Содержание

- 2. Lecture outline Rationale behind financial statements Reasons for recording financial transactions Sources of financial statements and

- 3. Rationale behind financial statements Pieces of paper with numbers – but what is behind? Historically, development

- 4. Rationale behind financial statements Currently: Owners (and lenders need) financial information to make decisions, managers to

- 5. Reasons for recording transactions Main reasons for recording: An evidence for the transaction Annual accounts can

- 6. Security issues Financial documents must be completed neatly and accurately. Three major aspects: authorization of orders,

- 7. Accounting methods Cash basis – simple: record a sale when a payment is received, expense when

- 8. Sources of financial statements and reports The annual report contains two types of information – numbers

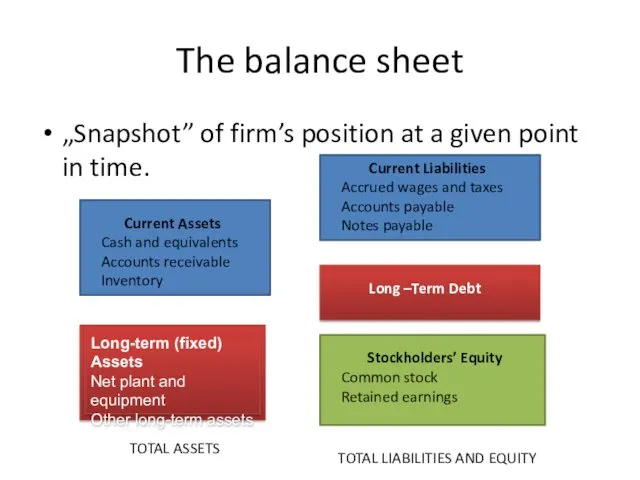

- 9. The balance sheet „Snapshot” of firm’s position at a given point in time. Current Assets Cash

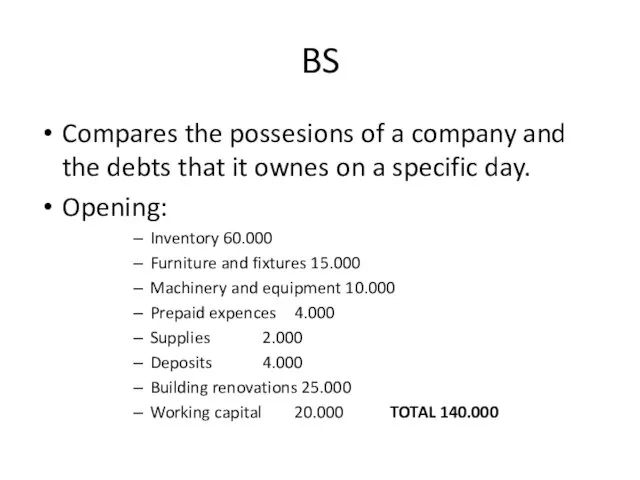

- 10. BS Compares the possesions of a company and the debts that it ownes on a specific

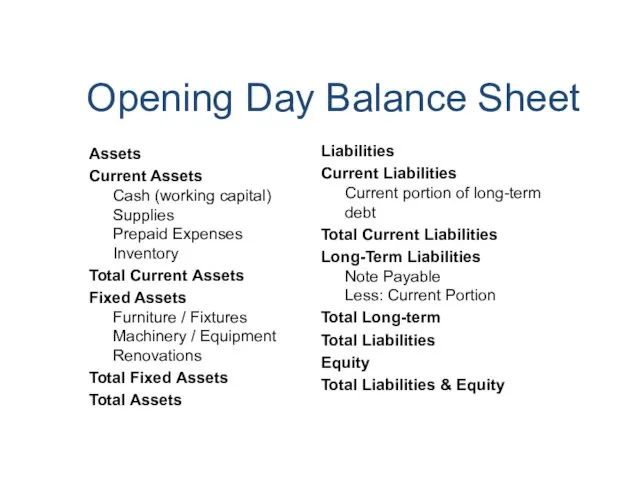

- 11. Opening Day Balance Sheet Assets Current Assets Cash (working capital) Supplies Prepaid Expenses Inventory Total Current

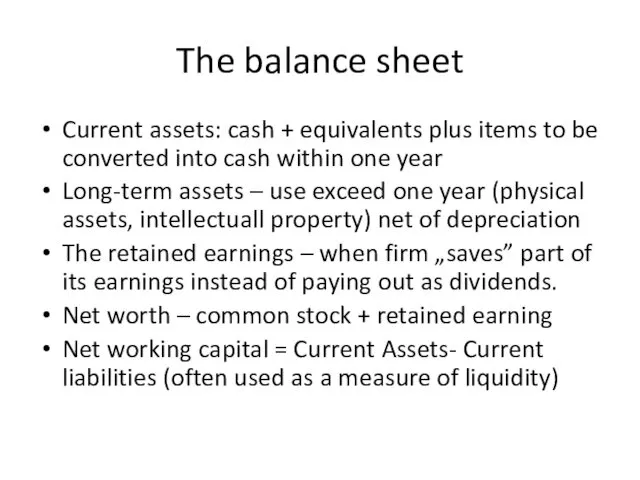

- 12. The balance sheet Current assets: cash + equivalents plus items to be converted into cash within

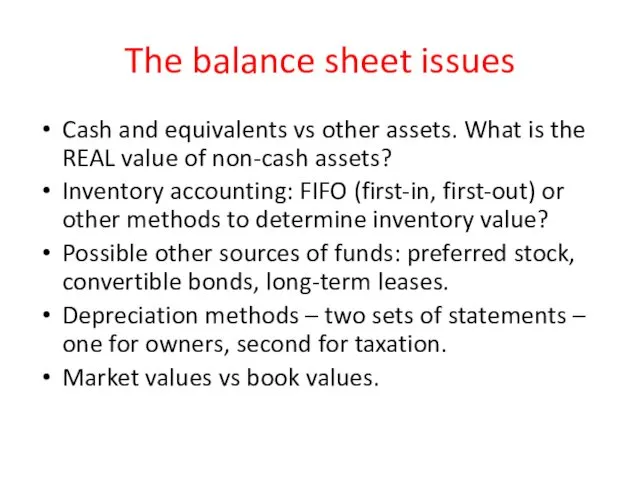

- 13. The balance sheet issues Cash and equivalents vs other assets. What is the REAL value of

- 14. The income statement A report summarizing revenues and expenses (or rather costs) during an accounting period

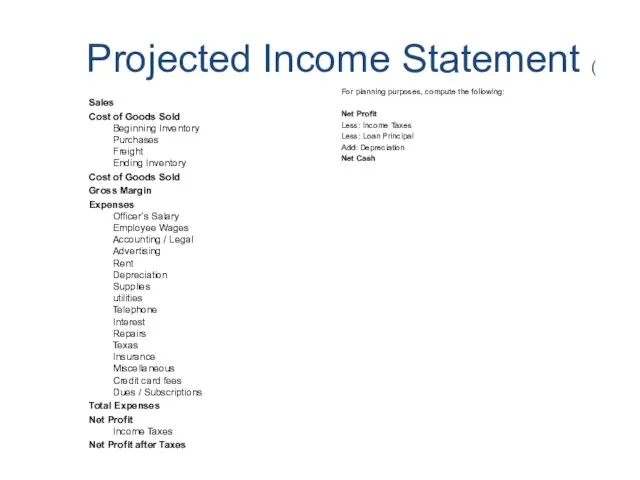

- 15. Projected Income Statement ( Sales Cost of Goods Sold Beginning Inventory Purchases Freight Ending Inventory Cost

- 16. Statement of cash flow Net CF represents a cash generated by business. But high cash flow

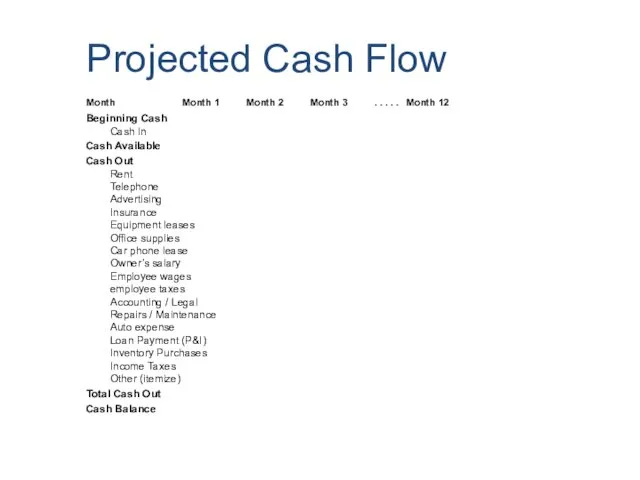

- 17. Projected Cash Flow Beginning Cash Cash In Cash Available Cash Out Rent Telephone Advertising Insurance Equipment

- 18. Statement of retained earnings How much of the firm’s earnings were retained in the business rather

- 19. Income statement vs cash-flow IS: Shows sales as they are generated Depreciation is shown Interest on

- 20. Break – even point The minimum amount of sales necessary for company’s survival After calculating it

- 21. Modifying accounting data Net Operating Working Capital (NOWC) – Operating working capital less accounts payable and

- 23. Скачать презентацию

Бюджетное ограничение

Бюджетное ограничение Кредитование. Классификация банковских кредитов

Кредитование. Классификация банковских кредитов Система управления финансами транснациональной корпорации

Система управления финансами транснациональной корпорации Инвентаризация товарно-материальных ценностей

Инвентаризация товарно-материальных ценностей АТФ Банк тарихы

АТФ Банк тарихы Учет и аудит расчетов с поставщиками и подрядчиками. ООО Инструментстрой

Учет и аудит расчетов с поставщиками и подрядчиками. ООО Инструментстрой День банка в Альфа-Банк

День банка в Альфа-Банк Европейский опыт – финансовая надежность. Овердрафт для малого бизнеса в ОТП Банке

Европейский опыт – финансовая надежность. Овердрафт для малого бизнеса в ОТП Банке Валютный контроль и международные расчёты

Валютный контроль и международные расчёты Микрофинансовые организации. Микрозаймы и банковские кредиты. (10 класс)

Микрофинансовые организации. Микрозаймы и банковские кредиты. (10 класс) Республикалық бюджет жобасын құрастыру кезеңдері

Республикалық бюджет жобасын құрастыру кезеңдері Определение размера источника дивидендных выплат и его влияние на размер дивидендных выплат и дивидендную доходность госкомпаний

Определение размера источника дивидендных выплат и его влияние на размер дивидендных выплат и дивидендную доходность госкомпаний Финансовая система и финансовая политика

Финансовая система и финансовая политика Кредит и кредитные отношения. Необходимость и сущность кредита

Кредит и кредитные отношения. Необходимость и сущность кредита Особенности бюджетной системы Швейцарии

Особенности бюджетной системы Швейцарии Коммерческая эксплуатация недвижимости

Коммерческая эксплуатация недвижимости Инвестиционный паспорт (предложение) объекта культурного наследия

Инвестиционный паспорт (предложение) объекта культурного наследия Медицинское страхование

Медицинское страхование Принципы оценки недвижимости. (Лекция 2)

Принципы оценки недвижимости. (Лекция 2) Автоматизированная система межбанковских расчётов

Автоматизированная система межбанковских расчётов Налог на игорный бизнес. Плательщики налога на игорный бизнес

Налог на игорный бизнес. Плательщики налога на игорный бизнес Работа на терминале Wave

Работа на терминале Wave Затраты на качество

Затраты на качество Судебные споры, банкротство и субсидиарная ответственность в финансовом секторе

Судебные споры, банкротство и субсидиарная ответственность в финансовом секторе Відкриття онлайн депозитів в ощад 24/7 (загальні відомості)

Відкриття онлайн депозитів в ощад 24/7 (загальні відомості) Платежные карты в организации розничных платежей на примере АОРоссельхозбанк

Платежные карты в организации розничных платежей на примере АОРоссельхозбанк Финансовое обеспечение инновационной деятельности

Финансовое обеспечение инновационной деятельности Электронные деньги

Электронные деньги