Содержание

- 2. People try to avoid risk 2

- 3. Why managers invest in risky projects? 3

- 4. RISK PREMIUM 4

- 5. I want to have a compensation not only for the use of my money, but for

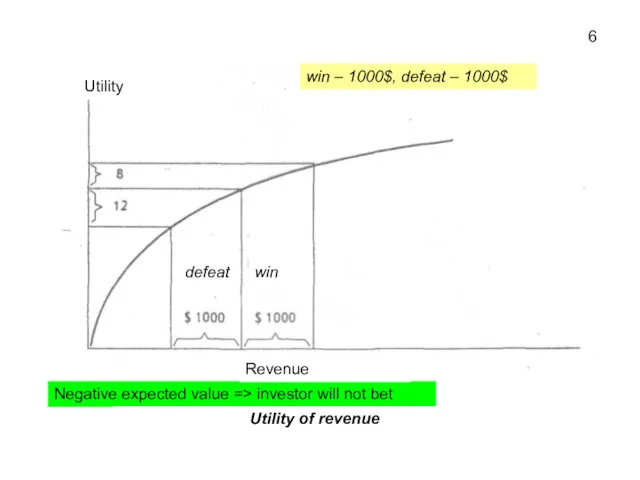

- 6. win – 1000$, defeat – 1000$ Negative expected value => investor will not bet 6 Utility

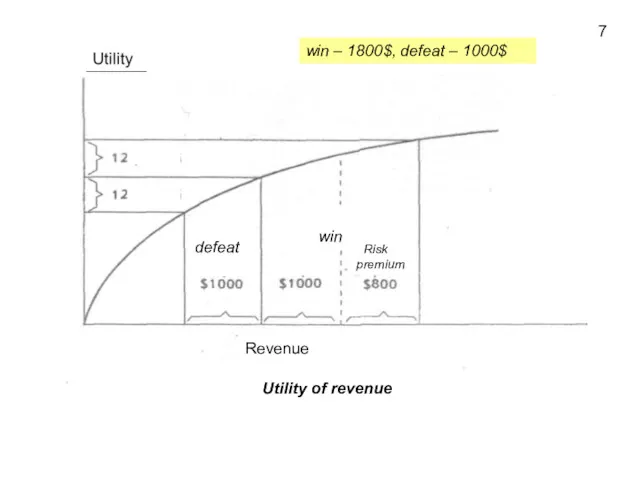

- 7. 7 win – 1800$, defeat – 1000$ defeat win Revenue Utility of revenue Risk premium

- 8. Business risk associated with a firm decision about investment 8

- 9. 9 Business risk is always there - no business does not guarantee success

- 10. Within one business direction, the investor usually faced with higher business risk in the newly created

- 11. On the other hand, the "old" company, products or methods of entrepreneurship which are outdated, can

- 12. Financial risk is determined by the financial decisions of the firm (the risk of possible insolvency)

- 13. The income of the company must first of all go to debt service 12

- 14. Adjustment of risk 14

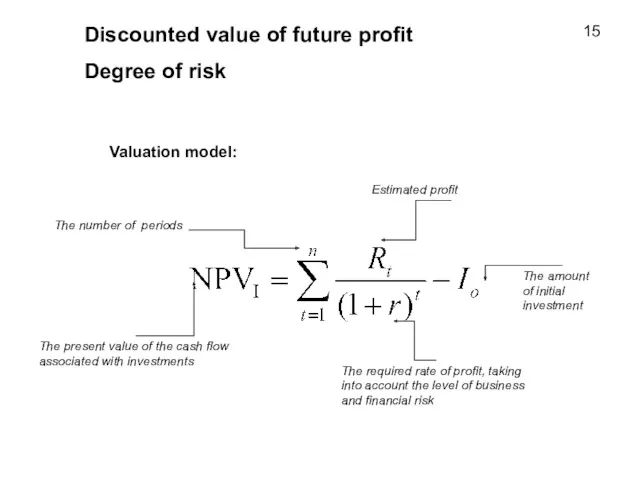

- 15. Discounted value of future profit Degree of risk Valuation model: The present value of the cash

- 16. Methods of risk account : The rate method, corrected for risk Method of certainty equivalent 16

- 17. The rate method, corrected for risk The rate, corrected for risk -the required rate of profit

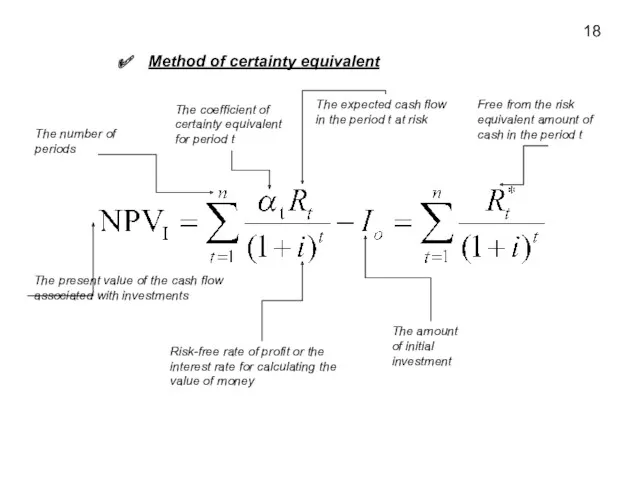

- 18. Method of certainty equivalent The present value of the cash flow associated with investments The coefficient

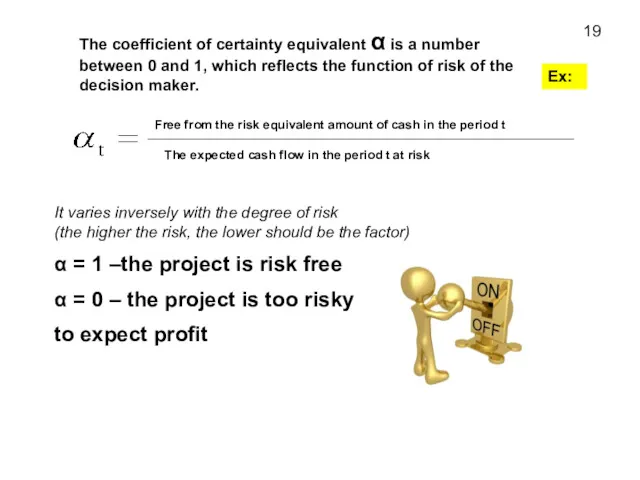

- 19. The coefficient of certainty equivalent α is a number between 0 and 1, which reflects the

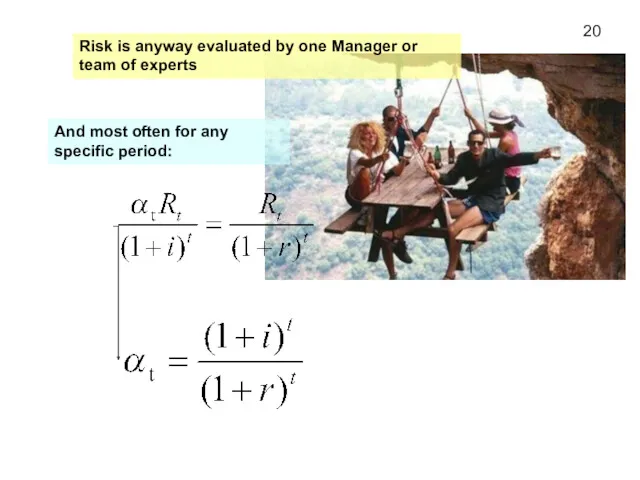

- 20. And most often for any specific period: 20 Risk is anyway evaluated by one Manager or

- 22. Скачать презентацию

Межбюджетные отношения

Межбюджетные отношения Операції банків в іноземній валюті

Операції банків в іноземній валюті Повестка заседания управляющего совета МАДОУ Детский сад № 94 г. Перми от 28.01.2019г

Повестка заседания управляющего совета МАДОУ Детский сад № 94 г. Перми от 28.01.2019г Характеристика финансовых институтов, как объекта оценки. (Лекция 1)

Характеристика финансовых институтов, как объекта оценки. (Лекция 1) Государственная экономическая политика. Лекция 5

Государственная экономическая политика. Лекция 5 Ценные бумаги

Ценные бумаги Финансы и управленческий учет

Финансы и управленческий учет Налоговое законодательство. Международные акты в системе налогового законодательства

Налоговое законодательство. Международные акты в системе налогового законодательства Финансовое прогнозирование

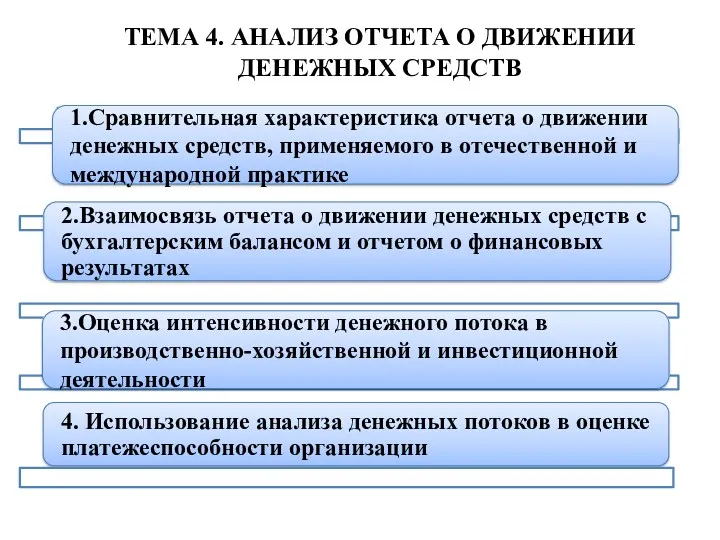

Финансовое прогнозирование Анализ отчета о движении денежных средств. (Тема 4)

Анализ отчета о движении денежных средств. (Тема 4) Финансовая политика

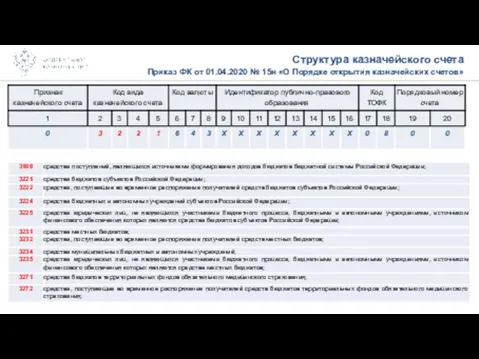

Финансовая политика Приказ ФК от 01.04.2020 № 15н О Порядке открытия казначейских счетов

Приказ ФК от 01.04.2020 № 15н О Порядке открытия казначейских счетов Организация и стимулирование труда персонала в системе менеджмента предприятия ЗАО Сервисный центр ремонта медицинской техники

Организация и стимулирование труда персонала в системе менеджмента предприятия ЗАО Сервисный центр ремонта медицинской техники Предложение способов пополнения счета. Тинькофф. День 3

Предложение способов пополнения счета. Тинькофф. День 3 Операции коммерческих банков на фондовом рынке

Операции коммерческих банков на фондовом рынке НДС 2019-2020: методология и практика исчисления с учетом последних изменений

НДС 2019-2020: методология и практика исчисления с учетом последних изменений Государственный аудит. Модель службы внутреннего контроля и аудита

Государственный аудит. Модель службы внутреннего контроля и аудита Финансовые инструменты

Финансовые инструменты Единый налог на вменённый доход (Енвд)

Единый налог на вменённый доход (Енвд) Cost-benefit analysis

Cost-benefit analysis Товар и деньги. (8 класс)

Товар и деньги. (8 класс) Основные вопросы бюджетного учета и отчетности 2023 года

Основные вопросы бюджетного учета и отчетности 2023 года Налог на добавленную стоимость (НДС)

Налог на добавленную стоимость (НДС) Бюджет для граждан

Бюджет для граждан Анализ прибыли и рентабельности компании

Анализ прибыли и рентабельности компании Разработка информационной системы складского учета средствами облачных вычислений

Разработка информационной системы складского учета средствами облачных вычислений Налоги. Налоговая система

Налоги. Налоговая система Зарплатный проект

Зарплатный проект