Содержание

- 2. The cost of products (works, services) is a valuation of the current costs of production and

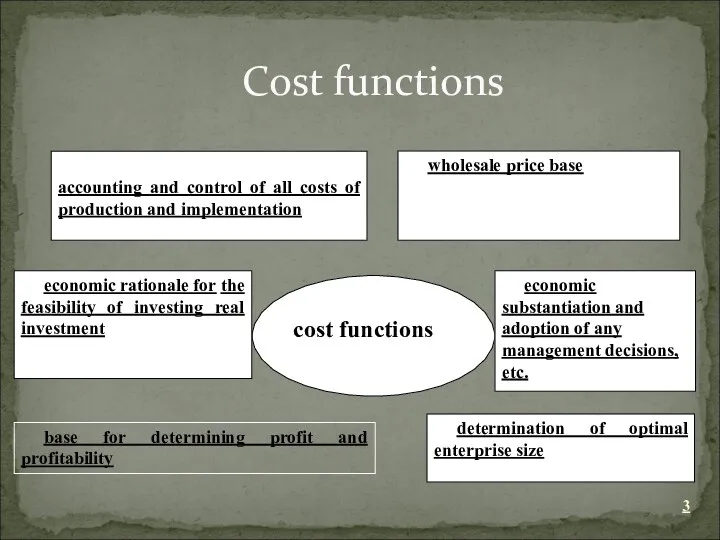

- 3. Cost functions base for determining profit and profitability

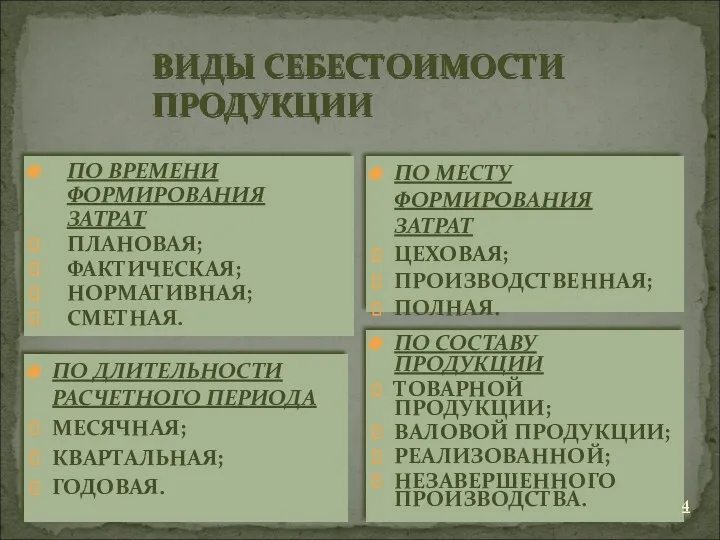

- 4. ВИДЫ СЕБЕСТОИМОСТИ ПРОДУКЦИИ ПО ВРЕМЕНИ ФОРМИРОВАНИЯ ЗАТРАТ ПЛАНОВАЯ; ФАКТИЧЕСКАЯ; НОРМАТИВНАЯ; СМЕТНАЯ. ПО МЕСТУ ФОРМИРОВАНИЯ ЗАТРАТ ЦЕХОВАЯ;

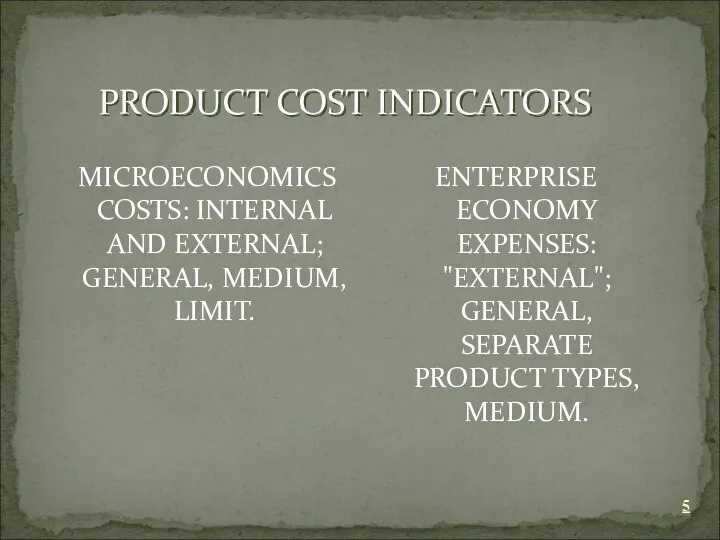

- 5. PRODUCT COST INDICATORS MICROECONOMICS COSTS: INTERNAL AND EXTERNAL; GENERAL, MEDIUM, LIMIT. ENTERPRISE ECONOMY EXPENSES: "EXTERNAL"; GENERAL,

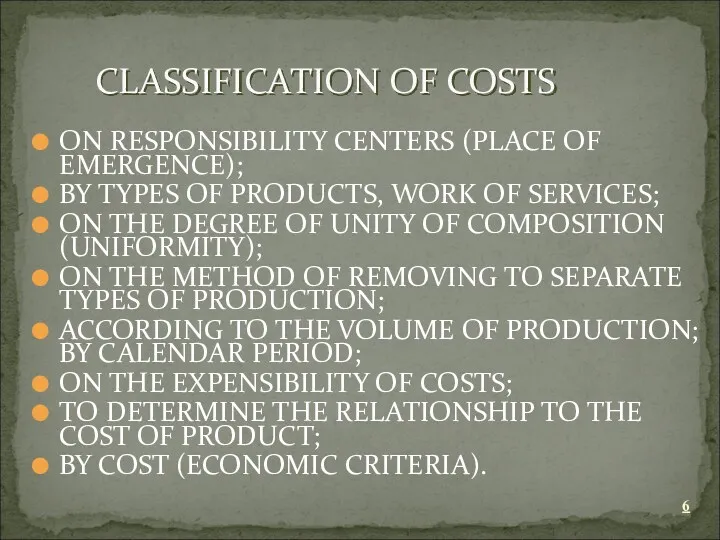

- 6. ON RESPONSIBILITY CENTERS (PLACE OF EMERGENCE); BY TYPES OF PRODUCTS, WORK OF SERVICES; ON THE DEGREE

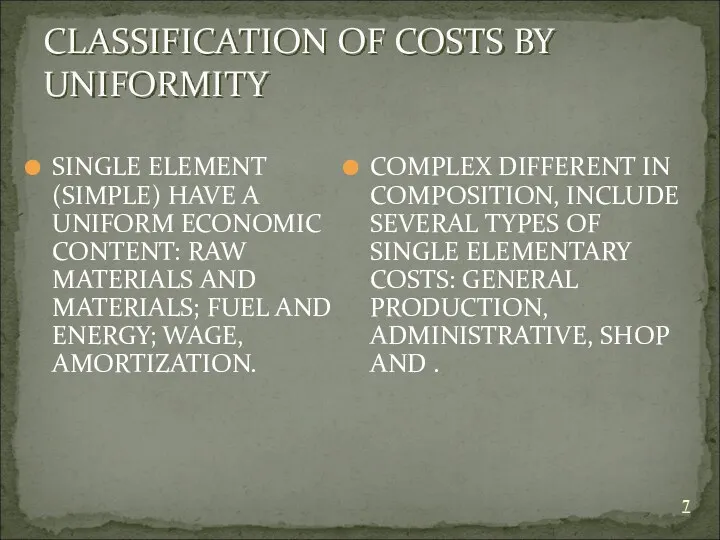

- 7. CLASSIFICATION OF COSTS BY UNIFORMITY SINGLE ELEMENT (SIMPLE) HAVE A UNIFORM ECONOMIC CONTENT: RAW MATERIALS AND

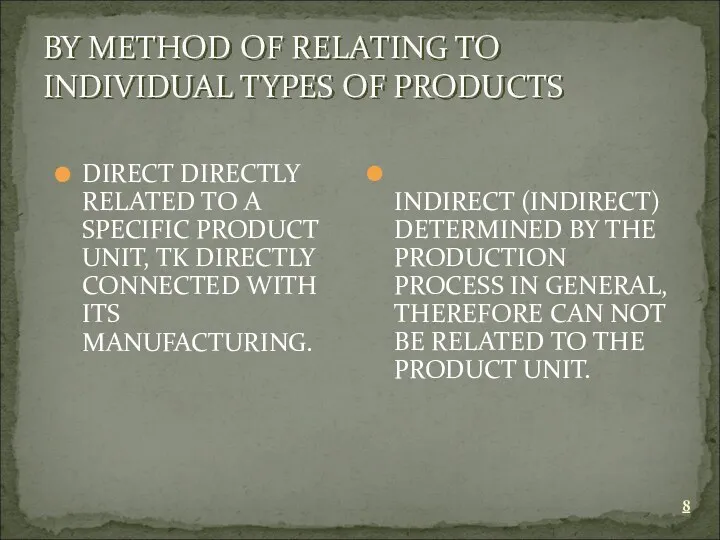

- 8. BY METHOD OF RELATING TO INDIVIDUAL TYPES OF PRODUCTS DIRECT DIRECTLY RELATED TO A SPECIFIC PRODUCT

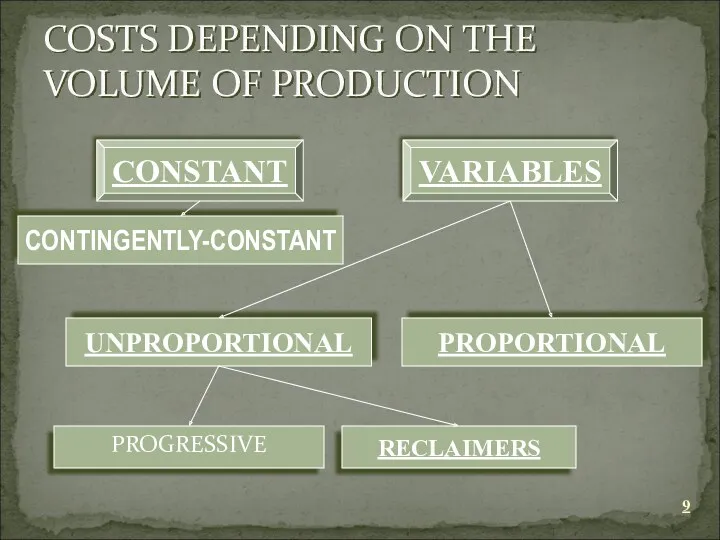

- 9. PROGRESSIVE COSTS DEPENDING ON THE VOLUME OF PRODUCTION CONSTANT VARIABLES CONTINGENTLY-CONSTANT UNPROPORTIONAL PROPORTIONAL RECLAIMERS

- 10. CURRENT - constant, ordinary expenses or at intervals of less than a month; LONG TERM -

- 11. ON THE COST OF PRODUCT PRODUCT COSTS FORM PRODUCTIVE COST OF PRODUCT - RELATED TO THE

- 12. DIRECT ACCOUNT IN FACT; NORMATIVE; SETTLEMENT ANALYTICAL. FACTOR (PARAMETRIC) ON TECHNICAL AND ECONOMIC FACTORS; INDEX INFLUENCE

- 13. ADMINISTRATIVE COSTS - general business expenses aimed at the maintenance and management of the enterprise; COSTS

- 15. Скачать презентацию

Страхование экспортного кредитования (на примере Российской Федерации и США)

Страхование экспортного кредитования (на примере Российской Федерации и США) Операционные риски

Операционные риски Страховой рынок Казахстана: современное состояние и перспективы развития

Страховой рынок Казахстана: современное состояние и перспективы развития Основы финансовых вычислений. Переменные и непрерывные ренты. (Тема 6)

Основы финансовых вычислений. Переменные и непрерывные ренты. (Тема 6) Федеральное Казначейство

Федеральное Казначейство Стандарты аудиторской деятельности, регулирующие форму, содержание, предоставление аудиторского заключения

Стандарты аудиторской деятельности, регулирующие форму, содержание, предоставление аудиторского заключения Фінанси підприємств. Кредитування підприємств. (Тема 8)

Фінанси підприємств. Кредитування підприємств. (Тема 8) Корпорация

Корпорация Бухгалтерский учет как информационная система

Бухгалтерский учет как информационная система Карту какого банка следует выбрать в 14 лет

Карту какого банка следует выбрать в 14 лет Сущность и организация корпоративных финансов

Сущность и организация корпоративных финансов Расчет пенсии

Расчет пенсии Особенности формирования проекта бюджета города Москвы на 2018 год и плановый период 2019 и 2020 годов

Особенности формирования проекта бюджета города Москвы на 2018 год и плановый период 2019 и 2020 годов Электронный бюджет

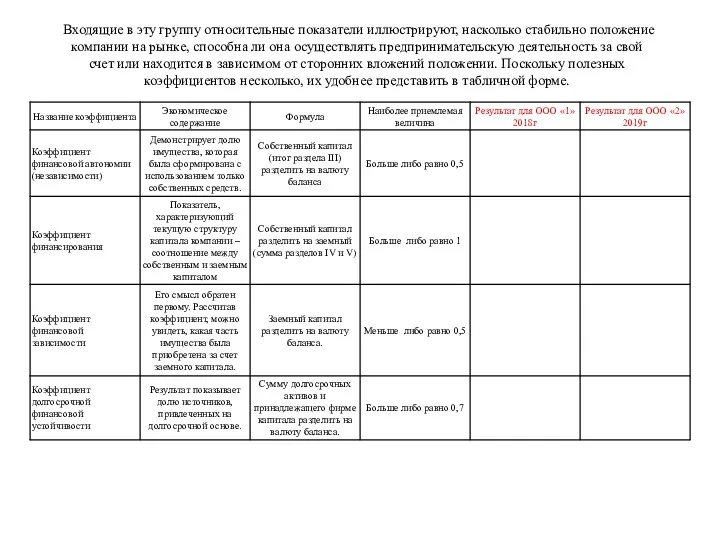

Электронный бюджет ПРАКТИКА СТРУКТУРА КАПИТАЛА

ПРАКТИКА СТРУКТУРА КАПИТАЛА Планирование деятельности коммерческого банка

Планирование деятельности коммерческого банка Эмиссия ценных бумаг

Эмиссия ценных бумаг Финансовые инновации. Краудинвестинг и налоговые гавани

Финансовые инновации. Краудинвестинг и налоговые гавани Взаимосвязь отмывания преступных доходов и финансирования терроризма с иными противоправными деяниями на международном уровне

Взаимосвязь отмывания преступных доходов и финансирования терроризма с иными противоправными деяниями на международном уровне Оборотные средства предприятия

Оборотные средства предприятия Нормирование труда педагогических работников в условиях новой системы оплаты труда

Нормирование труда педагогических работников в условиях новой системы оплаты труда Автомобили в кредит. ПАО Банк УралСиб

Автомобили в кредит. ПАО Банк УралСиб Добровольное медицинское страхование

Добровольное медицинское страхование Модель Du Ponta

Модель Du Ponta Организация денежного обращения. Законы денежного обращения. Денежная масса и скорость обращения денег. Денежная база

Организация денежного обращения. Законы денежного обращения. Денежная масса и скорость обращения денег. Денежная база Фінансовий менджмент. Тема 4

Фінансовий менджмент. Тема 4 Деловая игра. Бизнес-курс:максимум

Деловая игра. Бизнес-курс:максимум Исследование финансовой устойчивости предприятий агропромышленного комплекса

Исследование финансовой устойчивости предприятий агропромышленного комплекса