Содержание

- 2. Term Hedge an investment made in order to reduce the risk of losing money on shares,

- 3. Benefits and Disadvantages of Currency Hedging Benefits Also, since the objective of hedging currencies is to

- 4. Currency Hedging

- 5. Companies should develop a profile of probable cash flows—a profile that reflects a company-wide calculation of

- 7. Скачать презентацию

Слайд 2

Term

Hedge an investment made in order to reduce the risk of

Term

Hedge an investment made in order to reduce the risk of

losing money on shares, bonds, etc. that you own, for example, by buying futures (= agreements to sell shares for a particular price at a date in the future) or options (= the rights to buy or sell shares for a particular price within a particular time period)

Слайд 3

Benefits and Disadvantages of Currency Hedging

Benefits

Also, since the objective of hedging

Benefits and Disadvantages of Currency Hedging

Benefits

Also, since the objective of hedging

currencies is to minimize losses, it can also allow traders to survive economic downturns, or bearish market periods. If you are a successful hedger, you will be protected against inflation, interest rate changes, commodity price volatility and currency exchange rate fluctuations.

Disadvantages

Hedging usually involves huge costs and expenses that can eat up a big chunk of your profits.

Hedging is not ideal for beginner investors because it can be quite difficult to understand.

Currency hedging can be an investment trap if you think that it is without risks.

Disadvantages

Hedging usually involves huge costs and expenses that can eat up a big chunk of your profits.

Hedging is not ideal for beginner investors because it can be quite difficult to understand.

Currency hedging can be an investment trap if you think that it is without risks.

Слайд 4

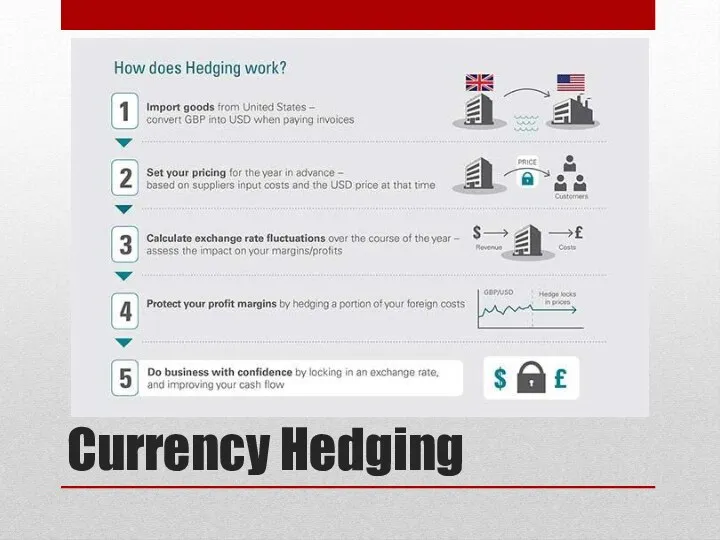

Currency Hedging

Currency Hedging

Слайд 5

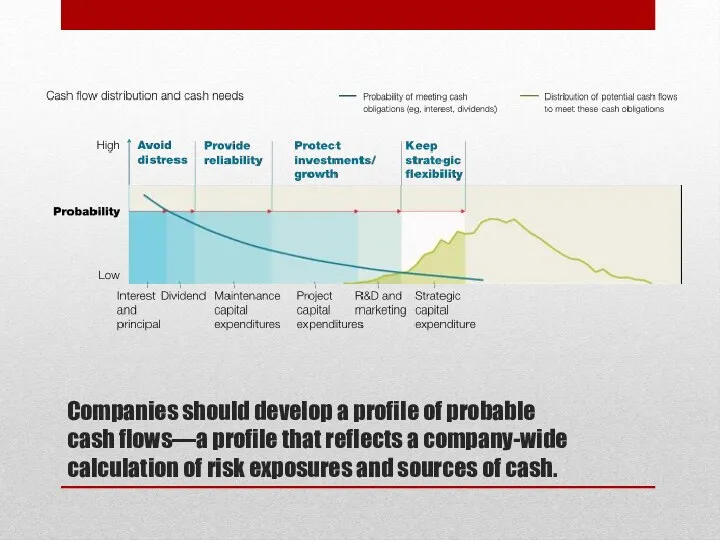

Companies should develop a profile of probable cash flows—a profile that

Companies should develop a profile of probable cash flows—a profile that

reflects a company-wide calculation of risk exposures and sources of cash.

Применение кода Село в годовой отчетности по форме СЗВ-стаж за 2019 год

Применение кода Село в годовой отчетности по форме СЗВ-стаж за 2019 год Программа поддержки местных инициатив

Программа поддержки местных инициатив Инновационная политика на железнодорожном транспорте и ее финансовое обеспечение

Инновационная политика на железнодорожном транспорте и ее финансовое обеспечение Социальные пособия на детей

Социальные пособия на детей Важнейшие нововведения, комментарии контролирующих органов, судебные решения по страховым взносам

Важнейшие нововведения, комментарии контролирующих органов, судебные решения по страховым взносам Тактическое финансовое планирование

Тактическое финансовое планирование Страховые пенсии в РФ

Страховые пенсии в РФ Учет расчетов с персоналом по оплате труда

Учет расчетов с персоналом по оплате труда Организация и способы ведения налогового учета на предприятии ООО ПКФ Монтажник

Организация и способы ведения налогового учета на предприятии ООО ПКФ Монтажник Налоговая грамотность. Разговоры о важном

Налоговая грамотность. Разговоры о важном Цели внутреннего контроля и аудита финансового бизнес-цикла и его функции

Цели внутреннего контроля и аудита финансового бизнес-цикла и его функции Банки. История банковского дела. Операции коммерческих банков. Банковская система. Центральный банк и его функции

Банки. История банковского дела. Операции коммерческих банков. Банковская система. Центральный банк и его функции Кредит и его роль в экономике

Кредит и его роль в экономике Обзор инвестиционных инструментов и оценивание степени риска продуктов и услуг для определения финансовых целей

Обзор инвестиционных инструментов и оценивание степени риска продуктов и услуг для определения финансовых целей Строительные рабочие, организация труда, заработная плата. Система оплаты труда

Строительные рабочие, организация труда, заработная плата. Система оплаты труда 1С Документооборот 8

1С Документооборот 8 Учет затрат на производство и калькулирование себестоимости продукции. (Тема 6)

Учет затрат на производство и калькулирование себестоимости продукции. (Тема 6) Учет материально-производственных запасов. Тема 4

Учет материально-производственных запасов. Тема 4 Переменные издержки на 100 кг

Переменные издержки на 100 кг Новый механизм оказания адресной социальной помощи с 1 января 2020 года

Новый механизм оказания адресной социальной помощи с 1 января 2020 года История денег

История денег О проекте бюджета Денисовского сельского поселения на 2018 год и плановый период 2019 и 2020 годов

О проекте бюджета Денисовского сельского поселения на 2018 год и плановый период 2019 и 2020 годов Учёт кассовых операций в иностранной валюте

Учёт кассовых операций в иностранной валюте Дидактическое пособие по формированию финансовой грамотности старших дошкольников Банковский терминал

Дидактическое пособие по формированию финансовой грамотности старших дошкольников Банковский терминал Банковская система России. Домашнее задание

Банковская система России. Домашнее задание Тема 2. Предмет, методы, объекты, субъект финансового контроля. Тема 2.1. Организационные основы проведения финансового контроля

Тема 2. Предмет, методы, объекты, субъект финансового контроля. Тема 2.1. Организационные основы проведения финансового контроля Финансирование образования

Финансирование образования Мемлекеттің валюталық саясатын қалыптастыру

Мемлекеттің валюталық саясатын қалыптастыру