Содержание

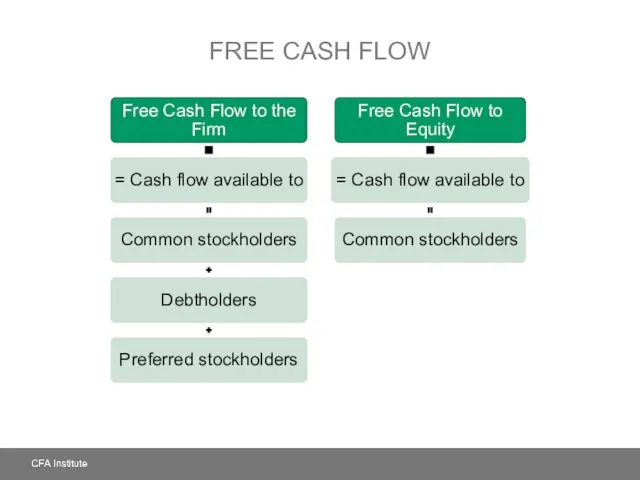

- 2. FREE CASH FLOW

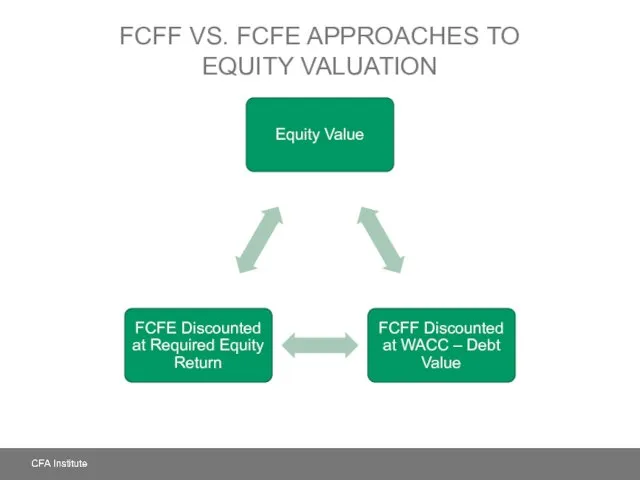

- 3. FCFF VS. FCFE APPROACHES TO EQUITY VALUATION

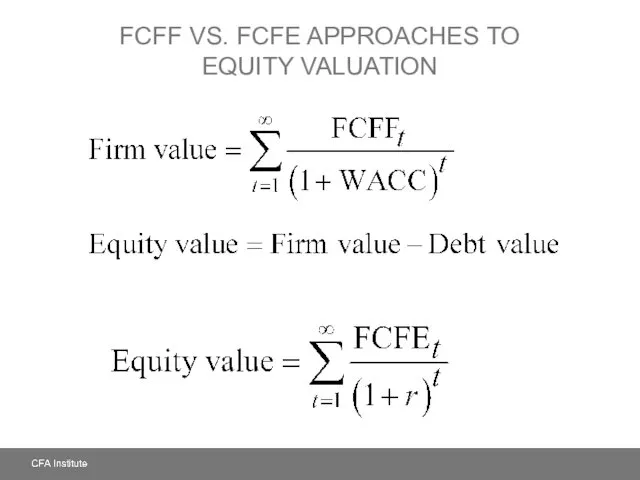

- 4. FCFF VS. FCFE APPROACHES TO EQUITY VALUATION

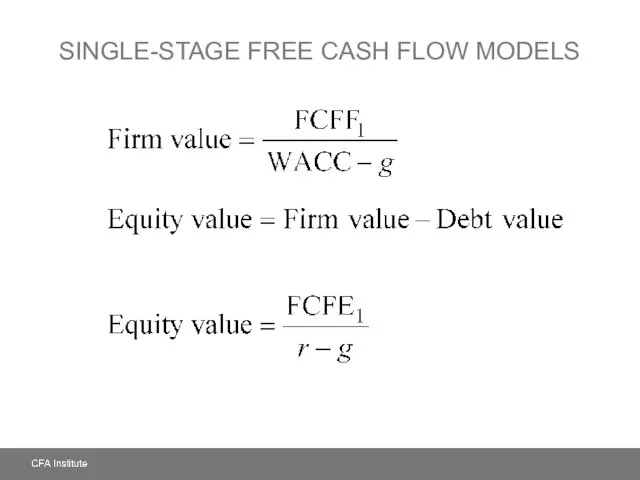

- 5. SINGLE-STAGE FREE CASH FLOW MODELS

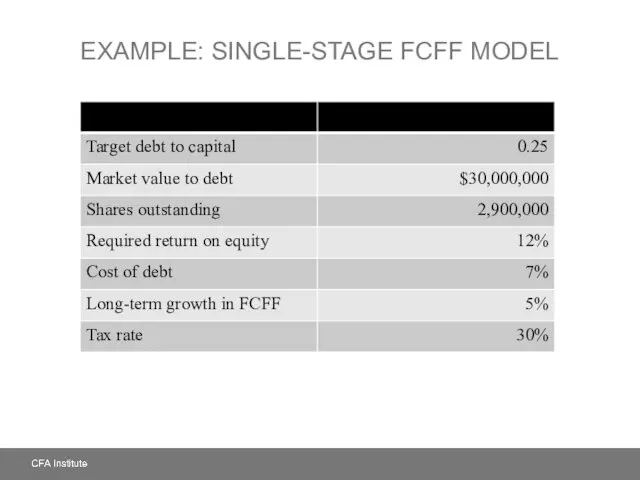

- 6. EXAMPLE: SINGLE-STAGE FCFF MODEL

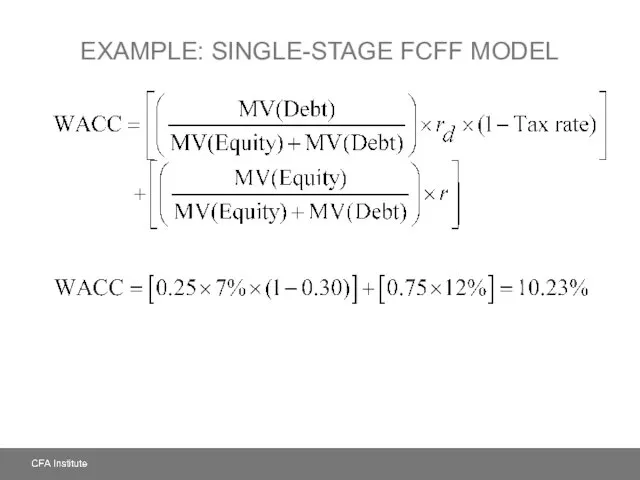

- 7. EXAMPLE: SINGLE-STAGE FCFF MODEL

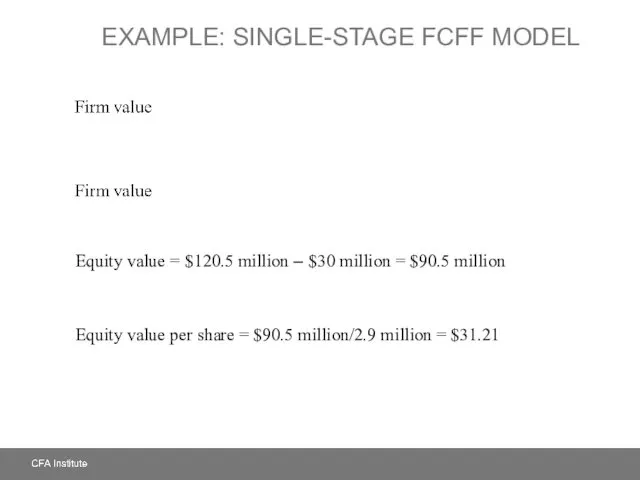

- 8. EXAMPLE: SINGLE-STAGE FCFF MODEL Equity value = $120.5 million – $30 million = $90.5 million Equity

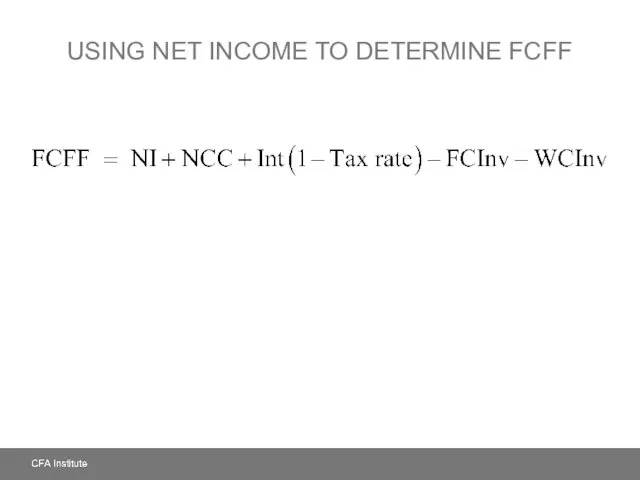

- 9. USING NET INCOME TO DETERMINE FCFF

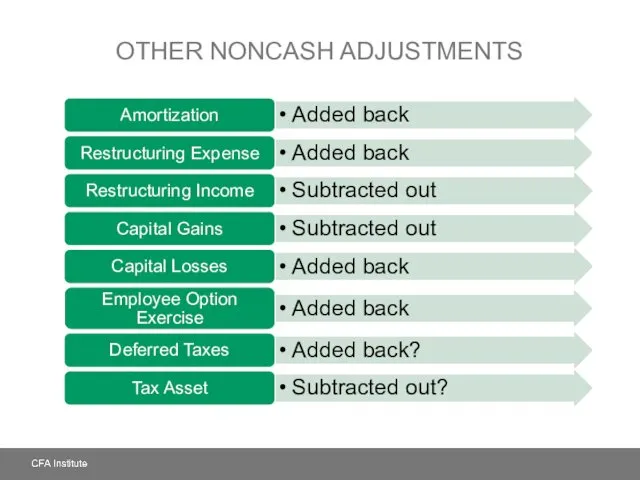

- 10. OTHER NONCASH ADJUSTMENTS

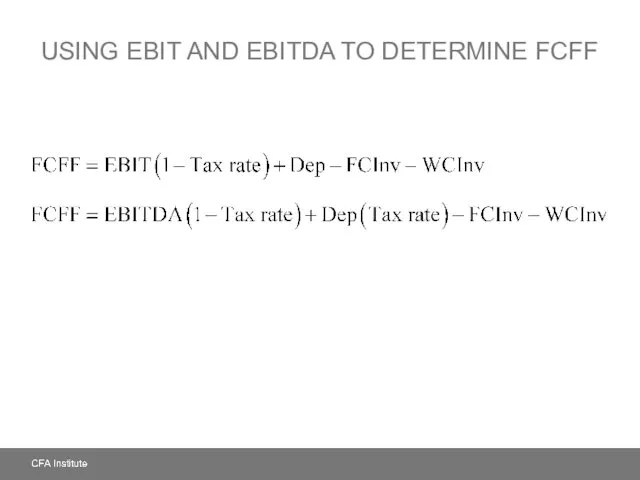

- 11. USING EBIT AND EBITDA TO DETERMINE FCFF

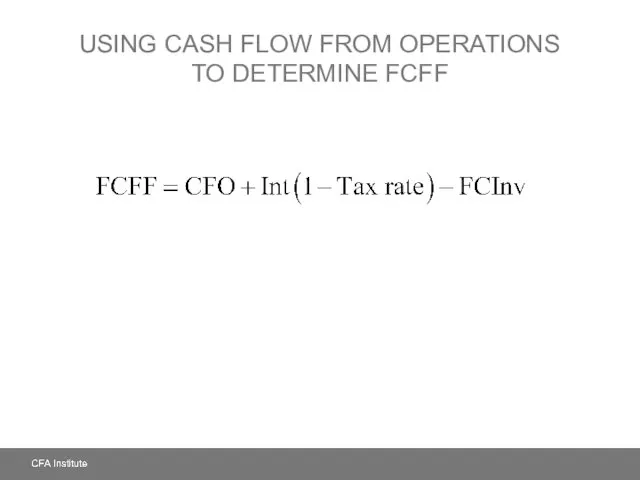

- 12. USING CASH FLOW FROM OPERATIONS TO DETERMINE FCFF

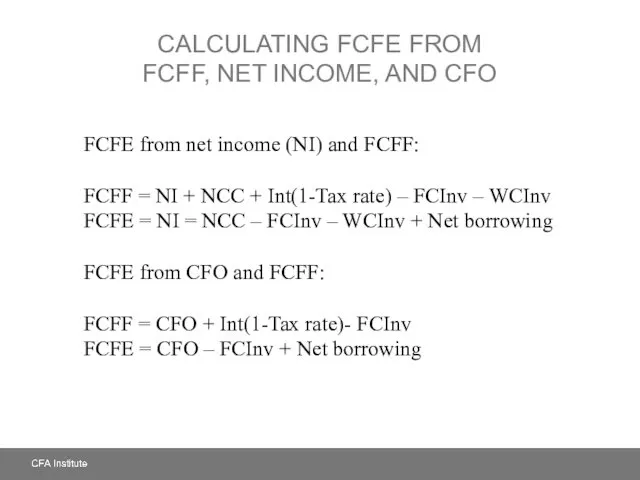

- 13. CALCULATING FCFE FROM FCFF, NET INCOME, AND CFO FCFE from net income (NI) and FCFF: FCFF

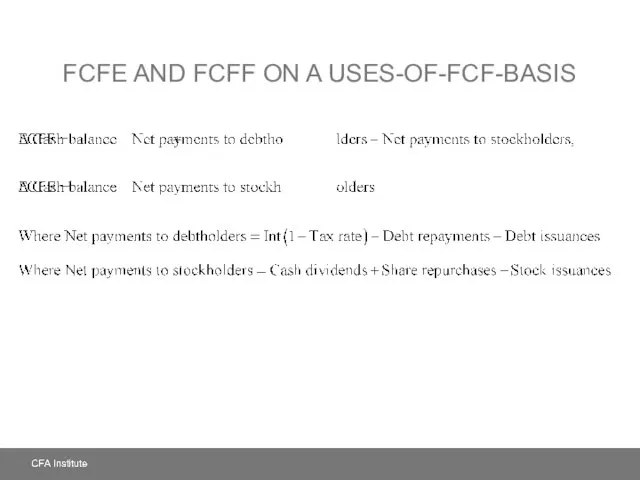

- 14. FCFE AND FCFF ON A USES-OF-FCF-BASIS

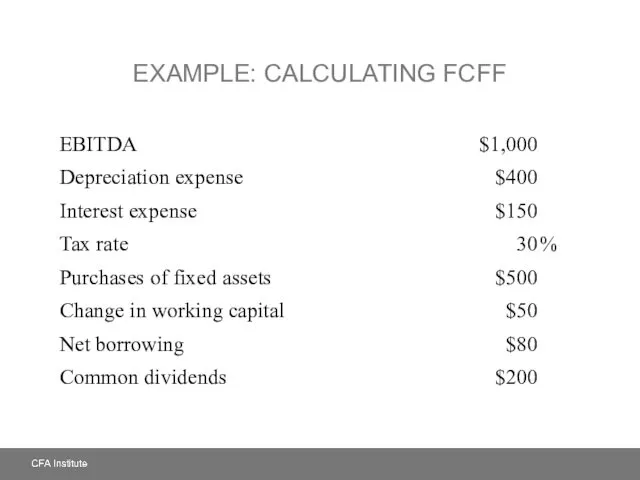

- 15. EXAMPLE: CALCULATING FCFF

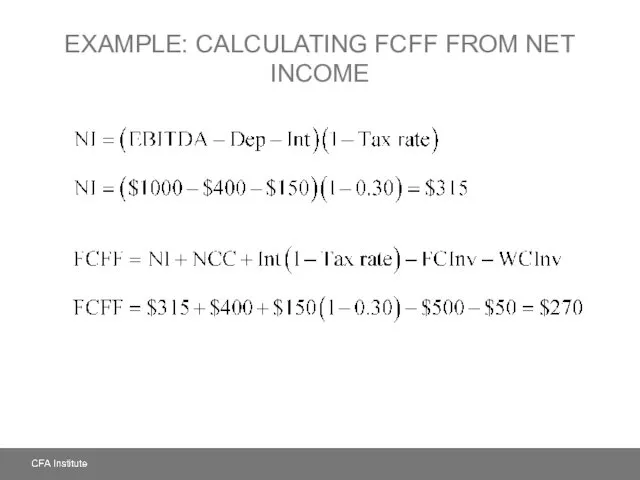

- 16. EXAMPLE: CALCULATING FCFF FROM NET INCOME

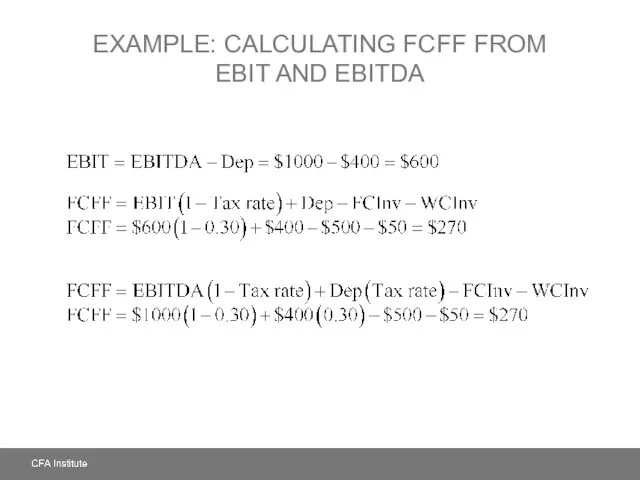

- 17. EXAMPLE: CALCULATING FCFF FROM EBIT AND EBITDA

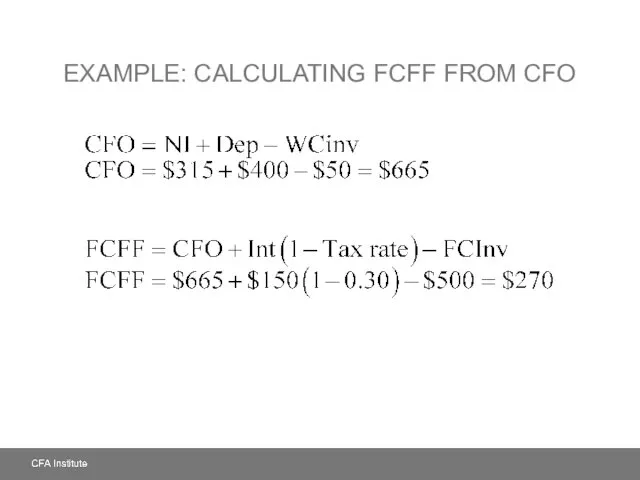

- 18. EXAMPLE: CALCULATING FCFF FROM CFO

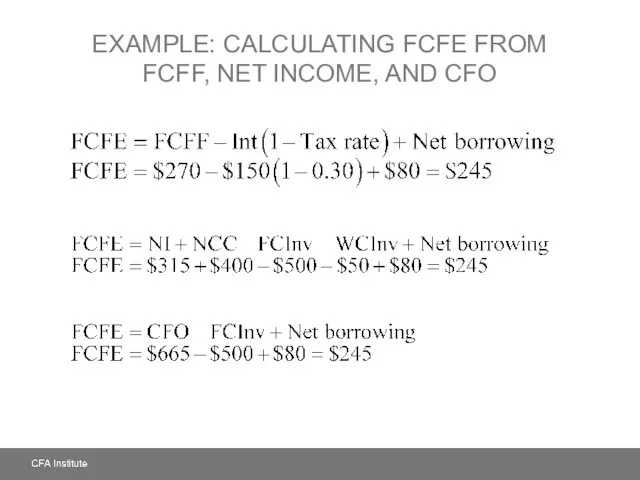

- 19. EXAMPLE: CALCULATING FCFE FROM FCFF, NET INCOME, AND CFO

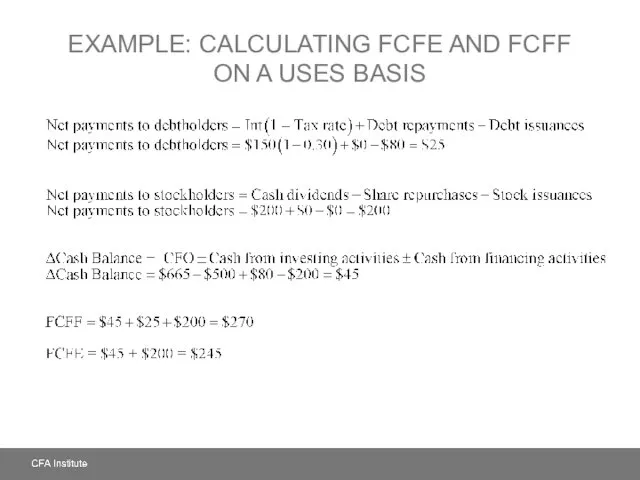

- 20. EXAMPLE: CALCULATING FCFE AND FCFF ON A USES BASIS

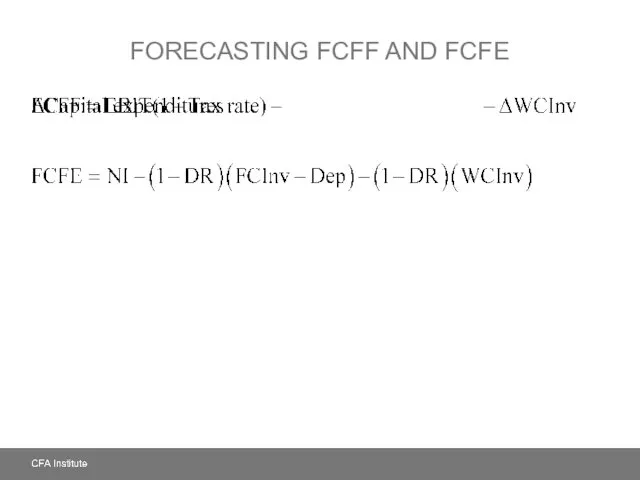

- 21. FORECASTING FCFF AND FCFE

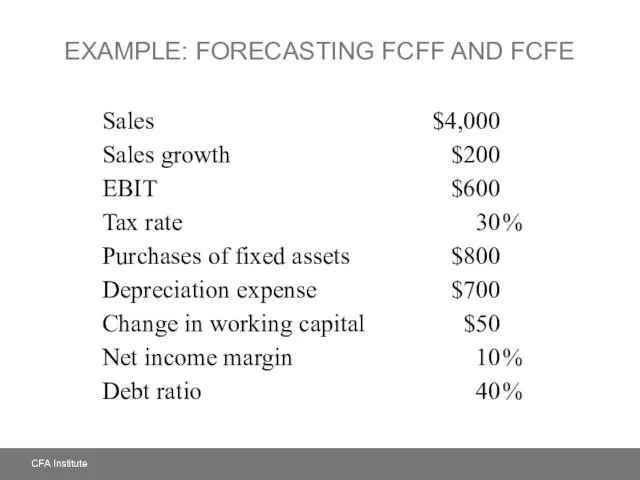

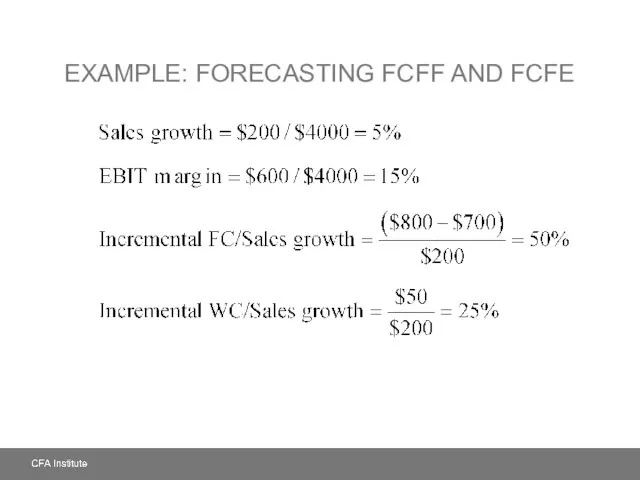

- 22. EXAMPLE: FORECASTING FCFF AND FCFE

- 23. EXAMPLE: FORECASTING FCFF AND FCFE

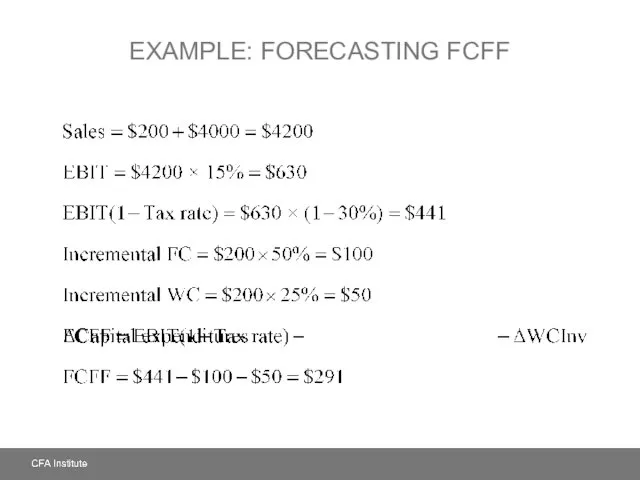

- 24. EXAMPLE: FORECASTING FCFF

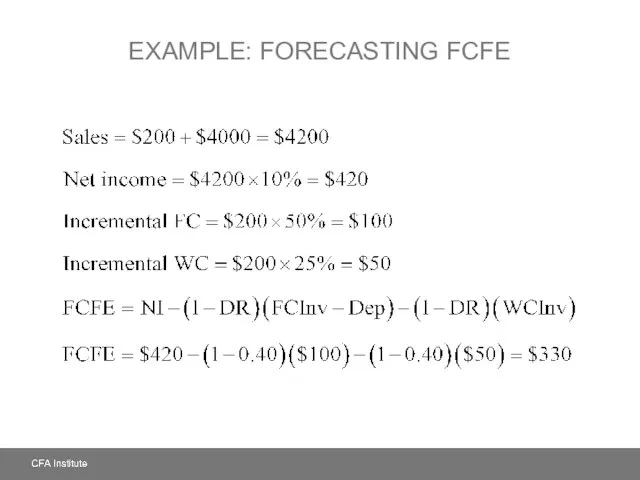

- 25. EXAMPLE: FORECASTING FCFE

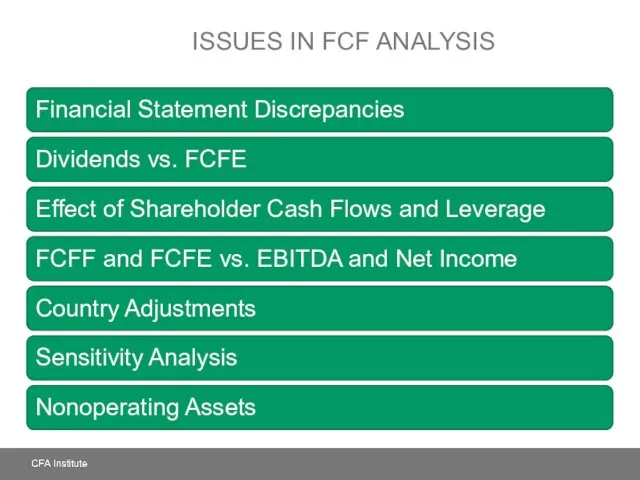

- 26. ISSUES IN FCF ANALYSIS

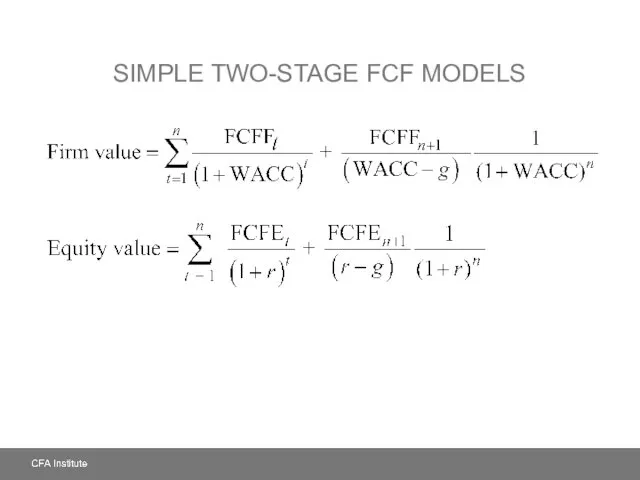

- 27. SIMPLE TWO-STAGE FCF MODELS

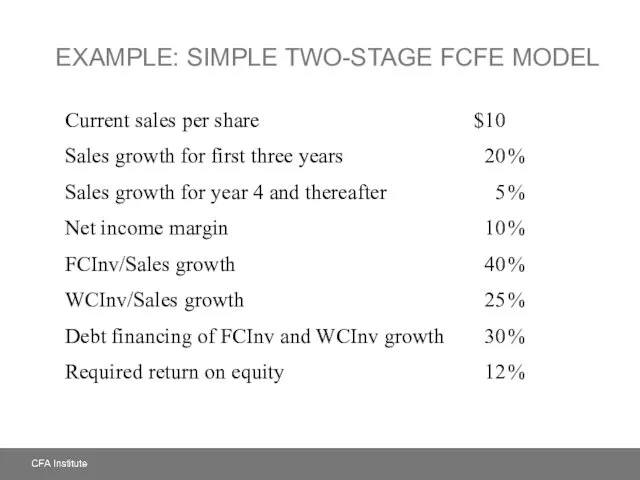

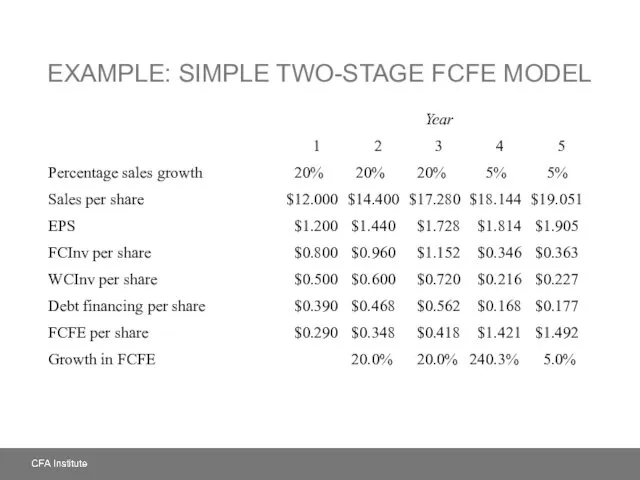

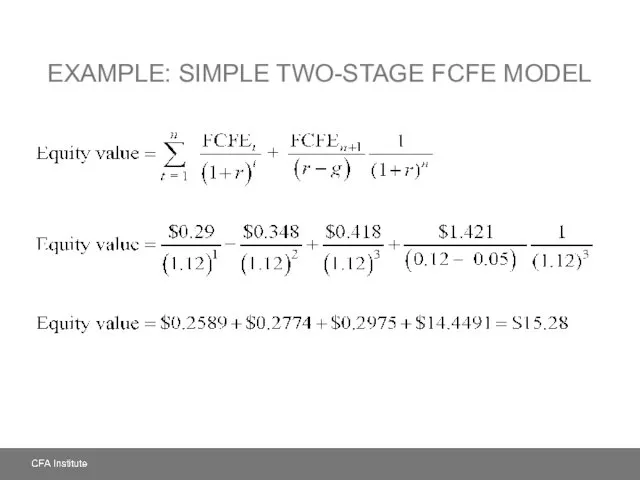

- 28. EXAMPLE: SIMPLE TWO-STAGE FCFE MODEL

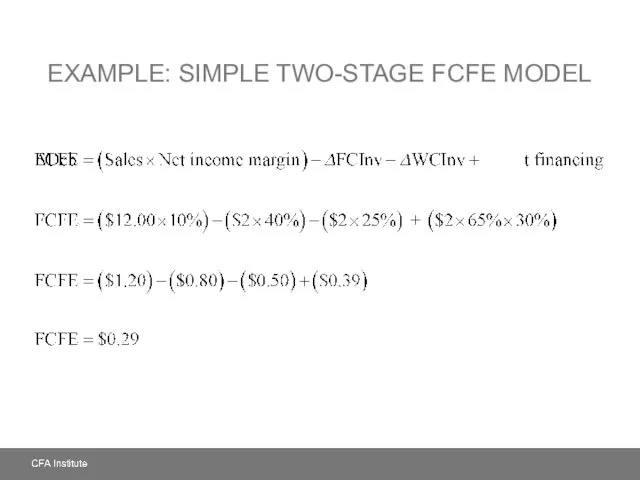

- 29. EXAMPLE: SIMPLE TWO-STAGE FCFE MODEL

- 30. EXAMPLE: SIMPLE TWO-STAGE FCFE MODEL

- 31. EXAMPLE: SIMPLE TWO-STAGE FCFE MODEL

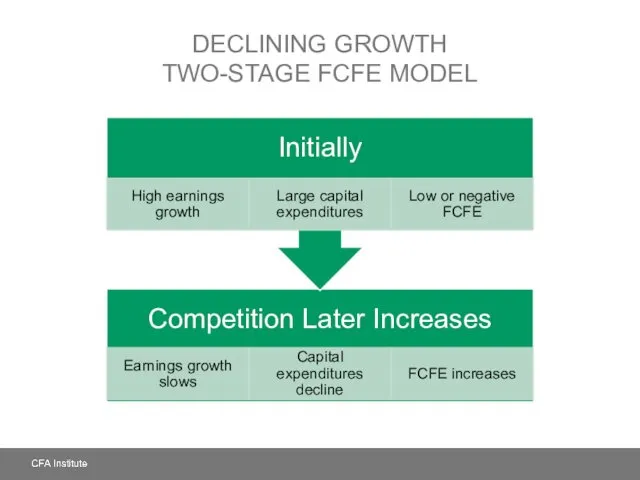

- 32. DECLINING GROWTH TWO-STAGE FCFE MODEL

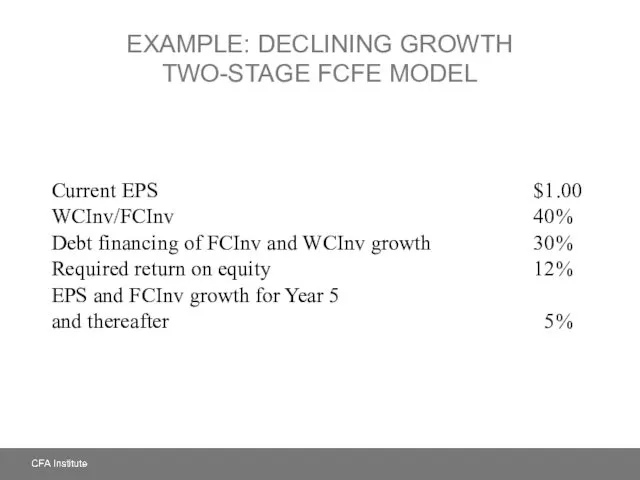

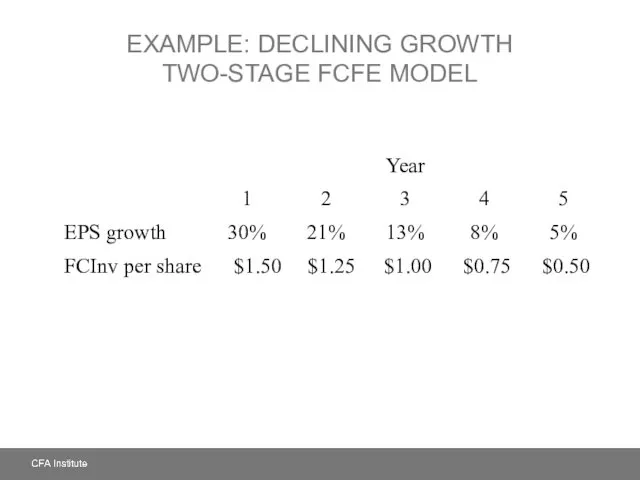

- 33. EXAMPLE: DECLINING GROWTH TWO-STAGE FCFE MODEL

- 34. EXAMPLE: DECLINING GROWTH TWO-STAGE FCFE MODEL

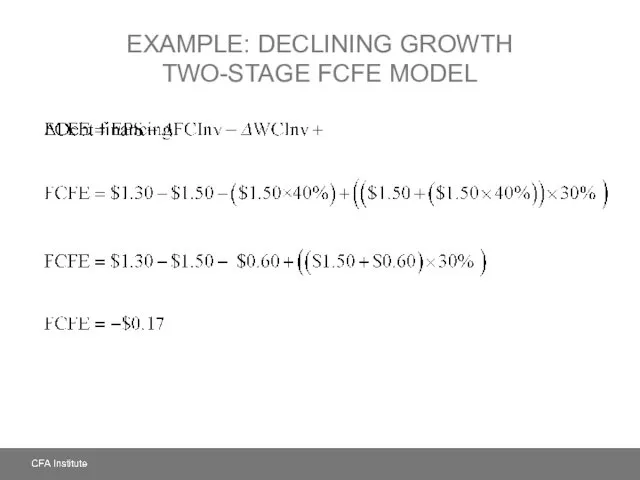

- 35. EXAMPLE: DECLINING GROWTH TWO-STAGE FCFE MODEL

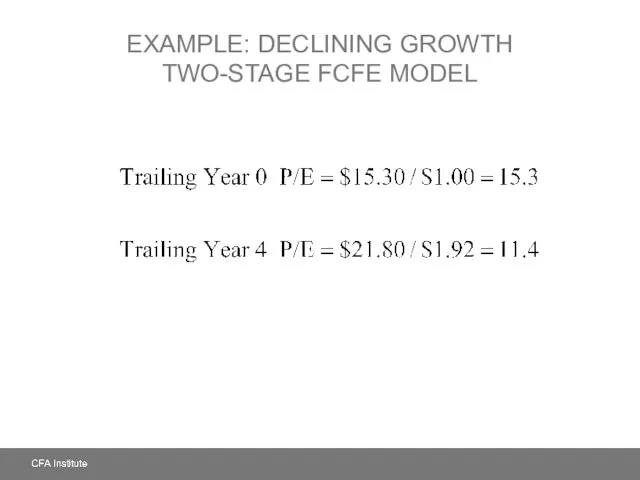

- 36. EXAMPLE: DECLINING GROWTH TWO-STAGE FCFE MODEL

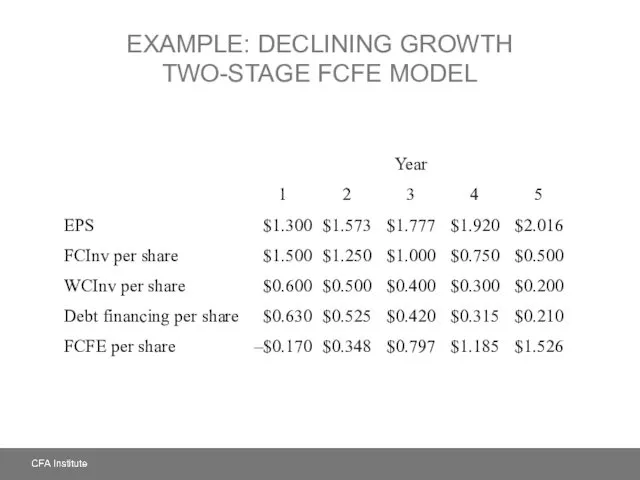

- 37. EXAMPLE: DECLINING GROWTH TWO-STAGE FCFE MODEL

- 38. EXAMPLE: DECLINING GROWTH TWO-STAGE FCFE MODEL

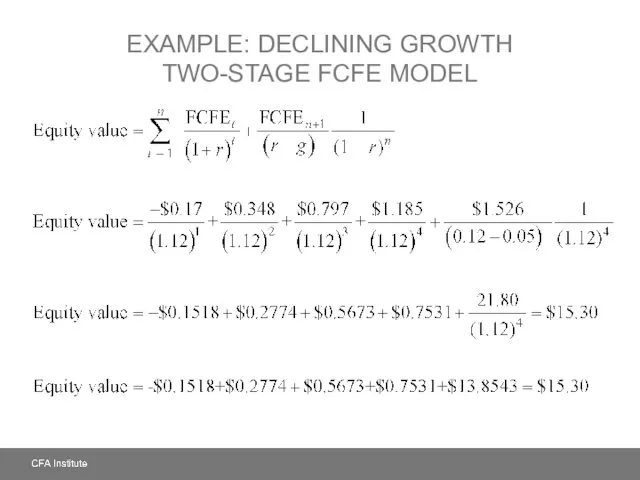

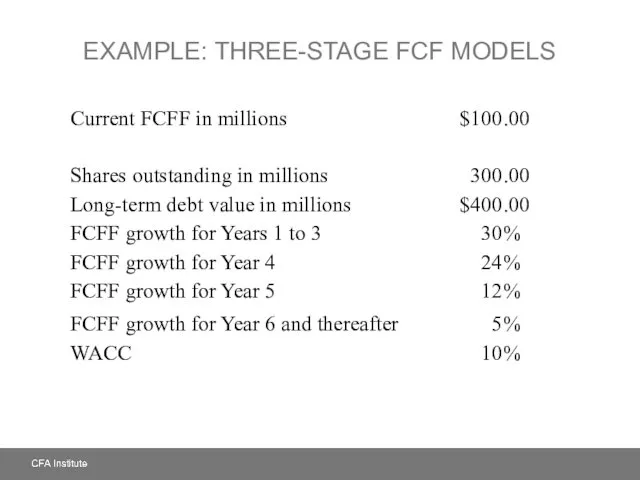

- 39. EXAMPLE: THREE-STAGE FCF MODELS

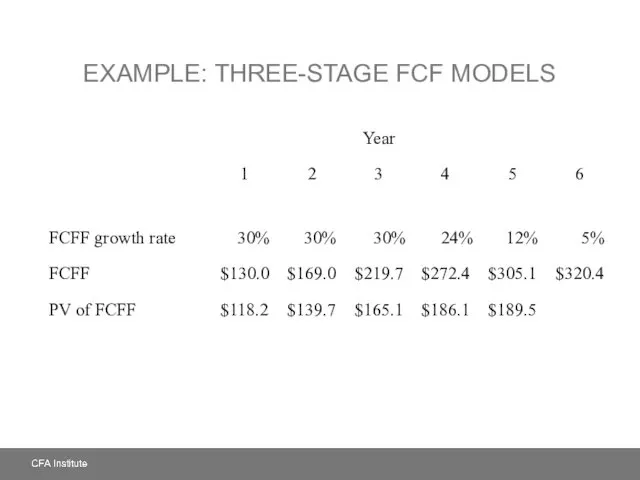

- 40. EXAMPLE: THREE-STAGE FCF MODELS

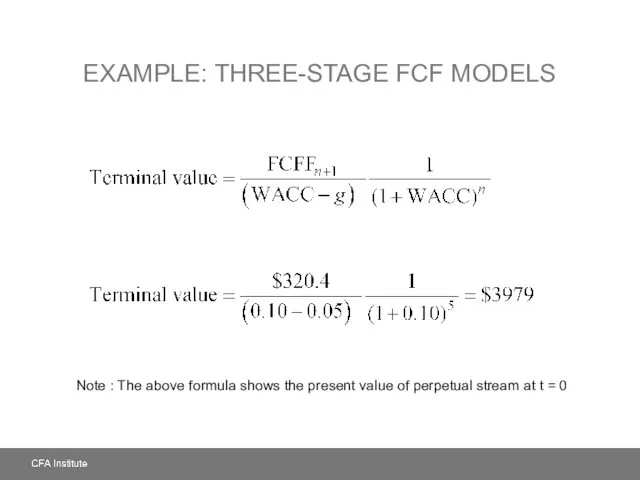

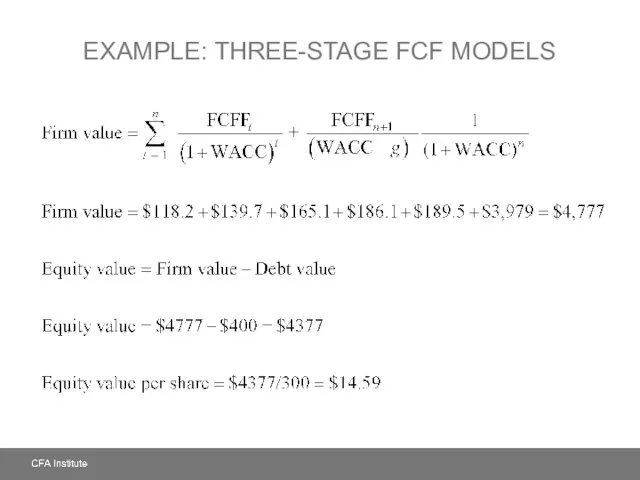

- 41. EXAMPLE: THREE-STAGE FCF MODELS Note : The above formula shows the present value of perpetual stream

- 42. EXAMPLE: THREE-STAGE FCF MODELS

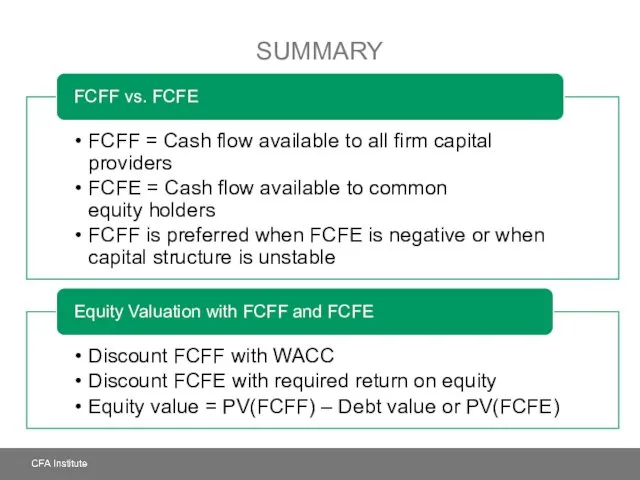

- 43. SUMMARY

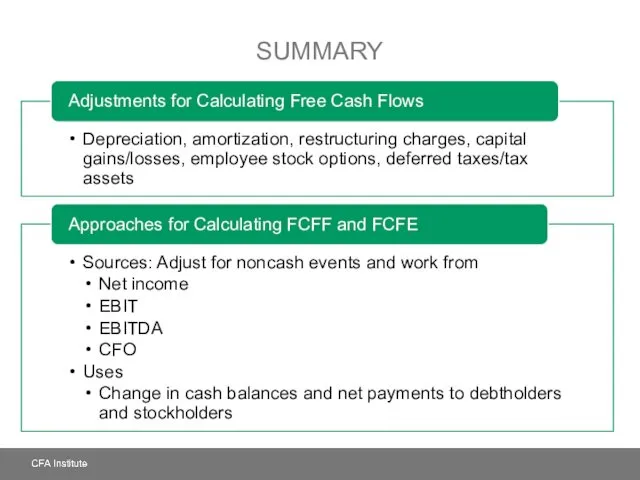

- 44. SUMMARY

- 45. SUMMARY

- 47. Скачать презентацию

Система сметного нормирования и сметных норм в строительстве

Система сметного нормирования и сметных норм в строительстве Денежно-кредитная система и монетарная политика государства

Денежно-кредитная система и монетарная политика государства Страхование имущества юридических лиц

Страхование имущества юридических лиц Прибыль и рентабельность предприятия

Прибыль и рентабельность предприятия Понятие, функции финансовых институтов

Понятие, функции финансовых институтов Оборотные средства

Оборотные средства Қазіргі кәсіпорын құрылымының нарықтық бағытталуы

Қазіргі кәсіпорын құрылымының нарықтық бағытталуы Добровольное медицинское страхование

Добровольное медицинское страхование Итоги деятельности ФНС России за 2019 год

Итоги деятельности ФНС России за 2019 год Управление прибылью предприятия

Управление прибылью предприятия Налоги

Налоги Фінансове право і політика. Тема 3

Фінансове право і політика. Тема 3 Введение в сметное дело и ценообразование в строительстве

Введение в сметное дело и ценообразование в строительстве Автозащита Базовый. Страхование на случай причинения вреда по вине третьих лиц, не имеющих полиса ОСАГО

Автозащита Базовый. Страхование на случай причинения вреда по вине третьих лиц, не имеющих полиса ОСАГО Программа поддержки местных инициатив (ППМИ) в Тверской области в 2016 году

Программа поддержки местных инициатив (ППМИ) в Тверской области в 2016 году Производительность труда. Тема 4

Производительность труда. Тема 4 Анализ ликвидности и платежеспособности на примере ООО Калиста

Анализ ликвидности и платежеспособности на примере ООО Калиста Финансы домохозяйств и корпораций и государственные финансы

Финансы домохозяйств и корпораций и государственные финансы Проект поддержки местных инициатив (ППМИ)

Проект поддержки местных инициатив (ППМИ) Регистрация 20% накопительной дисконтной карты на натуральные нутрицевтики и парафармацевтики производства Nature`s Sunshine

Регистрация 20% накопительной дисконтной карты на натуральные нутрицевтики и парафармацевтики производства Nature`s Sunshine Практические аспекты оценки объектов банковского залога

Практические аспекты оценки объектов банковского залога Trade and cash discounts

Trade and cash discounts 17.1_Договор условного депонирования

17.1_Договор условного депонирования Бюджет для граждан. Нуримановский район Республики Башкортостан

Бюджет для граждан. Нуримановский район Республики Башкортостан Страхование и страховые услуги

Страхование и страховые услуги Тактическое финансовое планирование

Тактическое финансовое планирование Финансы: функции и роль в рыночной экономике

Финансы: функции и роль в рыночной экономике Сущность и исторические аспекты корпоративной социальной ответственности; социальная ответственность бизнеса

Сущность и исторические аспекты корпоративной социальной ответственности; социальная ответственность бизнеса