Содержание

- 2. Basic Assumptions: All cash payments (receipts) Certainty regarding: Amount of cash flows Timing of cash flows

- 3. Basic Concepts: For Accounting almost always Present value. I.e.: Answer the question: Some amount of money

- 4. Basic Concepts I: Time Value of Money: Invested money earns interest (if in bank) or some

- 5. Basic Concepts II: Interest; rate of return; discount rate: For PV analysis they mean the same.

- 6. Present Value vs. Future Value Present value is based on future value, specifically the compound interest

- 7. Basic Future Value Concepts: Invested money earns more money $1,000 today is worth more than $1,000

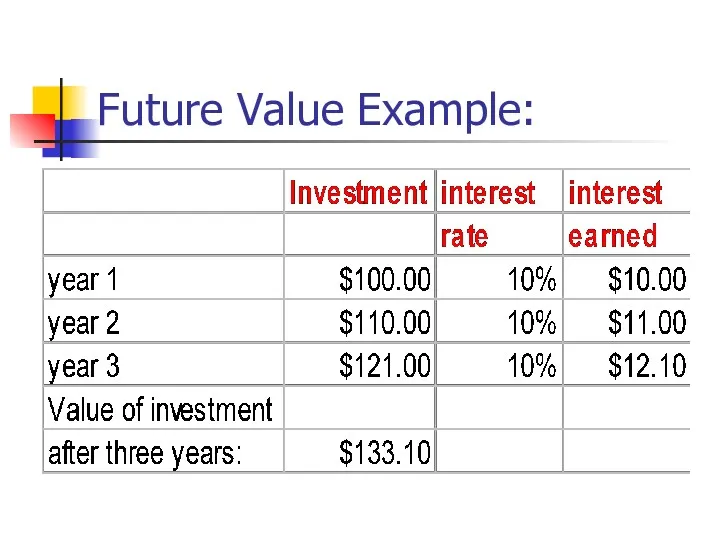

- 8. Future Value Example:

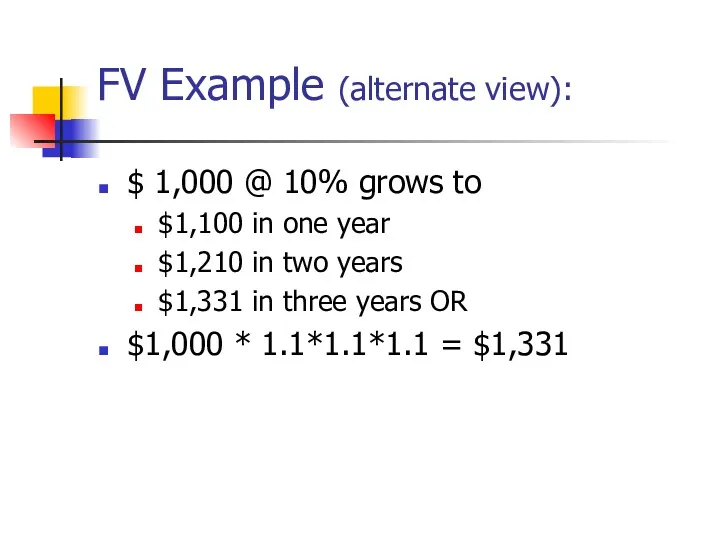

- 9. FV Example (alternate view): $ 1,000 @ 10% grows to $1,100 in one year $1,210 in

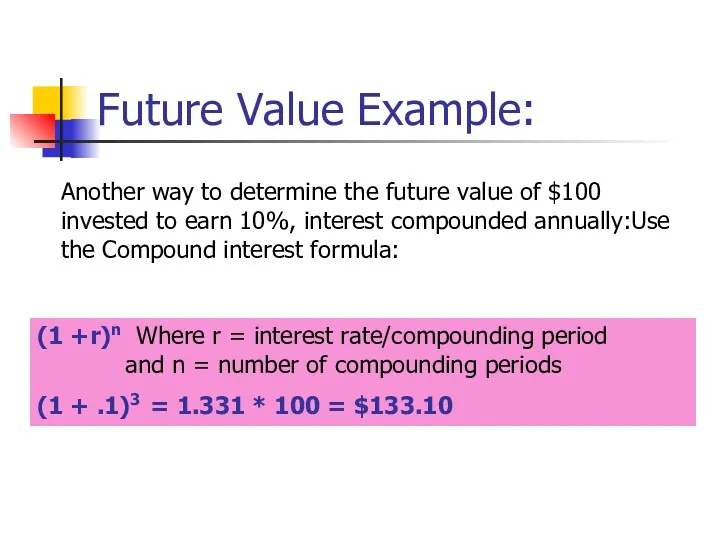

- 10. Future Value Example: Another way to determine the future value of $100 invested to earn 10%,

- 11. Compounding: Number of times per year interest is calculated May be annually, semi-annually, quarterly, etc. However:

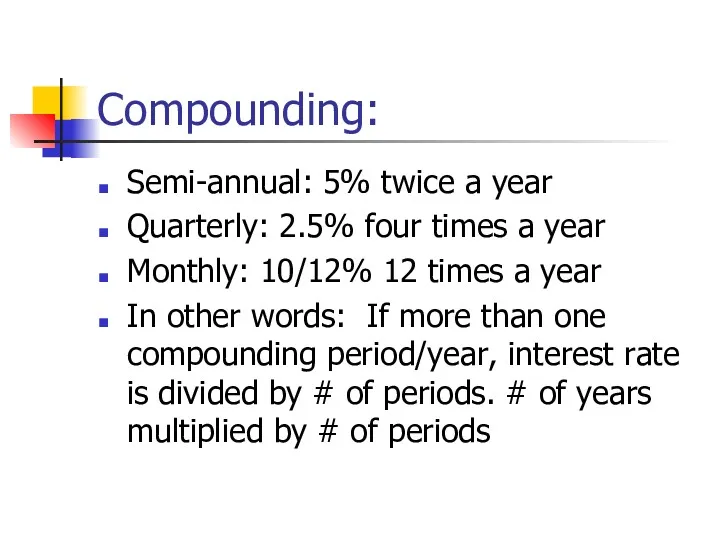

- 12. Compounding: Semi-annual: 5% twice a year Quarterly: 2.5% four times a year Monthly: 10/12% 12 times

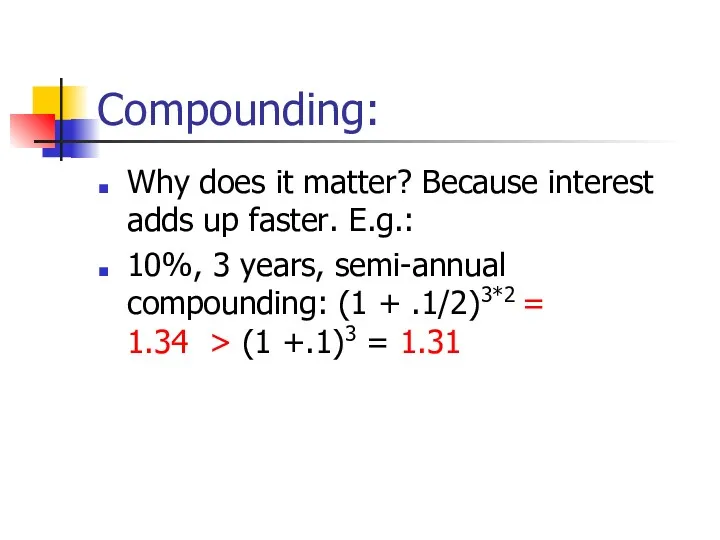

- 13. Compounding: Why does it matter? Because interest adds up faster. E.g.: 10%, 3 years, semi-annual compounding:

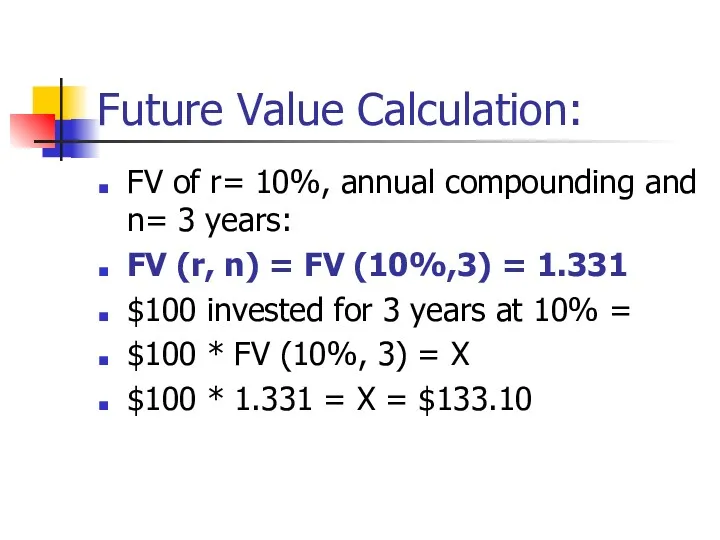

- 14. Future Value Calculation: FV of r= 10%, annual compounding and n= 3 years: FV (r, n)

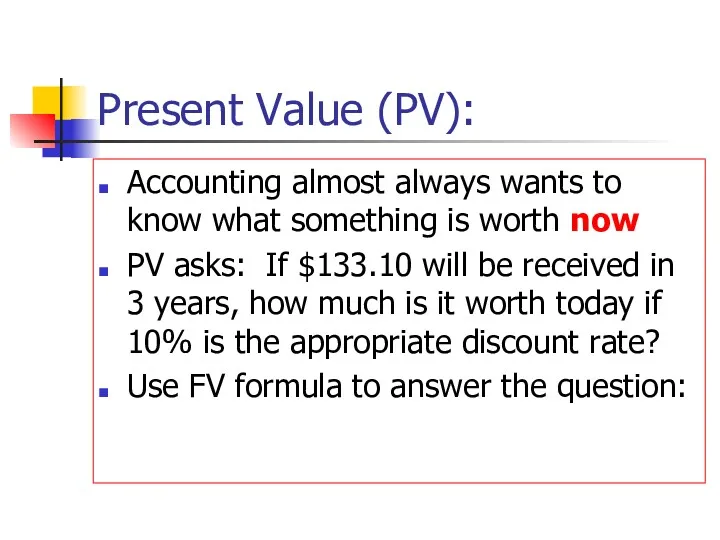

- 15. Present Value (PV): Accounting almost always wants to know what something is worth now PV asks:

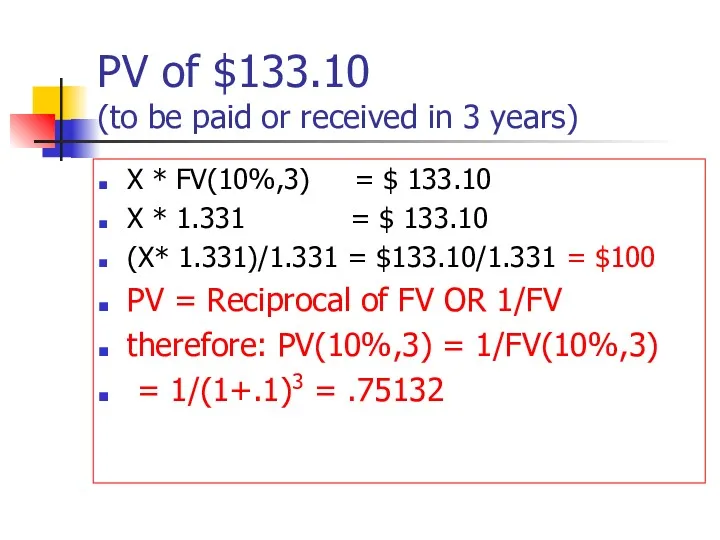

- 16. PV of $133.10 (to be paid or received in 3 years) X * FV(10%,3) = $

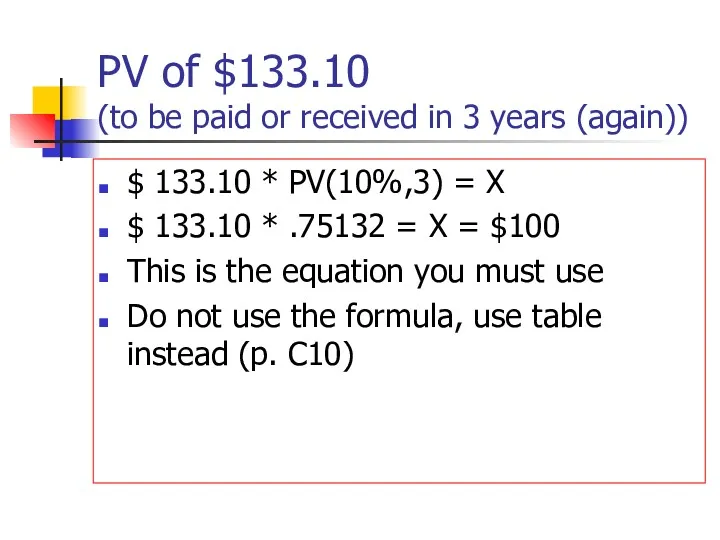

- 17. PV of $133.10 (to be paid or received in 3 years (again)) $ 133.10 * PV(10%,3)

- 18. Part II Annuities Basic PV used for single sum payments E.g. a note payable due in

- 19. PV of 3 payments of $ 100 each? Payments made at end of each of the

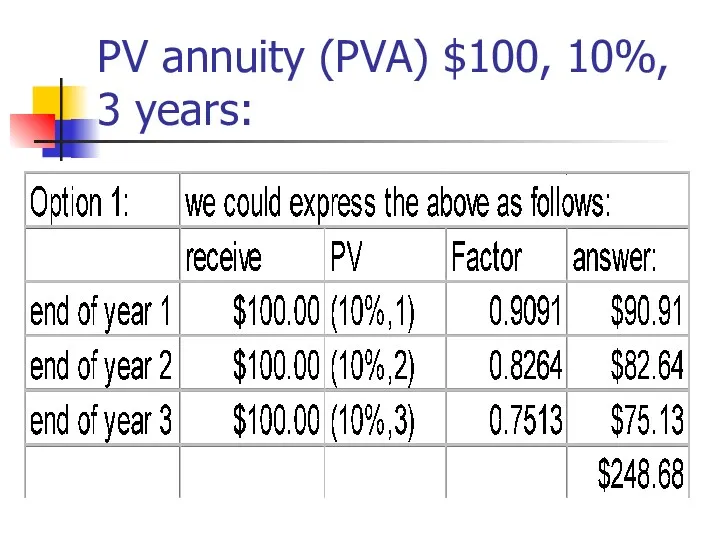

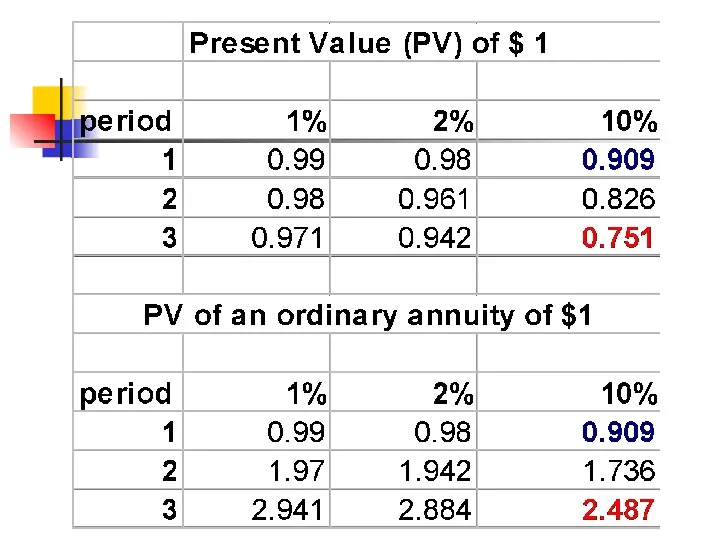

- 20. PV annuity (PVA) $100, 10%, 3 years:

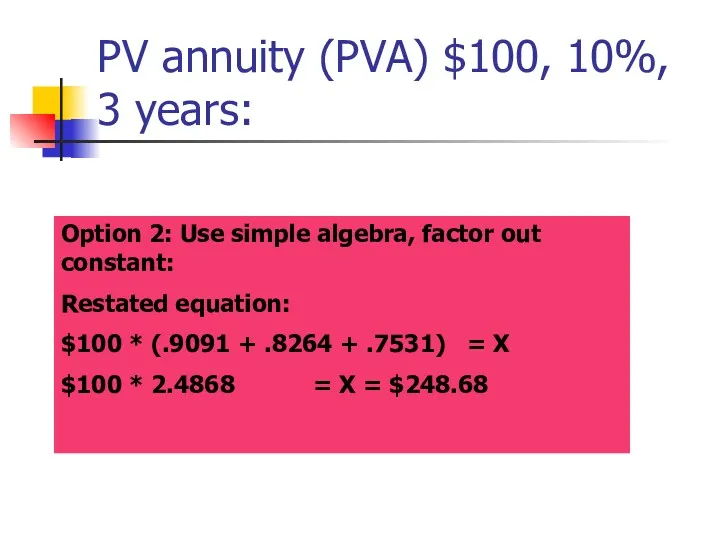

- 21. PV annuity (PVA) $100, 10%, 3 years: Option 2: Use simple algebra, factor out constant: Restated

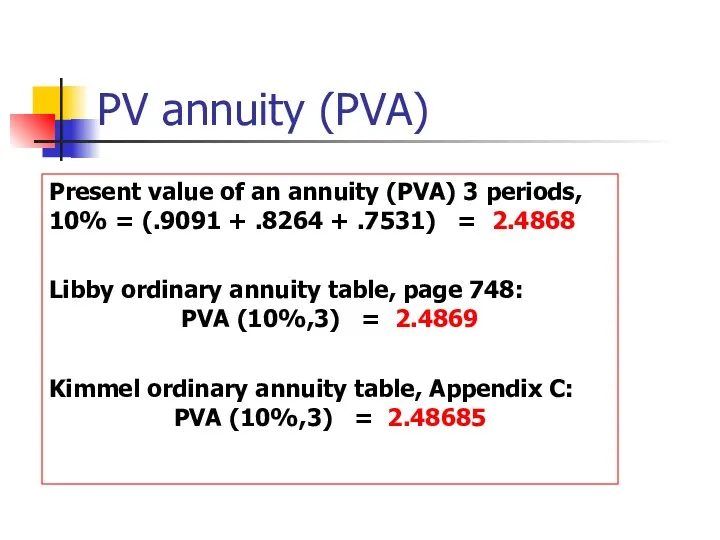

- 22. PV annuity (PVA) Present value of an annuity (PVA) 3 periods, 10% = (.9091 + .8264

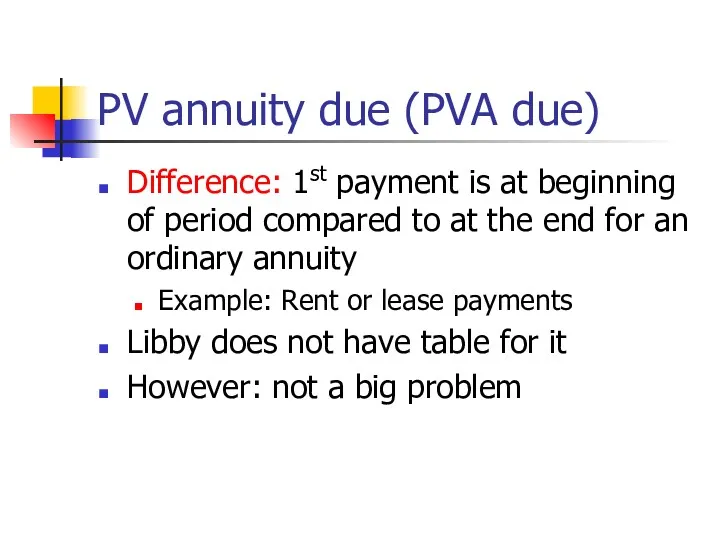

- 24. PV annuity due (PVA due) Difference: 1st payment is at beginning of period compared to at

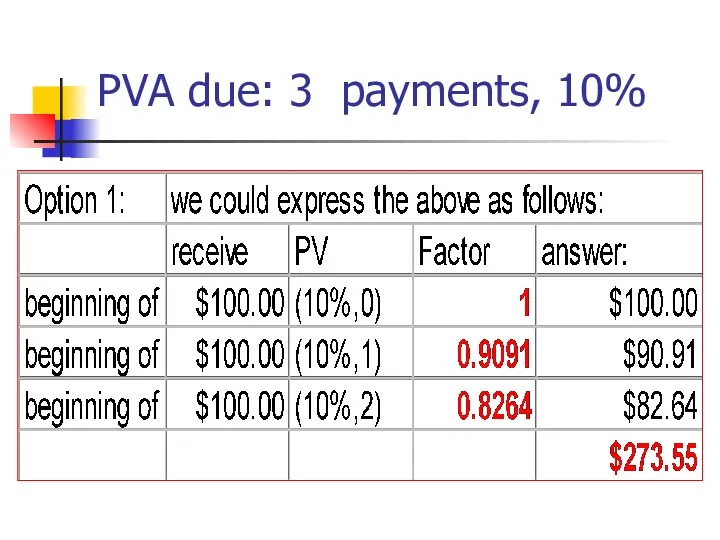

- 25. PVA due: 3 payments, 10%

- 27. Скачать презентацию

Имущество банка

Имущество банка Заем Проектный в рамках программы социально-экономического развития РМ

Заем Проектный в рамках программы социально-экономического развития РМ Оценка расходов на построение сети

Оценка расходов на построение сети Приостановление, возобновление, прекращение и восстановление выплаты страховой пенсии

Приостановление, возобновление, прекращение и восстановление выплаты страховой пенсии Зачем нужна наука?

Зачем нужна наука? Структура и содержание договора международной купли-продажи

Структура и содержание договора международной купли-продажи Фінанси підприємств. Оцінка фінансового стану підприємства. (Тема 9)

Фінанси підприємств. Оцінка фінансового стану підприємства. (Тема 9) Государственная поддержка МП в Кузбассе

Государственная поддержка МП в Кузбассе Еңбекақы статистикасы

Еңбекақы статистикасы Газпромбанк. Предоставление финансирования поставщикам и подрядчикам группы Газпром

Газпромбанк. Предоставление финансирования поставщикам и подрядчикам группы Газпром Страховой стаж

Страховой стаж Инкотермс 2000-2010. Международные правила толкования торговых терминов

Инкотермс 2000-2010. Международные правила толкования торговых терминов Надёжность и финансовая устойчивость коммерческого банка

Надёжность и финансовая устойчивость коммерческого банка Предложения по улучшению жилищных условий. Город Лабытнанги

Предложения по улучшению жилищных условий. Город Лабытнанги Ch1-2. Overview of the financial system. Financial Institutions and Markets

Ch1-2. Overview of the financial system. Financial Institutions and Markets Бюджет для граждан

Бюджет для граждан Рынок ценных бумаг

Рынок ценных бумаг Экологическое страхование

Экологическое страхование Микрофинансовая организация

Микрофинансовая организация Финансовые посредники как необходимый элемент функционирования финансовой системы публичных компаний. Тема 4

Финансовые посредники как необходимый элемент функционирования финансовой системы публичных компаний. Тема 4 Банковские союзы и ассоциации, как элемент национальной банковской системы

Банковские союзы и ассоциации, как элемент национальной банковской системы Управление финансовым состоянием ООО Торговый дом Цимлянские вина, оценка и разработка предложений по его улучшению

Управление финансовым состоянием ООО Торговый дом Цимлянские вина, оценка и разработка предложений по его улучшению Визначення вартості грошей у часі та її використання у фінансових розрахунках

Визначення вартості грошей у часі та її використання у фінансових розрахунках Банк Москвы

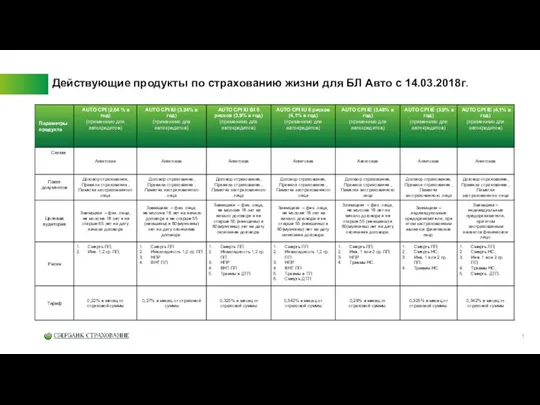

Банк Москвы Действующие продукты по страхованию жизни для БЛ Авто с 14.03.2018г

Действующие продукты по страхованию жизни для БЛ Авто с 14.03.2018г Информация о перерасчетах социальных выплат (через органы социальной защиты населения за счет средств областного бюджета)

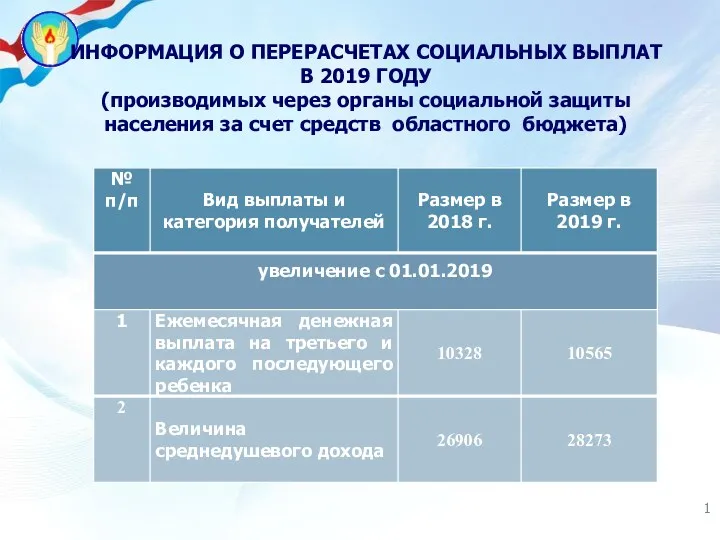

Информация о перерасчетах социальных выплат (через органы социальной защиты населения за счет средств областного бюджета) Оцінка фінансового стану підприємства

Оцінка фінансового стану підприємства A Brief History of Money

A Brief History of Money