Содержание

- 2. Preparing Financial Statements Publicly owned companies – those with shares listed on a stock exchange –

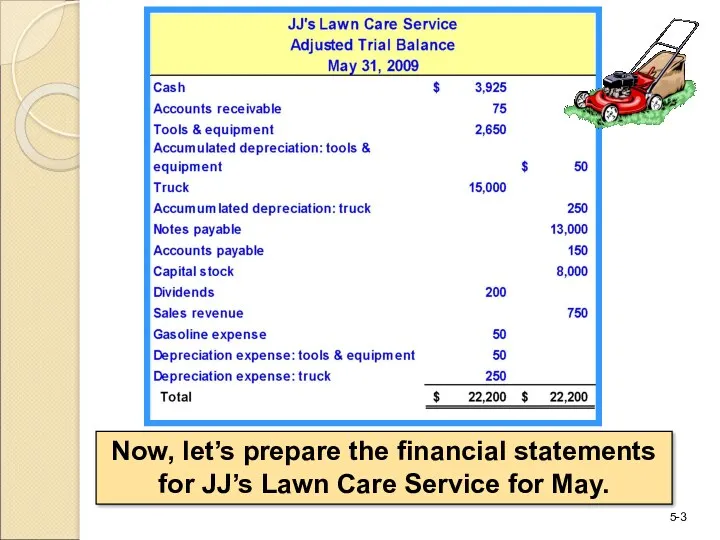

- 3. Now, let’s prepare the financial statements for JJ’s Lawn Care Service for May.

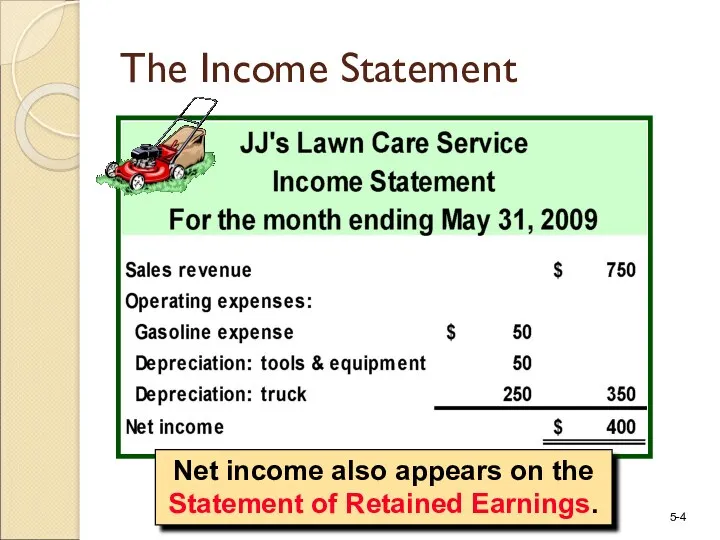

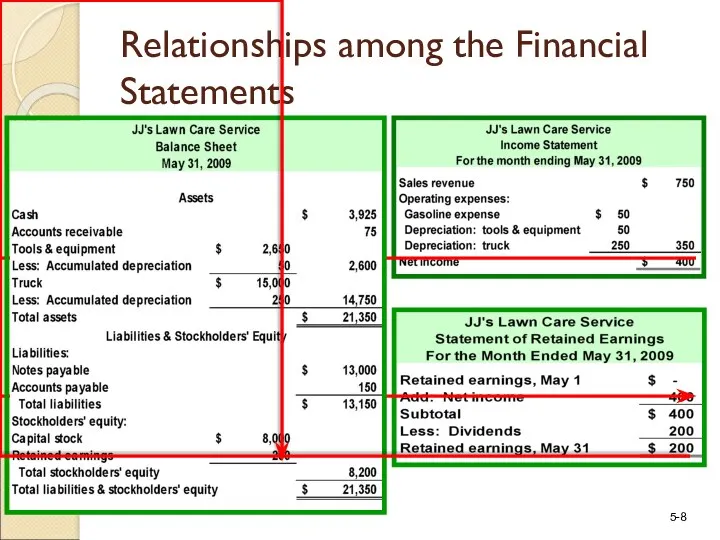

- 4. Net income also appears on the Statement of Retained Earnings. The Income Statement

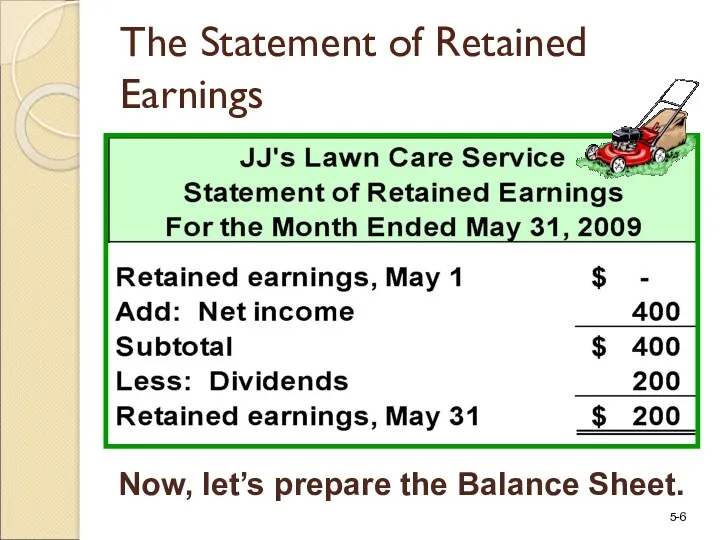

- 5. Summarizes the increases and decreases in Retained Earnings during the period. The Statement of Retained Earnings

- 6. Now, let’s prepare the Balance Sheet. The Statement of Retained Earnings

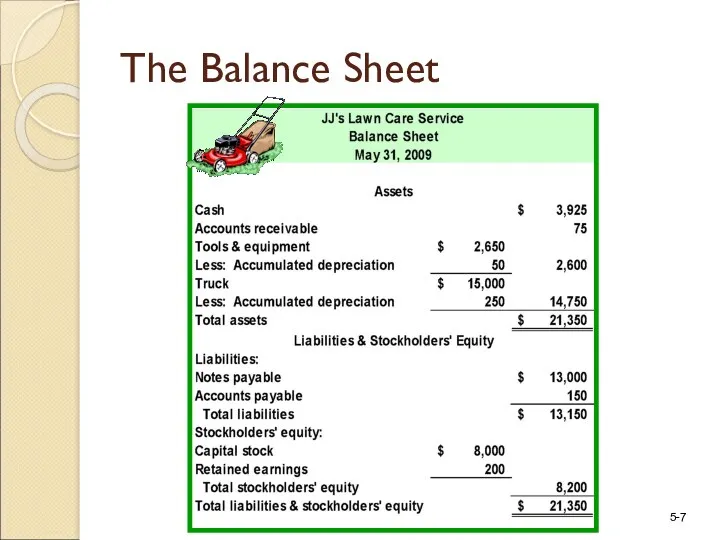

- 7. The Balance Sheet

- 8. Relationships among the Financial Statements

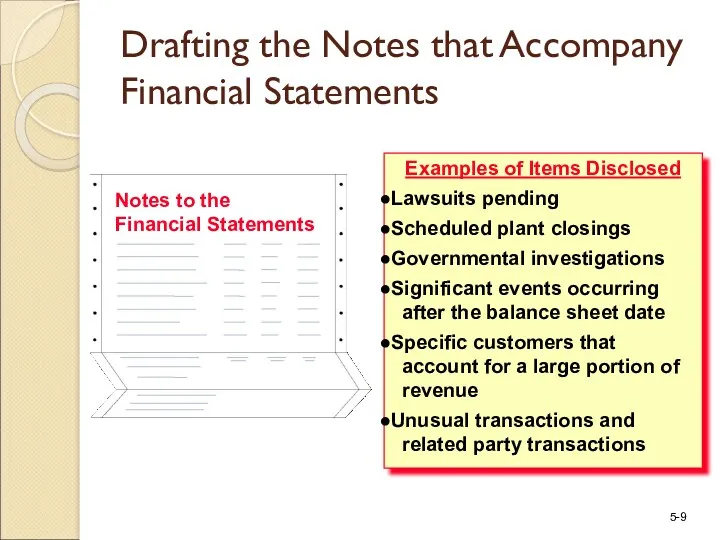

- 9. Notes to the Financial Statements Examples of Items Disclosed Lawsuits pending Scheduled plant closings Governmental investigations

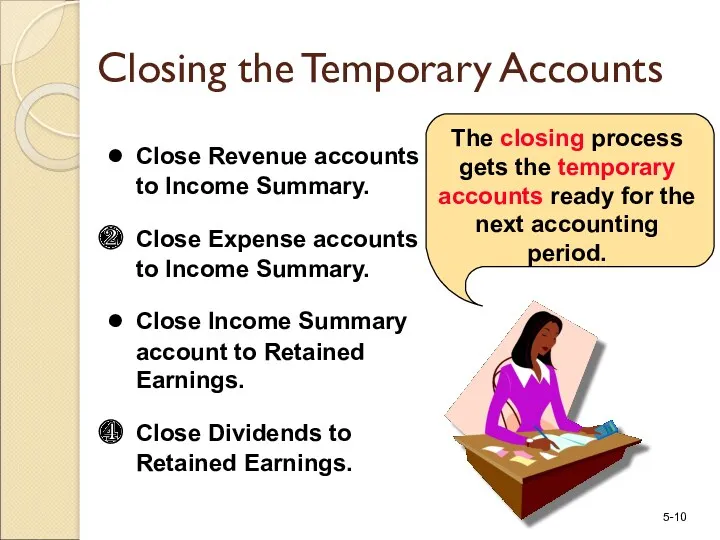

- 10. Closing the Temporary Accounts Close Revenue accounts to Income Summary. Close Expense accounts to Income Summary.

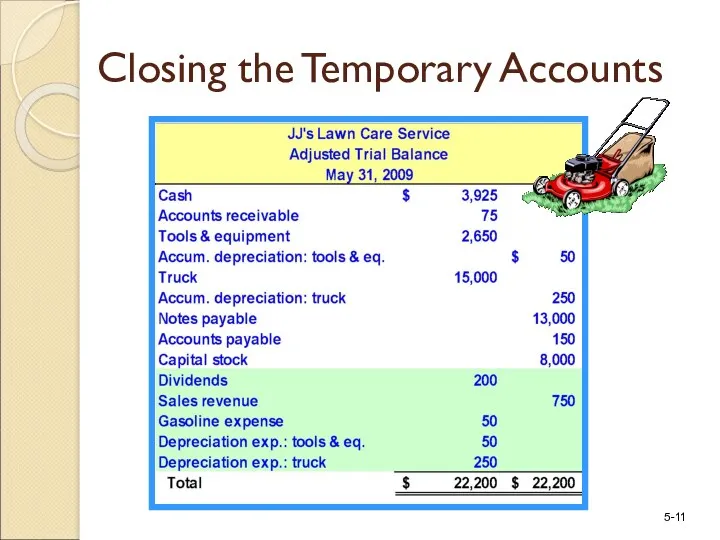

- 11. Closing the Temporary Accounts

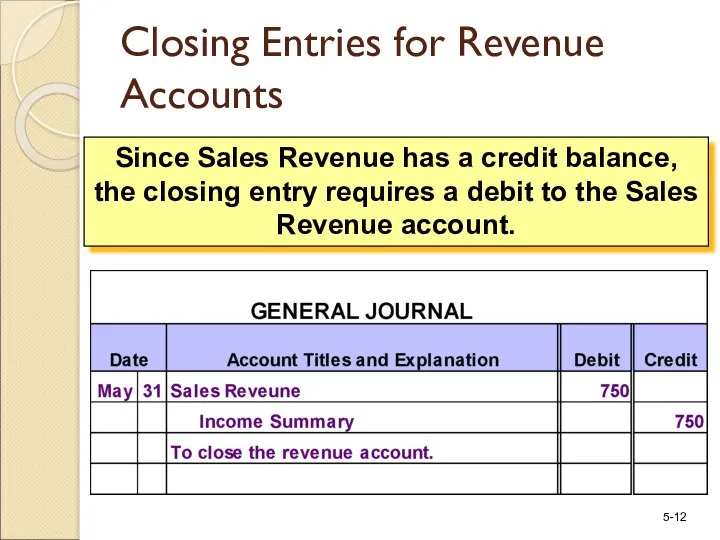

- 12. Since Sales Revenue has a credit balance, the closing entry requires a debit to the Sales

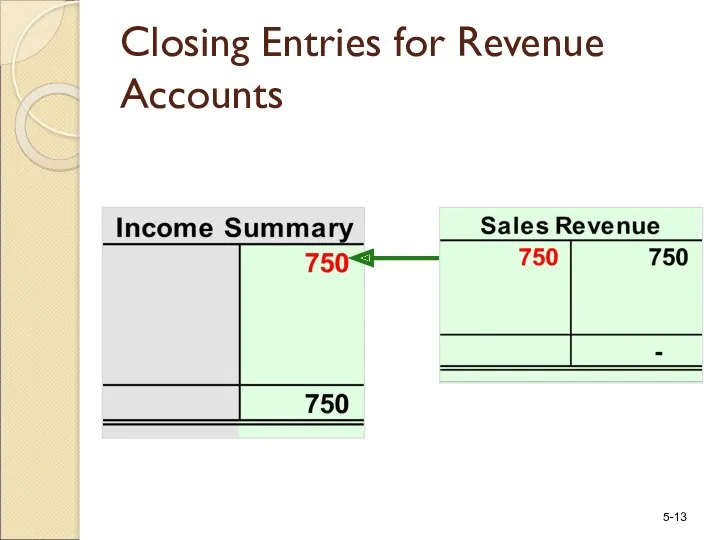

- 13. Closing Entries for Revenue Accounts

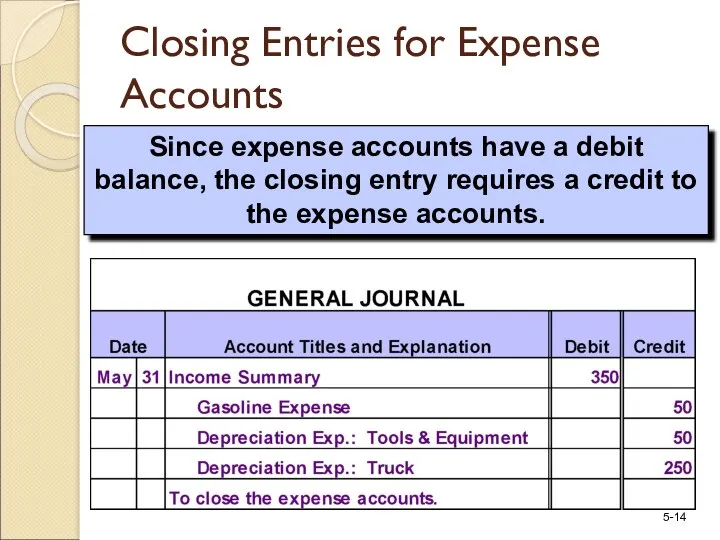

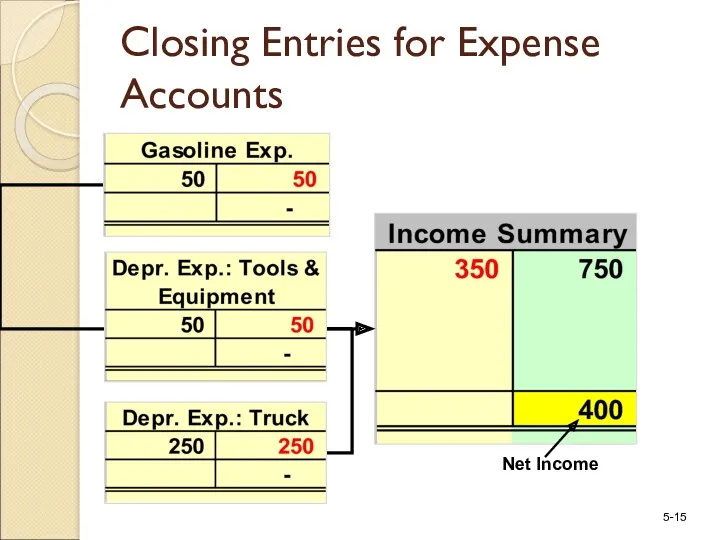

- 14. Since expense accounts have a debit balance, the closing entry requires a credit to the expense

- 15. Closing Entries for Expense Accounts

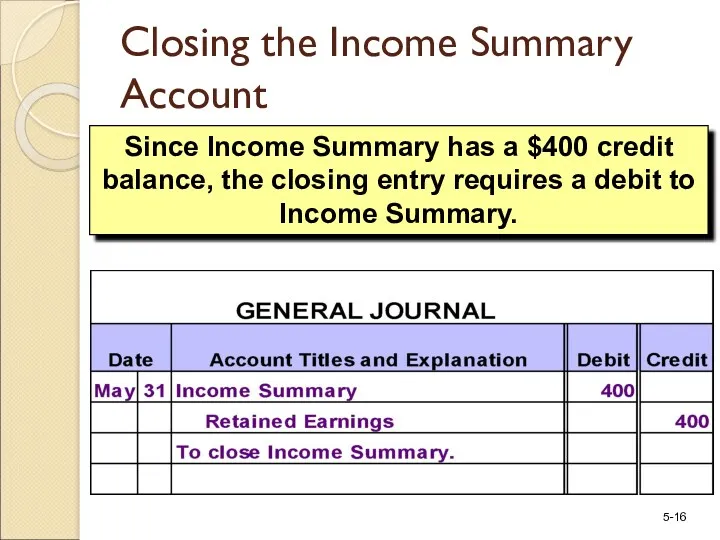

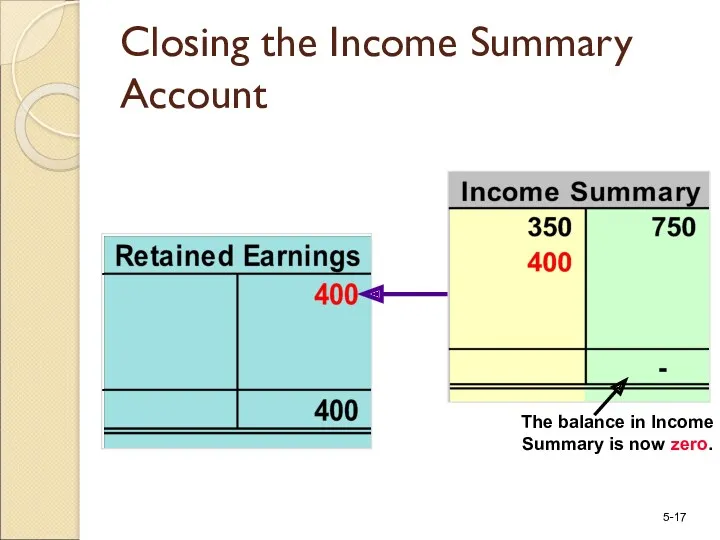

- 16. Since Income Summary has a $400 credit balance, the closing entry requires a debit to Income

- 17. Closing the Income Summary Account

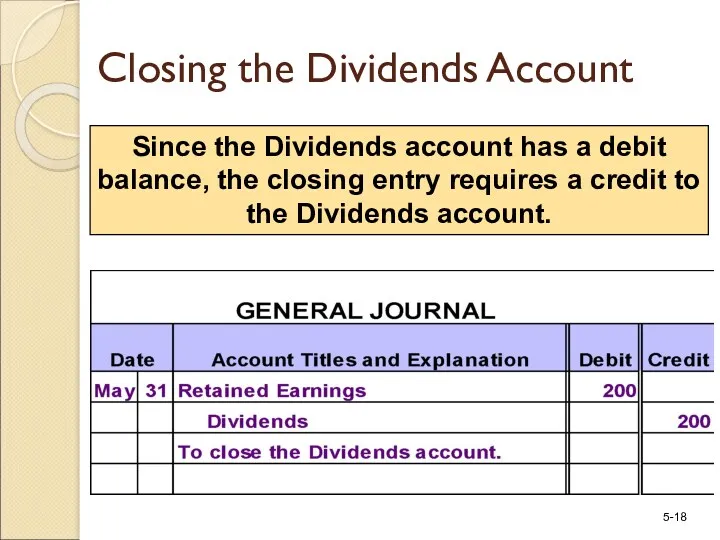

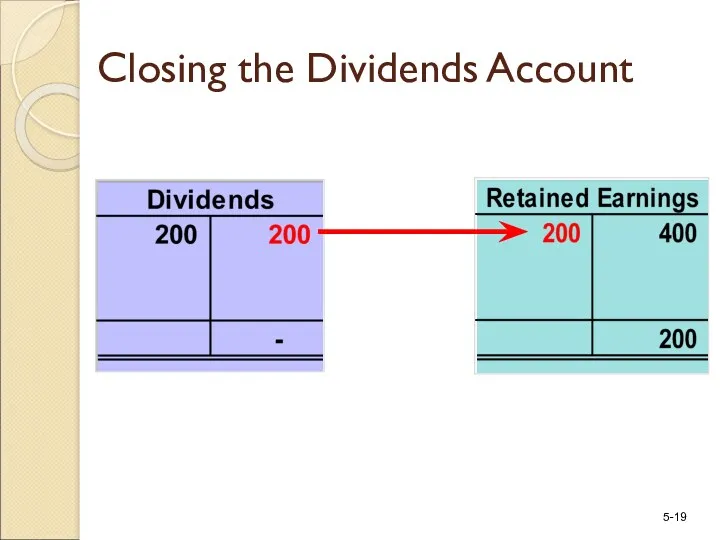

- 18. Since the Dividends account has a debit balance, the closing entry requires a credit to the

- 19. Closing the Dividends Account

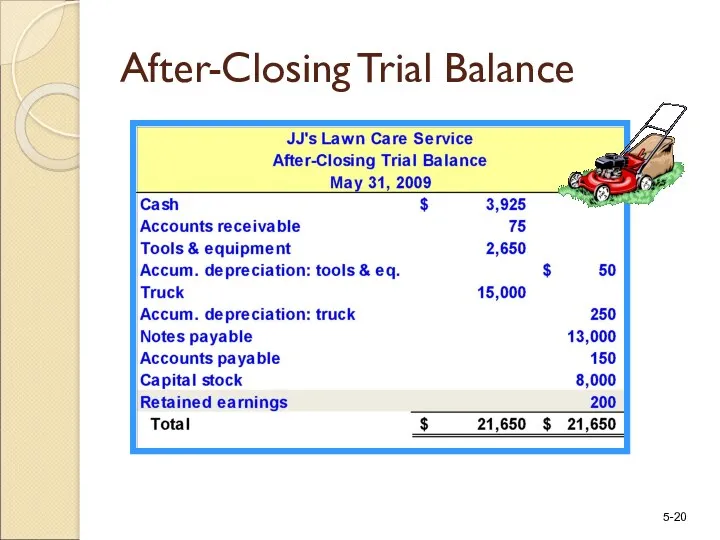

- 20. After-Closing Trial Balance

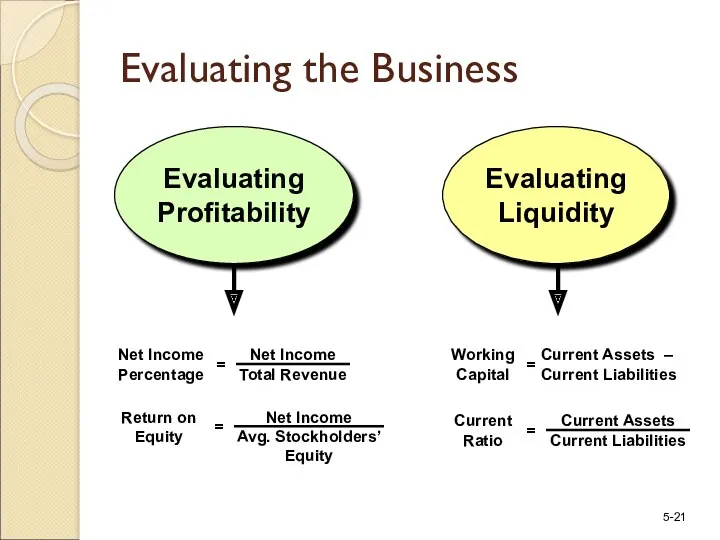

- 21. Evaluating the Business

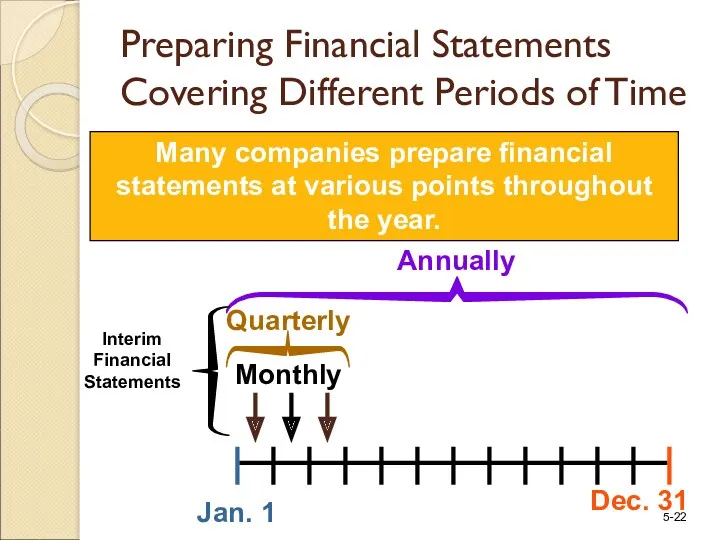

- 22. Monthly Quarterly Jan. 1 Dec. 31 Annually Many companies prepare financial statements at various points throughout

- 23. Ethics, Fraud, and Corporate Governance A company should disclose any facts that an intelligent person would

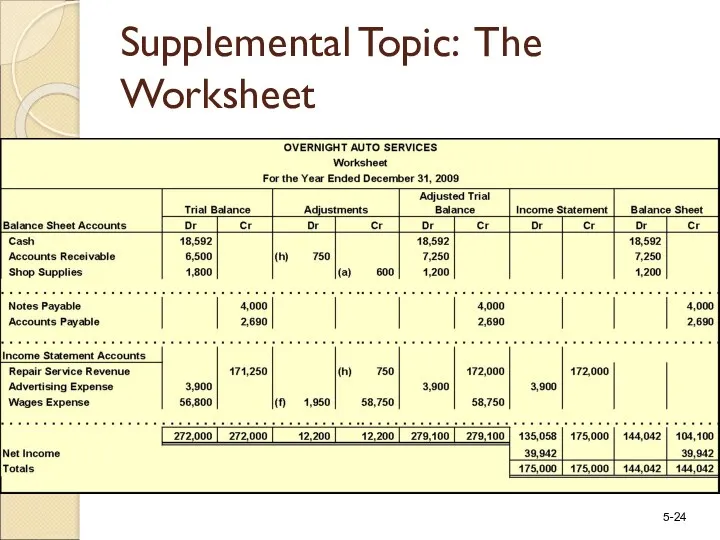

- 24. Supplemental Topic: The Worksheet

- 26. Скачать презентацию

ПриватБанк и Payoneer

ПриватБанк и Payoneer Стандарти державного фінансового аудиту

Стандарти державного фінансового аудиту Денежная система: черты денежных систем в России и в мире, характеристика основных элементов

Денежная система: черты денежных систем в России и в мире, характеристика основных элементов Лекция Тема 4 . Повышение эффективности хозяйственной деятельности фирмы (организации (предприятия))

Лекция Тема 4 . Повышение эффективности хозяйственной деятельности фирмы (организации (предприятия)) Компания TeleTrade

Компания TeleTrade Тчет по проекту: содержательный, финансовый, публичный

Тчет по проекту: содержательный, финансовый, публичный Сравнительный подход к оценке стоимости

Сравнительный подход к оценке стоимости Supply and demand botanov

Supply and demand botanov Формирование методики оценки экономической эффективности инвестиционных проектов

Формирование методики оценки экономической эффективности инвестиционных проектов Зарплатный МТС Банк

Зарплатный МТС Банк Система показателей экономической эффективности бизнес-планирования

Система показателей экономической эффективности бизнес-планирования Ценообразование. Тема 7

Ценообразование. Тема 7 Финансовый контроль на предприятии (на материалах международный аэропорт Казань)

Финансовый контроль на предприятии (на материалах международный аэропорт Казань) Материальное обеспечение инвалидов

Материальное обеспечение инвалидов Экологический сбор

Экологический сбор Критерии анализа деловой активности предприятия. (Тема 6)

Критерии анализа деловой активности предприятия. (Тема 6) Рынок долгового капитала. (4)

Рынок долгового капитала. (4) Учетная политика для целей налогообложения

Учетная политика для целей налогообложения Бухгалтерская финансовая отчетность

Бухгалтерская финансовая отчетность SCP-анализ

SCP-анализ ВКР Направления улучшения использования оборотных средств предприятия

ВКР Направления улучшения использования оборотных средств предприятия Бухгалтерский учет и анализ финансовых результатов на примере ООО Гермес

Бухгалтерский учет и анализ финансовых результатов на примере ООО Гермес Актуализация нормативной базы по вопросам наличного денежного обращения

Актуализация нормативной базы по вопросам наличного денежного обращения Деньги и денежный рынок

Деньги и денежный рынок Выявление проблем в области клиентоориентированности

Выявление проблем в области клиентоориентированности Криптовалюты- деньги будущего

Криптовалюты- деньги будущего Кәсіпорындағы еңбекақы төлеу

Кәсіпорындағы еңбекақы төлеу Кәсіпорынның табыстылығын диверсификациялау мәселелері

Кәсіпорынның табыстылығын диверсификациялау мәселелері