Содержание

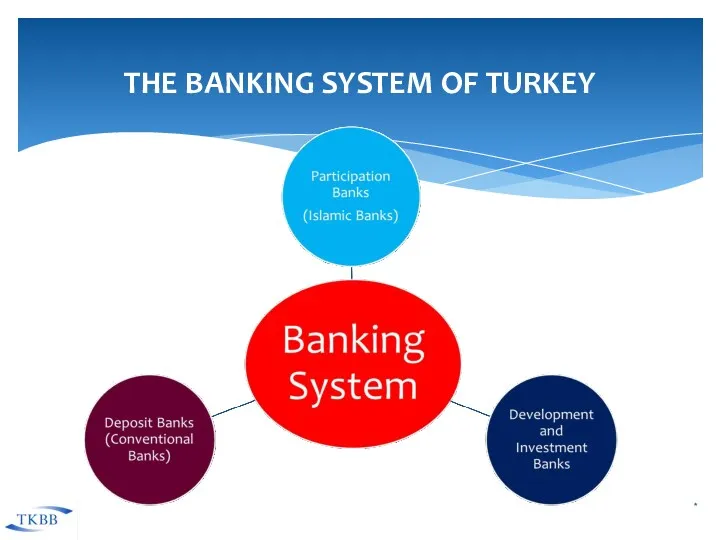

- 2. * THE BANKING SYSTEM OF TURKEY

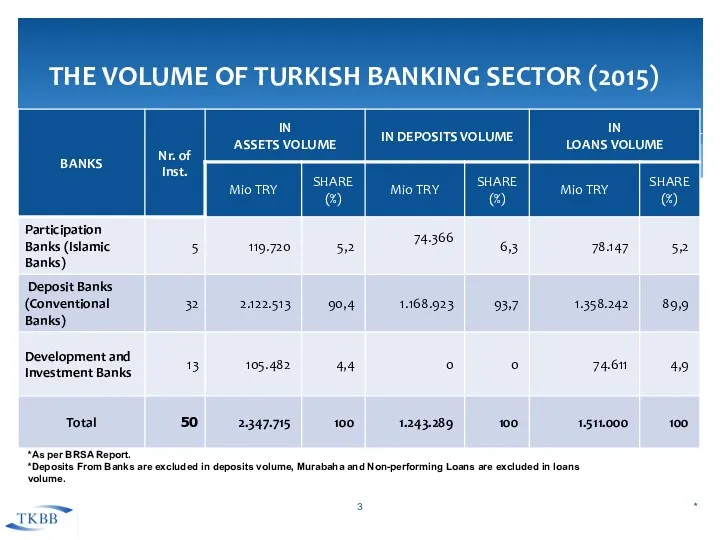

- 3. THE VOLUME OF TURKISH BANKING SECTOR (2015) * *As per BRSA Report. *Deposits From Banks are

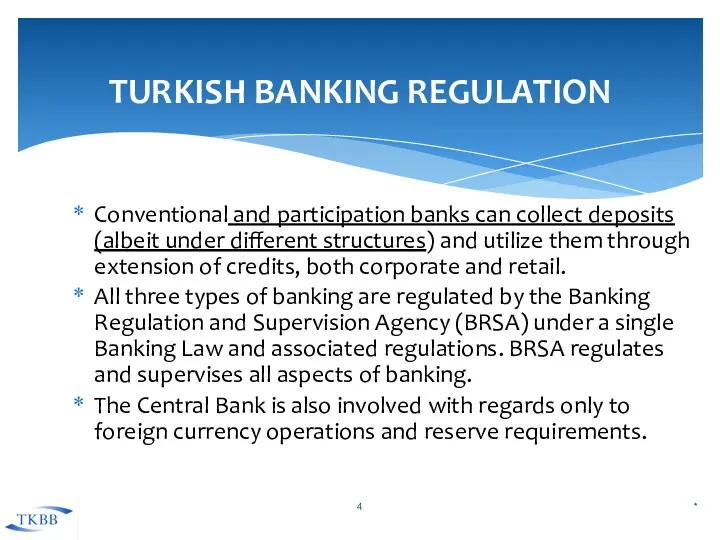

- 4. Conventional and participation banks can collect deposits (albeit under different structures) and utilize them through extension

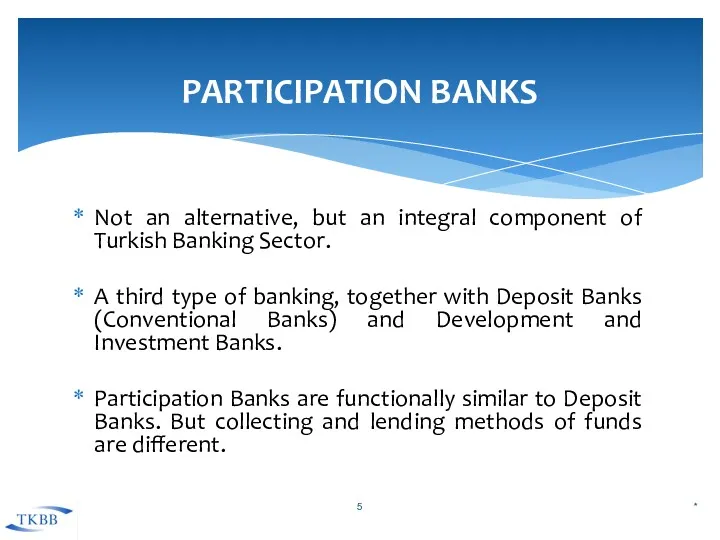

- 5. Not an alternative, but an integral component of Turkish Banking Sector. A third type of banking,

- 6. INTEREST-FREE BANKİNG REGULATORY ENVİRONMENT There is no separate regulation regarding participation banking. The law however distinguishes

- 7. SPECIAL CURRENT ACCOUNTS (DEMAND ACCOUNTS): - drawn partially or completely at any call. - earnings unpaid,

- 8. CORPORATE FINANCE SUPPORT : - financing the purchase of goods and service required by the Customer,

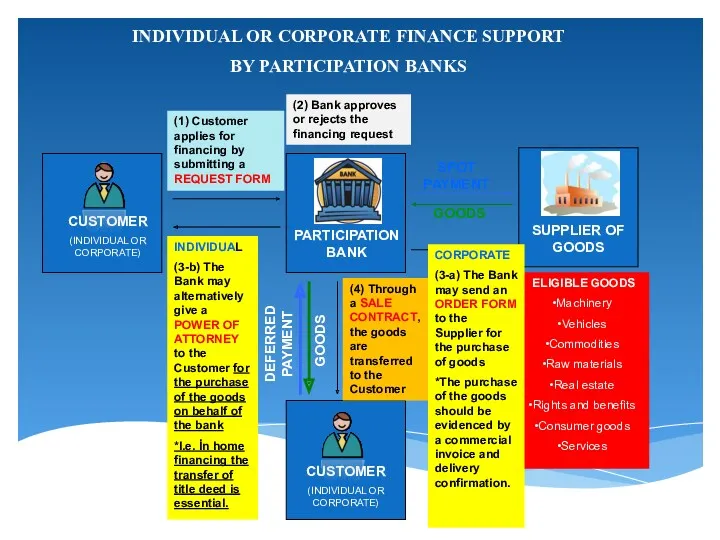

- 9. CUSTOMER (INDIVIDUAL OR CORPORATE) PARTICIPATION BANK SUPPLIER OF GOODS ELIGIBLE GOODS Machinery Vehicles Commodities Raw materials

- 10. LEASING : - movable/immovable goods are purchased by PBs, - purchased goods are hired to the

- 11. ASSETS GROWTH FUNDS RAISED GROWTH ALLOCATED FUNDS GROWTH ALLOCATED FUNDS / RAISED FUNDS RATIO SHAREHOLDERS’ EQUITY

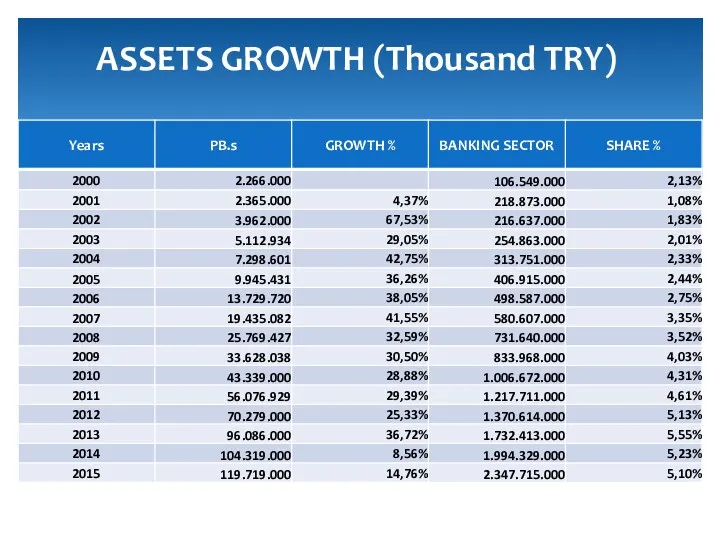

- 12. ASSETS GROWTH (Thousand TRY)

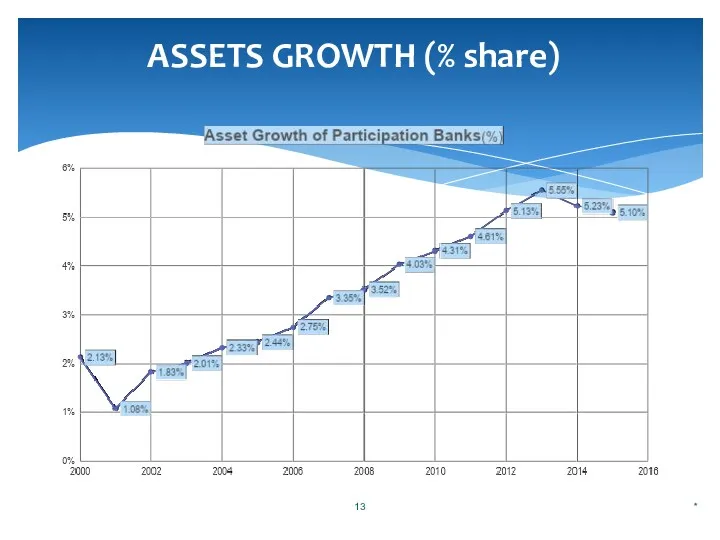

- 13. ASSETS GROWTH (% share) *

- 14. RAISED FUNDS (Thousand TRY)

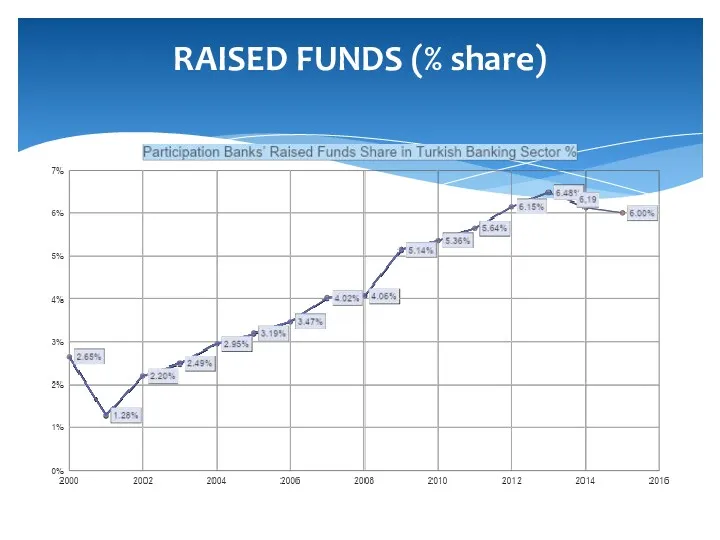

- 15. RAISED FUNDS (% share)

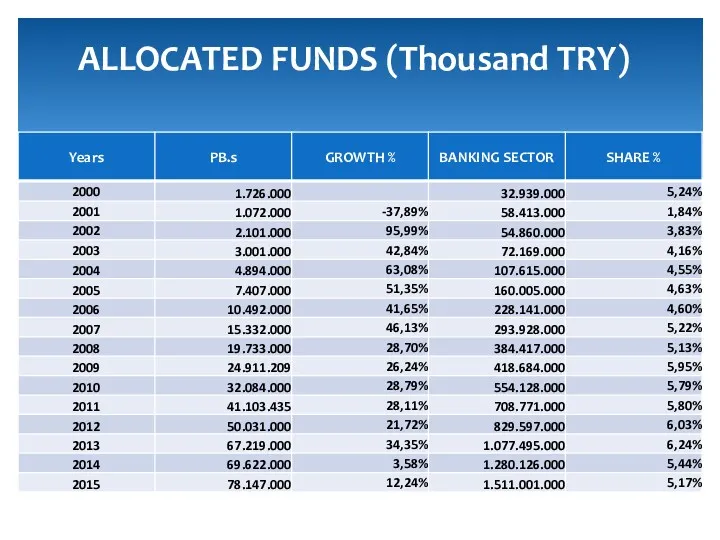

- 16. ALLOCATED FUNDS (Thousand TRY)

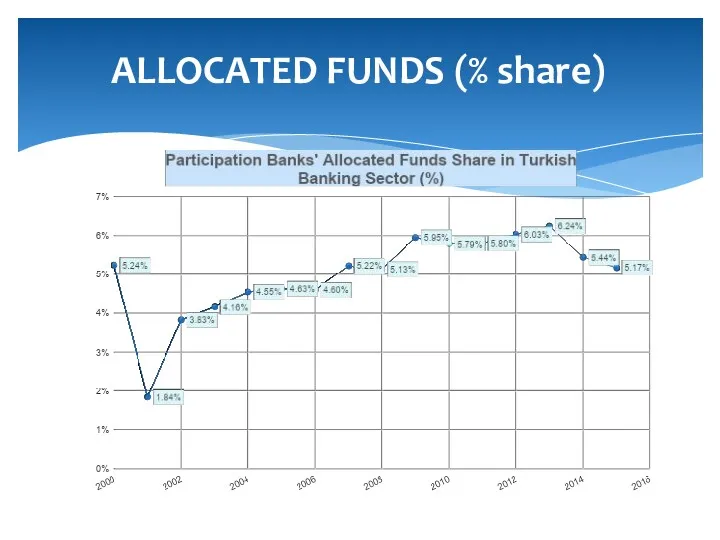

- 17. ALLOCATED FUNDS (% share)

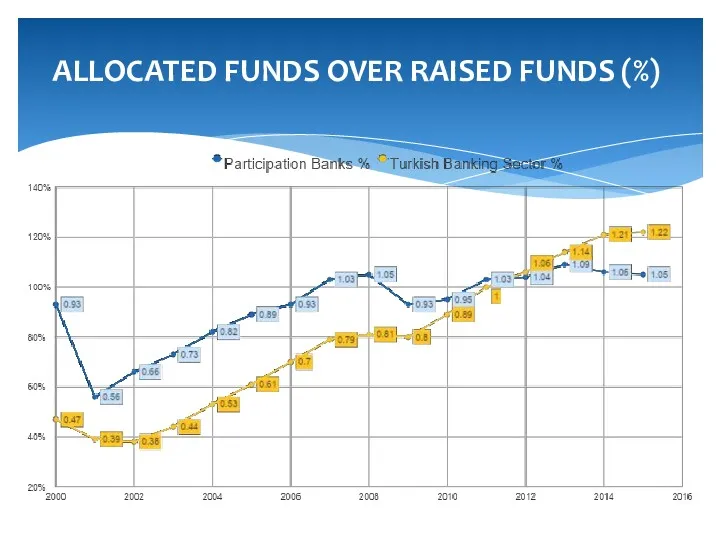

- 18. ALLOCATED FUNDS OVER RAISED FUNDS (%)

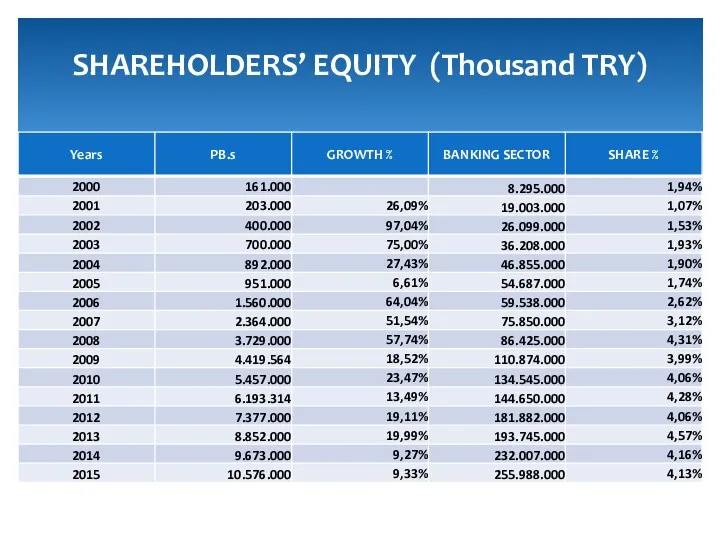

- 19. SHAREHOLDERS’ EQUITY (Thousand TRY)

- 20. SHAREHOLDERS’ EQUITY (% share)

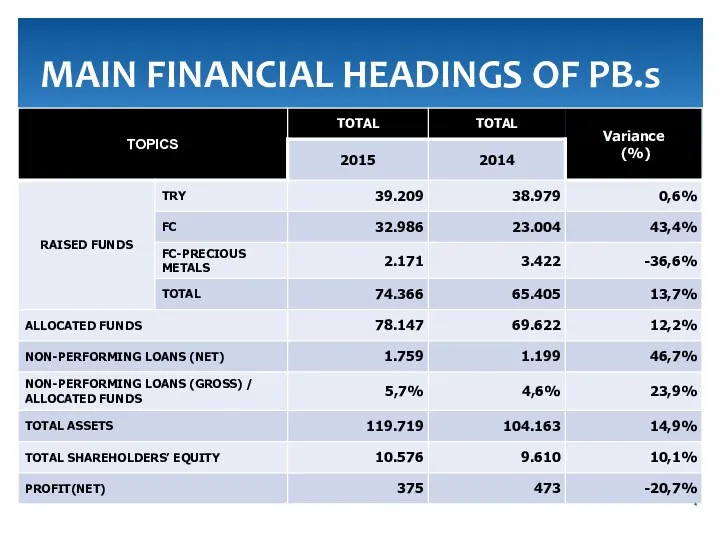

- 21. * MAIN FINANCIAL HEADINGS OF PB.s

- 22. BRANCHES AND STAFF GROWTH

- 23. 1-PARTICIPATION BANKS, a component of the banking system in Turkey, have brought the idle funds into

- 24. 6-Regular state auditings have greatly helped in developing the participation banks’ working principles. 7-Because PBs do

- 25. 9-In addition, PBs have taken a serious role in murabaha financing gathered from the Gulf region

- 26. Although nearly %50 of funds were drawn by depositors after the economic crises in 2000 and

- 27. -Also, this method eases controlling over the credits and customers. -The policy of lending loans in

- 29. Скачать презентацию

Проект бюджета муниципального образования городской округ город Котельнич Кировской области на 2019 год

Проект бюджета муниципального образования городской округ город Котельнич Кировской области на 2019 год Валютный рынок и валютные операции

Валютный рынок и валютные операции По вопросу реализации транспортной субсидии

По вопросу реализации транспортной субсидии Оффшорные компании и оффшорные зоны

Оффшорные компании и оффшорные зоны Отчет Ордабасинского филиала

Отчет Ордабасинского филиала Оформление онлайн-займов

Оформление онлайн-займов Порядок расчетов с работниками организации за неотработанное время на материалах организации

Порядок расчетов с работниками организации за неотработанное время на материалах организации Тема 4: Основы организации и регулирования международного инвестиционного сотрудничества

Тема 4: Основы организации и регулирования международного инвестиционного сотрудничества Отчет о работе фонда социальной поддержки населения города Урень (РАСТЕМ ВМЕСТЕ)

Отчет о работе фонда социальной поддержки населения города Урень (РАСТЕМ ВМЕСТЕ) Санкционирование расходов бюджетного учреждения. Тема 11

Санкционирование расходов бюджетного учреждения. Тема 11 Страховые взносы – 2018

Страховые взносы – 2018 Оценка рыночной стоимости недвижимости при вступлении в права наследования

Оценка рыночной стоимости недвижимости при вступлении в права наследования Аналіз фінансового стану малого бізнесу

Аналіз фінансового стану малого бізнесу сопутствующие услуги

сопутствующие услуги Облік грошових коштів. Тема. Облік касових операцій

Облік грошових коштів. Тема. Облік касових операцій Проблемы России

Проблемы России Заработная плата и факторы, влияющие на ее размер

Заработная плата и факторы, влияющие на ее размер Инвентаризация имущества и финансовых обязательств

Инвентаризация имущества и финансовых обязательств Финансовые функции Excel

Финансовые функции Excel Государственные (общегосударственные) финансы

Государственные (общегосударственные) финансы Обязательное применение единого налогового платежа (ЕНП) с 2023 года

Обязательное применение единого налогового платежа (ЕНП) с 2023 года Корпоративні фінанси. Фінансові та реальні інвестиціі корпоративних підприємств. (Тема 7)

Корпоративні фінанси. Фінансові та реальні інвестиціі корпоративних підприємств. (Тема 7) Виды и структура доходов бюджетов, их классификация и учет в процессе исполнения бюджетов

Виды и структура доходов бюджетов, их классификация и учет в процессе исполнения бюджетов Сутність перестрахування та його класифікація

Сутність перестрахування та його класифікація Роль и политика национального банка Республики Беларусь в процессе внедрения в банковскую практику МСФО

Роль и политика национального банка Республики Беларусь в процессе внедрения в банковскую практику МСФО Экономика семьи. 7 класс

Экономика семьи. 7 класс Бюджетные правонарушения

Бюджетные правонарушения Система национальных счетов (СНС) и принципы ее

Система национальных счетов (СНС) и принципы ее