Содержание

- 2. After studying Chapter 4, you should be able to: Distinguish among the various terms used to

- 3. The Valuation of Long-Term Securities Distinctions Among Valuation Concepts Bond Valuation Preferred Stock Valuation Common Stock

- 4. What is Value? Going-concern value represents the amount a firm could be sold for as a

- 5. What is Value? (2) a firm: total assets minus liabilities and preferred stock as listed on

- 6. What is Value? Intrinsic value represents the price a security “ought to have” based on all

- 7. Bond Valuation Important Terms Types of Bonds Valuation of Bonds Handling Semiannual Compounding

- 8. Important Bond Terms The maturity value (MV) [or face value] of a bond is the stated

- 9. Important Bond Terms The discount rate (capitalization rate) is dependent on the risk of the bond

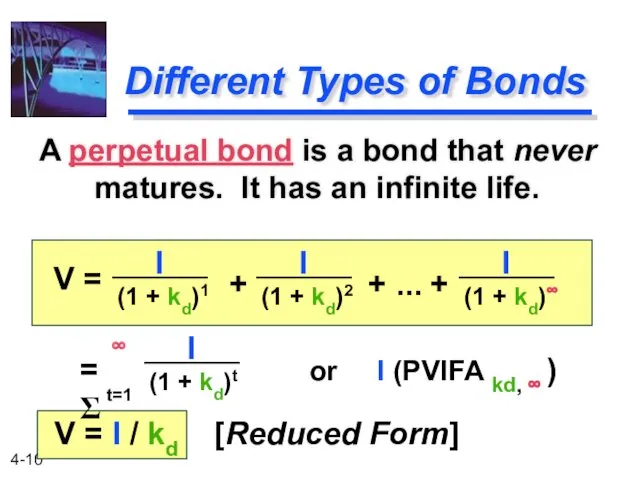

- 10. Different Types of Bonds A perpetual bond is a bond that never matures. It has an

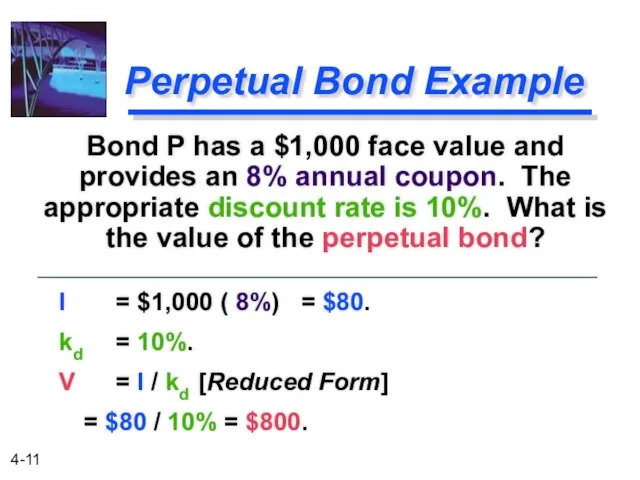

- 11. Perpetual Bond Example Bond P has a $1,000 face value and provides an 8% annual coupon.

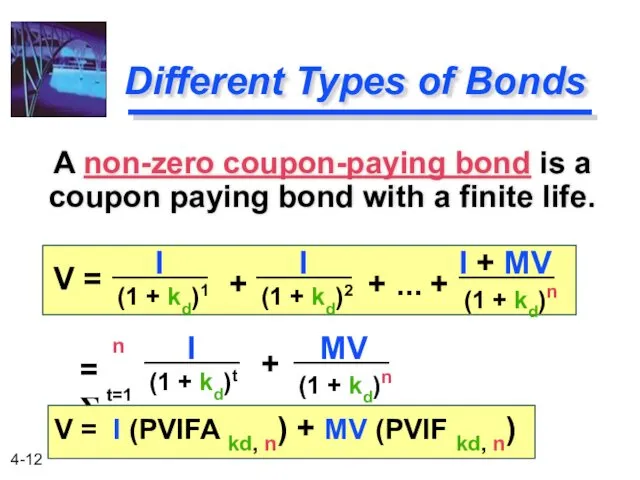

- 12. Different Types of Bonds A non-zero coupon-paying bond is a coupon paying bond with a finite

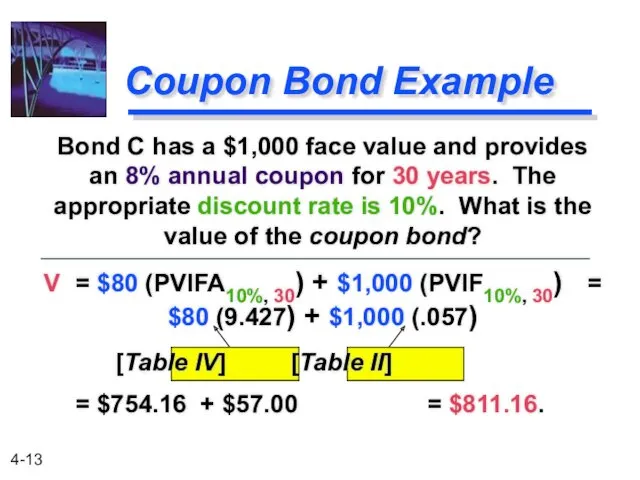

- 13. Bond C has a $1,000 face value and provides an 8% annual coupon for 30 years.

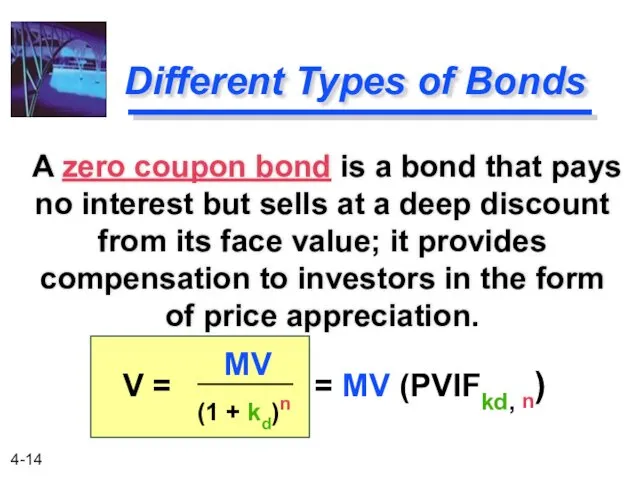

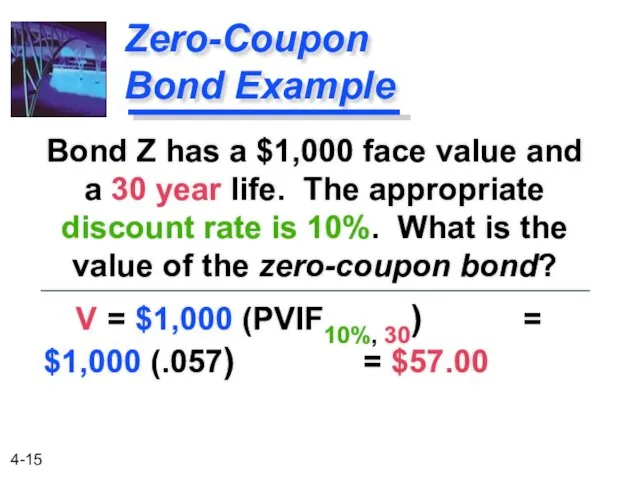

- 14. Different Types of Bonds A zero coupon bond is a bond that pays no interest but

- 15. V = $1,000 (PVIF10%, 30) = $1,000 (.057) = $57.00 Zero-Coupon Bond Example Bond Z has

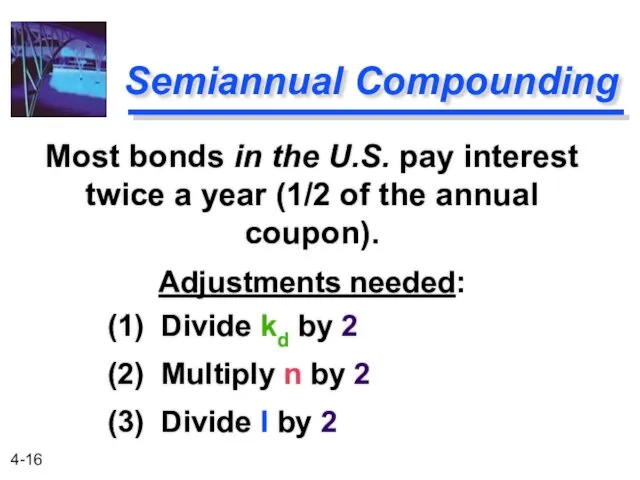

- 16. Semiannual Compounding (1) Divide kd by 2 (2) Multiply n by 2 (3) Divide I by

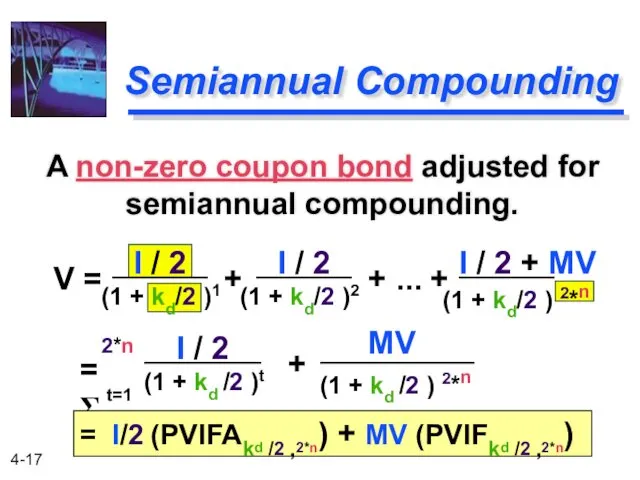

- 17. (1 + kd/2 ) 2*n (1 + kd/2 )1 Semiannual Compounding A non-zero coupon bond adjusted

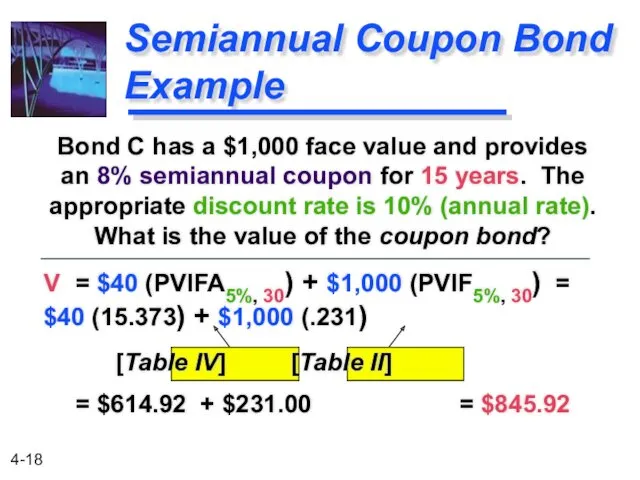

- 18. V = $40 (PVIFA5%, 30) + $1,000 (PVIF5%, 30) = $40 (15.373) + $1,000 (.231) [Table

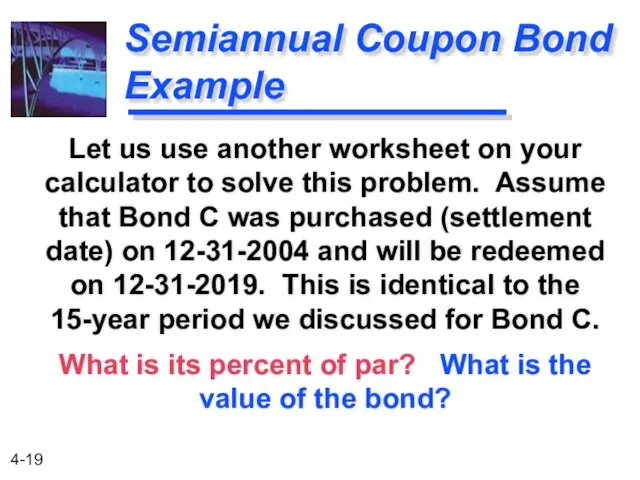

- 19. Semiannual Coupon Bond Example Let us use another worksheet on your calculator to solve this problem.

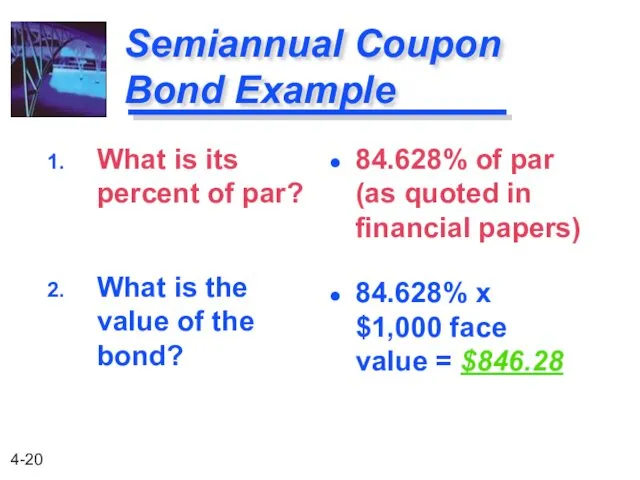

- 20. Semiannual Coupon Bond Example What is its percent of par? What is the value of the

- 21. Preferred Stock is a type of stock that promises a (usually) fixed dividend, but at the

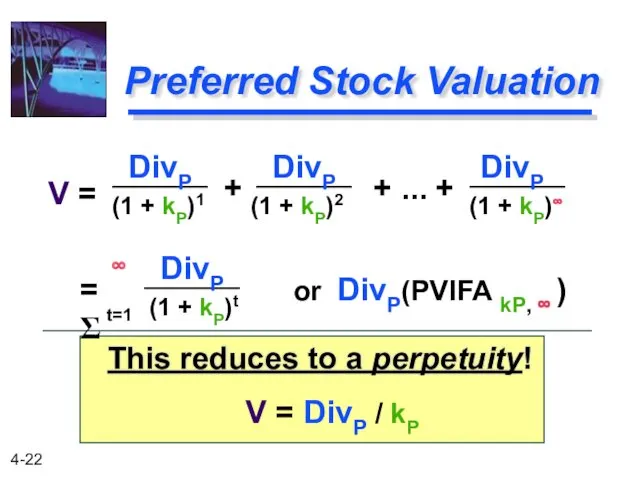

- 22. Preferred Stock Valuation This reduces to a perpetuity! (1 + kP)1 (1 + kP)2 (1 +

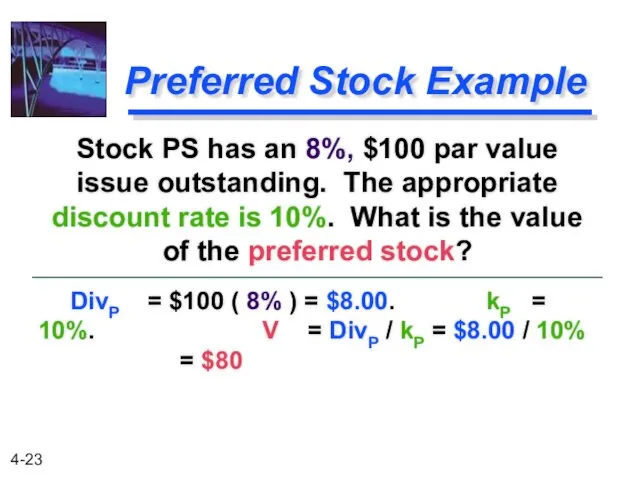

- 23. Preferred Stock Example DivP = $100 ( 8% ) = $8.00. kP = 10%. V =

- 24. Common Stock Valuation Pro rata share of future earnings after all other obligations of the firm

- 25. Common Stock Valuation (1) Future dividends (2) Future sale of the common stock shares What cash

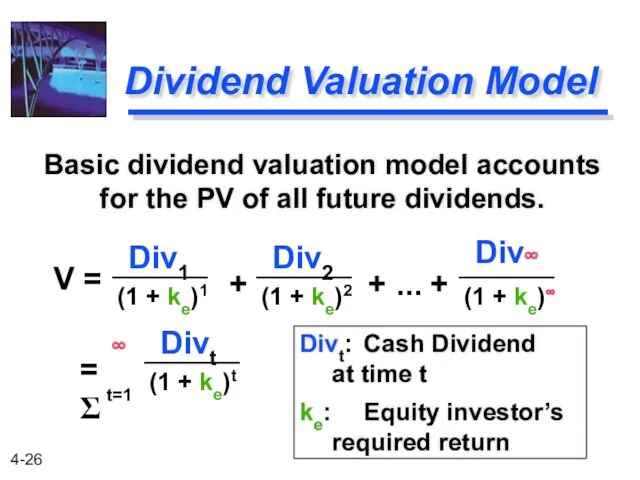

- 26. Dividend Valuation Model Basic dividend valuation model accounts for the PV of all future dividends. (1

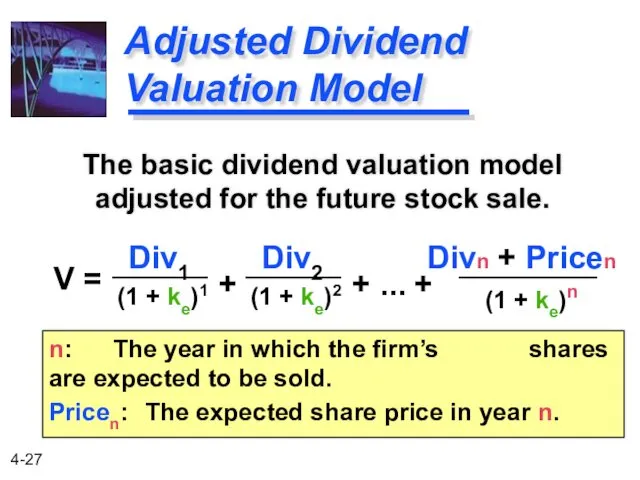

- 27. Adjusted Dividend Valuation Model The basic dividend valuation model adjusted for the future stock sale. (1

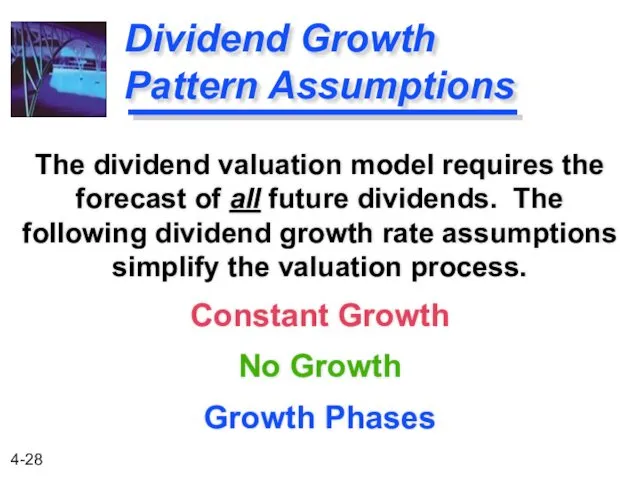

- 28. Dividend Growth Pattern Assumptions The dividend valuation model requires the forecast of all future dividends. The

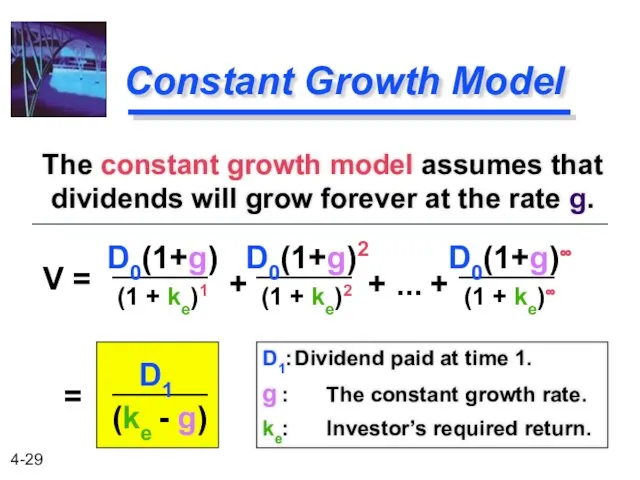

- 29. Constant Growth Model The constant growth model assumes that dividends will grow forever at the rate

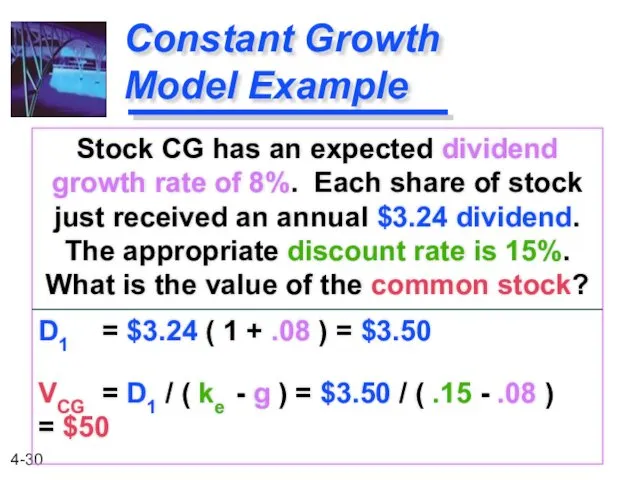

- 30. Constant Growth Model Example Stock CG has an expected dividend growth rate of 8%. Each share

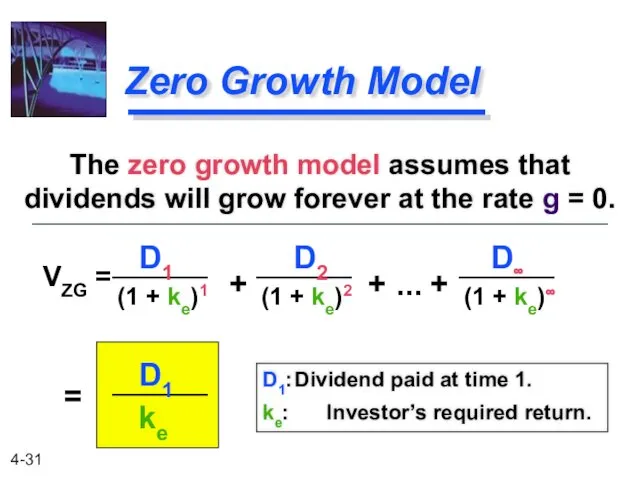

- 31. Zero Growth Model The zero growth model assumes that dividends will grow forever at the rate

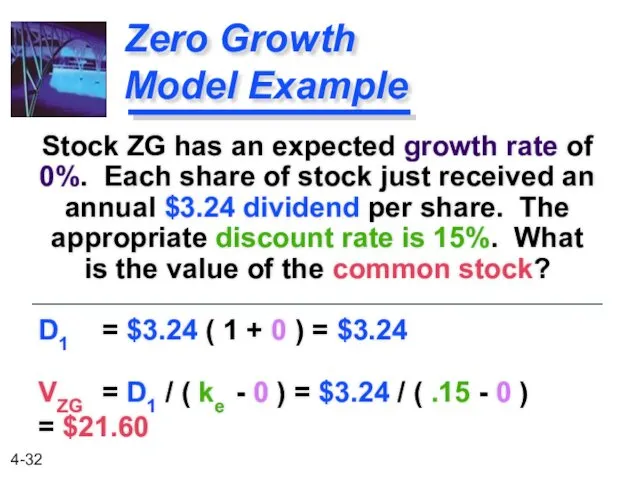

- 32. Zero Growth Model Example Stock ZG has an expected growth rate of 0%. Each share of

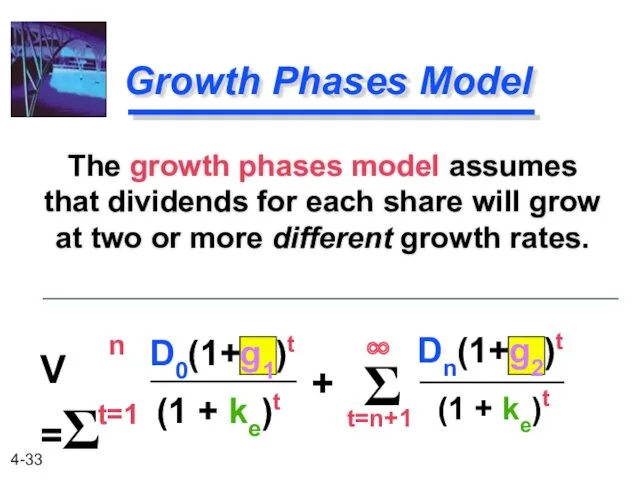

- 33. D0(1+g1)t Dn(1+g2)t Growth Phases Model The growth phases model assumes that dividends for each share will

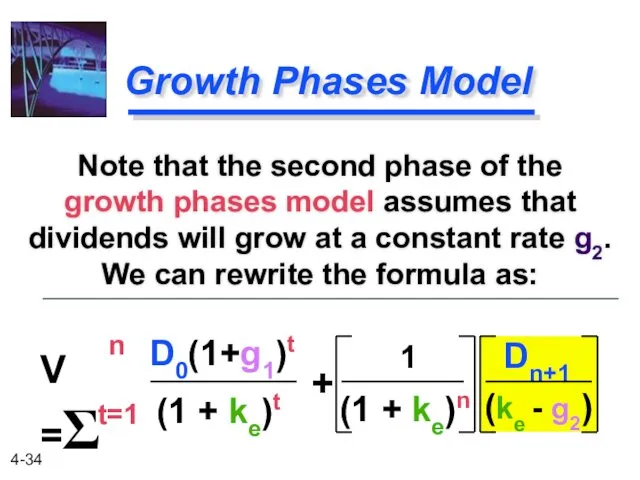

- 34. D0(1+g1)t Dn+1 Growth Phases Model Note that the second phase of the growth phases model assumes

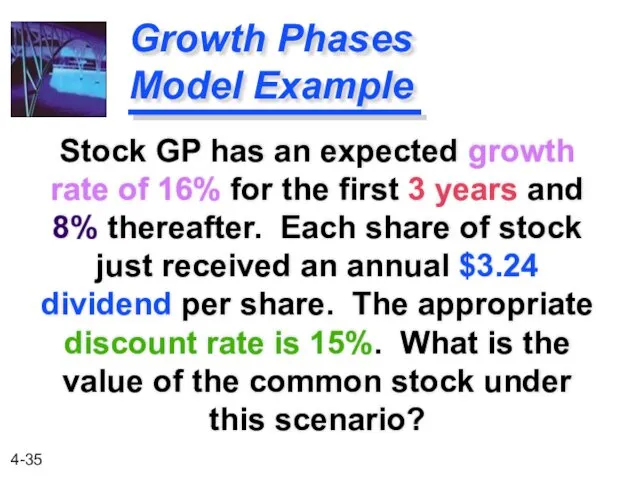

- 35. Growth Phases Model Example Stock GP has an expected growth rate of 16% for the first

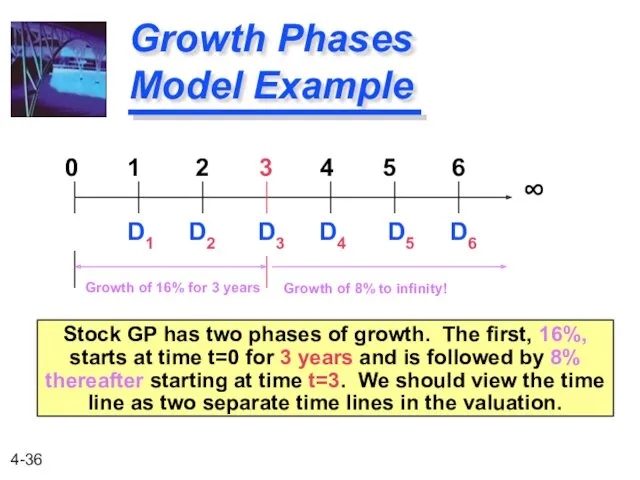

- 36. Growth Phases Model Example Stock GP has two phases of growth. The first, 16%, starts at

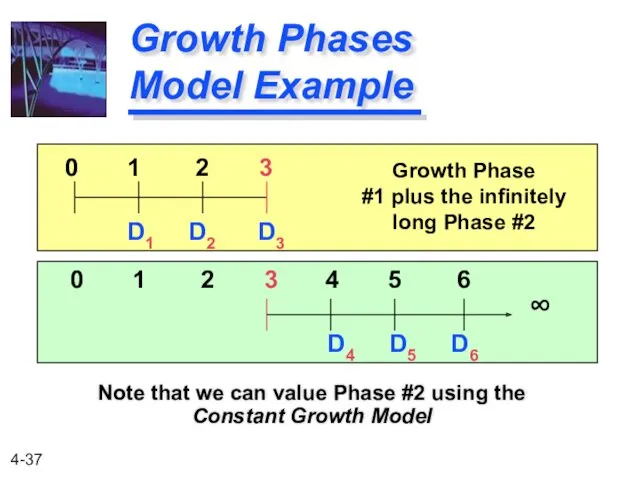

- 37. Growth Phases Model Example Note that we can value Phase #2 using the Constant Growth Model

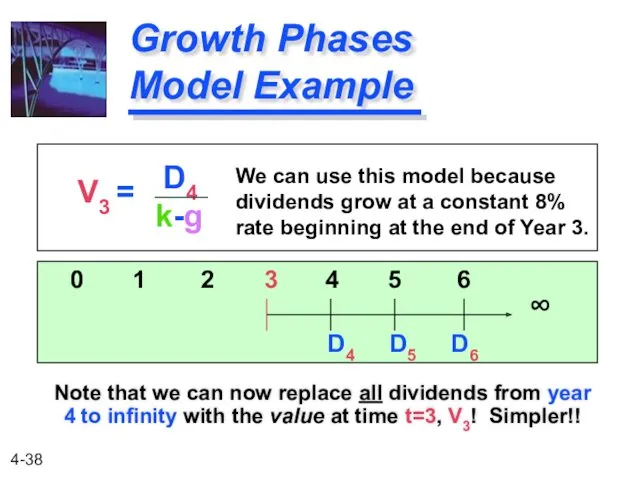

- 38. Growth Phases Model Example Note that we can now replace all dividends from year 4 to

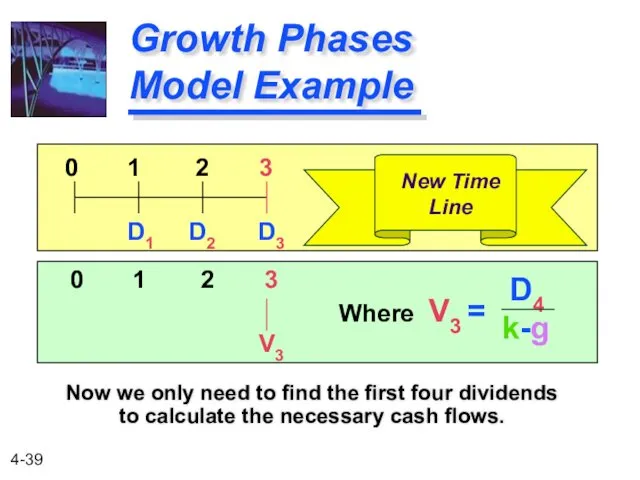

- 39. Growth Phases Model Example Now we only need to find the first four dividends to calculate

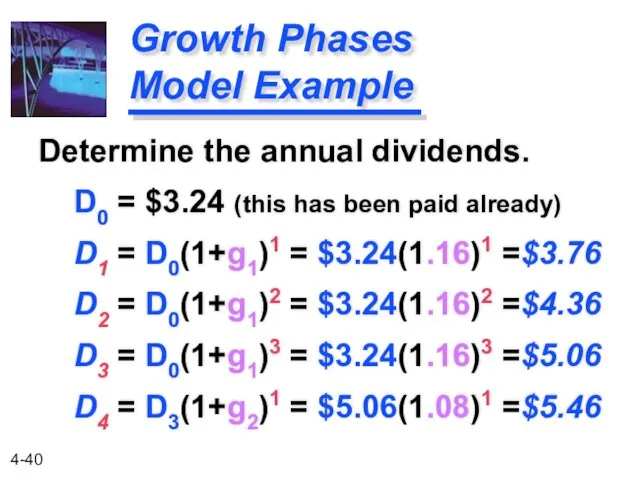

- 40. Growth Phases Model Example Determine the annual dividends. D0 = $3.24 (this has been paid already)

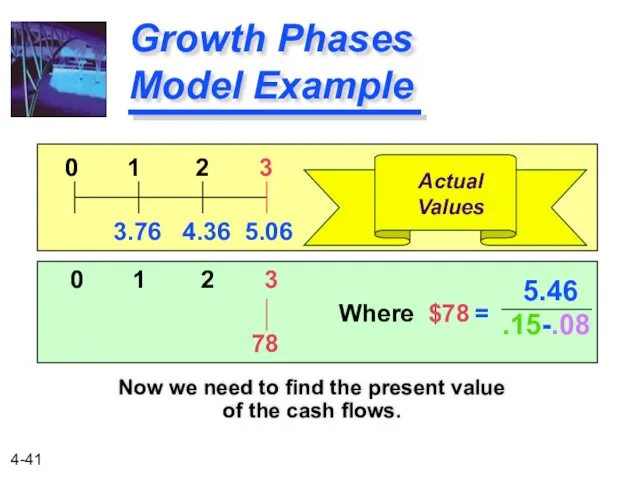

- 41. Growth Phases Model Example Now we need to find the present value of the cash flows.

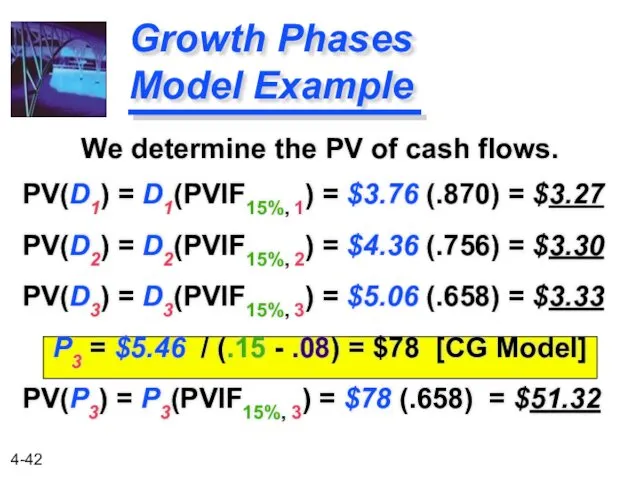

- 42. Growth Phases Model Example We determine the PV of cash flows. PV(D1) = D1(PVIF15%, 1) =

- 44. Скачать презентацию

![Important Bond Terms The maturity value (MV) [or face value]](/_ipx/f_webp&q_80&fit_contain&s_1440x1080/imagesDir/jpg/90227/slide-7.jpg)

Ипотечное кредитование

Ипотечное кредитование Структура подразделения доставки банковских продуктов

Структура подразделения доставки банковских продуктов Роль системы внутреннего контроля в предотвращении мошенничества в финансовой отчетности

Роль системы внутреннего контроля в предотвращении мошенничества в финансовой отчетности New York Stock Exchange (NYSE)

New York Stock Exchange (NYSE) Роль и значение пенсионного фонда РФ в пенсионном обеспечении граждан. Схема назначения и выплаты пенсий

Роль и значение пенсионного фонда РФ в пенсионном обеспечении граждан. Схема назначения и выплаты пенсий Анализ и диагностика финансовых результатов деятельности предприятий торговли и общественного питания

Анализ и диагностика финансовых результатов деятельности предприятий торговли и общественного питания Оценка финансового состояния и финансовой устойчивости организации

Оценка финансового состояния и финансовой устойчивости организации Сергиево-Посадский городской округ. Персонифицированное финансирование дополнительного образования детей

Сергиево-Посадский городской округ. Персонифицированное финансирование дополнительного образования детей Финансовые рынки и институты

Финансовые рынки и институты Бухгалтерские счета и двойная запись

Бухгалтерские счета и двойная запись Индивидуальные инвестиционные счета. АО ФИНАМ

Индивидуальные инвестиционные счета. АО ФИНАМ Ревизия денежных средств. Задачи

Ревизия денежных средств. Задачи Депозитні операції з фізичними особами та управління ними в банку

Депозитні операції з фізичними особами та управління ними в банку Банковская Система РФ

Банковская Система РФ Теоретические основы затратного подхода к оценке предприятий

Теоретические основы затратного подхода к оценке предприятий Инвестиционные проекты и оценка их эффективности

Инвестиционные проекты и оценка их эффективности Упрощенная система налогообложения в издательской деятельности на примере ИП Смолина С.С

Упрощенная система налогообложения в издательской деятельности на примере ИП Смолина С.С Экономическая оценка инвестиций в логистических системах. Часть 1

Экономическая оценка инвестиций в логистических системах. Часть 1 Основы организации бухгалтерского учета в кредитных организациях

Основы организации бухгалтерского учета в кредитных организациях Эффект финансового рычага

Эффект финансового рычага Межбанковские расчеты РК и порядок их осуществления. (Тема 4)

Межбанковские расчеты РК и порядок их осуществления. (Тема 4) Продукты и услуги АО Альфа-Банк для Клиентов физических лиц

Продукты и услуги АО Альфа-Банк для Клиентов физических лиц Правовое регулирование деятельности бирж в Республике Беларусь

Правовое регулирование деятельности бирж в Республике Беларусь Финансирование малого и среднего инновационного бизнеса на территории Российской Федерации

Финансирование малого и среднего инновационного бизнеса на территории Российской Федерации Международный стандарт аудита 300. Планирование аудита финансовой отчетности

Международный стандарт аудита 300. Планирование аудита финансовой отчетности Риск. Количественная и качественная оценка рисков

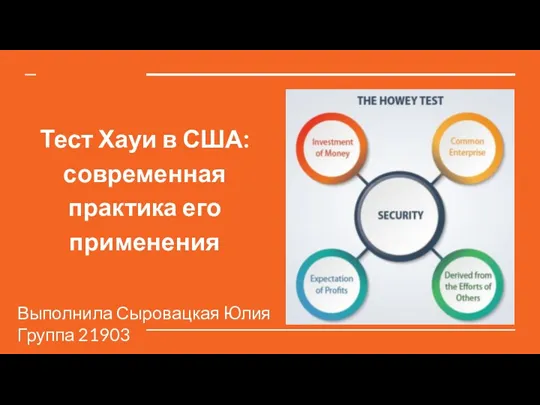

Риск. Количественная и качественная оценка рисков Тест Хауи в США: современная практика его применения

Тест Хауи в США: современная практика его применения Жалпы және таза табыс

Жалпы және таза табыс