Содержание

- 2. Today’s Outline We’ll review the exam from Friday

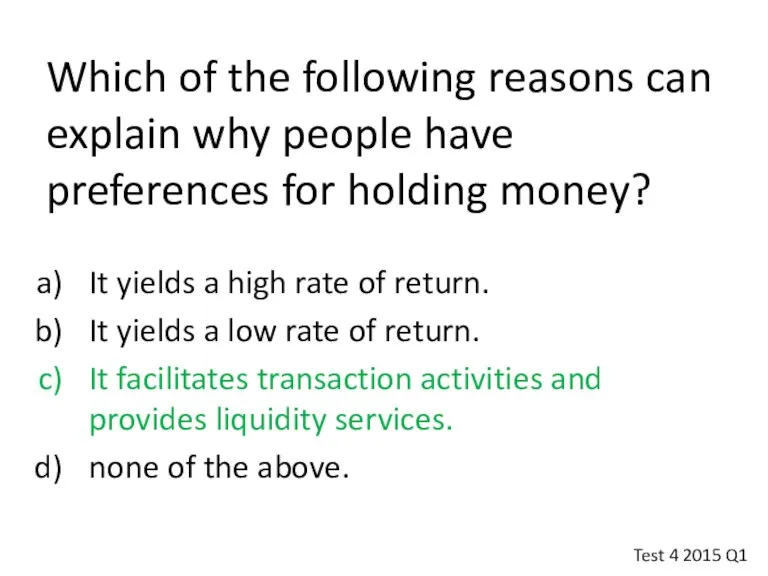

- 3. Which of the following reasons can explain why people have preferences for holding money? It yields

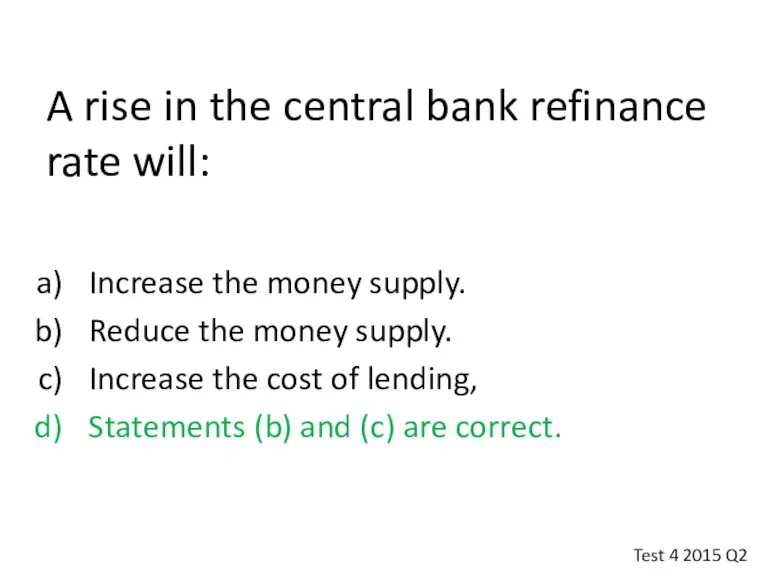

- 4. A rise in the central bank refinance rate will: Increase the money supply. Reduce the money

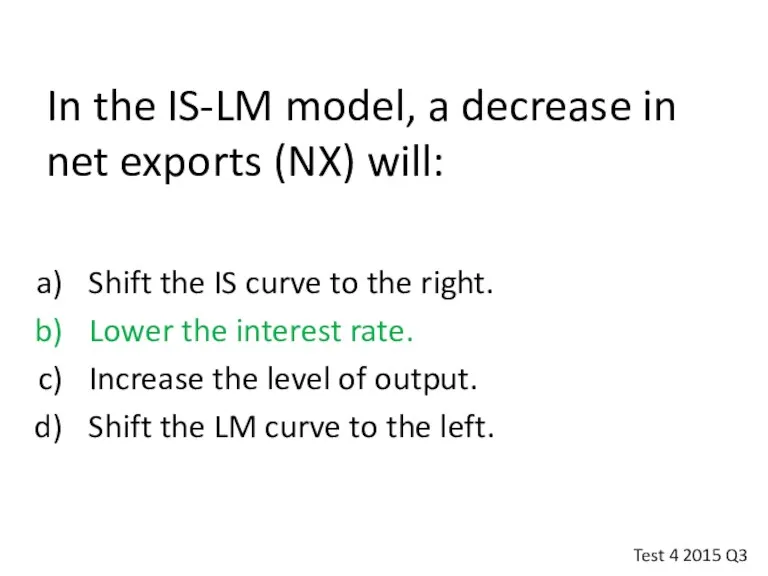

- 5. In the IS-LM model, a decrease in net exports (NX) will: Shift the IS curve to

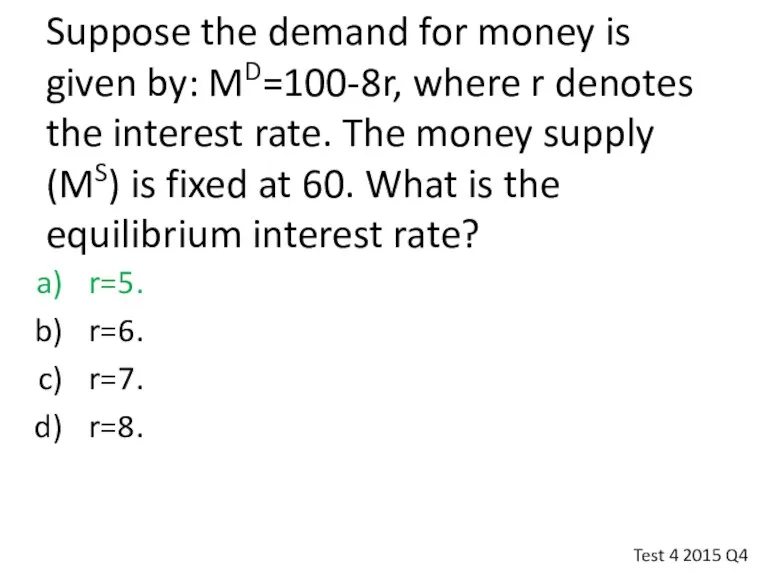

- 6. Suppose the demand for money is given by: MD=100-8r, where r denotes the interest rate. The

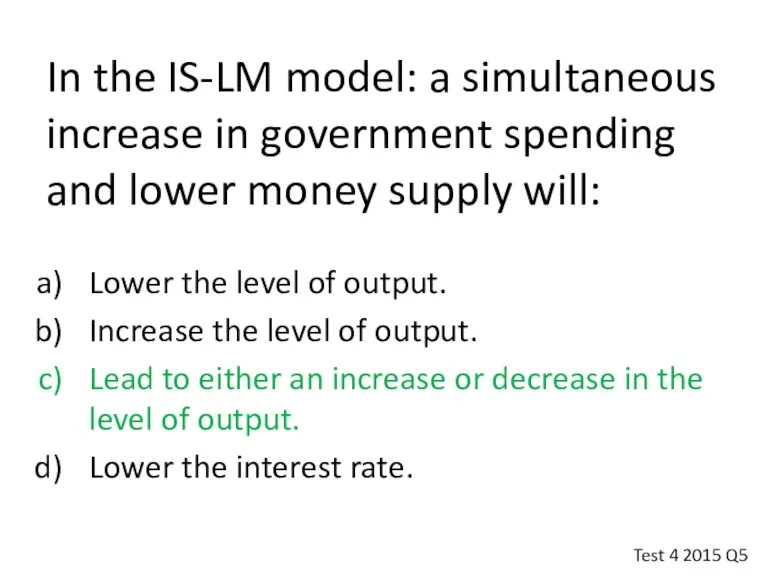

- 7. In the IS-LM model: a simultaneous increase in government spending and lower money supply will: Lower

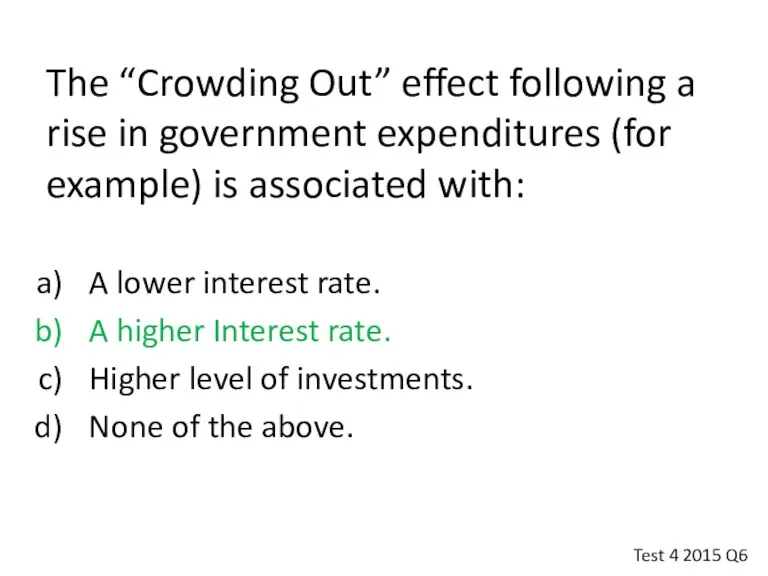

- 8. The “Crowding Out” effect following a rise in government expenditures (for example) is associated with: A

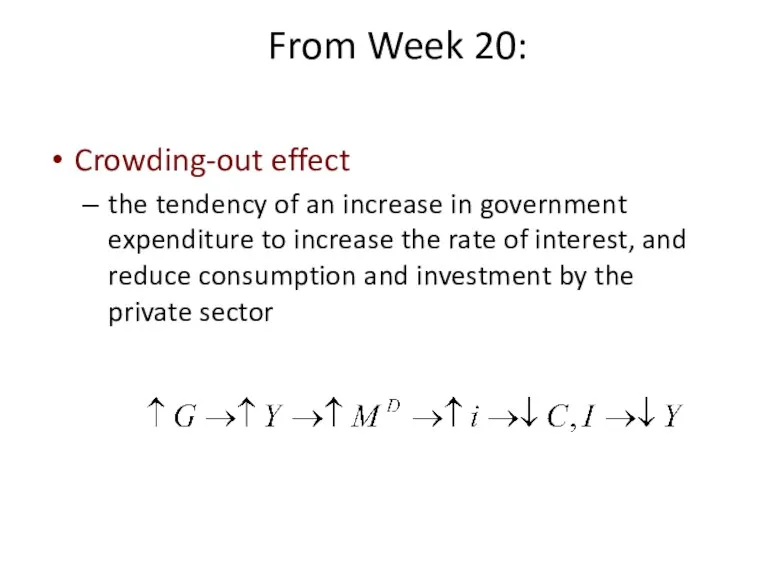

- 9. Crowding-out effect the tendency of an increase in government expenditure to increase the rate of interest,

- 10. In a liquidity trap: Monetary policy is effective in stabilizing the economy. Fiscal Policy is effective

- 11. Note from Roy on Q7: Recall that the LM curve in the liquidity trap is completely

- 12. The IS curve depicts: A positive relationship between output and prices A negative relationship between output

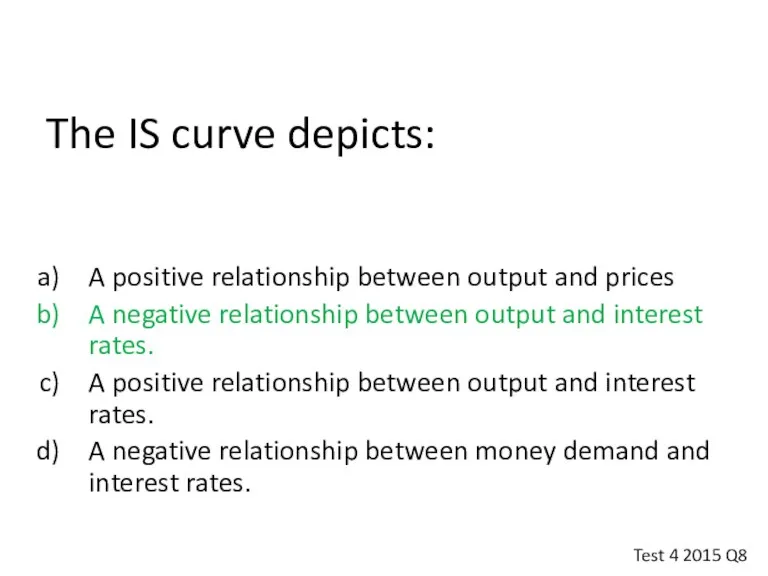

- 13. Week 19: The IS Curve IS Curve Recap IS curve plots combinations of the rate of

- 14. If the demand for money becomes less responsive to changes in the rate of interest then:

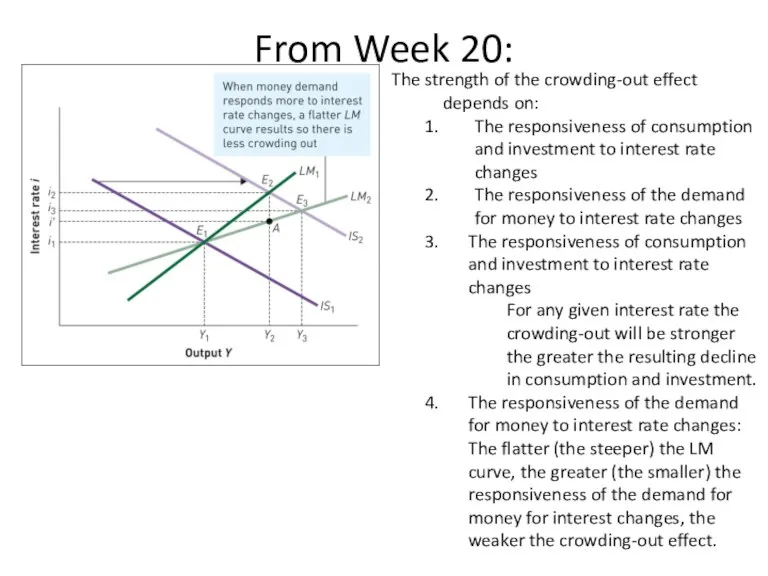

- 15. From Week 20: The strength of the crowding-out effect depends on: The responsiveness of consumption and

- 16. Assume consumption expenditures=2500, investment=2500, government purchases=1000, net exports=0. What is the gross domestic product (Y) and

- 17. For an economy with a consumption function of: C=0.75 (Y-T), where Y denotes output and T

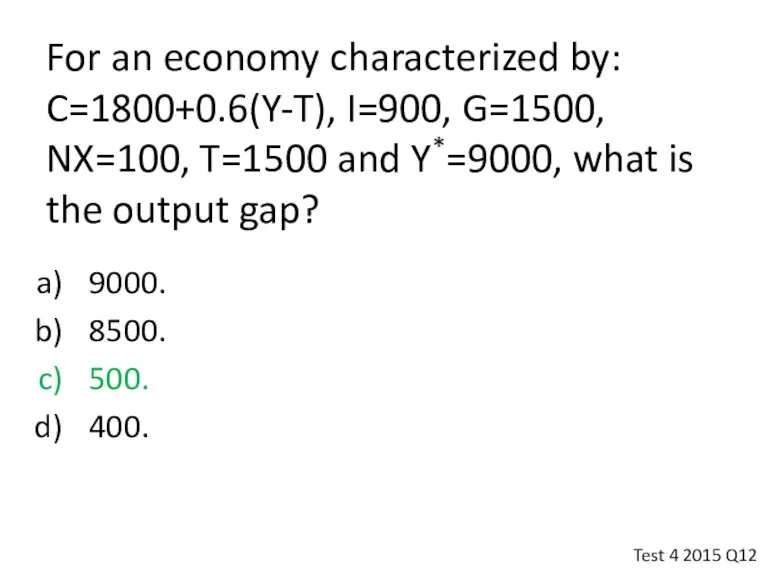

- 18. For an economy characterized by: C=1800+0.6(Y-T), I=900, G=1500, NX=100, T=1500 and Y*=9000, what is the output

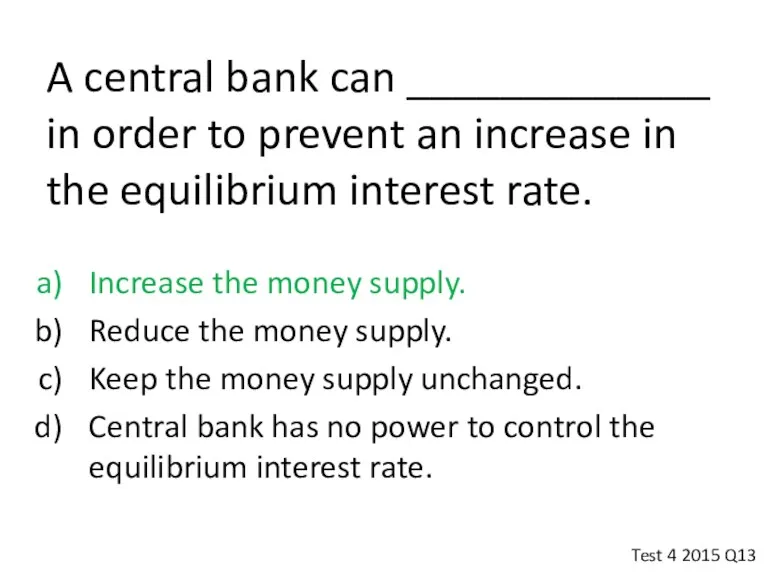

- 19. A central bank can _____________ in order to prevent an increase in the equilibrium interest rate.

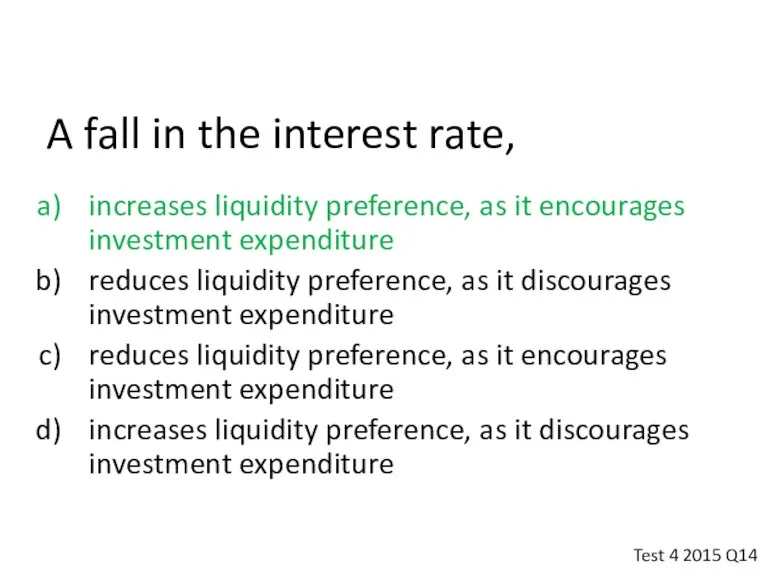

- 20. A fall in the interest rate, increases liquidity preference, as it encourages investment expenditure reduces liquidity

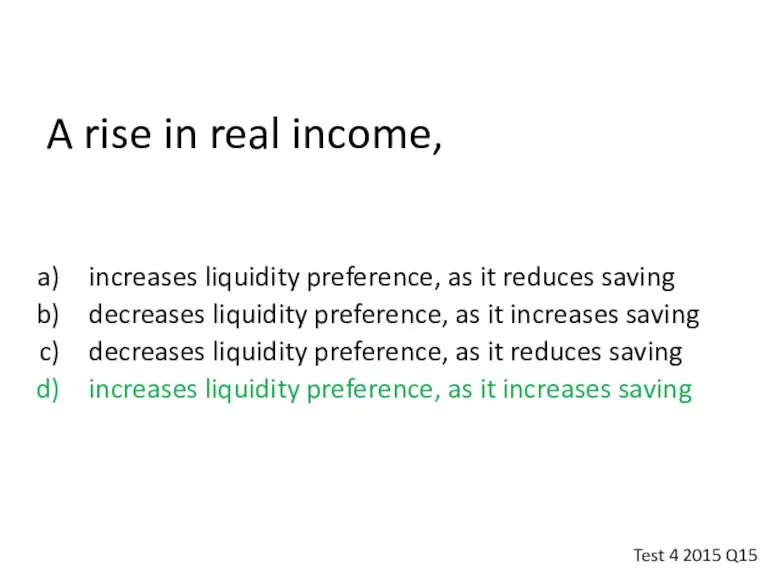

- 21. A rise in real income, increases liquidity preference, as it reduces saving decreases liquidity preference, as

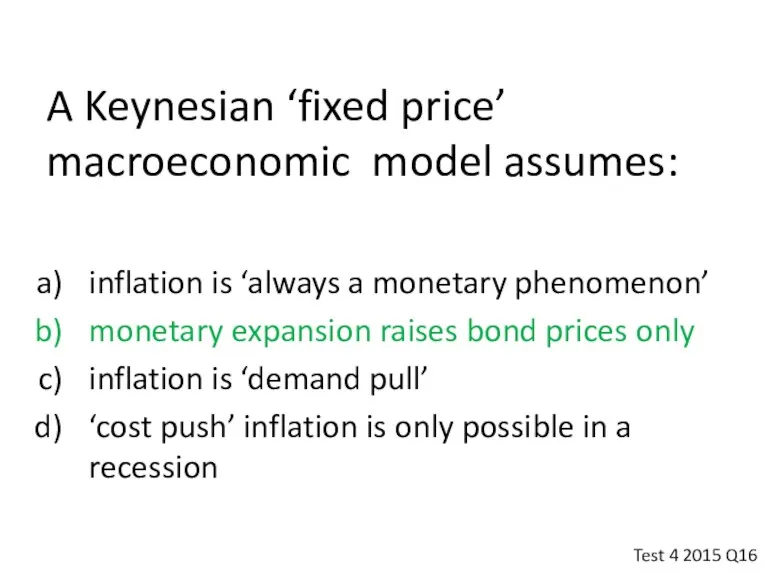

- 22. A Keynesian ‘fixed price’ macroeconomic model assumes: inflation is ‘always a monetary phenomenon’ monetary expansion raises

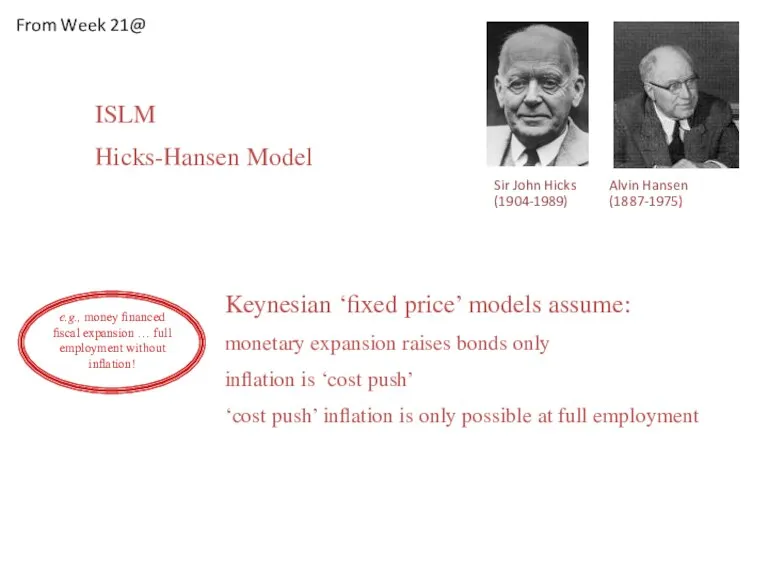

- 23. Sir John Hicks Alvin Hansen (1904-1989) (1887-1975) e.g., money financed fiscal expansion … full employment without

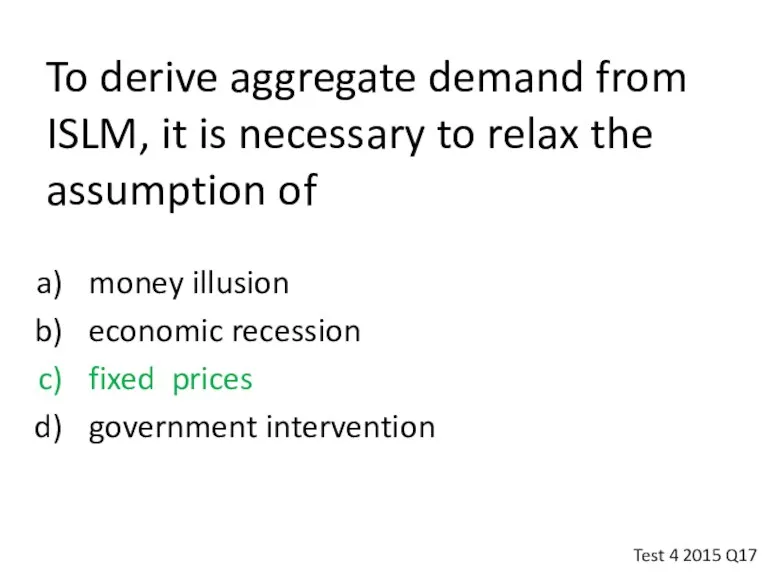

- 24. To derive aggregate demand from ISLM, it is necessary to relax the assumption of money illusion

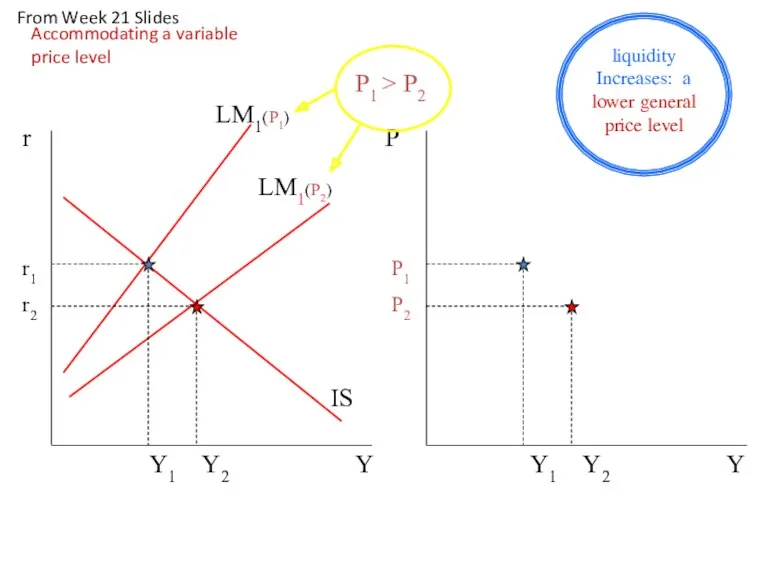

- 25. Y r LM1(P1) LM2(P1) Y P1 Y1 Y2 Y1 Y2 r1 r2 IS P M1 liquidity

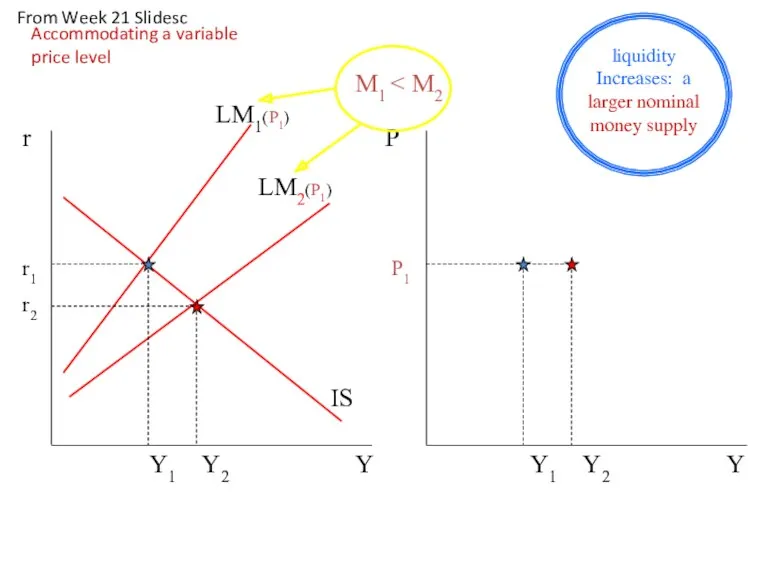

- 26. Y r LM1(P2) Y P1 P2 Y1 Y2 Y1 Y2 r1 r2 IS P LM1(P1) P1

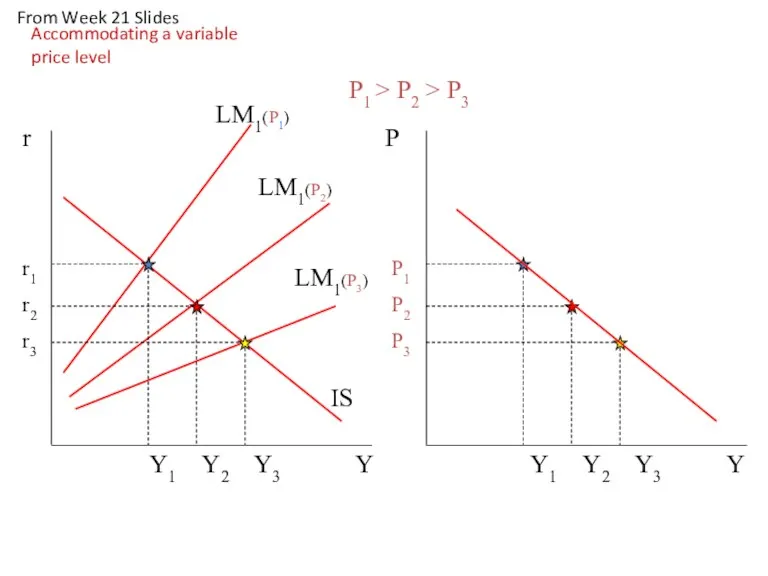

- 27. Y r LM1(P2) LM1(P3) Y P1 > P2 > P3 P1 P2 P3 Y1 Y2 Y3

- 28. The aggregate supply curve is drawn under the assumption that prices are constant employment is constant

- 29. The exogenous force that drives the original Phillips curve is the business cycle monetary policy trade

- 30. Job search and the reservation wage ‘In Phillips’ original treatment, variations in unemployment lead to variations

- 31. Note bene: statistical correlations only interesting when there is a plausible causal explanation do not establish

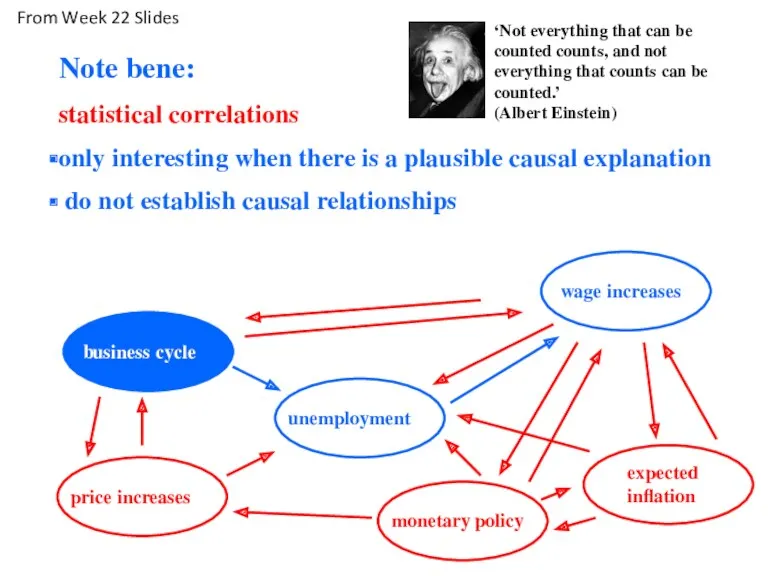

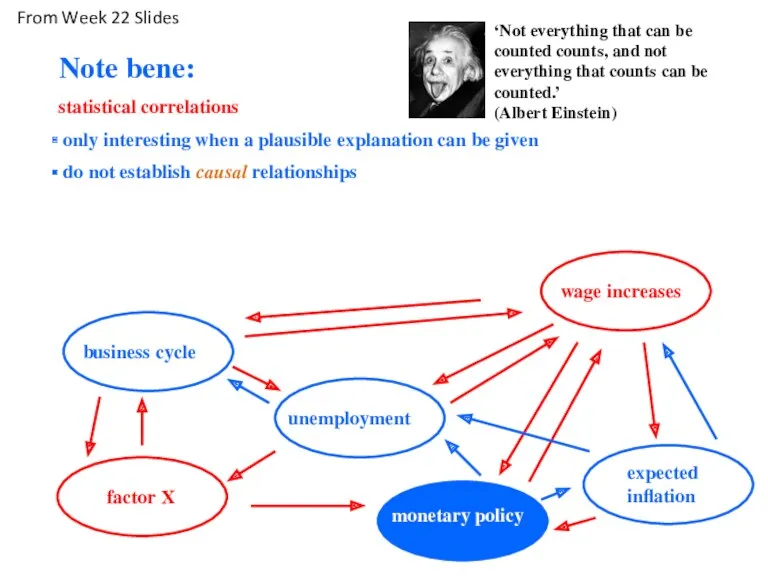

- 32. A.W Phillip: original hypothesis variations in the business cycle cause wage variations Friedman/Phelps: new hypothesis variations

- 33. The exogenous force that drives the price-expectations augmented Phillips curve is the business cycle monetary policy

- 34. Job search and the reservation wage ‘In Phillips’ original treatment, variations in unemployment lead to variations

- 35. Note bene: statistical correlations only interesting when a plausible explanation can be given do not establish

- 36. A.W Phillip: original hypothesis variations in the business cycle cause wage variations Friedman/Phelps: new hypothesis variations

- 37. Keynesian cost-push inflation occurs when trade unions go on strike when money supply exceeds money demand

- 38. Keynes, J.M. (1936) ‘an increase in the quantity of money will have no effect whatever on

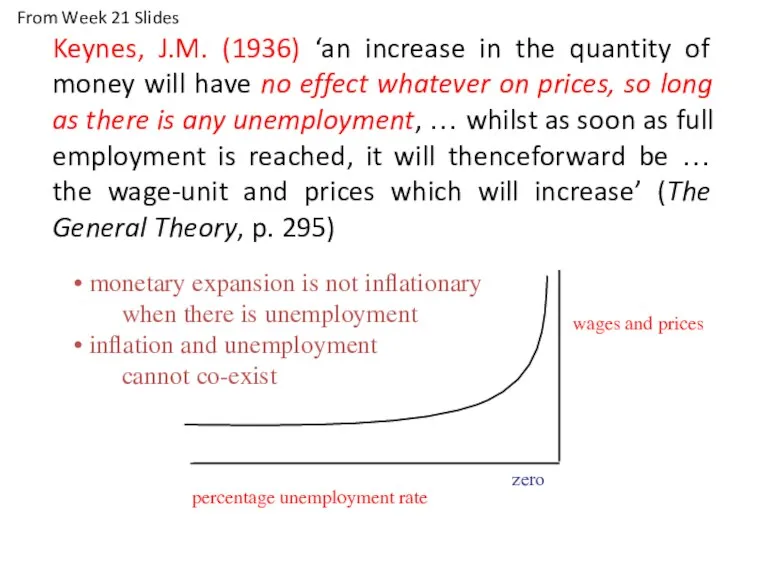

- 39. Monetarism vs Keynesianism Keynes, J.M. (1936) Cost push: inflation is caused by rising unit costs as

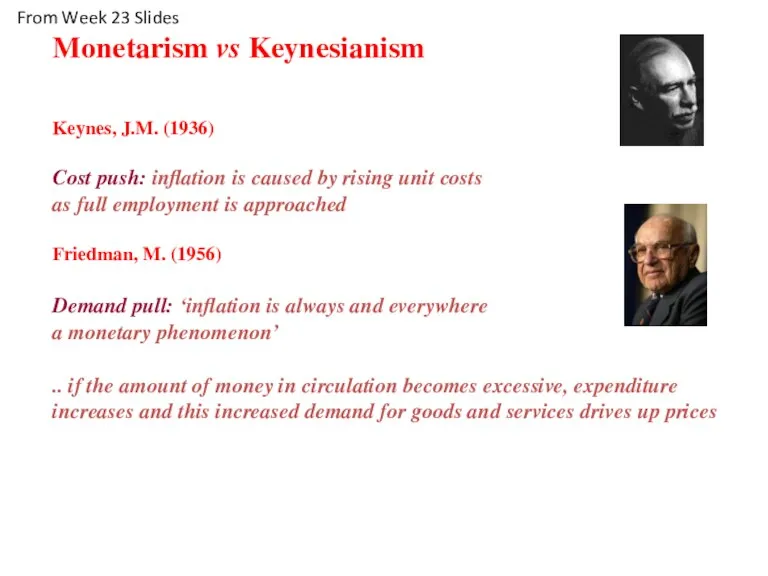

- 40. Classical demand-pull inflation occurs when trade unions go on strike when money supply exceeds money demand

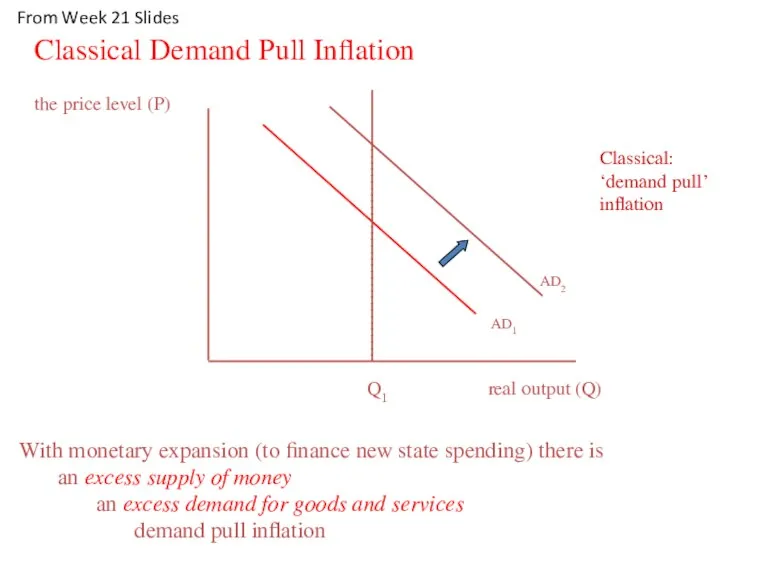

- 41. Monetarism vs Keynesianism Keynes, J.M. (1936) Cost push: inflation is caused by rising unit costs as

- 42. AD1 Classical Demand Pull Inflation AD2 real output (Q) Q1 Classical: ‘demand pull’ inflation the price

- 43. Monetarism argues for a stable relationship between real balances and the transactions demand for money inflation

- 44. Within the UK account of international payments, the ‘balance for official financing’ shows the level of

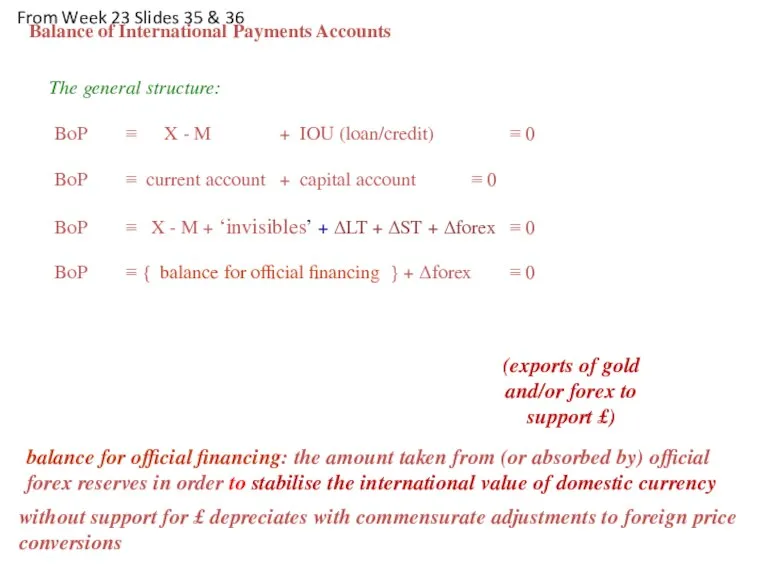

- 45. The general structure: BoP ≡ X - M + IOU (loan/credit) ≡ 0 BoP ≡ current

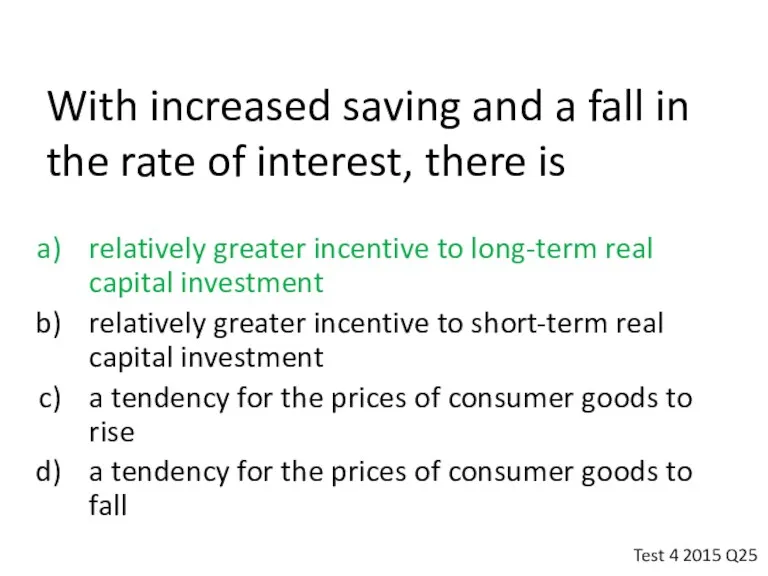

- 46. With increased saving and a fall in the rate of interest, there is relatively greater incentive

- 48. Скачать презентацию

Концепция развития строительного комплекса Республики Беларусь на 2011 - 2020 годы

Концепция развития строительного комплекса Республики Беларусь на 2011 - 2020 годы Развитие торгово - экономических связей между Китаем и Россией

Развитие торгово - экономических связей между Китаем и Россией Медицинская демография. Медико-социальные аспекты

Медицинская демография. Медико-социальные аспекты Экономическая политика государства. Тема 6

Экономическая политика государства. Тема 6 Рынок и рыночный механизм. Спрос и предложение

Рынок и рыночный механизм. Спрос и предложение Основы рыночного хозяйства и его структура. Тема № 2

Основы рыночного хозяйства и его структура. Тема № 2 Межцивилизационные конфликты как основа нового противостояния в мире

Межцивилизационные конфликты как основа нового противостояния в мире Система национальных счетов

Система национальных счетов Поведенческая экономика

Поведенческая экономика Малый бизнес в российской экономике

Малый бизнес в российской экономике Принципы экономики. Экономика и человек

Принципы экономики. Экономика и человек Формирование уставного капитала и его назначение. Потребности в основных и оборотных средствах. Тема № 3

Формирование уставного капитала и его назначение. Потребности в основных и оборотных средствах. Тема № 3 Организация экономического сотрудничества и развития как инструмент экономической дипломатии

Организация экономического сотрудничества и развития как инструмент экономической дипломатии Предприятие как производственная система, его организационно-правовые основы

Предприятие как производственная система, его организационно-правовые основы Макроэкономическая нестабильность

Макроэкономическая нестабильность Викторина Веселая экономика

Викторина Веселая экономика Экономическая безопасность

Экономическая безопасность Прогнозирование и планирование в условиях рынка

Прогнозирование и планирование в условиях рынка Monetary policy

Monetary policy Государственная поддержка малого и среднего бизнеса

Государственная поддержка малого и среднего бизнеса Научно-технический прогресс, как фактор глобализации

Научно-технический прогресс, как фактор глобализации Расчет финансового результата от реализации продукции

Расчет финансового результата от реализации продукции Стратегическое планирование в Республике Казахстан

Стратегическое планирование в Республике Казахстан Атлас специализации регионов России

Атлас специализации регионов России Организация производства. Предмет, содержание и задачи курса

Организация производства. Предмет, содержание и задачи курса Управление эксплуатацией жилищного фонда. Жилищное самоуправление. (Тема 4)

Управление эксплуатацией жилищного фонда. Жилищное самоуправление. (Тема 4) Российское предприятие на мировом рынке. Сравнительный анализ преимуществ и недостатков его конкурентоспособности

Российское предприятие на мировом рынке. Сравнительный анализ преимуществ и недостатков его конкурентоспособности Цифровая трансформация национальной экономики Беларуси

Цифровая трансформация национальной экономики Беларуси