Содержание

- 2. 20-1 CALLS, PUTS, AND SHARES Call Option Right to buy an asset at specified price on

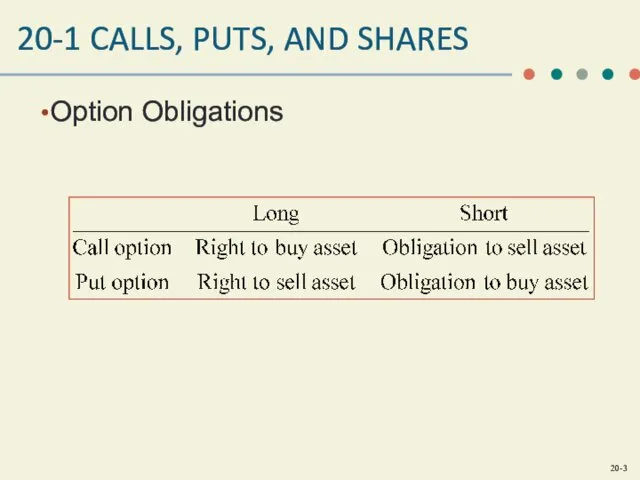

- 3. 20-1 CALLS, PUTS, AND SHARES Option Obligations

- 4. 20-1 CALLS, PUTS, AND SHARES Derivatives Financial instrument created from another instrument Option Premium Price paid

- 5. 20-1 CALLS, PUTS, AND SHARES Exercise Price (Strike Price) Price at which security is bought or

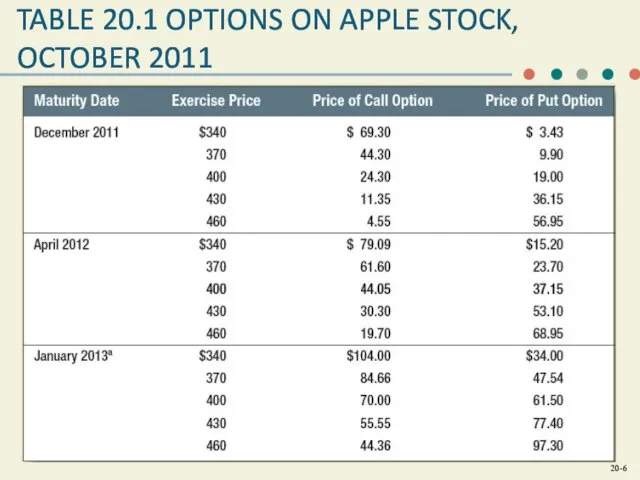

- 6. TABLE 20.1 OPTIONS ON APPLE STOCK, OCTOBER 2011

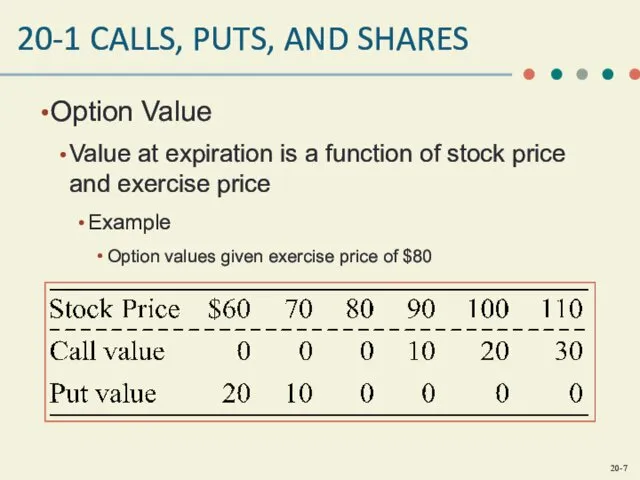

- 7. 20-1 CALLS, PUTS, AND SHARES Option Value Value at expiration is a function of stock price

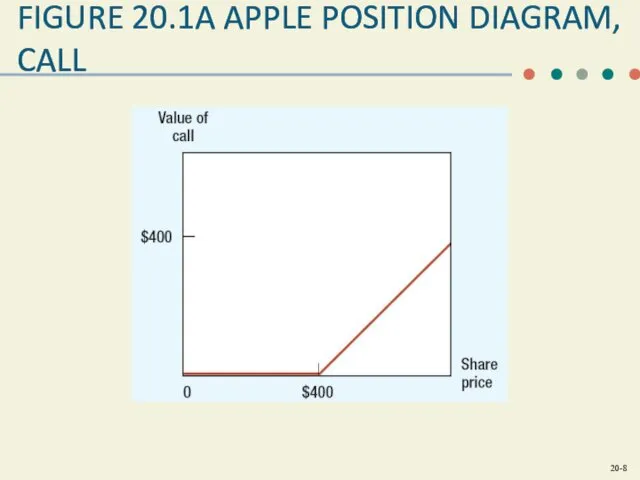

- 8. FIGURE 20.1A APPLE POSITION DIAGRAM, CALL

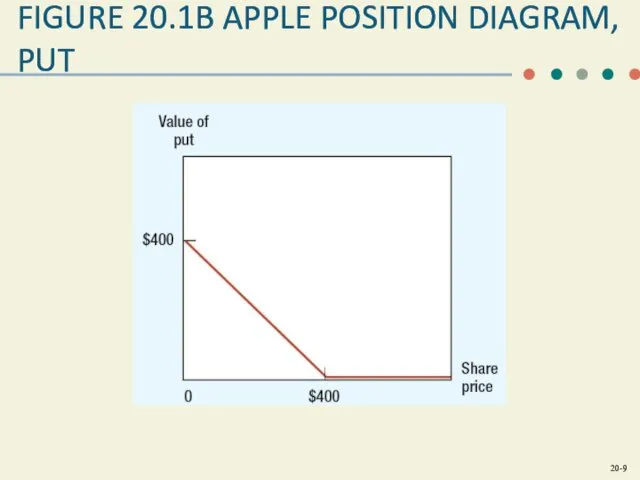

- 9. FIGURE 20.1B APPLE POSITION DIAGRAM, PUT

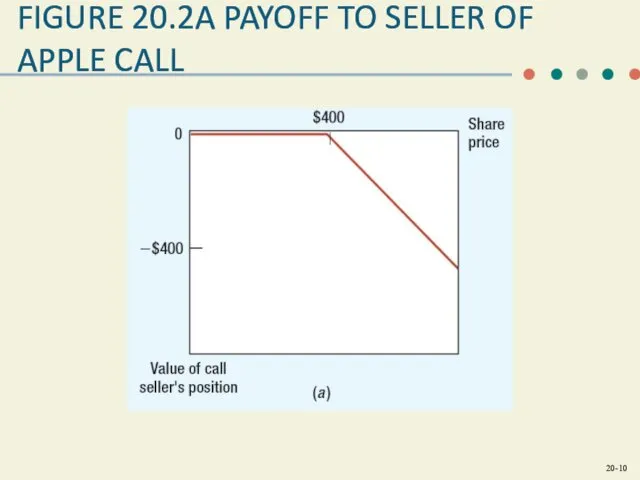

- 10. FIGURE 20.2A PAYOFF TO SELLER OF APPLE CALL

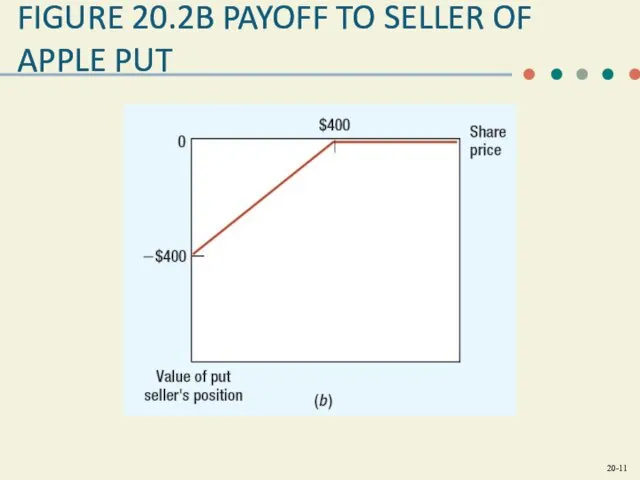

- 11. FIGURE 20.2B PAYOFF TO SELLER OF APPLE PUT

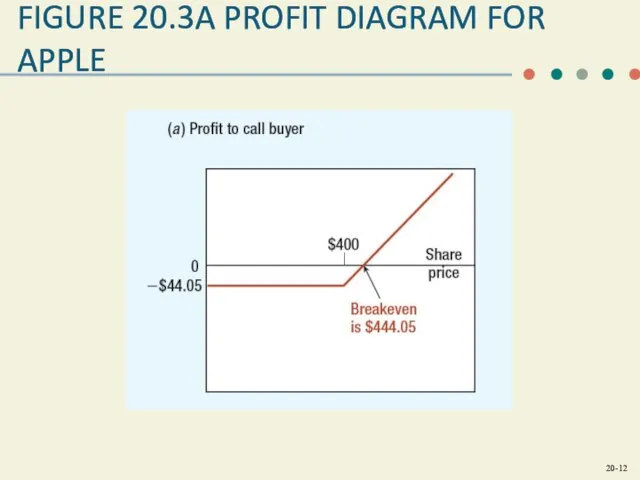

- 12. FIGURE 20.3A PROFIT DIAGRAM FOR APPLE

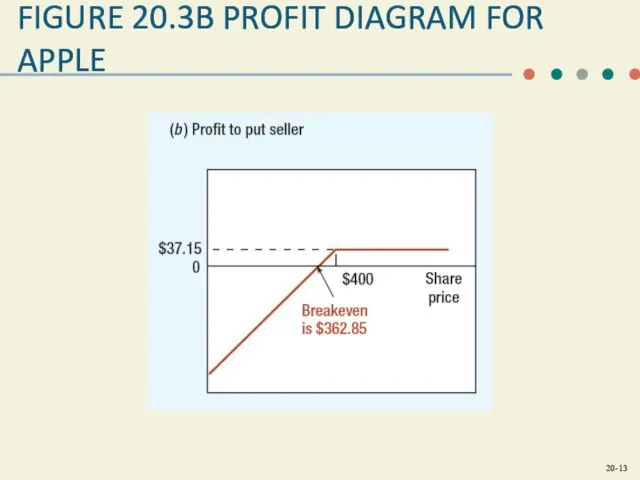

- 13. FIGURE 20.3B PROFIT DIAGRAM FOR APPLE

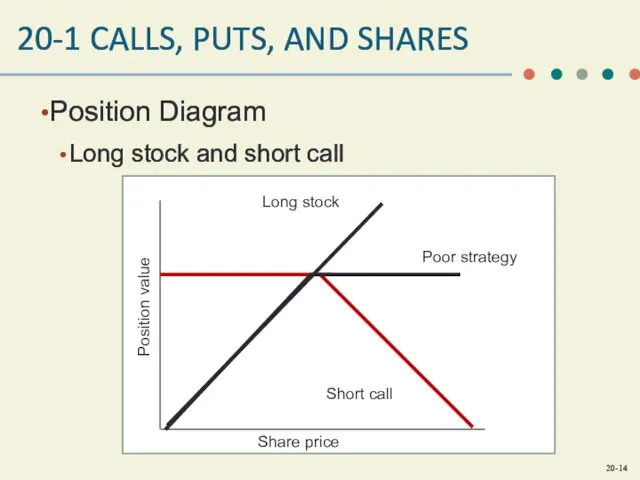

- 14. 20-1 CALLS, PUTS, AND SHARES Position Diagram Long stock and short call

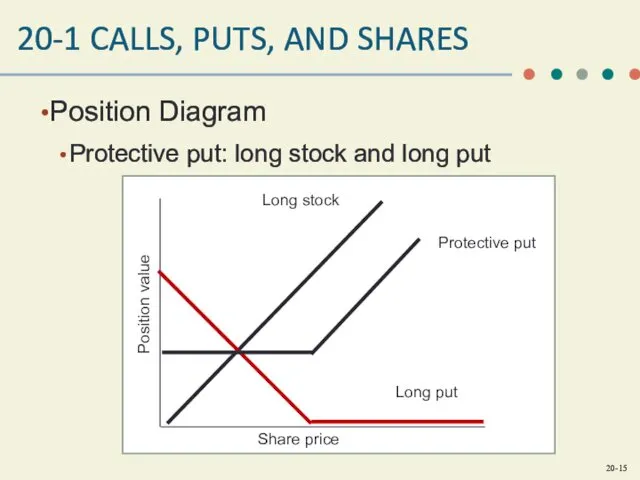

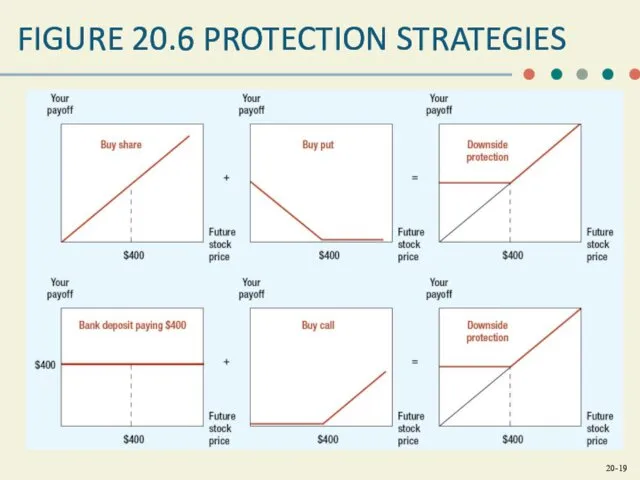

- 15. 20-1 CALLS, PUTS, AND SHARES Position Diagram Protective put: long stock and long put

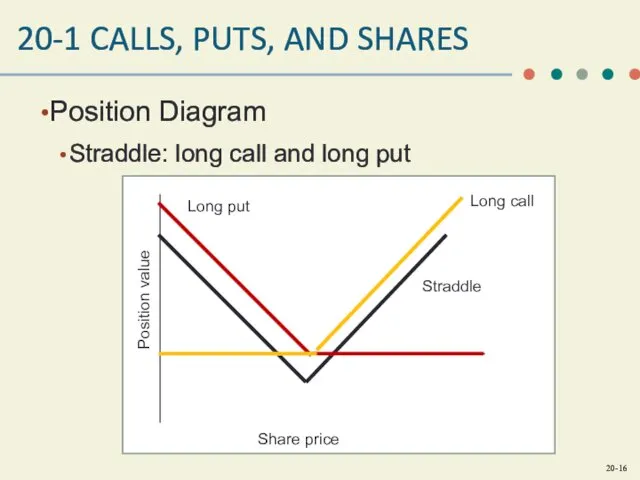

- 16. 20-1 CALLS, PUTS, AND SHARES Position Diagram Straddle: long call and long put

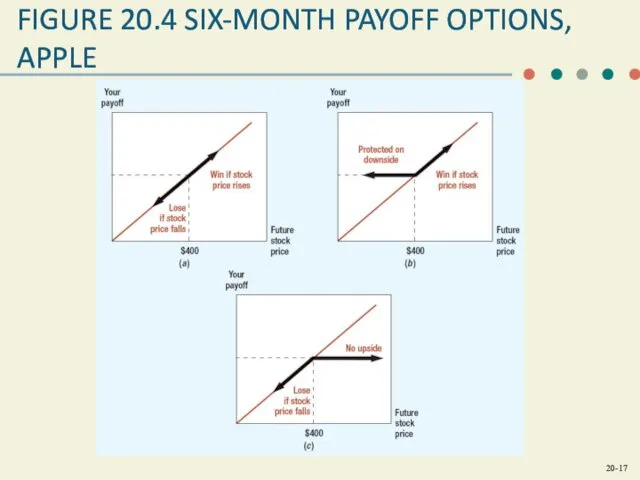

- 17. FIGURE 20.4 SIX-MONTH PAYOFF OPTIONS, APPLE

- 18. FIGURE 20.5 OPTIONS

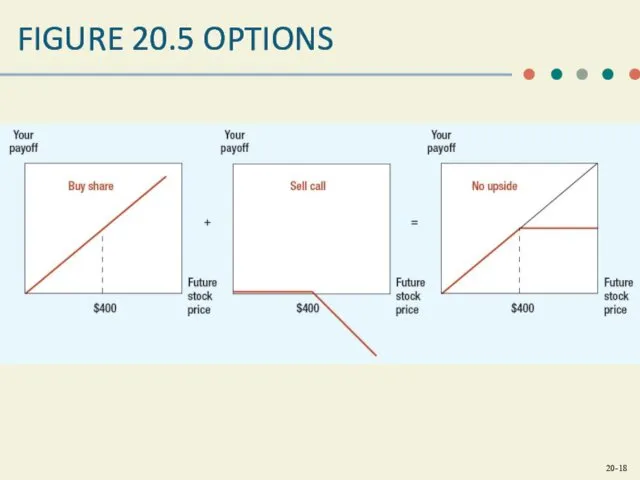

- 19. FIGURE 20.6 PROTECTION STRATEGIES

- 20. FIGURE 20.7 CALL TO PUT

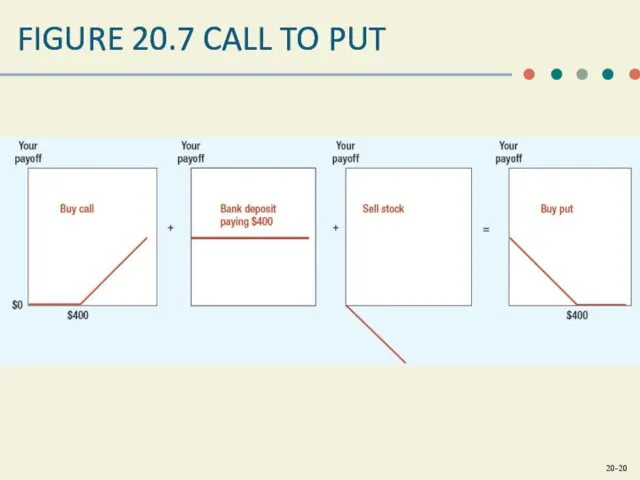

- 21. FIGURE 20.8 TICKET PAYOFF

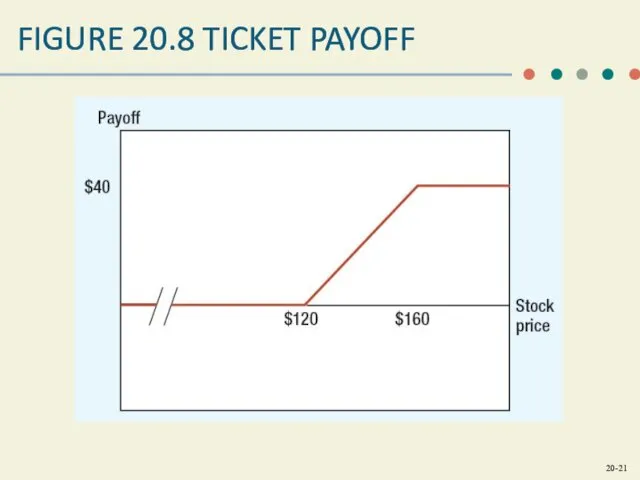

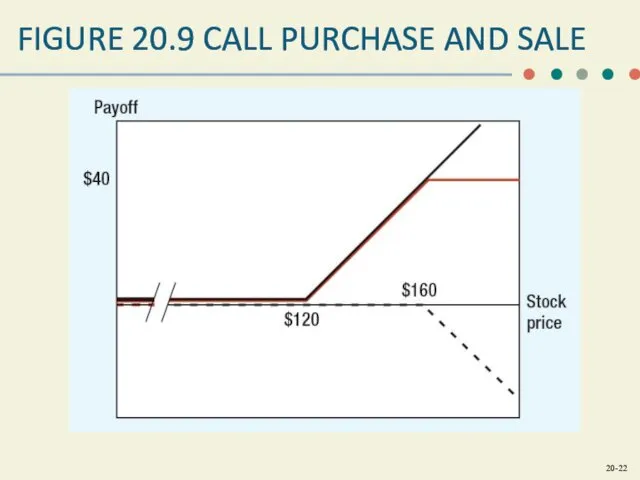

- 22. FIGURE 20.9 CALL PURCHASE AND SALE

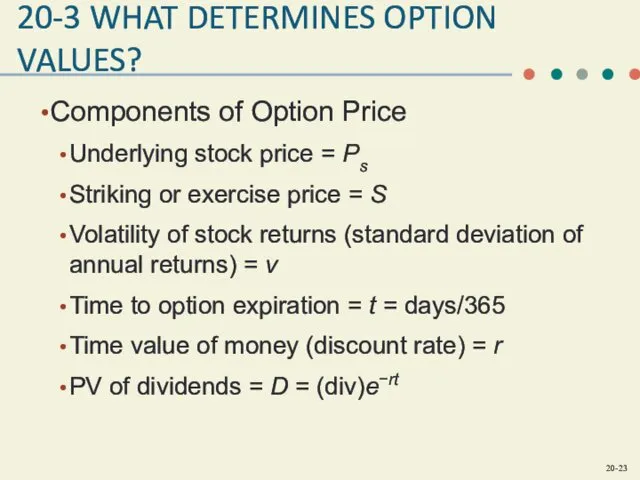

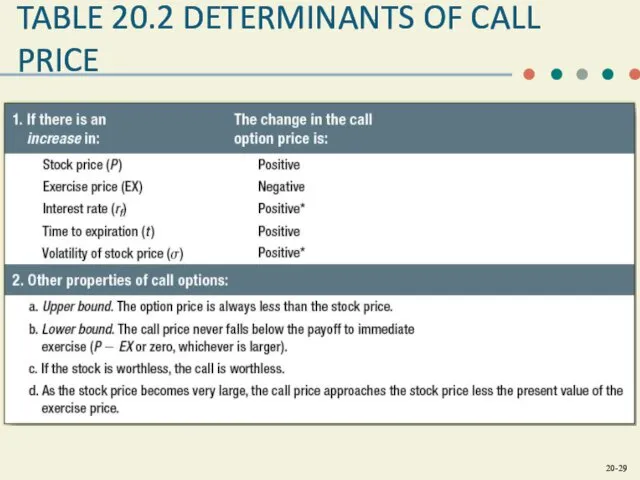

- 23. 20-3 WHAT DETERMINES OPTION VALUES? Components of Option Price Underlying stock price = Ps Striking or

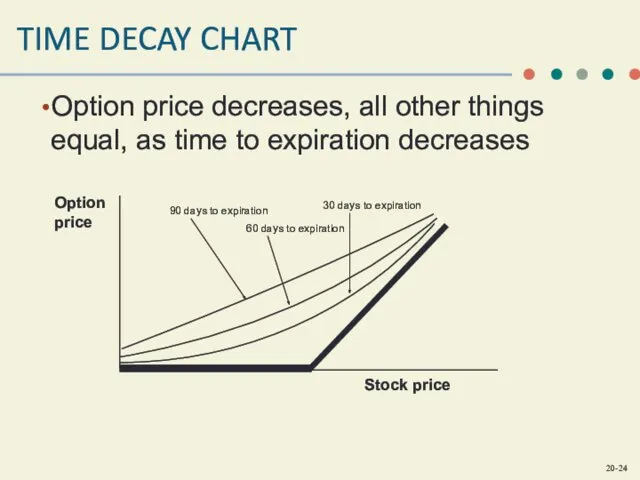

- 24. TIME DECAY CHART Option price decreases, all other things equal, as time to expiration decreases

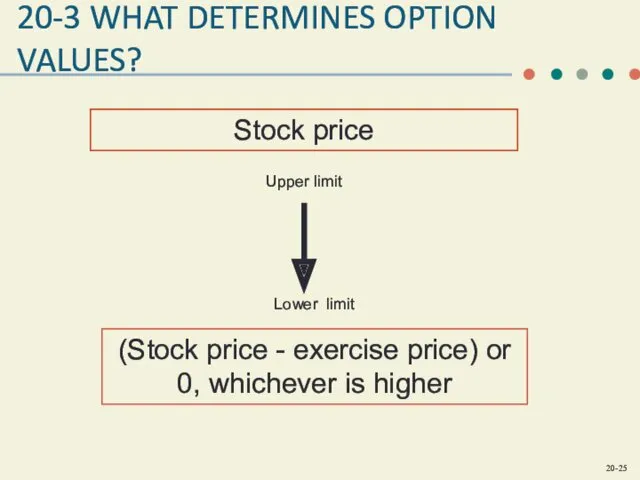

- 25. 20-3 WHAT DETERMINES OPTION VALUES?

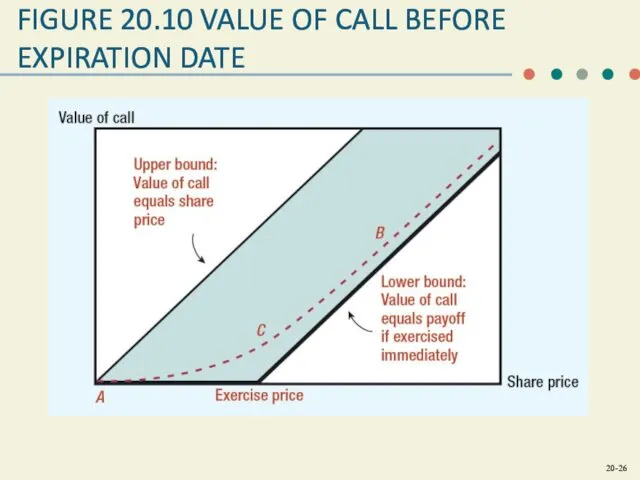

- 26. FIGURE 20.10 VALUE OF CALL BEFORE EXPIRATION DATE

- 27. FIGURE 20.11 CALL OPTIONS, FIRMS X AND Y In each case, current share price equals exercise

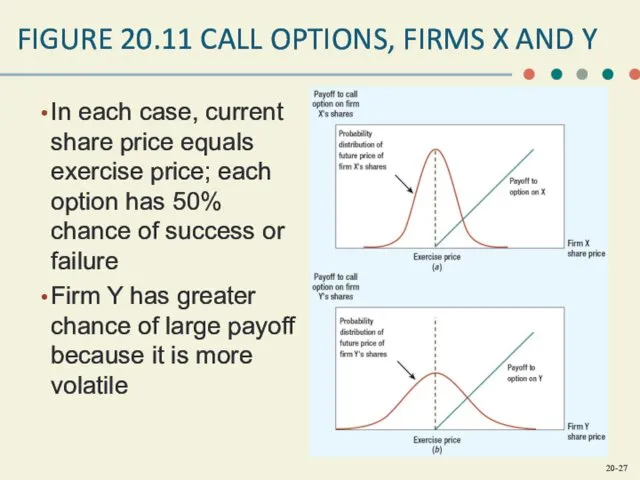

- 28. FIGURE 20.12 APPLE CALL OPTION VALUE VERSUS STOCK PRICE

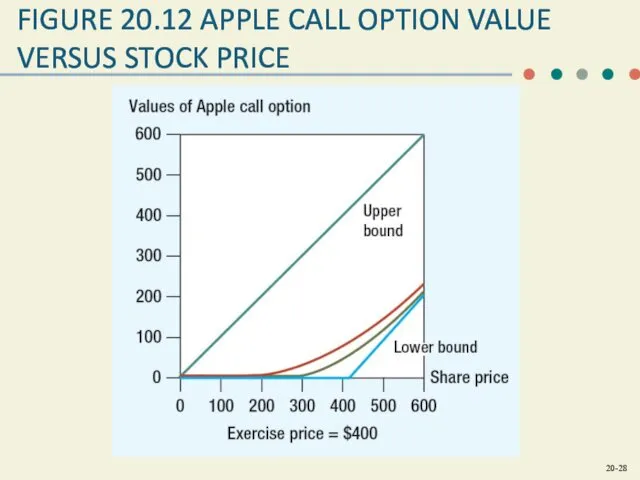

- 29. TABLE 20.2 DETERMINANTS OF CALL PRICE

- 31. Скачать презентацию

Страхование урожая с государственной поддержкой

Страхование урожая с государственной поддержкой Риск-менеджмент

Риск-менеджмент Казначейське обслуговування державного боргу. Організація контролю в системі казначейства

Казначейське обслуговування державного боргу. Організація контролю в системі казначейства Cекреты бухгалтерского и финансового учета в НКО

Cекреты бухгалтерского и финансового учета в НКО Операции банка с драгоценными металлами. Управление золото-валютными резервами

Операции банка с драгоценными металлами. Управление золото-валютными резервами Анализ портфеля акций

Анализ портфеля акций Описание земельного участка кинотеатр Победа. Кадастровая стоимость

Описание земельного участка кинотеатр Победа. Кадастровая стоимость Решение финансового кейса, разработанное командой Акулы бизнеса

Решение финансового кейса, разработанное командой Акулы бизнеса Карта рассрочки Халва

Карта рассрочки Халва Возможные источники финансирования СО НКО

Возможные источники финансирования СО НКО Финансово-хозяйственная деятельность МКП ПАТП-4, г. Новосибирск

Финансово-хозяйственная деятельность МКП ПАТП-4, г. Новосибирск Налоговое планирование налога на прибыль

Налоговое планирование налога на прибыль История возникновения денег

История возникновения денег Банковский вклад. Банковский счет

Банковский вклад. Банковский счет Налоги - обязательные платежи физических и юридических лиц государству

Налоги - обязательные платежи физических и юридических лиц государству Видатковий касовий ордер

Видатковий касовий ордер Миссия, основные направления деятельности ФНС России

Миссия, основные направления деятельности ФНС России Финансовые инновации. Краудинвестинг и налоговые гавани

Финансовые инновации. Краудинвестинг и налоговые гавани Рынок ценных бумаг

Рынок ценных бумаг Финансовый продукт Vista

Финансовый продукт Vista Эквайринг – как элемент маркетинга 2023 год

Эквайринг – как элемент маркетинга 2023 год Бухгалтерский баланс в анализе финансового результата предприятия и его улучшение в ОАО ПНППК

Бухгалтерский баланс в анализе финансового результата предприятия и его улучшение в ОАО ПНППК Города России на банкнотах разного достоинства

Города России на банкнотах разного достоинства Бюджетное право

Бюджетное право Аудит финансовых результатов

Аудит финансовых результатов Современное состояние рынка МФО

Современное состояние рынка МФО Сущность и функции финансов, их роль в системе денежных отношений

Сущность и функции финансов, их роль в системе денежных отношений Валовый доход и прибыль

Валовый доход и прибыль