Содержание

- 2. Three keys points to remember about capital budgeting decisions include: Typically, a go or no-go decision

- 3. Investment Decision Rules or Models for Capital Budgeting Decisions Payback period Discounted payback period (Modified from

- 4. 1. PAYBACK PERIOD Payback period: the time period needed to recover the initial investment. If the

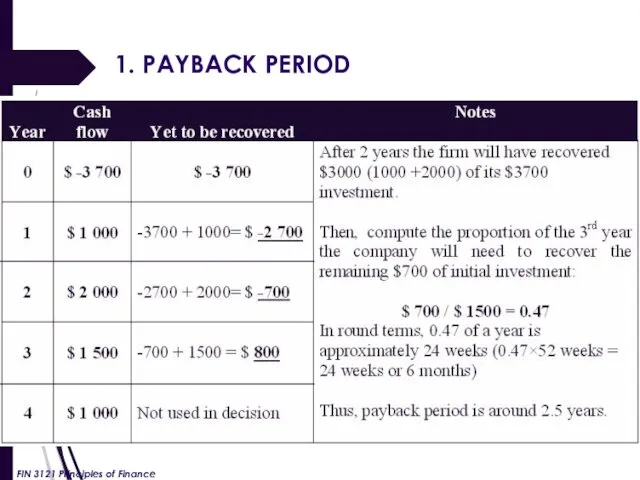

- 5. 1. PAYBACK PERIOD Illustration: The ABC Co. plans to invest in a project that has a

- 6. 1. PAYBACK PERIOD FIN 3121 Principles of Finance

- 7. 1. PAYBACK PERIOD The payback period method has two major flaws: It ignores all cash flow

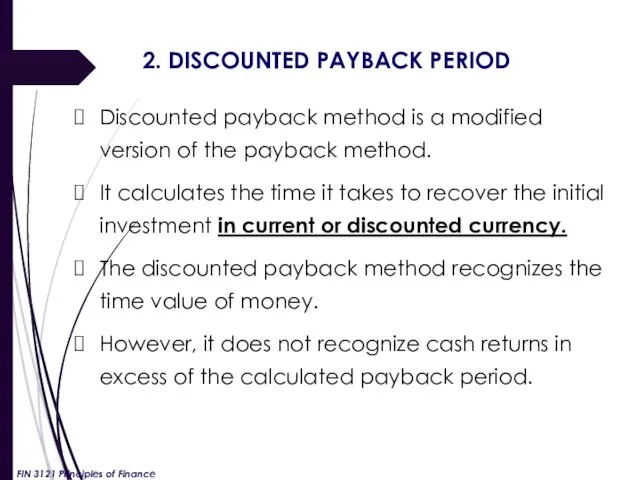

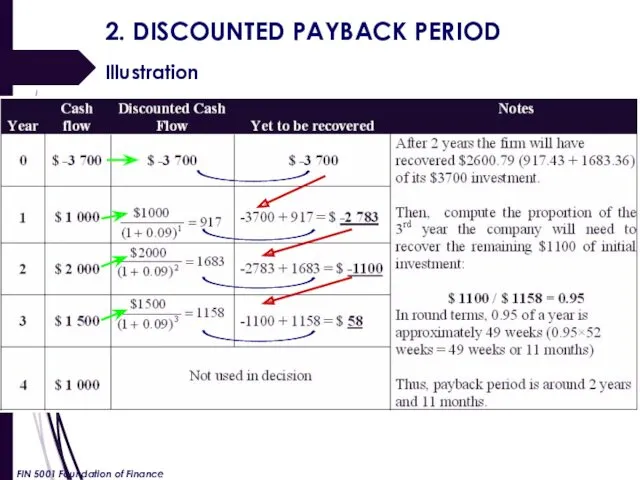

- 8. 2. DISCOUNTED PAYBACK PERIOD Discounted payback method is a modified version of the payback method. It

- 9. 2. DISCOUNTED PAYBACK PERIOD Illustration FIN 5001 Foundation of Finance

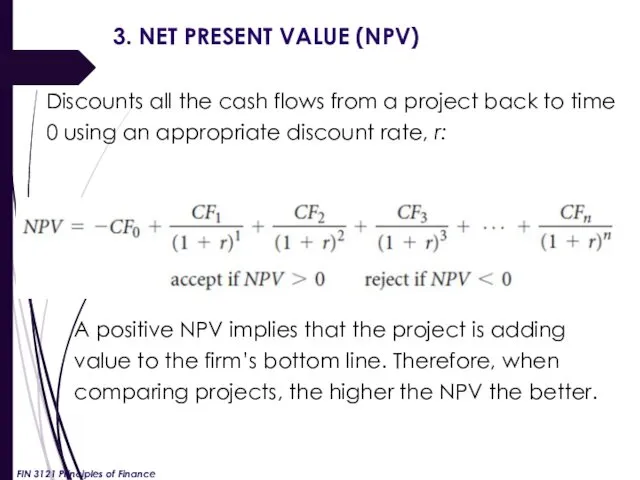

- 10. 3. NET PRESENT VALUE (NPV) Discounts all the cash flows from a project back to time

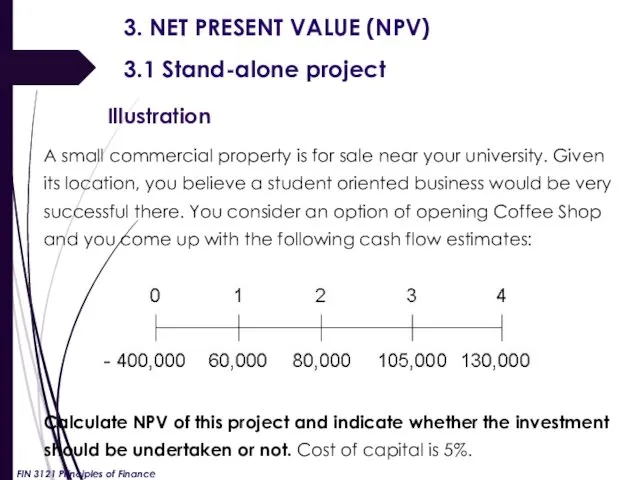

- 11. 3. NET PRESENT VALUE (NPV) 3.1 Stand-alone project Illustration A small commercial property is for sale

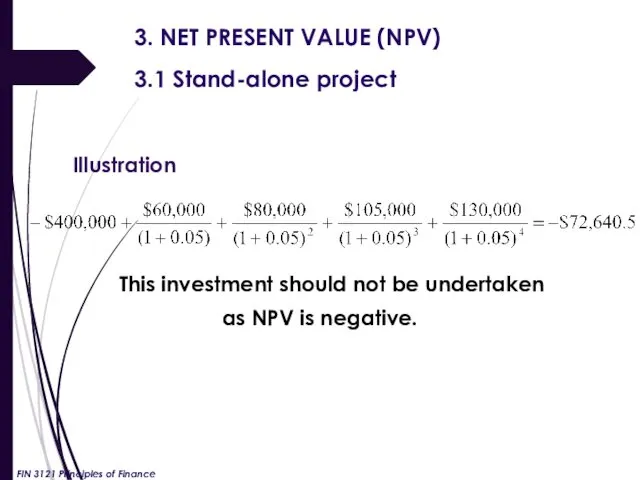

- 12. 3. NET PRESENT VALUE (NPV) 3.1 Stand-alone project Illustration This investment should not be undertaken as

- 13. 3.2. NPV: MUTUALLY EXCLUSIVE vs INDEPENDENT PROJECTS NPV approach useful for independent as well as mutually

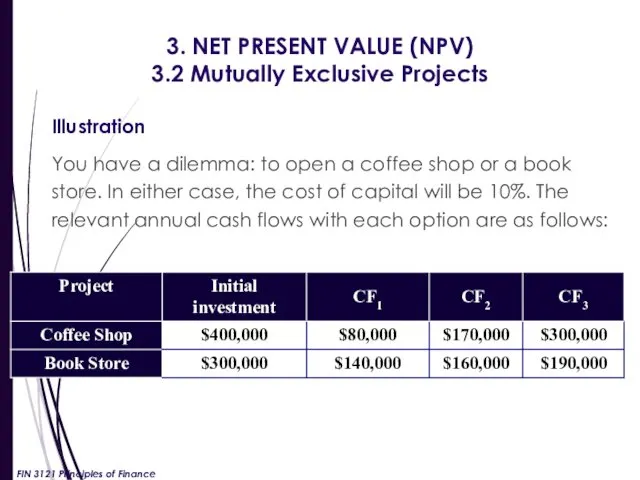

- 14. 3. NET PRESENT VALUE (NPV) 3.2 Mutually Exclusive Projects Illustration You have a dilemma: to open

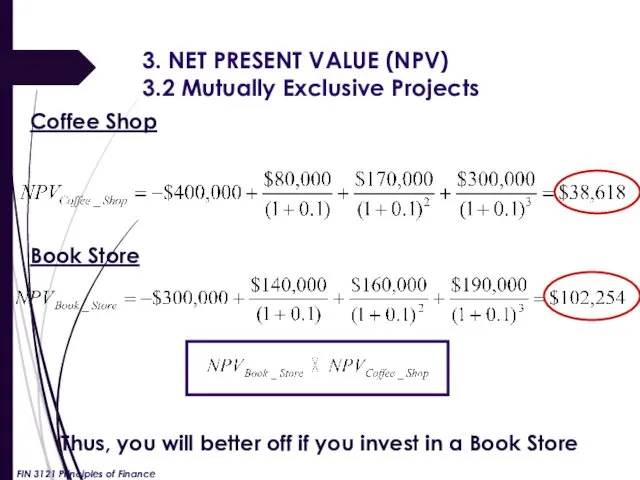

- 15. 3. NET PRESENT VALUE (NPV) 3.2 Mutually Exclusive Projects Coffee Shop Book Store Thus, you will

- 16. 3. NET PRESENT VALUE (NPV) 3.3 Unequal Lives of Projects Firms often have to decide between

- 17. 3. NET PRESENT VALUE (NPV) 3.3 Unequal Lives of Projects Under the NPV approach, mutually exclusive

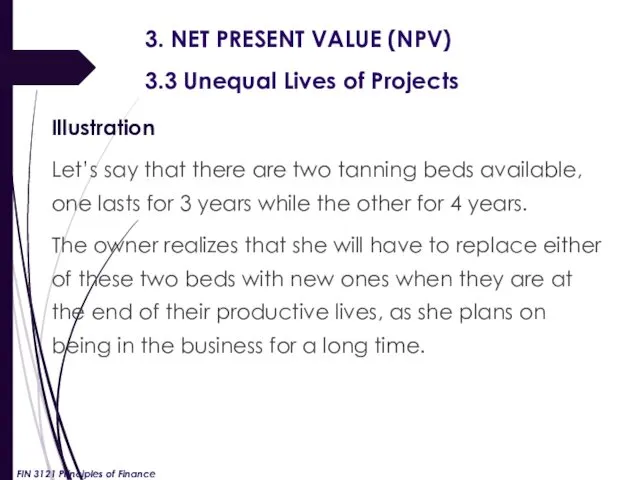

- 18. 3. NET PRESENT VALUE (NPV) 3.3 Unequal Lives of Projects Illustration Let’s say that there are

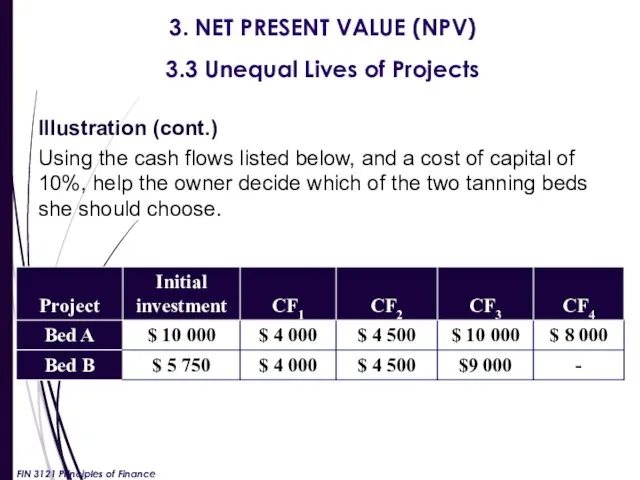

- 19. 3. NET PRESENT VALUE (NPV) 3.3 Unequal Lives of Projects Illustration (cont.) Using the cash flows

- 20. 3. NET PRESENT VALUE (NPV) 3.3 Unequal Lives of Projects 3.3.1. REPLACEMENT CHAIN METHOD STEP 1.

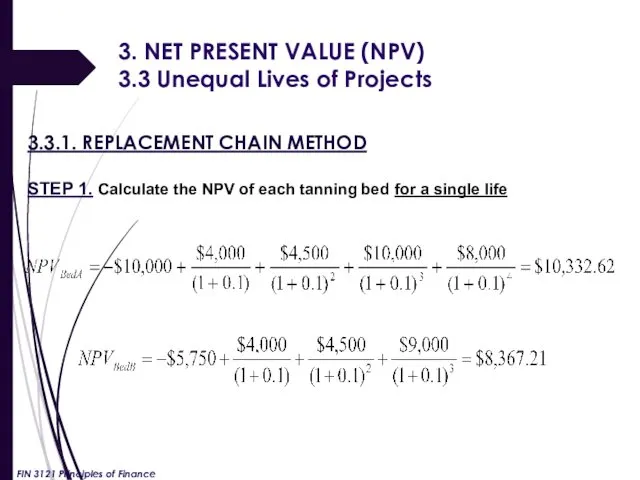

- 21. NET PRESENT VALUE (NPV) Unequal Lives of Projects: Example 3.3.1. REPLACEMENT CHAIN METHOD STEP 2. Calculate

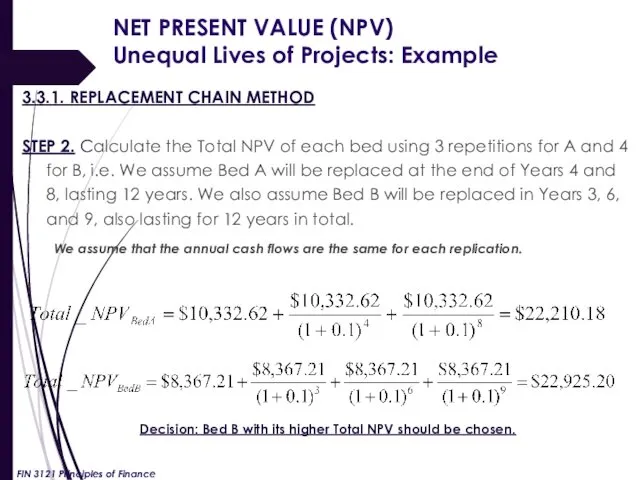

- 22. 3. NET PRESENT VALUE (NPV) 3.3 Unequal Lives of Projects 3.3.2 Equivalent Annual Annuity (EAA) method

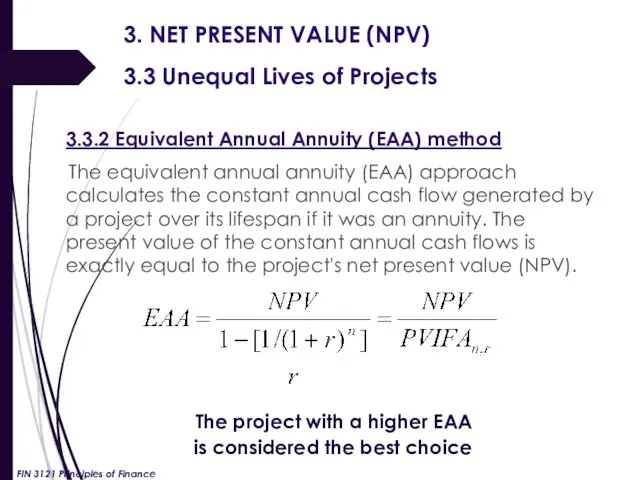

- 23. NET PRESENT VALUE (NPV) Unequal Lives of Projects: Example 3.3.2 EAA Method EAA bed a =

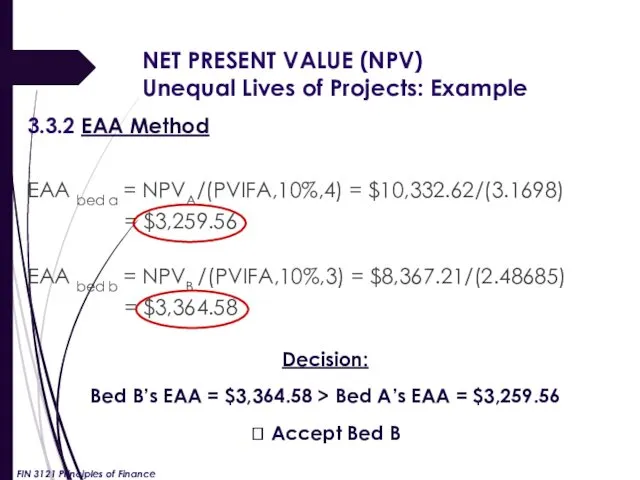

- 24. 4. PROFITABILITY INDEX (PI) Profitability Index (PI) measures the value created per dollar of an investment.

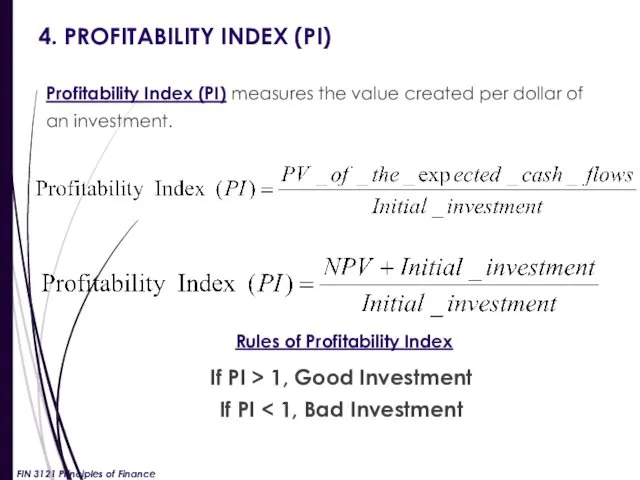

- 25. 4. PROFITABILITY INDEX (PI) Illustration Given the following cash flows for an investment, calculate the profitability

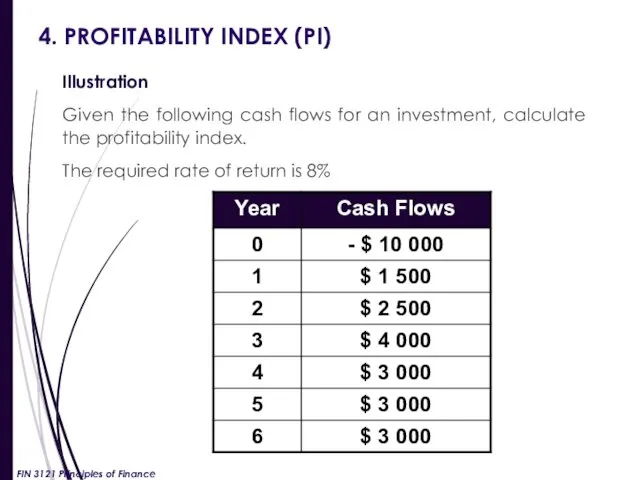

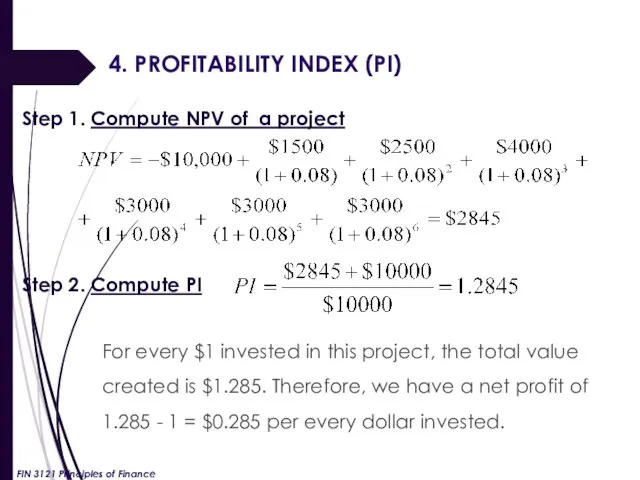

- 26. 4. PROFITABILITY INDEX (PI) Step 1. Compute NPV of a project Step 2. Compute PI For

- 27. 4. PROFITABILITY INDEX (PI) There is a linear relationship between NPV and PI. Here it is:

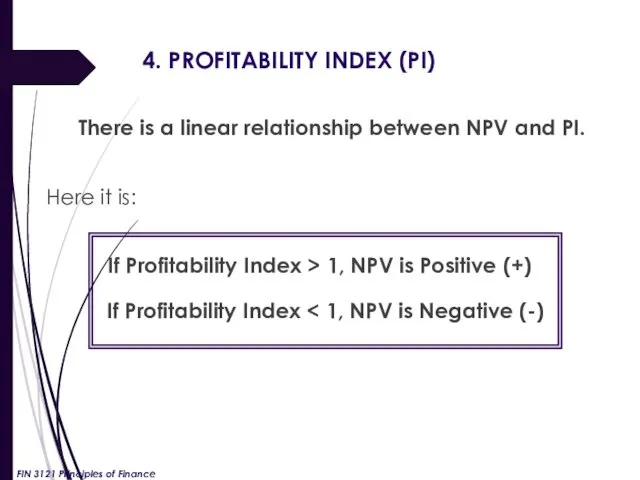

- 28. 5. INTERNAL RATE OF RETURN (IRR) The Internal Rate of Return (IRR) is the discount rate

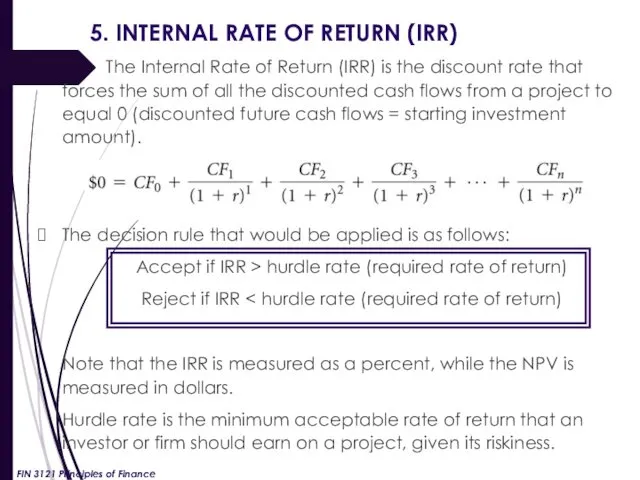

- 30. Скачать презентацию

Расчет критической точки безубыточности и запаса финансовой прочности

Расчет критической точки безубыточности и запаса финансовой прочности Мировая валютно-финансовая система

Мировая валютно-финансовая система Содействие безработным гражданам в организации самозанятости

Содействие безработным гражданам в организации самозанятости Переваги та недоліки податку на додану вартість

Переваги та недоліки податку на додану вартість Учет оплаты труда и расчетов с персоналом предприятия. (Тема 9)

Учет оплаты труда и расчетов с персоналом предприятия. (Тема 9) Инвентаризация дебиторской и кредиторской задолженности по состоянию на 30 июня 2018 года. Желдоручет ОАО РЖД

Инвентаризация дебиторской и кредиторской задолженности по состоянию на 30 июня 2018 года. Желдоручет ОАО РЖД Системы налогообложения в Российской Федерации

Системы налогообложения в Российской Федерации Фінансові ринки. Грошовий ринок та ринок капіталів. (Тема 4)

Фінансові ринки. Грошовий ринок та ринок капіталів. (Тема 4) Федеральное казначейство

Федеральное казначейство Модули финансовой грамотности в предмете Обществознание в 7-8 кл

Модули финансовой грамотности в предмете Обществознание в 7-8 кл Долгосрочные обязательства, особенности оценки их стоимости

Долгосрочные обязательства, особенности оценки их стоимости Сущность и источники ссудного капитала. Ссудный процент

Сущность и источники ссудного капитала. Ссудный процент Учет основных средств организации

Учет основных средств организации Учет затрат на изготовление продукции, выполнение работ, оказание услуг. Тема 8

Учет затрат на изготовление продукции, выполнение работ, оказание услуг. Тема 8 Бюджет для граждан

Бюджет для граждан Министерство финансов Российской Федерации

Министерство финансов Российской Федерации Қаржы жүйесі

Қаржы жүйесі Виды социального обеспечения. Пенсии, пособия, услуги

Виды социального обеспечения. Пенсии, пособия, услуги Сферы применения BlockChain в бизнесе

Сферы применения BlockChain в бизнесе Установление скидок и надбавок к страховым тарифам

Установление скидок и надбавок к страховым тарифам Международные стандарты аудита. Тема 7

Международные стандарты аудита. Тема 7 Этапы работы для выдачи займа

Этапы работы для выдачи займа Банковские карты

Банковские карты Сетевые пирамиды: легкий способ обогащения. Цели и последствия

Сетевые пирамиды: легкий способ обогащения. Цели и последствия Система права социального обеспечения. Общее понятие отрасли

Система права социального обеспечения. Общее понятие отрасли Аудит дебиторской и кредиторской задолженности

Аудит дебиторской и кредиторской задолженности Сингапурская биржа

Сингапурская биржа Оценка кредитоспособности. Диагностика риска банкротства предприятия. (Тема 5)

Оценка кредитоспособности. Диагностика риска банкротства предприятия. (Тема 5)