Содержание

- 2. Objectives Define the term markdown when applied to selling. Calculate markdown, reduced price, and percent of

- 3. Define the term Markdown when Applied to Selling When merchandise does not sell, the price is

- 4. Finding Reduced Price Reduced price = Original price – Markdown

- 5. Example 1 (1 of 2) Dick’s Sporting Goods has reduced, or marked down, the price of

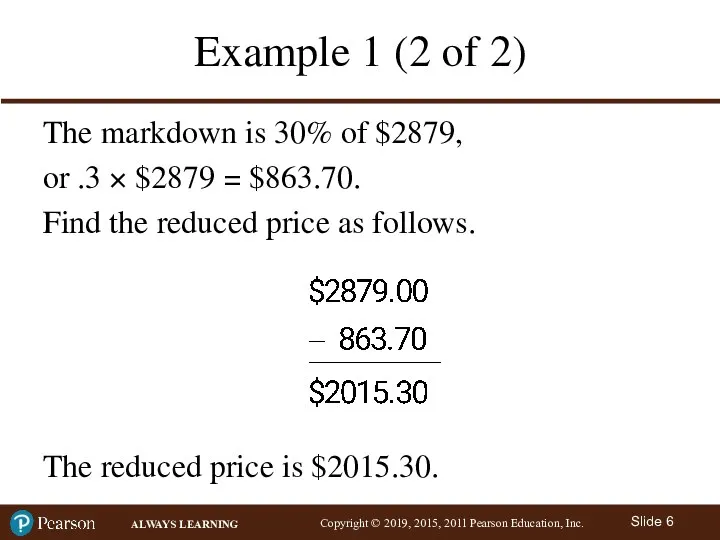

- 6. Example 1 (2 of 2) The markdown is 30% of $2879, or .3 × $2879 =

- 7. Example 2 (1 of 2) The total inventory of coffee mugs at a gift shop has

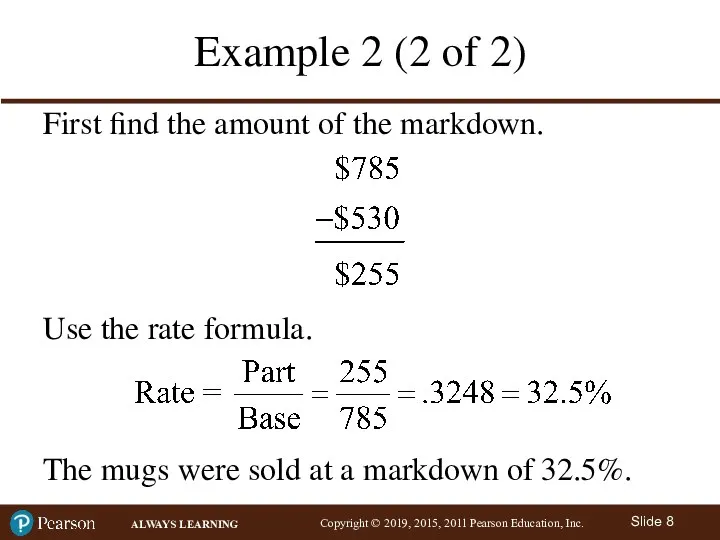

- 8. Example 2 (2 of 2) First find the amount of the markdown. Use the rate formula.

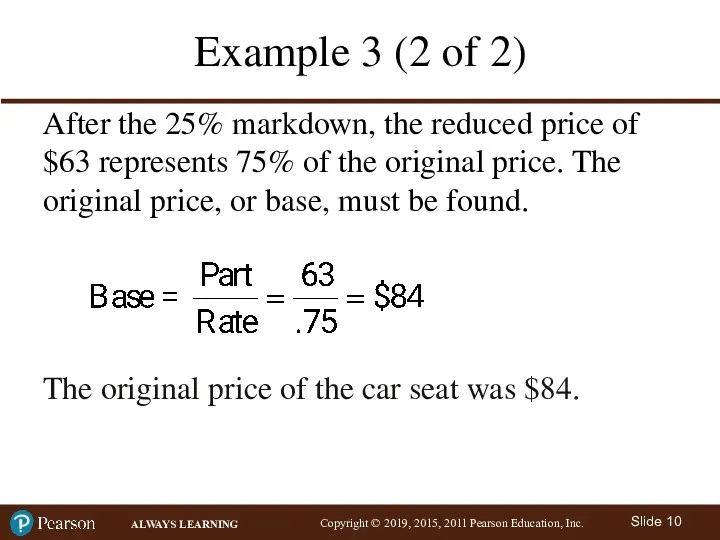

- 9. Example 3 (1 of 2) Target offers a child’s car seat at a reduced price of

- 10. Example 3 (2 of 2) After the 25% markdown, the reduced price of $63 represents 75%

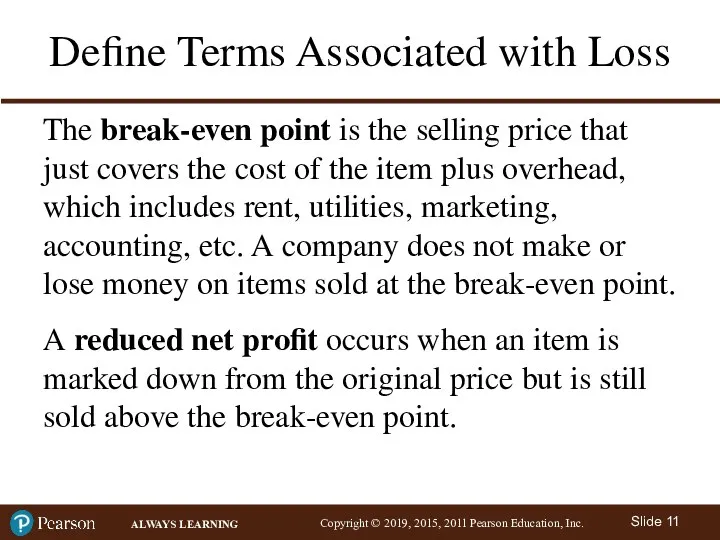

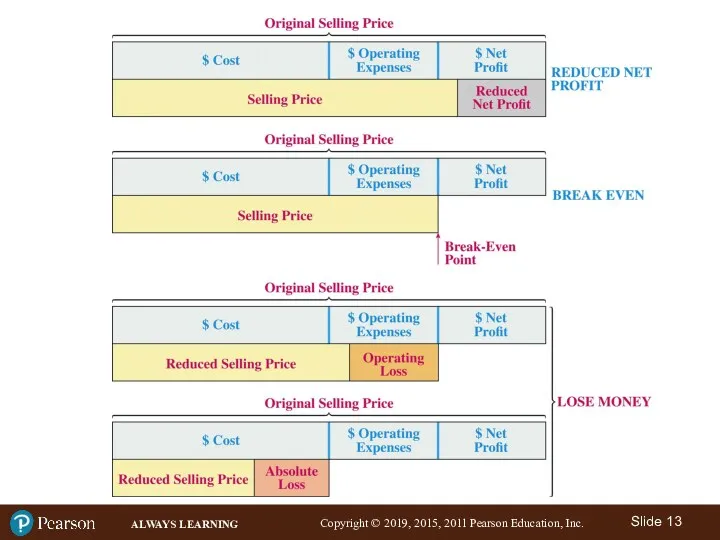

- 11. Define Terms Associated with Loss The break-even point is the selling price that just covers the

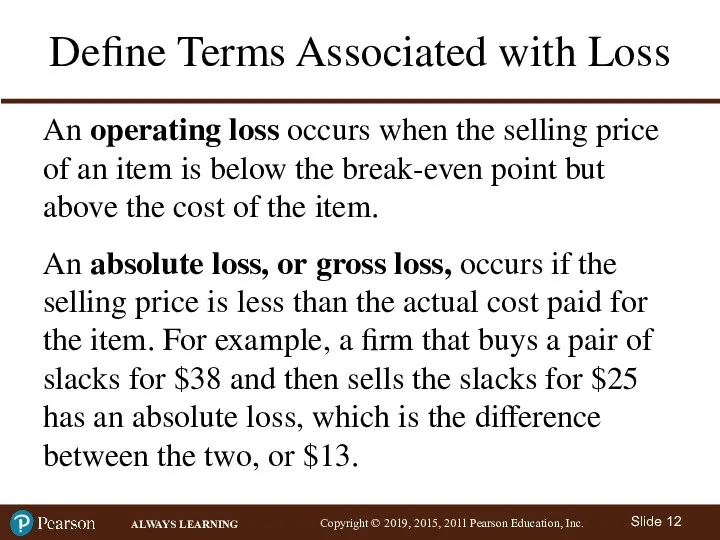

- 12. Define Terms Associated with Loss An operating loss occurs when the selling price of an item

- 14. Helpful Formulas Break-even point = Cost + Operating expenses Operating loss = Break-even point − Reduced

- 15. Example 4 (1 of 3) Appliance Giant paid $1600 for a 75-inch LCD flat-panel HDTV. If

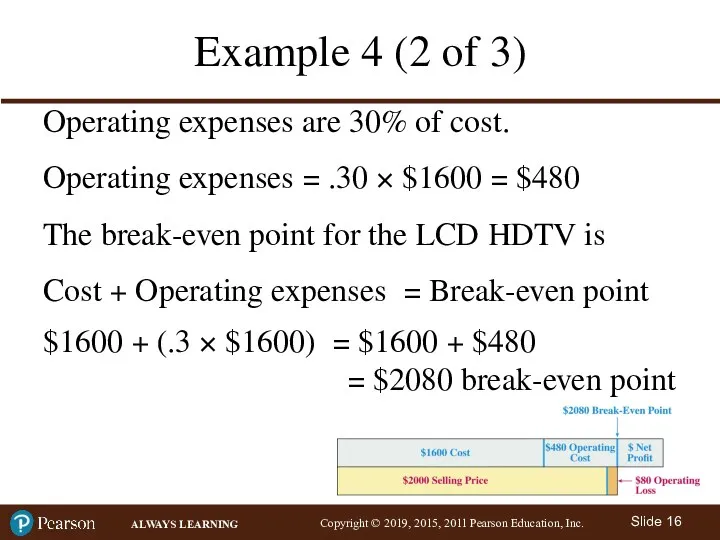

- 16. Example 4 (2 of 3) Operating expenses are 30% of cost. Operating expenses = .30 ×

- 17. Example 4 (3 of 3) So, the company makes a profit if the television is sold

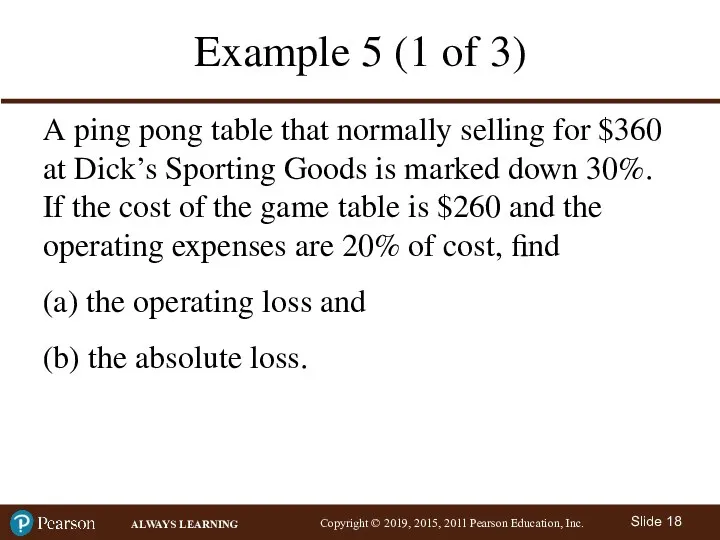

- 18. Example 5 (1 of 3) A ping pong table that normally selling for $360 at Dick’s

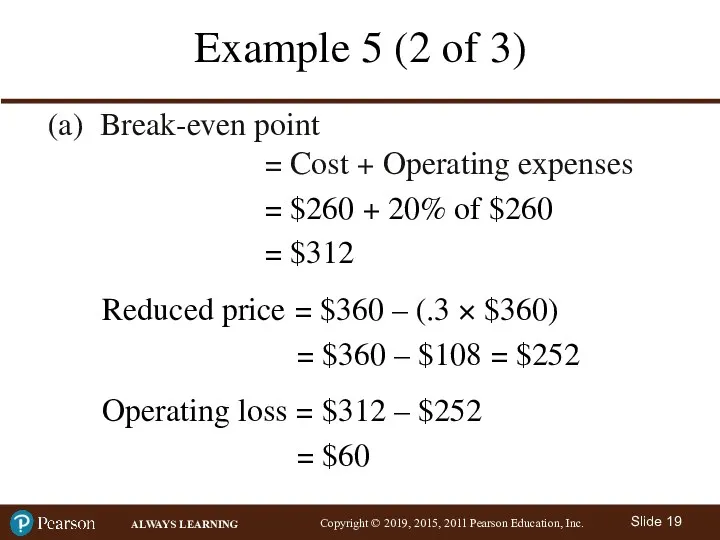

- 19. Example 5 (2 of 3) (a) Break-even point = Cost + Operating expenses = $260 +

- 21. Скачать презентацию

Оценка качества кредитного портфеля в современной банковской практике

Оценка качества кредитного портфеля в современной банковской практике Базисные условия поставки. Инкотермс-2010

Базисные условия поставки. Инкотермс-2010 Как увеличить денежный поток

Как увеличить денежный поток Внебюджетные фонды в финансовой системе государства

Внебюджетные фонды в финансовой системе государства Негосударственные пенсионные фонды

Негосударственные пенсионные фонды Федеральное казначейство РФ. Вопросы технологического обеспечения передачи полномочий по ведению бюджетного учета

Федеральное казначейство РФ. Вопросы технологического обеспечения передачи полномочий по ведению бюджетного учета Ақша. Шығу тарихы

Ақша. Шығу тарихы Оборотные средства организации (предприятия) и их эффективность

Оборотные средства организации (предприятия) и их эффективность Финансовые методы повышения стоимости компании

Финансовые методы повышения стоимости компании Режимы налогообложения. Задание 6

Режимы налогообложения. Задание 6 Экономическая сущность и классификация инвестиций. Темы 1-4

Экономическая сущность и классификация инвестиций. Темы 1-4 Аудиторский контроль

Аудиторский контроль Зарплатный проект. Пакетная линейка карт

Зарплатный проект. Пакетная линейка карт Range market. Торговля в боковом тренде

Range market. Торговля в боковом тренде Основы социального страхования

Основы социального страхования Программы накопительного страхования жизни

Программы накопительного страхования жизни Innovations in Insurance

Innovations in Insurance История фальшивых денег, как избежать подделки

История фальшивых денег, как избежать подделки Правове положення комерційних банків. (Тема 3)

Правове положення комерційних банків. (Тема 3) Бухучет и налоги в 2020 году: отчетная революция

Бухучет и налоги в 2020 году: отчетная революция Семейный бюджет. Бюджет школьника

Семейный бюджет. Бюджет школьника Государственные ипотечные программы, реализуемые ГП НО НИКА

Государственные ипотечные программы, реализуемые ГП НО НИКА Управление денежными потоками по инвестиционной деятельности

Управление денежными потоками по инвестиционной деятельности Nauka o organizacji. Konsorcjum

Nauka o organizacji. Konsorcjum Зарплатный проект в рамках Пакетов решений Alfa Smart

Зарплатный проект в рамках Пакетов решений Alfa Smart Акционерное общество

Акционерное общество Daň z přidané hodnoty

Daň z přidané hodnoty Криптотрейдинг с нуля

Криптотрейдинг с нуля