Слайд 2

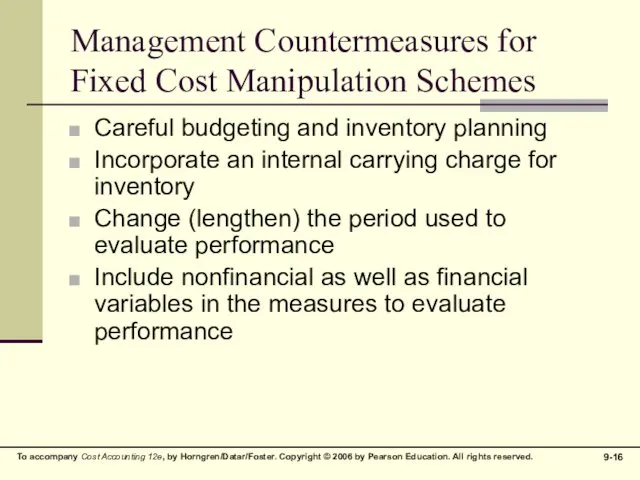

Inventory Costing Choices: Summary

Absorption Costing – product costs are capitalized; period

costs are expensed

Variable Costing – variable product and period costs are capitalized; fixed product and period costs are expensed

Throughput Costing – only Direct Materials are capitalized; all other costs are expensed

Слайд 3

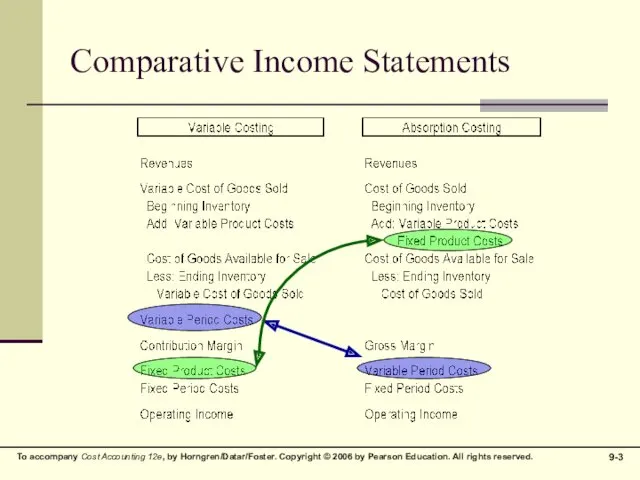

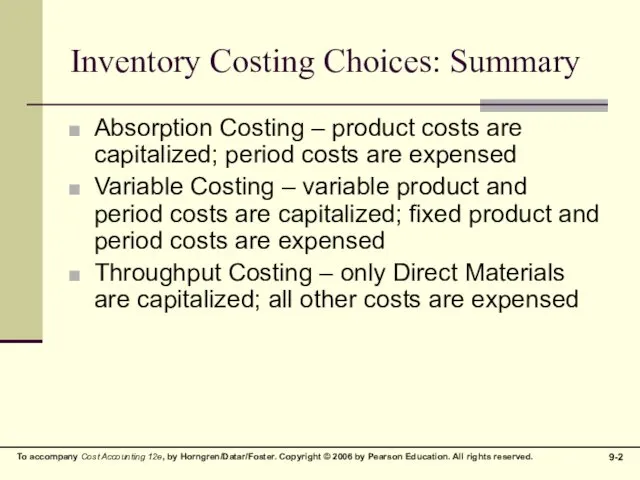

Comparative Income Statements

Слайд 4

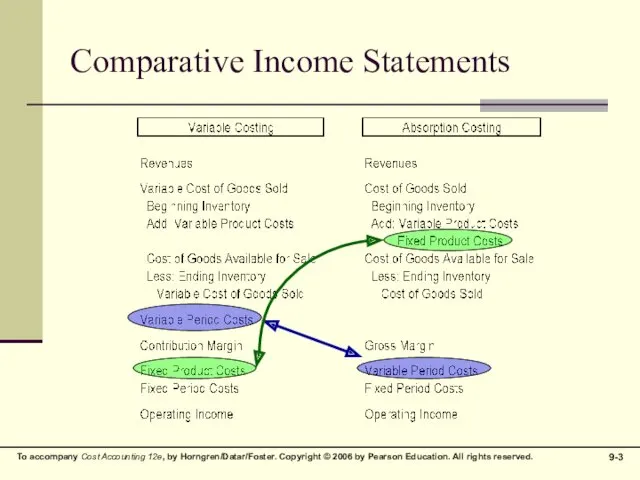

Costing Comparison

Variable costing is a method of inventory costing in which

only variable manufacturing costs are included as inventoriable costs

Absorption costing is a method of inventory costing in which all variable manufacturing costs and all fixed manufacturing costs are included as inventoriable costs

Слайд 5

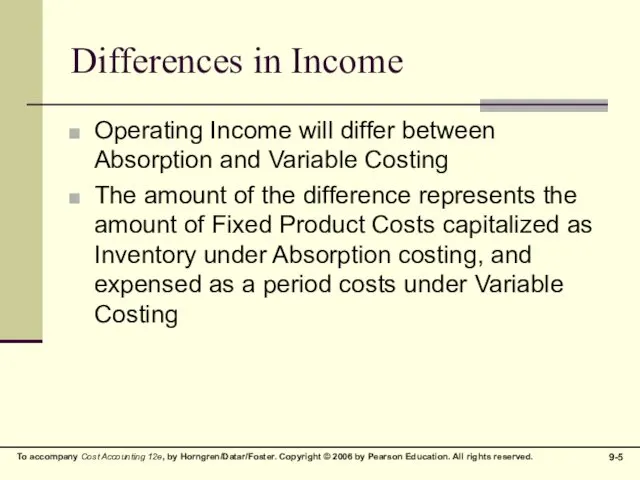

Differences in Income

Operating Income will differ between Absorption and Variable Costing

The

amount of the difference represents the amount of Fixed Product Costs capitalized as Inventory under Absorption costing, and expensed as a period costs under Variable Costing

Слайд 6

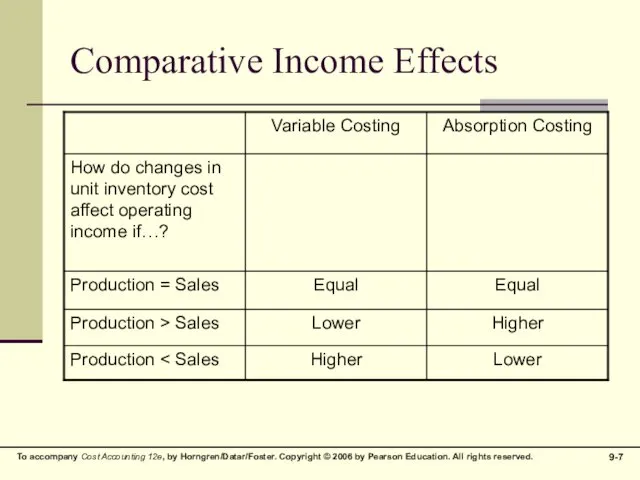

Comparative Income Effects

Слайд 7

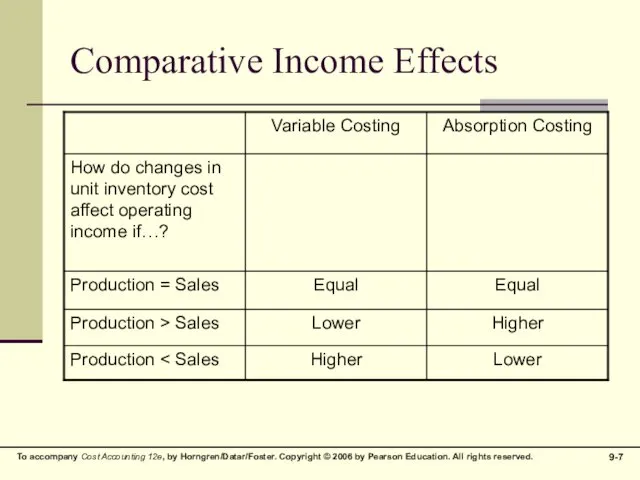

Comparative Income Effects

Слайд 8

Comparative Income Effects

Слайд 9

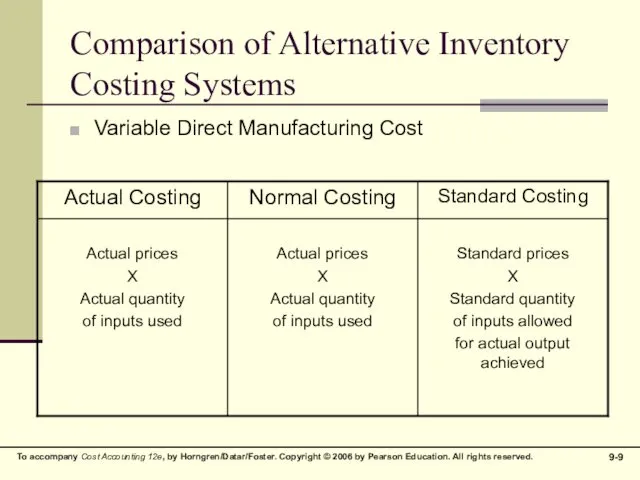

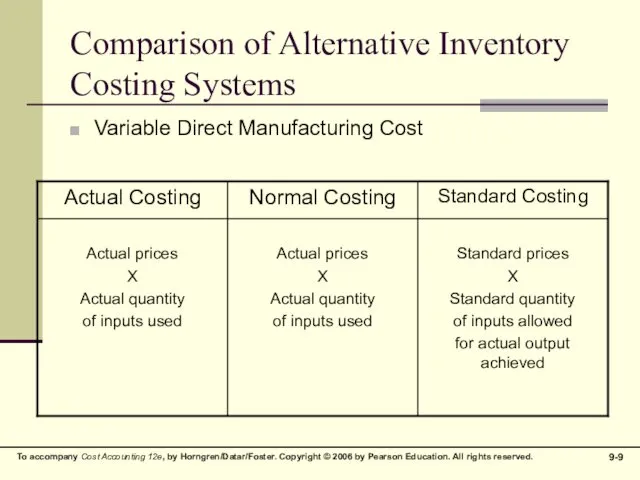

Comparison of Alternative Inventory Costing Systems

Variable Direct Manufacturing Cost

Слайд 10

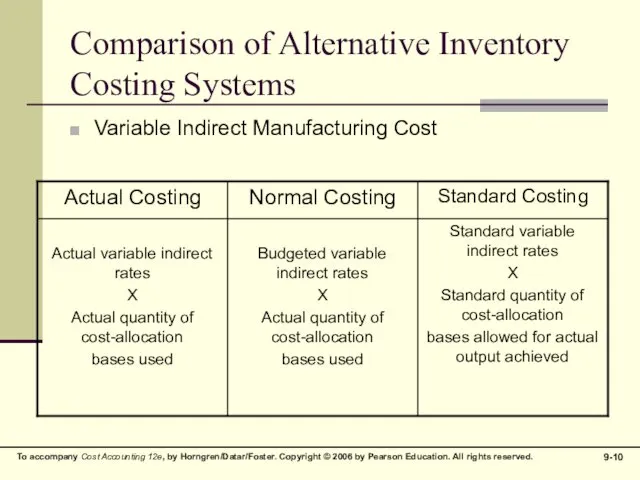

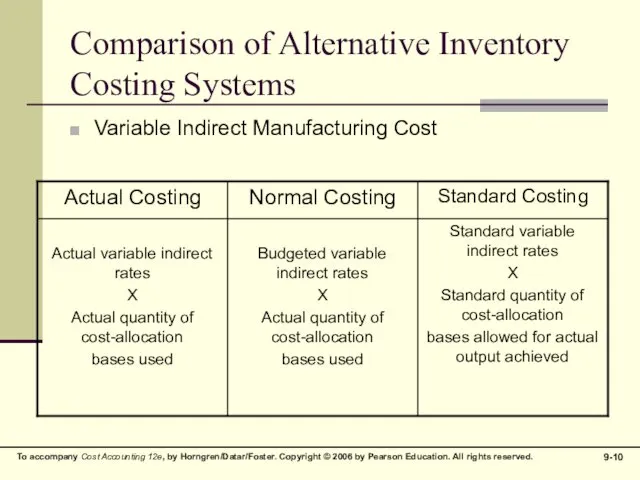

Comparison of Alternative Inventory Costing Systems

Variable Indirect Manufacturing Cost

Слайд 11

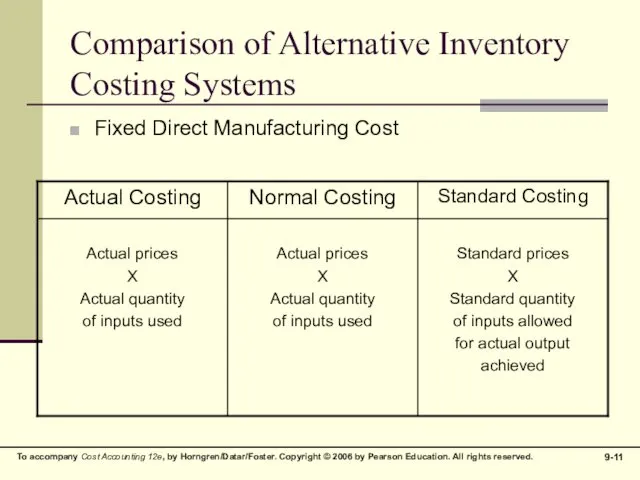

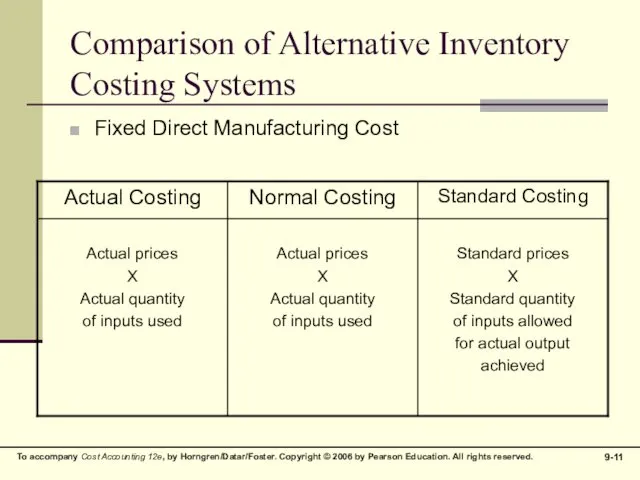

Comparison of Alternative Inventory Costing Systems

Fixed Direct Manufacturing Cost

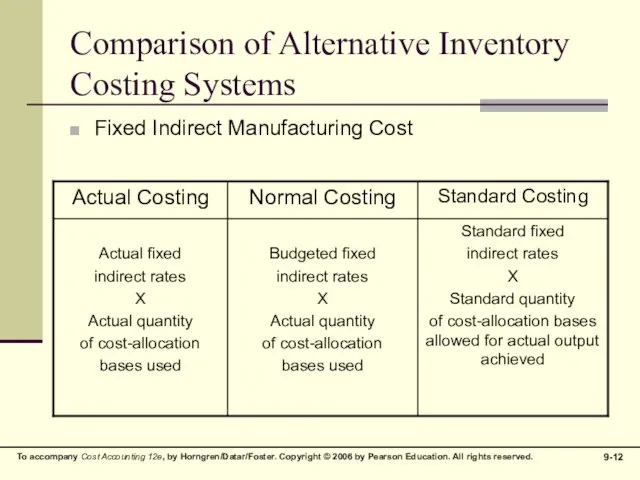

Слайд 12

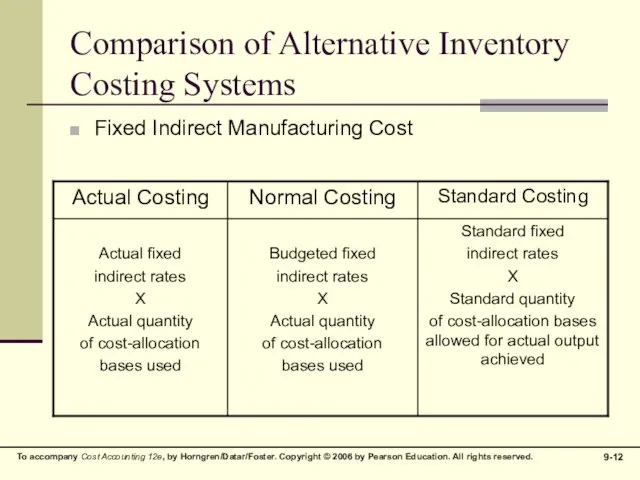

Comparison of Alternative Inventory Costing Systems

Fixed Indirect Manufacturing Cost

Слайд 13

Performance Issues and Absorption Costing

Managers may seek to manipulate income by

producing too many units

Production beyond demand will increase the amount of inventory on hand

This will result in more fixed costs being capitalized as inventory

That will leave a smaller amount of fixed costs to be expensed during the period

Profit increases, and potentially so does a manager’s bonus

Слайд 14

Inventories and Costing Methods

One way to prevent the unnecessary buildup of

inventory for bonus purposes is to base manager’s bonuses on profit calculated using Variable Costing

Drawback: complicated system of producing two inventory figures – one for external reporting and the other for bonus calculations

Слайд 15

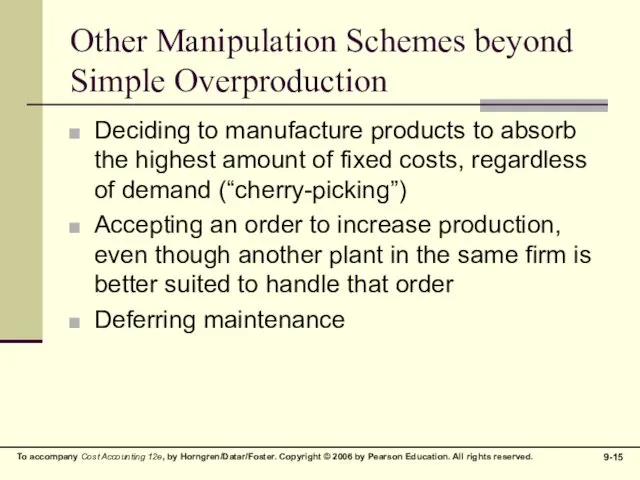

Other Manipulation Schemes beyond Simple Overproduction

Deciding to manufacture products to absorb

the highest amount of fixed costs, regardless of demand (“cherry-picking”)

Accepting an order to increase production, even though another plant in the same firm is better suited to handle that order

Deferring maintenance

Слайд 16

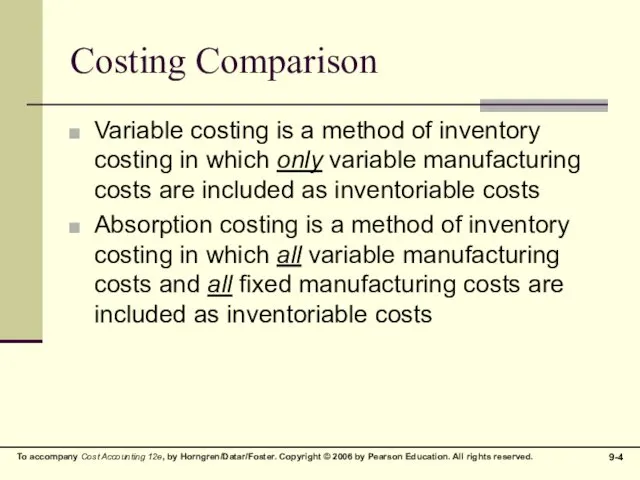

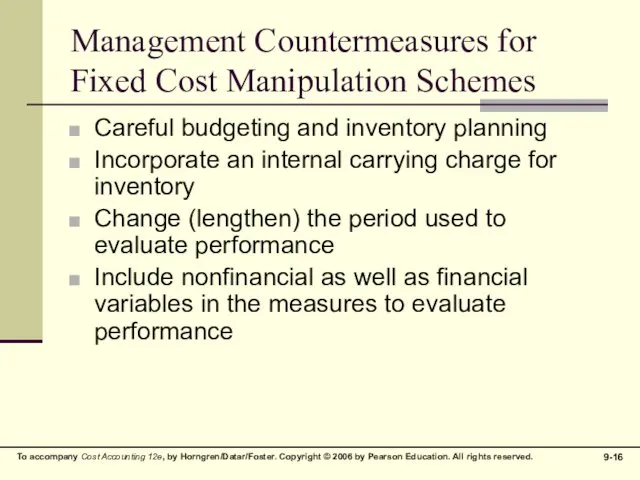

Management Countermeasures for Fixed Cost Manipulation Schemes

Careful budgeting and inventory planning

Incorporate

an internal carrying charge for inventory

Change (lengthen) the period used to evaluate performance

Include nonfinancial as well as financial variables in the measures to evaluate performance

Международные тарифы, скидки, льготы

Международные тарифы, скидки, льготы Управление государственными и муниципальными закупками в системе образования

Управление государственными и муниципальными закупками в системе образования Межправительственная рабочая группа экспертов по международным стандартам учета и отчетности ( МСУО). Налоговые органы

Межправительственная рабочая группа экспертов по международным стандартам учета и отчетности ( МСУО). Налоговые органы Ценовая политика, как объект финансового менеджмента

Ценовая политика, как объект финансового менеджмента Бумажные деньги. Фиатные деньги. Электронные деньги

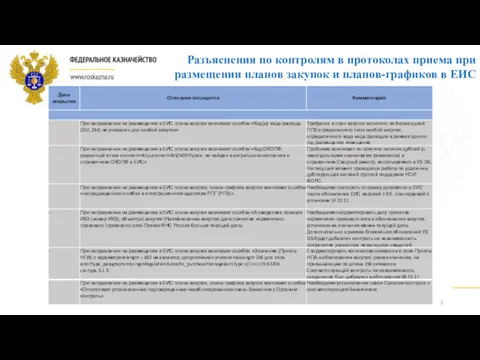

Бумажные деньги. Фиатные деньги. Электронные деньги Разъяснения по контролям в протоколах приема при размещении планов закупок и планов-графиков в ЕИС

Разъяснения по контролям в протоколах приема при размещении планов закупок и планов-графиков в ЕИС Урок финансовой грамотности. Слитки

Урок финансовой грамотности. Слитки Налог на доходы физических лиц

Налог на доходы физических лиц Расчет пенсии

Расчет пенсии Шесть предложений по финансированию

Шесть предложений по финансированию Распределительно-уравнительная система формирования пенсии

Распределительно-уравнительная система формирования пенсии Страховое общество Ресо-гарантия Краснодар • 2020

Страховое общество Ресо-гарантия Краснодар • 2020 Банк жүйесі

Банк жүйесі Основы правового регулирования иностранных инвестиций

Основы правового регулирования иностранных инвестиций Построение систем управления на базе ERP-технологий. Управление бизнес-процессами: бюджетирование, контроллинг. (Лекция 8)

Построение систем управления на базе ERP-технологий. Управление бизнес-процессами: бюджетирование, контроллинг. (Лекция 8) Оценка эффективности инвестиционного проекта по созданию LBS приложения

Оценка эффективности инвестиционного проекта по созданию LBS приложения Лекция № 2

Лекция № 2 Правила призначення стипендій у Кременецькому медичному училищі

Правила призначення стипендій у Кременецькому медичному училищі Сутність інвестиційного менеджменту. (Тема 1)

Сутність інвестиційного менеджменту. (Тема 1) Налог на имущество физических лиц

Налог на имущество физических лиц Оценка финансового состояния организации. Тема 8

Оценка финансового состояния организации. Тема 8 Создание сведений об операциях с целевыми средствами в ГИИС ЭБ ПУР (КС)

Создание сведений об операциях с целевыми средствами в ГИИС ЭБ ПУР (КС) Расчет критической точки безубыточности и запаса финансовой прочности

Расчет критической точки безубыточности и запаса финансовой прочности Бухгалтерский учет образовательных услуг

Бухгалтерский учет образовательных услуг Soliq ma’murchiligi

Soliq ma’murchiligi Управление коммерческими банками

Управление коммерческими банками Консультант в сфере финансового планирования жизни

Консультант в сфере финансового планирования жизни Обязательное пенсионное страхование ОАО НПФ РГС

Обязательное пенсионное страхование ОАО НПФ РГС