Содержание

- 2. RAM Introduction RAM is the combined creation led by the U.S. Government Agency Overseas Private Investment

- 3. RAM Introduction RAM’s mission is also to export to the Russian market the latest financial technology

- 4. Greenwich Financial Services Experience in securitizing billions of dollars of RMBS Pioneers in Russian Asset Securitizations:

- 5. RAM’s Russian RMBS Approach RAM approaches Russian RMBS structure and distribution as Standard RMBS NOT Emerging

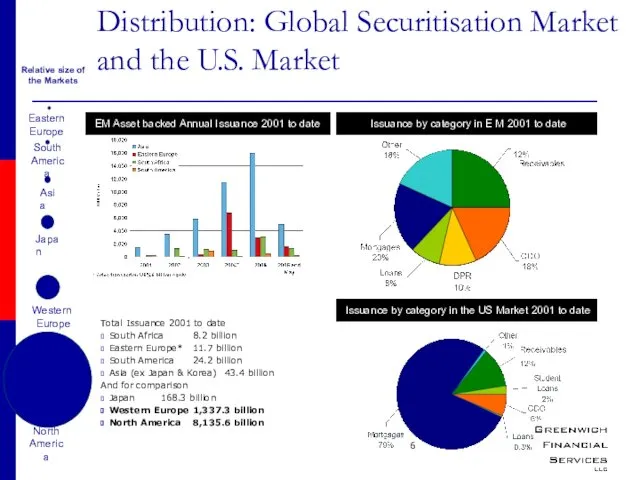

- 6. Distribution: Global Securitisation Market and the U.S. Market Total Issuance 2001 to date South Africa 8.2

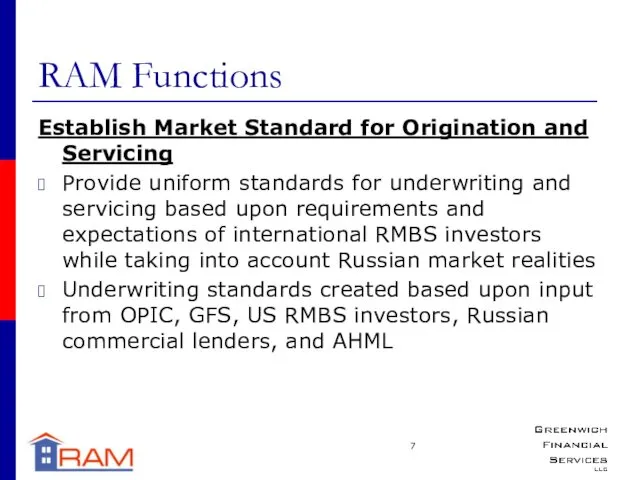

- 7. RAM Functions Establish Market Standard for Origination and Servicing Provide uniform standards for underwriting and servicing

- 8. Benefits to Originator Recognition in US RMBS Market One of the primary goals of RAM is

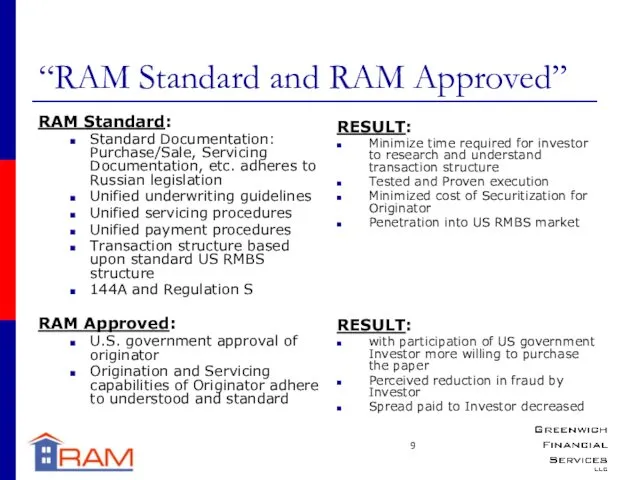

- 9. “RAM Standard and RAM Approved” RAM Standard: Standard Documentation: Purchase/Sale, Servicing Documentation, etc. adheres to Russian

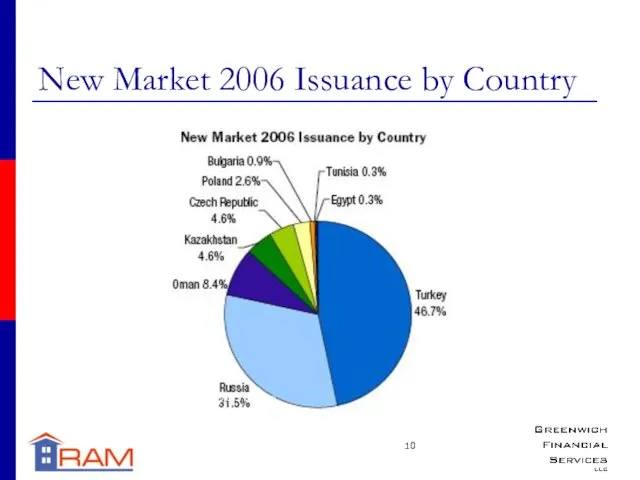

- 10. New Market 2006 Issuance by Country Source: Moody’s Investors Service

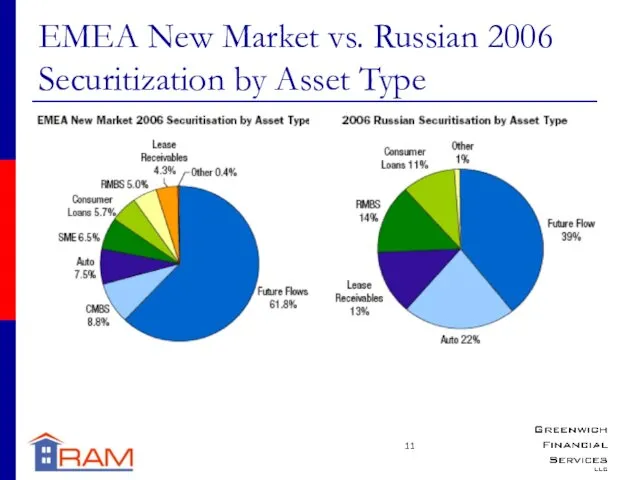

- 11. EMEA New Market vs. Russian 2006 Securitization by Asset Type

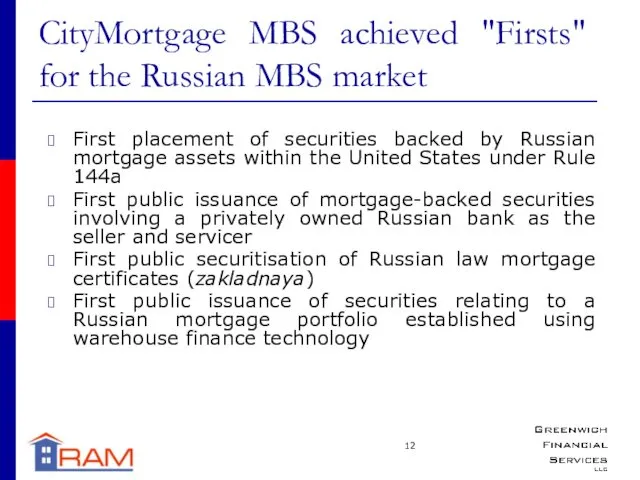

- 12. CityMortgage MBS achieved "Firsts" for the Russian MBS market First placement of securities backed by Russian

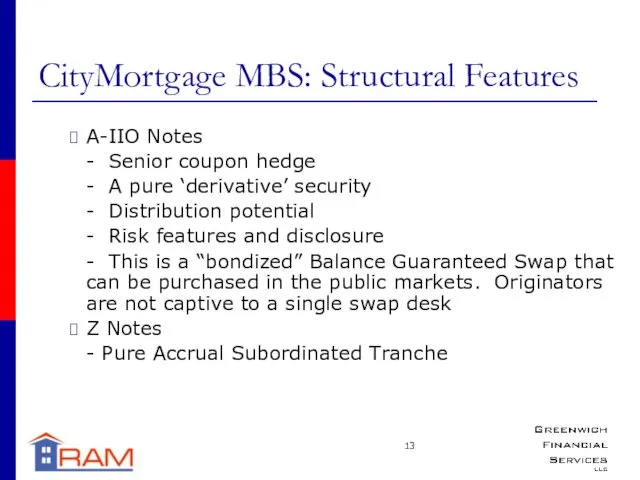

- 13. CityMortgage MBS: Structural Features A-IIO Notes - Senior coupon hedge - A pure ‘derivative’ security -

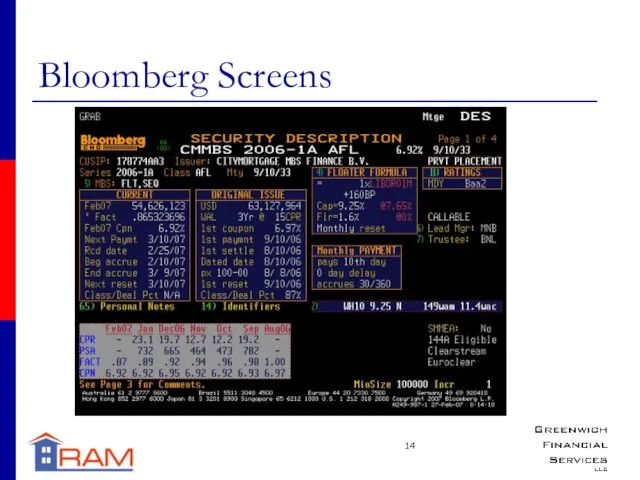

- 14. Bloomberg Screens

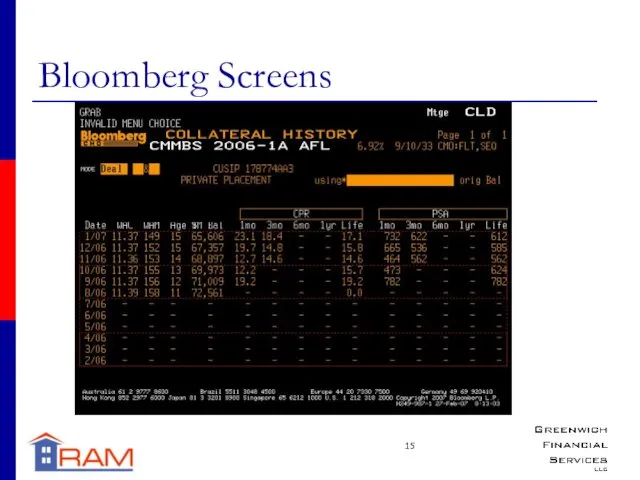

- 15. Bloomberg Screens

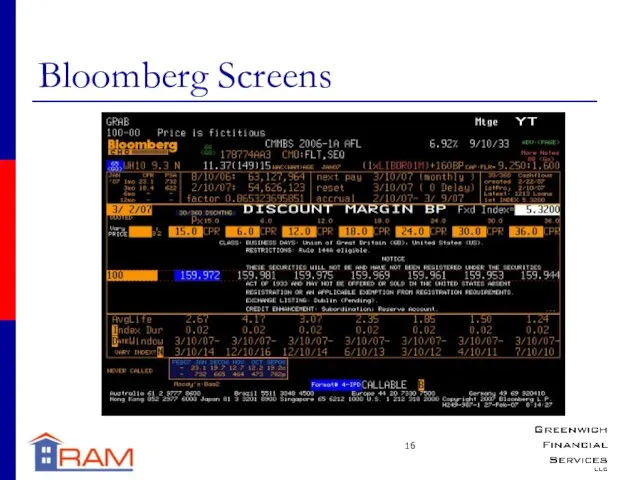

- 16. Bloomberg Screens

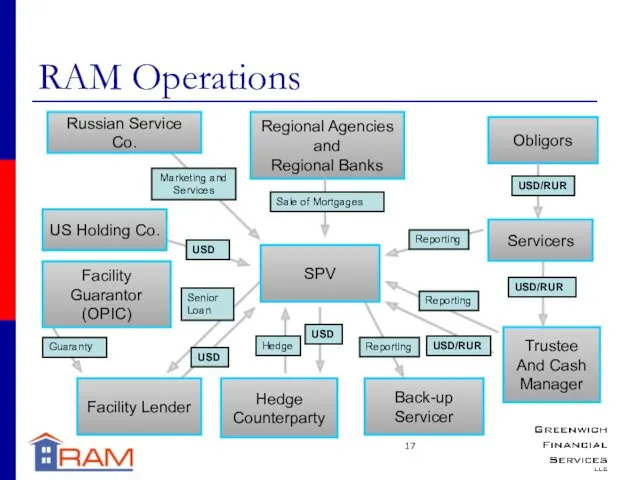

- 17. RAM Operations

- 18. Benefits of RAM Facilitate a more efficient and liquid MBS market in Russia by accessing the

- 19. Conclusion The partners of RAM, GFS and its employees believe in the Russian economy and country

- 21. Скачать презентацию

Способи реалізації інвестиційних проектів

Способи реалізації інвестиційних проектів Деловой завтрак с Россельхозбанком. О программе развития молочной отрасли республики Башкортостан до 2030 года

Деловой завтрак с Россельхозбанком. О программе развития молочной отрасли республики Башкортостан до 2030 года Лекция 16. Японские свечи

Лекция 16. Японские свечи Учет и аудит расчетов с персоналом по оплате труда

Учет и аудит расчетов с персоналом по оплате труда Қазіргі кәсіпорын құрылымының нарықтық бағытталуы

Қазіргі кәсіпорын құрылымының нарықтық бағытталуы Проект территориальной схемы обращения с отходами на территории Архангельской области

Проект территориальной схемы обращения с отходами на территории Архангельской области Бюджет для граждан

Бюджет для граждан Сущность и классификация инвестиций. Инвестиционный проект: сущность, классификация

Сущность и классификация инвестиций. Инвестиционный проект: сущность, классификация Простые шаги к финансовому благополучию. Открытый урок для учеников 8-9 классов средних школ

Простые шаги к финансовому благополучию. Открытый урок для учеников 8-9 классов средних школ Банковское право

Банковское право Международный проект логистики

Международный проект логистики Поведение участников финансового рынка

Поведение участников финансового рынка Деньги и их функции

Деньги и их функции Андеррайтинговые операции банков

Андеррайтинговые операции банков Організація бухгалтерського обліку

Організація бухгалтерського обліку Средства государственного бюджета РФ

Средства государственного бюджета РФ Учет расчетов с персоналом по оплате труда

Учет расчетов с персоналом по оплате труда Планирование прибыли различными методами. Оптимизация прибыли

Планирование прибыли различными методами. Оптимизация прибыли Центральный Банк (Банк России)

Центральный Банк (Банк России) Проект поддержки местных инициатив Новгородская область 2018г

Проект поддержки местных инициатив Новгородская область 2018г Perfecționarea mecanismului de gestiune a riscului de credit in bancă

Perfecționarea mecanismului de gestiune a riscului de credit in bancă Анализ финансового состояния предприятия

Анализ финансового состояния предприятия Центральный банк и его функции

Центральный банк и его функции Кредитная карта Билайн

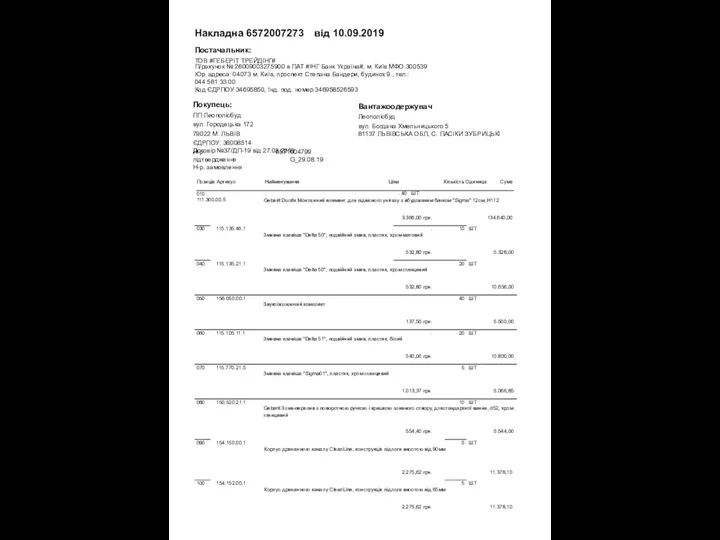

Кредитная карта Билайн Накладна 6572007273 від 10.09.2019. Постачальник: ТОВ Геберіт трейдінг

Накладна 6572007273 від 10.09.2019. Постачальник: ТОВ Геберіт трейдінг Совершенствование системы вознаграждения, за труд на предприятии ИП Дудин кафе Бульвар

Совершенствование системы вознаграждения, за труд на предприятии ИП Дудин кафе Бульвар Счета бухгалтерского учёта и двойная запись

Счета бухгалтерского учёта и двойная запись Финансовая система Российской Федерации. Деньги и их функции

Финансовая система Российской Федерации. Деньги и их функции