Содержание

- 2. The Question Being Asked in VaR “What loss level is such that we are X% confident

- 3. VaR and Regulatory Capital (Business Snapshot 18.1, page 436) Regulators base the capital they require banks

- 4. VaR vs. C-VaR (See Figures 18.1 and 18.2) VaR is the loss level that will not

- 5. Advantages of VaR It captures an important aspect of risk in a single number It is

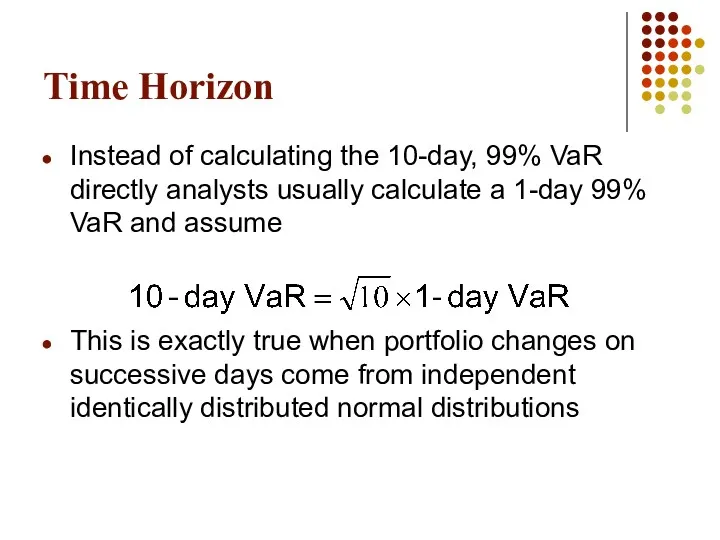

- 6. Time Horizon Instead of calculating the 10-day, 99% VaR directly analysts usually calculate a 1-day 99%

- 7. Historical Simulation (See Tables 18.1 and 18.2, page 438-439)) Create a database of the daily movements

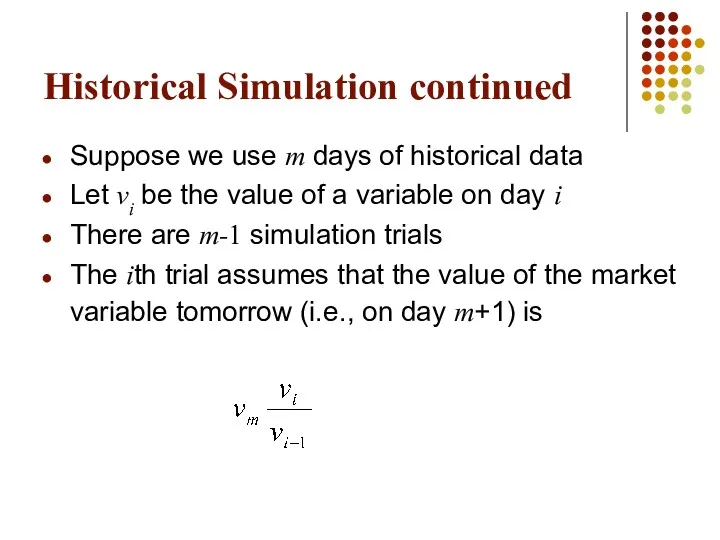

- 8. Historical Simulation continued Suppose we use m days of historical data Let vi be the value

- 9. The Model-Building Approach The main alternative to historical simulation is to make assumptions about the probability

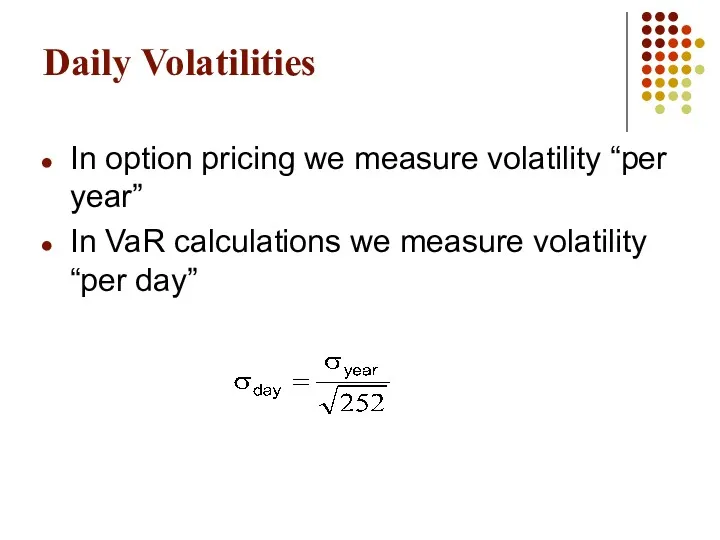

- 10. Daily Volatilities In option pricing we measure volatility “per year” In VaR calculations we measure volatility

- 11. Daily Volatility continued Strictly speaking we should define σday as the standard deviation of the continuously

- 12. Microsoft Example (page 440) We have a position worth $10 million in Microsoft shares The volatility

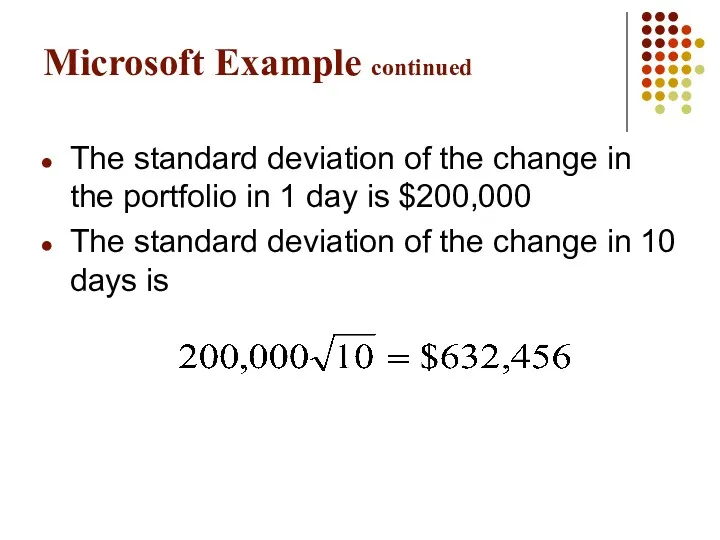

- 13. Microsoft Example continued The standard deviation of the change in the portfolio in 1 day is

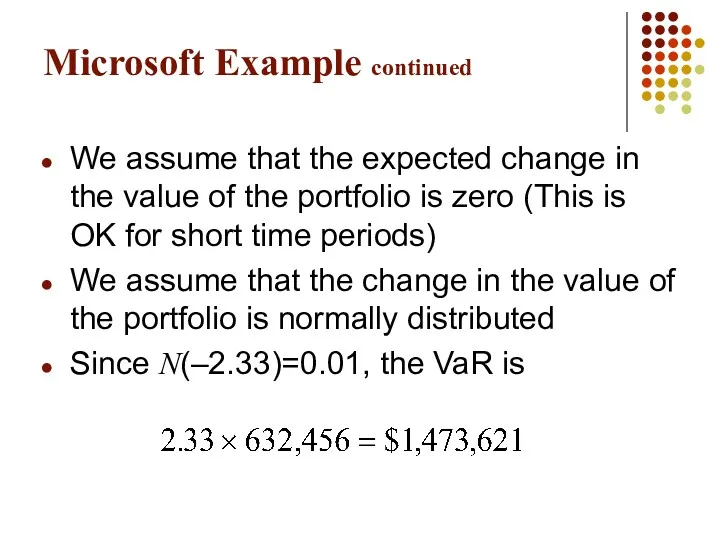

- 14. Microsoft Example continued We assume that the expected change in the value of the portfolio is

- 15. AT&T Example (page 441) Consider a position of $5 million in AT&T The daily volatility of

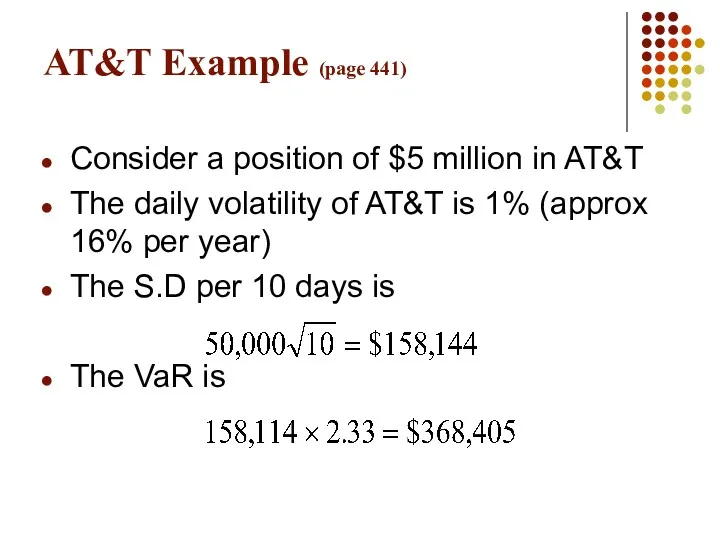

- 16. Portfolio Now consider a portfolio consisting of both Microsoft and AT&T Suppose that the correlation between

- 17. S.D. of Portfolio A standard result in statistics states that In this case σX = 200,000

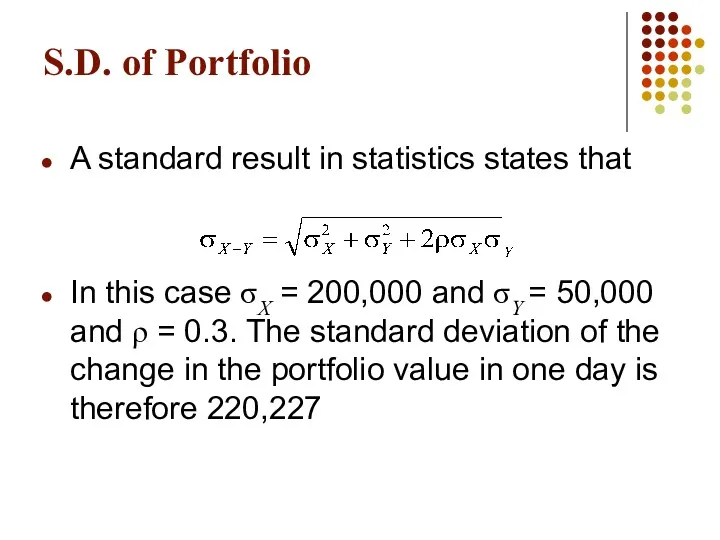

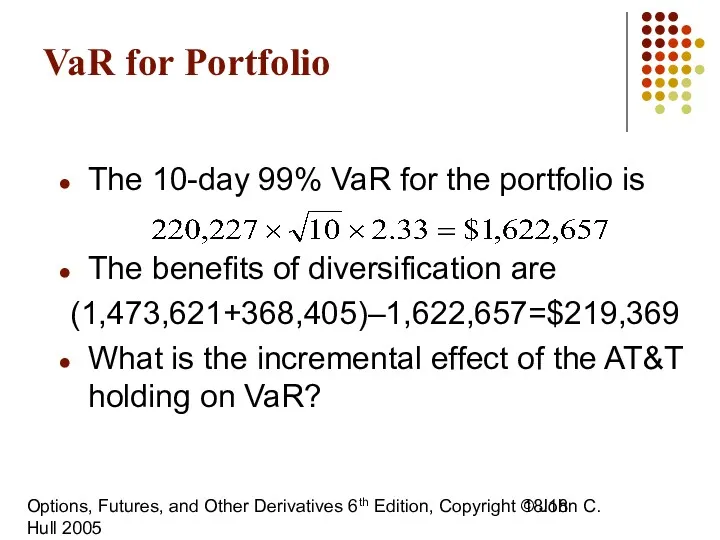

- 18. Options, Futures, and Other Derivatives 6th Edition, Copyright © John C. Hull 2005 18. VaR for

- 19. Value at Risk

- 20. Overview Concepts Components Calculations Corporate perspective Comments

- 21. I VALUE AT RISK - CONCEPTS

- 22. Risk Financial Risks - Market Risk, Credit Risk, Liquidity Risk, Operational Risk Risk is the variability

- 23. VAR measures Market risk Credit risk of late

- 24. VAR is an estimate of the adverse impact on P&L in a conservative scenario. It is

- 25. Ingredients - Exposure to market variable Sensitivity Probability of adverse market movement Probability distribution of market

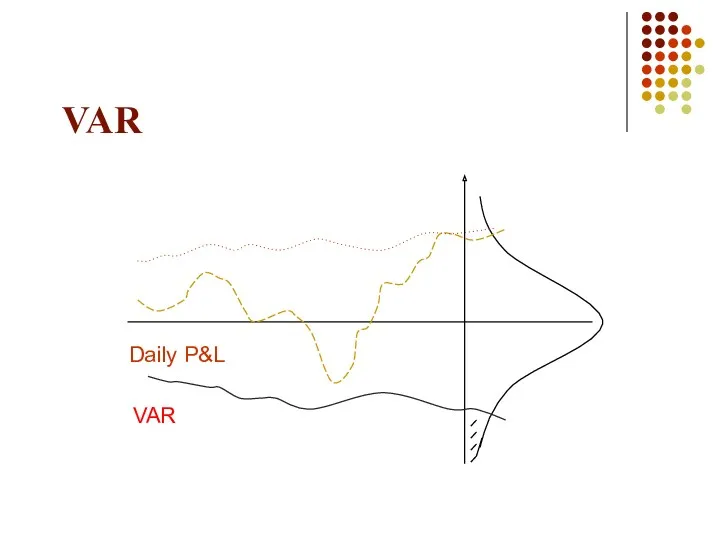

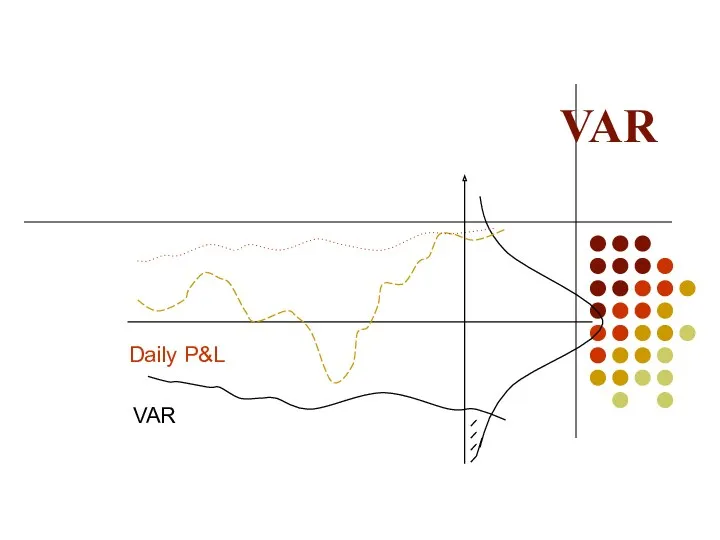

- 26. VAR Daily P&L VAR

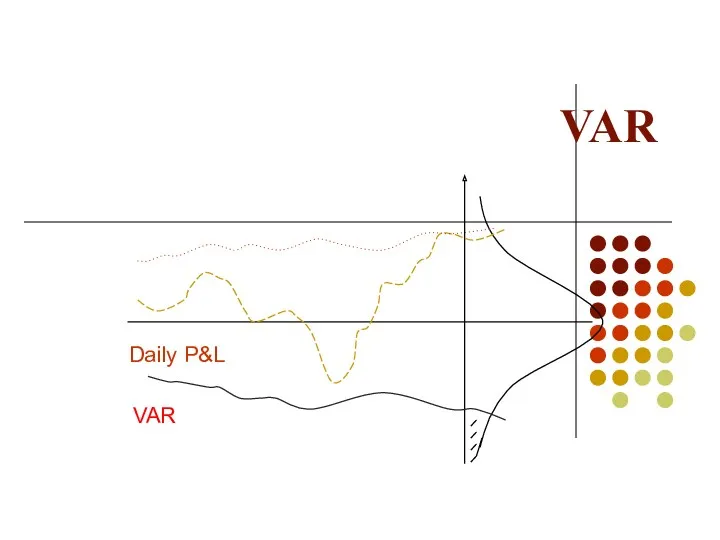

- 27. VAR Daily P&L VAR

- 28. II VALUE AT RISK - COMPONENTS

- 29. Key components of VAR Market Factors (MF) Factor Sensitivity (FS) Defeasance Period (DP) Volatility

- 30. Market Factors (MF) A market variable that causes the price of an instrument to change A

- 31. Factor Sensitivity (FS) FS is the change in the value of a position due to a

- 32. Factor Sensitivity - Zero Coupon Bond What is the 1 BP FS of a $2,100 1-year

- 33. Market Volatility Volatility is a measure of the dispersion of a market variable against its mean

- 34. Estimating Volatility 1. Historical data analysis 2. Judgmental 3. Implied (from options prices)

- 35. Defeasance period This is defined as the time elapsed (normally expressed in days) before a position

- 36. Defeasance Factor (DF) DF is the total volatility over the defeasance period On the assumption that

- 37. VAR formula VAR = zα σp √Δt * FS Where: zα is the constant giving the

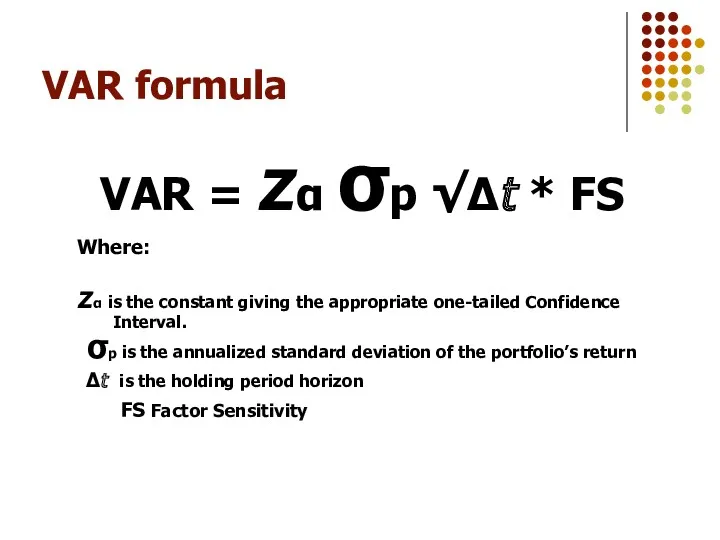

- 38. VAR Daily P&L VAR

- 39. III VALUE AT RISK - CALCULATIONS

- 40. Sample VAR Calculations Let us consider the following positions: Long EUR against the USD : $

- 41. Sample VAR Calculations Annual volatility of DEM is 9% Volatility for N days = annual volatility

- 42. Sample VAR Calculations Now, a 1% change has an impact of 10,000 (FS) So, a 1.30%

- 43. Sample VAR Calculations Similarly, for JPY, the annual volatility is 12% The 1 day volatility =

- 44. IV VALUE AT RISK FOR CORPORATIONS

- 45. VAR FOR CORPORATIONS Trading portfolios Longer time horizons for close outs Business risk as opposed to

- 46. VAR FOR CORPORATIONS Identify market variables impacting business Map income sensitivity to market variables - Scenario

- 47. VAR FOR CORPORATIONS Hedging tools Forward FX Currency swaps Interest Rate swaps Options on non-INR market

- 48. V VALUE AT RISK- A FEW COMMENTS

- 49. Significance of VAR Applicable mainly to trading portfolios Regulatory capital requirements Provides senior executives with a

- 50. VAR : A Few Comments VAR does not represent the maximum loss VAR does not represent

- 51. Where to use VAR? Macro measure. High level monitoring, managing, eg. Regional level Currently used mainly

- 52. How to use Var Stress Testing : * “worst case” scenario * Multiple Stress Scenarios *

- 53. General Market Risk Issues Integrity - Rate Reasonability - At Inception - Revaluation Model Certification Control

- 55. Скачать презентацию

Семейный бюджет

Семейный бюджет Финансы. Задачи. Тема 1

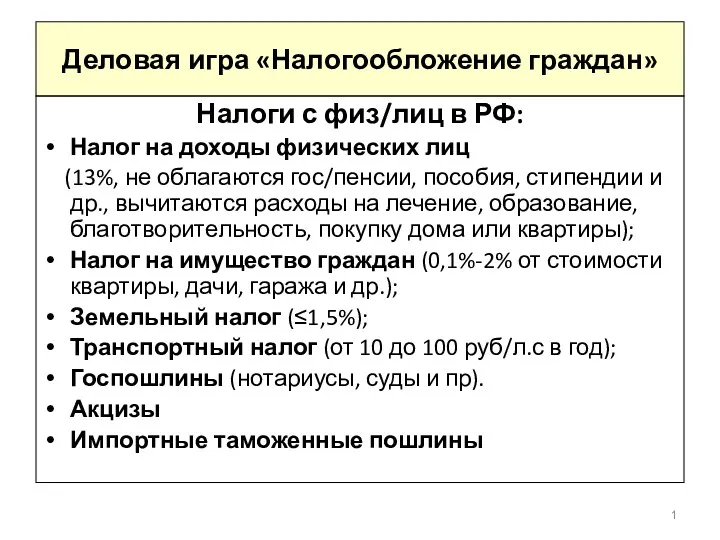

Финансы. Задачи. Тема 1 Деловая игра Налогообложение граждан

Деловая игра Налогообложение граждан Ең төменгі жалақы және кедейлер

Ең төменгі жалақы және кедейлер Деньги и их функции

Деньги и их функции Учет сырья, продуктов и тары в кладовых п о п

Учет сырья, продуктов и тары в кладовых п о п Внешнеторговые документарные операции (2)

Внешнеторговые документарные операции (2) Инвестиции и методы финансирования

Инвестиции и методы финансирования Центральный банк и его роль в банковской системе

Центральный банк и его роль в банковской системе Перевод работников АО Красная звезда на новые условия оплаты труда

Перевод работников АО Красная звезда на новые условия оплаты труда Муниципальное образование город Алапаевск. Бюджет для граждан

Муниципальное образование город Алапаевск. Бюджет для граждан Інформаційне забезпечення фінансового аналізу. Лекція 2

Інформаційне забезпечення фінансового аналізу. Лекція 2 Страховой рынок и его структура

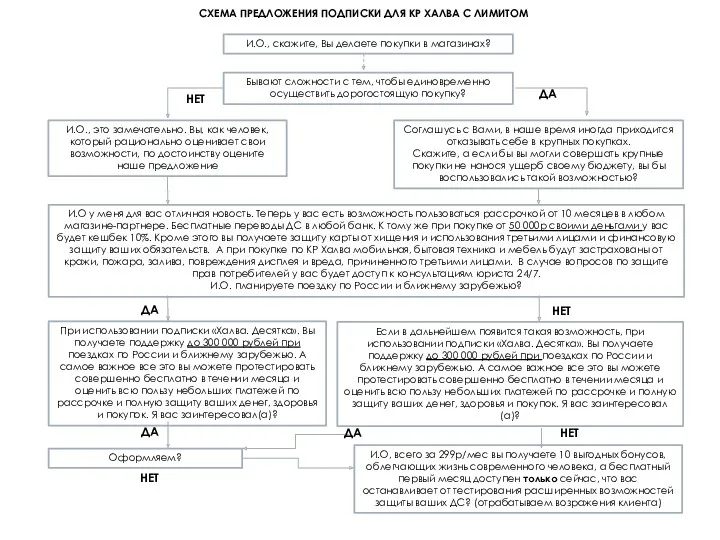

Страховой рынок и его структура Схема предложения подписки Халва. Десятка

Схема предложения подписки Халва. Десятка Учет в бюджетных учреждениях

Учет в бюджетных учреждениях Бюджетирование проектов. (Лекция 7)

Бюджетирование проектов. (Лекция 7) Составление смет на пусконаладочные работы

Составление смет на пусконаладочные работы Оценка целостных имущественных комплексов

Оценка целостных имущественных комплексов Бухгалтерлік есеп нысандары

Бухгалтерлік есеп нысандары Виды кредитов

Виды кредитов Портфель финансовых активов

Портфель финансовых активов Денежный оборот и его структура

Денежный оборот и его структура Налоговая и бухгалтерская отчетность садоводческих товариществ

Налоговая и бухгалтерская отчетность садоводческих товариществ Бухгалтерский Учет кредитов и займов

Бухгалтерский Учет кредитов и займов Выручка. Международные стандарты финансовой отчётности (МСФО 18)

Выручка. Международные стандарты финансовой отчётности (МСФО 18) Страховой надзор

Страховой надзор Международные ценные бумаги. Эффективная система внешних заимствований. Тема 5

Международные ценные бумаги. Эффективная система внешних заимствований. Тема 5 Фінансові інвестиції

Фінансові інвестиції