Содержание

- 2. Comparing diplomatic situation in KAZAKHSTAN BELARUS

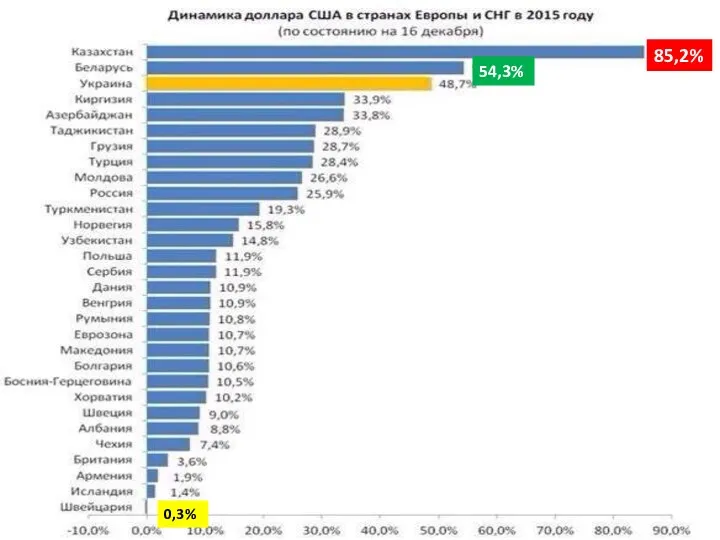

- 3. INCREASING THE DOLLAR DEVALUATION

- 4. 85,2% 54,3% 0,3%

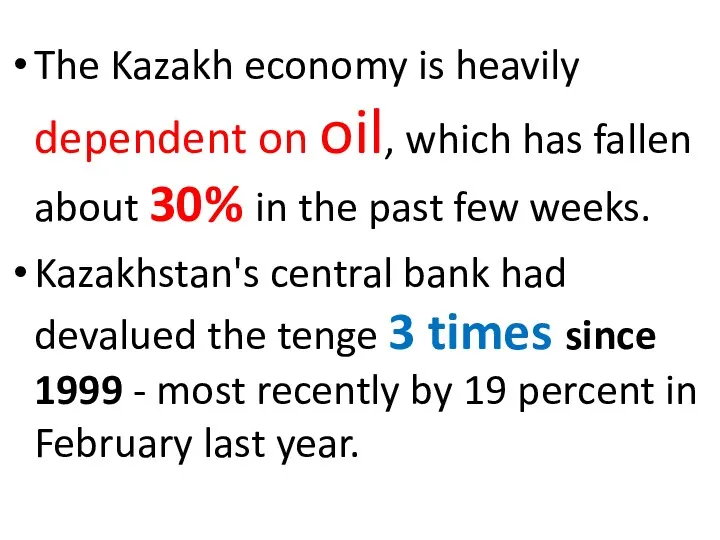

- 5. KAZAKHSTAN

- 6. 1 USD= 368,17 KZT

- 7. The Kazakh economy is heavily dependent on oil, which has fallen about 30% in the past

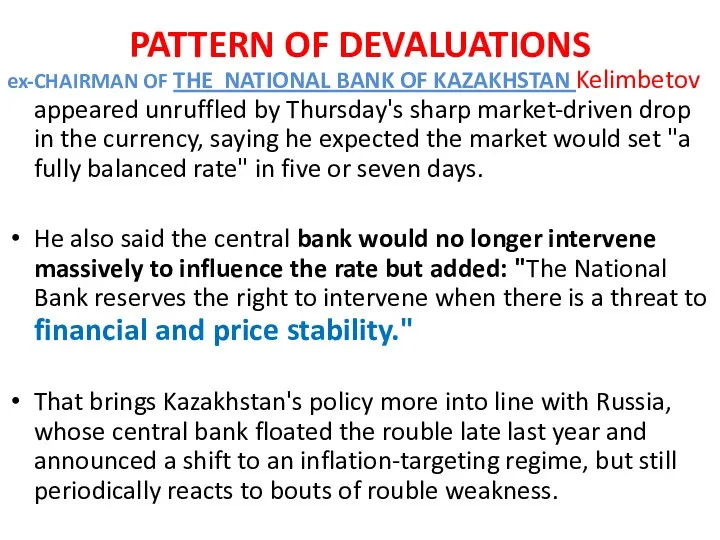

- 8. PATTERN OF DEVALUATIONS ex-CHAIRMAN OF THE NATIONAL BANK OF KAZAKHSTAN Kelimbetov appeared unruffled by Thursday's sharp

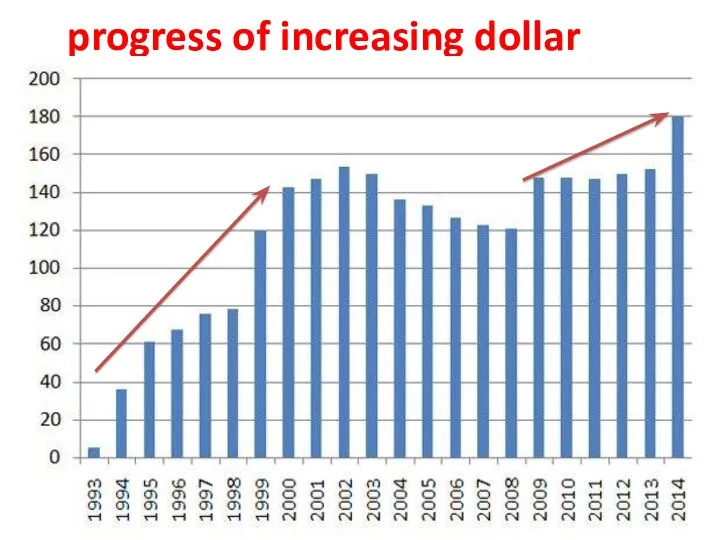

- 9. progress of increasing dollar

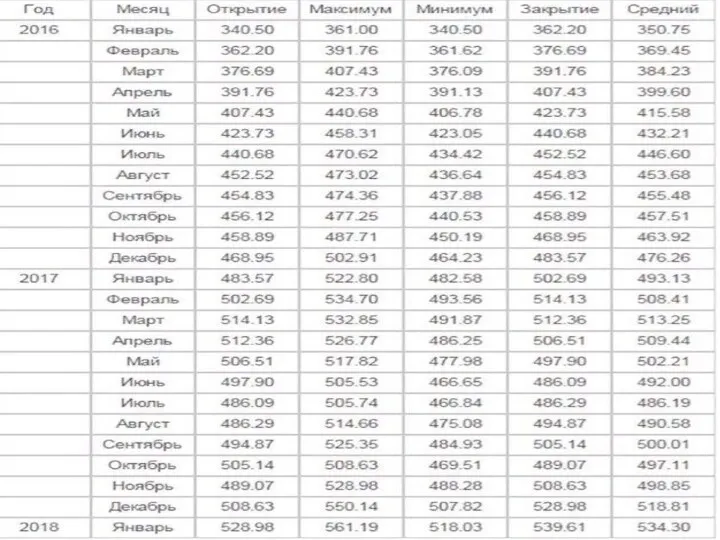

- 11. The predictions of Politicians of KZ about devaluation

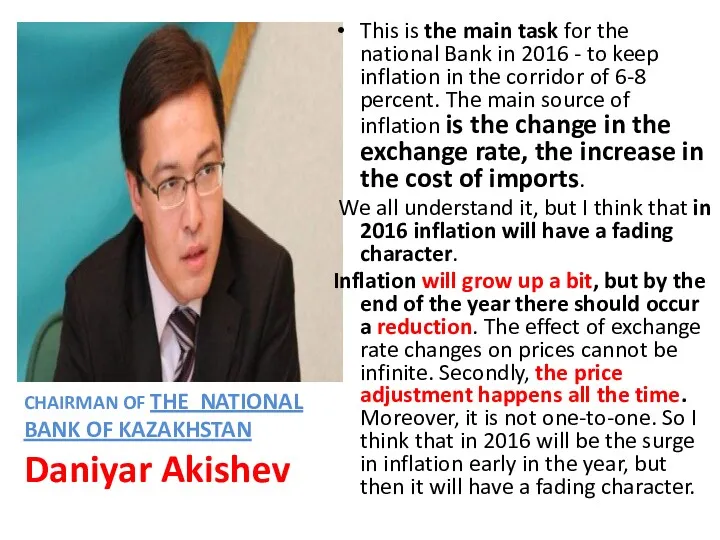

- 12. This is the main task for the national Bank in 2016 - to keep inflation in

- 13. "the rate of tenge is highly depend on oil prices, which is still in a downtrend.

- 14. today it is important to look not just at the exchange rate of tenge , and

- 15. “At the end of the year, the oil may fall another 10% In his macroeconomic report

- 16. BELARUS

- 17. 1 USD = 21970,1 BYR

- 18. Belarusian ruble devaluation continues - the dollar each day beat historical records

- 19. January 12, 2016, at the auction of the Belarusian Currency and Stock Exchange on the US

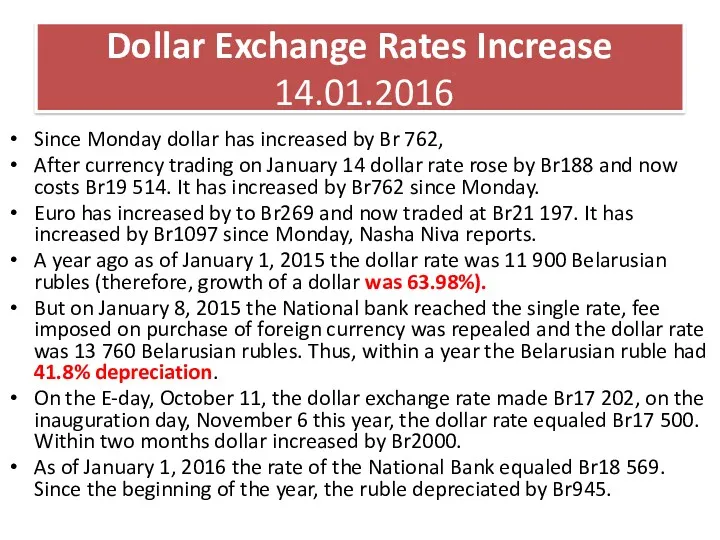

- 20. Dollar Exchange Rates Increase 14.01.2016 Since Monday dollar has increased by Br 762, After currency trading

- 21. For a month the Belarusian ruble devalued the dollar by 12% Last January the dollar -

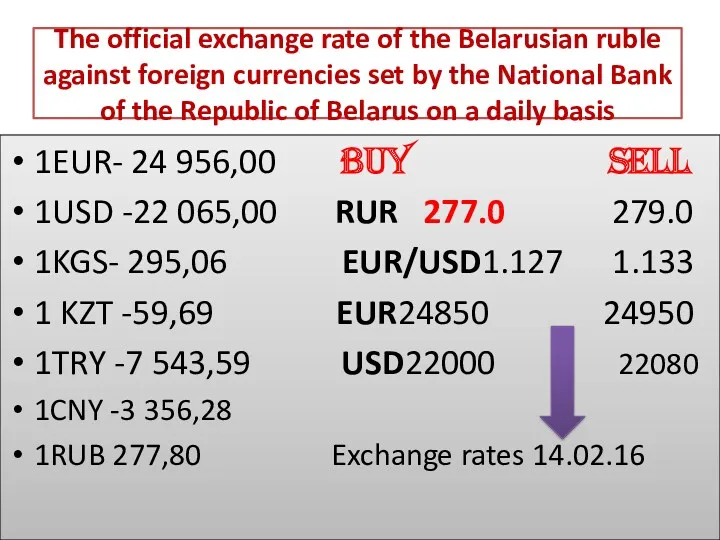

- 22. The official exchange rate of the Belarusian ruble against foreign currencies set by the National Bank

- 23. The predictions of Politicians of BELARUS about devaluation

- 24. With regard to matters related to the conduct of monetary policy, in recent years, the most

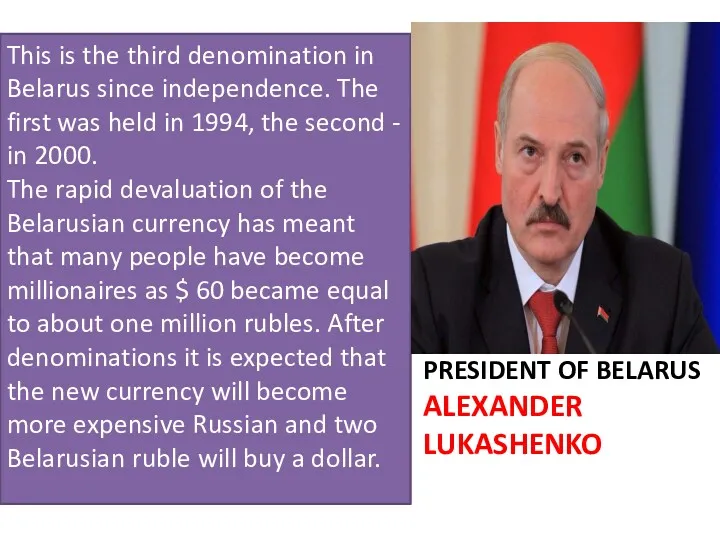

- 25. PRESIDENT OF BELARUS ALEXANDER LUKASHENKO This is the third denomination in Belarus since independence. The first

- 26. In practice it often happens that immediately after the denomination in the economy experienced a surge

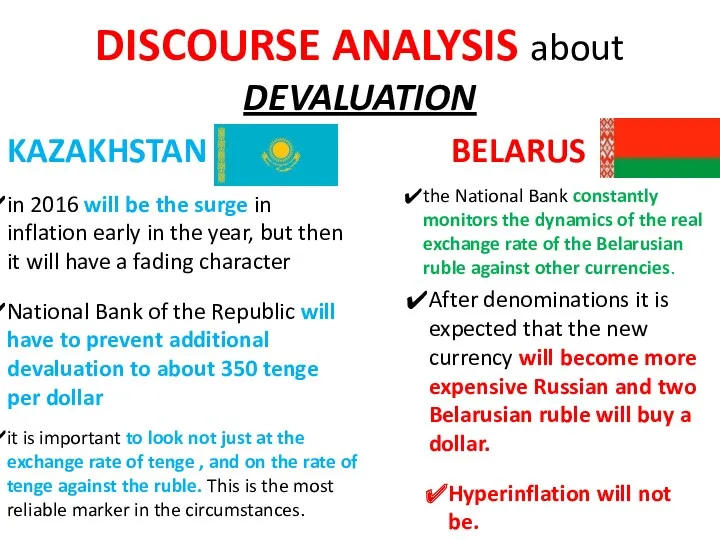

- 27. DISCOURSE ANALYSIS about DEVALUATION KAZAKHSTAN BELARUS in 2016 will be the surge in inflation early in

- 29. Скачать презентацию

Лизинг – один из видов финансовых услуг

Лизинг – один из видов финансовых услуг Налогообложение. Классификация налогов

Налогообложение. Классификация налогов Бюджет для граждан

Бюджет для граждан Финансовая политика международных организаций и финансовых институтов

Финансовая политика международных организаций и финансовых институтов Организация бухгалтерского управленческого учета в организации

Организация бухгалтерского управленческого учета в организации Существенность в аудите

Существенность в аудите Граждане и бюджет. Принципы налогообложения, функции налогов. (Тема 2)

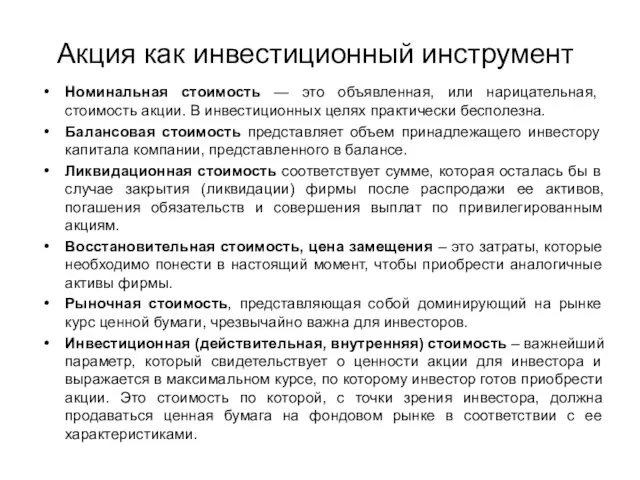

Граждане и бюджет. Принципы налогообложения, функции налогов. (Тема 2) Акция как инвестиционный инструмент

Акция как инвестиционный инструмент Определение рыночной стоимости объекта недвижимости на примере одноэтажного бревенчатого дома

Определение рыночной стоимости объекта недвижимости на примере одноэтажного бревенчатого дома Понятие и назначение финансов

Понятие и назначение финансов Тема 2. Специальный налоговый режим для самозанятых граждан. Регистрация в качестве самозанятого

Тема 2. Специальный налоговый режим для самозанятых граждан. Регистрация в качестве самозанятого Банковские ресурсы: формирование и управление

Банковские ресурсы: формирование и управление Контрольно-кассовая машина. Работа и обслуживание

Контрольно-кассовая машина. Работа и обслуживание Венчурные фонды в России

Венчурные фонды в России Основы бизнес-планирования

Основы бизнес-планирования Оформление результатов выездной налоговой проверки. Лекция 5

Оформление результатов выездной налоговой проверки. Лекция 5 Оценка зданий и сооружений

Оценка зданий и сооружений Бухгалтерские услуги для бизнеса. Патентная система

Бухгалтерские услуги для бизнеса. Патентная система Банки и банковская система

Банки и банковская система Кредитная карта

Кредитная карта Страховой рынок Казахстана: современное состояние и перспективы развития

Страховой рынок Казахстана: современное состояние и перспективы развития Митний режим

Митний режим Классификация и содержание инвестиционных и инновационных рисков

Классификация и содержание инвестиционных и инновационных рисков Бухгалтерский учет операций по выдаче (размещению) денежных средств по договорам займа и банковского вклада. Глава 4

Бухгалтерский учет операций по выдаче (размещению) денежных средств по договорам займа и банковского вклада. Глава 4 Различие между оценкой бизнеса в России и за рубежом

Различие между оценкой бизнеса в России и за рубежом Издержки и выручка предприятия

Издержки и выручка предприятия История денежной единицы России

История денежной единицы России Налоговая политика и налоговая система

Налоговая политика и налоговая система