Содержание

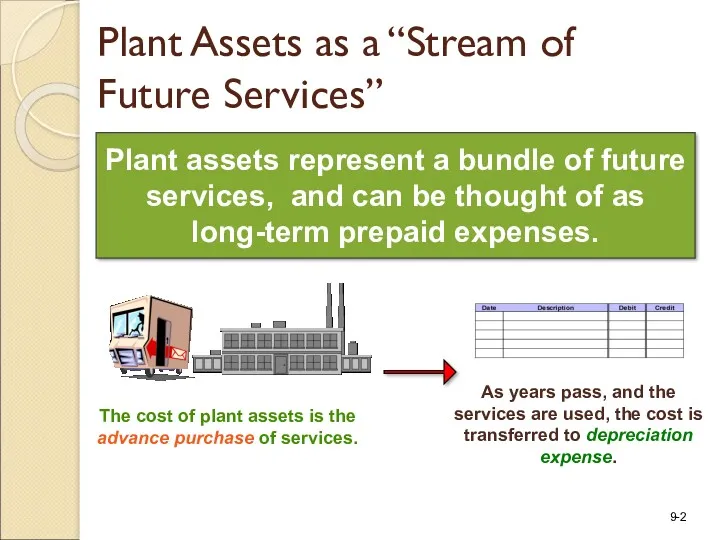

- 2. Plant assets represent a bundle of future services, and can be thought of as long-term prepaid

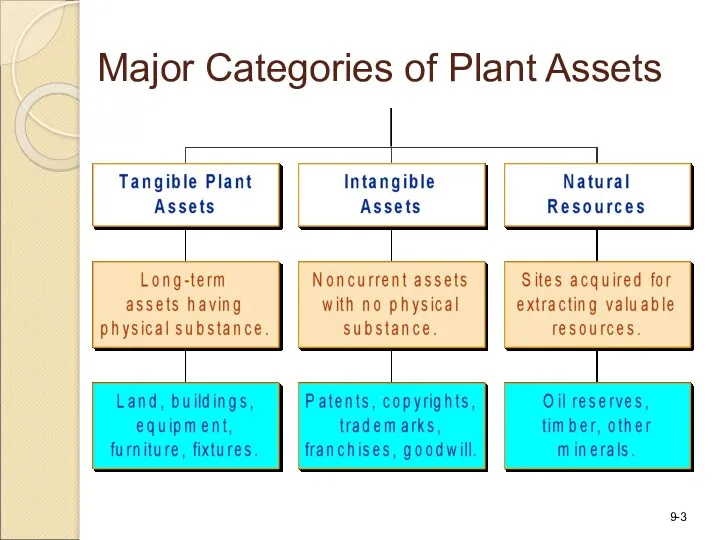

- 3. Major Categories of Plant Assets

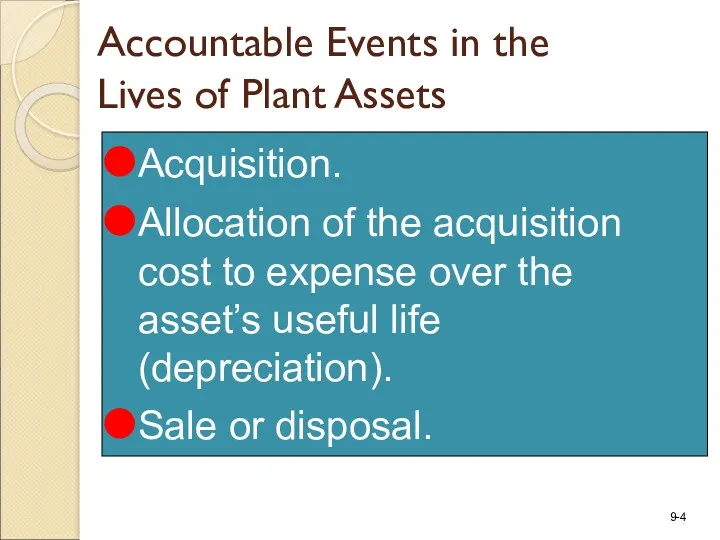

- 4. Accountable Events in the Lives of Plant Assets Acquisition. Allocation of the acquisition cost to expense

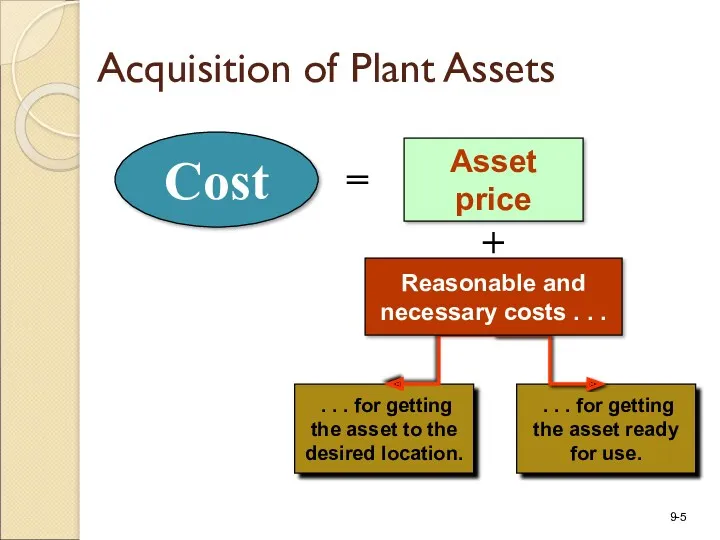

- 5. Asset price . . . for getting the asset to the desired location. . . .

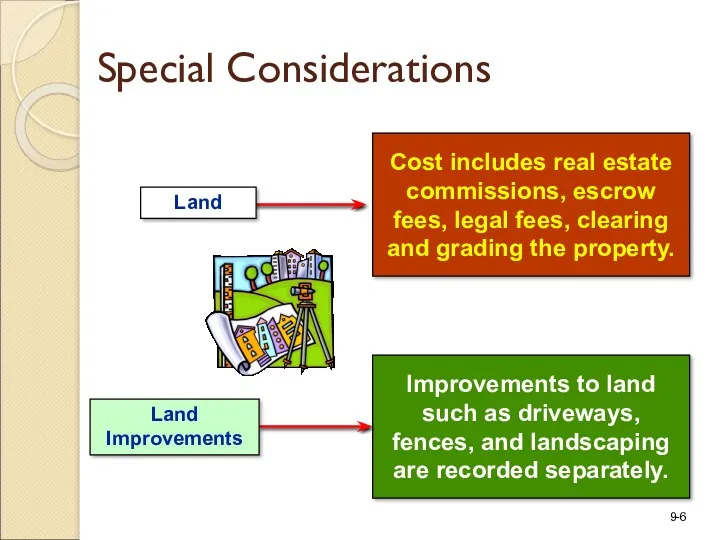

- 6. Improvements to land such as driveways, fences, and landscaping are recorded separately. Cost includes real estate

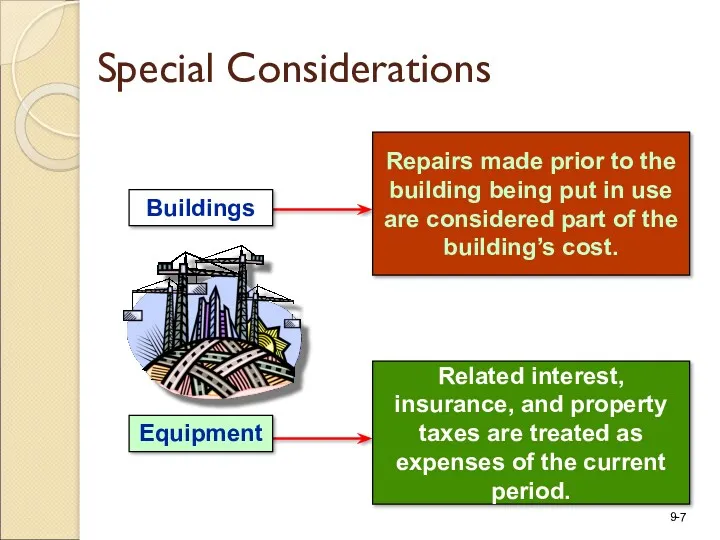

- 7. Repairs made prior to the building being put in use are considered part of the building’s

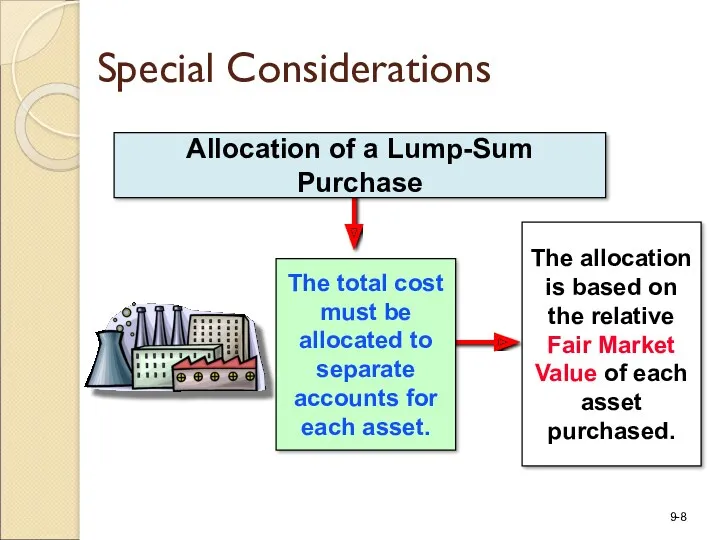

- 8. Special Considerations The allocation is based on the relative Fair Market Value of each asset purchased.

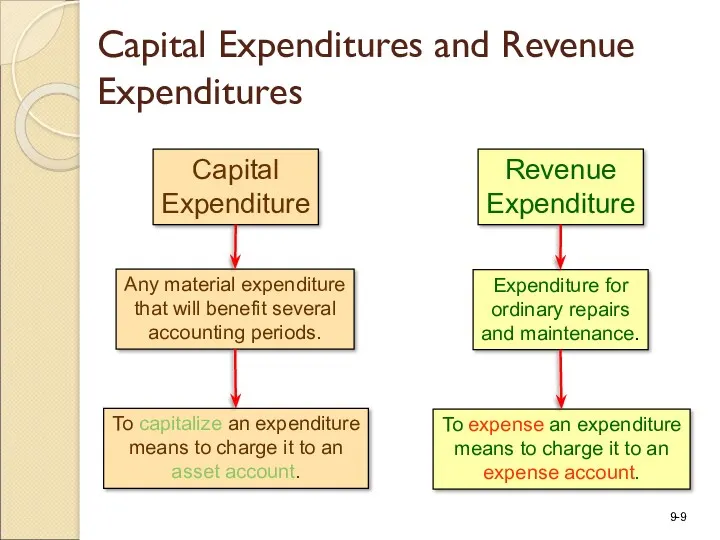

- 9. Capital Expenditure Revenue Expenditure Any material expenditure that will benefit several accounting periods. To capitalize an

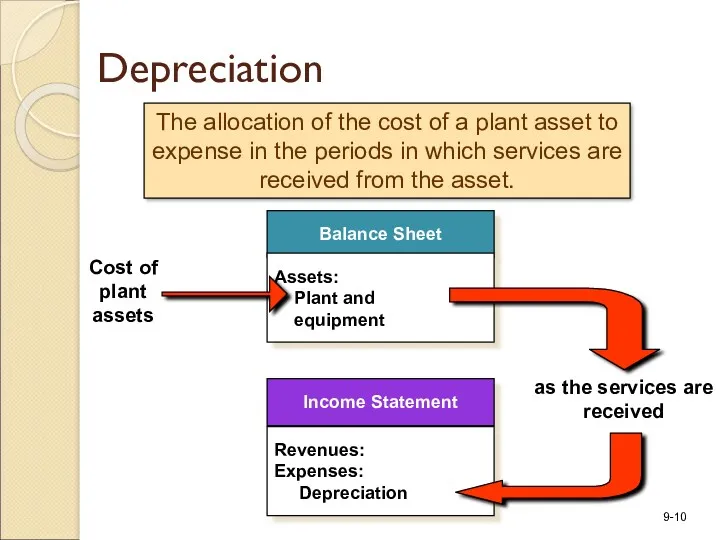

- 10. The allocation of the cost of a plant asset to expense in the periods in which

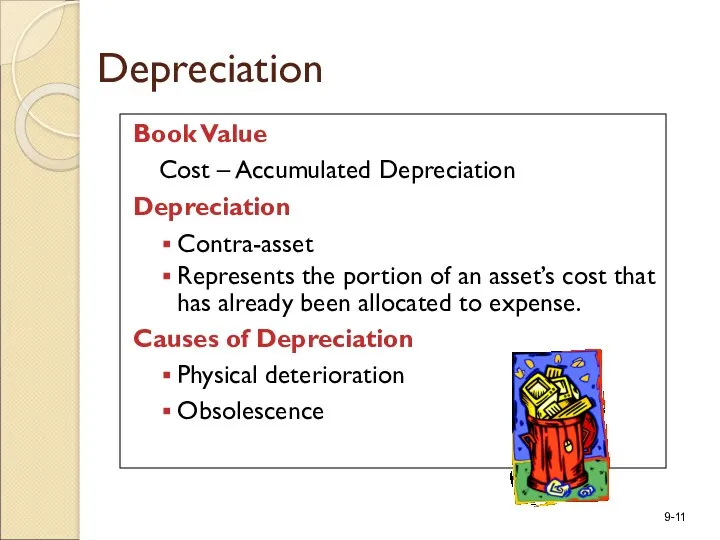

- 11. Depreciation Book Value Cost – Accumulated Depreciation Depreciation Contra-asset Represents the portion of an asset’s cost

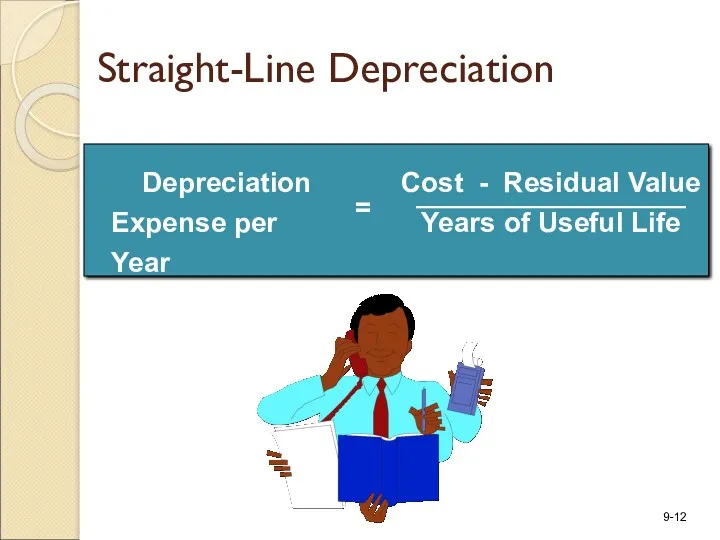

- 12. Straight-Line Depreciation

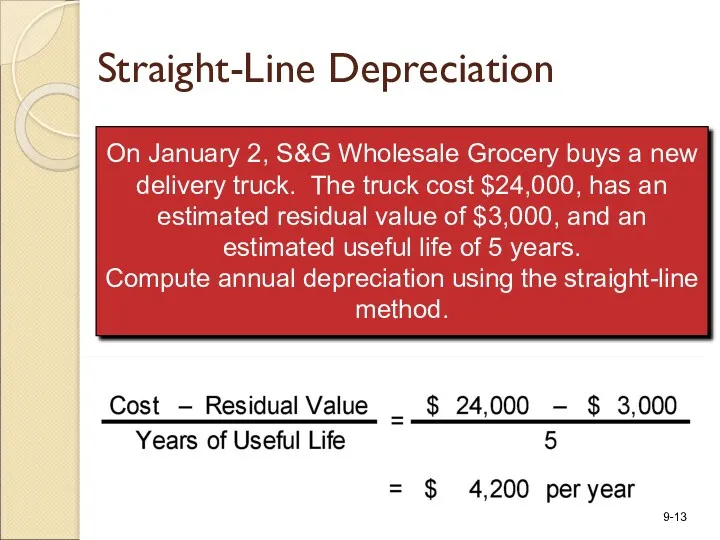

- 13. On January 2, S&G Wholesale Grocery buys a new delivery truck. The truck cost $24,000, has

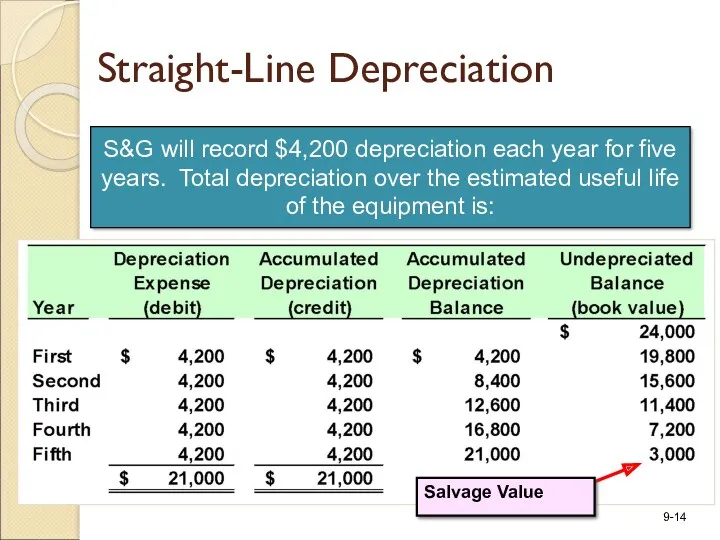

- 14. S&G will record $4,200 depreciation each year for five years. Total depreciation over the estimated useful

- 15. When an asset is acquired during the year, depreciation in the year of acquisition must be

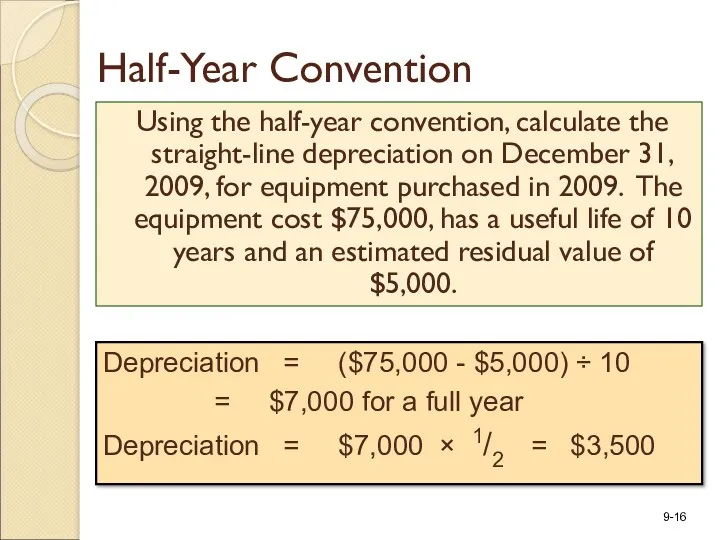

- 16. Half-Year Convention Using the half-year convention, calculate the straight-line depreciation on December 31, 2009, for equipment

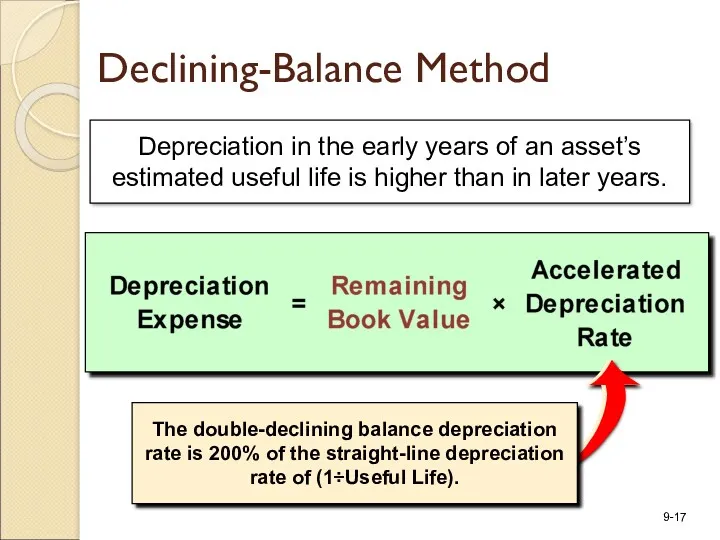

- 17. Depreciation in the early years of an asset’s estimated useful life is higher than in later

- 18. On January 2, S&G buys a new delivery truck paying $24,000 cash. The truck has an

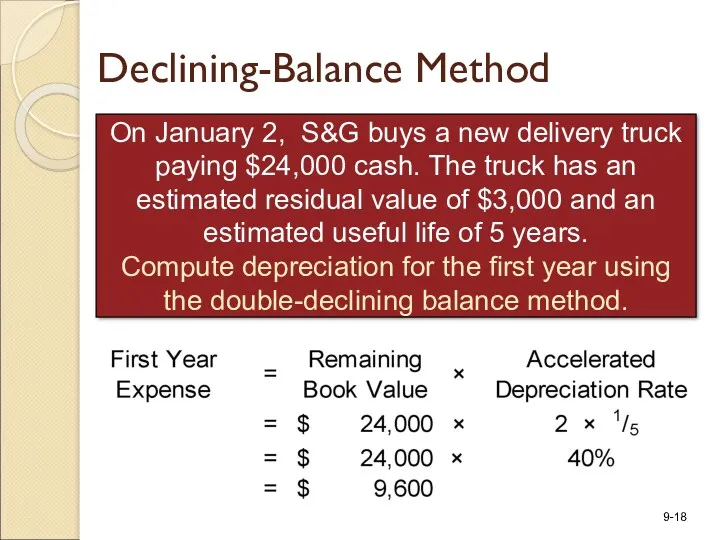

- 19. Compute depreciation for the rest of the truck’s estimated useful life. Declining-Balance Method Total depreciation over

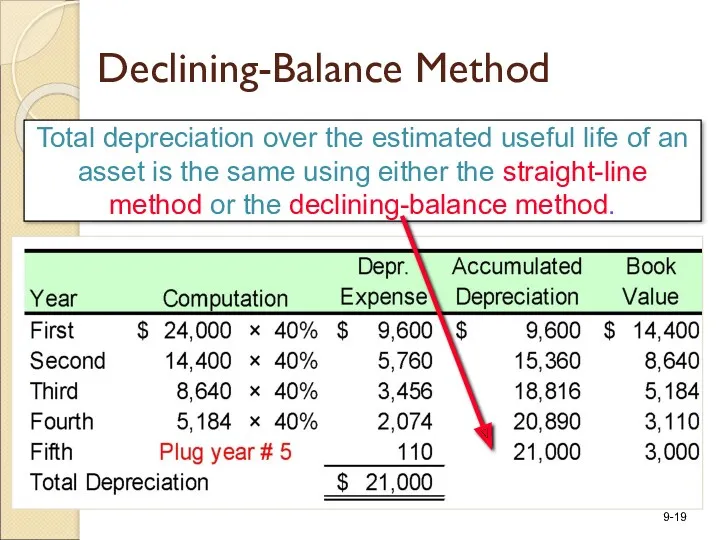

- 20. Financial Statement Disclosures Estimates of Useful Life and Residual Value May differ from company to company.

- 21. So depreciation is an estimate. Predicted salvage value Revising Depreciation Rates Over the life of an

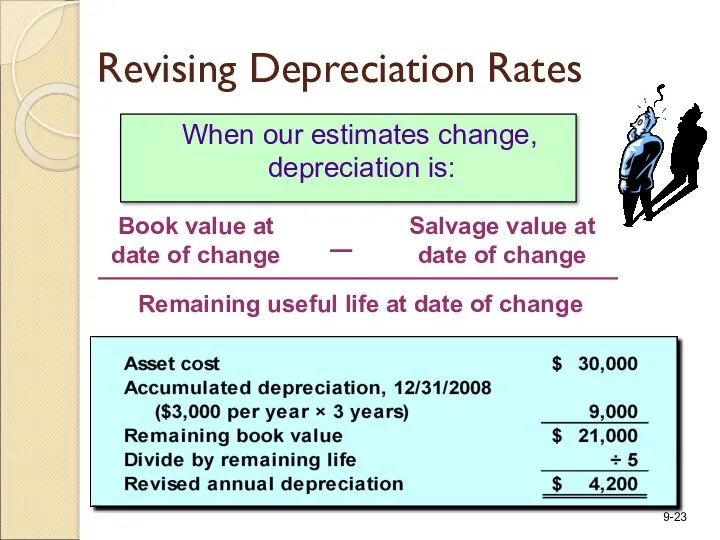

- 22. Revising Depreciation Rates On January 1, 2006, equipment was purchased that cost $30,000, has a useful

- 23. When our estimates change, depreciation is: Revising Depreciation Rates

- 24. If the cost of an asset cannot be recovered through future use or sale, the asset

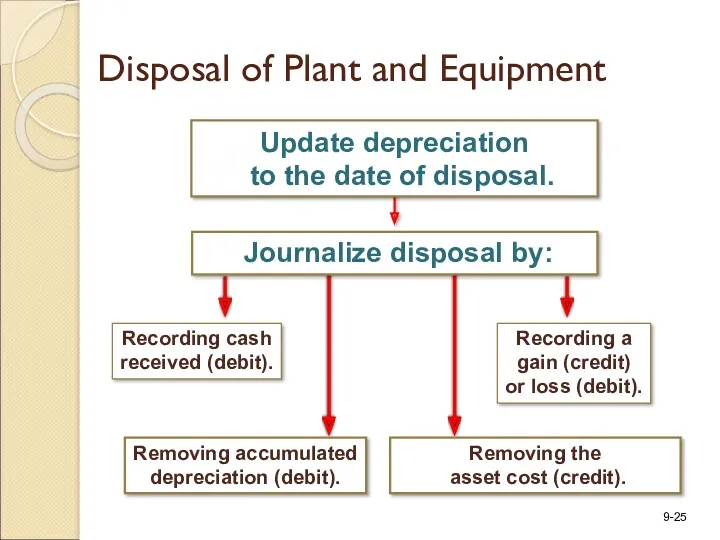

- 25. Update depreciation to the date of disposal. Recording cash received (debit). Removing accumulated depreciation (debit). Removing

- 26. If Cash > BV, record a gain (credit). If Cash If Cash = BV, no gain

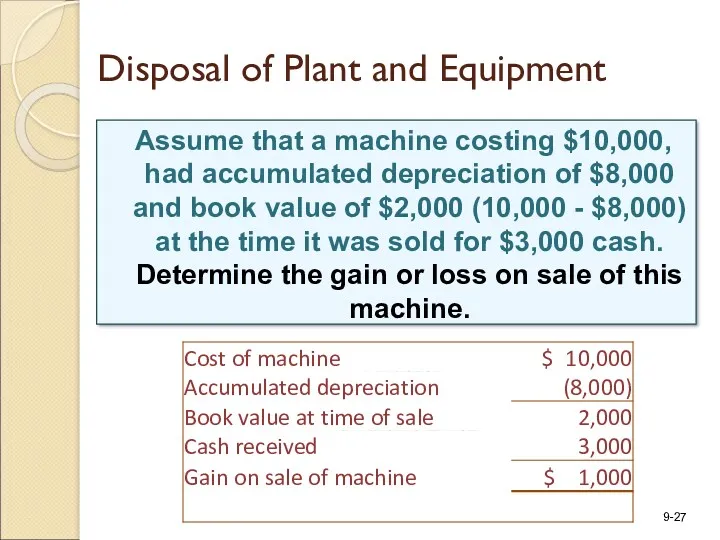

- 27. Assume that a machine costing $10,000, had accumulated depreciation of $8,000 and book value of $2,000

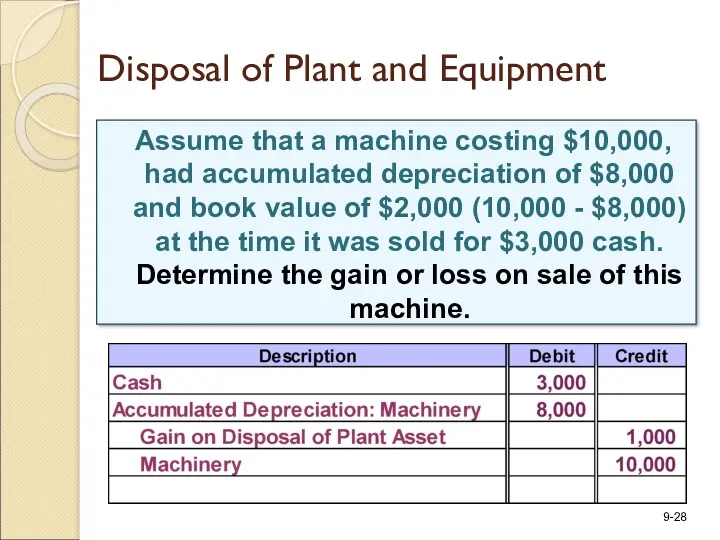

- 28. Disposal of Plant and Equipment Assume that a machine costing $10,000, had accumulated depreciation of $8,000

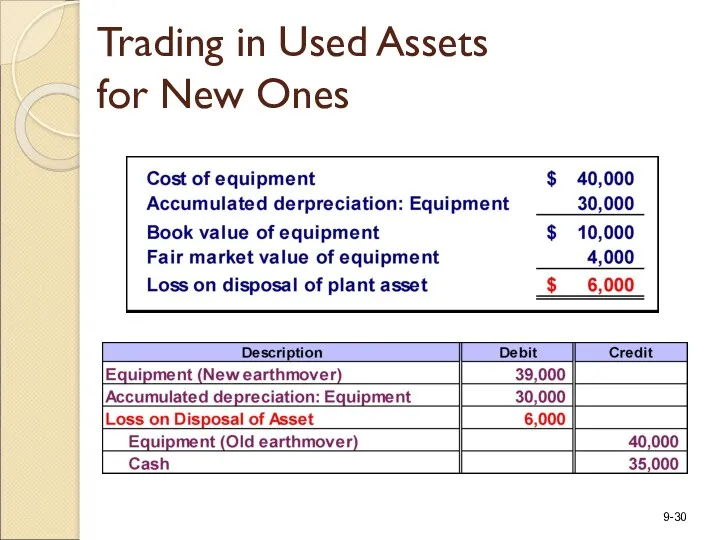

- 29. Assume that Essex Company exchanges a used earthmover and $35,000 cash for a new earthmoving machine.

- 30. Trading in Used Assets for New Ones

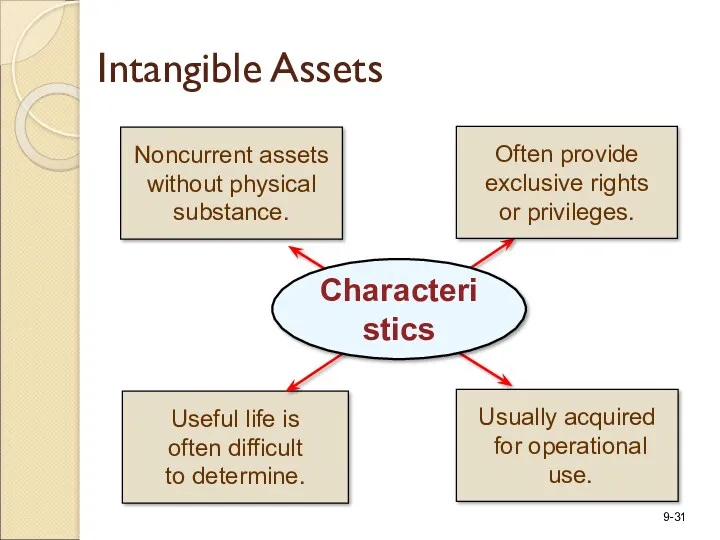

- 31. Noncurrent assets without physical substance. Useful life is often difficult to determine. Usually acquired for operational

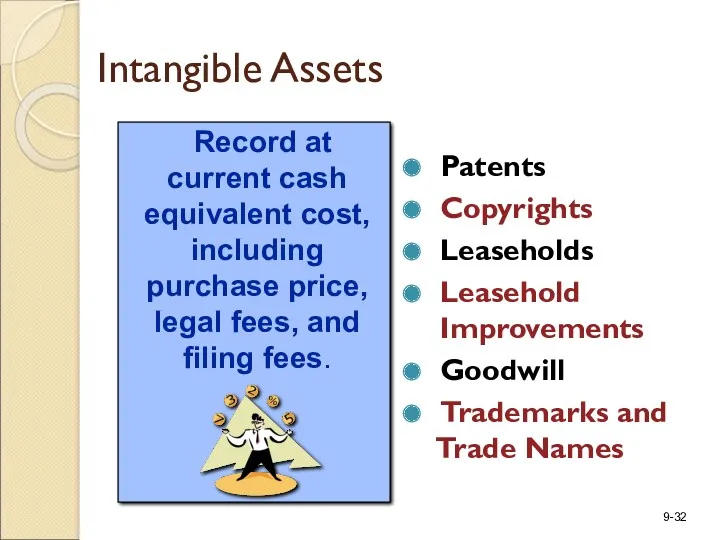

- 32. Intangible Assets Patents Copyrights Leaseholds Leasehold Improvements Goodwill Trademarks and Trade Names Record at current cash

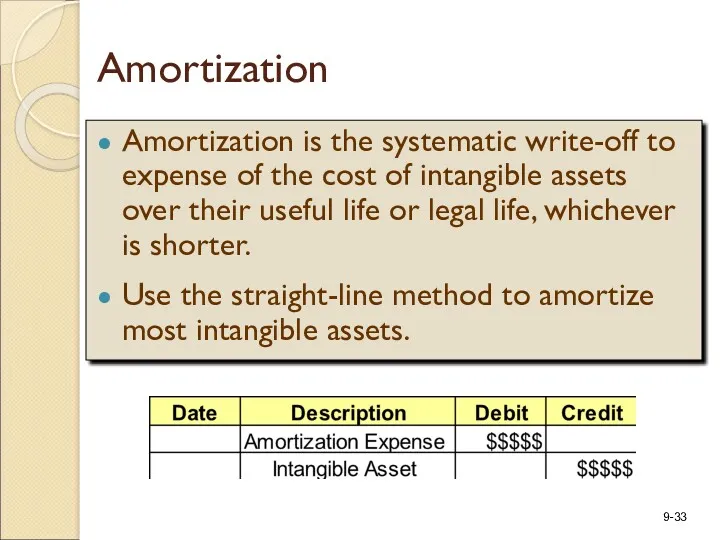

- 33. Amortization Amortization is the systematic write-off to expense of the cost of intangible assets over their

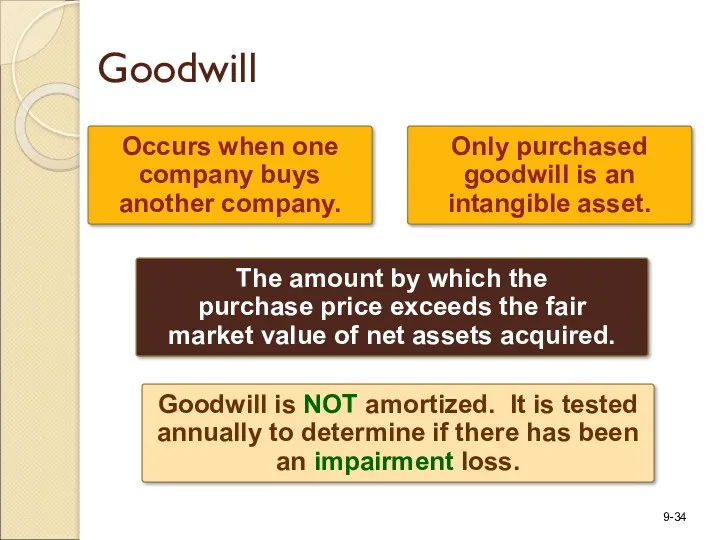

- 34. The amount by which the purchase price exceeds the fair market value of net assets acquired.

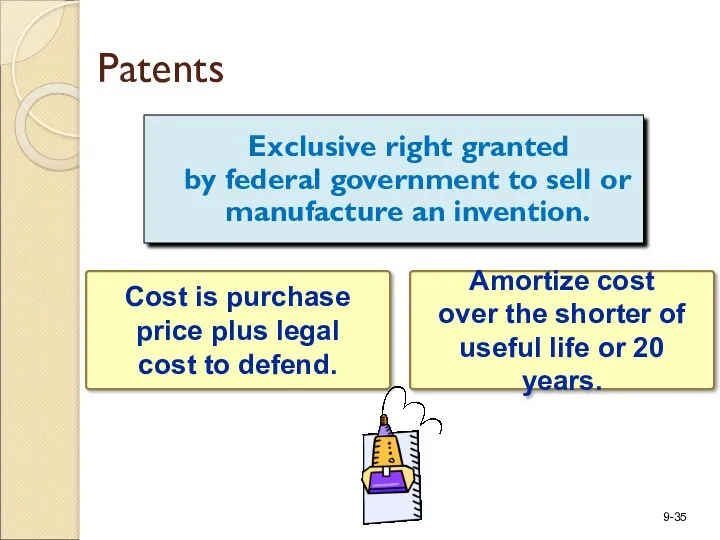

- 35. Patents Exclusive right granted by federal government to sell or manufacture an invention.

- 36. Trademarks and Trade Names A symbol, design, or logo associated with a business.

- 37. Franchises Legally protected right to sell products or provide services purchased by franchisee from franchisor. Purchase

- 38. Copyrights Exclusive right granted by the federal government to protect artistic or intellectual properties. Amortize cost

- 39. Research and Development Costs All expenditures classified as research and development should be charged to expense

- 40. Total cost, including exploration and development, is charged to depletion expense over periods benefited. Examples: oil,

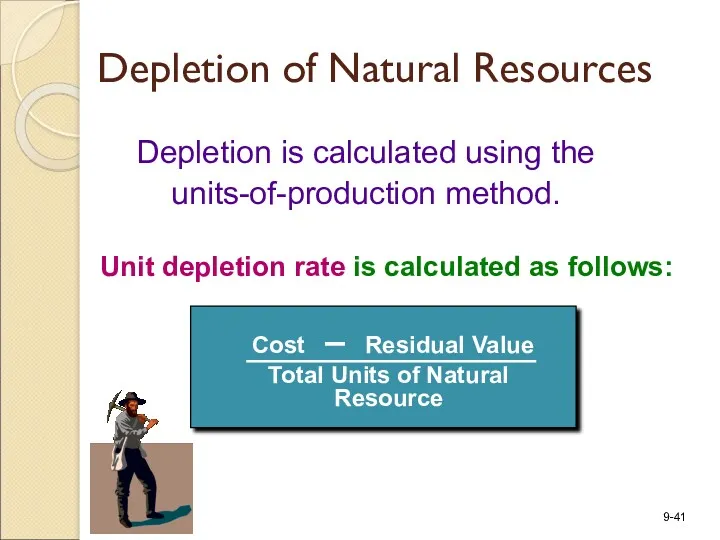

- 41. Depletion is calculated using the units-of-production method. Unit depletion rate is calculated as follows: Depletion of

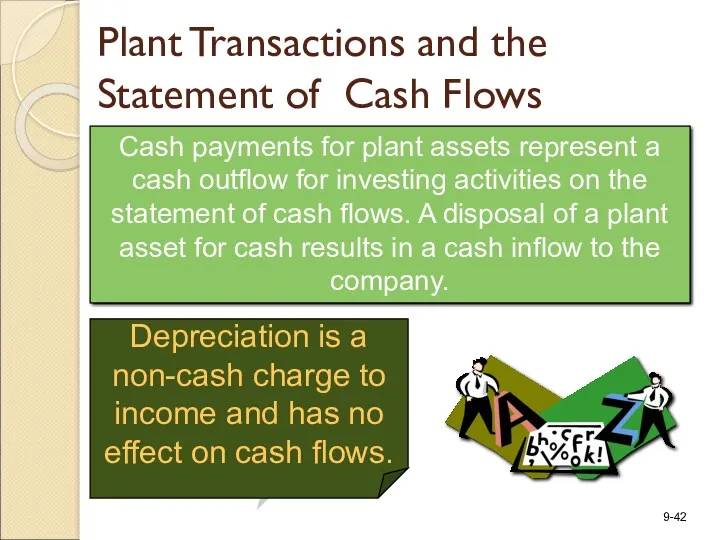

- 42. Plant Transactions and the Statement of Cash Flows Cash payments for plant assets represent a cash

- 44. Скачать презентацию

Анализ платежеспособности и финансовой устойчивости предприятия и пути их повышения

Анализ платежеспособности и финансовой устойчивости предприятия и пути их повышения Налоги. Кодификатор

Налоги. Кодификатор Ордера Market / Limit / Stop

Ордера Market / Limit / Stop Денежная система и денежное обращение

Денежная система и денежное обращение Зарплатная карта Твой плюс

Зарплатная карта Твой плюс Какие денежные средства в банке являются застахованными

Какие денежные средства в банке являются застахованными Внебюджетные фонды

Внебюджетные фонды Краевая программа поддержки молодых специалистов

Краевая программа поддержки молодых специалистов Қаржылық жоспарлау және болжау, оның мәні мен рөлі

Қаржылық жоспарлау және болжау, оның мәні мен рөлі Построение сети GPON в посёлке Новое Доскино

Построение сети GPON в посёлке Новое Доскино Кредиты и займы

Кредиты и займы Зарубежный опыт социального страхования

Зарубежный опыт социального страхования Принудительное исполнение налоговой обязанности

Принудительное исполнение налоговой обязанности Медицинское страхование как форма социальной защиты населения в области охраны здоровья

Медицинское страхование как форма социальной защиты населения в области охраны здоровья Страховые формальности. Страхование в туризме. Виды страховых программ

Страховые формальности. Страхование в туризме. Виды страховых программ Спрос на деньги (классическая и кейнсианская концепции). Модель предложения денег. Равновесие на денежном рынке

Спрос на деньги (классическая и кейнсианская концепции). Модель предложения денег. Равновесие на денежном рынке Система обліку і калькулювання за нормативними витратами (Тема 7)

Система обліку і калькулювання за нормативними витратами (Тема 7) Учет и анализ прибыли и рентабельности и их роль в финансовой устойчивости в ООО Лебяжинское

Учет и анализ прибыли и рентабельности и их роль в финансовой устойчивости в ООО Лебяжинское Совершенствование управления запасами предприятия в условиях повышенных рисков в целях поставок

Совершенствование управления запасами предприятия в условиях повышенных рисков в целях поставок Аудит учредительных документов и учетной политики организации

Аудит учредительных документов и учетной политики организации Учет и анализ расчетов организации с бюджетом и внебюджетными фондами (на примере средней школы №3 г. Мензелинск)

Учет и анализ расчетов организации с бюджетом и внебюджетными фондами (на примере средней школы №3 г. Мензелинск) Жилой Комплекс Окский берег. Государственная программа “Жилье для российской семьи” Нижний Новгород

Жилой Комплекс Окский берег. Государственная программа “Жилье для российской семьи” Нижний Новгород Особенности налогообложения

Особенности налогообложения Доходы и прибыль предприятия. Тема 8

Доходы и прибыль предприятия. Тема 8 Финансовые меры поддержки для СМСП по линии Фонда моногородов

Финансовые меры поддержки для СМСП по линии Фонда моногородов Функциональные возможности ЕИС по формированию сведений о бюджетных обязательствах. Доработки версии 9.3

Функциональные возможности ЕИС по формированию сведений о бюджетных обязательствах. Доработки версии 9.3 Понятие временной нетрудоспособности. Виды пособий по временной нетрудоспособности

Понятие временной нетрудоспособности. Виды пособий по временной нетрудоспособности Государственная экономическая политика. Лекция 5

Государственная экономическая политика. Лекция 5