Содержание

- 2. Contents: 1. Determination of the securities market and its types 2. Functions of the securities market

- 3. 1. Determination of the securities market and its types Stock Market - is a set of

- 4. Capital investment is depending on many factors: - The level of profitability of the market; -

- 5. Primary market & Stock market Markets, where you can only invest, or the primary market. The

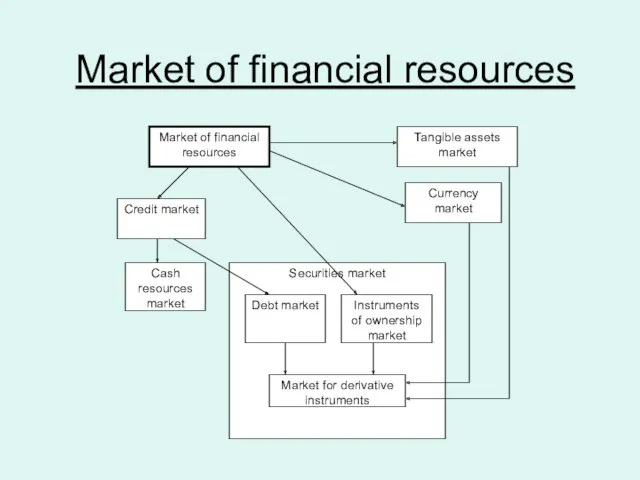

- 6. Market of financial resources Credit market Currency market Tangible assets market Securities market Debt market Instruments

- 7. Credit market The credit market - a mechanism for the relationship between legal entities (enterprises, state),

- 8. Currency market & tangible assets market Currency market - a mechanism for organizing economic and legal

- 9. Cash resources market & Debt market Cash resources market operates primarily in the form of banking

- 10. Instruments of ownership market & Derivatives market Attraction of additional owners of the funds through the

- 11. Securities market & Securities Securities market includes part of a credit relationship (bond market) and the

- 12. 2. Functions of the securities market General market functions: - Business function, function of getting profit

- 13. Specific functions: Besides the market functions inherent any market (price, information, commercial, regulating), the equity market

- 14. 3. The structure of the securities market Depend on the way of trade in this market

- 15. Primary market & Secondary market Primary market - a market first and re-issues (issues) of securities,

- 16. Organized securities market - their circulation on the basis of firm rules between licensed professional intermediaries

- 17. Traditional & Computerized Cash & Term Markets Securities trading may be carried out on traditional and

- 18. 4. Types and models of legal regulation of the stock market World standards of the stock

- 19. - Agreements executed not later than 2 business days after the conclusion of (T +3); -

- 20. Security markets regulation is concerned with overseeing the circulation of information about securities that are traded,

- 21. Legal Regulation of Securities and Stock Market in Ukraine The EBRD’s 2008 Law in Transition reports

- 22. The Securities Commission is the main regulator of the Ukrainian security market. The Security Commission is

- 23. Types of legal regulation General allowance: it is based on the whole allowance, from which we

- 24. How the U.S. Stock Markets are Regulated Stock markets of different countries have different operating model

- 25. Regulatory system The organizational structure of the regulatory system based on the concept of a two-level

- 26. Two main models for regulating the securities market The first model - the regulation of the

- 27. The second model - the maximum possible amount of powers transferred CPO important in controlling not

- 28. From more than 30 countries with developed securities markets more than 50% are independent agencies (

- 29. Ukrainian regulatory system In Ukraine, the regulatory system of the stock market took two stages. The

- 30. The State Commission on Securities and Stock Market The purpose of the State Commission on Securities

- 31. Self-regulation This is primarily Stock Exchange, representing the auction, where the purchase - sale of securities

- 32. IN USA The U.S. Congress is at the top of the heap. It created most of

- 34. Скачать презентацию

Направление продаж. Крупные организации города Воронеж

Направление продаж. Крупные организации города Воронеж Теоретические основы страхования по КАСКО

Теоретические основы страхования по КАСКО Бюджет для граждан

Бюджет для граждан Калькулирование по полноте. Управленческий учет. Тема 6

Калькулирование по полноте. Управленческий учет. Тема 6 Семейная экономика

Семейная экономика Обов'язкові види страхування від нещасних випадків і професійних захворювань

Обов'язкові види страхування від нещасних випадків і професійних захворювань Анализ финансово-хозяйственной деятельности предприятия на примере ООО Фурла Рус

Анализ финансово-хозяйственной деятельности предприятия на примере ООО Фурла Рус Банки, их виды и причины появления

Банки, их виды и причины появления Prospects stimulation for investment activity in Russia

Prospects stimulation for investment activity in Russia Сбалансированность бюджетов

Сбалансированность бюджетов Потери грузов. Причины потерь и способы их предотвращения

Потери грузов. Причины потерь и способы их предотвращения Бухгалтерлік есеп ақпараттық жүйе ретінде. Бухгалтерлік есептің пәні және әдісі

Бухгалтерлік есеп ақпараттық жүйе ретінде. Бухгалтерлік есептің пәні және әдісі О государственном аудите

О государственном аудите Вводный курс. Потребительское кредитование. Дополнительные услуги

Вводный курс. Потребительское кредитование. Дополнительные услуги Заем Проектный в рамках программы социально-экономического развития РМ

Заем Проектный в рамках программы социально-экономического развития РМ Производственный план

Производственный план Бюджет для граждан. Финансовый отдел администрации Красноармейского района Чувашской Республики

Бюджет для граждан. Финансовый отдел администрации Красноармейского района Чувашской Республики Роль денег в экономике

Роль денег в экономике Налогообложение индивидуальных предпринимателей в РФ

Налогообложение индивидуальных предпринимателей в РФ Финансовые рынки и финансовые институты

Финансовые рынки и финансовые институты Венчурная деятельность

Венчурная деятельность Ұйымның қысқа мерзімді міндеттемелерінің есебі және аудиті

Ұйымның қысқа мерзімді міндеттемелерінің есебі және аудиті Стратегия, методы и этапы ценообразования

Стратегия, методы и этапы ценообразования Договор лизинга (понятие, содержание, виды)

Договор лизинга (понятие, содержание, виды) Классификация счетов бухгалтерского учета

Классификация счетов бухгалтерского учета Бизнес. Трейдинг. Инвестирование. Облигации

Бизнес. Трейдинг. Инвестирование. Облигации Банковские карты

Банковские карты Банковские гарантии

Банковские гарантии