Содержание

- 2. Financial Statement Analysis: Lecture Outline Review of Financial Statements Review of Ratios Types of Ratios Examples

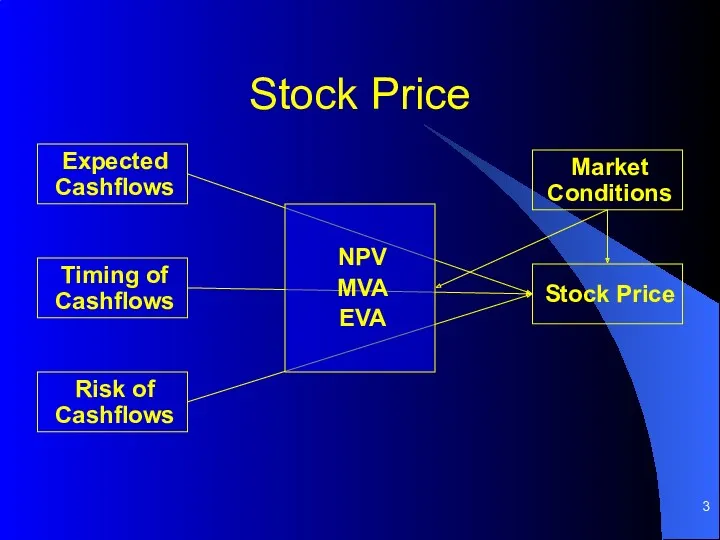

- 3. Stock Price Risk of Cashflows Timing of Cashflows Expected Cashflows Stock Price Market Conditions NPV MVA

- 4. Financial Analysis Assessment of the firm’s past, present and future financial conditions Done to find firm’s

- 5. Financial Statements Balance Sheet Income Statement Cashflow Statement Statement of Retained Earnings

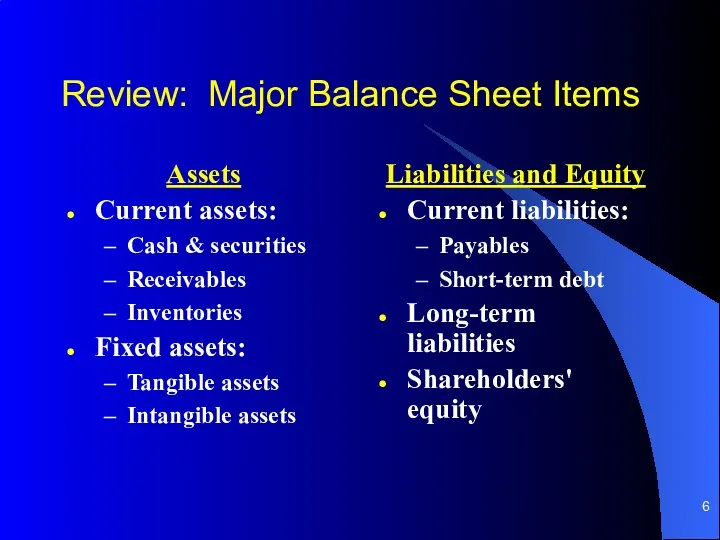

- 6. Review: Major Balance Sheet Items Assets Current assets: Cash & securities Receivables Inventories Fixed assets: Tangible

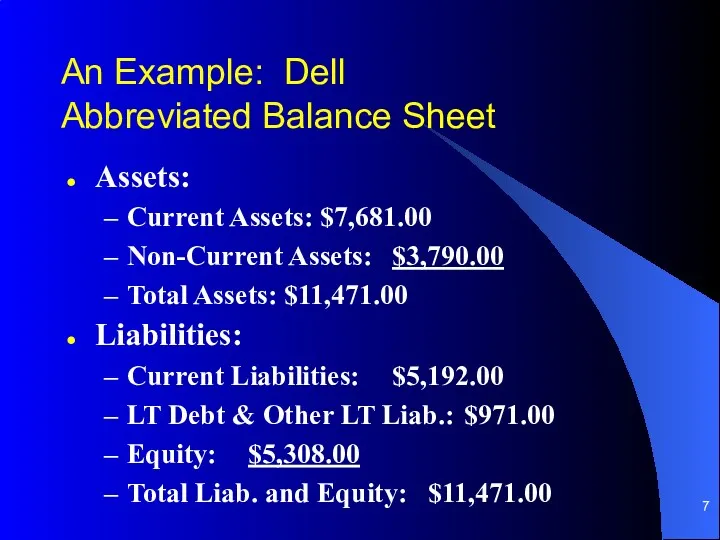

- 7. An Example: Dell Abbreviated Balance Sheet Assets: Current Assets: $7,681.00 Non-Current Assets: $3,790.00 Total Assets: $11,471.00

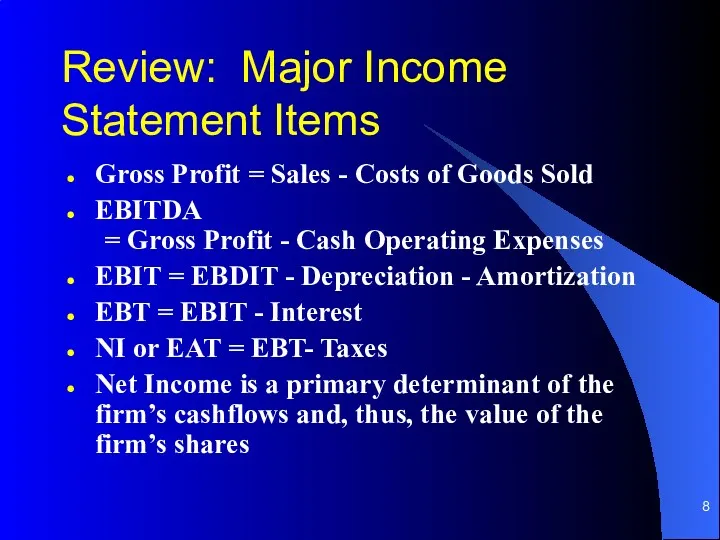

- 8. Review: Major Income Statement Items Gross Profit = Sales - Costs of Goods Sold EBITDA =

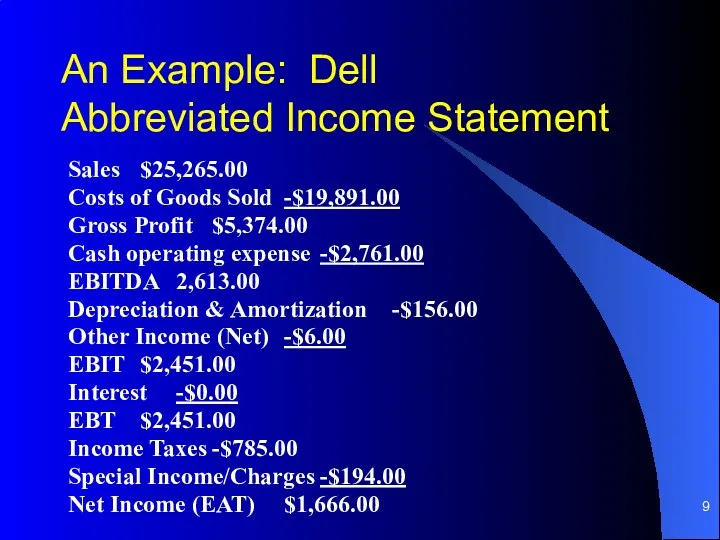

- 9. An Example: Dell Abbreviated Income Statement Sales $25,265.00 Costs of Goods Sold -$19,891.00 Gross Profit $5,374.00

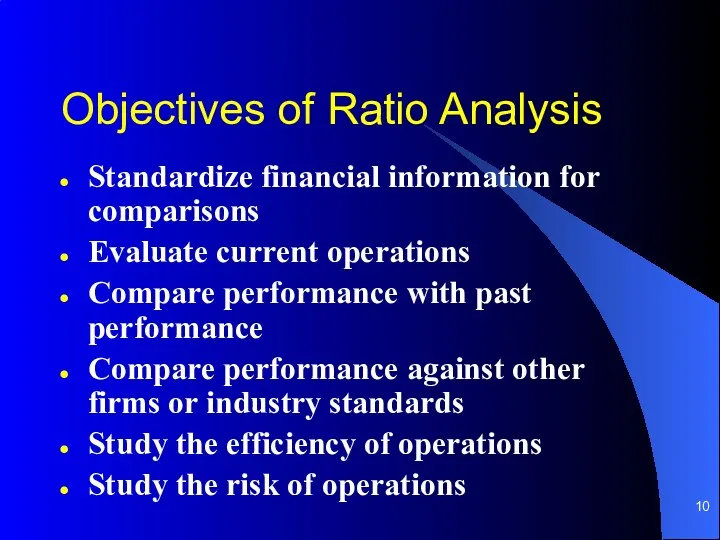

- 10. Objectives of Ratio Analysis Standardize financial information for comparisons Evaluate current operations Compare performance with past

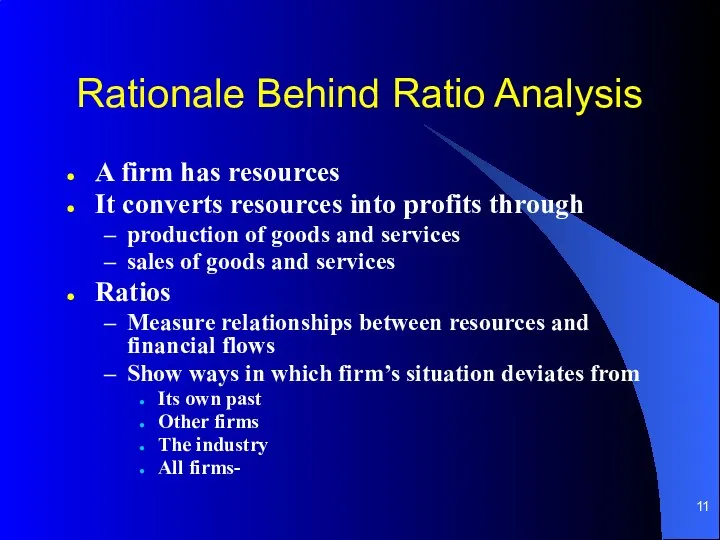

- 11. Rationale Behind Ratio Analysis A firm has resources It converts resources into profits through production of

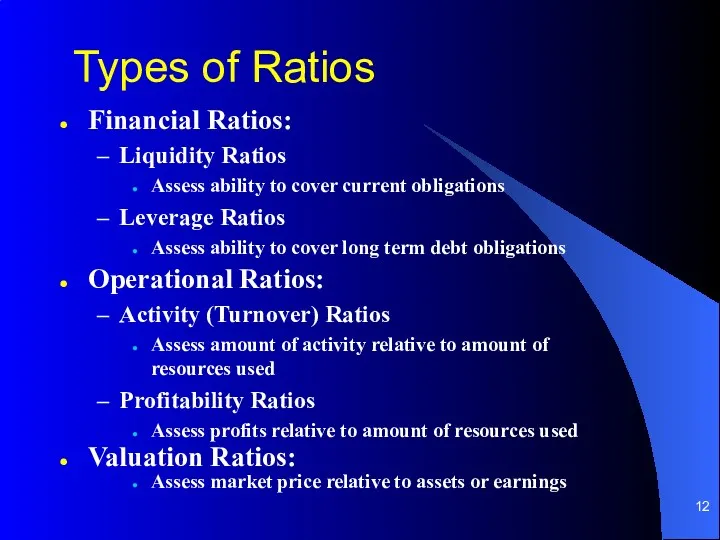

- 12. Types of Ratios Financial Ratios: Liquidity Ratios Assess ability to cover current obligations Leverage Ratios Assess

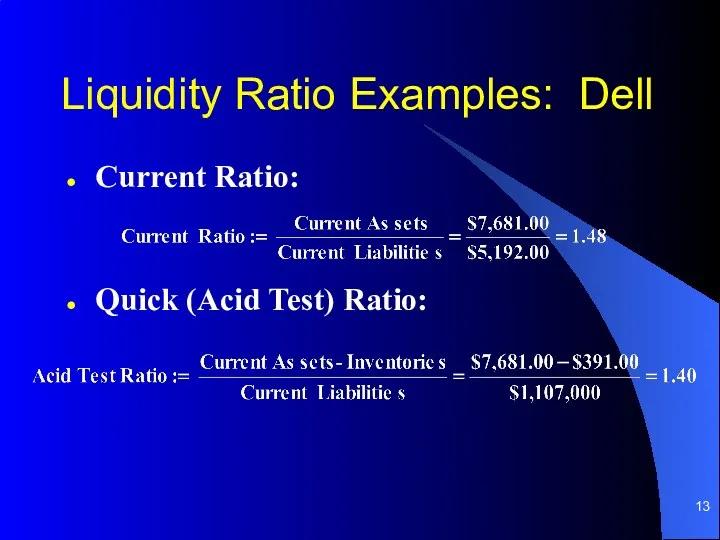

- 13. Current Ratio: Quick (Acid Test) Ratio: Liquidity Ratio Examples: Dell

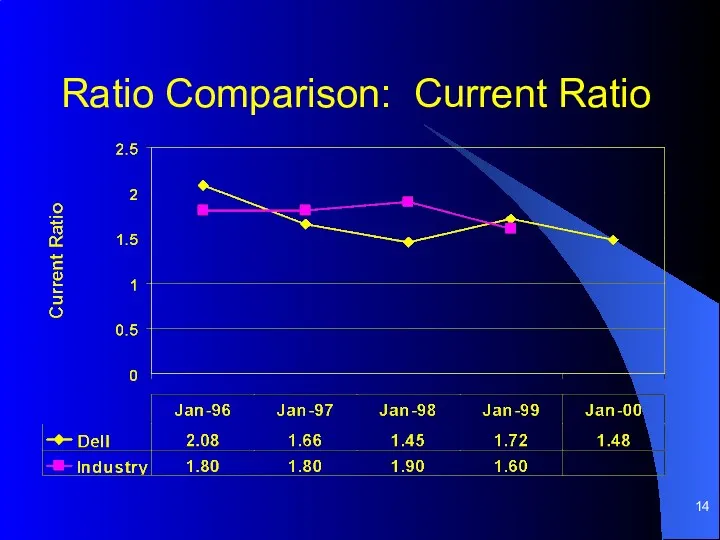

- 14. Ratio Comparison: Current Ratio

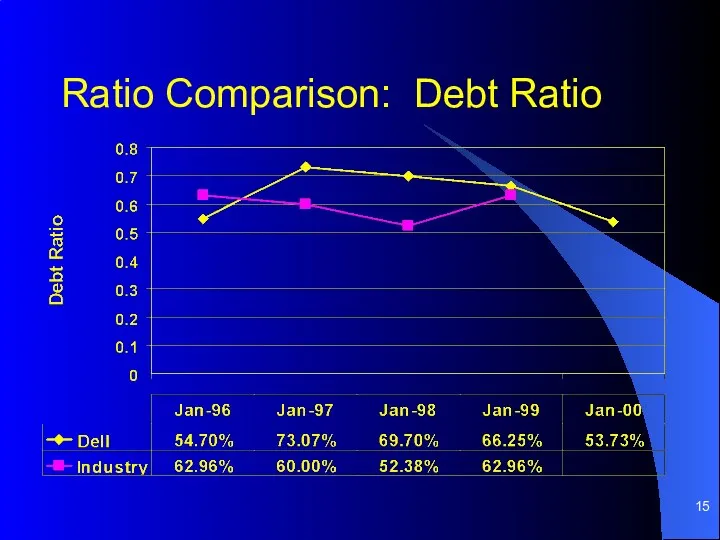

- 15. Ratio Comparison: Debt Ratio

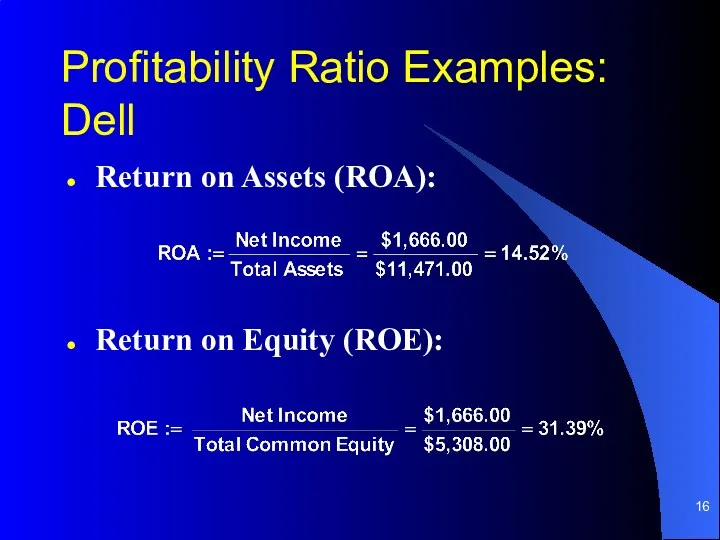

- 16. Return on Assets (ROA): Return on Equity (ROE): Profitability Ratio Examples: Dell

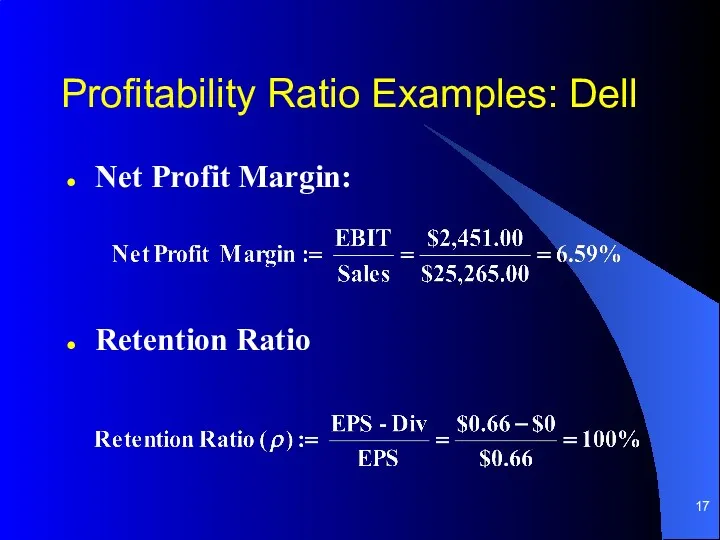

- 17. Profitability Ratio Examples: Dell Net Profit Margin: Retention Ratio

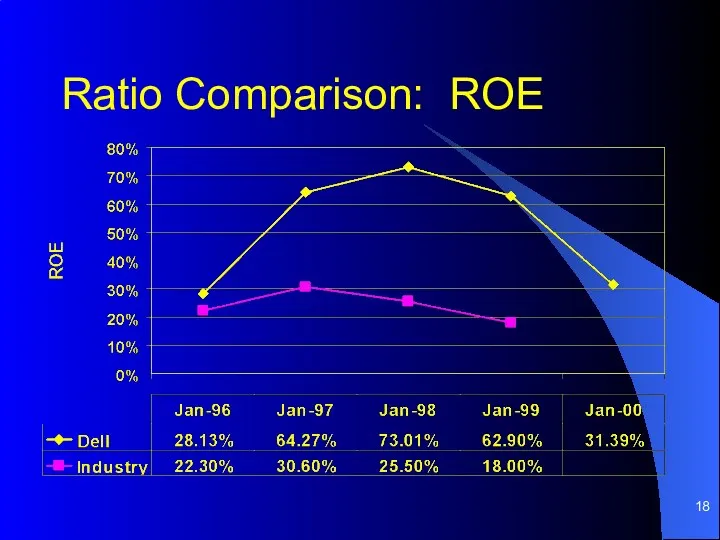

- 18. Ratio Comparison: ROE

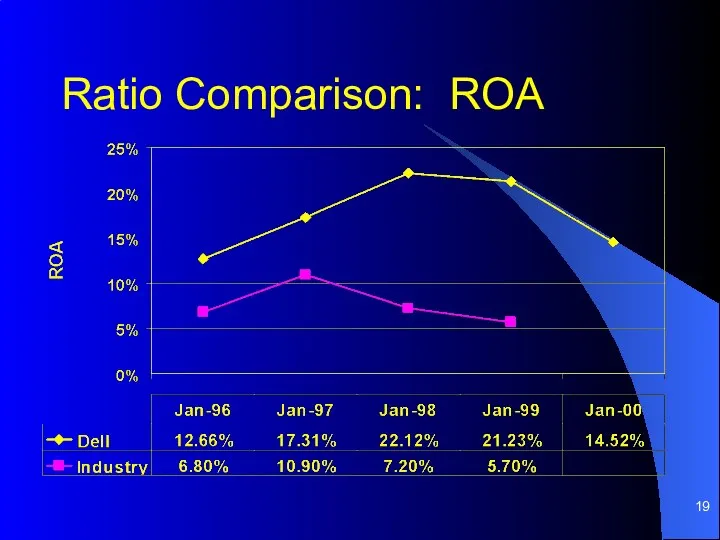

- 19. Ratio Comparison: ROA

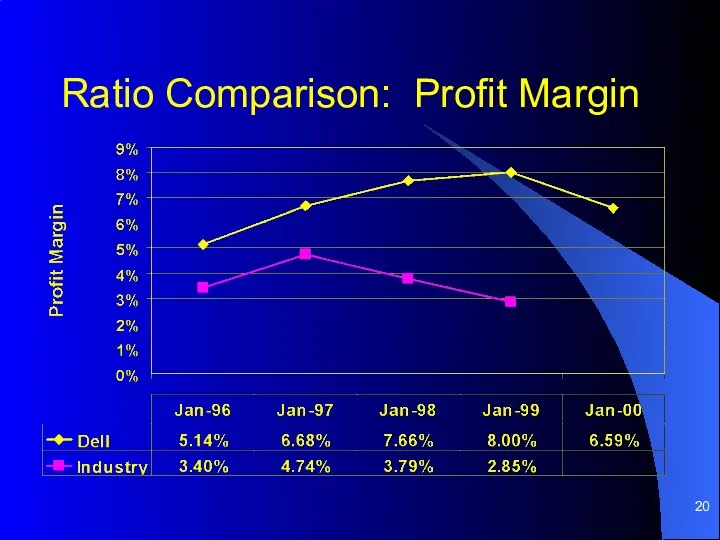

- 20. Ratio Comparison: Profit Margin

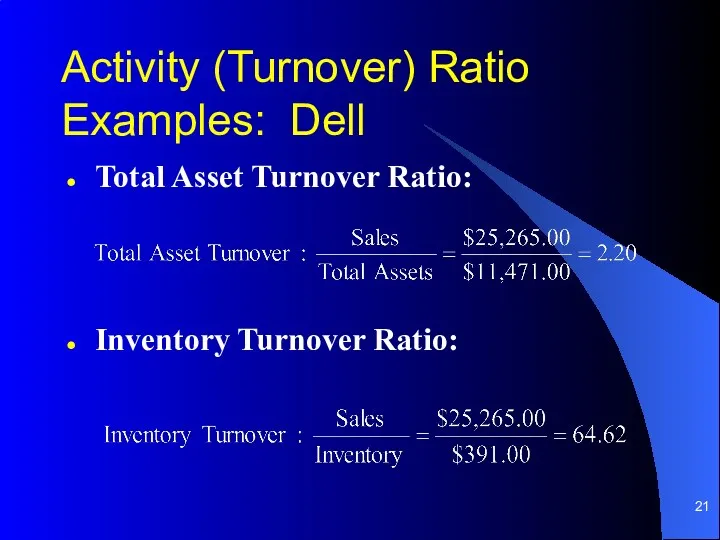

- 21. Total Asset Turnover Ratio: Inventory Turnover Ratio: Activity (Turnover) Ratio Examples: Dell

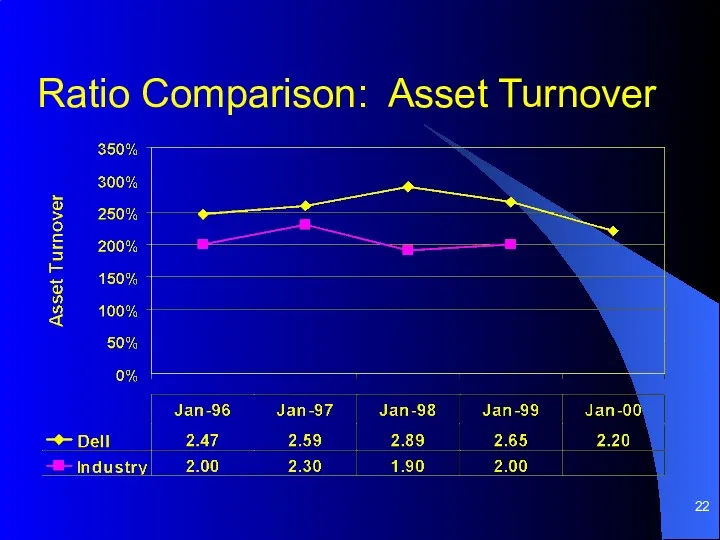

- 22. Ratio Comparison: Asset Turnover

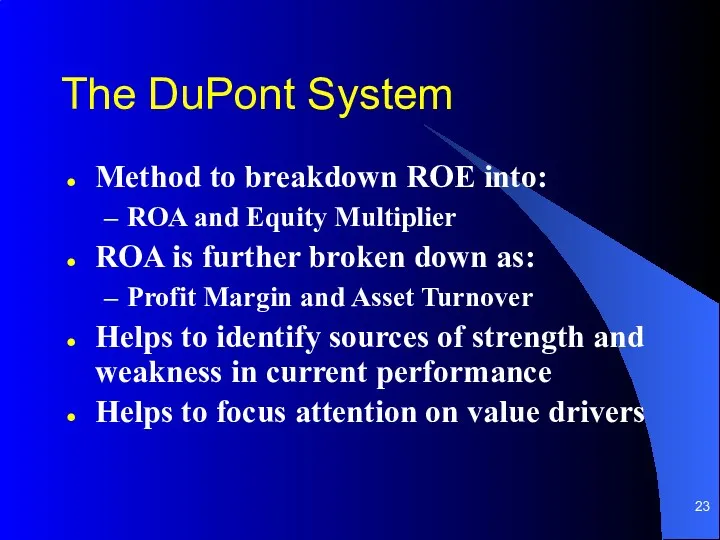

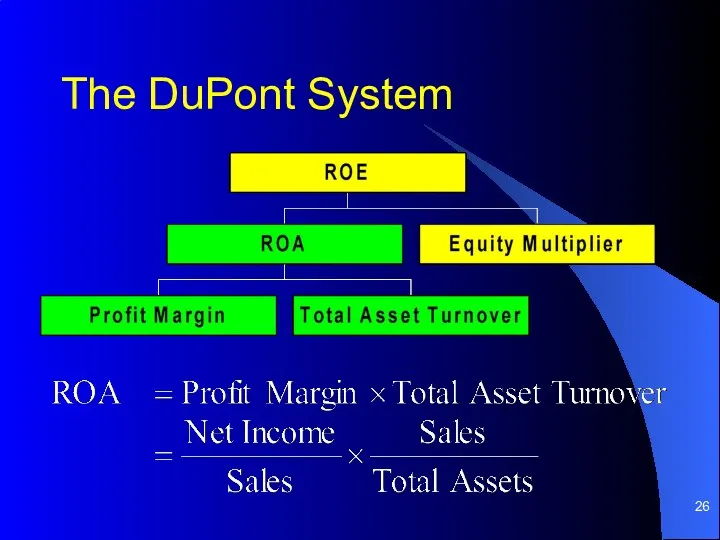

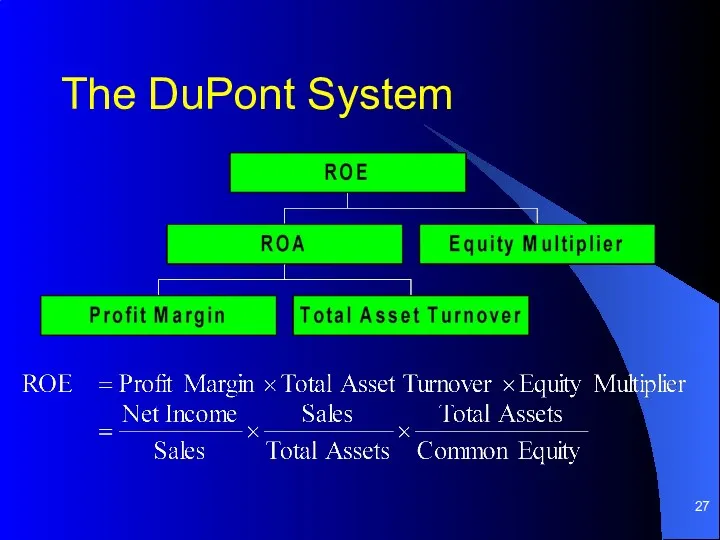

- 23. The DuPont System Method to breakdown ROE into: ROA and Equity Multiplier ROA is further broken

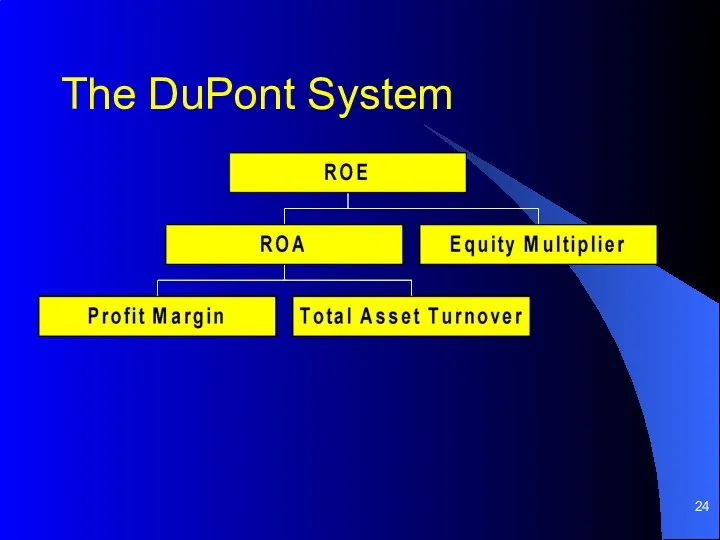

- 24. The DuPont System

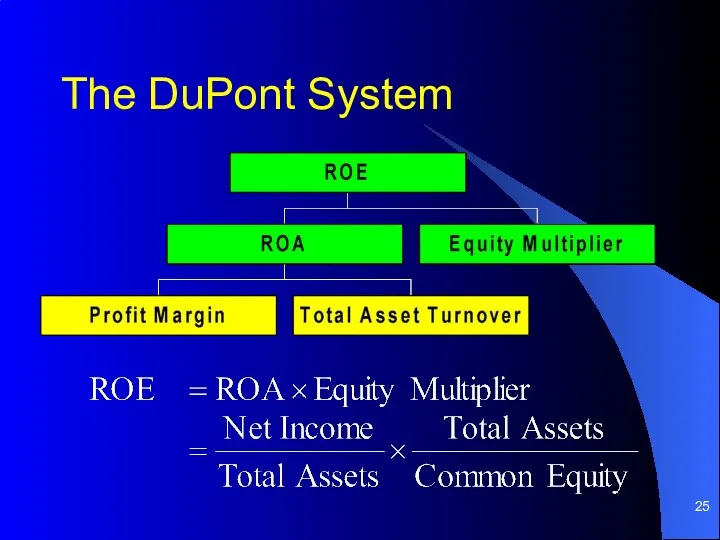

- 25. The DuPont System

- 26. The DuPont System

- 27. The DuPont System

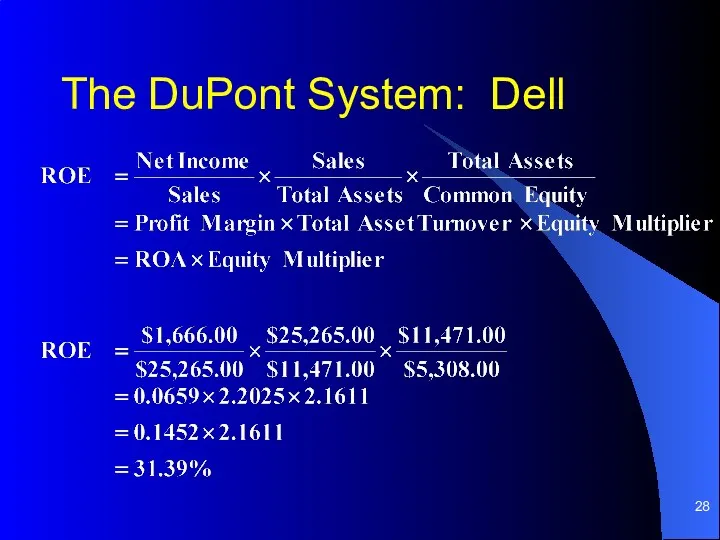

- 28. The DuPont System: Dell

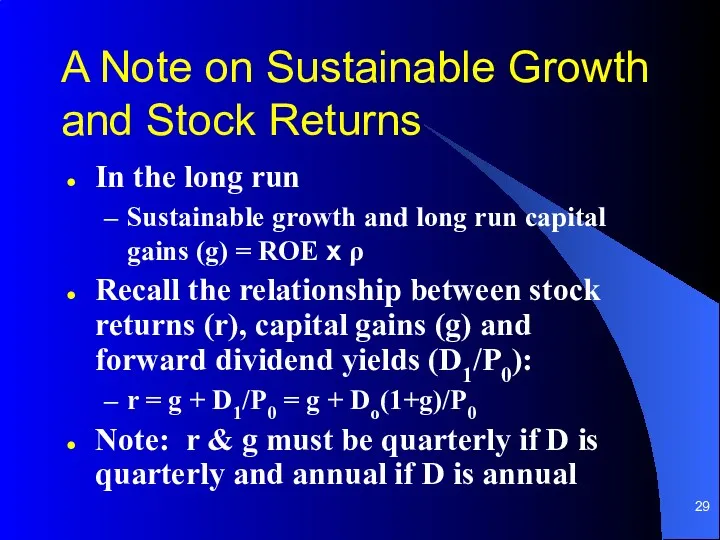

- 29. A Note on Sustainable Growth and Stock Returns In the long run Sustainable growth and long

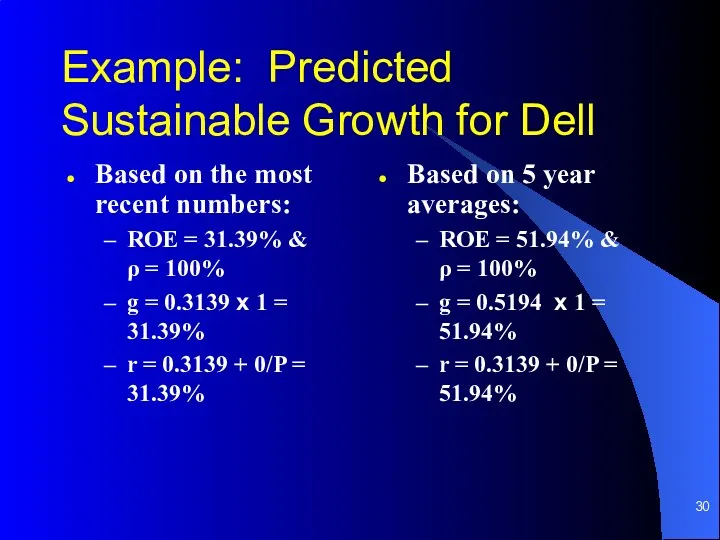

- 30. Example: Predicted Sustainable Growth for Dell Based on the most recent numbers: ROE = 31.39% &

- 31. Ratios and Forecasting Common stock valuation based on Expected cashflows to stockholders ROE and ρ are

- 32. Summary of Financial Ratios Ratios help to: Evaluate performance Structure analysis Show the connection between activities

- 33. Limitations of Ratio Analysis A firm’s industry category is often difficult to identify Published industry averages

- 34. Limitations of Ratio Analysis We have been talking as if management always wants to increase ROE

- 35. The Timing Problem As a decision-maker in a business environment you are often encouraged to focus

- 36. The Risk Problem We talked a lot about how risk and return go together. ROE is

- 37. The Value Problem ROE measures a “return” figure but it is based on two accounting figures.

- 39. Скачать презентацию

Налоги и их классификация

Налоги и их классификация Создание финансовой службы с нуля

Создание финансовой службы с нуля Банковская система России

Банковская система России Рынок криптовалют

Рынок криптовалют Анализ эффективности и интенсивности использования капитала предприятия

Анализ эффективности и интенсивности использования капитала предприятия Бюджет и бюджетная система РФ

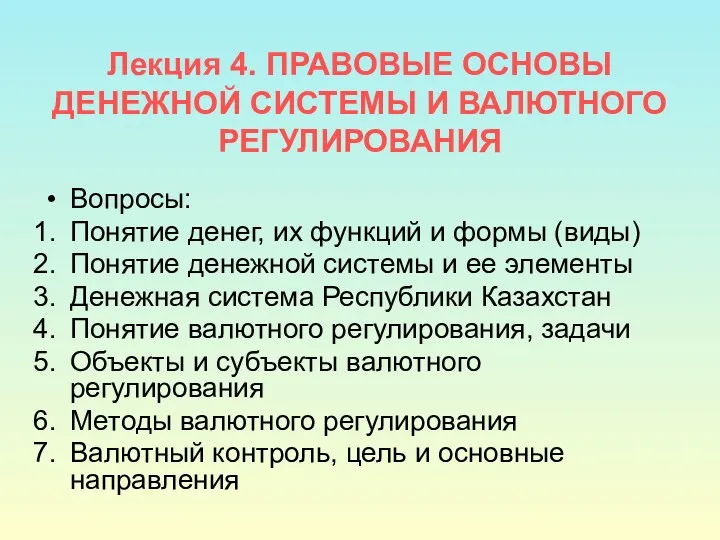

Бюджет и бюджетная система РФ Лекция 4. Правовые основы денежной системы и валютного регулирования

Лекция 4. Правовые основы денежной системы и валютного регулирования Поняття банківської таємниці. (Тема 9)

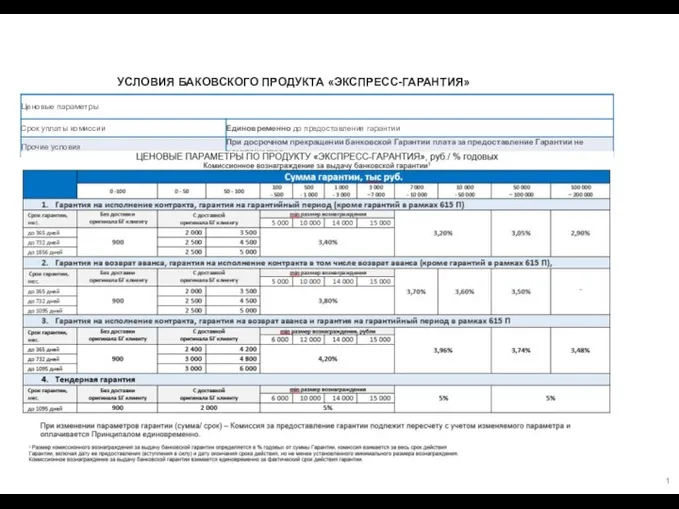

Поняття банківської таємниці. (Тема 9) Условия баковского продукта Экспресс-гарантия

Условия баковского продукта Экспресс-гарантия Фінансовий ринок: сутність, функції та роль в економіці

Фінансовий ринок: сутність, функції та роль в економіці Мастер-класс Розничная торговля. Главные критерии успеха в офлайн-бизнесе

Мастер-класс Розничная торговля. Главные критерии успеха в офлайн-бизнесе Управление рисками в рамках концепции устойчивого банкинга ОАО КБ Центр-инвест Ростов-на-Дону

Управление рисками в рамках концепции устойчивого банкинга ОАО КБ Центр-инвест Ростов-на-Дону Ценные бумаги

Ценные бумаги Совершенствование финансово-хозяйственной деятельности ООО СТРОЙПРОФИ ЕКБ

Совершенствование финансово-хозяйственной деятельности ООО СТРОЙПРОФИ ЕКБ Положение по бухгалтерскому учету Доходы организации

Положение по бухгалтерскому учету Доходы организации Почтабанк. Как не стать жертвой мошенничества

Почтабанк. Как не стать жертвой мошенничества Заимствования органами государственной власти и органами местного самоуправления на примере США

Заимствования органами государственной власти и органами местного самоуправления на примере США Условия финансирования АО КазАгроФинанс на 2019 год

Условия финансирования АО КазАгроФинанс на 2019 год Нормативная база Закон РСФСР О государственной налоговой службе РСФСР

Нормативная база Закон РСФСР О государственной налоговой службе РСФСР Финансовое планирование и прогнозирование. Бюджетирование

Финансовое планирование и прогнозирование. Бюджетирование Деньги. Понятие денег

Деньги. Понятие денег Понятие и признаки предпринимательской деятельности

Понятие и признаки предпринимательской деятельности Кредиты. Новые условия по кредитным продуктам банка

Кредиты. Новые условия по кредитным продуктам банка Внедрение системы персонифицированного финансирования в Белгородской области

Внедрение системы персонифицированного финансирования в Белгородской области Финансовый контроль

Финансовый контроль Грошовий, фінансовий ринок. (Тема 3)

Грошовий, фінансовий ринок. (Тема 3) Финансы коммерческого предприятия и направления повышения эффективности их использования (на примере ООО УВА)

Финансы коммерческого предприятия и направления повышения эффективности их использования (на примере ООО УВА) Заработная плата: юридический аспект

Заработная плата: юридический аспект