Содержание

- 2. AGENDA Part I – Financial Planning 101 How To Get Started Financial Plan, Budgeting, Net Worth

- 3. How To Get Started A Plan is a Must! Where Am I Now? Net Worth (Assets

- 4. Personal Financial Plan Data Gathering (Where Am I Now, Budget, Net Worth) Set Goals and Objectives

- 5. Financial Planning A financial plan is designed for your individual needs, whether you’re still working or

- 6. Personal Budget List all Income Items Net income, spouse’s net income Rental income, pension income, alimony,

- 7. Surplus or Deficit? How do I increase my monthly cash flow? Increase your income; or Decrease

- 8. Who Can Help? Who Can Help? Your Local Bank (Mutual Fund Rep, Financial Planner, Bank Manager)

- 9. Wealth Management Services Personal investment advice Portfolio management Financial plan Saving for education Retirement planning Maximizing

- 10. The Full Range of Investment Solutions Royalty trusts Preferred shares Common stocks World-class money management programs

- 11. Common Investment Solutions & Tax Treatment Types of Investments Cash or Cash Equivalents (T-Bills, GICs, Money

- 12. Types of Investment Accounts Registered Retirement Savings Plan Tax Deferred Registered Education Savings Plan Tax Deferred

- 13. RSP Strategies RSP Advantages Save for retirement Tax savings Tax-deferred growth

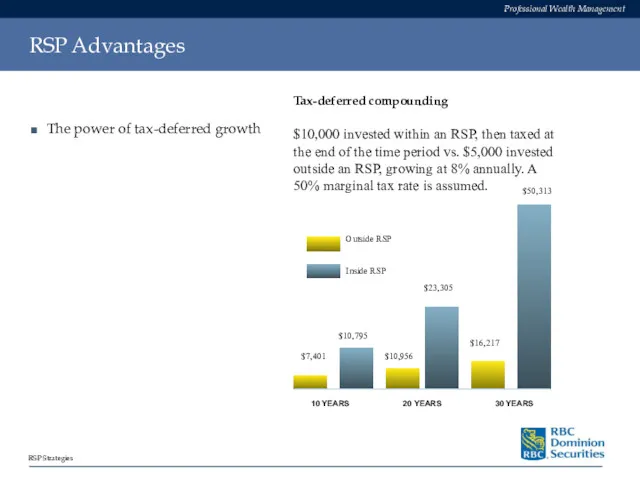

- 14. RSP Advantages The power of tax-deferred growth

- 15. The Power of Compounding Here is an interesting example: A person saves $200 per month and,

- 16. The Right Asset Mix Asset mix is the balance between stocks, bonds and cash Your asset

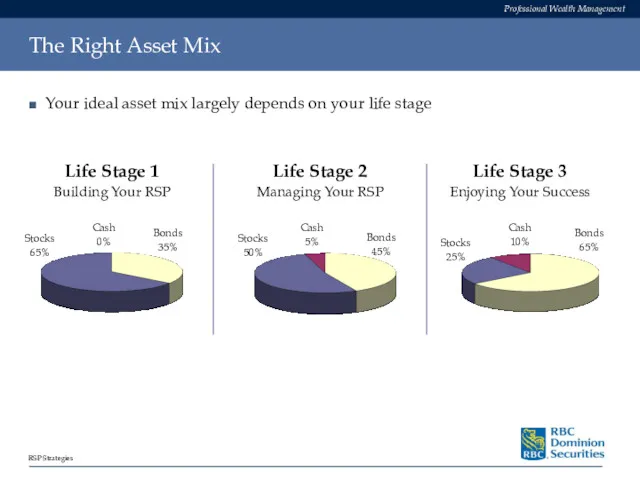

- 17. The Right Asset Mix Your ideal asset mix largely depends on your life stage

- 18. Eligible Investments Most types of investments are RSP-eligible Liquid investments, fixed income, equity, mutual funds Elimination

- 19. How to Use Tax Refunds Top up your RSP Make your current year’s RSP contribution Add

- 20. Making Contributions Contributions based on earned income Pension adjustment Carry forward

- 21. Consolidation Benefits Understand your financial “big picture” Easier to keep track of asset mix Reduced administrative

- 22. Maximize your Foreign Content No foreign content limit Reduced risk through diversification Greater return potential More

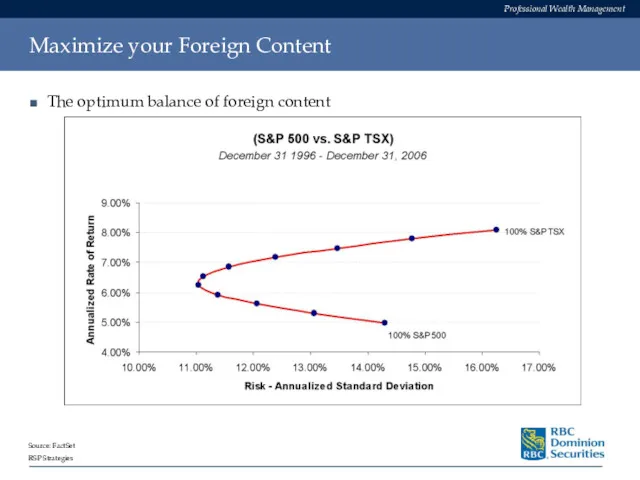

- 23. Maximize your Foreign Content The optimum balance of foreign content Source: FactSet

- 24. Spousal RSPs Legitimate form of income splitting Couples can benefit from a spousal RSP Tax savings

- 25. Options at Retirement Retirement What Does It Look Like? Longer Life Spans = Longer Retirements Options

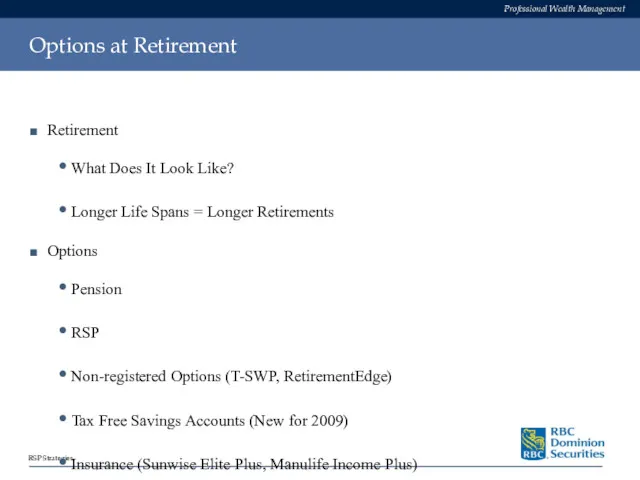

- 26. Sources of Information www.globefund.ca www.morningstar.ca www.canadianbusiness.com www.canadianbusiness.com/moneysense_magazine The Wealthy Barber

- 27. Tim’s Contact Information Direct Office Line: 416-842-2468 Email: tim.patriquin@rbc.com Website: www.timpatriquin.com

- 29. Скачать презентацию

Стандарти державного фінансового аудиту

Стандарти державного фінансового аудиту Мотивация и стимулирование труда персонала

Мотивация и стимулирование труда персонала Банки. Страхование, 8 класс

Банки. Страхование, 8 класс Прибыль и рентабельность

Прибыль и рентабельность Supply and demand botanov

Supply and demand botanov Экономическая эффективность использования оборотных средств ОАО Пермский завод Машиностроитель

Экономическая эффективность использования оборотных средств ОАО Пермский завод Машиностроитель Программа накопительного страхования жизни Семья Престиж

Программа накопительного страхования жизни Семья Престиж Отчет главы Сосьвинского городского округа

Отчет главы Сосьвинского городского округа Тест по теме: Рынки факторов производства

Тест по теме: Рынки факторов производства ЗПП АО Альфа-Банк Ultra. Зарплатный проект

ЗПП АО Альфа-Банк Ultra. Зарплатный проект Основы продаж. Технический и графический анализ

Основы продаж. Технический и графический анализ ехнический анализ финансовых рынков

ехнический анализ финансовых рынков Ценовая политика. Тема 6

Ценовая политика. Тема 6 Электронный бюджет

Электронный бюджет Тау самал'' тұрғын үй кешенінің электрэнергетикасы шығынын төмендетуді есептеу мен саралау

Тау самал'' тұрғын үй кешенінің электрэнергетикасы шығынын төмендетуді есептеу мен саралау Компьютерный анализ. Осцилляторы. Контртрендовые индикаторы

Компьютерный анализ. Осцилляторы. Контртрендовые индикаторы Понятие и принципы инвестиционной деятельности

Понятие и принципы инвестиционной деятельности Практикум. Запас материальных ресурсов

Практикум. Запас материальных ресурсов Изменения в бухгалтерском учете учреждений бюджетной сферы вступающие в силу с 2023 года

Изменения в бухгалтерском учете учреждений бюджетной сферы вступающие в силу с 2023 года Міжнародні фінансово-кредитні установи та їх співробітництво з Україною

Міжнародні фінансово-кредитні установи та їх співробітництво з Україною Сметы в НКО. Составление смет к заявке на грант и субсидию. Финансовые отчеты в Фонд Президентских Грантов

Сметы в НКО. Составление смет к заявке на грант и субсидию. Финансовые отчеты в Фонд Президентских Грантов История становления и развития принципов налогообложения

История становления и развития принципов налогообложения Применение методов DCF

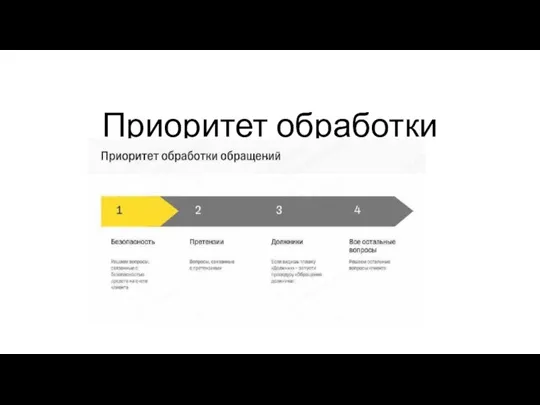

Применение методов DCF Приоритет обработки

Приоритет обработки Салық ұғымымен салық жүйесі ұғымы тығыз байланысты

Салық ұғымымен салық жүйесі ұғымы тығыз байланысты Заемщики. Отношения кредитор - заемщик

Заемщики. Отношения кредитор - заемщик Стоимостная оценка облигаций

Стоимостная оценка облигаций Инструменты повышения прозрачности бюджетной политики. Место России в рейтинге открытости бюджета

Инструменты повышения прозрачности бюджетной политики. Место России в рейтинге открытости бюджета