Содержание

- 2. Hernan Cortes In 1519 Hernan Cortes and his conquistadores invaded Mexico. The Aztecs noticed that the

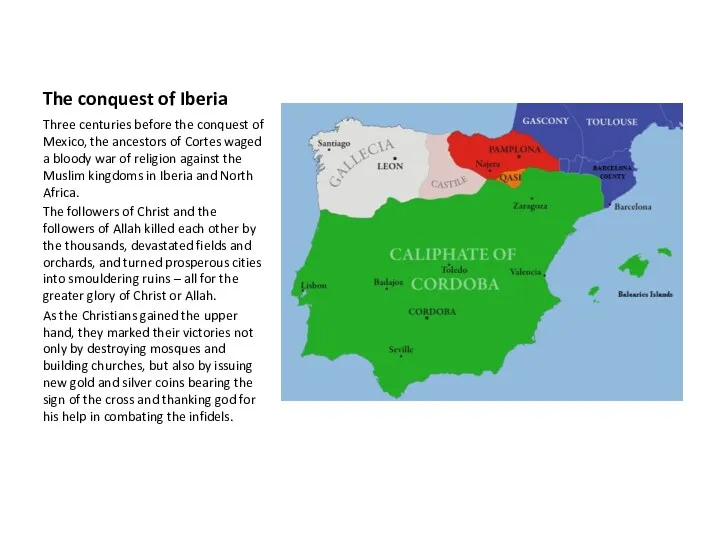

- 3. The conquest of Iberia Three centuries before the conquest of Mexico, the ancestors of Cortes waged

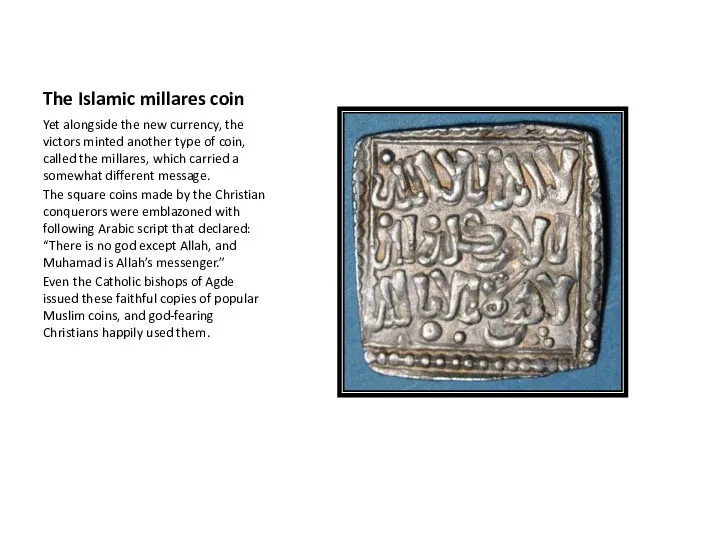

- 4. The Islamic millares coin Yet alongside the new currency, the victors minted another type of coin,

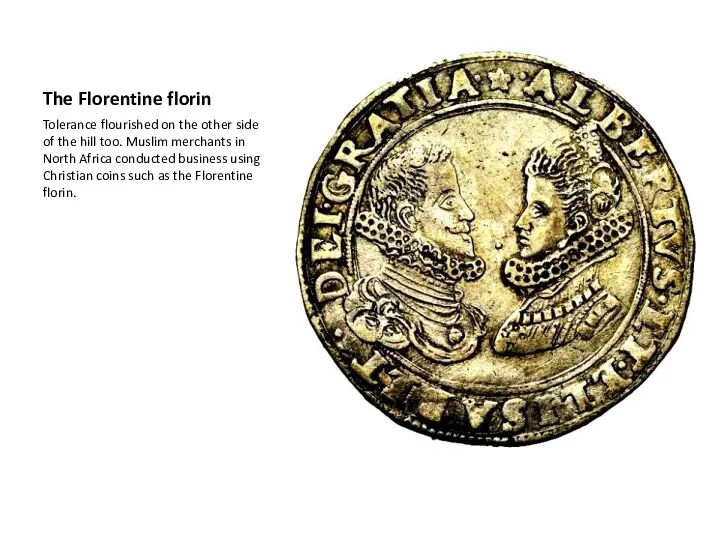

- 5. The Florentine florin Tolerance flourished on the other side of the hill too. Muslim merchants in

- 6. The Venetian ducat

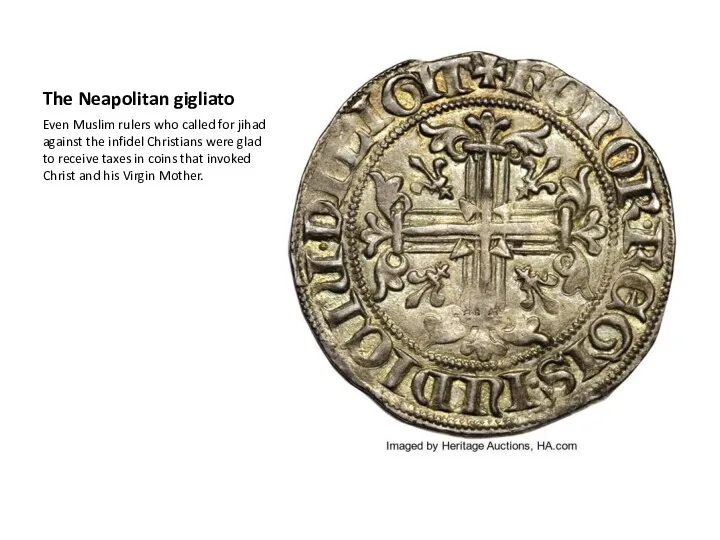

- 7. The Neapolitan gigliato Even Muslim rulers who called for jihad against the infidel Christians were glad

- 8. How Much Is It? Hunter-gatherers had no money. Different band members specialized in different tasks, but

- 9. Barter is effective only when exchanging a limited range of products. It cannot form the basis

- 10. Shells and Cigarettes The development of money required no technological breakthroughs – it was a purely

- 11. Cowry-shells Money existed long before the invention of coinage, and cultures have prospered using other things

- 12. POW camp In modern prisons and POW camps, cigarettes have often served as money. One Auschwitz

- 13. Even today coins and banknotes are a rare form of money. The sum total of money

- 14. The sales of indulgences Money is thus a universal medium of exchange that enables people to

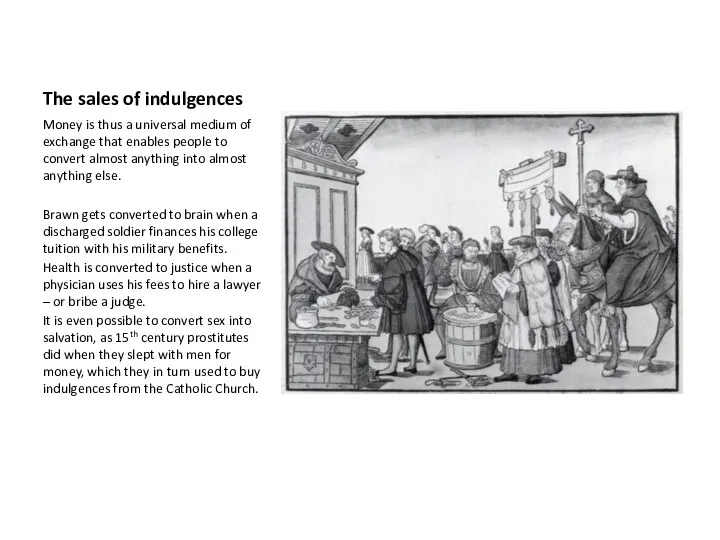

- 15. Because money can convert, store and transport wealth easily and cheaply, it made a vital contribution

- 16. How Does Money Work? Cowry shells and dollars have value only in our common imagination. Their

- 17. Money is the most universal and most efficient system of mutual trust ever devised. Why do

- 18. When the first versions of money were created, people did not have this sort of trust,

- 19. The most common measurement was the sila, equivalent to roughly one litre. Standardized bowls, each containing

- 20. Silver shekel from Mesopotamia 3000 BC The real breakthrough in monetary history occurred when people gained

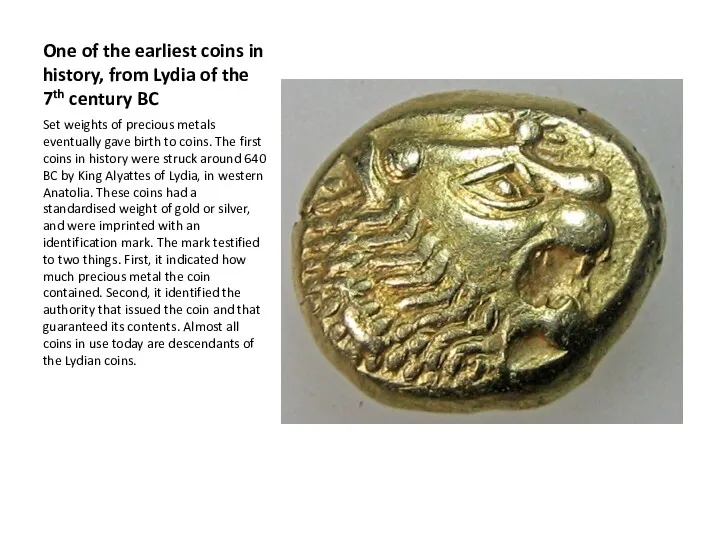

- 21. One of the earliest coins in history, from Lydia of the 7th century BC Set weights

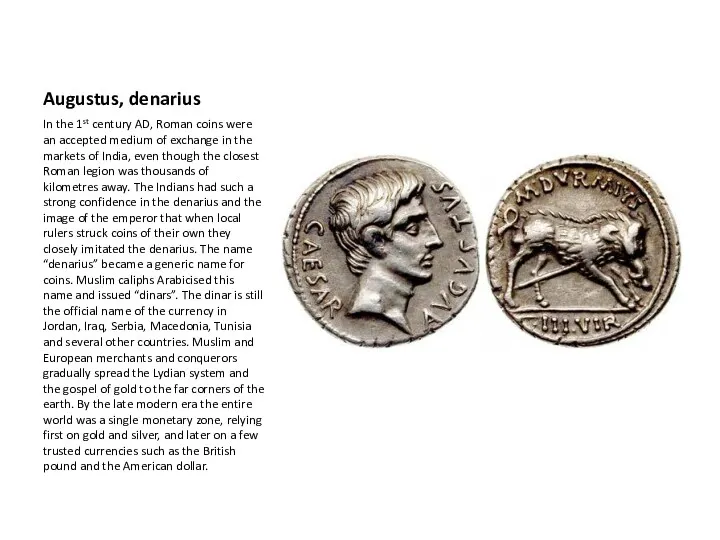

- 22. Augustus, denarius In the 1st century AD, Roman coins were an accepted medium of exchange in

- 23. The Gospel of Gold People continued to speak mutually incomprehensible languages, obey different rulers and worship

- 24. Yet why should Chinese, Indians, Muslims and Spaniards – who belonged to very different cultures that

- 25. For thousands of years, philosophers and prophets have besmirched money and called it the root of

- 27. Скачать презентацию

Закон волн Эллиотта. Идентификация волн в режиме реального времени

Закон волн Эллиотта. Идентификация волн в режиме реального времени Отчет об исполнении бюджета Бардымского муниципального района за 2019 год

Отчет об исполнении бюджета Бардымского муниципального района за 2019 год Возможности программ Фонда содействия инновациям

Возможности программ Фонда содействия инновациям Индивидуальные инвестиционные cчета. Казначейство РНКБ Банк (ПАО) 2018

Индивидуальные инвестиционные cчета. Казначейство РНКБ Банк (ПАО) 2018 Банк Авангард. Программа Школьное питание

Банк Авангард. Программа Школьное питание Актуальные вопросы учета поступлений в бюджетную систему Российской Федерации в 2021 г. и администрирование

Актуальные вопросы учета поступлений в бюджетную систему Российской Федерации в 2021 г. и администрирование Деньги. История денег

Деньги. История денег Профессия бухгалтер

Профессия бухгалтер Налоги. Структура налога

Налоги. Структура налога ВТБ24. Лизинг оборудования

ВТБ24. Лизинг оборудования Депозитная программа. Депозитный модуль АБС

Депозитная программа. Депозитный модуль АБС Анализ финансовой устойчивости предприятия

Анализ финансовой устойчивости предприятия Проектирование бизнеса. Практика 5. Денежные потоки инвестиционного проекта

Проектирование бизнеса. Практика 5. Денежные потоки инвестиционного проекта Бухгалтерский учет и налогообложение в субъектах малого предпринимательства

Бухгалтерский учет и налогообложение в субъектах малого предпринимательства Учёт, анализ состояния и оценка динамики дебиторской задолженности

Учёт, анализ состояния и оценка динамики дебиторской задолженности Инициативное предложение члена бюджетной комиссии Андреевой Натальи Евгеньевны в рамках проекта Народный бюджет

Инициативное предложение члена бюджетной комиссии Андреевой Натальи Евгеньевны в рамках проекта Народный бюджет Бюджет для граждан

Бюджет для граждан Субсидии администрации Краснодарского края для реализации программ социально ориентированных некоммерческих организаций

Субсидии администрации Краснодарского края для реализации программ социально ориентированных некоммерческих организаций Оценка состояния бухгалтерского учета и внутреннего контроля основных средств в ООО Электротехническая компания

Оценка состояния бухгалтерского учета и внутреннего контроля основных средств в ООО Электротехническая компания Управление капиталом организации

Управление капиталом организации Мастер-класс Финансовые ресурсы предприятия и Эффективность и риски предпринимательской деятельности

Мастер-класс Финансовые ресурсы предприятия и Эффективность и риски предпринимательской деятельности Финансовая политика государства

Финансовая политика государства План-график закупок для обеспечения государственных и муниципальных нужд на финансовый год

План-график закупок для обеспечения государственных и муниципальных нужд на финансовый год Ипотечное кредитование. ПАО Банк ЗЕНИТ

Ипотечное кредитование. ПАО Банк ЗЕНИТ Виды ценных бумаг

Виды ценных бумаг Вопросы по продуктам РКО Tinkoff

Вопросы по продуктам РКО Tinkoff Цели и задачи управления государственным долгом

Цели и задачи управления государственным долгом Ночной аудитор отеля

Ночной аудитор отеля