- Главная

- Математика

- Winston p. 313

Содержание

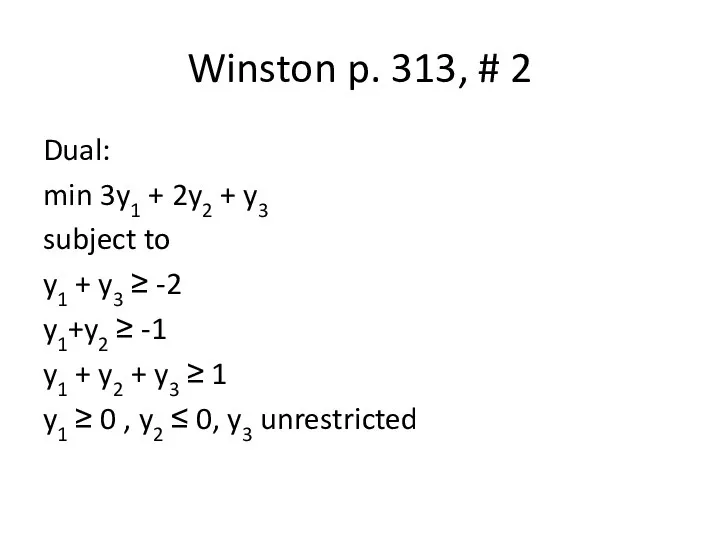

- 2. Winston p. 313, # 2 Dual: min 3y1 + 2y2 + y3 subject to y1 +

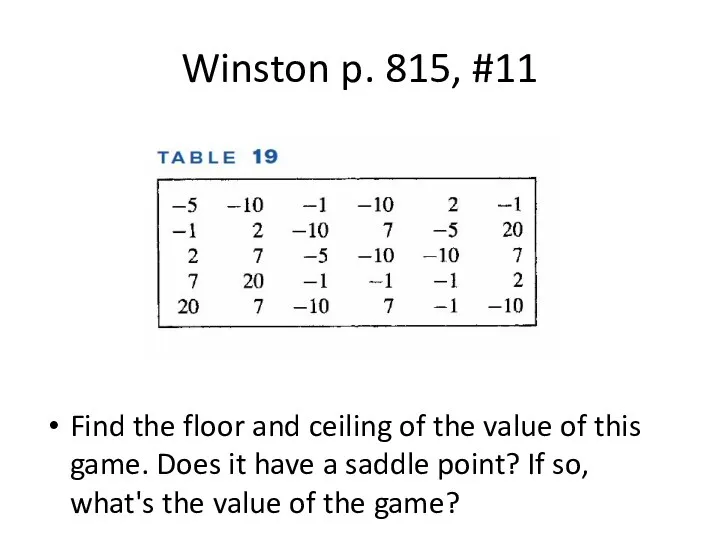

- 3. Winston p. 815, #11 Find the floor and ceiling of the value of this game. Does

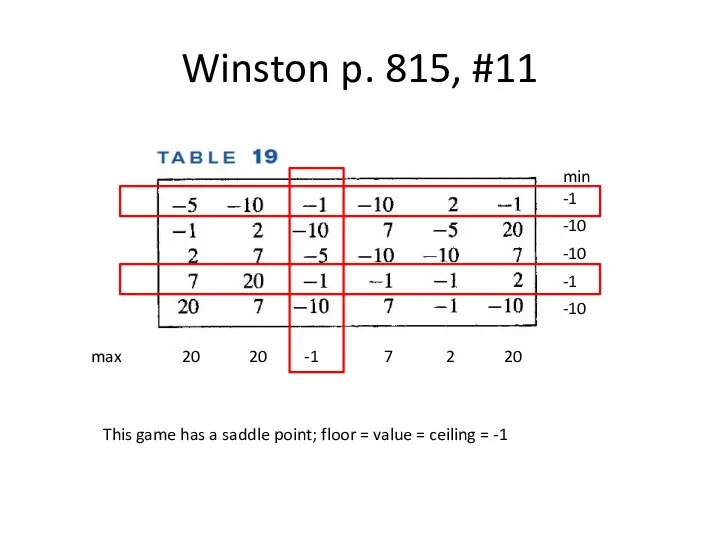

- 4. Winston p. 815, #11 min -1 -10 -10 -1 -10 max 20 20 -1 7 2

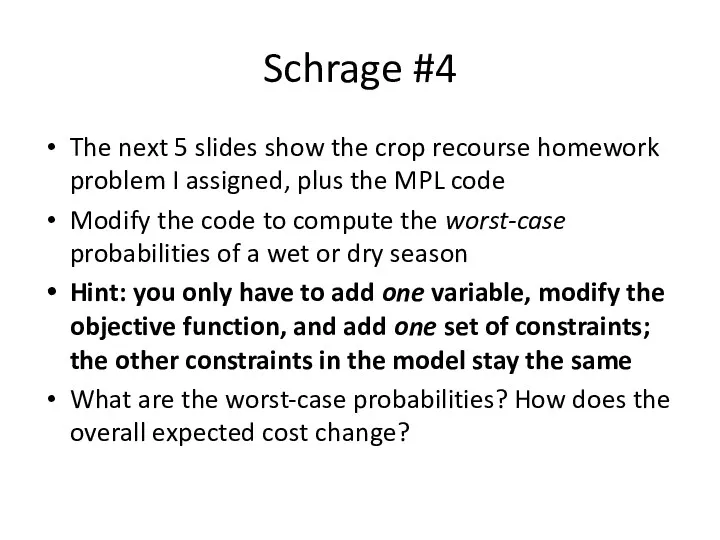

- 5. Schrage #4 The next 5 slides show the crop recourse homework problem I assigned, plus the

- 6. Schrage #4 (Formulate Only)

- 7. Schrage Handout, #4 Indices s = season {wet,dry} c = crops {corn, sorg, bean} Data YIELDcs

- 8. Schrage Handout, #4 (cont’d)

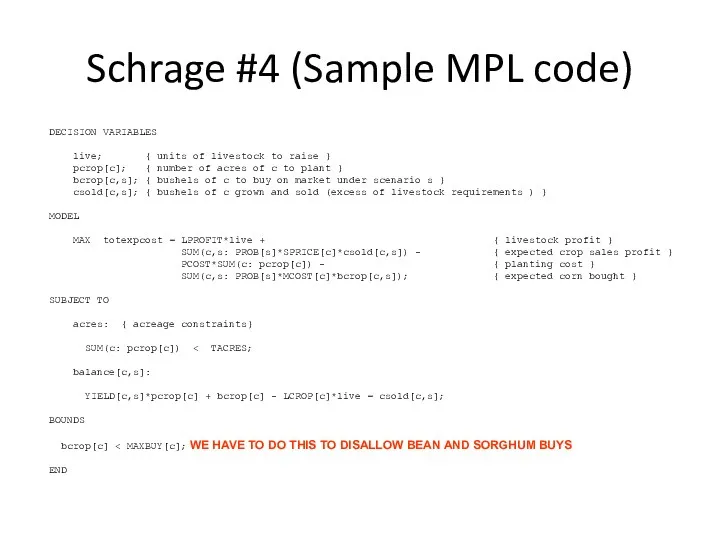

- 9. Schrage #4 (Sample MPL Code) TITLE RecourseCrops; INDEX s := (wet,dry); { seasons } c :=

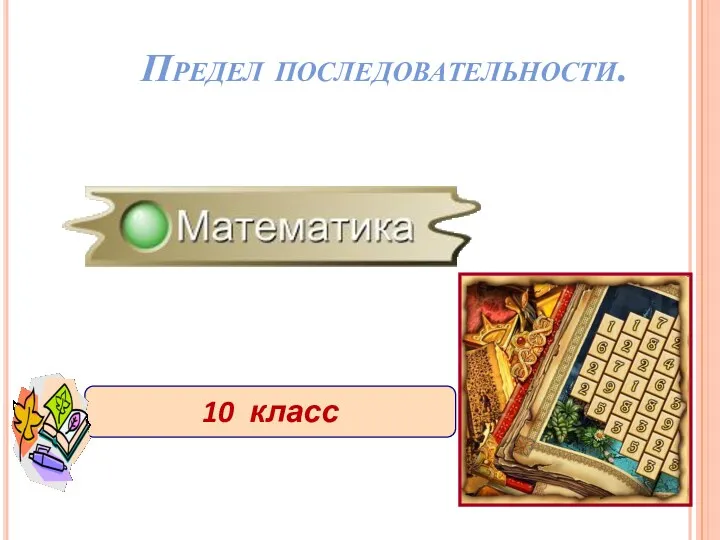

- 10. Schrage #4 (Sample MPL code) DECISION VARIABLES live; { units of livestock to raise } pcrop[c];

- 12. Скачать презентацию

Слайд 2

Winston p. 313, # 2

Dual:

min 3y1 + 2y2 + y3

subject to

y1

Winston p. 313, # 2

Dual:

min 3y1 + 2y2 + y3

subject to

y1

+ y3 ≥ -2

y1+y2 ≥ -1

y1 + y2 + y3 ≥ 1

y1 ≥ 0 , y2 ≤ 0, y3 unrestricted

y1+y2 ≥ -1

y1 + y2 + y3 ≥ 1

y1 ≥ 0 , y2 ≤ 0, y3 unrestricted

Слайд 3

Winston p. 815, #11

Find the floor and ceiling of the value

Winston p. 815, #11

Find the floor and ceiling of the value

of this game. Does it have a saddle point? If so, what's the value of the game?

Слайд 4

Winston p. 815, #11

min

-1

-10

-10

-1

-10

max 20 20 -1 7 2 20

This game

Winston p. 815, #11

min

-1

-10

-10

-1

-10

max 20 20 -1 7 2 20

This game

has a saddle point; floor = value = ceiling = -1

Слайд 5

Schrage #4

The next 5 slides show the crop recourse homework problem

Schrage #4

The next 5 slides show the crop recourse homework problem

I assigned, plus the MPL code

Modify the code to compute the worst-case probabilities of a wet or dry season

Hint: you only have to add one variable, modify the objective function, and add one set of constraints; the other constraints in the model stay the same

What are the worst-case probabilities? How does the overall expected cost change?

Modify the code to compute the worst-case probabilities of a wet or dry season

Hint: you only have to add one variable, modify the objective function, and add one set of constraints; the other constraints in the model stay the same

What are the worst-case probabilities? How does the overall expected cost change?

Слайд 6

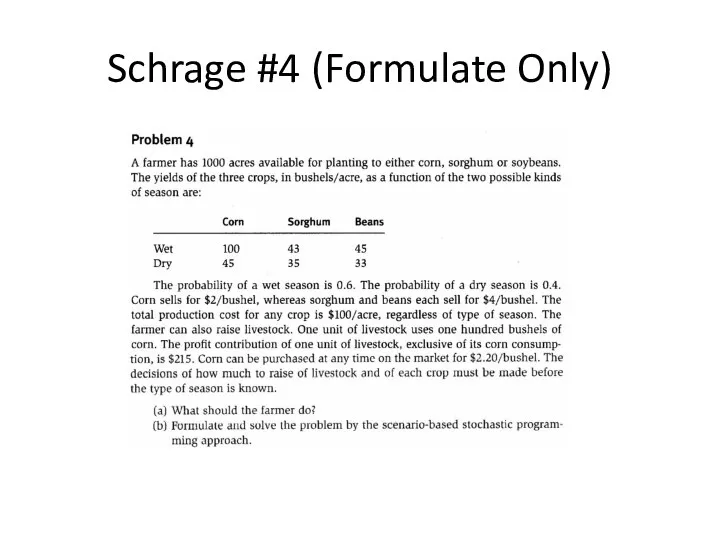

Schrage #4 (Formulate Only)

Schrage #4 (Formulate Only)

Слайд 7

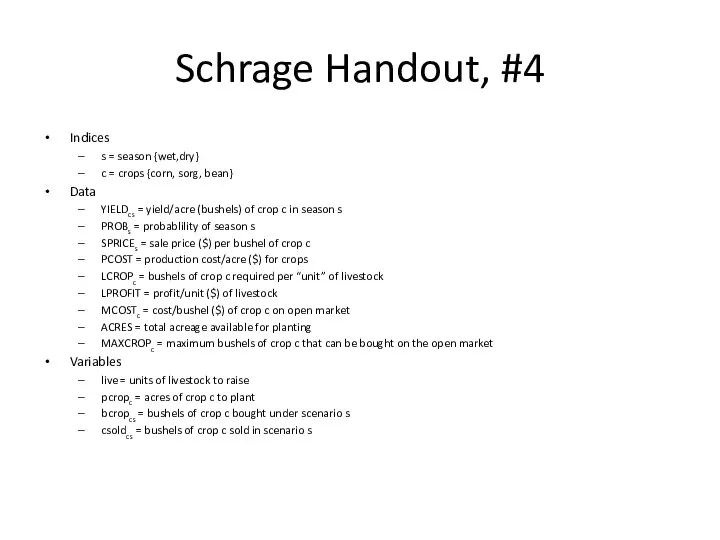

Schrage Handout, #4

Indices

s = season {wet,dry}

c = crops {corn, sorg, bean}

Data

YIELDcs

Schrage Handout, #4

Indices

s = season {wet,dry}

c = crops {corn, sorg, bean}

Data

YIELDcs

= yield/acre (bushels) of crop c in season s

PROBs = probablility of season s

SPRICEs = sale price ($) per bushel of crop c

PCOST = production cost/acre ($) for crops

LCROPc = bushels of crop c required per “unit” of livestock

LPROFIT = profit/unit ($) of livestock

MCOSTc = cost/bushel ($) of crop c on open market

ACRES = total acreage available for planting

MAXCROPc = maximum bushels of crop c that can be bought on the open market

Variables

live = units of livestock to raise

pcropc = acres of crop c to plant

bcropcs = bushels of crop c bought under scenario s

csoldcs = bushels of crop c sold in scenario s

PROBs = probablility of season s

SPRICEs = sale price ($) per bushel of crop c

PCOST = production cost/acre ($) for crops

LCROPc = bushels of crop c required per “unit” of livestock

LPROFIT = profit/unit ($) of livestock

MCOSTc = cost/bushel ($) of crop c on open market

ACRES = total acreage available for planting

MAXCROPc = maximum bushels of crop c that can be bought on the open market

Variables

live = units of livestock to raise

pcropc = acres of crop c to plant

bcropcs = bushels of crop c bought under scenario s

csoldcs = bushels of crop c sold in scenario s

Слайд 8

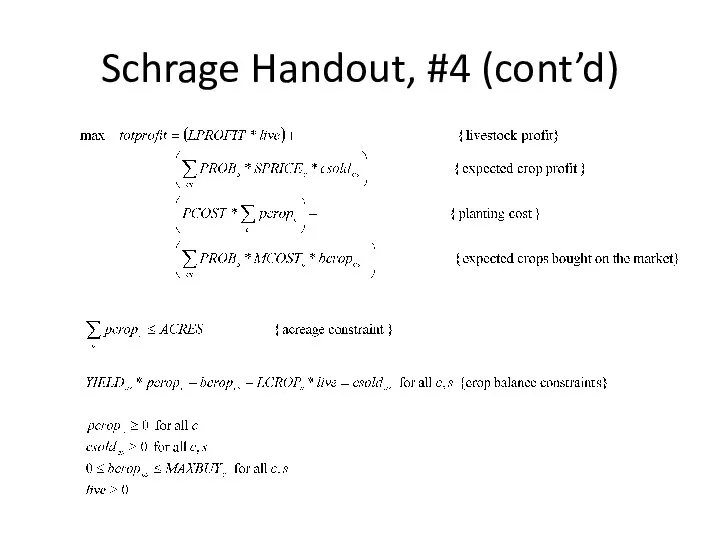

Schrage Handout, #4 (cont’d)

Schrage Handout, #4 (cont’d)

Слайд 9

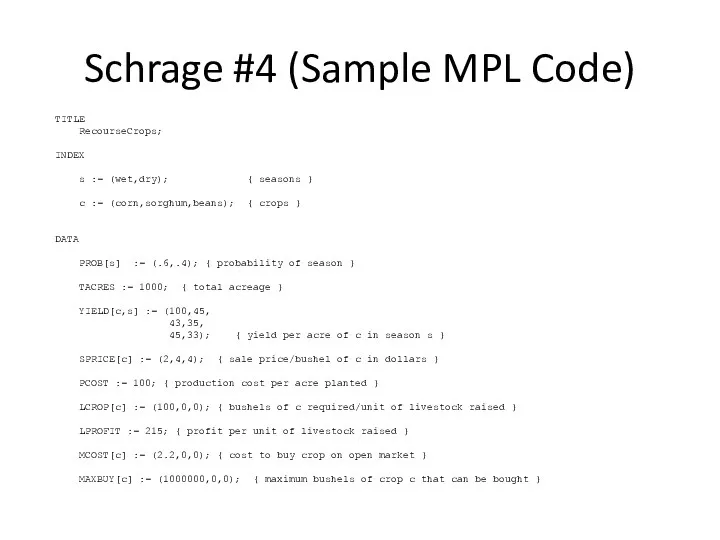

Schrage #4 (Sample MPL Code)

TITLE

RecourseCrops;

INDEX

s := (wet,dry); { seasons

Schrage #4 (Sample MPL Code)

TITLE

RecourseCrops;

INDEX

s := (wet,dry); { seasons

}

c := (corn,sorghum,beans); { crops }

DATA

PROB[s] := (.6,.4); { probability of season }

TACRES := 1000; { total acreage }

YIELD[c,s] := (100,45,

43,35,

45,33); { yield per acre of c in season s }

SPRICE[c] := (2,4,4); { sale price/bushel of c in dollars }

PCOST := 100; { production cost per acre planted }

LCROP[c] := (100,0,0); { bushels of c required/unit of livestock raised }

LPROFIT := 215; { profit per unit of livestock raised }

MCOST[c] := (2.2,0,0); { cost to buy crop on open market }

MAXBUY[c] := (1000000,0,0); { maximum bushels of crop c that can be bought }

c := (corn,sorghum,beans); { crops }

DATA

PROB[s] := (.6,.4); { probability of season }

TACRES := 1000; { total acreage }

YIELD[c,s] := (100,45,

43,35,

45,33); { yield per acre of c in season s }

SPRICE[c] := (2,4,4); { sale price/bushel of c in dollars }

PCOST := 100; { production cost per acre planted }

LCROP[c] := (100,0,0); { bushels of c required/unit of livestock raised }

LPROFIT := 215; { profit per unit of livestock raised }

MCOST[c] := (2.2,0,0); { cost to buy crop on open market }

MAXBUY[c] := (1000000,0,0); { maximum bushels of crop c that can be bought }

Слайд 10

Schrage #4 (Sample MPL code)

DECISION VARIABLES

live; { units of livestock

Schrage #4 (Sample MPL code)

DECISION VARIABLES

live; { units of livestock

to raise }

pcrop[c]; { number of acres of c to plant }

bcrop[c,s]; { bushels of c to buy on market under scenario s }

csold[c,s]; { bushels of c grown and sold (excess of livestock requirements ) }

MODEL

MAX totexpcost = LPROFIT*live + { livestock profit }

SUM(c,s: PROB[s]*SPRICE[c]*csold[c,s]) - { expected crop sales profit }

PCOST*SUM(c: pcrop[c]) - { planting cost }

SUM(c,s: PROB[s]*MCOST[c]*bcrop[c,s]); { expected corn bought }

SUBJECT TO

acres: { acreage constraints}

SUM(c: pcrop[c]) < TACRES;

balance[c,s]:

YIELD[c,s]*pcrop[c] + bcrop[c] - LCROP[c]*live = csold[c,s];

BOUNDS

bcrop[c] < MAXBUY[c]; WE HAVE TO DO THIS TO DISALLOW BEAN AND SORGHUM BUYS

END

pcrop[c]; { number of acres of c to plant }

bcrop[c,s]; { bushels of c to buy on market under scenario s }

csold[c,s]; { bushels of c grown and sold (excess of livestock requirements ) }

MODEL

MAX totexpcost = LPROFIT*live + { livestock profit }

SUM(c,s: PROB[s]*SPRICE[c]*csold[c,s]) - { expected crop sales profit }

PCOST*SUM(c: pcrop[c]) - { planting cost }

SUM(c,s: PROB[s]*MCOST[c]*bcrop[c,s]); { expected corn bought }

SUBJECT TO

acres: { acreage constraints}

SUM(c: pcrop[c]) < TACRES;

balance[c,s]:

YIELD[c,s]*pcrop[c] + bcrop[c] - LCROP[c]*live = csold[c,s];

BOUNDS

bcrop[c] < MAXBUY[c]; WE HAVE TO DO THIS TO DISALLOW BEAN AND SORGHUM BUYS

END

Предел числовой последовательности. Способы задания числовой последовательности

Предел числовой последовательности. Способы задания числовой последовательности Линейная функция и её график

Линейная функция и её график Задачи теории вероятностей. Повторение к ГИА и ЕГЭ

Задачи теории вероятностей. Повторение к ГИА и ЕГЭ Вынесение общего множителя

Вынесение общего множителя Урок Весёлый математик - 2 класс

Урок Весёлый математик - 2 класс Сравнение, сложение и вычитание дробей с разными знаменателями

Сравнение, сложение и вычитание дробей с разными знаменателями Умножение и деление на 9

Умножение и деление на 9 Свойства логарифмов. Джон Непер (1550-1617)

Свойства логарифмов. Джон Непер (1550-1617) Решение задач на движение

Решение задач на движение Векторное произведение векторов

Векторное произведение векторов презентация КВМ внеклассное мероприятие по математике 4 класс

презентация КВМ внеклассное мероприятие по математике 4 класс Презентация к уроку закрепление умножение и деление на 2

Презентация к уроку закрепление умножение и деление на 2 10 способов решения квадратных уравнений

10 способов решения квадратных уравнений Мәтінді есептерді шығару

Мәтінді есептерді шығару презентация Числа от 1 до 7

презентация Числа от 1 до 7 Определение степени с целым отрицательным показателем. 8 класс

Определение степени с целым отрицательным показателем. 8 класс Алгебра. Исторический очерк

Алгебра. Исторический очерк Деление суммы на число

Деление суммы на число Выражение. Составь выражение

Выражение. Составь выражение Сложение и вычитание алгебраических дробей с разными знаменателями

Сложение и вычитание алгебраических дробей с разными знаменателями презентация по математике Табличное умножение и деление 2 класс

презентация по математике Табличное умножение и деление 2 класс Линейная алгебра. Матрицы

Линейная алгебра. Матрицы Двусвязность. (Лекция 7)

Двусвязность. (Лекция 7) Физминутка в картинках

Физминутка в картинках Определённый интеграл

Определённый интеграл Слагаемое. Компоненты при умножении

Слагаемое. Компоненты при умножении Сложение однозначных чисел с переходом через десяток

Сложение однозначных чисел с переходом через десяток Пропорции» и «Прямая и обратная пропорциональность

Пропорции» и «Прямая и обратная пропорциональность