Содержание

- 2. Overview 26/04/2016 Slide Macro-prudential oversight in Germany - European context - Implementation of the macroprudential mandate

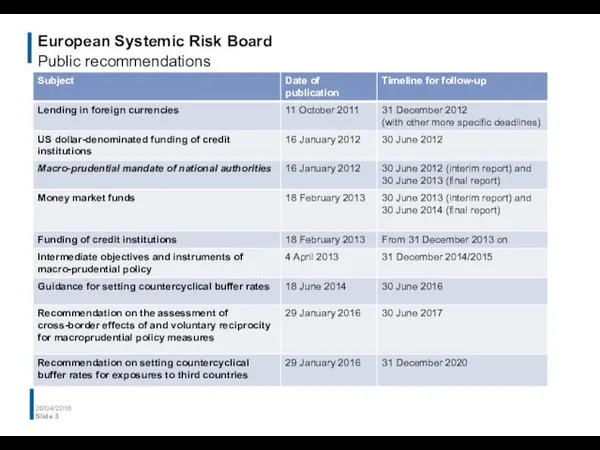

- 3. European Systemic Risk Board Public recommendations 26/04/2016 Slide

- 4. European Systemic Risk Board Recommendation on macroprudential mandate of national authorities EU Member States should bestow

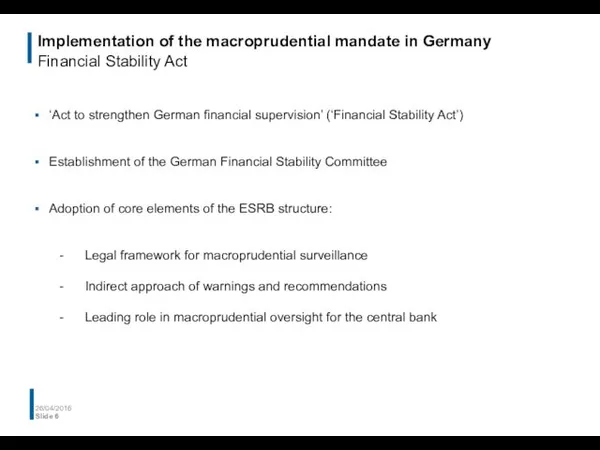

- 5. Implementation of the macroprudential mandate in Germany Financial Stability Act Implementation of the ESRB /2011/3 recommendation

- 6. Implementation of the macroprudential mandate in Germany Financial Stability Act ‘Act to strengthen German financial supervision’

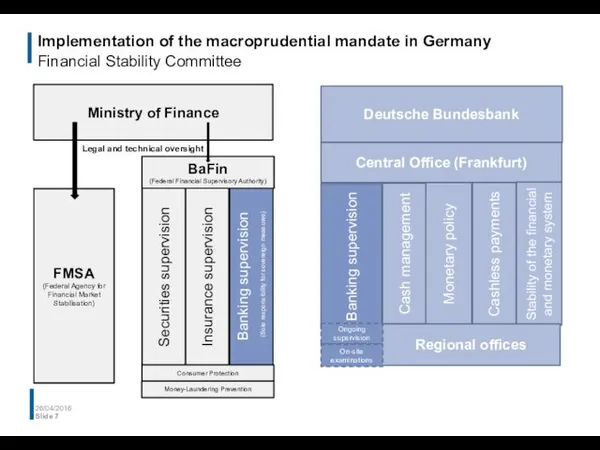

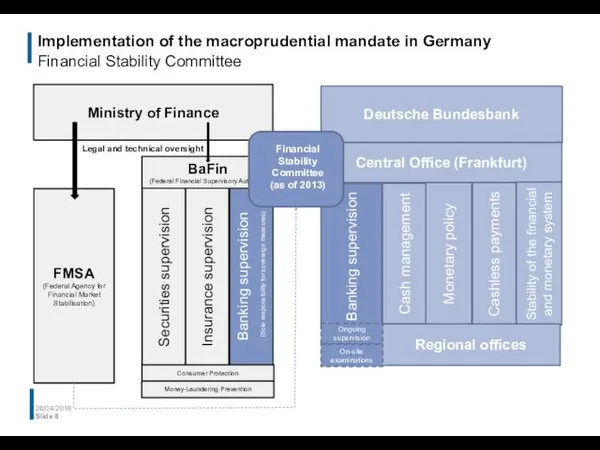

- 7. Implementation of the macroprudential mandate in Germany Financial Stability Committee 26/04/2016 Slide Deutsche Bundesbank Central Office

- 8. Implementation of the macroprudential mandate in Germany Financial Stability Committee 26/04/2016 Slide Deutsche Bundesbank Central Office

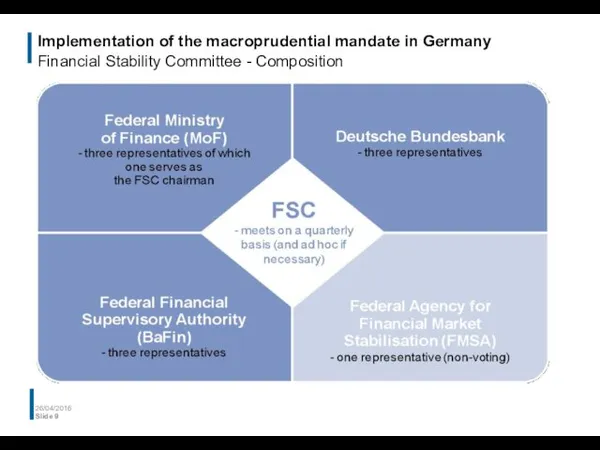

- 9. Implementation of the macroprudential mandate in Germany Financial Stability Committee - Composition 26/04/2016 Slide

- 10. Implementation of the macroprudential mandate in Germany Financial Stability Committee - Objectives Strengthening German financial supervision

- 11. Implementation of the macroprudential mandate in Germany Financial Stability Committee - Role of the Deutsche Bundesbank

- 12. Implementation of the macroprudential mandate in Germany Financial Stability Committee - Role of the Deutsche Bundesbank

- 13. Implementation of the macroprudential mandate in Germany Financial Stability Committee - Role of the Deutsche Bundesbank

- 14. Overview 26/04/2016 Slide Macro-prudential oversight in Germany - European context - Implementation of the macroprudential mandate

- 15. Financial Stability Committee in Germany 2nd Report (30 June 2015): Stability situation in German financial system

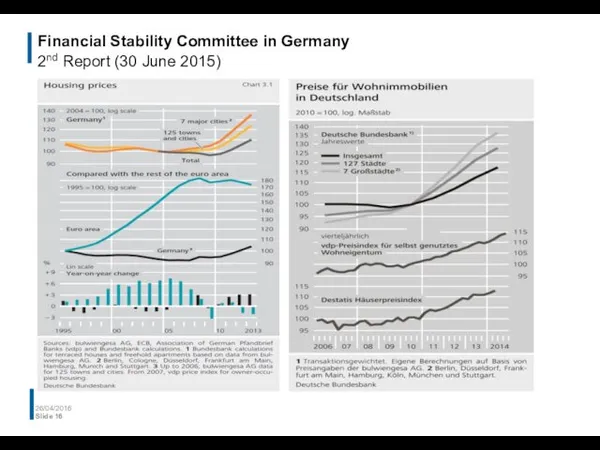

- 16. Financial Stability Committee in Germany 2nd Report (30 June 2015) 26/04/2016 Slide

- 17. Financial Stability Committee in Germany Recommendation to the Federal Government (as of 30 June 2015) A:

- 18. Overview 26/04/2016 Slide Macro-prudential oversight in Germany - European context - Implementation of the macroprudential mandate

- 19. Organisational developments in financial stability From a cross-departmental committee approach in 2003… 26/04/2016 Slide Financial Stability

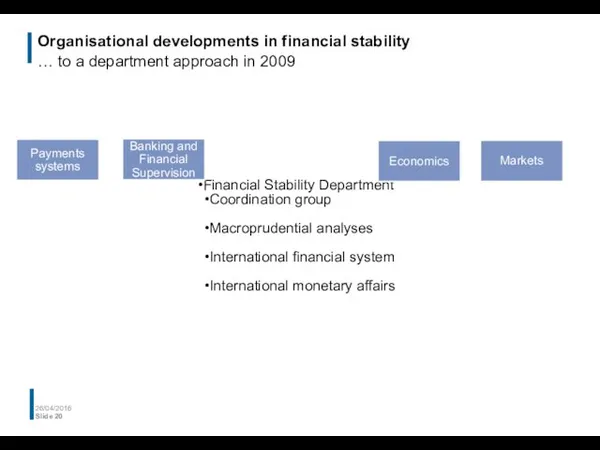

- 20. Organisational developments in financial stability … to a department approach in 2009 26/04/2016 Slide Financial Stability

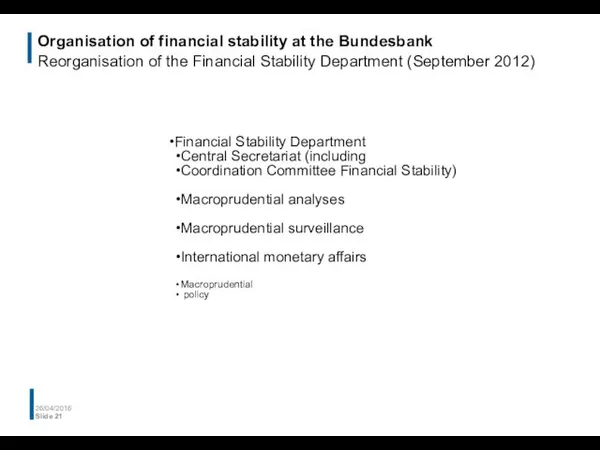

- 21. Organisation of financial stability at the Bundesbank Reorganisation of the Financial Stability Department (September 2012) 26/04/2016

- 22. Organisation of financial stability at the Bundesbank Reorganisation of the Financial Stability Department (September 2012) 26/04/2016

- 23. Organisation of financial stability at the Bundesbank Reorganisation of the Financial Stability Department (January 2016) 26/04/2016

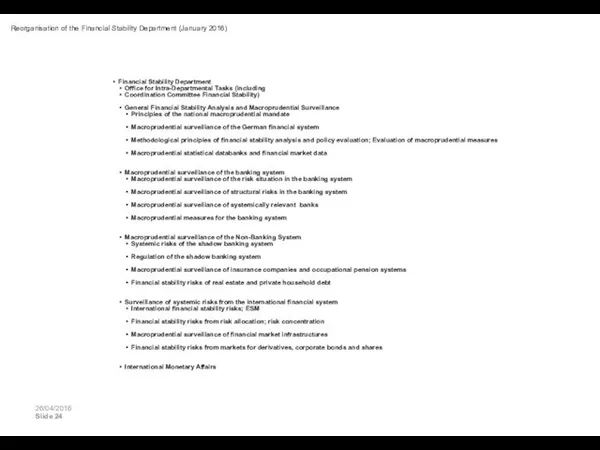

- 24. Financial Stability Department Office for Intra-Departmental Tasks (including Coordination Committee Financial Stability) General Financial Stability Analysis

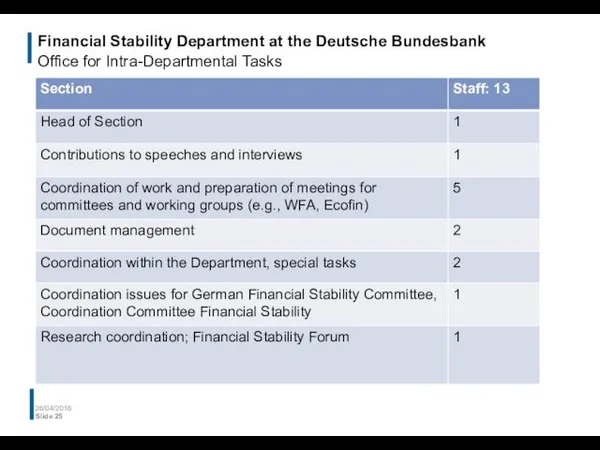

- 25. Financial Stability Department at the Deutsche Bundesbank Office for Intra-Departmental Tasks 26/04/2016 Slide

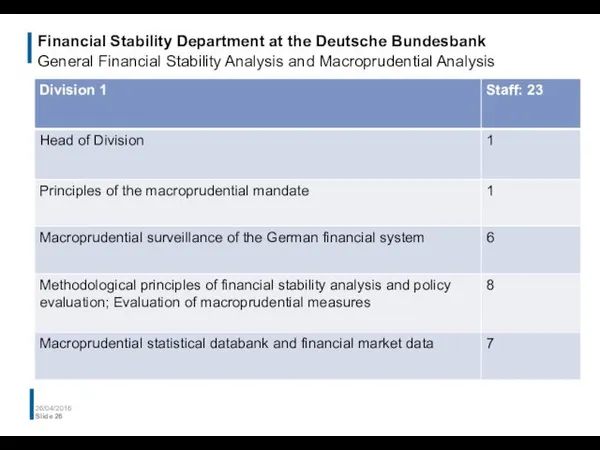

- 26. Financial Stability Department at the Deutsche Bundesbank General Financial Stability Analysis and Macroprudential Analysis 26/04/2016 Slide

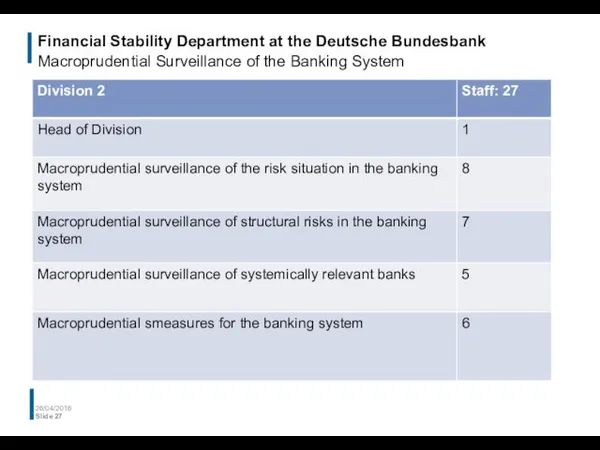

- 27. Financial Stability Department at the Deutsche Bundesbank Macroprudential Surveillance of the Banking System 26/04/2016 Slide

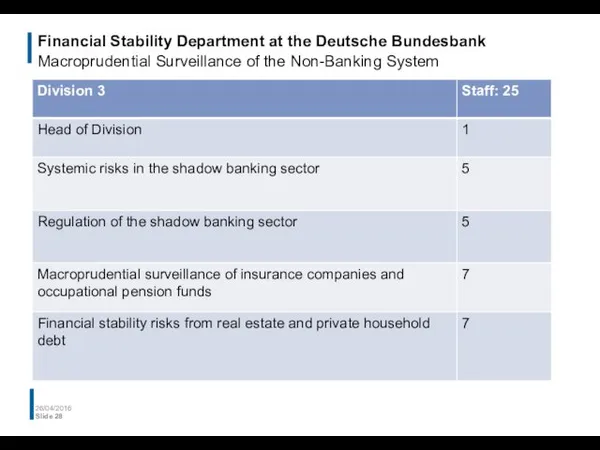

- 28. Financial Stability Department at the Deutsche Bundesbank Macroprudential Surveillance of the Non-Banking System 26/04/2016 Slide

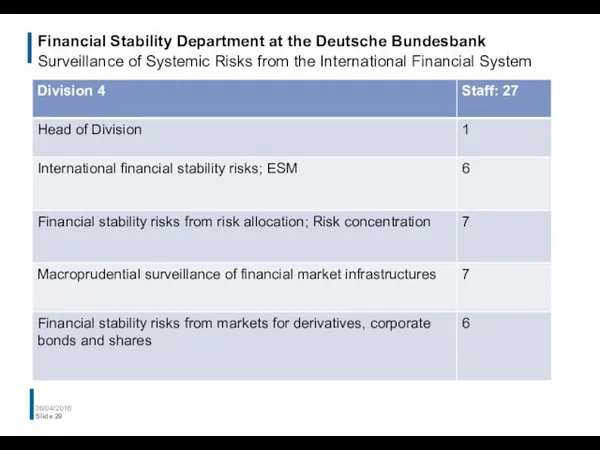

- 29. Financial Stability Department at the Deutsche Bundesbank Surveillance of Systemic Risks from the International Financial System

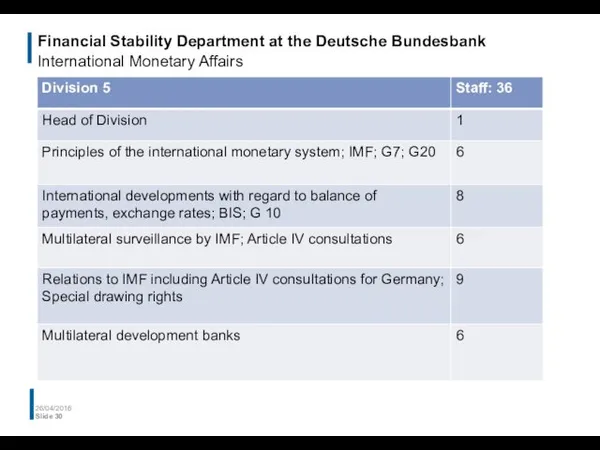

- 30. Financial Stability Department at the Deutsche Bundesbank International Monetary Affairs 26/04/2016 Slide

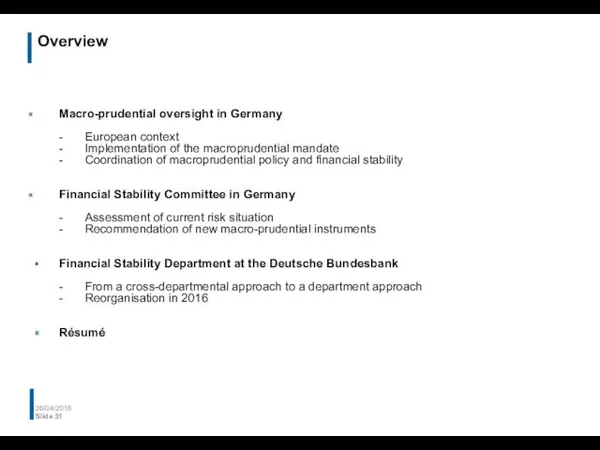

- 31. Overview 26/04/2016 Slide Macro-prudential oversight in Germany - European context - Implementation of the macroprudential mandate

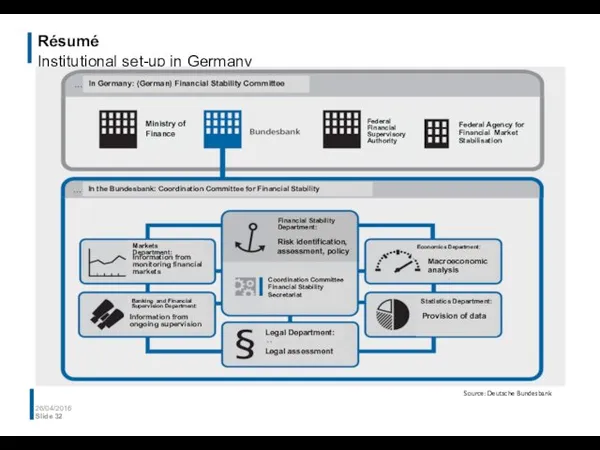

- 32. Résumé Institutional set-up in Germany 26/04/2016 Slide In Germany: (German) Financial Stability Committee In the Bundesbank:

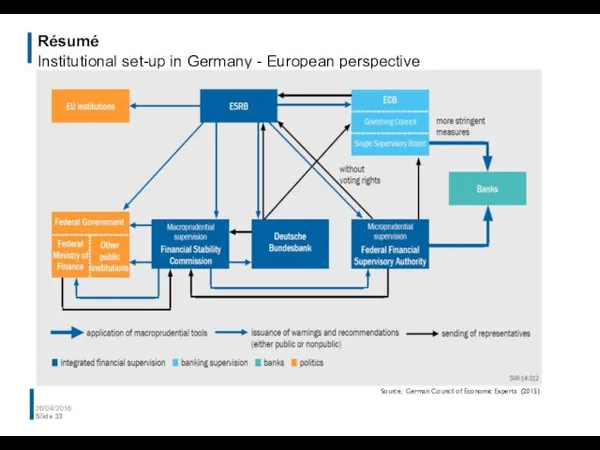

- 33. Résumé Institutional set-up in Germany - European perspective 26/04/2016 Slide Source: German Council of Economic Experts

- 34. References Bank for International Settlements, Annual Report, various issues Borio, Claudio: Towards a macroprudential framework for

- 36. Скачать презентацию

Оздоровление и отдых членов профсоюза

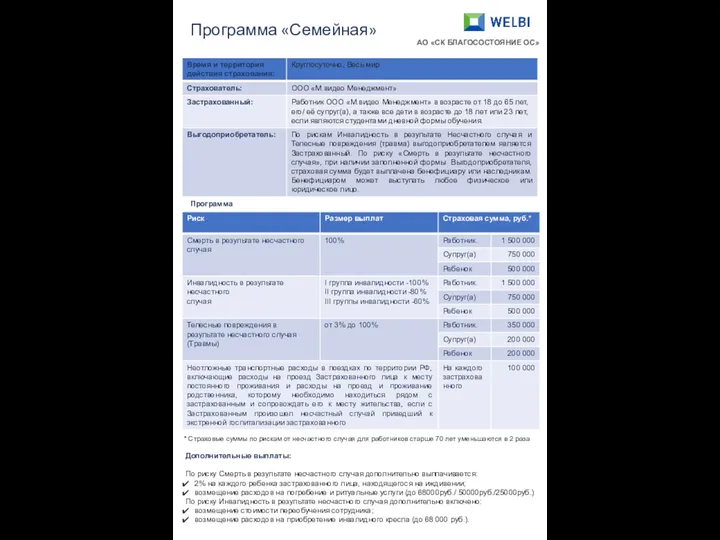

Оздоровление и отдых членов профсоюза Программа Семейная. AO СК Благосостояние ОС

Программа Семейная. AO СК Благосостояние ОС Операції та послуги комерційних банків. (Тема 3)

Операції та послуги комерційних банків. (Тема 3) Порядок работы в ПУР КС ГИИС Электронный бюджет при проведении расходных операций

Порядок работы в ПУР КС ГИИС Электронный бюджет при проведении расходных операций Инвестиции в бизнес: барьеры и возможности

Инвестиции в бизнес: барьеры и возможности Государственные услуги ФСС

Государственные услуги ФСС Основи організації управлінського обліку на підприємстві (тема 2)

Основи організації управлінського обліку на підприємстві (тема 2) Корпорация

Корпорация Організація оплати праці на підприємстві

Організація оплати праці на підприємстві Бухгалтерская и налоговая отчетность 2019. Новые формы и требования

Бухгалтерская и налоговая отчетность 2019. Новые формы и требования О состоянии финансового сектора Калининградской области

О состоянии финансового сектора Калининградской области Инвестициялық стратегия

Инвестициялық стратегия Налогообложение страховых организаций

Налогообложение страховых организаций Füüsilisest isikust ettevõtja ja tulumaks

Füüsilisest isikust ettevõtja ja tulumaks Валютный рынок

Валютный рынок Проект городского бюджета на 2019 год и плановый период 2020 и 2021 годов, г. Череповец

Проект городского бюджета на 2019 год и плановый период 2020 и 2021 годов, г. Череповец Нормативный метод учета затрат и анализ отклонений

Нормативный метод учета затрат и анализ отклонений Финансовые коэффициенты

Финансовые коэффициенты Условия финансирования АО КазАгроФинанс на 2019 год

Условия финансирования АО КазАгроФинанс на 2019 год Учет расчетов по кредитам и займам

Учет расчетов по кредитам и займам Інвестиційна компанія InFuture

Інвестиційна компанія InFuture Теоретические основы учета основных средств

Теоретические основы учета основных средств География на купюрах

География на купюрах Повышение денежного довольствия военнослужащих в 2019 году

Повышение денежного довольствия военнослужащих в 2019 году Основные направления бюджетной политики на 2017 год и на плановый период 2018 и 2019 годов

Основные направления бюджетной политики на 2017 год и на плановый период 2018 и 2019 годов Important notes. Financial standing of hotel

Important notes. Financial standing of hotel Казначейське обслуговування державного боргу. Організація контролю в системі казначейства

Казначейське обслуговування державного боргу. Організація контролю в системі казначейства Тенденции развития современной финансовой науки

Тенденции развития современной финансовой науки