Содержание

- 2. Open Bank CSP & Provide Banking Services To Your Customers SBI Kiosk Banking CSP model aims

- 3. About Kiosk Banking A large number of people, particularly the migrant laborers and factory workers do

- 4. Tatkal Money Transfer to any Bank Account Aadhar Enabled Payment System(AEPS facility) IMPS Transaction/ Balance Enquiry

- 5. WHAT ARE THE DUTIES AND RESPONSIBILITIES OF CSP? To help citizens to open a saving bank

- 6. WHAT ARE BENEFITS OF BECOMING CSP? Its an opportunity to work with banks as a NICT

- 7. WHAT ARE THE REQUIREMENTS TO BECOME CSP? To become a CSP to any bank you must

- 8. Our Products & Services BANKING SERVICES TRAVEL BOOKING MONEY TRANSFER RECHARGE POINT UTILITY BILL PAYMENT TRUE

- 9. BANKING SERVICES Make your shop Mini bank and give fundamental all Banking keeping money administrations to

- 10. MONEY TRANSFER Tatkal Rupya was propelled by NICT in relationship with NICT Wallet in mid-2012. The

- 11. UTILITY BILL PAYMENT Each family unit expends administrations like power, phone, mobiles, gas, water and so

- 12. SBI KIOSK BANKING :- Kiosk banking solution the following services can be offered: Tatkal Money Transfer

- 13. www.nictcsp.org

- 15. Скачать презентацию

Банкротство предприятия: основные определения и порядок оценки вероятности. (тема 15)

Банкротство предприятия: основные определения и порядок оценки вероятности. (тема 15) Система оплаты труда. Сдельная плата

Система оплаты труда. Сдельная плата Міжнародна міжбанківська мережа SWIFT

Міжнародна міжбанківська мережа SWIFT Рухани байлық па? Материалдық байлық па?

Рухани байлық па? Материалдық байлық па? Сложные случаи учёта НДС в 1С:Бухгалтерии 8

Сложные случаи учёта НДС в 1С:Бухгалтерии 8 Платёжная система биткойн

Платёжная система биткойн Анализ ликвидности и платежеспособности предприятия средств на примере ОАО Пермский завод Машиностроитель

Анализ ликвидности и платежеспособности предприятия средств на примере ОАО Пермский завод Машиностроитель Размеры подушевого норматива финансирования среднего образования на 2021год

Размеры подушевого норматива финансирования среднего образования на 2021год Бюджет Артемовского городского округа на 2020 год и плановый период 2021 и 2022 годов

Бюджет Артемовского городского округа на 2020 год и плановый период 2021 и 2022 годов Отчетность для НКО в 2019 году

Отчетность для НКО в 2019 году Българска народна банка. Нова българска възпоменателна монета

Българска народна банка. Нова българска възпоменателна монета Финансовое планирование и методы прогнозирования

Финансовое планирование и методы прогнозирования Анализ Приложения к бухгалтерскому балансу

Анализ Приложения к бухгалтерскому балансу Организация и бухгалтерский учет межбанковских расчетов

Организация и бухгалтерский учет межбанковских расчетов Классификации ценных бумаг

Классификации ценных бумаг Возникновение и эволюция денег на Руси

Возникновение и эволюция денег на Руси Mezzanine. Mezzanine versus bank and equity

Mezzanine. Mezzanine versus bank and equity Влияние учета основных средств на объем производства на примере ООО ПКК Технорегион

Влияние учета основных средств на объем производства на примере ООО ПКК Технорегион Учет кредитных рисков в деятельности коммерческих банков

Учет кредитных рисков в деятельности коммерческих банков Как взять ипотеку и не остаться без штанов

Как взять ипотеку и не остаться без штанов Меры поддержки бизнеса в Пермском крае

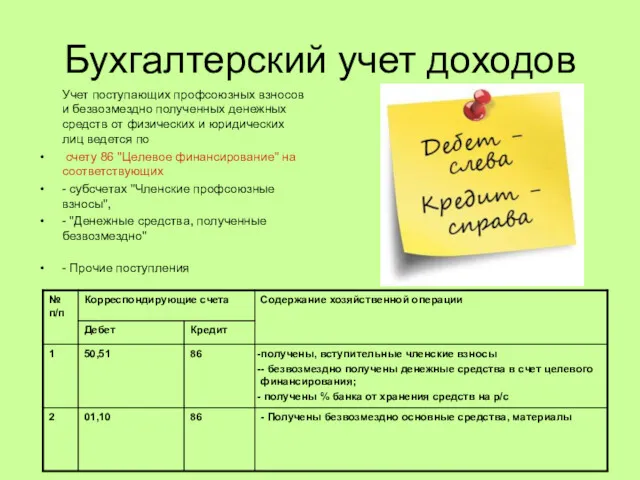

Меры поддержки бизнеса в Пермском крае Бухгалтерский учет доходов и расходов

Бухгалтерский учет доходов и расходов Страхование ответсвенности

Страхование ответсвенности Финансовая политика государства

Финансовая политика государства Оформление результатов налоговой проверки

Оформление результатов налоговой проверки Профессиональные участники рынка ценных бумаг

Профессиональные участники рынка ценных бумаг Форфейтинг. Сущность, особенности, организация

Форфейтинг. Сущность, особенности, организация Раздельный учет по контрактам ГОЗ: соблюдение требований, закрепление правил в учетной политике

Раздельный учет по контрактам ГОЗ: соблюдение требований, закрепление правил в учетной политике