Содержание

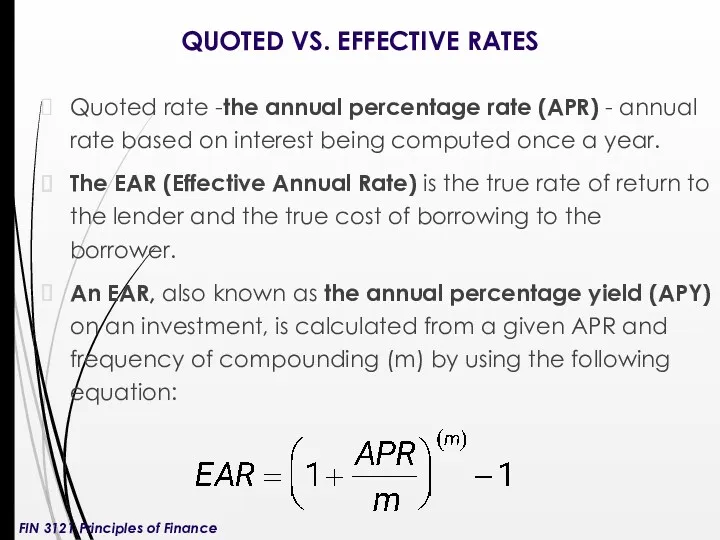

- 2. QUOTED VS. EFFECTIVE RATES Quoted rate -the annual percentage rate (APR) - annual rate based on

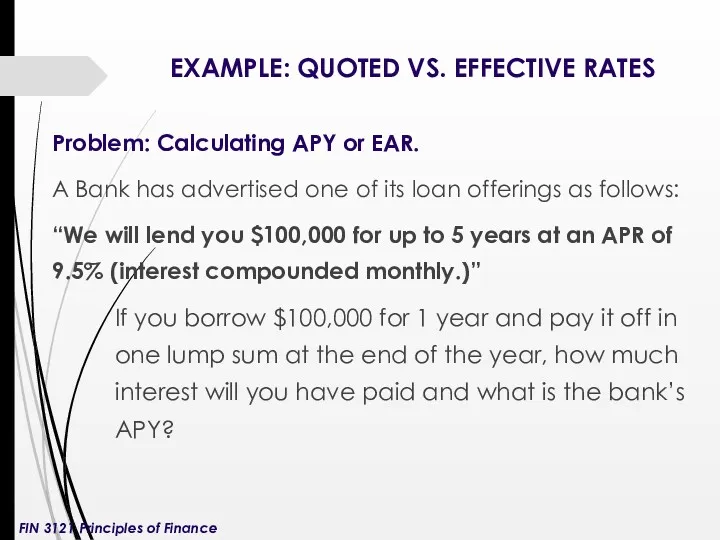

- 3. EXAMPLE: QUOTED VS. EFFECTIVE RATES Problem: Calculating APY or EAR. A Bank has advertised one of

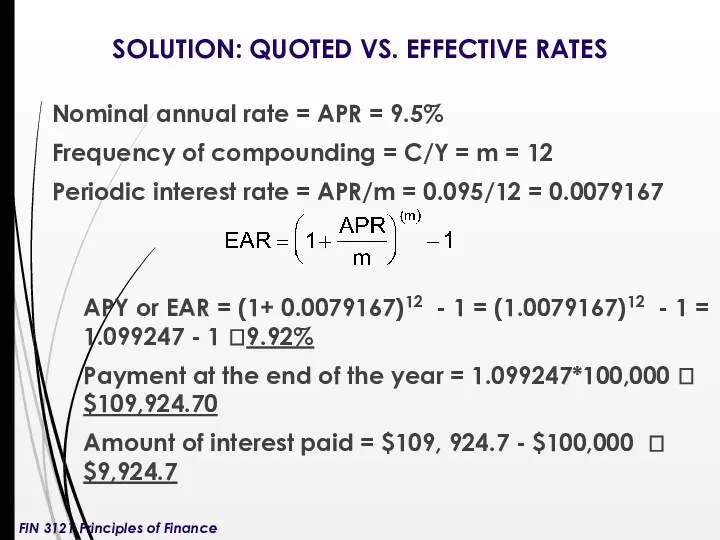

- 4. SOLUTION: QUOTED VS. EFFECTIVE RATES Nominal annual rate = APR = 9.5% Frequency of compounding =

- 5. Effect of Compounding Periods on the Time Value of Money Equations In TVM equations the periodic

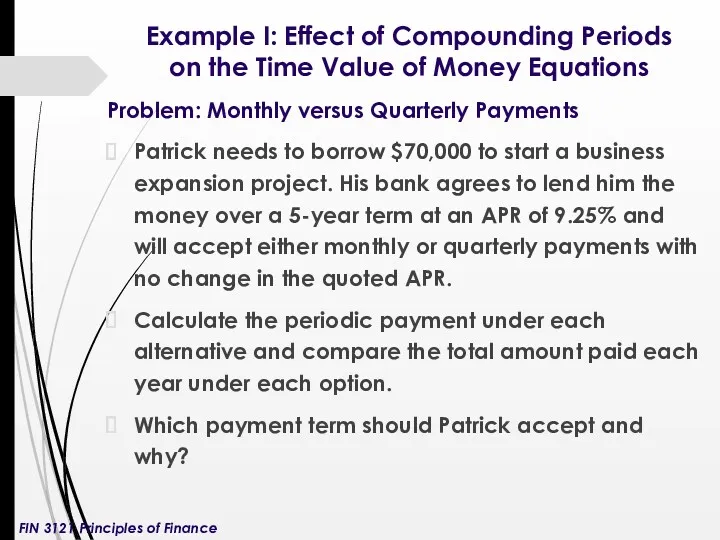

- 6. Example I: Effect of Compounding Periods on the Time Value of Money Equations Problem: Monthly versus

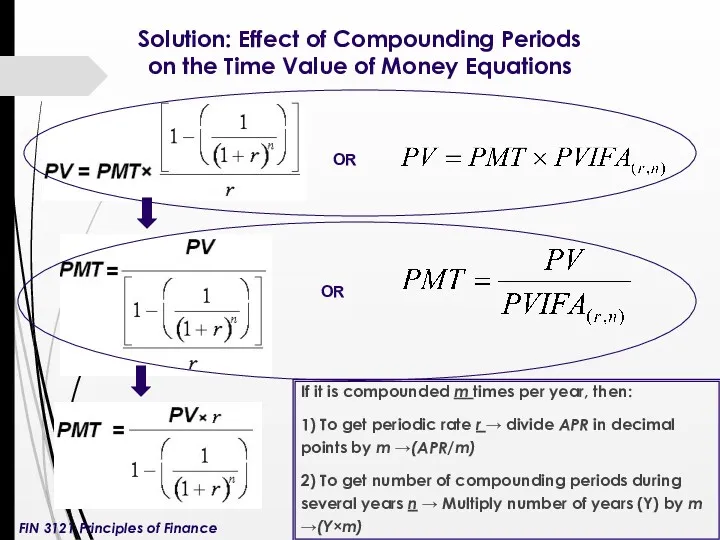

- 7. Solution: Effect of Compounding Periods on the Time Value of Money Equations If it is compounded

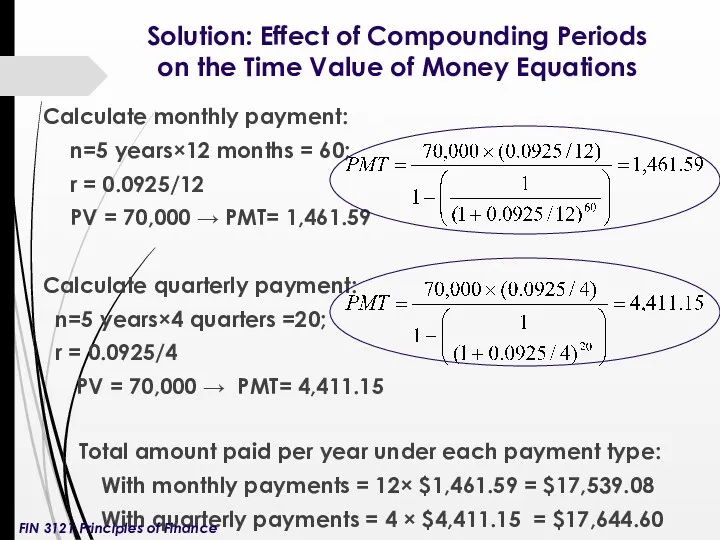

- 8. Solution: Effect of Compounding Periods on the Time Value of Money Equations Calculate monthly payment: n=5

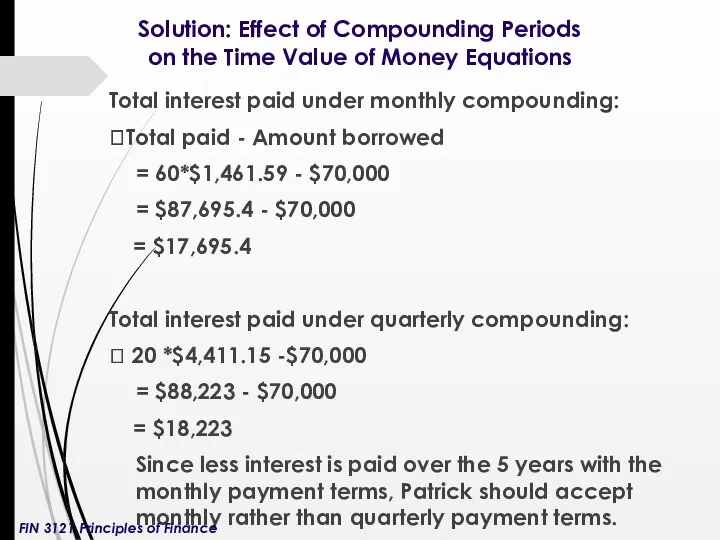

- 9. Solution: Effect of Compounding Periods on the Time Value of Money Equations Total interest paid under

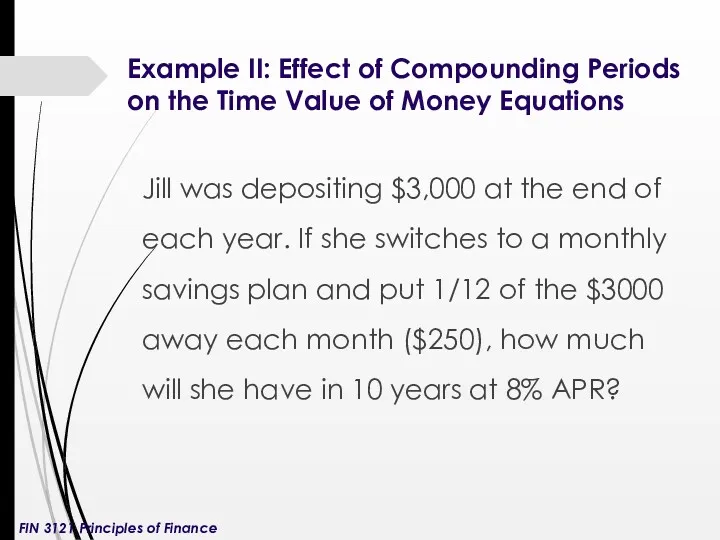

- 10. Example II: Effect of Compounding Periods on the Time Value of Money Equations Jill was depositing

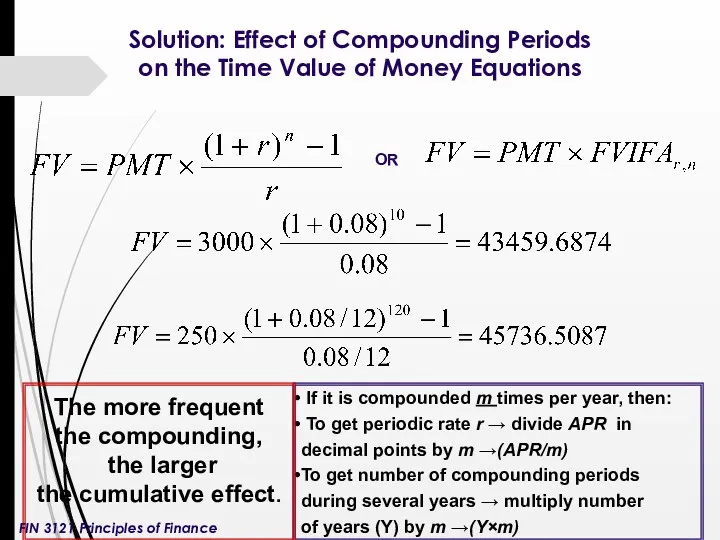

- 11. Solution: Effect of Compounding Periods on the Time Value of Money Equations If it is compounded

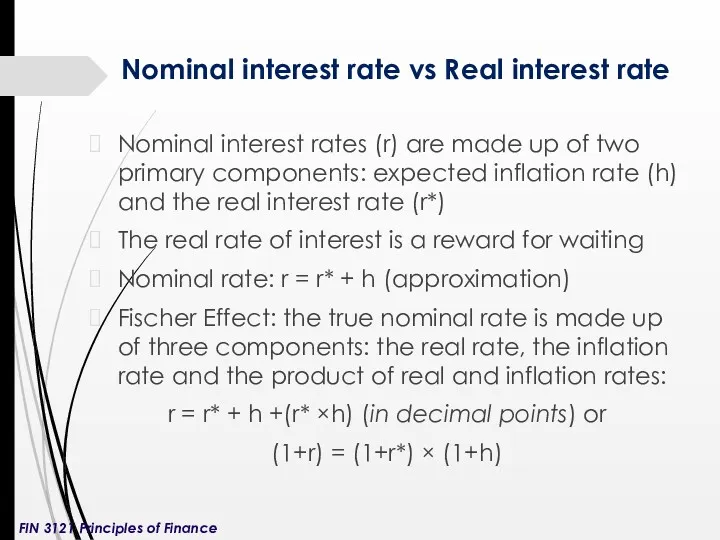

- 12. Nominal interest rate vs Real interest rate Nominal interest rates (r) are made up of two

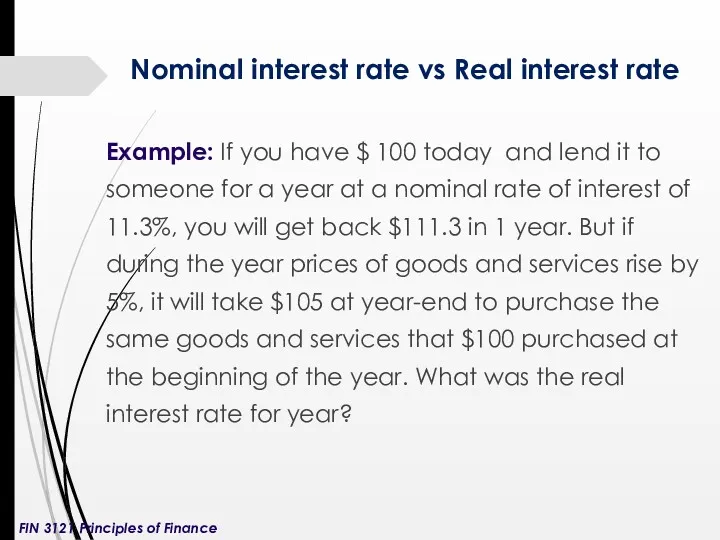

- 13. Example: If you have $ 100 today and lend it to someone for a year at

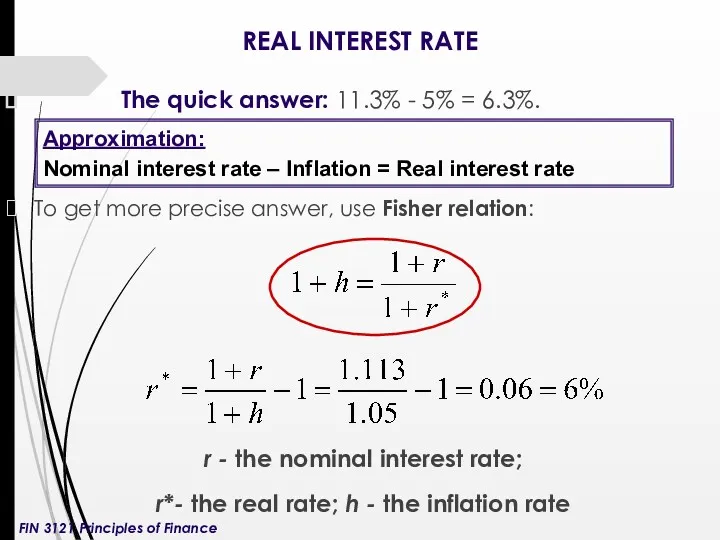

- 14. REAL INTEREST RATE The quick answer: 11.3% - 5% = 6.3%. To get more precise answer,

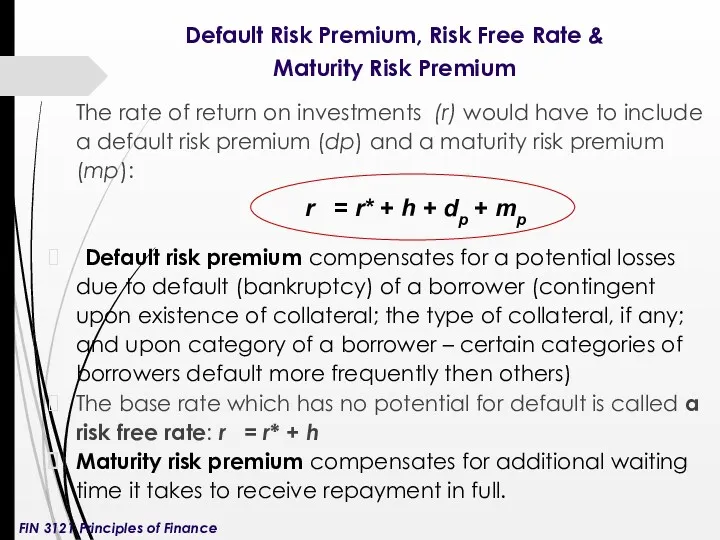

- 15. Default Risk Premium, Risk Free Rate & Maturity Risk Premium The rate of return on investments

- 17. Скачать презентацию

Страховые брокеры в России

Страховые брокеры в России МСФО (IFRS) 16 Аренда

МСФО (IFRS) 16 Аренда Доллар США

Доллар США Порядок заполнения справок о доходах, расходах, об имуществе с использованием специального программного обеспечения Справка БК+

Порядок заполнения справок о доходах, расходах, об имуществе с использованием специального программного обеспечения Справка БК+ Инициативное (партисипаторное) бюджетирование

Инициативное (партисипаторное) бюджетирование Лизинг медицинского оборудования

Лизинг медицинского оборудования Продукты и услуги ПАО АК БАРС Банк

Продукты и услуги ПАО АК БАРС Банк Публічний звіт голови державного космічного агентства України

Публічний звіт голови державного космічного агентства України Теория и методология ценообразования

Теория и методология ценообразования Оптимизация налогов для субъектов МСП

Оптимизация налогов для субъектов МСП Инвестиционный анализ и инвестиционное проектирование на предприятии

Инвестиционный анализ и инвестиционное проектирование на предприятии Денежные доходы и поступления предприятия

Денежные доходы и поступления предприятия Оценка общественной эффективности инвестиционного проекта

Оценка общественной эффективности инвестиционного проекта Expedite. Month of December

Expedite. Month of December Аудит расчетов с персоналом и подотчетными лицами

Аудит расчетов с персоналом и подотчетными лицами The Burden of Debt

The Burden of Debt Изменения в бухгалтерском учете учреждений бюджетной сферы

Изменения в бухгалтерском учете учреждений бюджетной сферы 1С:Зарплата и кадры государственного учреждения 8 - от концепции до реализации

1С:Зарплата и кадры государственного учреждения 8 - от концепции до реализации Financial stability and macroprudential oversight in Germany

Financial stability and macroprudential oversight in Germany Бухгалтерский и налоговый учёт (иностранные сотрудники)

Бухгалтерский и налоговый учёт (иностранные сотрудники) Организация и функционирование рынка ценных бумаг. Тема 4.2

Организация и функционирование рынка ценных бумаг. Тема 4.2 Зоны риска кредитных вложений

Зоны риска кредитных вложений Налоговая система в РФ. Виды налогов. Функции налогов. Налоги, уплачиваемые предприятиями

Налоговая система в РФ. Виды налогов. Функции налогов. Налоги, уплачиваемые предприятиями Корпоративні фінанси. Робочий капітал корпоративних підприємств. (Тема 8)

Корпоративні фінанси. Робочий капітал корпоративних підприємств. (Тема 8) Деньги и их функции. Урок обществознания в 7 классе

Деньги и их функции. Урок обществознания в 7 классе Оценка готовой продукции: аспект бухгалтерской отчётности

Оценка готовой продукции: аспект бухгалтерской отчётности Глобализация

Глобализация Принципы банковского кредитования и их развитие в современных условиях. Курсовая работа

Принципы банковского кредитования и их развитие в современных условиях. Курсовая работа