Содержание

- 2. What is Arbitration? FIX API arbitration is a type of trading strategy, which suggests to search

- 3. Types of Arbitrage Trade Latency Arbitrage 2-Leg Arbitrage Triangular Arbitrage

- 4. Triangular arbitrage is a type of arbitrage trade, the essence of which is in opening positions

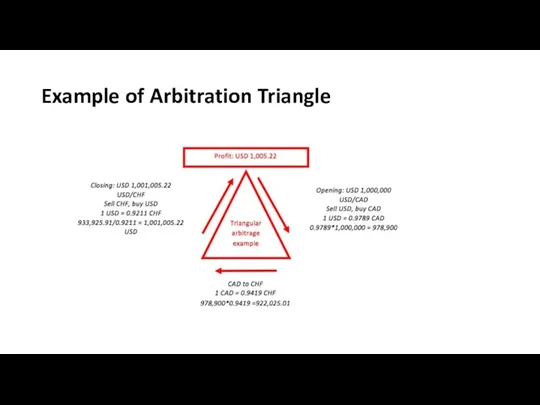

- 5. Example of Arbitration Triangle

- 6. Diversification of exchange differences; Risk minimization; There are practically no risk of operation drawdown, since the

- 7. Use of slow software can lead to performing operations on irrelevant prices, which increases the risks.

- 9. Скачать презентацию

Директ-страхование

Директ-страхование Право социального обеспечения как отрасль права: предмет, метод, система

Право социального обеспечения как отрасль права: предмет, метод, система Обзор инвестиционных инструментов и оценивание степени риска продуктов и услуг для определения финансовых целей

Обзор инвестиционных инструментов и оценивание степени риска продуктов и услуг для определения финансовых целей Кредиттер бойынша субсидиялар мен кепілдіктерді қалай алуға болады?

Кредиттер бойынша субсидиялар мен кепілдіктерді қалай алуға болады? Тауарайналым” экономикалық көрсеткішінің сипаттамасы, жалпы тауарайналым, бөлшек және көтерме тауарайналым

Тауарайналым” экономикалық көрсеткішінің сипаттамасы, жалпы тауарайналым, бөлшек және көтерме тауарайналым Кредит. Признаки кредита

Кредит. Признаки кредита Финансовый менеджмент и управление инвестициями

Финансовый менеджмент и управление инвестициями Управление портфелем ценных бумаг. Портфельные стратегии

Управление портфелем ценных бумаг. Портфельные стратегии Българска народна банка

Българска народна банка История развития банковского дела. Современная структура банковской системы РФ

История развития банковского дела. Современная структура банковской системы РФ Антикризисный менеджмент. Диагностика финансового состояния организации. (Лекция 5)

Антикризисный менеджмент. Диагностика финансового состояния организации. (Лекция 5) Валютный курс, факторы его определяющие. (Тема 2)

Валютный курс, факторы его определяющие. (Тема 2) Бухгалтерская (финансовая) отчетность. Тема 18

Бухгалтерская (финансовая) отчетность. Тема 18 Упрощенная система налогообложения в издательской деятельности на примере ИП Смолина С.С

Упрощенная система налогообложения в издательской деятельности на примере ИП Смолина С.С Управление проектами. Финансирование проектов

Управление проектами. Финансирование проектов Факторинг

Факторинг Управление коммерческими банками

Управление коммерческими банками Работа с бюджетами в условиях нестабильности

Работа с бюджетами в условиях нестабильности Цена. Цели ценообразования

Цена. Цели ценообразования Личные вещи. Продукт по страхованию

Личные вещи. Продукт по страхованию Микрофинансовые организации. Микрозаймы и банковские кредиты. (10 класс)

Микрофинансовые организации. Микрозаймы и банковские кредиты. (10 класс) Бюджетна децентралізація України: правове регулювання, значення та перспективи проведення

Бюджетна децентралізація України: правове регулювання, значення та перспективи проведення Социальное проектирование и грантооператоры

Социальное проектирование и грантооператоры Оценка кредитоспособности клиента банка

Оценка кредитоспособности клиента банка Оценка расходов на построение сети

Оценка расходов на построение сети Әлемдегі 10 құнды валюта

Әлемдегі 10 құнды валюта Дивидендная политика различных компаний (3). ПАО МАГНИТ

Дивидендная политика различных компаний (3). ПАО МАГНИТ Семейный бюджет

Семейный бюджет