Содержание

- 2. Loans in modern life Finance

- 3. Plan Loans and modern lending conditions Loans: advantages and disadvantages Is it necessary to take a

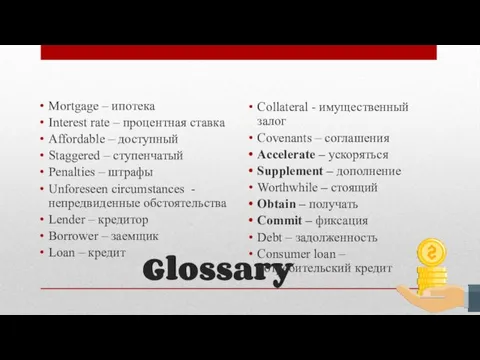

- 4. Glossary Mortgage – ипотека Interest rate – процентная ставка Affordable – доступный Staggered – ступенчатый Penalties

- 5. Citation Credit is a system whereby a person who can not pay gets another person who

- 6. Definition A loan is the act of giving money, property or other material goods to another

- 7. How Do Interest Rates Affect Loans? Interest rates have a huge effect on loans. In short,

- 8. Types of loans 1.Consumer loan 2. Mortgage 3. Credit cards 4. Car loan 5. Educational loan

- 9. The loan agreement should reflect the terms of the loan, which include: - amount of loan;

- 10. Advantages 1. There is a loan for just about anything. 2. It helps a person afford

- 11. Disadvantages 1. Overpayment 2. Punishment 3. Unforeseen circumstances 4. Long-term debt. 5. Not be able to

- 12. Statistics

- 14. Lending terms the final value of the cost of a loan taking into account insurance, the

- 15. Banks It is impossible to determine the most profitable bank for obtaining a loan. All depends

- 16. Survey Your relation to the loans. Positive Negative Neutral Are you familiar with terms for crediting?

- 17. Article Review “ 5 Ways to Beat Student Loan Debt” 1. Live frugally in college and/or

- 18. Conclusion Everything depends on you! You shouldn't be afraid to take the loan. Fulfill the dream!

- 19. Questions 1. Is it necessary to take a loan (your opinion) Or we can live without

- 20. THANK YOU!

- 22. Скачать презентацию

Налоговое право

Налоговое право Бухгалтеру. Новые возможности системы

Бухгалтеру. Новые возможности системы Статистика денежного обращения

Статистика денежного обращения Финансовая деятельность предприятия

Финансовая деятельность предприятия Сущность и функции страхования. Законодательные основы страховой деятельности. Рынок страхования

Сущность и функции страхования. Законодательные основы страховой деятельности. Рынок страхования Учебный центр БКС. Таблицы роста акций

Учебный центр БКС. Таблицы роста акций Учет доходов и расходов при совмещении ОСНО и ЕНВД

Учет доходов и расходов при совмещении ОСНО и ЕНВД Инклюзивті білім беру жүиесін материалдық техникалық қамтамасыз ету жолдары

Инклюзивті білім беру жүиесін материалдық техникалық қамтамасыз ету жолдары Инвестиционный проект: содержание, классификация, фазы развития

Инвестиционный проект: содержание, классификация, фазы развития Кәсіпорындағы еңбекақы төлеу

Кәсіпорындағы еңбекақы төлеу Анализ безубыточности и целевое планирование прибыли в процессе инвестиционного проектирования. Тема 2

Анализ безубыточности и целевое планирование прибыли в процессе инвестиционного проектирования. Тема 2 Организация системы учета в аптечной организации. Объекты учета. Документация хозяйственной деятельности

Организация системы учета в аптечной организации. Объекты учета. Документация хозяйственной деятельности Рынок государственных ценных бумаг России

Рынок государственных ценных бумаг России Временная оценка денежных потоков. (Лекция 3)

Временная оценка денежных потоков. (Лекция 3) Особливості комп'ютерної системи бухгалтерського обліку

Особливості комп'ютерної системи бухгалтерського обліку Банки, банковские системы и банковские операции

Банки, банковские системы и банковские операции Организация оплаты труда работников железнодорожного транспорта. Российские железные дороги

Организация оплаты труда работников железнодорожного транспорта. Российские железные дороги Развитие межбюджетных отношений в Российской Федерации

Развитие межбюджетных отношений в Российской Федерации Деньги, их виды и функции

Деньги, их виды и функции Управління фінансовою стійкістю підприємства на прикладі ПАТ Білоцерківський завод ЗБК

Управління фінансовою стійкістю підприємства на прикладі ПАТ Білоцерківський завод ЗБК Инвентаризация дебиторской и кредиторской задолженности по состоянию на 30 июня 2018 года. Желдоручет ОАО РЖД

Инвентаризация дебиторской и кредиторской задолженности по состоянию на 30 июня 2018 года. Желдоручет ОАО РЖД Структура и объекты социальной защиты населения

Структура и объекты социальной защиты населения Предмет и метод бухгалтерского учета. Бухгалтерский баланс

Предмет и метод бухгалтерского учета. Бухгалтерский баланс Прямая поставка коммунальных ресурсов

Прямая поставка коммунальных ресурсов Финансовый взлет

Финансовый взлет Рынки ресурсов. Сбережения и их превращение в капитал, инвестиции, устройство рынка капитала

Рынки ресурсов. Сбережения и их превращение в капитал, инвестиции, устройство рынка капитала Анализ и оценка институциональных проблем в банковской системе РФ

Анализ и оценка институциональных проблем в банковской системе РФ Кредитный Договор

Кредитный Договор