Содержание

- 2. Planning and Control Planning -- involves developing objectives and preparing various budgets to achieve these objectives.

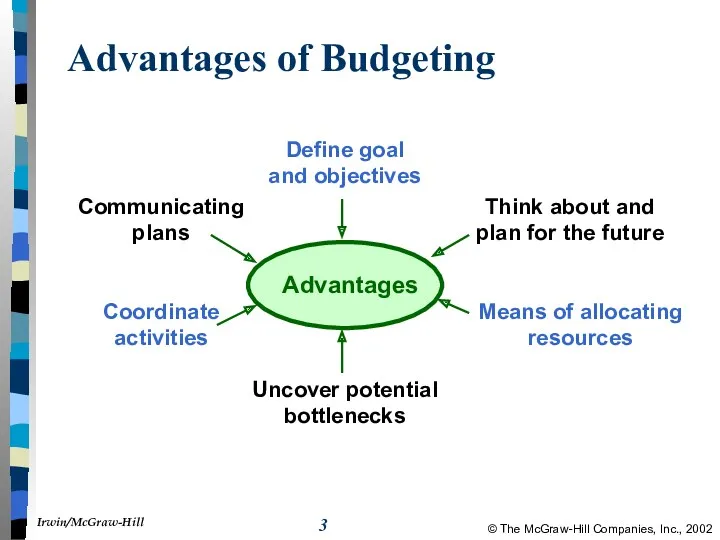

- 3. Advantages of Budgeting Advantages

- 4. Responsibility Accounting Managers should be held responsible for those items — and only those items —

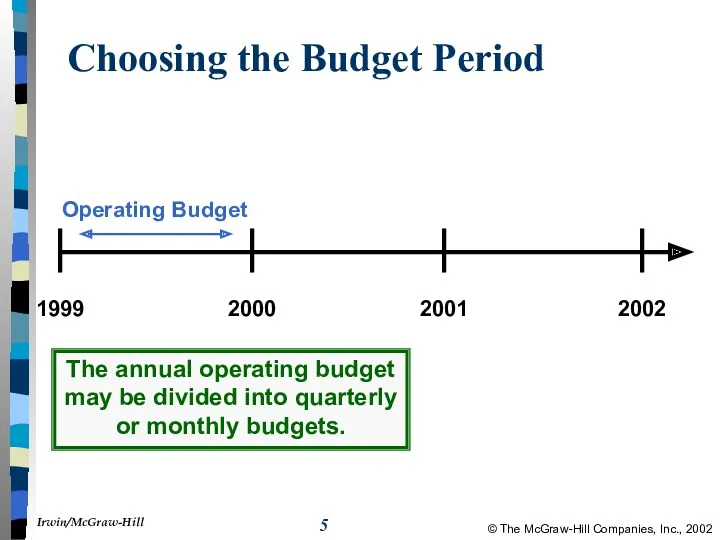

- 5. Choosing the Budget Period Operating Budget 1999 2000 2001 2002 The annual operating budget may be

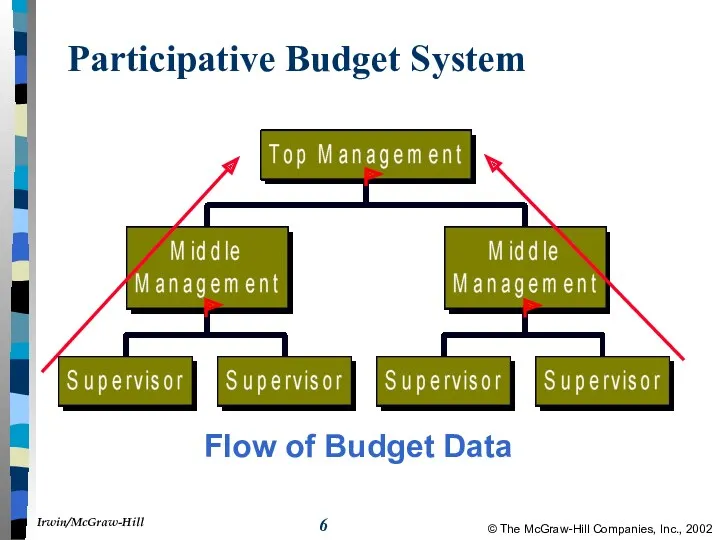

- 6. Participative Budget System Flow of Budget Data

- 7. The Budget Committee A standing committee responsible for overall policy matters relating to the budget coordinating

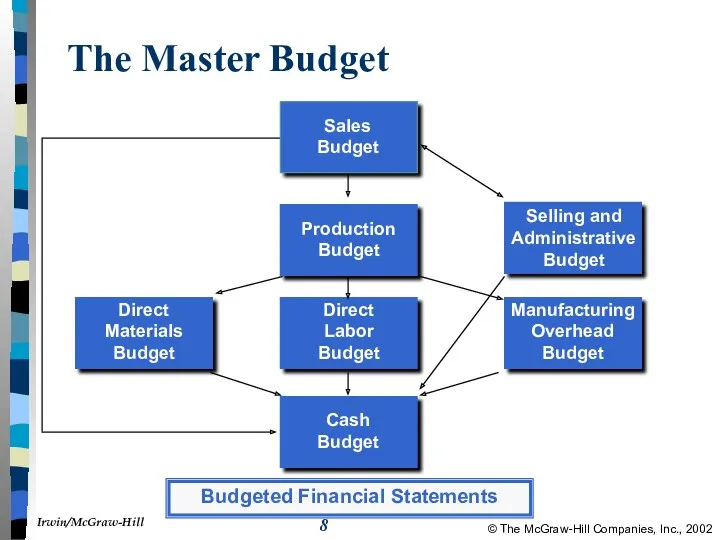

- 8. The Master Budget Budgeted Financial Statements

- 9. The Sales Budget Detailed schedule showing expected sales for the coming periods expressed in units and

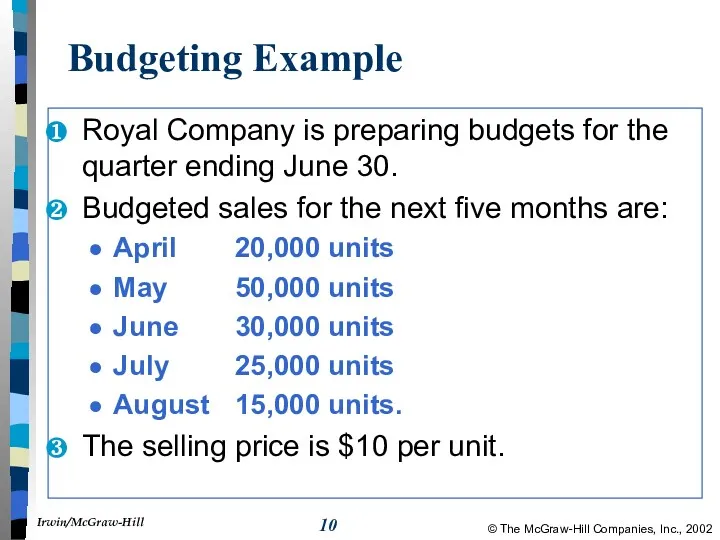

- 10. Budgeting Example Royal Company is preparing budgets for the quarter ending June 30. Budgeted sales for

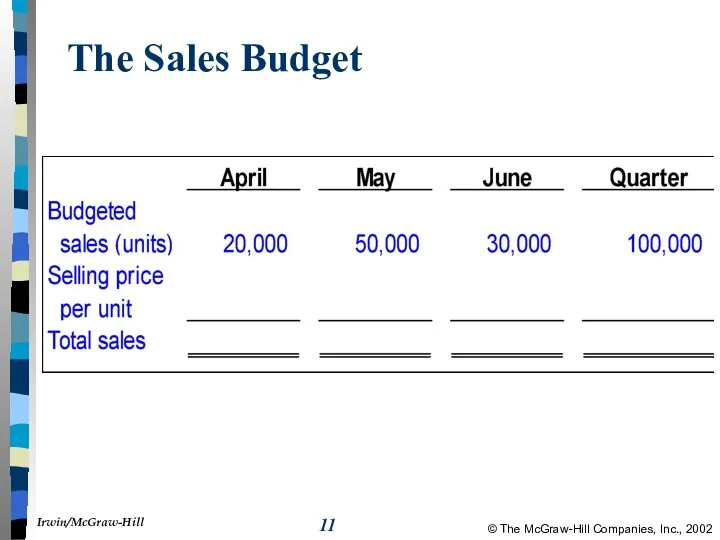

- 11. The Sales Budget

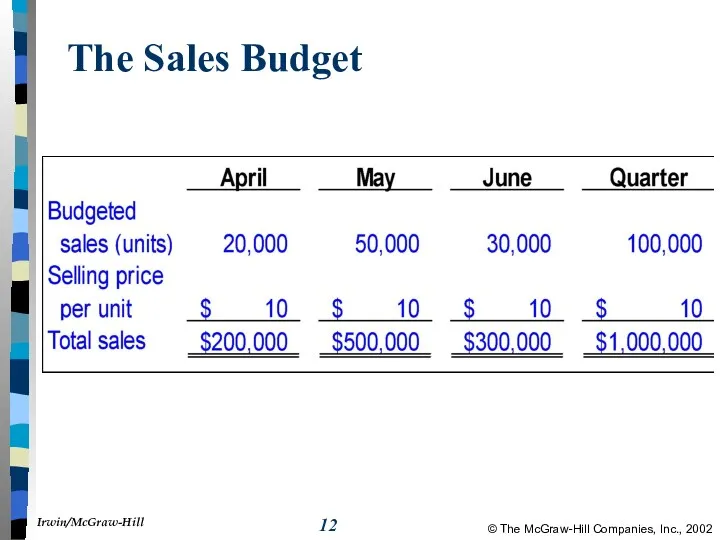

- 12. The Sales Budget

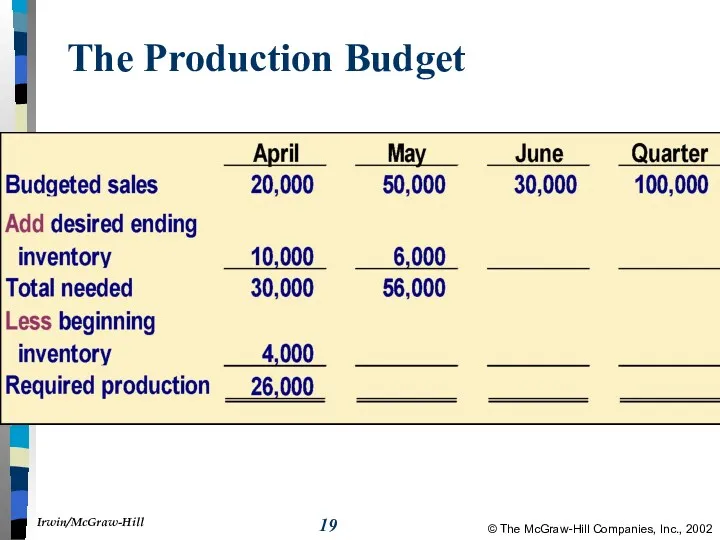

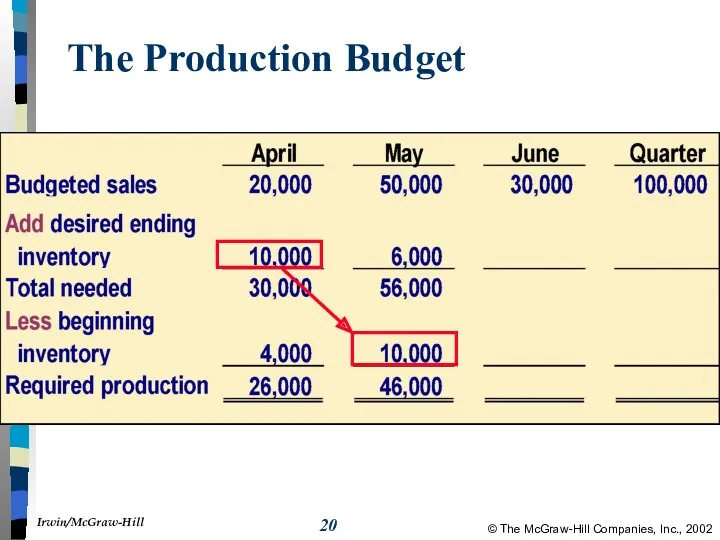

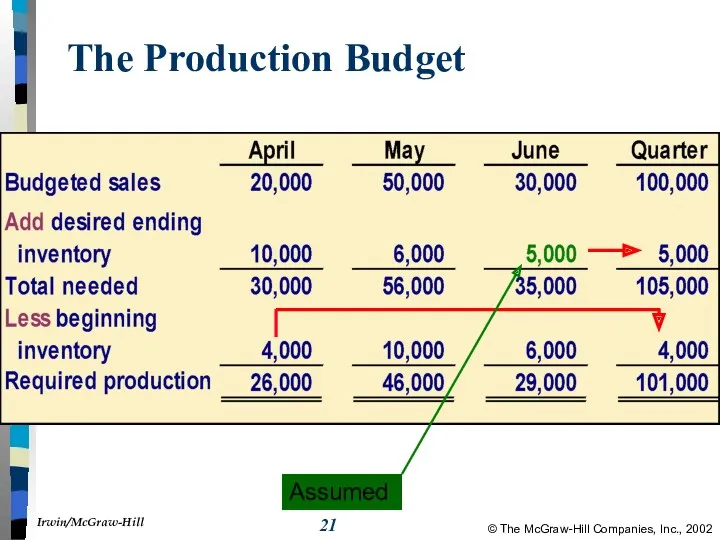

- 13. The Production Budget Production must be adequate to meet budgeted sales and provide for sufficient ending

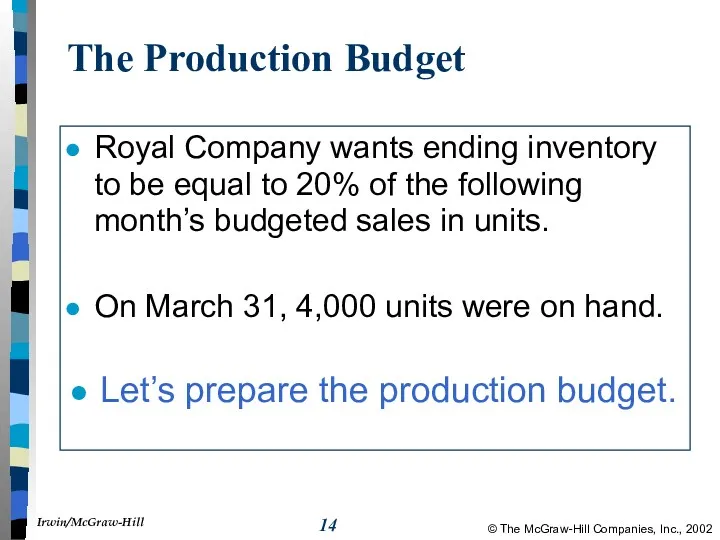

- 14. The Production Budget Royal Company wants ending inventory to be equal to 20% of the following

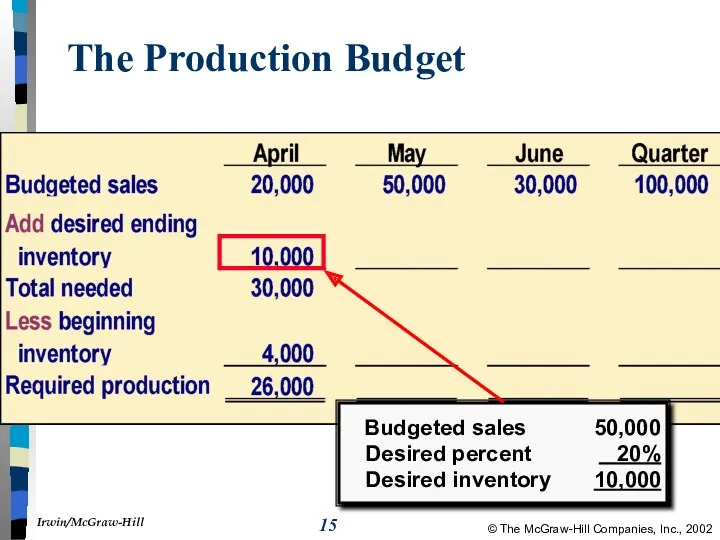

- 15. The Production Budget

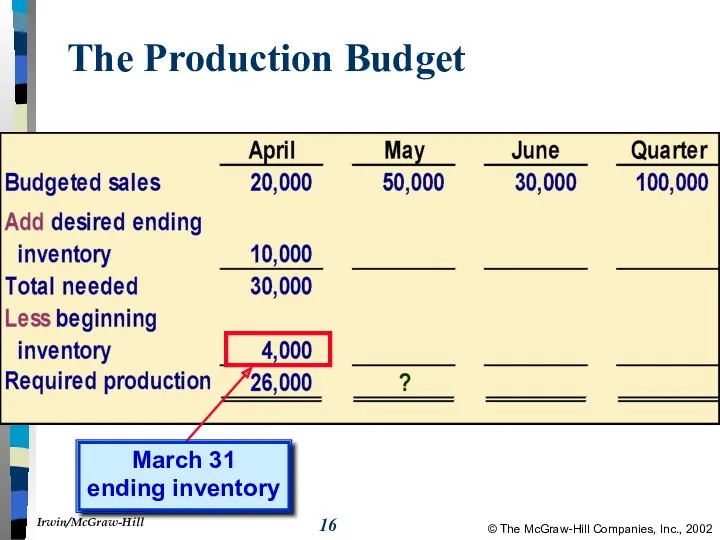

- 16. The Production Budget

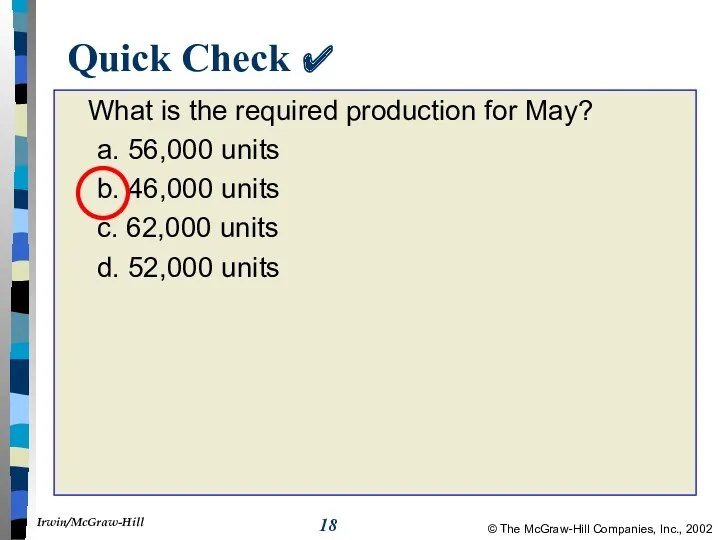

- 17. Quick Check ✔ What is the required production for May? a. 56,000 units b. 46,000 units

- 18. Quick Check ✔ What is the required production for May? a. 56,000 units b. 46,000 units

- 19. The Production Budget

- 20. The Production Budget

- 21. The Production Budget Assumed

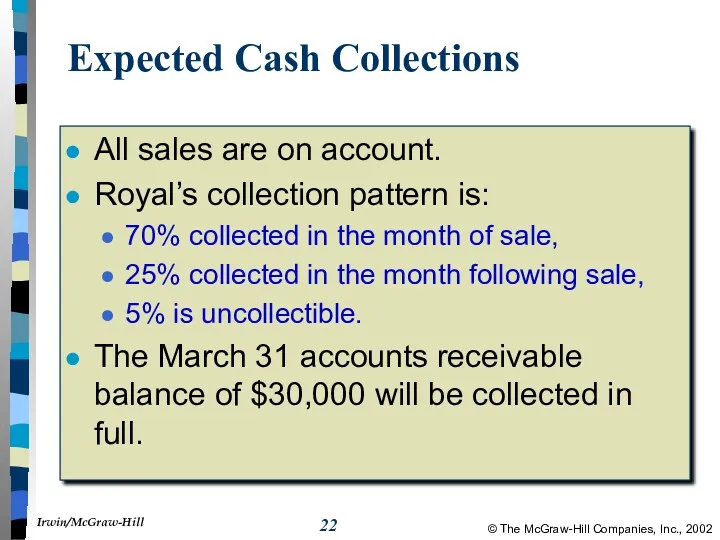

- 22. Expected Cash Collections All sales are on account. Royal’s collection pattern is: 70% collected in the

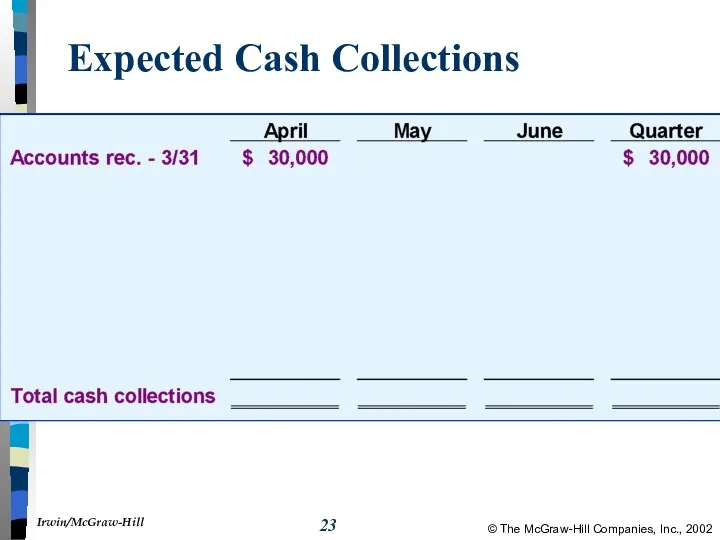

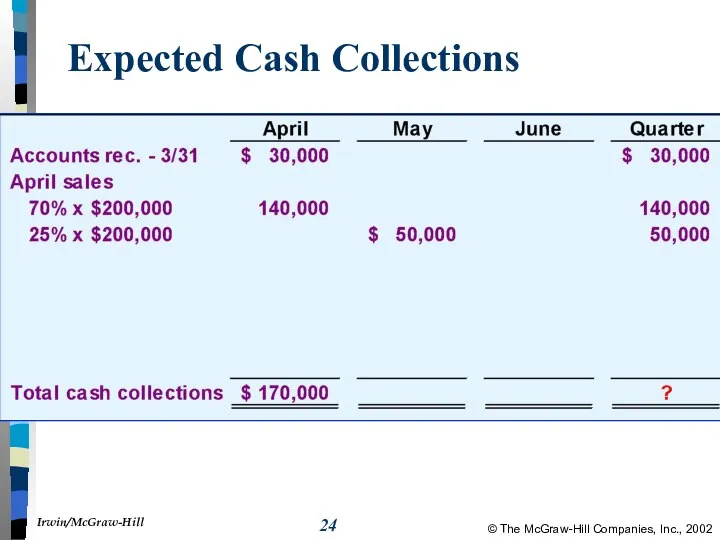

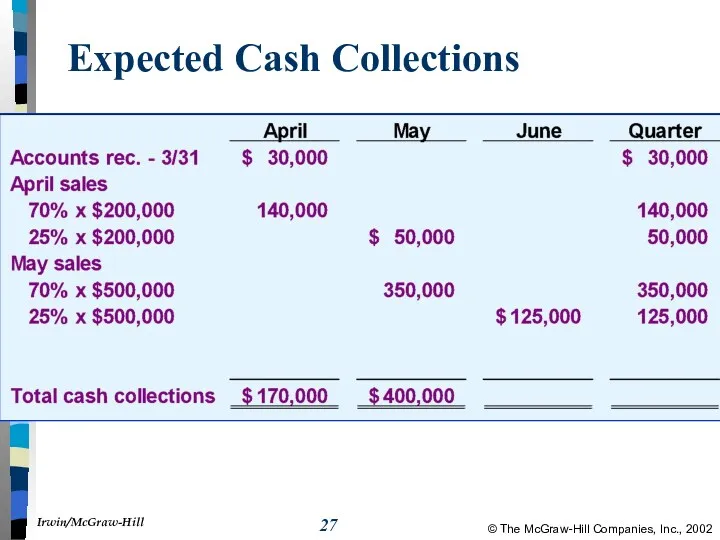

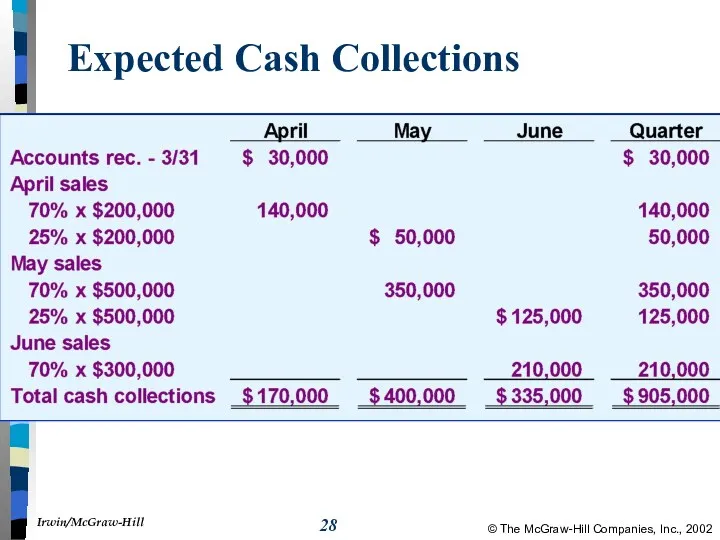

- 23. Expected Cash Collections

- 24. Expected Cash Collections

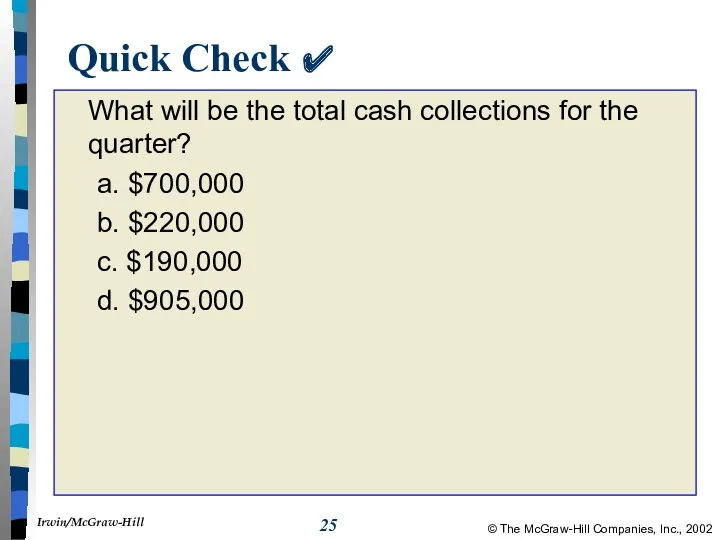

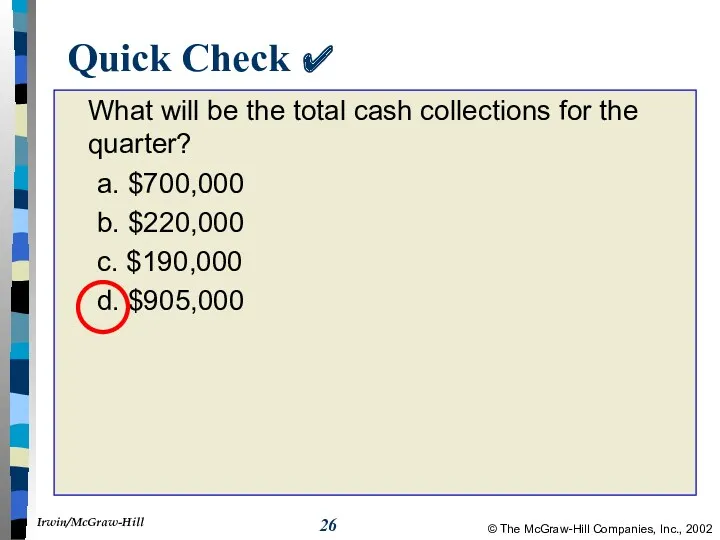

- 25. Quick Check ✔ What will be the total cash collections for the quarter? a. $700,000 b.

- 26. Quick Check ✔ What will be the total cash collections for the quarter? a. $700,000 b.

- 27. Expected Cash Collections

- 28. Expected Cash Collections

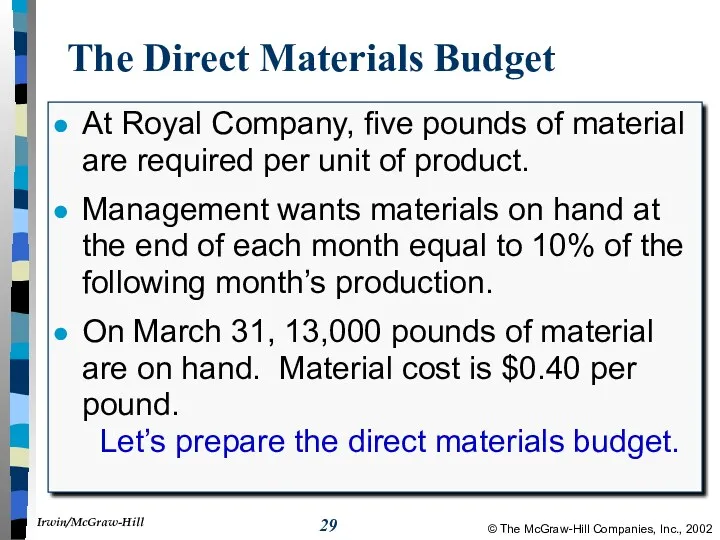

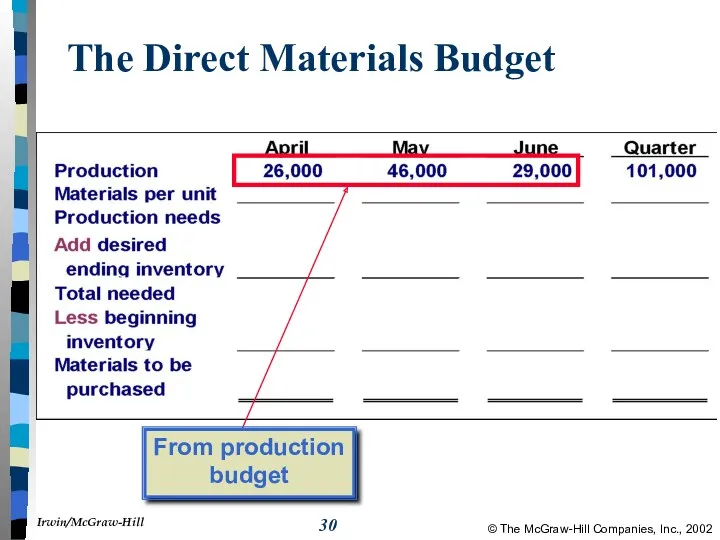

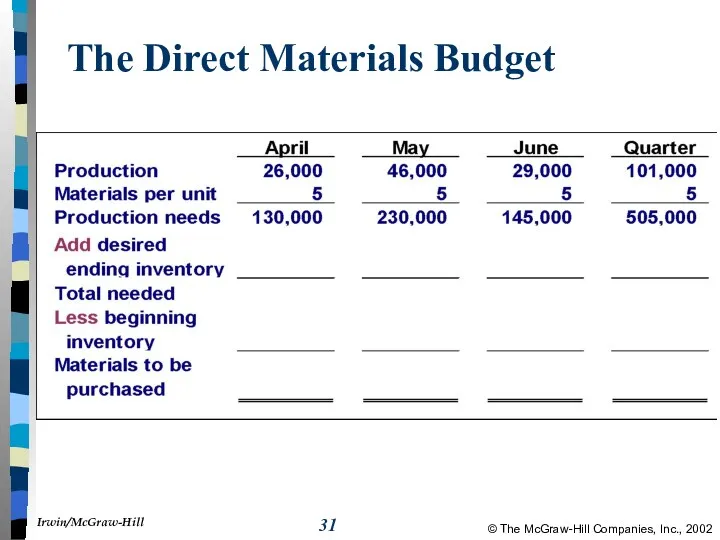

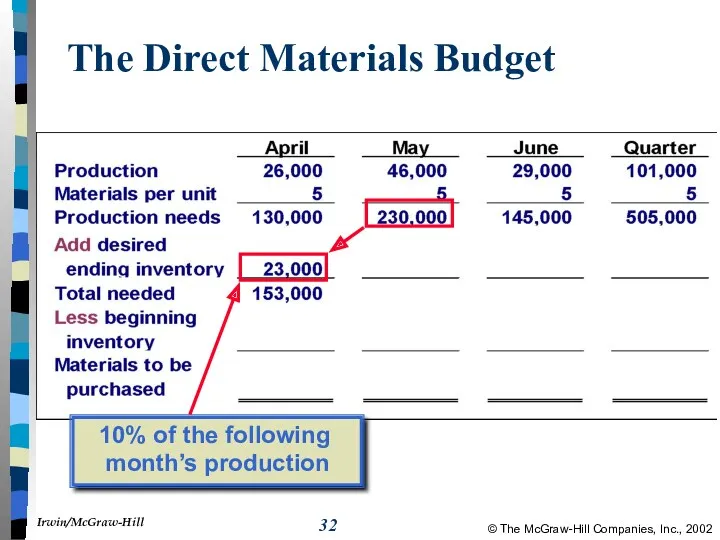

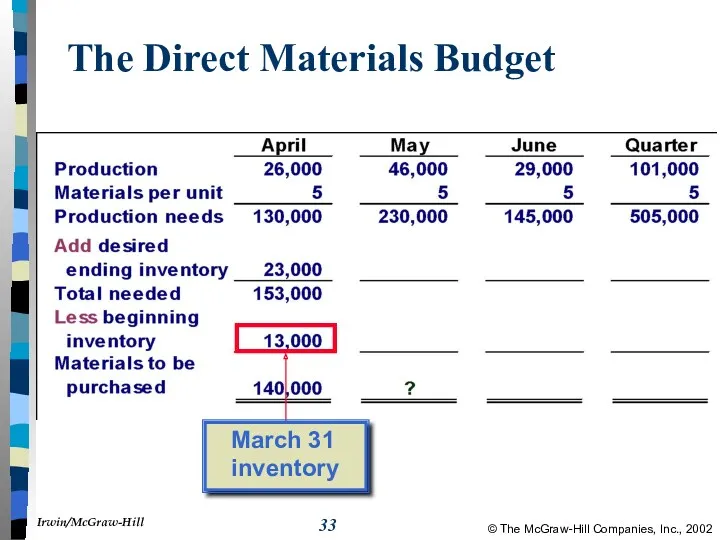

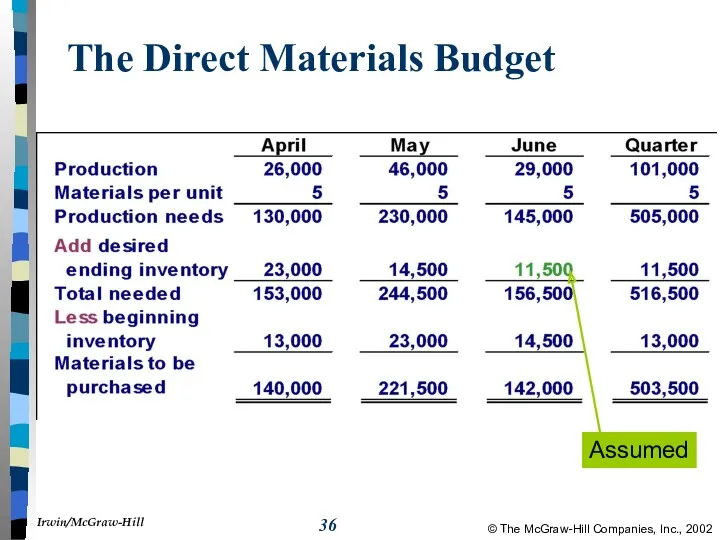

- 29. The Direct Materials Budget At Royal Company, five pounds of material are required per unit of

- 30. The Direct Materials Budget

- 31. The Direct Materials Budget

- 32. The Direct Materials Budget

- 33. The Direct Materials Budget March 31 inventory

- 34. Quick Check ✔ How much materials should be purchased in May? a. 221,500 pounds b. 240,000

- 35. Quick Check ✔ How much materials should be purchased in May? a. 221,500 pounds b. 240,000

- 36. The Direct Materials Budget Assumed

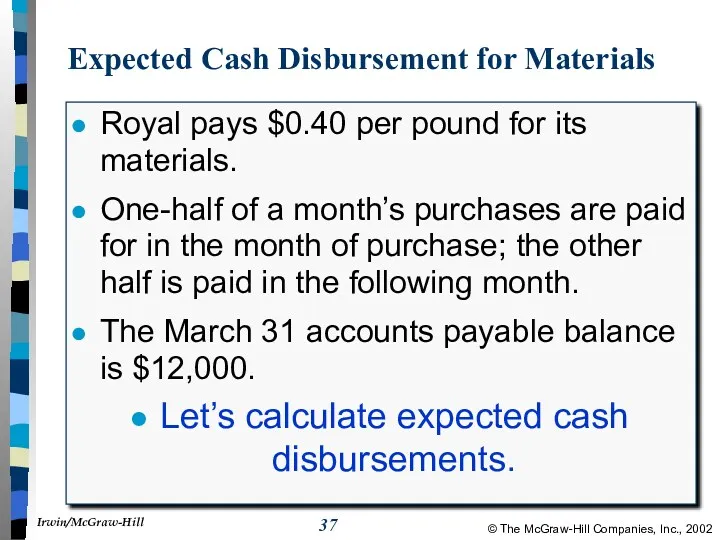

- 37. Expected Cash Disbursement for Materials Royal pays $0.40 per pound for its materials. One-half of a

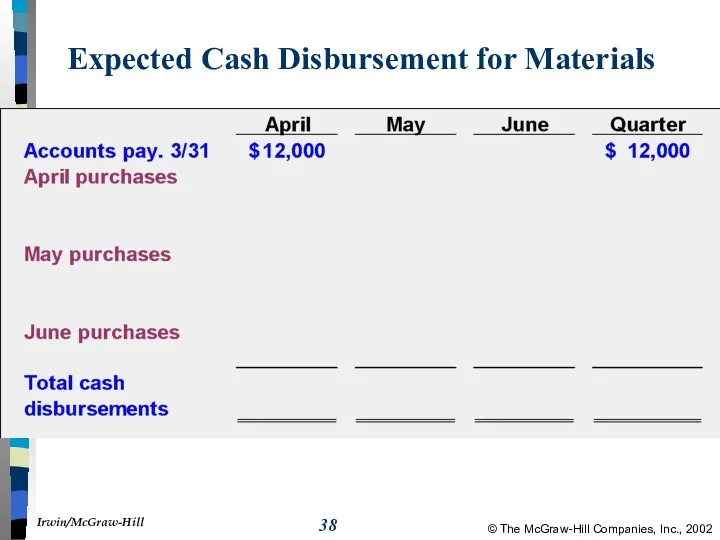

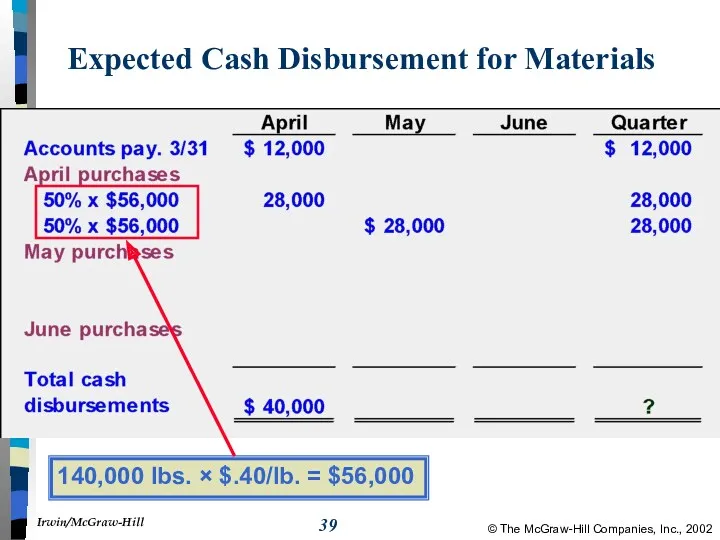

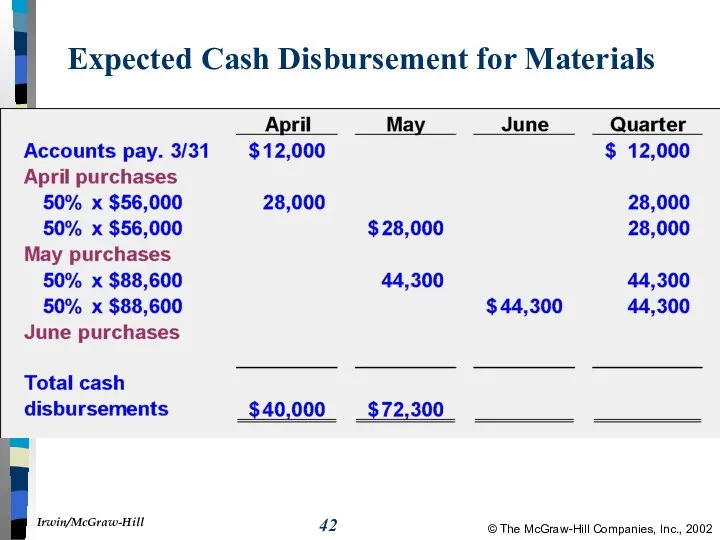

- 38. Expected Cash Disbursement for Materials

- 39. Expected Cash Disbursement for Materials

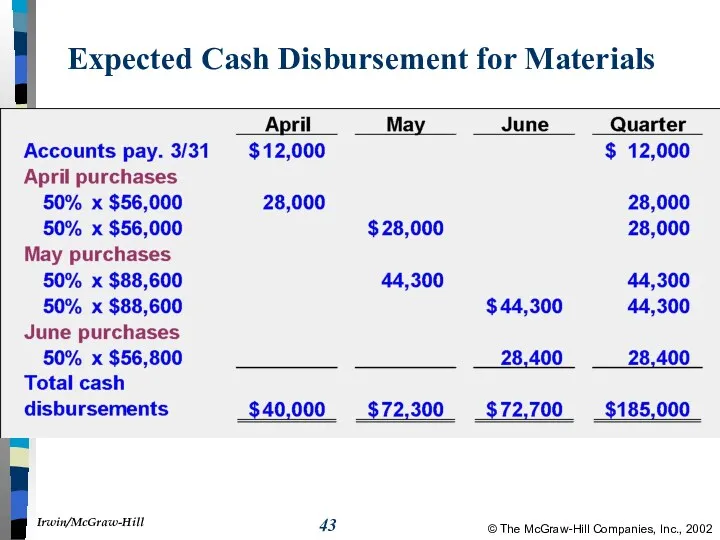

- 40. Quick Check ✔ What are the total cash disbursements for the quarter? a. $185,000 b. $

- 41. Quick Check ✔ What are the total cash disbursements for the quarter? a. $185,000 b. $

- 42. Expected Cash Disbursement for Materials

- 43. Expected Cash Disbursement for Materials

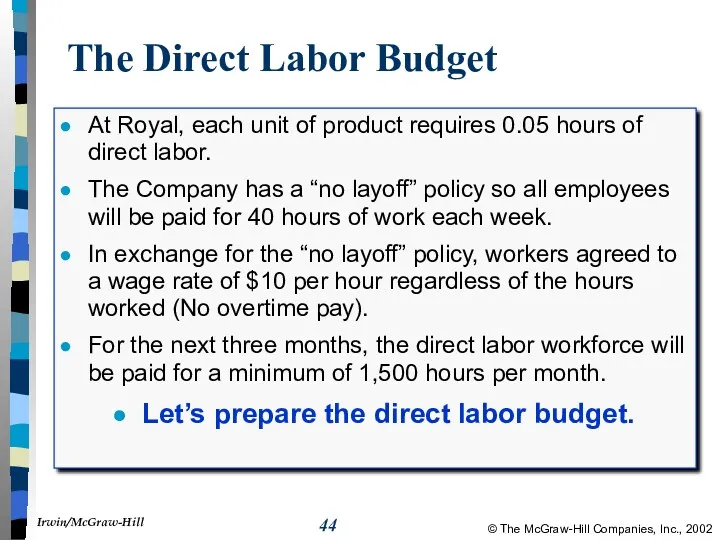

- 44. The Direct Labor Budget At Royal, each unit of product requires 0.05 hours of direct labor.

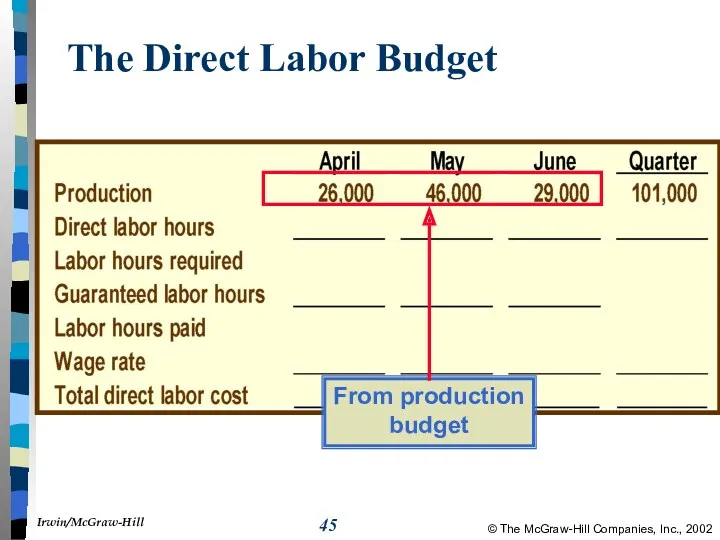

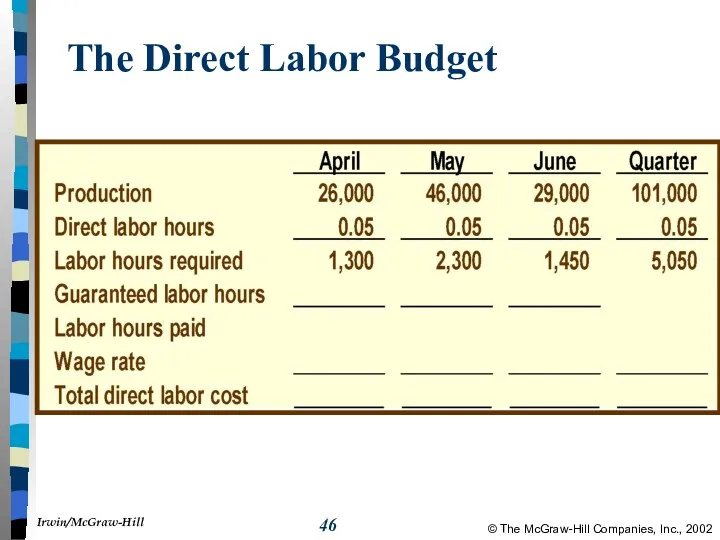

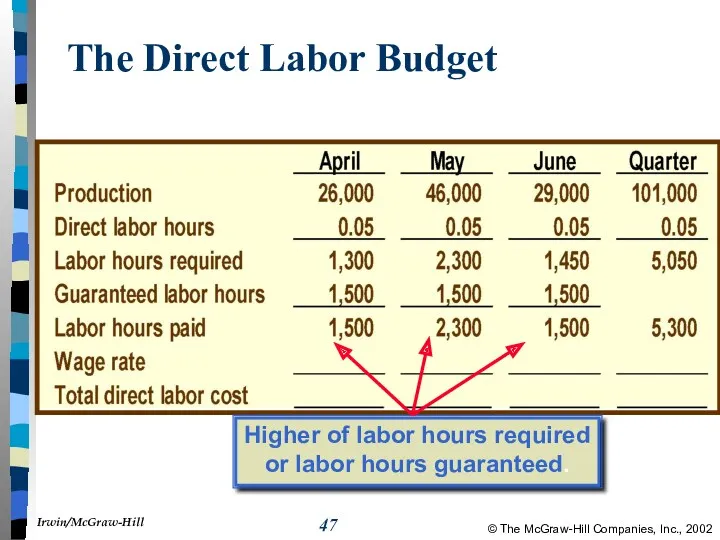

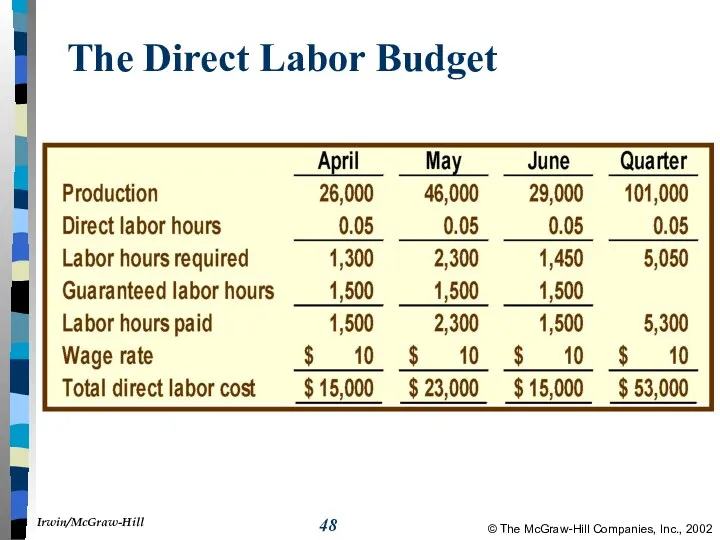

- 45. The Direct Labor Budget

- 46. The Direct Labor Budget

- 47. The Direct Labor Budget

- 48. The Direct Labor Budget

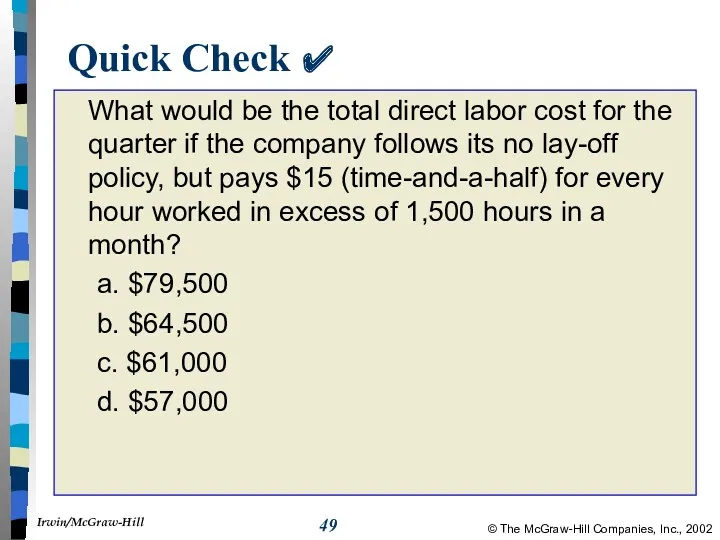

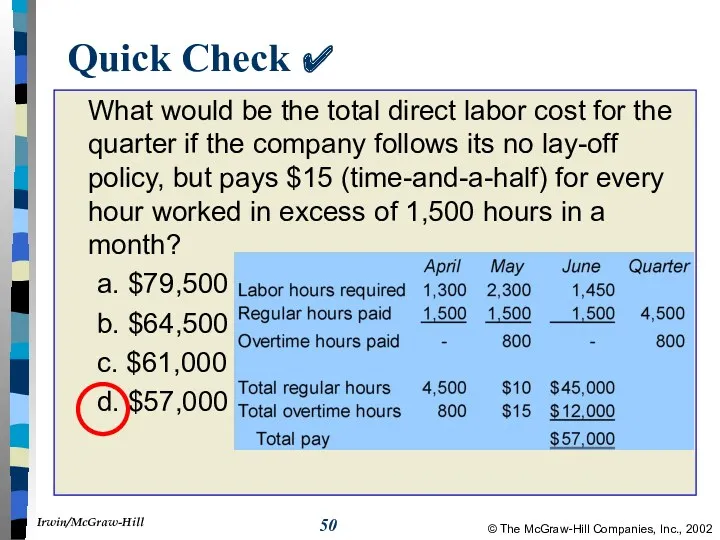

- 49. Quick Check ✔ What would be the total direct labor cost for the quarter if the

- 50. Quick Check ✔ What would be the total direct labor cost for the quarter if the

- 51. Manufacturing Overhead Budget Royal Company uses a variable manufacturing overhead rate of $1 per unit produced.

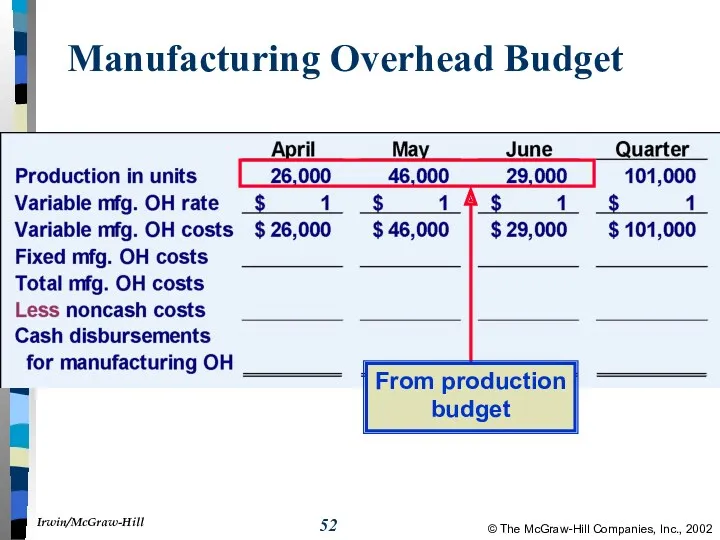

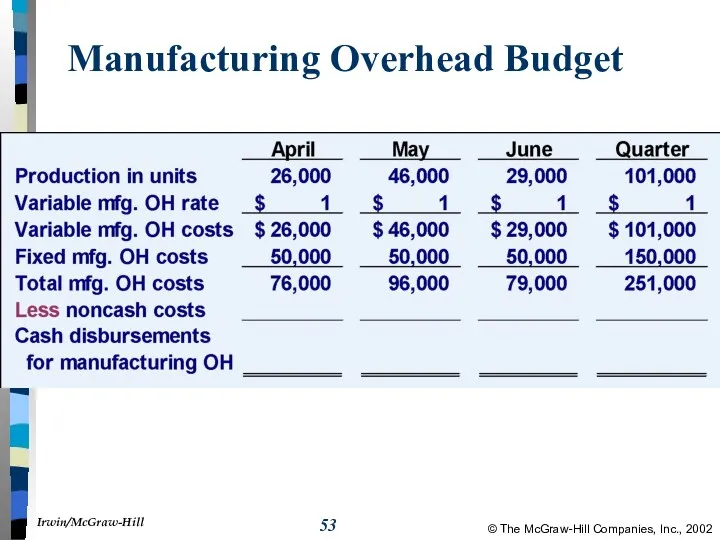

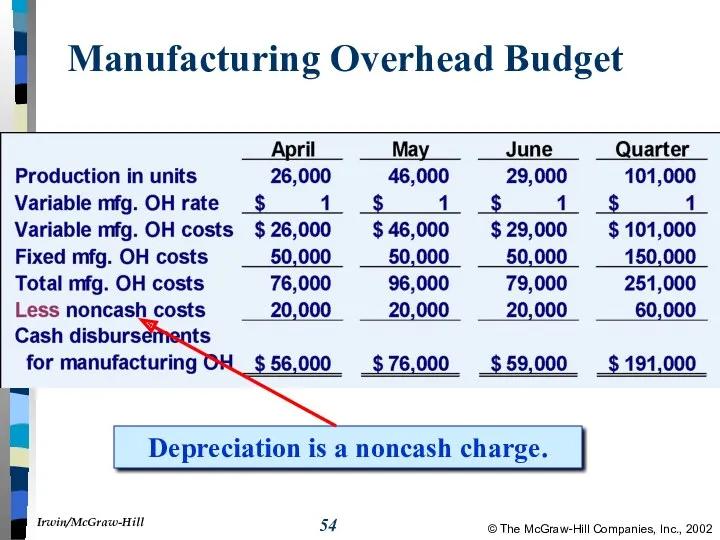

- 52. Manufacturing Overhead Budget

- 53. Manufacturing Overhead Budget

- 54. Manufacturing Overhead Budget

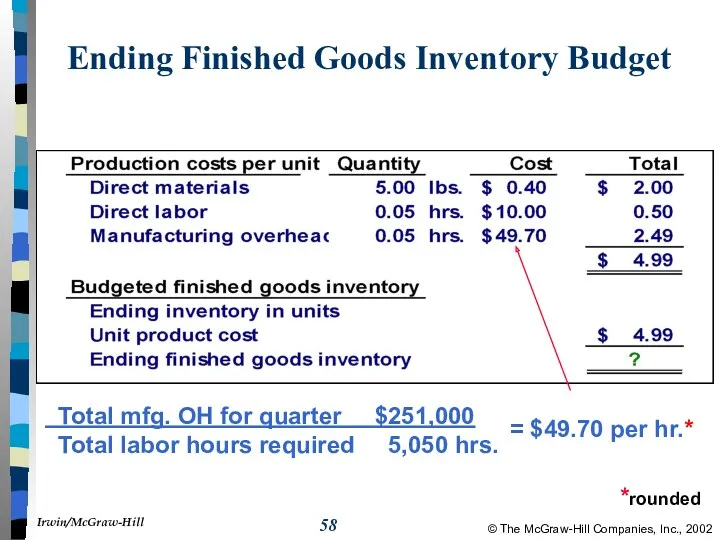

- 55. Ending Finished Goods Inventory Budget Now, Royal can complete the ending finished goods inventory budget. At

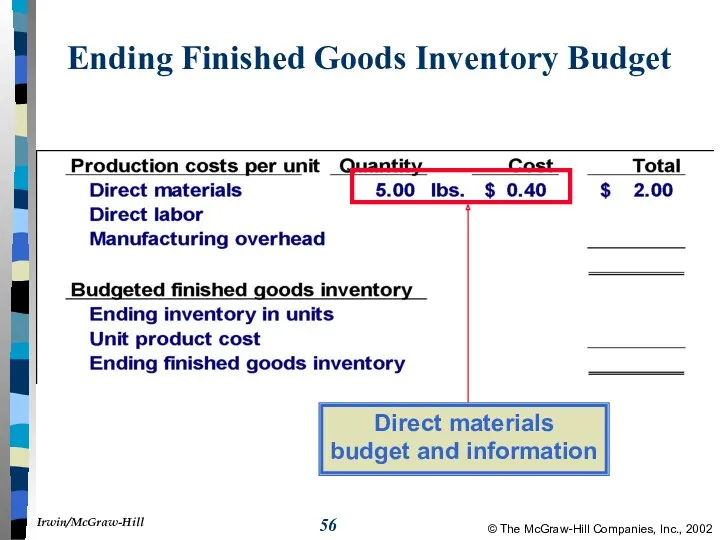

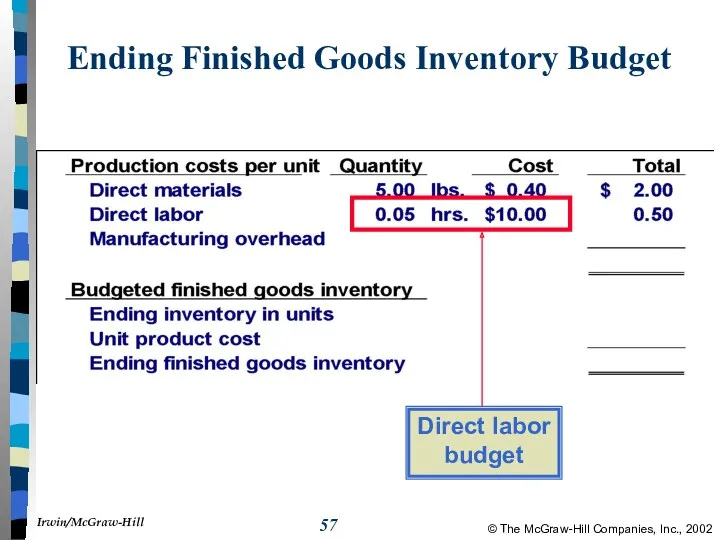

- 56. Ending Finished Goods Inventory Budget

- 57. Ending Finished Goods Inventory Budget

- 58. Ending Finished Goods Inventory Budget

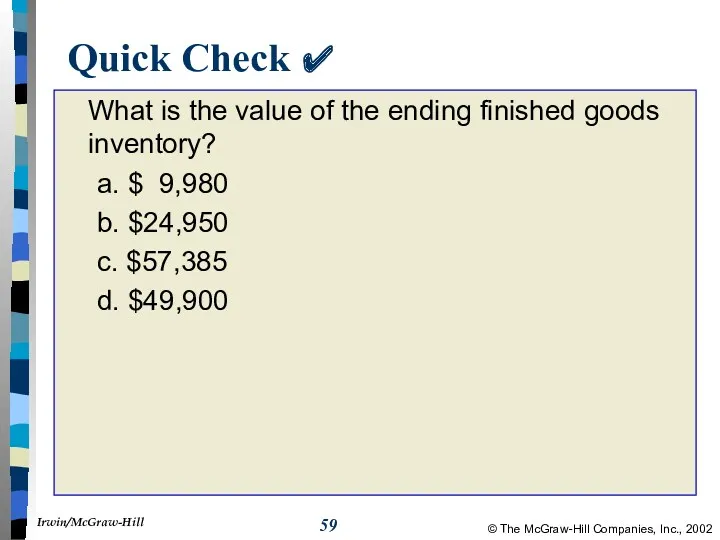

- 59. Quick Check ✔ What is the value of the ending finished goods inventory? a. $ 9,980

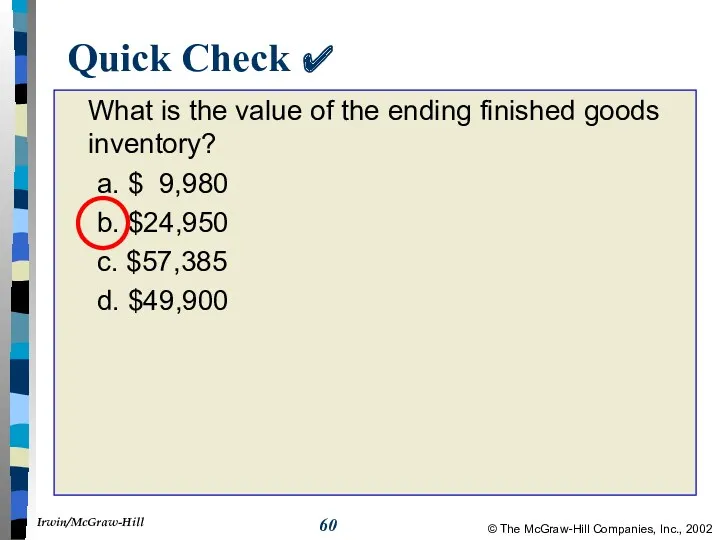

- 60. Quick Check ✔ What is the value of the ending finished goods inventory? a. $ 9,980

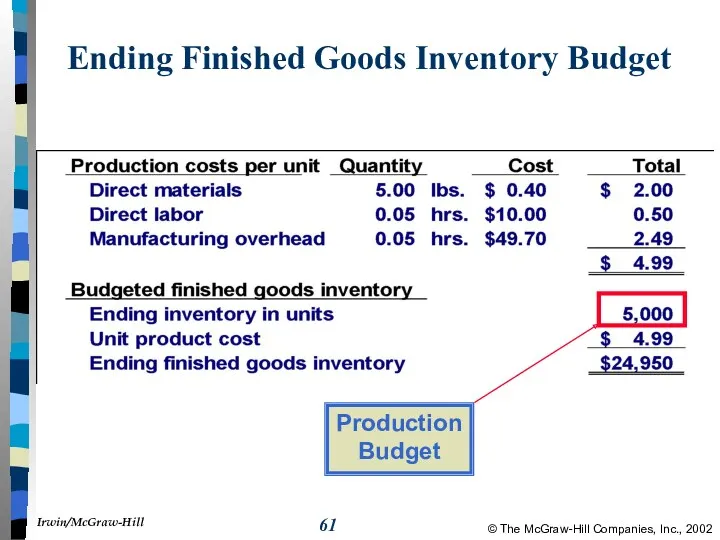

- 61. Ending Finished Goods Inventory Budget

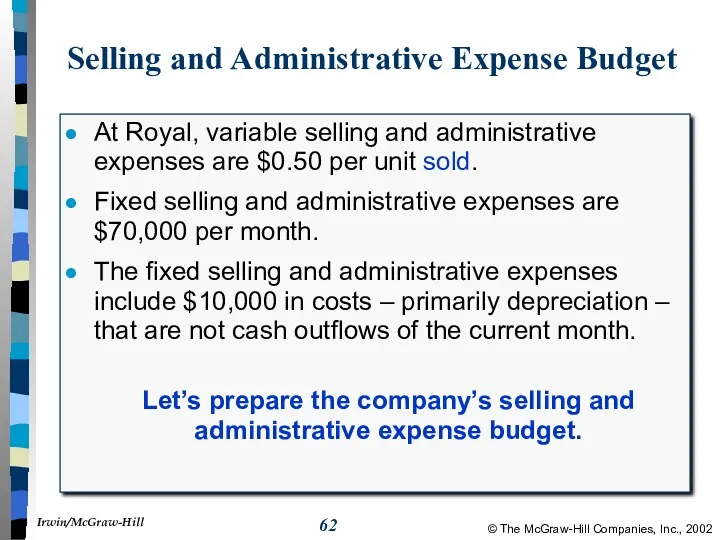

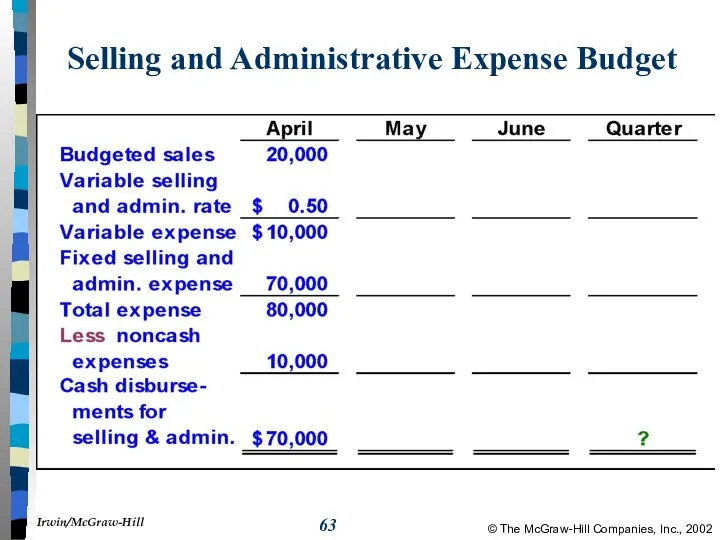

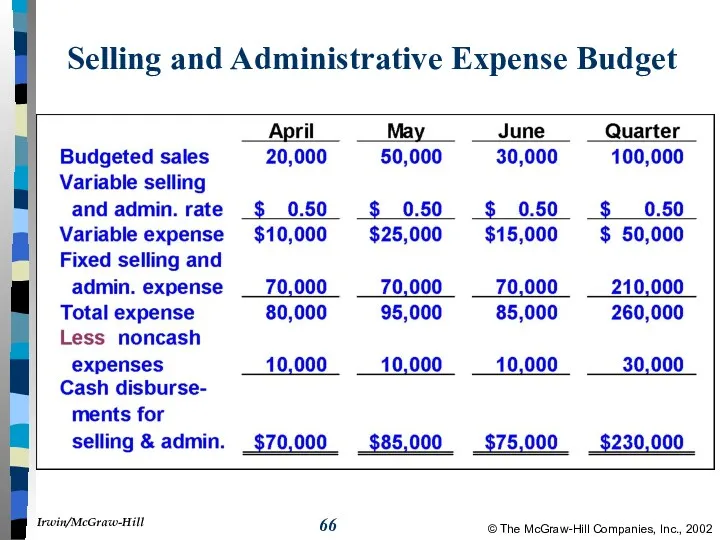

- 62. Selling and Administrative Expense Budget At Royal, variable selling and administrative expenses are $0.50 per unit

- 63. Selling and Administrative Expense Budget

- 64. Quick Check ✔ What are the total cash disbursements for selling and administrative expenses for the

- 65. Quick Check ✔ What are the total cash disbursements for selling and administrative expenses for the

- 66. Selling and Administrative Expense Budget

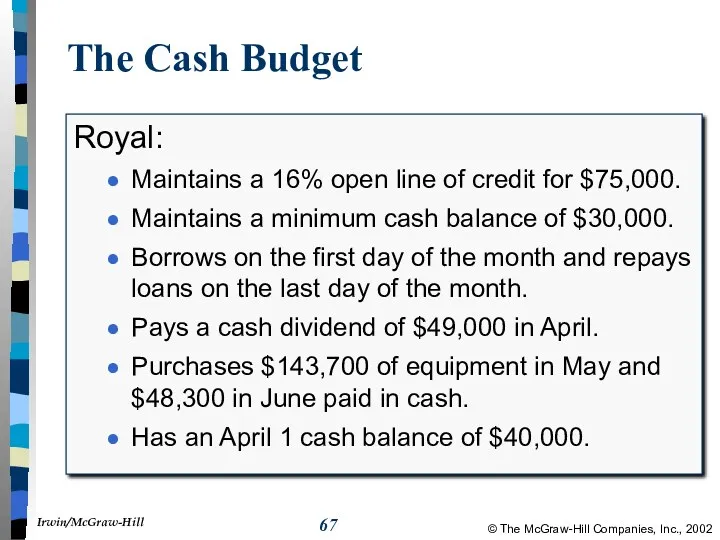

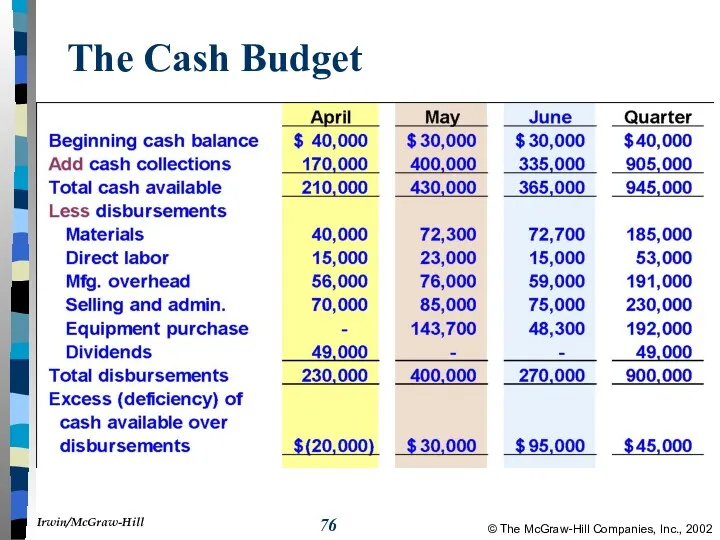

- 67. The Cash Budget Royal: Maintains a 16% open line of credit for $75,000. Maintains a minimum

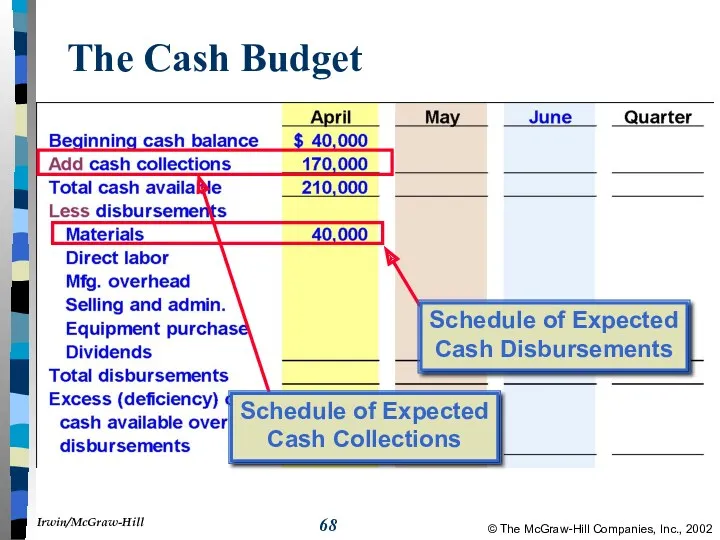

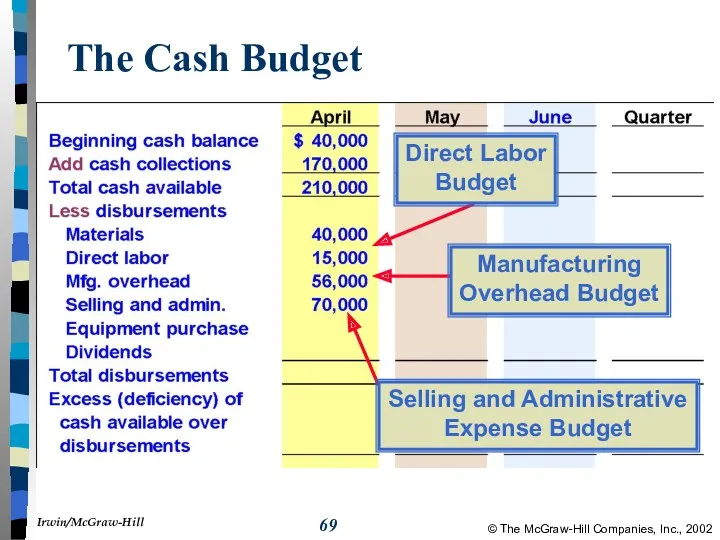

- 68. The Cash Budget

- 69. The Cash Budget

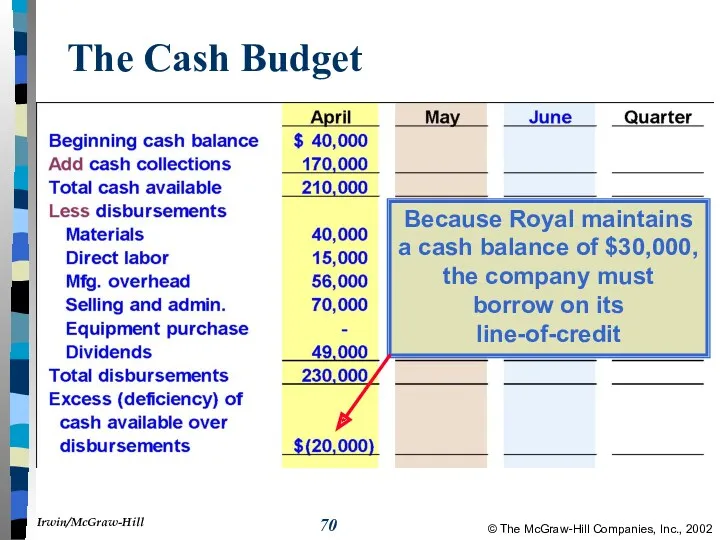

- 70. The Cash Budget

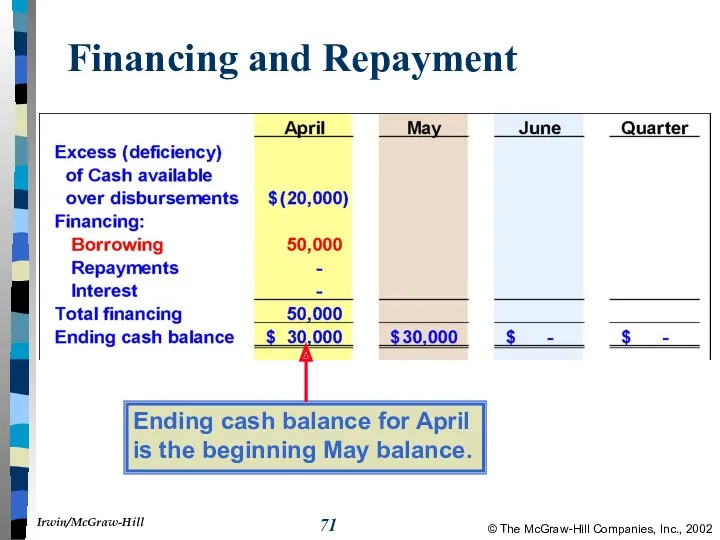

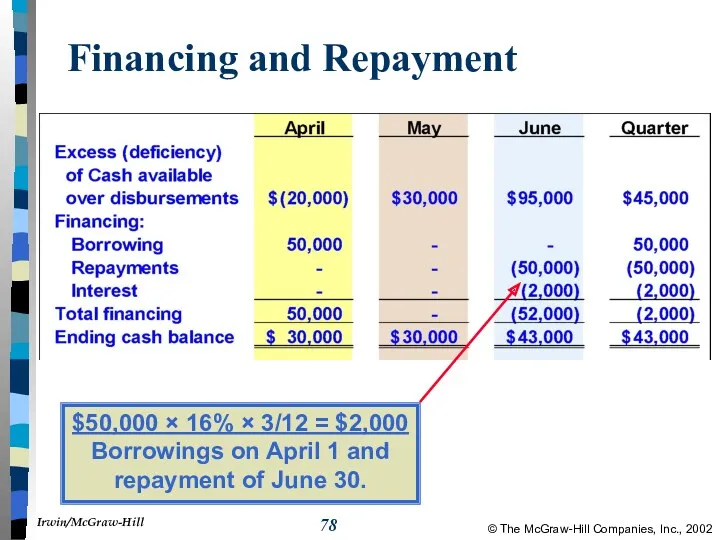

- 71. Financing and Repayment

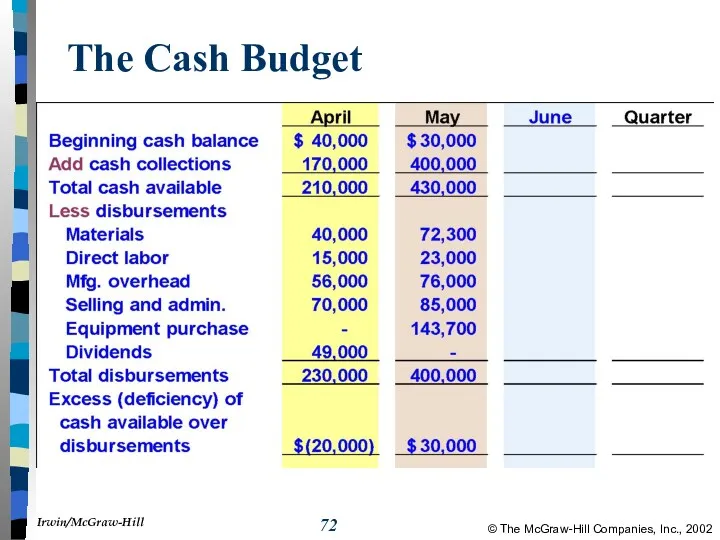

- 72. The Cash Budget

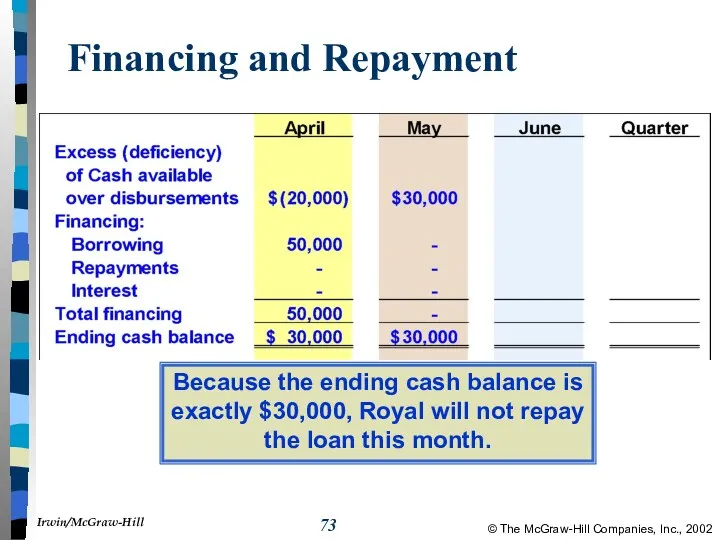

- 73. Financing and Repayment Because the ending cash balance is exactly $30,000, Royal will not repay the

- 74. Quick Check ✔ What is the excess (deficiency) of cash available over disbursements for June? a.

- 75. Quick Check ✔ What is the excess (deficiency) of cash available over disbursements for June? a.

- 76. The Cash Budget

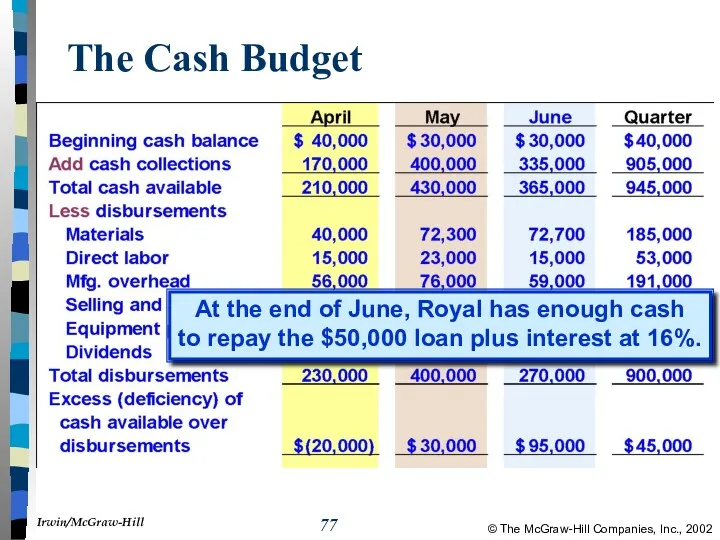

- 77. The Cash Budget At the end of June, Royal has enough cash to repay the $50,000

- 78. Financing and Repayment

- 79. The Budgeted Income Statement After we complete the cash budget, we can prepare the budgeted income

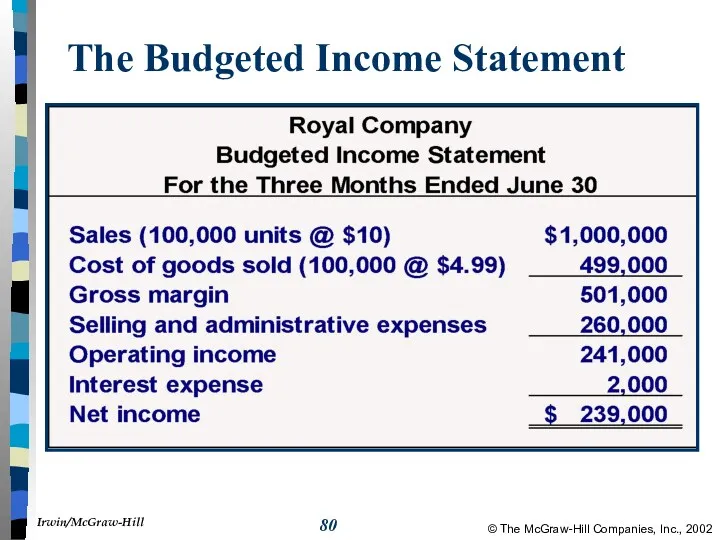

- 80. The Budgeted Income Statement

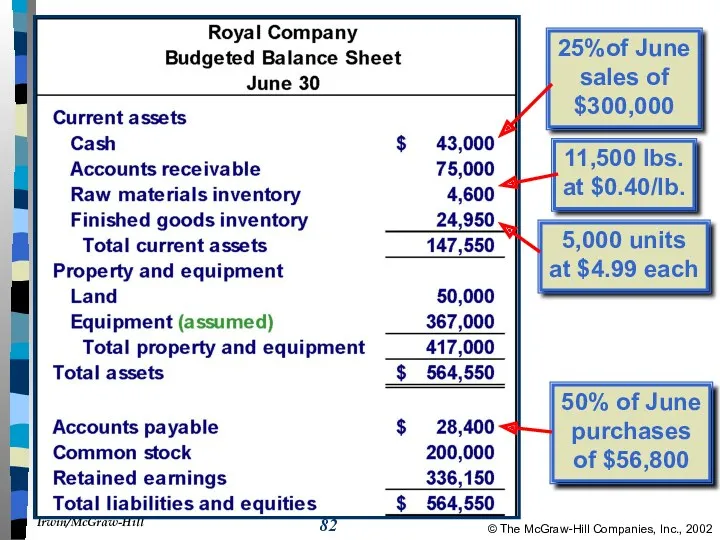

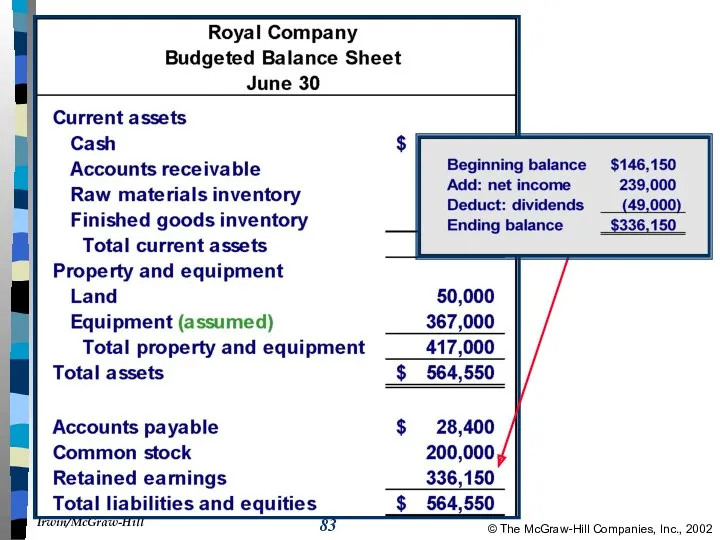

- 81. The Budgeted Balance Sheet Royal reported the following account balances prior to preparing its budgeted financial

- 85. Скачать презентацию

Стратегический менеджмент в образовании: формирование стратегического плана школы

Стратегический менеджмент в образовании: формирование стратегического плана школы Трудовые ресурсы предприятия. (Тема 8)

Трудовые ресурсы предприятия. (Тема 8) Менеджмент качества образования в высшей школе

Менеджмент качества образования в высшей школе Методы и формы управления в гостиничном бизнесе

Методы и формы управления в гостиничном бизнесе Мировые управленческие концепции. Американская, европейская, японская и российская модели менеджмента

Мировые управленческие концепции. Американская, европейская, японская и российская модели менеджмента How managers can make a decision in an uncertainty environment?

How managers can make a decision in an uncertainty environment? Time management. How to do everything

Time management. How to do everything Система внутреннего контроля современного предприятия

Система внутреннего контроля современного предприятия Оценка использования трудовых ресурсов и обоснование путей их улучшения ОАО Витебские ковры

Оценка использования трудовых ресурсов и обоснование путей их улучшения ОАО Витебские ковры Основы управления качеством и оценки соответствия

Основы управления качеством и оценки соответствия Организационный план. Персонал

Организационный план. Персонал Анализ кадровой политики ОАО РУСАЛ-ИркАЗ

Анализ кадровой политики ОАО РУСАЛ-ИркАЗ Совершенствование процесса адаптации персонала на предприятии на примере строительной организации ООО Застройщик

Совершенствование процесса адаптации персонала на предприятии на примере строительной организации ООО Застройщик Обще́ственное пита́ние

Обще́ственное пита́ние Теория поведения человека в организации

Теория поведения человека в организации Практическое задание по менеджменту

Практическое задание по менеджменту Вероятностные модели управления запасами

Вероятностные модели управления запасами Етапи процесу прийняття рішення

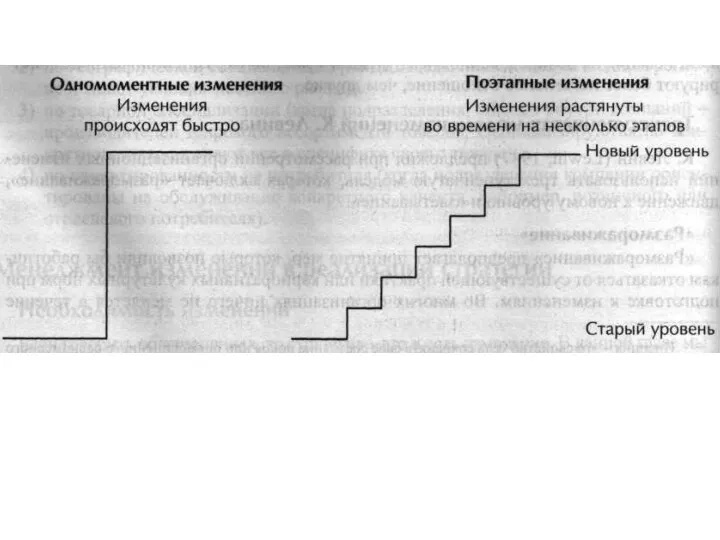

Етапи процесу прийняття рішення Изменения в организации и расходование ресурсов

Изменения в организации и расходование ресурсов Проект тайный ангел

Проект тайный ангел Экспертные методы оценки рисков

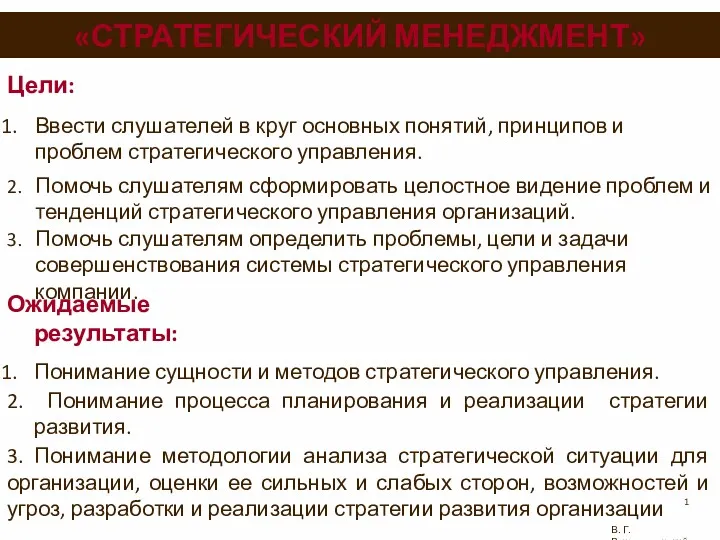

Экспертные методы оценки рисков Стратегический менеджмент

Стратегический менеджмент Школа менеджеров

Школа менеджеров Реинжиниринг бизнес-процессов. Основные концепции улучшения бизнес-процессов. (Тема 1)

Реинжиниринг бизнес-процессов. Основные концепции улучшения бизнес-процессов. (Тема 1) Понятие стратегического менеджмента

Понятие стратегического менеджмента Управление научными исследованиями и разработками. Разработки новых продуктов и технологий

Управление научными исследованиями и разработками. Разработки новых продуктов и технологий Оценка персонала компании

Оценка персонала компании Види туроперейтингу

Види туроперейтингу