Содержание

- 2. LEARNING OBJECTIVES Understand and conduct horizontal analysis Create, understand, and interpret common-size financial statements. Calculate and

- 3. I. Overview of Financial Statements

- 4. TYPES OF FINANCIAL STATEMENTS Balance Sheet Income Statement Statement of Cash Flows Statement of Changes in

- 5. BALANCE SHEET Assets Liabilities Equity = + Statement of financial position Statement of financial Condition The

- 6. INCOME STATEMENT (P/L STATEMENT) It is also known as Profit/Loss Statement, Operating Statement, or Statement of

- 7. INCOME STATEMENT (P/L STATEMENT) Total Sales / Revenues Cost of Goods Sold (COGS) Gross Profit Operating

- 8. CASH FLOWS STATEMENT Cash flows from Operations Cash flows from Investments Cash flows from Financing Net

- 9. STATEMENT OF OWNER’S EQUITY Statement of Changes in the Owner’s Equity is a financial statement that

- 10. Stockholders’ (Owners’) Equity accounts Owners’ investment in the corporation through the ownership of stock Owners’ claims

- 11. Stockholders’ (Owners’) Equity accounts Increase in stockholders’ equity from delivering goods or services to customers (revenues

- 12. (1) Increases in stockholders’ equity: Sale of stock and net income (revenue greater than expenses). (2)

- 13. II. ANALYSIS OF FINANCIAL STATEMENTS

- 14. APPROACHES TOWARDS FINANCIAL ANALYSIS To conduct financial analysis it is possible to Compare actual with budgeted

- 15. PERFORMANCE ANALYSIS: BUDGETED VS. ACTUAL

- 16. PERFORMANCE ANALYSIS: BUDGETED VS. ACTUAL

- 17. HORIZONTAL (TREND) ANALYSIS Type 1: Percentage changes from year-to-year Two steps: Compute dollar (or any currency)

- 18. Illustration: Amazon.com, Inc. Step 1 Compute the dollar amount of change from 2011 to 2012 Step

- 19. Illustration: Amazon.com, Inc. Comparative Consolidated Statements of Operations—Horizontal Analysis (partial exhibit)

- 20. Illustration: Amazon.com, Inc. Consolidated Balance Sheets—Horizontal Analysis (partial exhibit)

- 21. Illustration Prepare a horizontal analysis of the comparative income statements of Ama Music Co.

- 22. HORIZONTAL (TREND) ANALYSIS Type 2: Trend Percentages Base year selected and set equal to 100% Amount

- 23. HORIZONTAL (TREND) ANALYSIS Type2: Trend Percentages Amazon.com, Inc., showed income from operations as follows: Trend percentages

- 24. HORIZONTAL (TREND) ANALYSIS Type 3: Used to find an average growth (declining) rate and to find

- 25. HORIZONTAL (TREND) ANALYSIS Cogswell Cola’s Abbreviated Income Statements ($ in thousands)

- 26. VERTICAL ANALYSIS Shows relationship of a financial-statement item to its base Income statement, base is total

- 27. Illustration: Amazon.com, Inc. Comparative Consolidated Statements of Operations—Vertical Analysis (partial exhibit)

- 28. Illustration: Amazon.com, Inc. Consolidated Balance Sheets—Vertical Analysis (partial exhibit)

- 29. COMMON-SIZE FINANCIAL STATEMENTS Type of vertical analysis Report only percentages (no dollar amounts) Assists in the

- 30. Calculate the common-size percentages for the following income statement:

- 31. FINANCIAL RATIO ANALYSIS Financial ratios are relationships between different accounts from financial statements (due to this

- 32. FINANCIAL RATIO ANALYSIS Firm’s performance can be analyzed by using five key sets of financial ratios:

- 33. PROFITABILITY RATIOS

- 34. NET INCOME AS A % OF SALES (NET PROFIT MARGIN)

- 35. RETURN ON ASSETS (ROA)

- 37. RETURN ON EQUITY (ROE)

- 39. LIQUIDITY RATIOS / SHORT-TERM SOLVENCY RATIOS

- 40. CURRENT RATIO

- 41. QUICK RATIO OR ACID RATIO TEST

- 42. SOLVENCY RATIOS / FINANCIAL LEVERAGE RATIOS

- 43. FINANCIAL LEVERAGE RATIOS In the area of financial leverage, Company A is in a much better

- 45. ACTIVITY / ASSET MANAGEMENT RATIOS These ratios measure how efficiently a firm is using its assets

- 46. TOTAL ASSETS TURNOVER RATIO / MANAGEMENT EFFICIENCY RATIO

- 47. FIXED ASSET TURNOVER RATIO

- 48. INVENTORY TURNOVER

- 49. INVENTORY TURNOVER A lower inventory turnover ratio may be an indication of over-stocking which may pose

- 50. INVENTORY TURNOVER

- 51. INVENTORY TURNOVER A low turnover is usually a bad sign because products tend to deteriorate as

- 52. RECEIVABLE TURNOVER

- 53. RECEIVABLE TURNOVER Accounts receivable turnover measures the efficiency of a business in collecting its credit sales.

- 54. Example: Total sales of Company A during the year ended December 31, 2013 were $984,000. Customers

- 55. INVESTMENT VALUATION RATIOS / MARKET VALUE RATIOS Investment valuation ratios are used by investors to estimate

- 56. EARNINGS PER SHARE

- 57. PRICE PER EARNINGS (P/E) RATIO

- 58. PRICE / EARNING TO GROWTH RATIO (PEG RATIO)

- 59. PRICE / EARNING TO GROWTH RATIO (PEG RATIO) Example: Company A is currently trading with a

- 60. MARKET TO BOOK VALUE (PRICE TO BOOK RATIO)

- 61. To be useful, ratios should be analyzed over a period of years to consider all relevant

- 63. Скачать презентацию

Фонд пенсионного и социального страхования Российской Федерации

Фонд пенсионного и социального страхования Российской Федерации Особенности составления и представления Пояснительной записки в составе годовой бюджетной (бухгалтерской) отчетности за 2019 год

Особенности составления и представления Пояснительной записки в составе годовой бюджетной (бухгалтерской) отчетности за 2019 год Публічні доходи та публічні видатки

Публічні доходи та публічні видатки Финансово-инновационный продукт ”FIRST”

Финансово-инновационный продукт ”FIRST” Ценовая политика предприятия

Ценовая политика предприятия Народный бюджет на территории муниципального образования Омутнинское городское поселение

Народный бюджет на территории муниципального образования Омутнинское городское поселение Декларування майна, набутого за договором фінансового лізингу

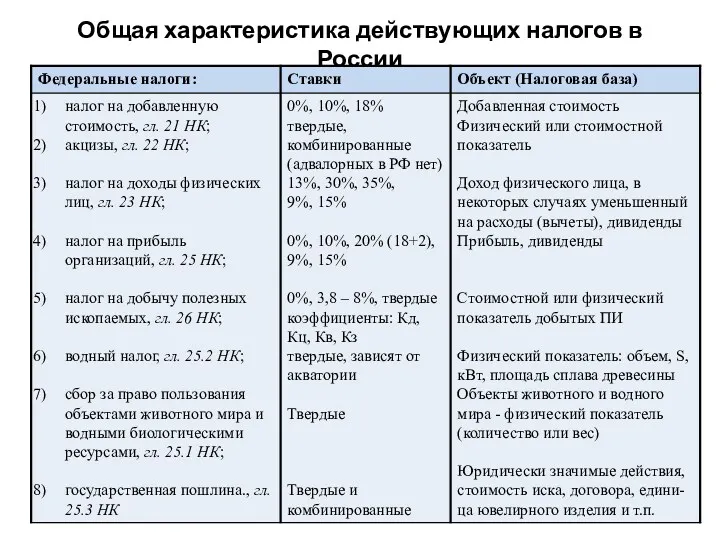

Декларування майна, набутого за договором фінансового лізингу Общая характеристика действующих налогов в России

Общая характеристика действующих налогов в России Бюджетное ограничение потребителя

Бюджетное ограничение потребителя Организационно- финансовые основы антикризисного управления Нормативная база оценки на признаки банкротства

Организационно- финансовые основы антикризисного управления Нормативная база оценки на признаки банкротства Платежный баланс

Платежный баланс Еңбек қарым-катынасы, нысандары және ҚР еңбекақыны төлеу жүйесі. Дәріхана ұйымындағы еңбек жене еңбекақы есебі

Еңбек қарым-катынасы, нысандары және ҚР еңбекақыны төлеу жүйесі. Дәріхана ұйымындағы еңбек жене еңбекақы есебі Постоянный спутник деньги

Постоянный спутник деньги Ұзақ мерзімді активтердің операциялық аудиті

Ұзақ мерзімді активтердің операциялық аудиті Банковские продукты и услуги для компаний - контрагентов РУСАЛ

Банковские продукты и услуги для компаний - контрагентов РУСАЛ 20230320_modul_1.5._kakoy_kredit_brat

20230320_modul_1.5._kakoy_kredit_brat Классификация источников финансирования инвестиций. Формы и методы финансирования. Тема 3

Классификация источников финансирования инвестиций. Формы и методы финансирования. Тема 3 Заработная плата, гарантии, компенсации

Заработная плата, гарантии, компенсации Инвестициялық климаттың

Инвестициялық климаттың Профессия бухгалтер

Профессия бухгалтер Поведение участников финансового рынка

Поведение участников финансового рынка Инвестициялық нарық

Инвестициялық нарық Учет доходов и расходов при совмещении ОСНО и ЕНВД

Учет доходов и расходов при совмещении ОСНО и ЕНВД Деньги. Виды денег:

Деньги. Виды денег: Учёт основных средств производства

Учёт основных средств производства Формирование карточек укрупненных закупок. Саратовская область

Формирование карточек укрупненных закупок. Саратовская область Стандарты аудита. (Тема 4)

Стандарты аудита. (Тема 4) Домашняя бухгалтерия

Домашняя бухгалтерия