Содержание

- 2. Course objectives preparing and understanding companies’ financial statements

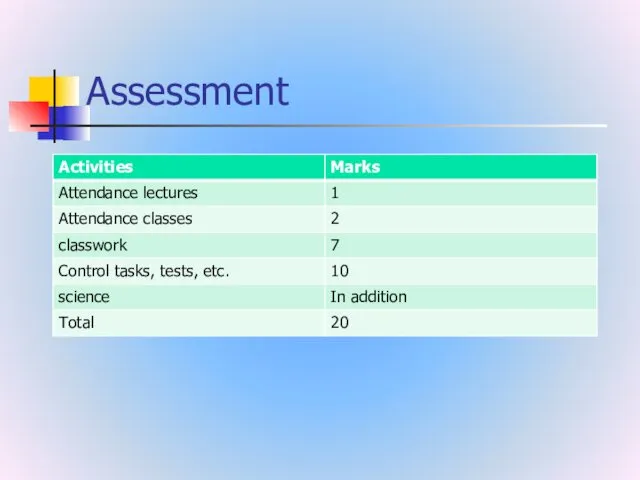

- 3. Assessment

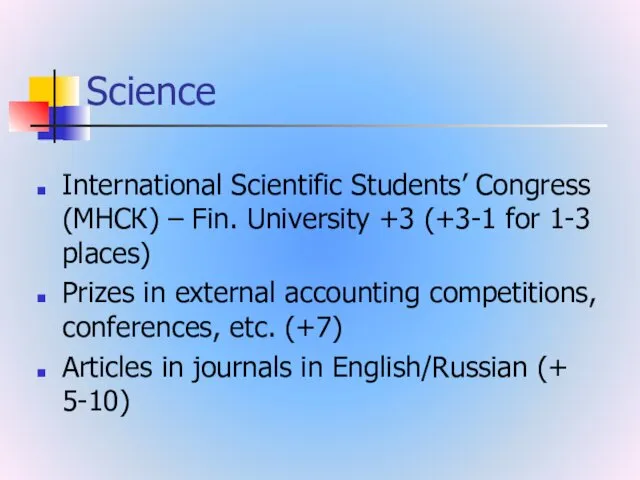

- 4. Science International Scientific Students’ Congress (МНСК) – Fin. University +3 (+3-1 for 1-3 places) Prizes in

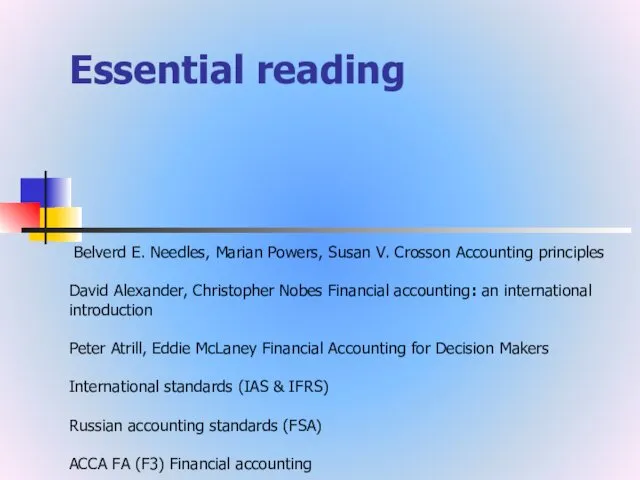

- 5. Essential reading Belverd E. Needles, Marian Powers, Susan V. Crosson Accounting principles David Alexander, Christopher Nobes

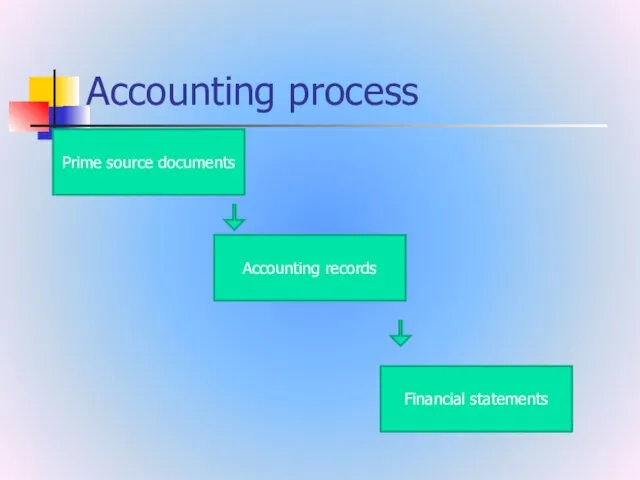

- 6. Accounting process Prime source documents Accounting records Financial statements

- 7. 1– Communications Through Financial Statements Identify the four financial statements

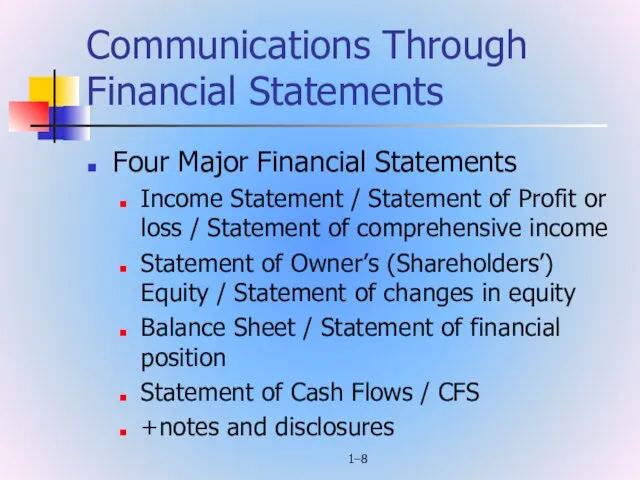

- 8. 1– Communications Through Financial Statements Four Major Financial Statements Income Statement / Statement of Profit or

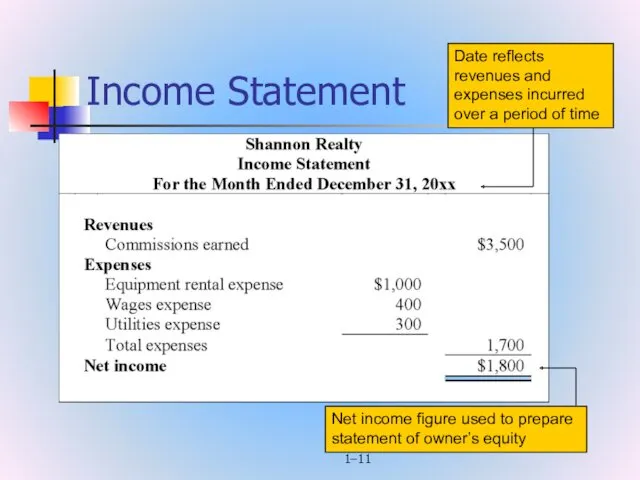

- 9. 1– Income Statement / P&L Summarizes revenues earned and expenses incurred over a period of time

- 10. 1– Income Statement (cont’d) Considered by many to be most important financial statement First financial statement

- 11. 1– Income Statement

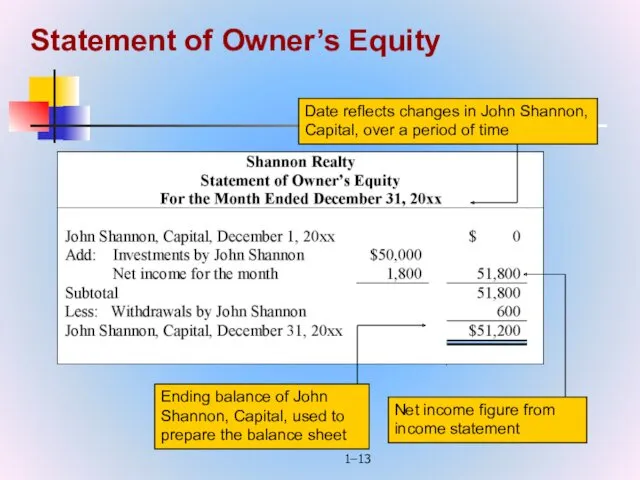

- 12. 1– Statement of Owner’s Equity Shows changes in owner’s equity over a period of time Dated

- 13. 1– Statement of Owner’s Equity

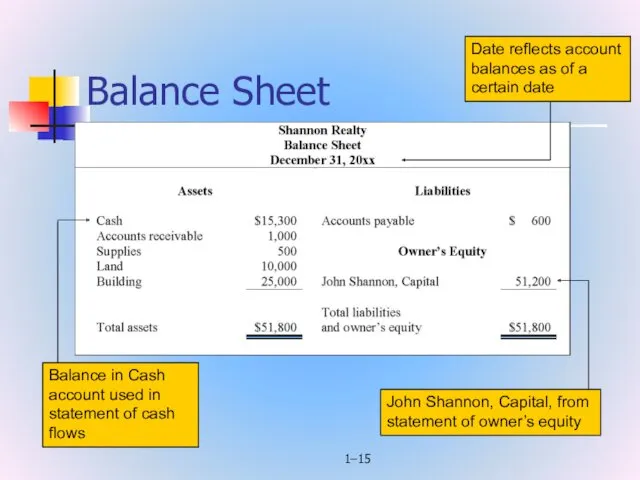

- 14. 1– Balance Sheet Shows the financial position of a company on a certain date Dated as

- 15. 1– Balance Sheet

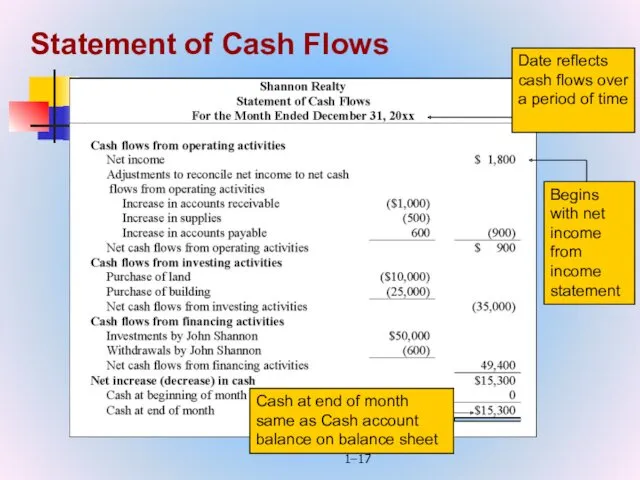

- 16. 1– Statement of Cash Flows Shows cash flows into and out of a business over a

- 17. 1– Statement of Cash Flows

- 18. 1– Discussion The balance sheet is often referred to as the statement of financial position. What

- 19. Towards a definition Accounting is a science as well as an art Accounting is concerned with

- 20. The American Institute of Certified Public Accountants: Accounting is the art of recording, classifying and summarizing

- 21. Accounting is the language of business (i) What he owns? (ii) What he owes? (iii) Whether

- 22. Decisions that users of accounting information make Economic (allocation of resources) Legal (management/stewardship)

- 23. A brief history stewardship function regular reports (financial reporting) accounting information is used to help make

- 24. The changing role of accounting Many businesses operate globally (different regulators, need for common set of

- 25. The functions of accounting Information for decisions Classification Measurement Stewardship Recording Monitoring and control Performance evaluation

- 26. Users of accounting information external internal

- 27. Common needs of most users (a) to decide when to buy, hold or sell an equity

- 28. Investors information to help them determine whether they should buy, hold or sell assess the ability

- 29. Employees stability and profitability of their employers ability of the entity to provide remuneration, retirement benefits

- 30. Lenders whether their loans, and the interest attaching to them, will be paid when due

- 31. Suppliers and other trade creditors determine whether amounts owing to them will be paid when due

- 32. Customers continuance of an entity, especially when they have a long-term involvement with, or are dependent

- 33. Governments and their agencies allocation of resources and, therefore, the activities of entities information in order

- 34. Public substantial contribution to the local economy trends and recent developments in the prosperity of the

- 35. Management interested in every aspect of accounting as their uses are diverse for different purposes interested

- 36. BOOK-KEEPING AND ACCOUNTANCY Book-keeping is the art of recording business transactions in a set of books

- 37. The functions of an accountant (i) Examination of entries made in the books of accounts (ii)

- 38. Accounting Financial Management Tax Cost Environmental Sustainability …

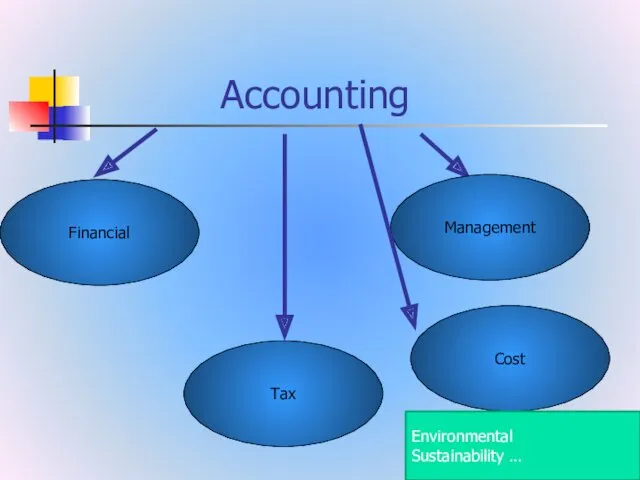

- 39. A comparison of financial accounting and management accounting

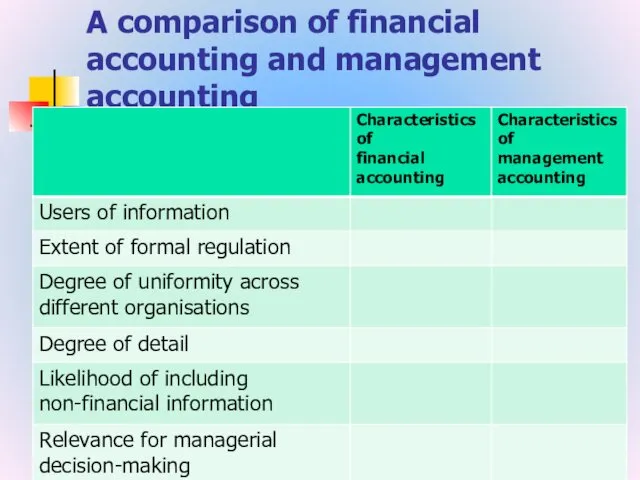

- 40. Accounting principles the rules based on assumptions, customs, usages and traditions for recording transactions Accounting principles

- 41. Need for Regulation Relevant&reliable information Comparability Fair information

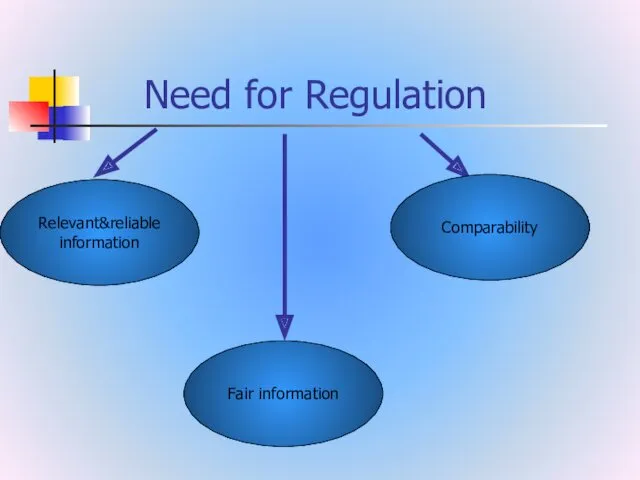

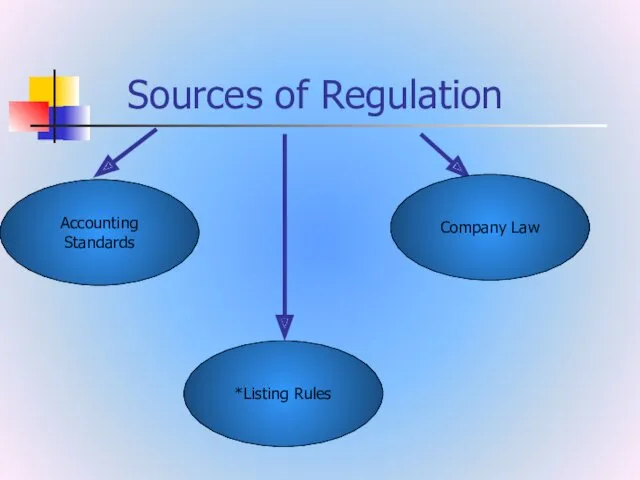

- 42. Sources of Regulation Accounting Standards Company Law *Listing Rules

- 43. GAAP International National IAS IFRS UK GAAP US GAAP

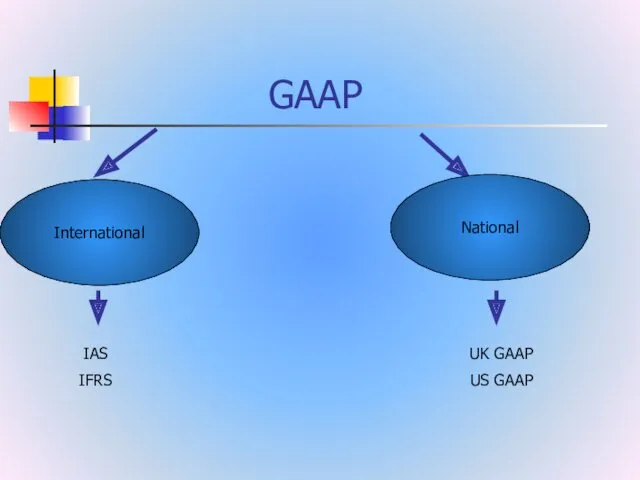

- 44. IASB IFRS IAS Conceptual Framework for Financial Reporting IFRIC SIC issued before 2001

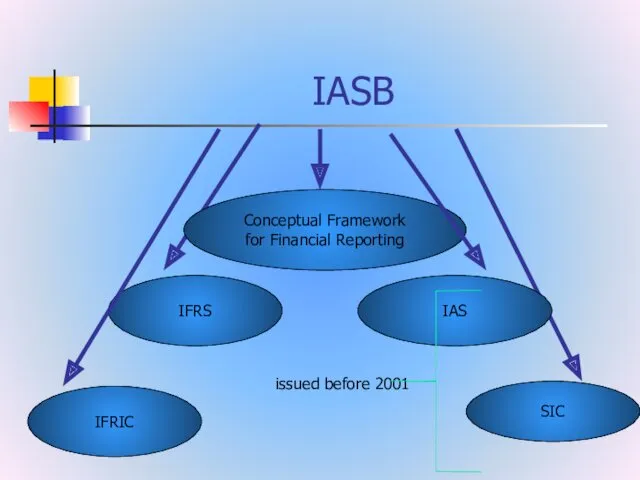

- 45. IASB www.ifrs.org The mission To develop IFRS Standards that bring transparency, accountability and efficiency to financial

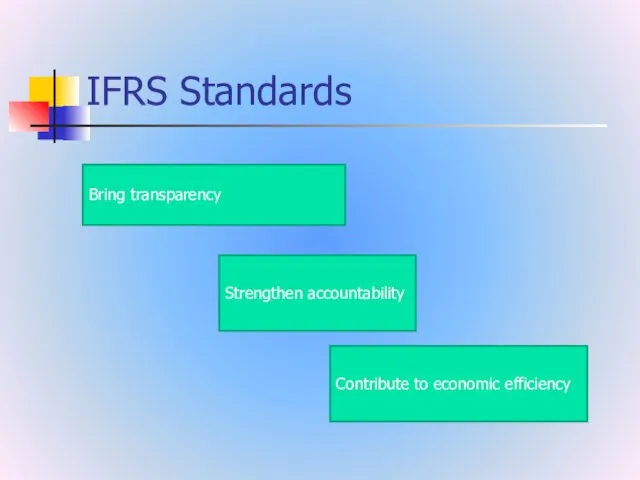

- 46. IFRS Standards Strengthen accountability Bring transparency Contribute to economic efficiency

- 47. The Need for a Conceptual Framework To develop a coherent set of standards and rules To

- 48. Purpose of the Conceptual Framework (a) to assist the Board in the development of future IFRSs

- 49. The Conceptual Framework deals with: (a) the objective of financial reporting; (b) the qualitative characteristics of

- 50. Concepts that underlie the preparation and presentation of financial statement Underlying assumptions Qualitative characteristics Elements of

- 51. The qualitative characteristics identify the types of information that are likely to be most useful to

- 52. Qualitative characteristics of financial statements Relevance Faithful representation Materiality complete neutral free from error

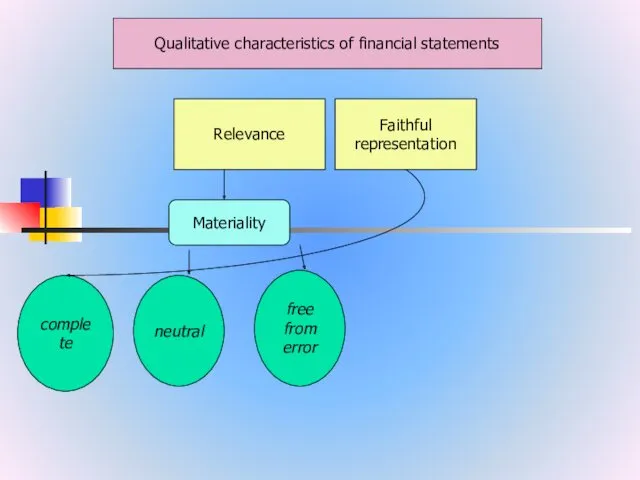

- 53. Relevance Relevant financial information is capable of making a difference in the decisions made by users.

- 54. Faithful representation financial information must faithfully represent the phenomena that it purports to represent

- 55. complete A complete depiction includes all information necessary for a user to understand the phenomenon being

- 56. neutral A neutral depiction is without bias in the selection or presentation of financial information

- 57. free from error there are no errors or omissions in the description of the phenomenon, and

- 58. Process for applying the fundamental qualitative characteristics 1. identify an economic phenomenon that has the potential

- 59. Enhancing qualitative characteristics of financial statements Understandability Verifiability Timeliness Comparability

- 60. Comparability enables users to identify and understand similarities in, and differences among, items Consistency

- 61. Verifiability different knowledgeable and independent observers could reach consensus, although not necessarily complete agreement, that a

- 62. Timeliness having information available to decision-makers in time to be capable of influencing their decisions

- 63. Understandability Classifying, characterising and presenting information clearly and concisely makes it understandable

- 64. The cost constraint on useful financial reporting Providers of financial information - collecting, processing, verifying and

- 65. Underlying assumption The financial statements are normally prepared on the assumption that an entity is a

- 66. Accrual basis Effects of transactions and other events are recognised when they occur (and not as

- 67. 1– Money Measurement Recording of all business transactions in terms of money Money is the only

- 68. 1– Money Measure (cont’d) Exchange Rate The value of one currency in terms of another Changes

- 69. 1– Separate Entity A business is distinct from its Owner(s) Creditors Customers Its financial records and

- 70. The elements of financial statements Assets Liabilities Equity financial position

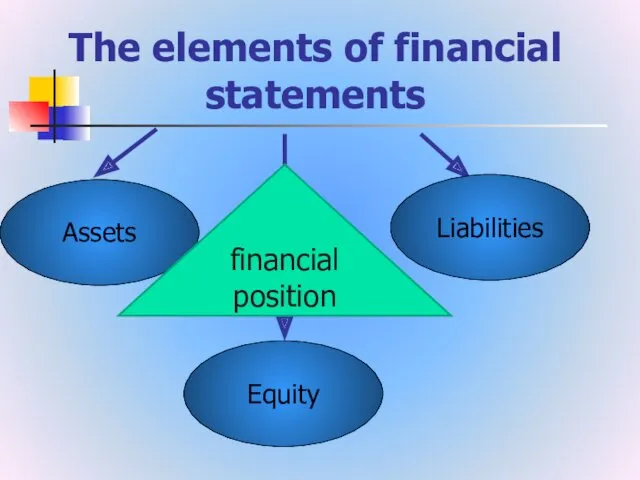

- 71. Profit Income Expenses Performance

- 72. Recognition of the elements of financial statements The probability of future economic benefit Reliability of measurement

- 73. Measurement of the elements of financial statements Historical cost Current cost Realisable (settlement) value Present value

- 74. Concepts of capital financial concept physical concept

- 76. Скачать презентацию

Тәуекелділік және табыстылық

Тәуекелділік және табыстылық ВКР: Финансовое состояние как фактор обеспечения экономической безопасности организации

ВКР: Финансовое состояние как фактор обеспечения экономической безопасности организации Учет основных средств в 2023 году

Учет основных средств в 2023 году История возникновения денег

История возникновения денег Світовий ринок робочої сили. Міжнародна міграція робочої сили (Тема 7, Тема 8)

Світовий ринок робочої сили. Міжнародна міграція робочої сили (Тема 7, Тема 8) Фінансовий аналіз діяльності комерційних банків

Фінансовий аналіз діяльності комерційних банків Деньги и денежный оборот

Деньги и денежный оборот Лизинг как форма финансирования капитальных вложений (на примере ООО Мир у дачи)

Лизинг как форма финансирования капитальных вложений (на примере ООО Мир у дачи) Содействие повышению уровня финансовой грамотности населения и развитию финансового образования в РФ в Республике Татарстан

Содействие повышению уровня финансовой грамотности населения и развитию финансового образования в РФ в Республике Татарстан Анализ финансового состояния компании. (Лекция 3)

Анализ финансового состояния компании. (Лекция 3) Налог на доходы физических лиц

Налог на доходы физических лиц Совершенствование системы оплаты труда персонала на примере ООО Промтехэнерго

Совершенствование системы оплаты труда персонала на примере ООО Промтехэнерго Финансовый контроль

Финансовый контроль Прием подраздела 1.2. Сведения о страховом стаже формы ЕФС-1

Прием подраздела 1.2. Сведения о страховом стаже формы ЕФС-1 Деятельность Фонда социального страхования

Деятельность Фонда социального страхования Формирование финансовой грамотности

Формирование финансовой грамотности Анализ финансового состояния предприятия

Анализ финансового состояния предприятия Деятельность администрации города Апатиты для создания благоприятных условий для развития малого и среднего предпринимательства

Деятельность администрации города Апатиты для создания благоприятных условий для развития малого и среднего предпринимательства Отчет о работе фонда социальной поддержки населения города Урень (РАСТЕМ ВМЕСТЕ)

Отчет о работе фонда социальной поддержки населения города Урень (РАСТЕМ ВМЕСТЕ) Система MyAdvertisingPays

Система MyAdvertisingPays The equity. Implications of taxation. Tax incidence. (Lecture 11-19)

The equity. Implications of taxation. Tax incidence. (Lecture 11-19) Учет и анализ денежных средств в ООО НПК Механика Сервис

Учет и анализ денежных средств в ООО НПК Механика Сервис Франшиза. Франшайзиинг. Патент. Сертификация. Ноу хау. Лицензия

Франшиза. Франшайзиинг. Патент. Сертификация. Ноу хау. Лицензия Еңбекақы бойынша жұмысшылармен және бюджетпен есеп айырысу есебін ұйымдастыру

Еңбекақы бойынша жұмысшылармен және бюджетпен есеп айырысу есебін ұйымдастыру Технологія складання бізнес-плану

Технологія складання бізнес-плану Доходность и риск финансовой операции

Доходность и риск финансовой операции Правове регулювання валютних операцій

Правове регулювання валютних операцій О мерах социальной поддержки семей с детьми

О мерах социальной поддержки семей с детьми