Содержание

- 2. Contents Main approach to National Accounting Definition of National Accounting Main concepts of National Accounting Main

- 3. Definition of National Accounting accounting | erp | import | legal | tax System or approach

- 4. Main concepts of National Accounting accounting | erp | import | legal | tax AGENTS:

- 5. Main concepts of National Accounting accounting | erp | import | legal | tax COMPONENTS:

- 6. Tools for macroeconomic analysis accounting | erp | import | legal | tax

- 7. Input-output framework: Definition accounting | erp | import | legal | tax 4 5

- 8. Input-output framework: Purpose accounting | erp | import | legal | tax

- 9. Input-output framework: Structure & assumptions to follow accounting | erp | import | legal | tax

- 10. Input-output framework: Table of intermediate consumption Purpose / essence To calculate the amount of intermediate consumption

- 11. Input-output framework: Table of intermediate consumption accounting | erp | import | legal | tax Formula

- 12. Input-output framework: Table of intermediate consumption accounting | erp | import | legal | tax 1

- 13. Input-output framework: Table of output by branches accounting | erp | import | legal | tax

- 14. Input-output framework: Table of output by branches accounting | erp | import | legal | tax

- 15. Input-output framework: Table of output by products accounting | erp | import | legal | tax

- 16. Input-output framework: Table of output by products accounting | erp | import | legal | tax

- 17. Input-output framework: Table of resources by products accounting | erp | import | legal | tax

- 18. Input-output framework: Table of resources by products accounting | erp | import | legal | tax

- 19. Input-output framework: Table of Uses (by products) accounting | erp | import | legal | tax

- 20. Input-output framework: Table of Uses (by products) ASSUMPTIONS Amount of expenses made by non-residents within the

- 21. Thank you for your attention accounting | erp | import | legal | tax

- 22. accounting | erp | import | legal | tax Smirnova Ekaterina, PhD in Economics Accounting team

- 24. Скачать презентацию

Основы финансовой политики и ее роль в развитии общества

Основы финансовой политики и ее роль в развитии общества Понятие бухгалтерского учёта

Понятие бухгалтерского учёта Математические методы в оценке

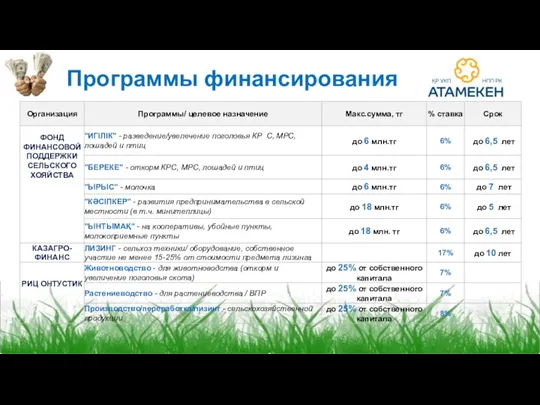

Математические методы в оценке Программы финансирования

Программы финансирования Основы организации финансовой работы в бюджетной организации

Основы организации финансовой работы в бюджетной организации Налоговые правонарушения и налоговая ответственность

Налоговые правонарушения и налоговая ответственность Оценка целостных имущественных комплексов

Оценка целостных имущественных комплексов Оценка имущественного положения предприятия ГУП Анивское ДРСУ

Оценка имущественного положения предприятия ГУП Анивское ДРСУ Планирование и нормирование производственных затрат

Планирование и нормирование производственных затрат Карманные деньги подростков. Как их приумножить

Карманные деньги подростков. Как их приумножить Місце фінансового ринку в фінансовій системі

Місце фінансового ринку в фінансовій системі Аналіз фінансових результатів діяльності підприємства

Аналіз фінансових результатів діяльності підприємства Основные изменения налогового законодательства на 2023 год

Основные изменения налогового законодательства на 2023 год Банки. Классификация активных операций

Банки. Классификация активных операций Материально-техническое обеспечение системы образования

Материально-техническое обеспечение системы образования Фінансові послуги на ринку позик

Фінансові послуги на ринку позик Contabilitatea şi auditul stocurilor

Contabilitatea şi auditul stocurilor Оценка потенциального банкротства организации ОАО Туймаада-Агроснаб

Оценка потенциального банкротства организации ОАО Туймаада-Агроснаб Финансовая деятельность предприятия

Финансовая деятельность предприятия Подготовка компании к IPO. Правовые аспекты IPO

Подготовка компании к IPO. Правовые аспекты IPO Кредитный процесс

Кредитный процесс Основы организации Бухгалтерского учета на предприятии

Основы организации Бухгалтерского учета на предприятии Доведення банку до неплатоспроможності

Доведення банку до неплатоспроможності Планы закупок и планы-графики закупок товаров, работ, услуг муниципальными заказчиками Тульской области

Планы закупок и планы-графики закупок товаров, работ, услуг муниципальными заказчиками Тульской области Онлайн-кассы. Новые требования

Онлайн-кассы. Новые требования Управление вендинговой компанией с помощью конфигурации ВЕНДИНГ 8.3

Управление вендинговой компанией с помощью конфигурации ВЕНДИНГ 8.3 Управление личными финансами

Управление личными финансами Налог на добычу полезных ископаемых. Глава 26 НК РФ

Налог на добычу полезных ископаемых. Глава 26 НК РФ