Содержание

- 2. CEM & SQM & NPM – Huawei’s Capability SmartCare® Business Value on a Customer Case Use

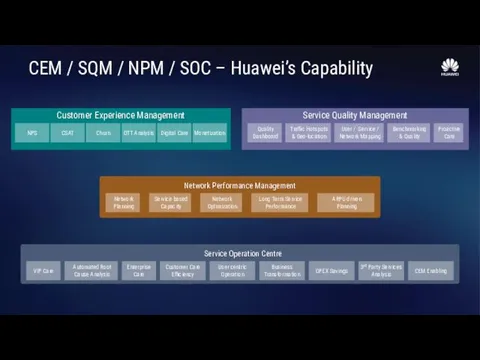

- 3. CEM / SQM / NPM / SOC – Huawei’s Capability

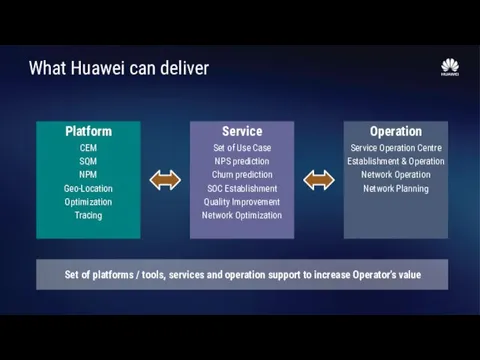

- 4. What Huawei can deliver Platform CEM SQM NPM Geo-Location Optimization Tracing Service Set of Use Case

- 5. CEM & SQM & NPM – Huawei’s Capability SmartCare® Business Value on a Customer Case Use

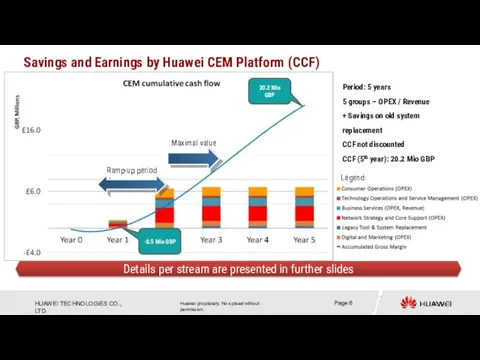

- 6. Savings and Earnings by Huawei CEM Platform (CCF) Legend: Details per stream are presented in further

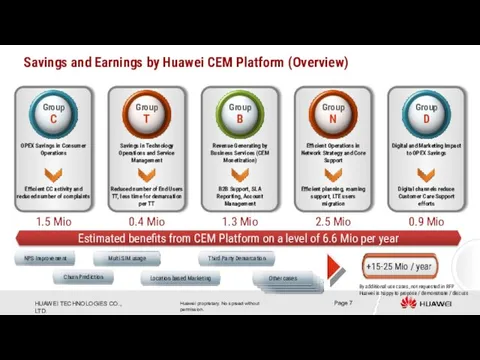

- 7. Savings and Earnings by Huawei CEM Platform (Overview) Estimated benefits from CEM Platform on a level

- 8. CEM & SQM & NPM – Huawei’s Capability SmartCare® Business Value on a Customer Case Use

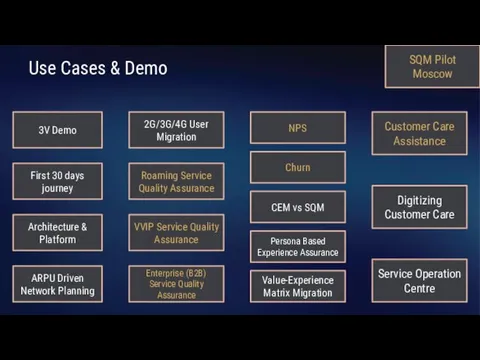

- 9. 3V Demo Architecture & Platform First 30 days journey Use Cases & Demo Roaming Service Quality

- 10. CEM & SQM & NPM – Huawei’s Capability SmartCare® Business Value on a Customer Cases Use

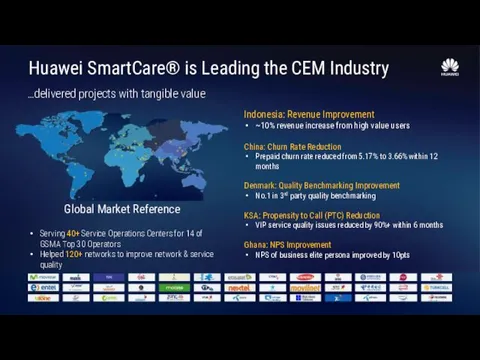

- 11. …delivered projects with tangible value Huawei SmartCare® is Leading the CEM Industry

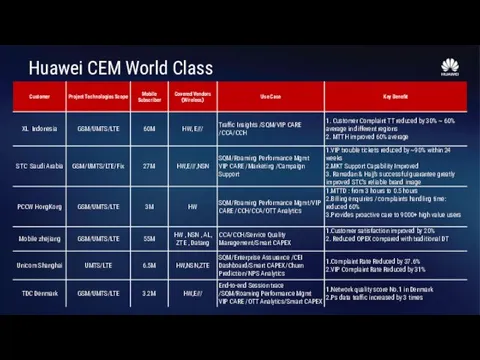

- 12. Huawei CEM World Class

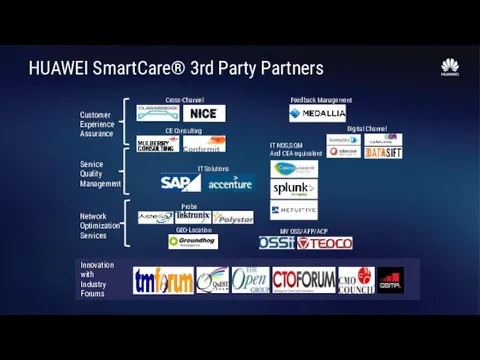

- 13. HUAWEI SmartCare® 3rd Party Partners

- 15. Appendix & Supportive Materials

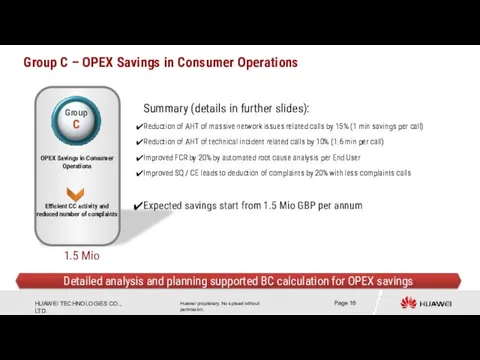

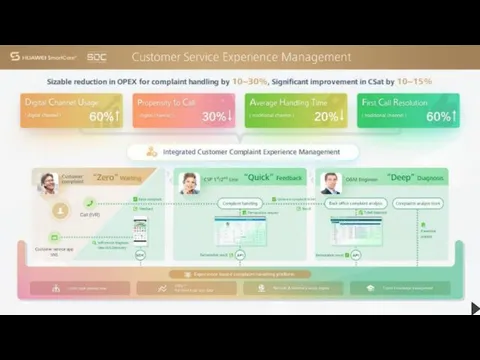

- 16. Group C – OPEX Savings in Consumer Operations OPEX Savings in Consumer Operations Efficient CC activity

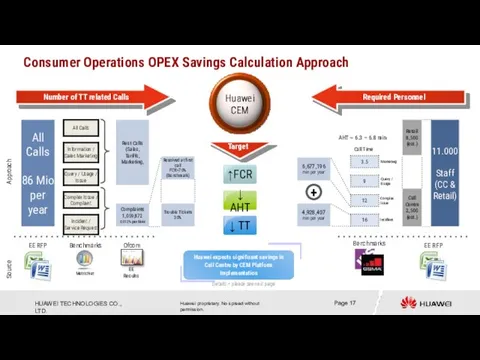

- 17. Consumer Operations OPEX Savings Calculation Approach Complaints 1,059,872 0.012% per User All Calls 86 Mio per

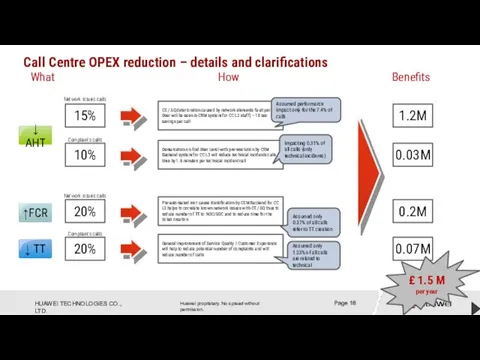

- 18. Call Centre OPEX reduction – details and clarifications 15% CE / SQ deterioration caused by network

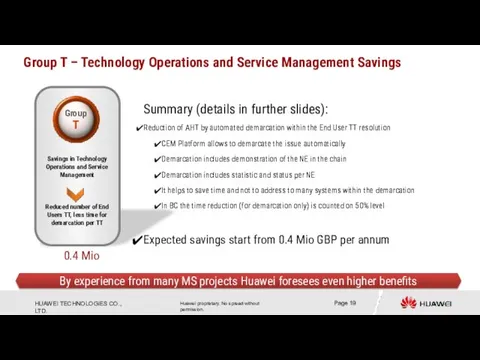

- 19. Group T – Technology Operations and Service Management Savings 0.4 Mio By experience from many MS

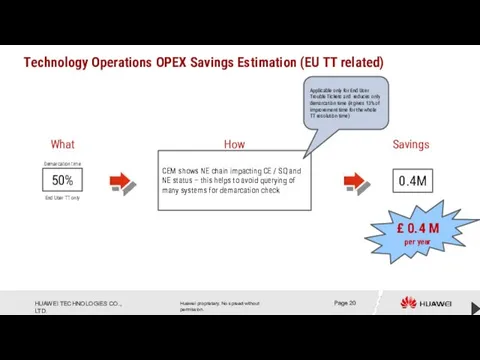

- 20. Technology Operations OPEX Savings Estimation (EU TT related) CEM shows NE chain impacting CE / SQ

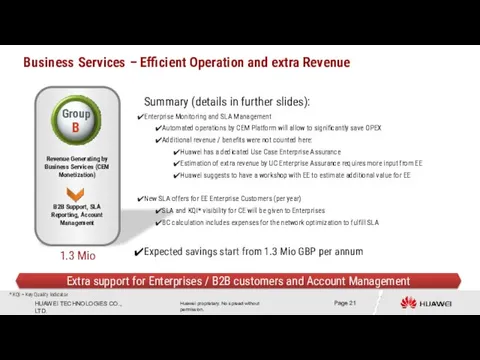

- 21. Business Services – Efficient Operation and extra Revenue 1.3 Mio Extra support for Enterprises / B2B

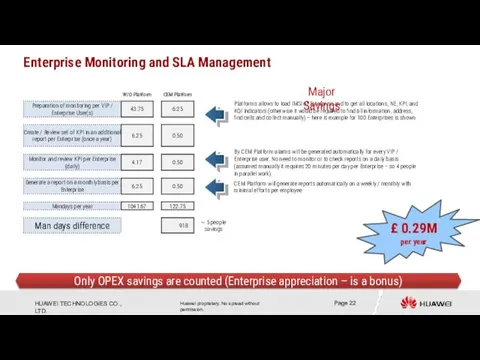

- 22. Only OPEX savings are counted (Enterprise appreciation – is a bonus) Enterprise Monitoring and SLA Management

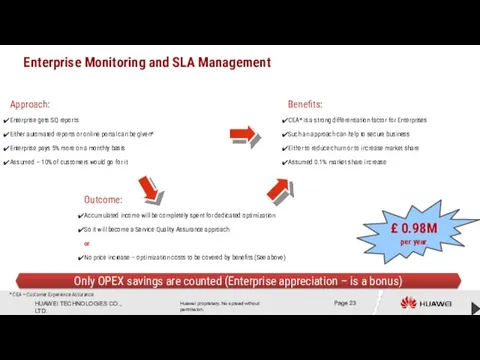

- 23. Only OPEX savings are counted (Enterprise appreciation – is a bonus) Enterprise Monitoring and SLA Management

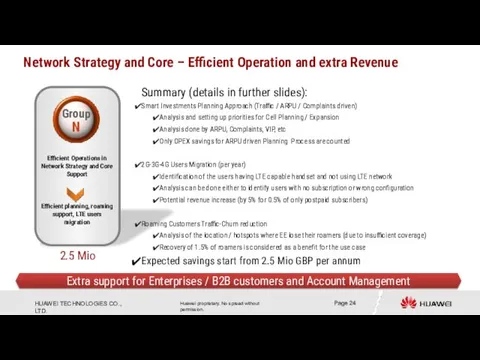

- 24. Network Strategy and Core – Efficient Operation and extra Revenue 2.5 Mio Extra support for Enterprises

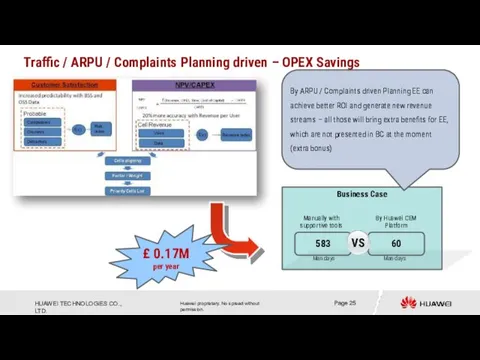

- 25. Business Case Traffic / ARPU / Complaints Planning driven – OPEX Savings 583 60 Manually with

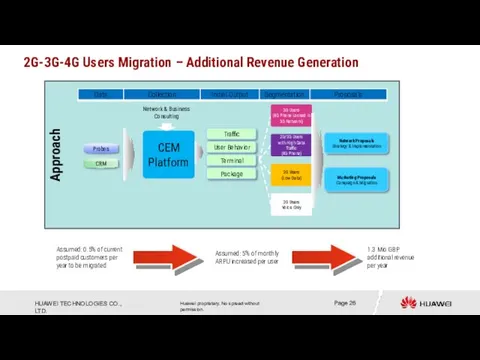

- 26. Approach 2G-3G-4G Users Migration – Additional Revenue Generation

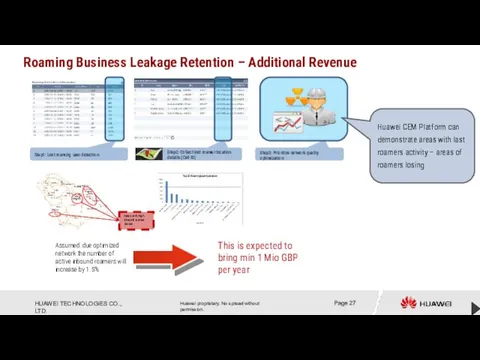

- 27. Roaming Business Leakage Retention – Additional Revenue Assumed: due optimized network the number of active inbound

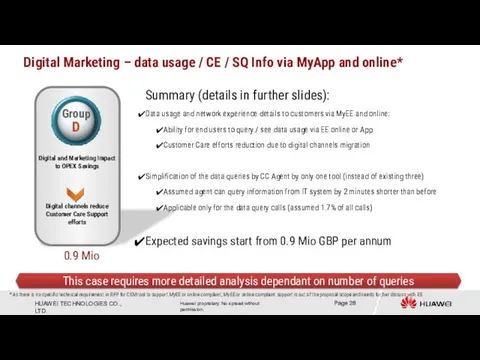

- 28. Digital Marketing – data usage / CE / SQ Info via MyApp and online* Digital and

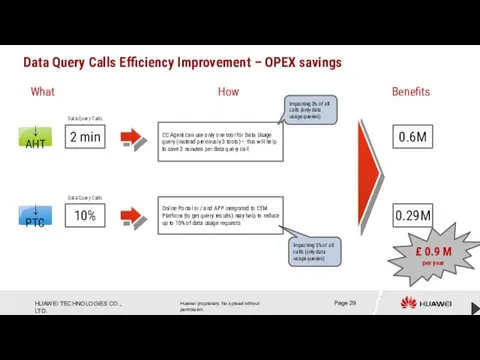

- 29. Data Query Calls Efficiency Improvement – OPEX savings 2 min Data Query Calls CC Agent can

- 30. SmartCare® Business Value on a Customer Case Use Cases Set Global References & Why HUAWEI Appendix

- 31. 3V Demo – Supportive Materials

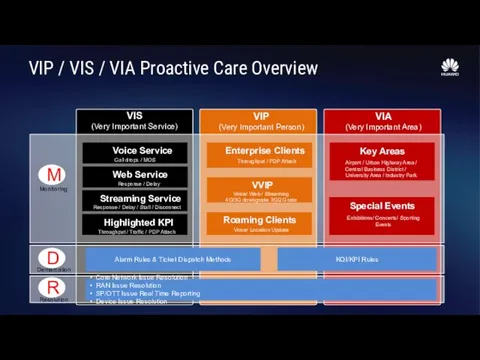

- 32. VIP / VIS / VIA Proactive Care Overview

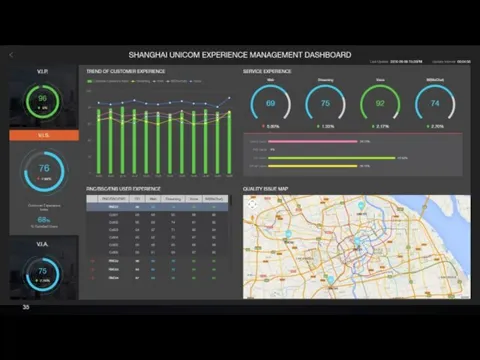

- 33. 3V Dashboard

- 37. 3V Demo – end of supportive materials

- 38. First 30 days journey – Supportive Materials

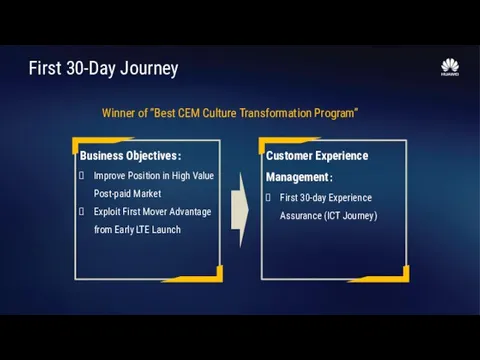

- 39. First 30-Day Journey Winner of “Best CEM Culture Transformation Program”

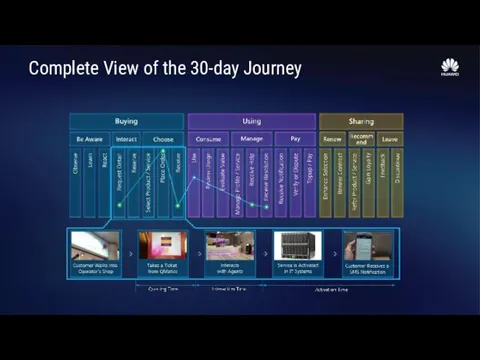

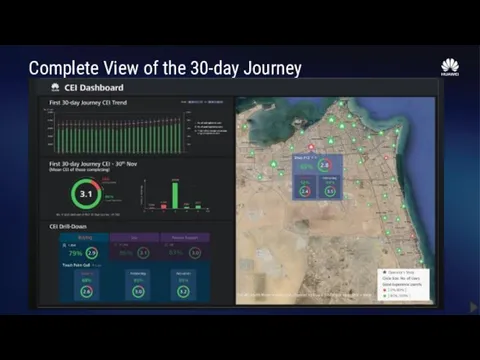

- 40. Complete View of the 30-day Journey

- 41. Complete View of the 30-day Journey

- 42. First 30 days journey – end of supportive materials

- 43. Architecture & Platform – Supportive Materials

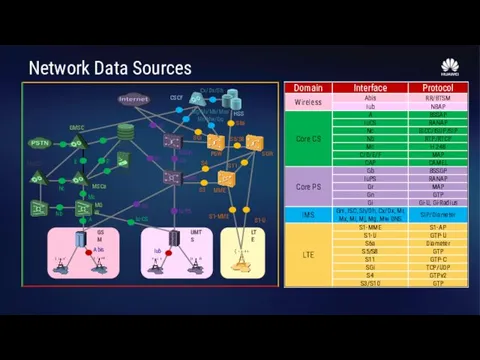

- 44. S1-U SGW Network Data Sources

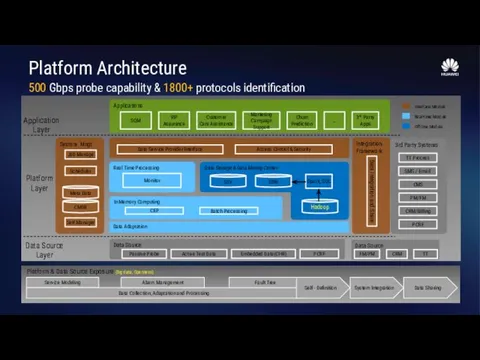

- 45. 500 Gbps probe capability & 1800+ protocols identification Platform Architecture

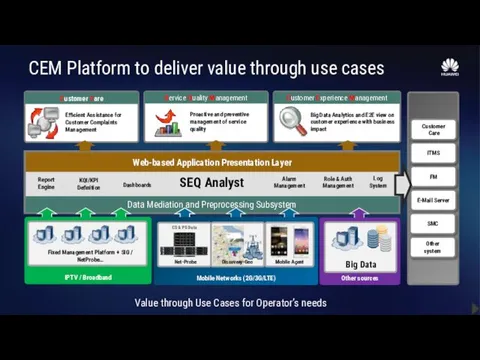

- 46. CEM Platform to deliver value through use cases SEQ Analyst Report Engine Data Mediation and Preprocessing

- 47. Architecture & Platform – end of supportive materials

- 48. ARPU Driven Network Planning – Supportive Materials

- 49. Quality Brand Experience & Value Driven Site Ranking

- 50. Value/experience Classified Model Quality Brand Experience & Value Driven Site Ranking

- 51. Quality Brand Experience & Value Driven Site Ranking

- 52. Quality Brand Experience & Value Driven Site Ranking

- 53. ARPU Driven Network Planning – end of supportive materials

- 54. 2G/3G/4G User Migration – Supportive Materials

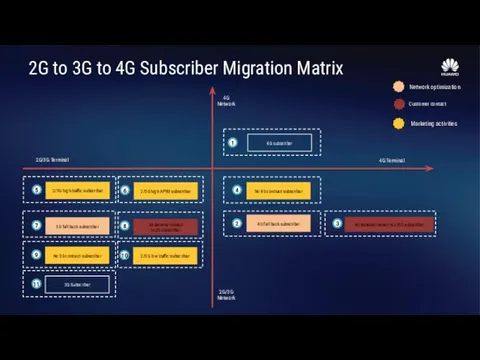

- 55. 2G to 3G to 4G Subscriber Migration Matrix 2G/3G Terminal 4G Terminal 4G Network 2G/3G Network

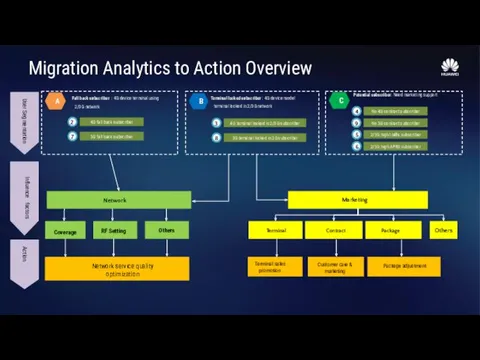

- 56. Migration Analytics to Action Overview 2 4G fall back subscriber 7 3G fall back subscriber A

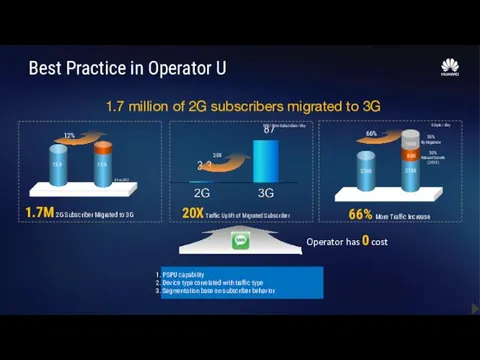

- 57. 20X MB / Data Subscriber / day 2014/4/3 2014/8/21 8% in 2013 2014/4/3 2014/8/21 30% Natural

- 58. 2G/3G/4G User Migration – end of supportive materials

- 59. Roaming Service Quality Assurance – Supportive Materials

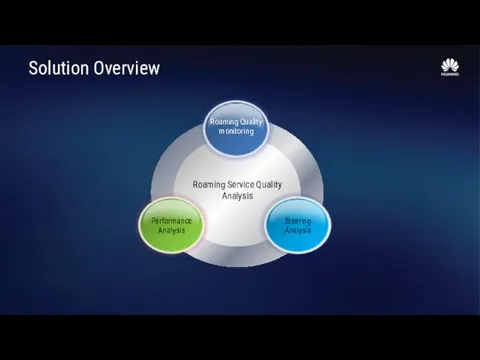

- 60. Solution Overview

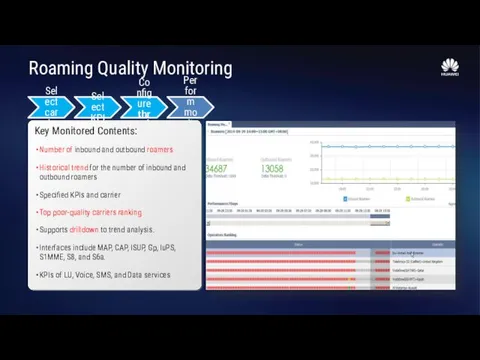

- 61. Roaming Quality Monitoring Select carrier Select KPI Configure threshold Perform monitoring Key Monitored Contents: Number of

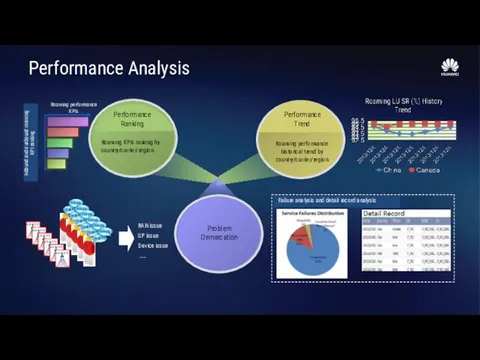

- 62. Inbound and outbound roaming KPI ranking Failure analysis and detail record analysis Performance Ranking Performance Trend

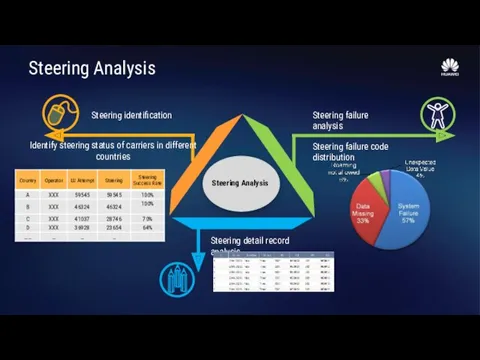

- 63. Identify steering status of carriers in different countries Steering identification Steering failure analysis Steering failure code

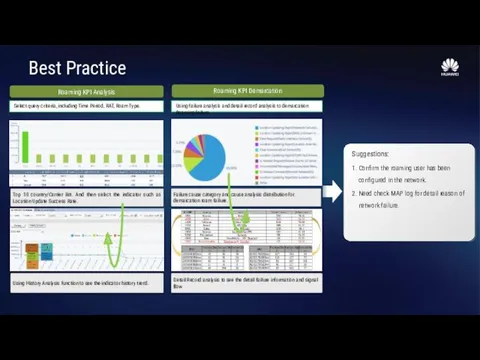

- 64. Best Practice

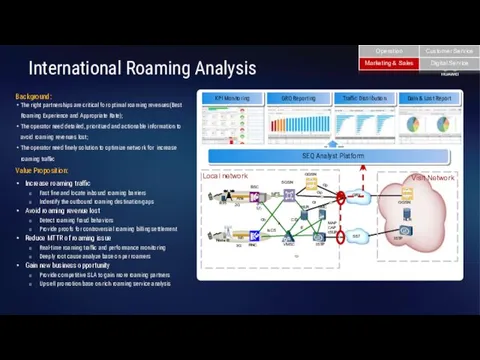

- 65. International Roaming Issues SMC HLR RNC Node B 3G Iub BTS BSC Abis GRX SGSN (PCU)

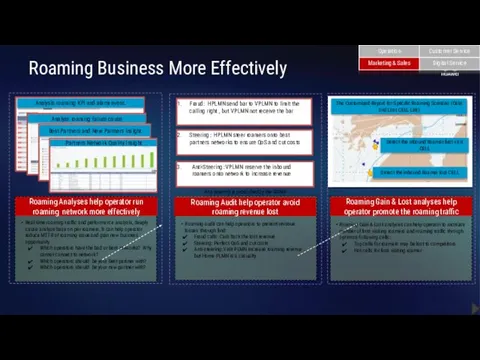

- 66. Roaming Business More Effectively

- 67. Roaming Service Quality Assurance – Supportive Materials

- 68. VVIP Service Quality Assurance – Supportive Materials

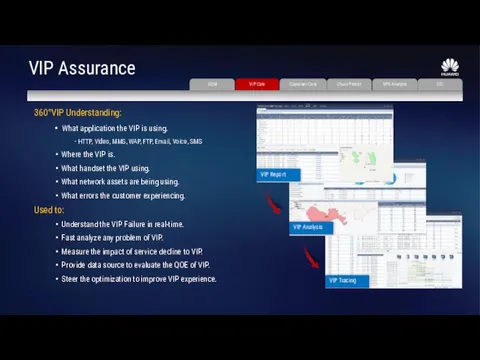

- 69. VIP Assurance 360°VIP Understanding: What application the VIP is using. - HTTP, Video, MMS, WAP, FTP,

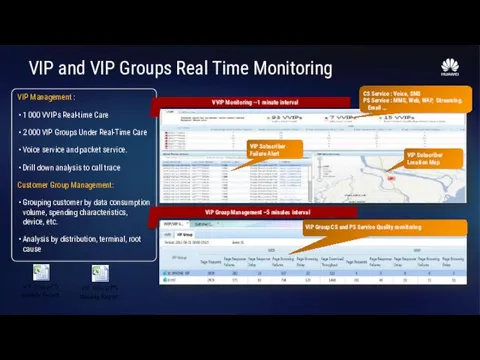

- 70. VIP and VIP Groups Real Time Monitoring VIP Management : 1 000 VVIPs Real-time Care 2

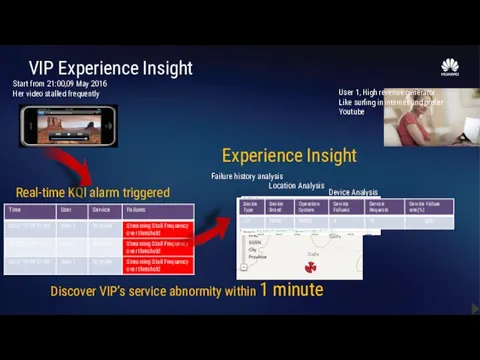

- 71. VIP Experience Insight User 1, High revenue generator Like surfing in internet and prefer Youtube Real-time

- 72. VVIP Service Quality Assurance – Supportive Materials

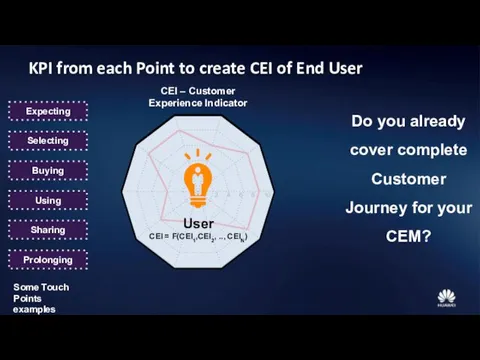

- 73. Customer Experience from whole Customer Journey Advertisement Product Information Product Comparison Subscribing Activating Using Paying Requesting

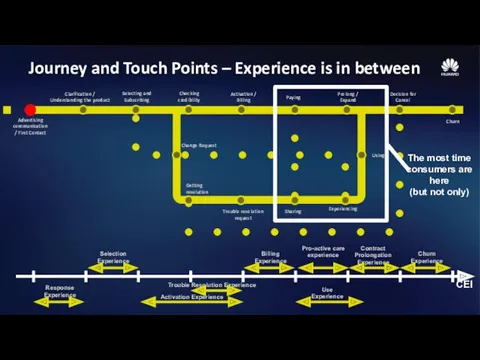

- 74. Journey and Touch Points – Experience is in between

- 75. Contract Prolongation Experience Pro-active care experience Selection Experience Trouble Resolution Experience Use Experience Response Experience Activation

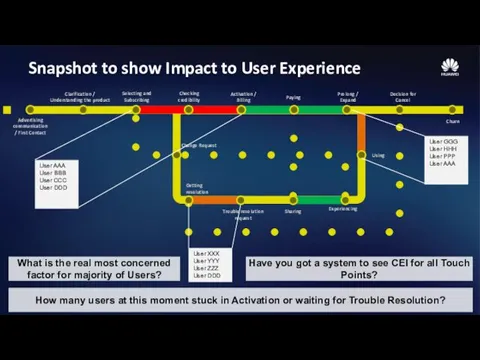

- 76. Snapshot to show Impact to User Experience Using Sharing Trouble resolution request Getting resolution Change Request

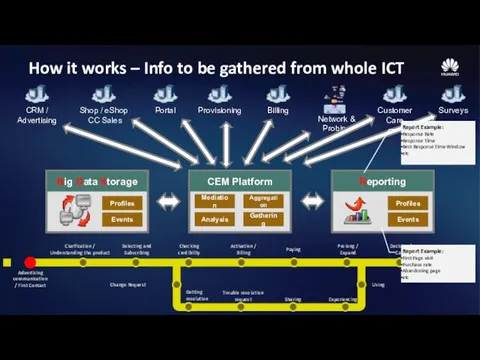

- 77. How it works – Info to be gathered from whole ICT Using Sharing Trouble resolution request

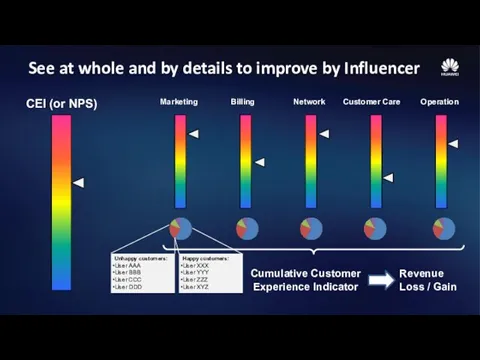

- 78. See at whole and by details to improve by Influencer CEI (or NPS) Marketing Billing Network

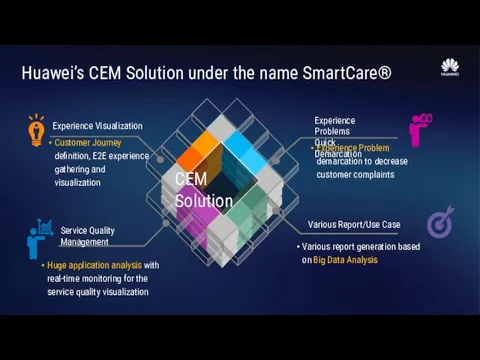

- 79. Huawei’s CEM Solution under the name SmartCare®

- 80. Service Quality Management CEM or SQM What is the difference?

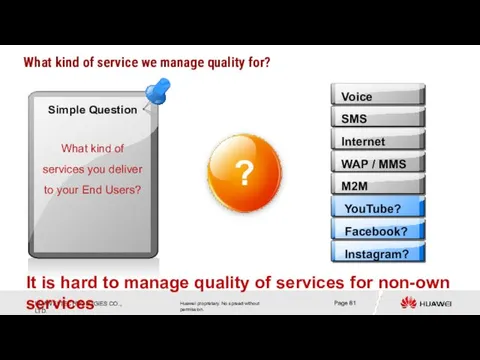

- 81. Internet WAP / MMS M2M Voice Facebook? Instagram? SMS It is hard to manage quality of

- 82. SQM is a typical entity existing almost in all network operators From QoS via Service Quality

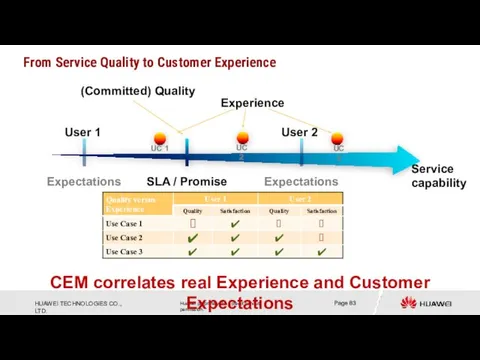

- 83. Experience Service capability CEM correlates real Experience and Customer Expectations From Service Quality to Customer Experience

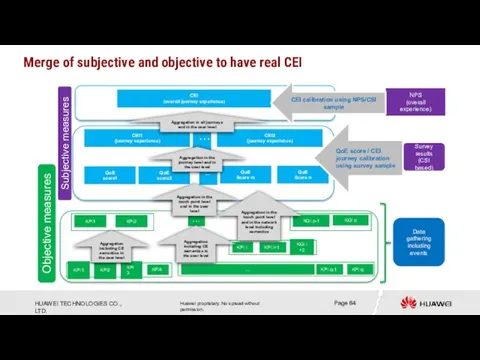

- 84. Objective measures Subjective measures Aggregation in all journeys and in the user level Aggregation in the

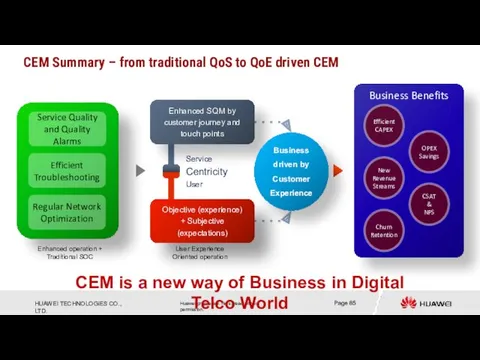

- 85. CEM Summary – from traditional QoS to QoE driven CEM Enhanced SQM by customer journey and

- 86. Net Promoter Score

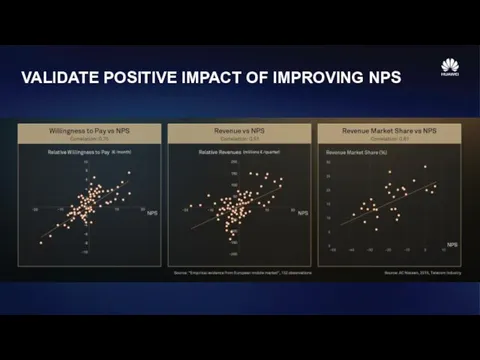

- 87. VALIDATE POSITIVE IMPACT OF IMPROVING NPS

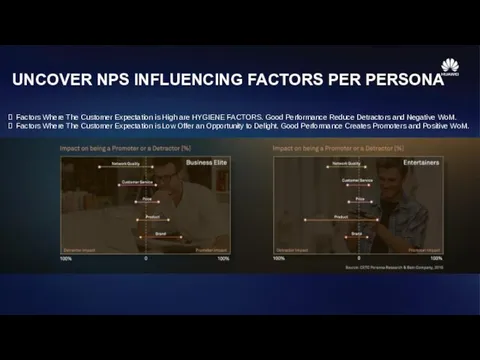

- 88. UNCOVER NPS INFLUENCING FACTORS PER PERSONA Factors Where The Customer Expectation is High are HYGIENE FACTORS.

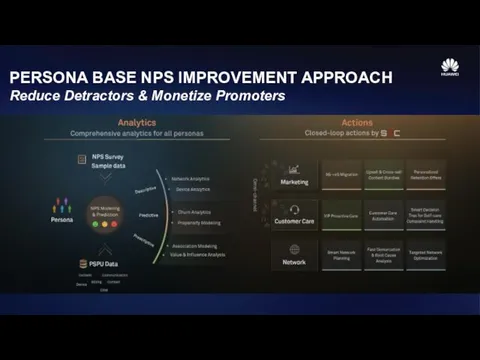

- 89. PERSONA BASE NPS IMPROVEMENT APPROACH Reduce Detractors & Monetize Promoters

- 90. VALUE DELIVERED IN PRACTICE WORLD NPS Improved 10pts with $1.2 Additional Earning

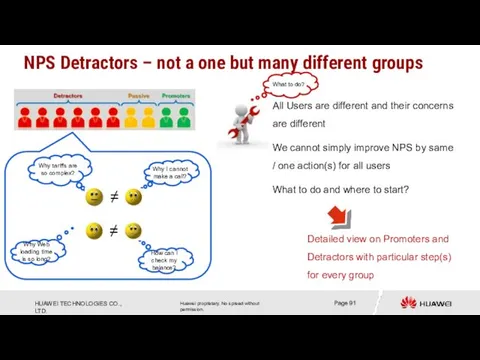

- 91. NPS Detractors – not a one but many different groups All Users are different and their

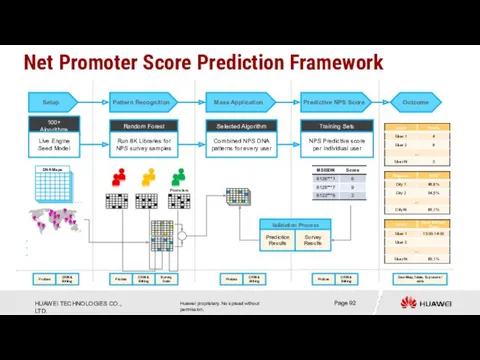

- 92. Net Promoter Score Prediction Framework 8000 DNA-pattern maps Source: 24 countries Approach: Individual User Level …

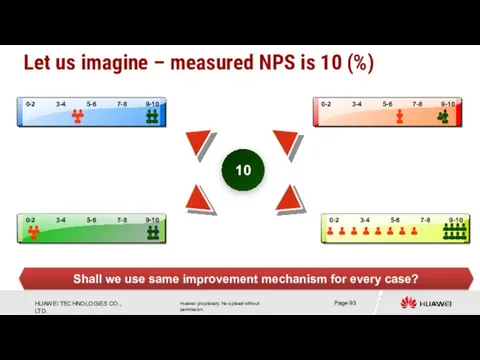

- 93. Let us imagine – measured NPS is 10 (%) 10 Shall we use same improvement mechanism

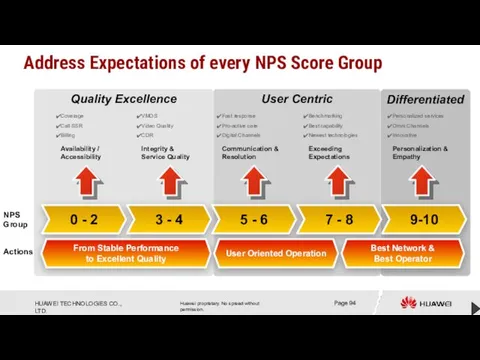

- 94. User Centric Differentiated Quality Excellence Address Expectations of every NPS Score Group Benchmarking Best capability Newest

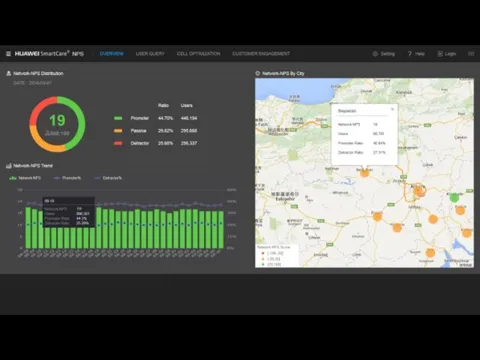

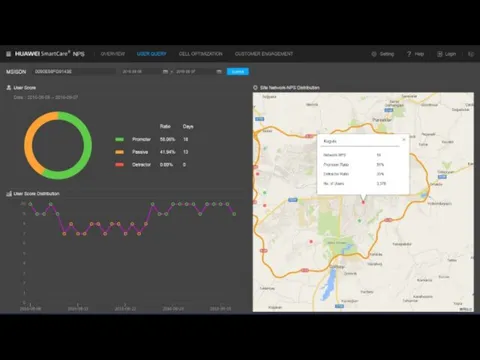

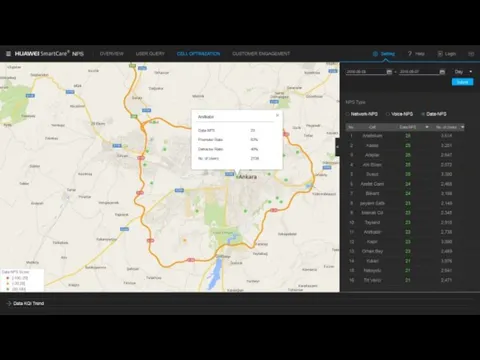

- 95. NPS Demo

- 100. Churn Prediction – Details

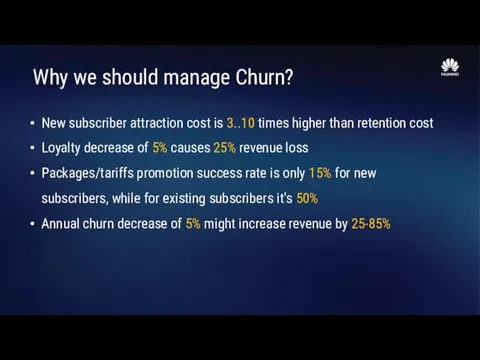

- 101. Why we should manage Churn? New subscriber attraction cost is 3..10 times higher than retention cost

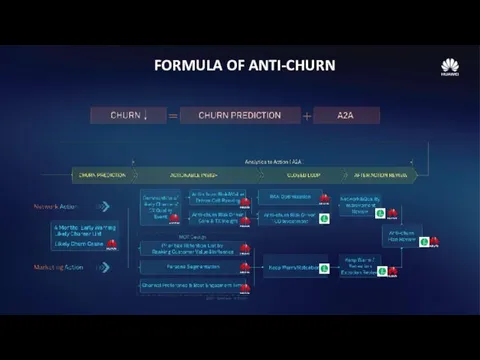

- 102. FORMULA OF ANTI-CHURN

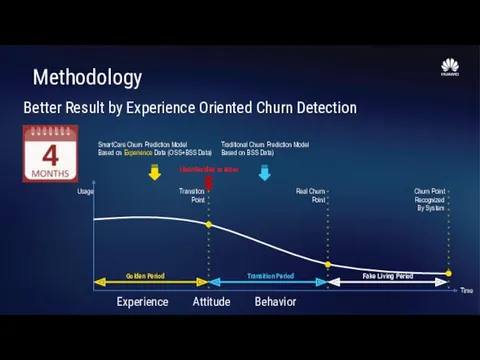

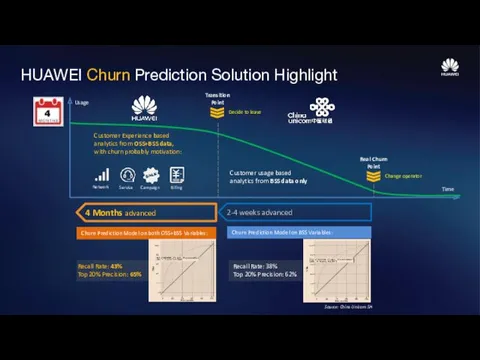

- 103. Methodology Better Result by Experience Oriented Churn Detection SmartCare Churn Prediction Model Based on Experience Data

- 104. Decide to leave Transition Point Real Churn Point Customer usage based analytics from BSS data only

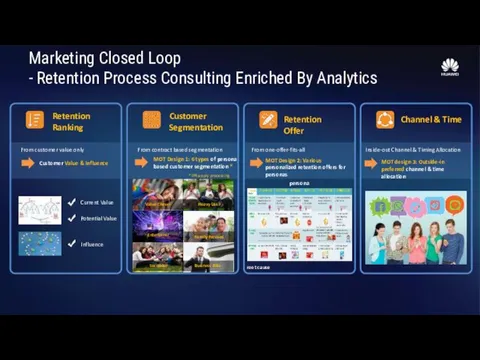

- 105. Customer Segmentation From contract based segmentation MOT Design 1: 6 types of persona based customer segmentation

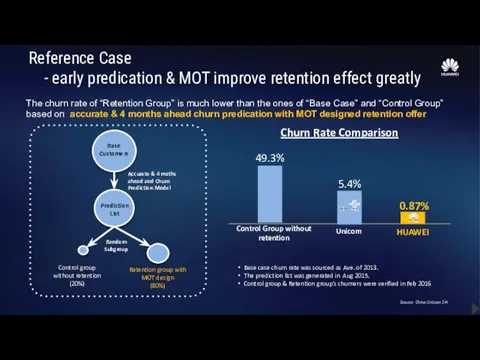

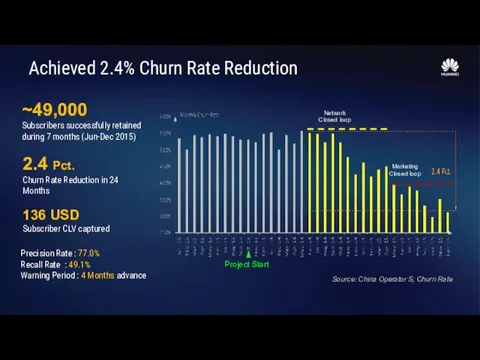

- 106. Reference Case - early predication & MOT improve retention effect greatly The churn rate of “Retention

- 107. Achieved 2.4% Churn Rate Reduction ~49,000 Subscribers successfully retained during 7 months (Jun-Dec 2015) 2.4 Pct.

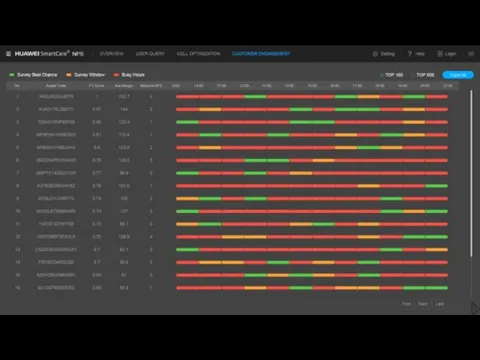

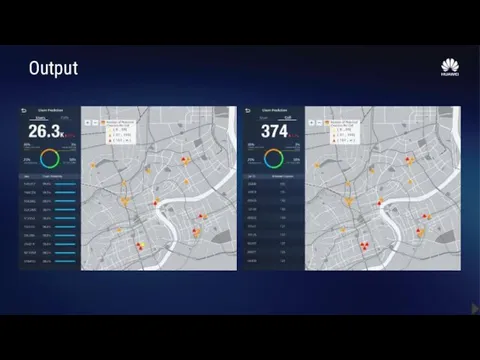

- 108. Output

- 109. Data Explorer Demo – Churn

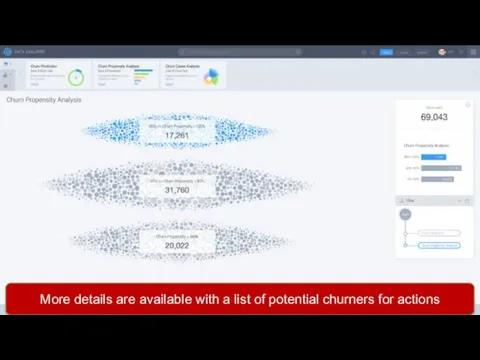

- 110. In this demo we monitor all users to identify churners among them

- 111. More details are available with a list of potential churners for actions

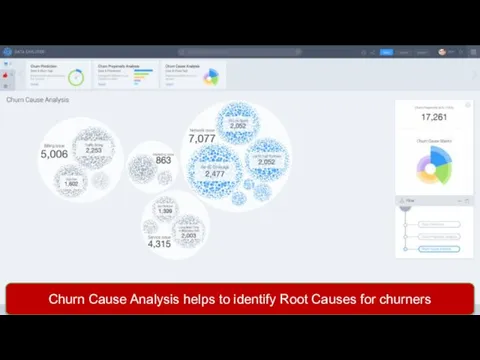

- 112. Churn Cause Analysis helps to identify Root Causes for churners

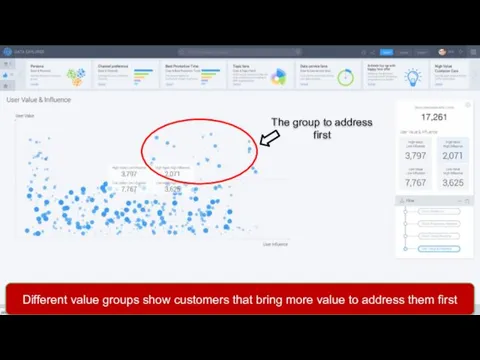

- 113. The group to address first Different value groups show customers that bring more value to address

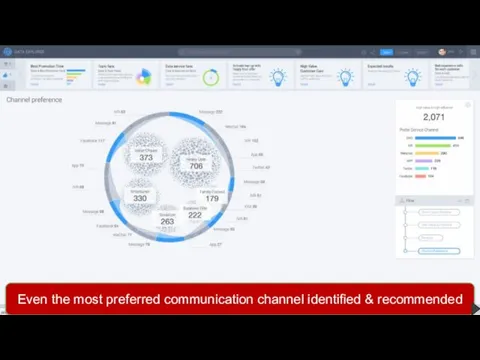

- 114. Even the most preferred communication channel identified & recommended

- 115. Customer Care Assistance Module

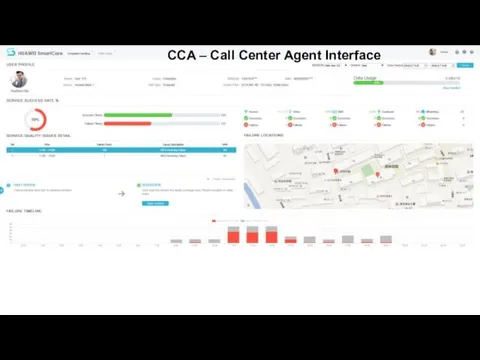

- 116. CCA – Call Center Agent Interface

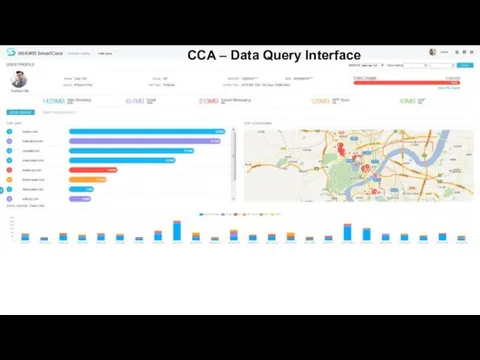

- 117. CCA – Data Query Interface

- 119. SOC to close the loop in the whole Customer Lifecycle Journey

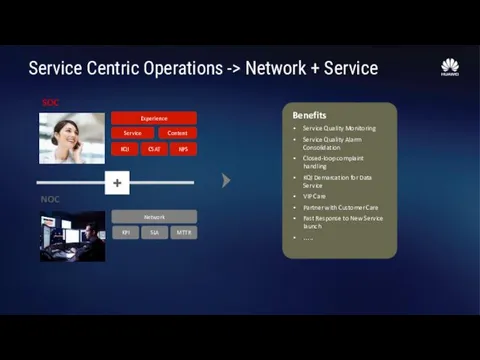

- 120. Service Centric Operations -> Network + Service NOC SOC Network KPI SLA MTTR Experience KQI CSAT

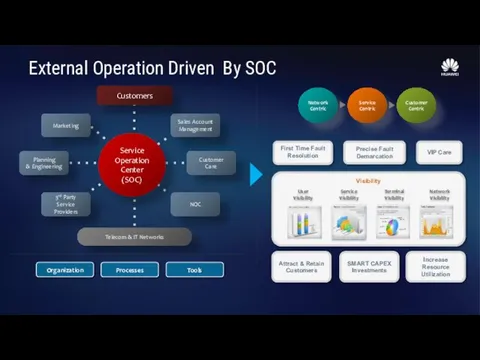

- 121. External Operation Driven By SOC Tools Processes Organization

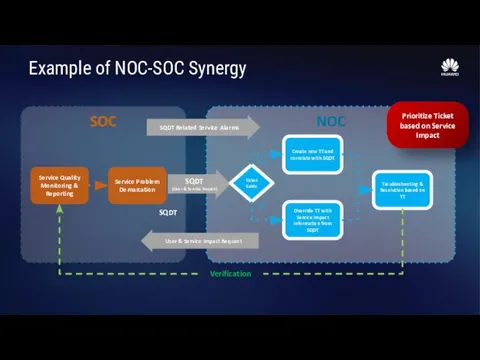

- 122. Example of NOC-SOC Synergy SOC NOC Service Quality Monitoring & Reporting Service Problem Demarcation Troubleshooting &

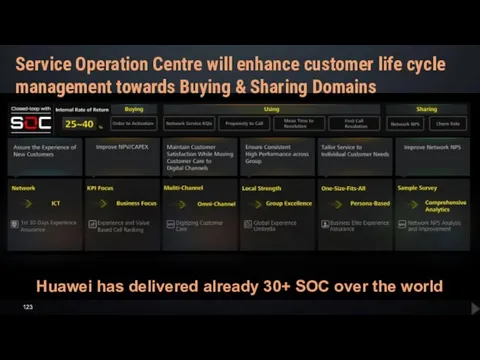

- 123. Huawei has delivered already 30+ SOC over the world Service Operation Centre will enhance customer life

- 124. Separator

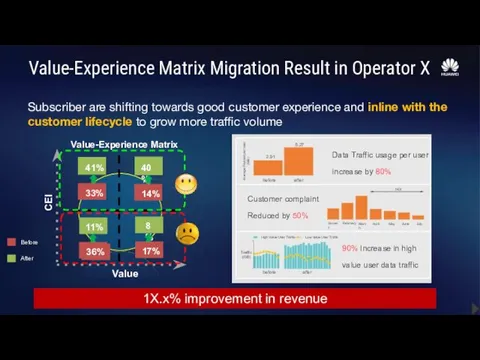

- 125. Value-Experience Matrix Migration Result in Operator X 1X.x% improvement in revenue Subscriber are shifting towards good

- 126. Separator

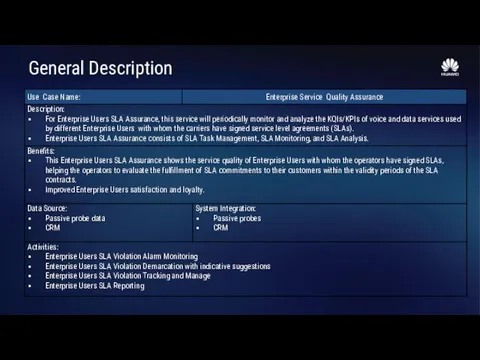

- 127. General Description

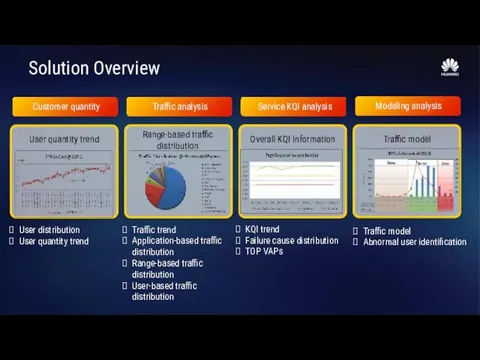

- 128. Solution Overview User distribution User quantity trend Traffic trend Application-based traffic distribution Range-based traffic distribution User-based

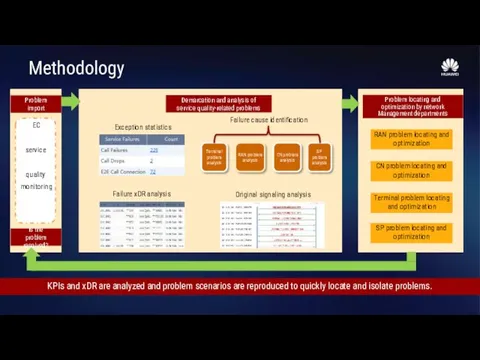

- 129. Methodology KPIs and xDR are analyzed and problem scenarios are reproduced to quickly locate and isolate

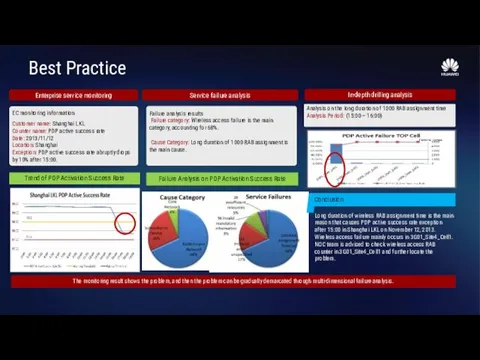

- 130. Best Practice

- 131. Separator

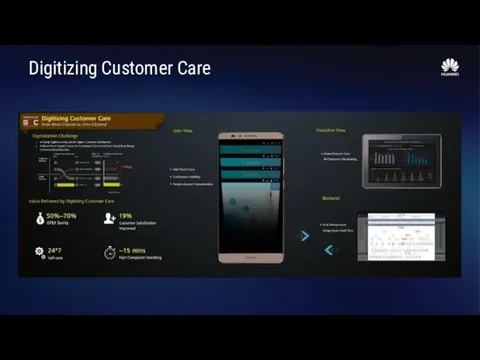

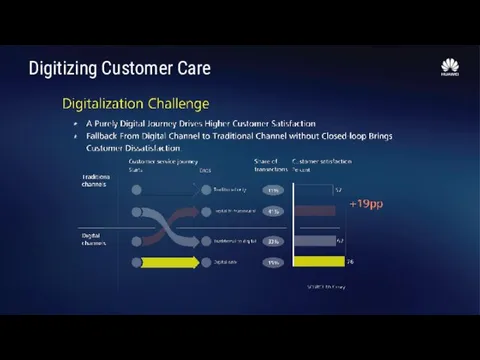

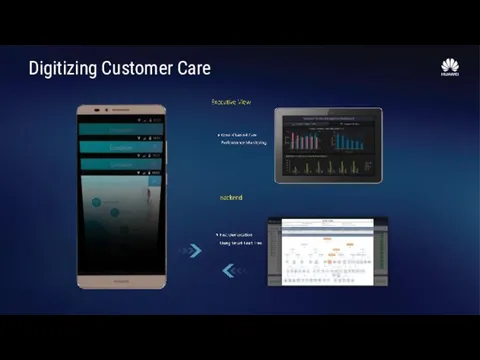

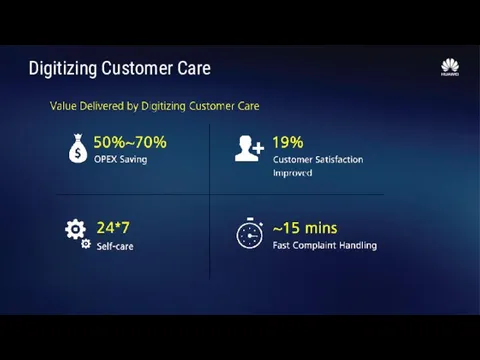

- 132. Digitizing Customer Care

- 133. Digitizing Customer Care

- 134. Digitizing Customer Care

- 135. Digitizing Customer Care

- 136. Separator

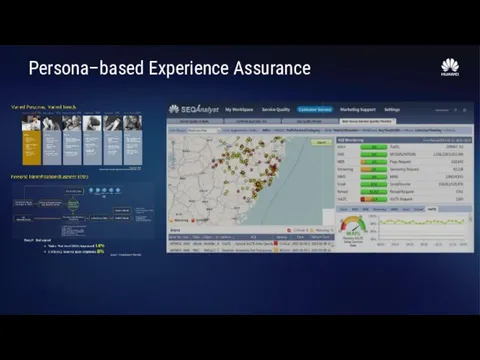

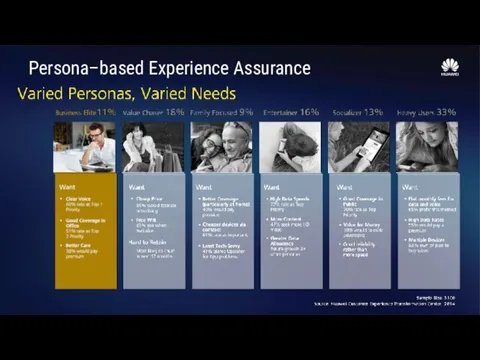

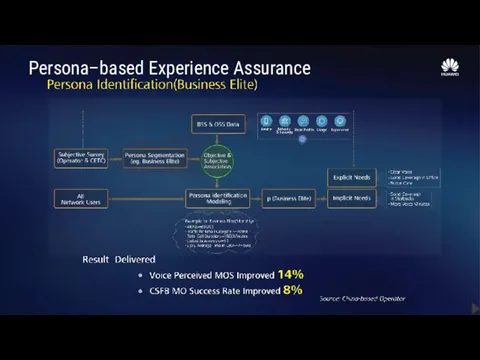

- 137. Persona–based Experience Assurance

- 138. Persona–based Experience Assurance

- 139. Persona–based Experience Assurance

- 140. Separator

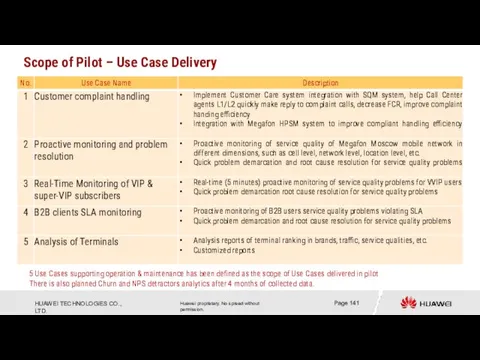

- 141. Scope of Pilot – Use Case Delivery 5 Use Cases supporting operation & maintenance has been

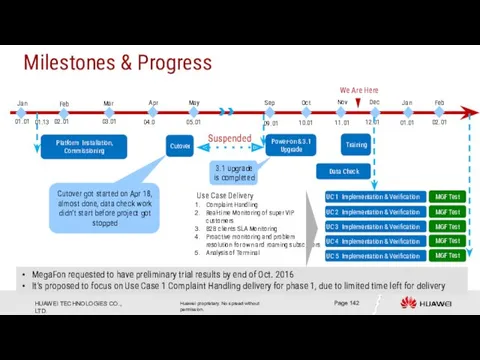

- 142. UC 1 Implementation & Verification Milestones & Progress Feb Apr Mar Jan 03.01 04.0 02.01 01.01

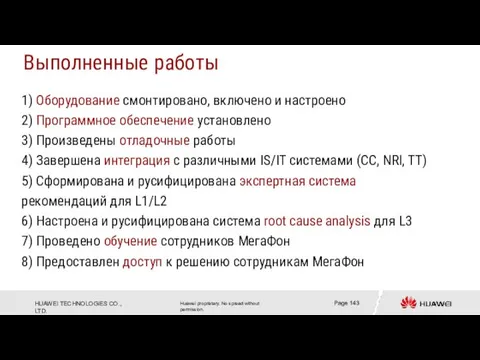

- 143. 1) Оборудование смонтировано, включено и настроено 2) Программное обеспечение установлено 3) Произведены отладочные работы 4) Завершена

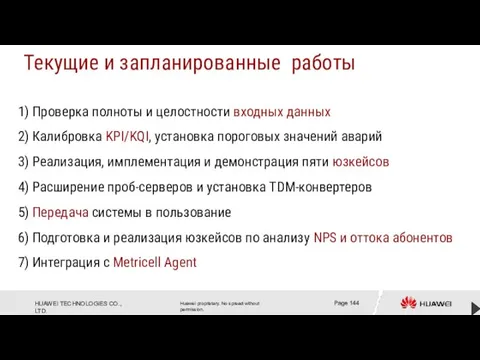

- 144. 1) Проверка полноты и целостности входных данных 2) Калибровка KPI/KQI, установка пороговых значений аварий 3) Реализация,

- 145. Собираемые KPI

- 147. Скачать презентацию

Организация как социально-экономическая система

Организация как социально-экономическая система Практики управління знаннями при наданні публічних послуг

Практики управління знаннями при наданні публічних послуг Management Tools

Management Tools Управленческие решения

Управленческие решения Бизнес-план проекта. Часть 3. План менеджмента

Бизнес-план проекта. Часть 3. План менеджмента Документационное обеспечение управления. Документооборот в управлении

Документационное обеспечение управления. Документооборот в управлении Автоматизация рабочего места специалиста по кадрам

Автоматизация рабочего места специалиста по кадрам Современные тенденции управления в сфере гостеприимства

Современные тенденции управления в сфере гостеприимства Системы управления качеством. Лекция 3

Системы управления качеством. Лекция 3 Современные тенденции в развитии GR-менеджмента и осуществление лоббистской деятельности в России и за рубежом

Современные тенденции в развитии GR-менеджмента и осуществление лоббистской деятельности в России и за рубежом Мотивация сотрудников

Мотивация сотрудников Информационные разработки на службе ЖКХ: эффективное управление предприятиями ЖКХ разных форм собственности

Информационные разработки на службе ЖКХ: эффективное управление предприятиями ЖКХ разных форм собственности Производственные потери. Система 5S.Все наинается с малого...

Производственные потери. Система 5S.Все наинается с малого... Организационная культура

Организационная культура Совершенствование процессов снабжения предприятия быстрого питания кафе Ori Puri

Совершенствование процессов снабжения предприятия быстрого питания кафе Ori Puri Классификация моделей систем управления качеством. Цели их использования, преимущества и ограничения

Классификация моделей систем управления качеством. Цели их использования, преимущества и ограничения Доклад И.В. Кузнецова Результаты мониторинга совершения таможенных операций на таможенных постах

Доклад И.В. Кузнецова Результаты мониторинга совершения таможенных операций на таможенных постах Системный подход к бизнесу в международном клубе Авто

Системный подход к бизнесу в международном клубе Авто Презентация БП для СТБ (студенты)

Презентация БП для СТБ (студенты) Логистика для интернет-магазина. Подводные камни и успешные модели

Логистика для интернет-магазина. Подводные камни и успешные модели Fast food restaurant

Fast food restaurant Мировые управленческие концепции

Мировые управленческие концепции КБ Ренессанс кредит. ООО Поиск клининговой компании для офиса в г. Москва

КБ Ренессанс кредит. ООО Поиск клининговой компании для офиса в г. Москва Кадровый консалтинг и аудит персонала

Кадровый консалтинг и аудит персонала ВКР: Разработка подсистемы учета движения комплектующих материалов и сырья

ВКР: Разработка подсистемы учета движения комплектующих материалов и сырья Влияние изменении таможенного законодательства на логистическую цепь поставки товаров

Влияние изменении таможенного законодательства на логистическую цепь поставки товаров Как оптимизировать управление финансами на предприятии

Как оптимизировать управление финансами на предприятии Системный анализ. Анализ проблемы

Системный анализ. Анализ проблемы