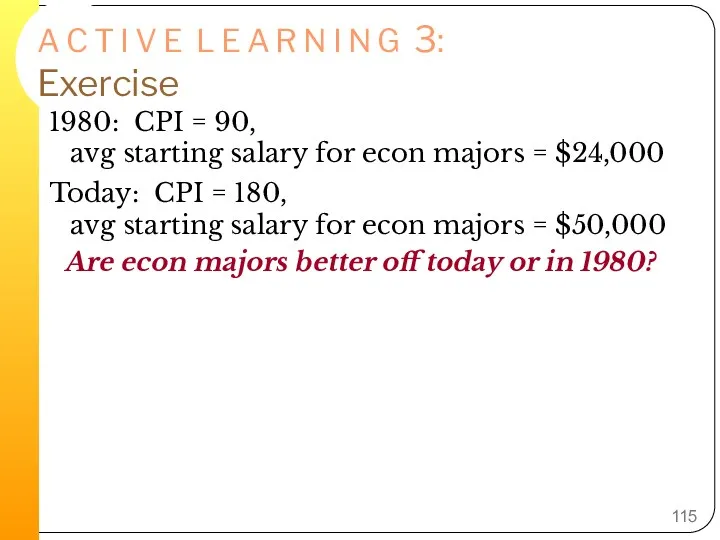

- 115. A C T I V E L E A R N I N G 3: Exercise

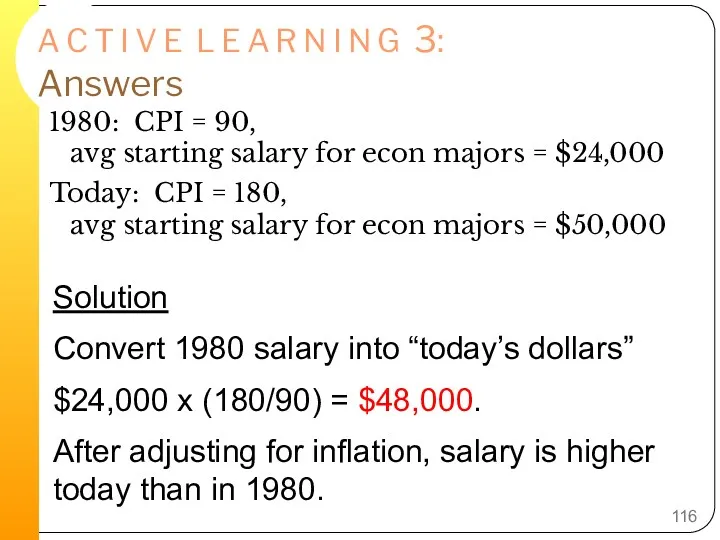

- 116. A C T I V E L E A R N I N G 3: Answers

- 117. Indexation Indexation – the automatic correction of a dollar amount for the effects of inflation by

- 118. Real And Nominal Interest Rates Nominal interest rate – the interest rate as usually reported without

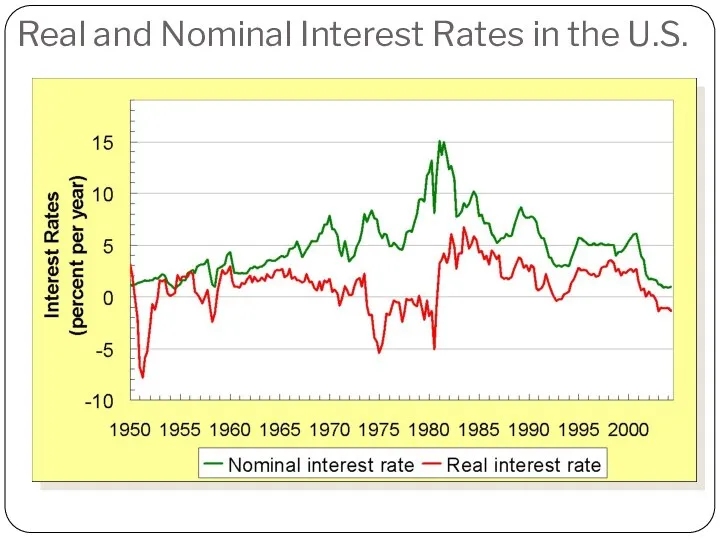

- 119. Real and Nominal Interest Rates in the U.S.

- 120. Nominal and Real Interest Rate Suppose a student has $100 in his savings account earning 3

- 122. Скачать презентацию

Спрос и предложение

Спрос и предложение Институциональная экономика. Лекция 9. Теория контрактов

Институциональная экономика. Лекция 9. Теория контрактов Преступления в сфере экономической деятельности. Тема 26

Преступления в сфере экономической деятельности. Тема 26 Фирмы в рыночной экономике

Фирмы в рыночной экономике Методическая разработка урока Лауреаты Нобелевской премии по экономике в 10 классе социально-экономического профиля

Методическая разработка урока Лауреаты Нобелевской премии по экономике в 10 классе социально-экономического профиля Инфляция (виды, причины и последствия)

Инфляция (виды, причины и последствия) Ресурсы хозяйствующих субъектов и эффективность их использования

Ресурсы хозяйствующих субъектов и эффективность их использования Ценовая политика предприятия

Ценовая политика предприятия Бизнес-модель, бюджет проекта и его экономические показатели

Бизнес-модель, бюджет проекта и его экономические показатели Лекция по мировой экономике

Лекция по мировой экономике Технология продажи

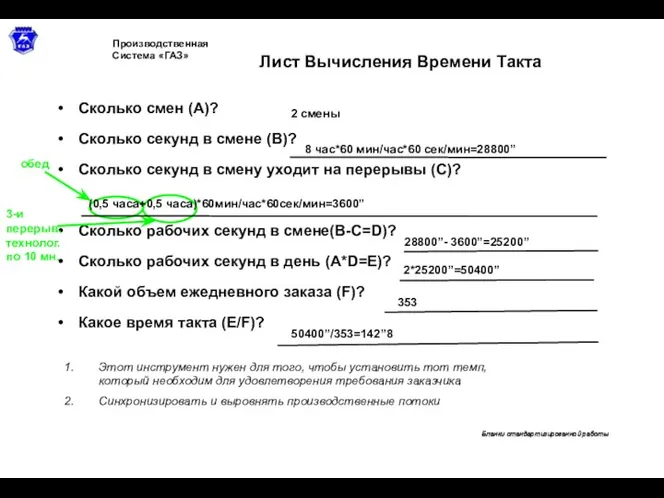

Технология продажи Лист вычисления времени такта

Лист вычисления времени такта Корпоративная социальная ответственность бизнеса в России и в Европе (на примере Google)

Корпоративная социальная ответственность бизнеса в России и в Европе (на примере Google) Экономика. Товары и услуги. Ресурсы и потребности. 9 класс

Экономика. Товары и услуги. Ресурсы и потребности. 9 класс Основы теории спроса и предложения

Основы теории спроса и предложения Издержки производства, доход и прибыль фирмы

Издержки производства, доход и прибыль фирмы Введение в экономическую теорию

Введение в экономическую теорию Мировое хозяйство в период НТР

Мировое хозяйство в период НТР Экономика Австралии

Экономика Австралии Экономика Турции

Экономика Турции Рынки факторов производства. Модуль 5

Рынки факторов производства. Модуль 5 Социальные факторы формирования заработной платы

Социальные факторы формирования заработной платы О социально-экономическом развитии Беломорского муниципального района по итогам 2021 года и задачах на 2022 год

О социально-экономическом развитии Беломорского муниципального района по итогам 2021 года и задачах на 2022 год Голодная планета

Голодная планета Экономические циклы. Безработица

Экономические циклы. Безработица Совокупный спрос и совокупное предложение

Совокупный спрос и совокупное предложение Проектирование агрегатного участка дилерского центра ООО Сфера KIA

Проектирование агрегатного участка дилерского центра ООО Сфера KIA Қазақстадағы шетел мұнай компанялары

Қазақстадағы шетел мұнай компанялары