Слайд 2

Problem statement

Financial crisis in 2008-2009 years disclosed that liquidity management is

not efficient in Russian banks. It’s hard for bank management find the most profitable and liquid structure of assets. In this case it’s important to find ways of increasing the efficiency of liquidity management in banks in order to improve the performance of commercial banks.

Слайд 3

Purpose statement

The purpose of this explanatory study is to proof the

suggestion that structure of banks assets which is determined by liquidity risk management influences bank profitability that is the main indicator of performance in banks. That’s why it’s vital for banks to find way that can help to increase efficiency of liquidity risk management.

Слайд 4

Type of research

applied research

quantitative research

explanatory research

Слайд 5

Objectives

1. To determine the effect of liquidity management on the performance

of commercial banks;

2. To find out the relationship between the structure of assets in banks and bank profitability;

3. To find out ways of improving the structure of assets in order to avoid lack and excess of liquid assets in banks and increase bank profitability.

Слайд 6

Research questions

1. What is nature of the relationship between bank liquidity

management and bank profitability?

2. How the structure of assets (level of cash, loans and investments in securities) influences bank profitability?

3. How to improve the structure of assets in order to avoid lack and excess of liquid assets and increase bank profitability?

Слайд 7

Hypothesis

1. There is a significant relationship between bank liquidity management and

bank profitability.

2. The versatile structure of assets increases bank profitability.

3. Making decisions about the structure of bank assets it’s important to take into account that liquidity can be distinguished in different ways according to the size of assets, its quality, level of riskiness and time required for selling this assets.

Слайд 8

A sample design – stratified random sampling and simple random sampling

Data

collection method – documentary secondary data

Слайд 9

Methodology

Liquidity analysis coefficients that would be used in this study:

The liquidity

ratio = liquid assets / total assets

Cash ratio = cash / total assets

Short-term funding ratio = liabilities maturing within one year / total liabilities

Capital adequacy ratio = capital / risk weighted assets

Loan / deposit ratio = loans / deposits

Loan / liabilities ratio = loans / liabilities

“Banks liquidity risk analysis in the new European Union member countries: evidence from Bulgaria and Romania” written by Roman and Sargu in 2014

Слайд 10

Methodology

Method of analysis is the regression analysis.

The function for this study

is given as:

Y = b0 + b1X1 + b2X2 + b3X3 + e

Where: Y = Profitability representing the dependent variable;

b0, b1, b2, b3 are regression parameters;

X1 , X2 , X3 are independent variables;

X1 – bank cash assets;

X2 – bank loans assets;

X3 – bank securities assets.

“The Impact of Liquidity Management on the Profitability of Banks in Nigeria” written by Sunny Obilor Ibe in 2013

Слайд 11

Literature review

“Liquidity risk in banking” written by Bonfim and Kim in

2012

Definitions of liquidity, risk of liquidity , liquidity management;

Слайд 12

Literature review

“Some Quantitative Aspects of Stability Management Strategy in a Bank”

written by Sksonova and Solojova in 2012

Ways of increasing the effectiveness of liquidity risk management:

Bank assets must be distinguished on three types of transformation : quantitative, qualitative and time.

It’s important to keep in mind that management of liquidity in short-term differ from long-term liquidity management

Оптимизация структуры капитала малого предприятия

Оптимизация структуры капитала малого предприятия Кәсіпкерлік қызметтегі тәуекелдер

Кәсіпкерлік қызметтегі тәуекелдер Коммерческое предложение для туристов. Банк Русский Стандарт

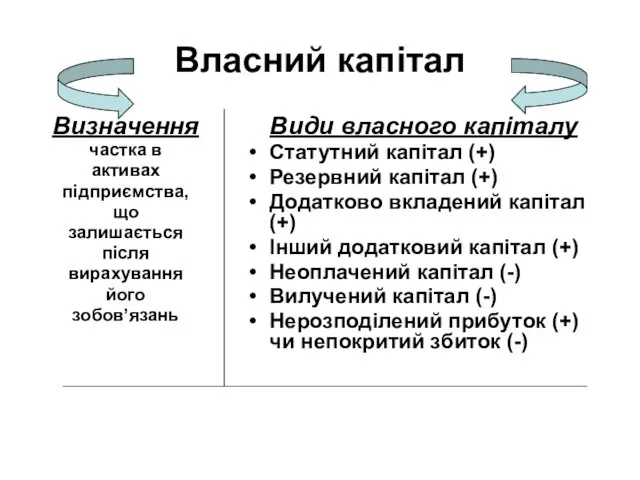

Коммерческое предложение для туристов. Банк Русский Стандарт Власний капітал

Власний капітал Банктің мөлшерлеме саясаты: пайыздық тәуекелдің қалыптастыру принциптері және басқару

Банктің мөлшерлеме саясаты: пайыздық тәуекелдің қалыптастыру принциптері және басқару Учет внеоборотных активов. Тема 7.5

Учет внеоборотных активов. Тема 7.5 Страхование имущества физических лиц САО ВСК. Страховые продукты

Страхование имущества физических лиц САО ВСК. Страховые продукты Доходы населения

Доходы населения История сотрудничества с ГК Уралэлектрострой и анализ причин образования проблемной задолженности

История сотрудничества с ГК Уралэлектрострой и анализ причин образования проблемной задолженности Особенности учета и аудита кредиторской задолженности на предприятии торговли Челябинский филиал ОАО ЖТК

Особенности учета и аудита кредиторской задолженности на предприятии торговли Челябинский филиал ОАО ЖТК Налог на имущество физических лиц

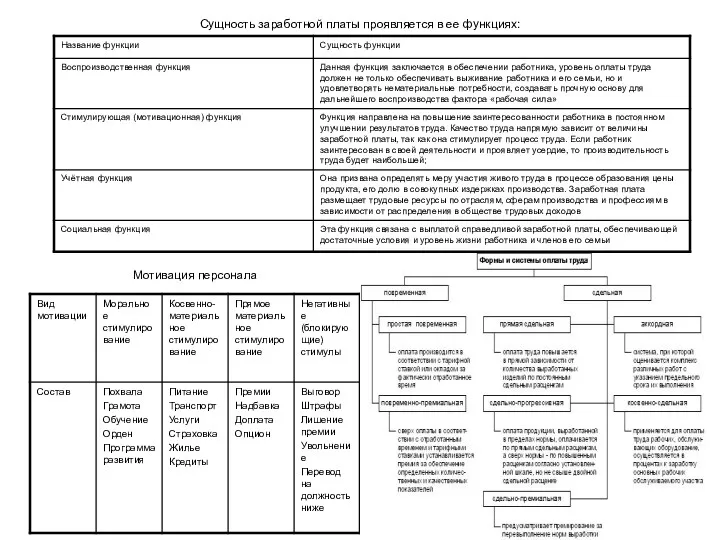

Налог на имущество физических лиц Заработная плата

Заработная плата Финансы домашних хозяйств

Финансы домашних хозяйств Налог на доходы физических лиц

Налог на доходы физических лиц Комерческое предложение по БВД

Комерческое предложение по БВД Доходность и риск финансовой операции

Доходность и риск финансовой операции Бюджет для граждан. К решению Земского собрания Варнавинского муниципального района О районном бюджете на 2017 год

Бюджет для граждан. К решению Земского собрания Варнавинского муниципального района О районном бюджете на 2017 год Бухгалтерские информационные системы

Бухгалтерские информационные системы Доходы и расходы семей

Доходы и расходы семей Страховий ринок США

Страховий ринок США Классификация доходов бюджета

Классификация доходов бюджета Способи реалізації інвестиційних проектів

Способи реалізації інвестиційних проектів Себестоимость продукции

Себестоимость продукции О введении обязательной маркировки

О введении обязательной маркировки Правовое регулирование и учет расчетов с персоналом по оплате труда

Правовое регулирование и учет расчетов с персоналом по оплате труда Сущность и классификация инвестиций. Инвестиционный проект: сущность, классификация

Сущность и классификация инвестиций. Инвестиционный проект: сущность, классификация Страховые формальности. Страхование в туризме. Виды страховых программ

Страховые формальности. Страхование в туризме. Виды страховых программ Бухгалтерский учет договоров аренды отдельными некредитными финансовыми организациями. Глава 13

Бухгалтерский учет договоров аренды отдельными некредитными финансовыми организациями. Глава 13