Содержание

- 2. Table of Contents

- 3. Table of Contents

- 4. Table of Contents

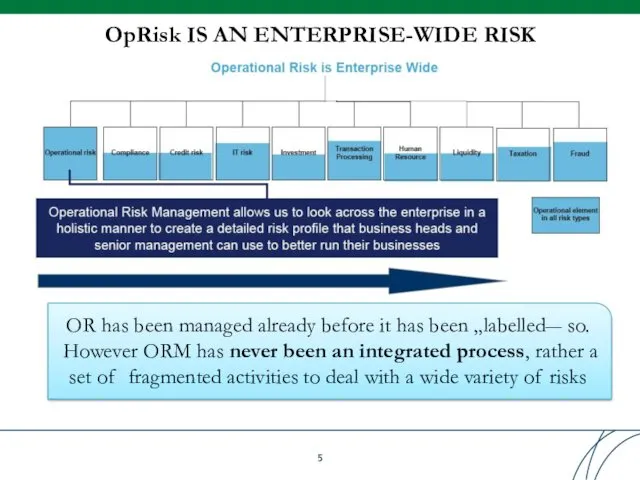

- 5. OpRisk IS AN ENTERPRISE-WIDE RISK OR has been managed already before it has been „labelled― so.

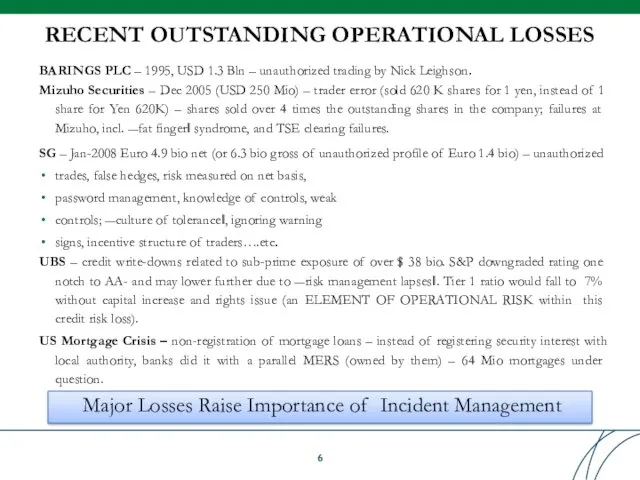

- 6. RECENT OUTSTANDING OPERATIONAL LOSSES BARINGS PLC – 1995, USD 1.3 Bln – unauthorized trading by Nick

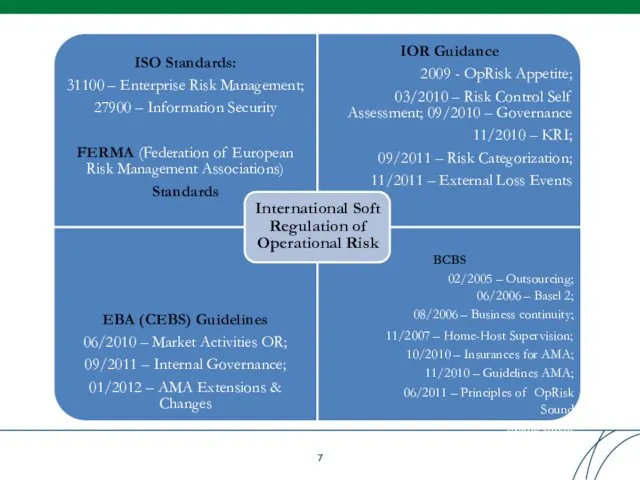

- 7. ISO Standards: 31100 – Enterprise Risk Management; 27900 – Information Security FERMA (Federation of European Risk

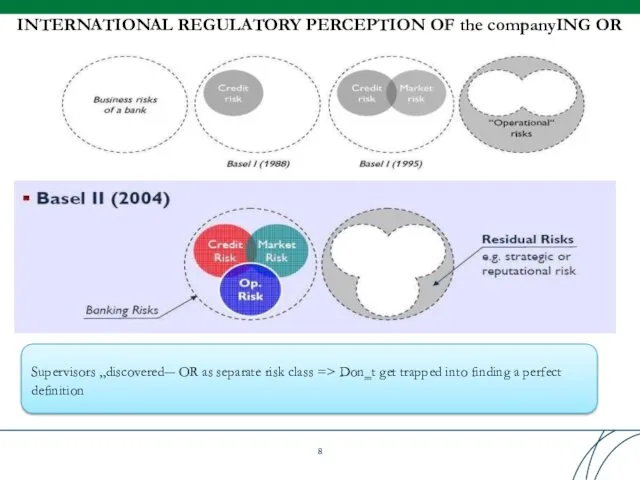

- 8. INTERNATIONAL REGULATORY PERCEPTION OF the companyING OR Supervisors „discovered― OR as separate risk class => Don‗t

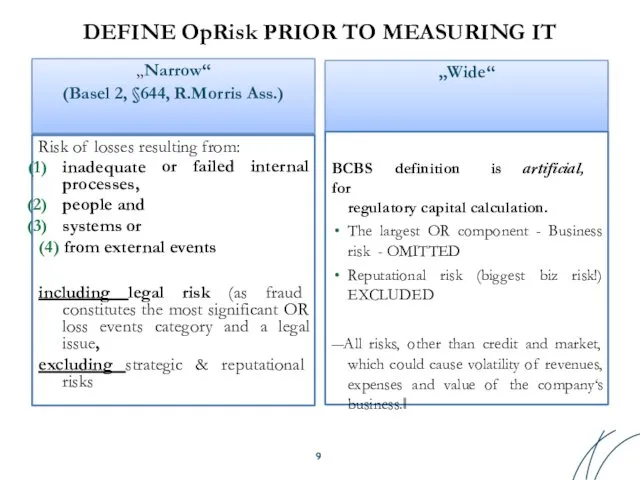

- 9. DEFINE OpRisk PRIOR TO MEASURING IT „Wide“ „Narrow“ (Basel 2, §644, R.Morris Ass.) Risk of losses

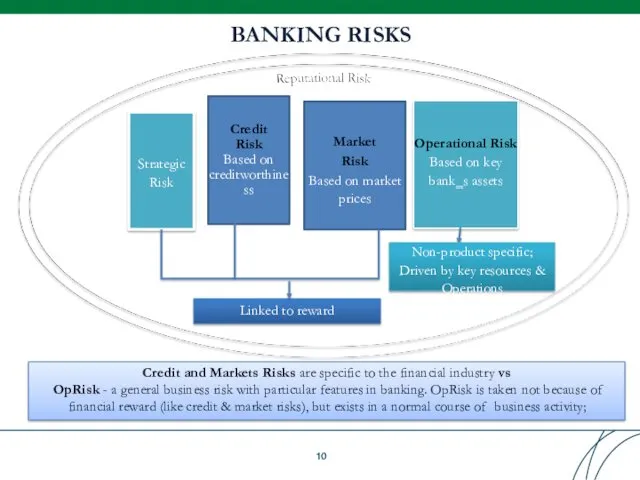

- 10. BANKING RISKS Strategic Risk Credit Risk Based on creditworthine ss Market Risk Based on market prices

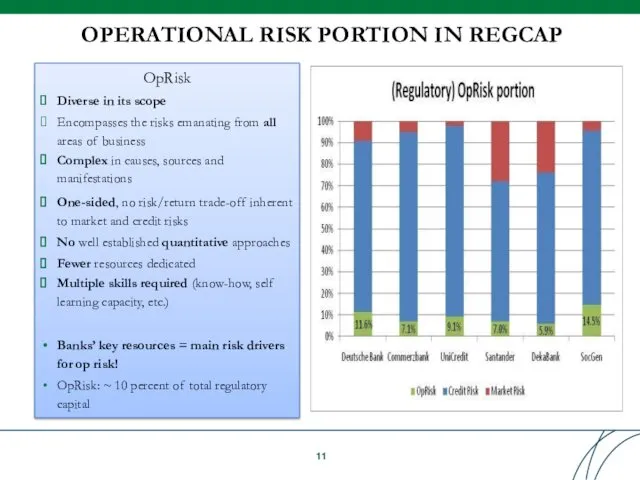

- 11. OPERATIONAL RISK PORTION IN REGCAP OpRisk Diverse in its scope Encompasses the risks emanating from all

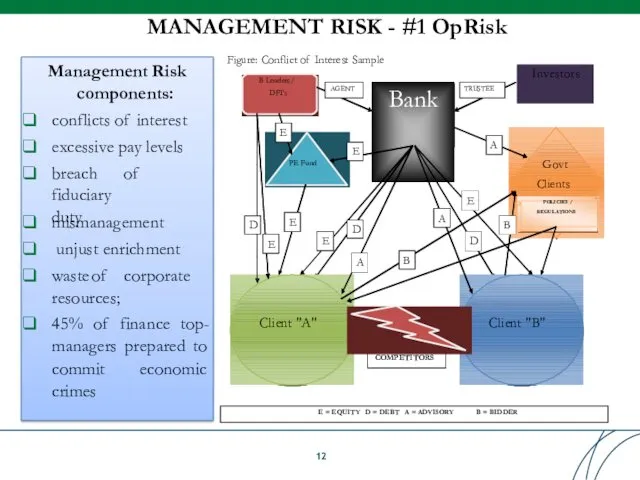

- 12. MANAGEMENT RISK - #1 OpRisk Management Risk components: conflicts of interest excessive pay levels breach of

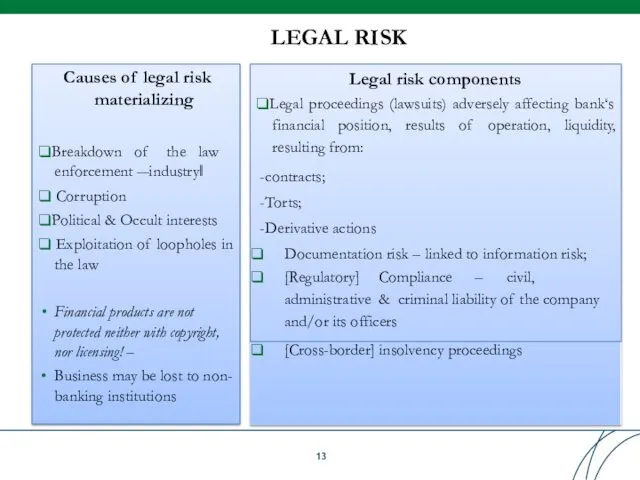

- 13. LEGAL RISK Causes of legal risk materializing ❑Breakdown of the law enforcement ―industry‖ ❑ Corruption ❑Political

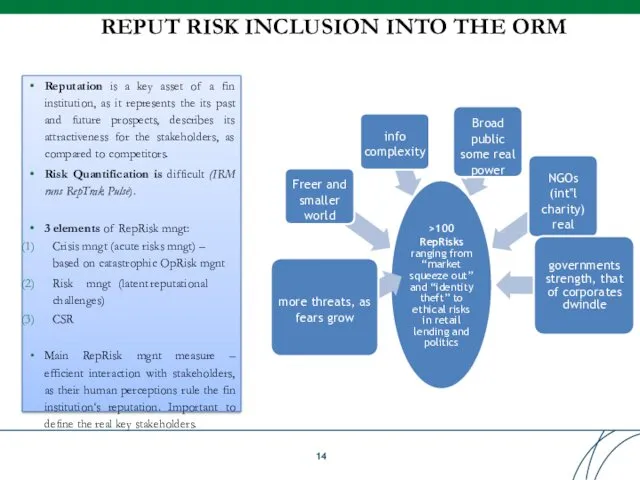

- 14. REPUT RISK INCLUSION INTO THE ORM Reputation is a key asset of a fin institution, as

- 15. Table of Contents

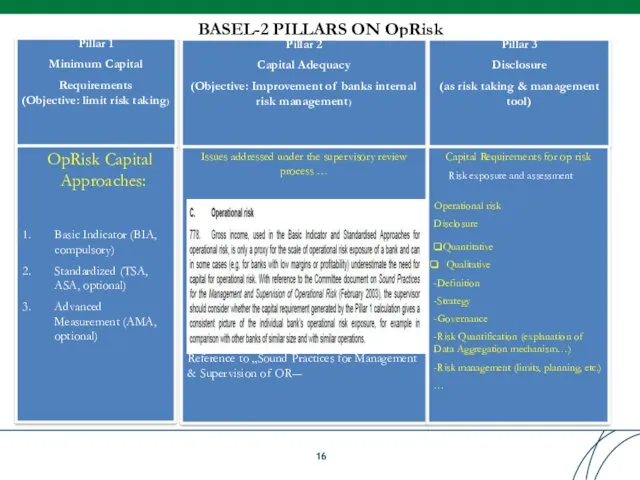

- 16. BASEL-2 PILLARS ON OpRisk Pillar 1 Minimum Capital Requirements (Objective: limit risk taking) Pillar 2 Capital

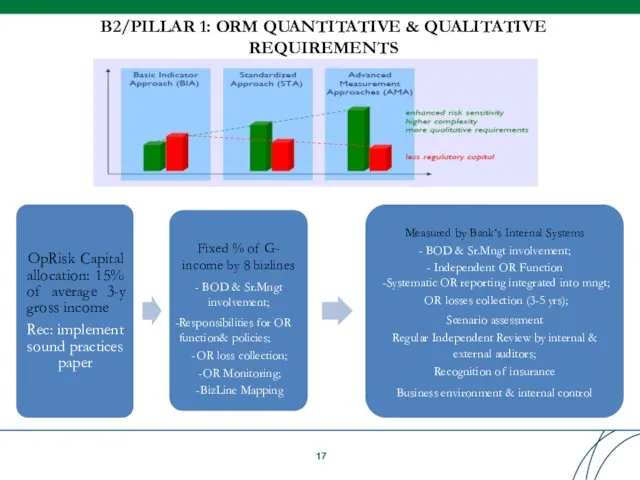

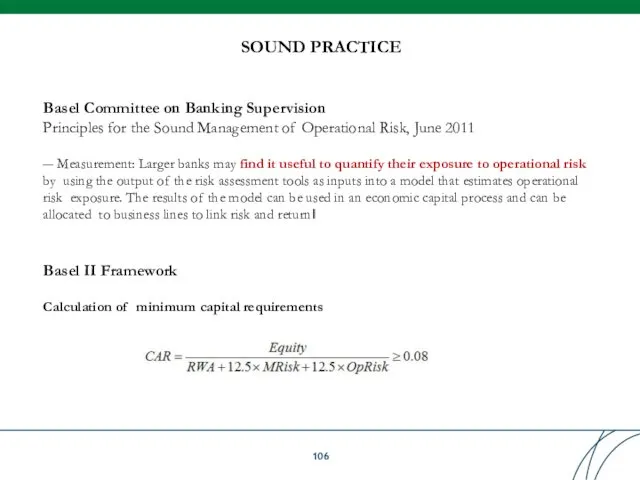

- 17. B2/PILLAR 1: ORM QUANTITATIVE & QUALITATIVE REQUIREMENTS OpRisk Capital allocation: 15% of average 3-y gross income

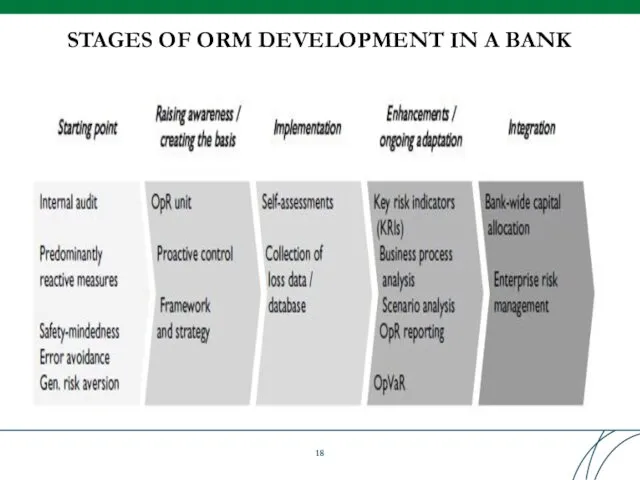

- 18. STAGES OF ORM DEVELOPMENT IN A BANK

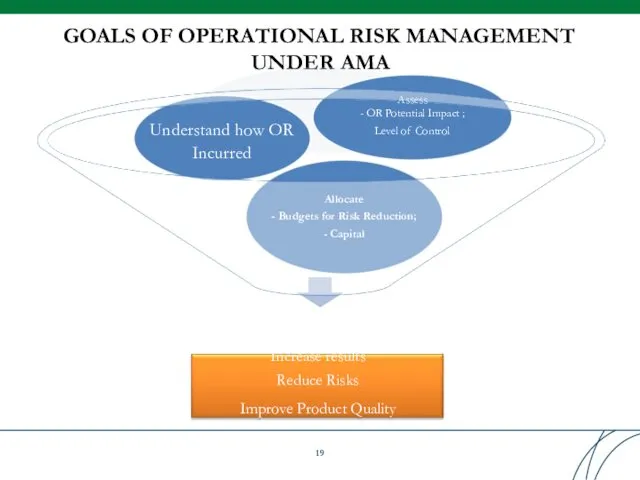

- 19. GOALS OF OPERATIONAL RISK MANAGEMENT UNDER AMA Allocate - Budgets for Risk Reduction; - Capital Understand

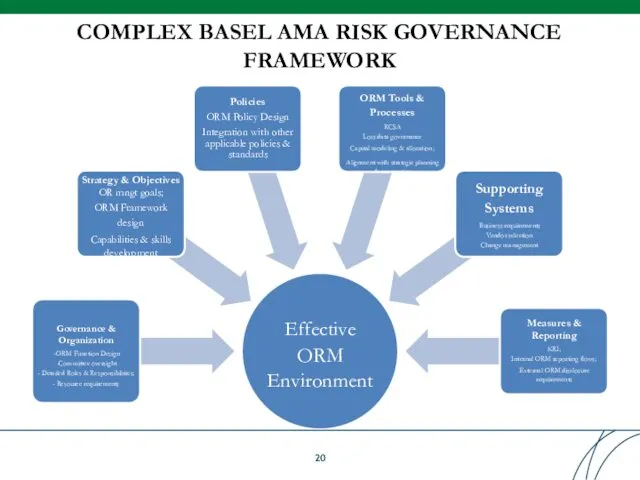

- 20. COMPLEX BASEL AMA RISK GOVERNANCE FRAMEWORK Effective ORM Environment Governance & Organization ORM Function Design Committee

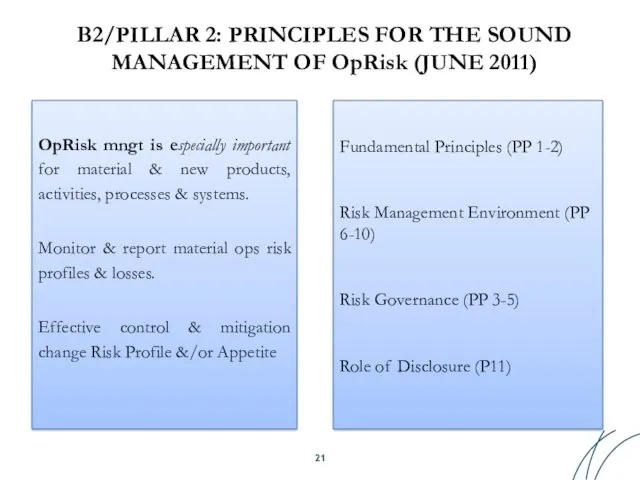

- 21. B2/PILLAR 2: PRINCIPLES FOR THE SOUND MANAGEMENT OF OpRisk (JUNE 2011) OpRisk mngt is especially important

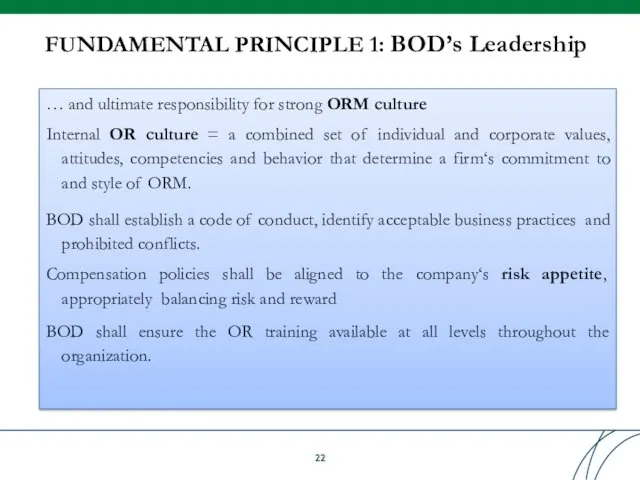

- 22. FUNDAMENTAL PRINCIPLE 1: BOD’s Leadership … and ultimate responsibility for strong ORM culture Internal OR culture

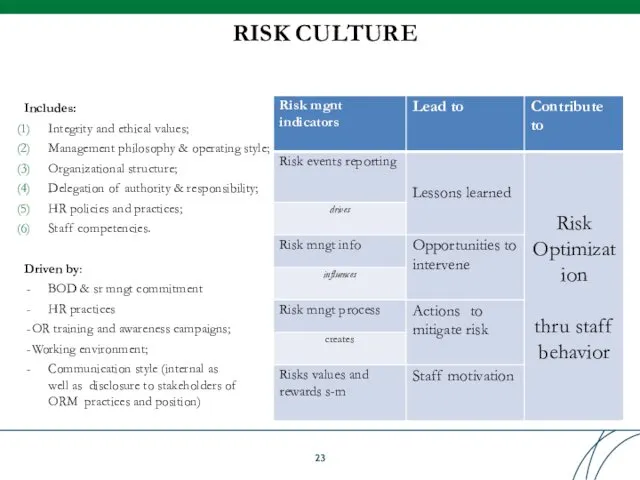

- 23. RISK CULTURE Includes: Integrity and ethical values; Management philosophy & operating style; Organizational structure; Delegation of

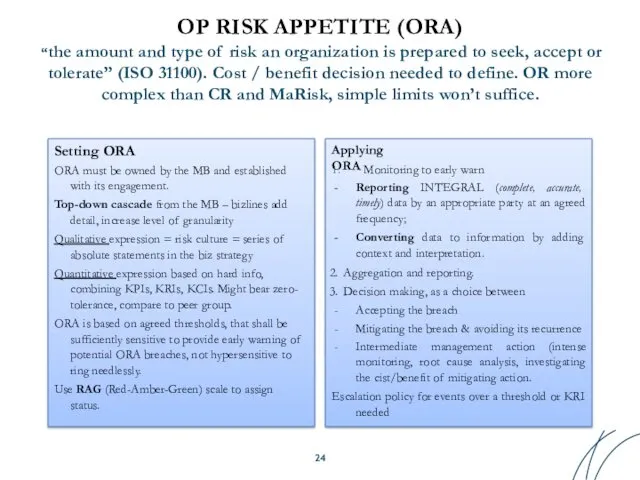

- 24. OP RISK APPETITE (ORA) “the amount and type of risk an organization is prepared to seek,

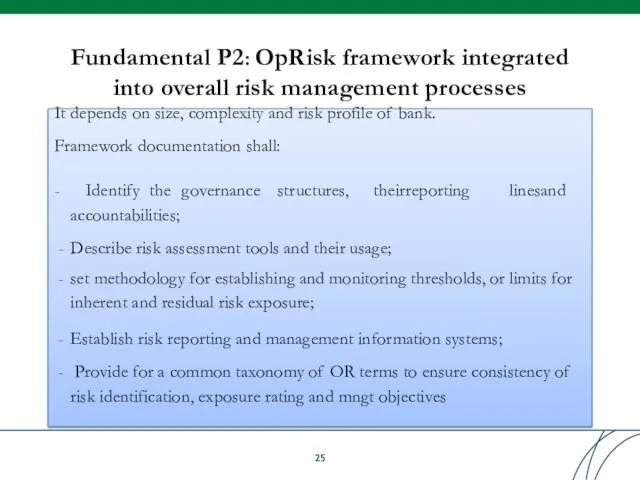

- 25. Fundamental P2: OpRisk framework integrated into overall risk management processes It depends on size, complexity and

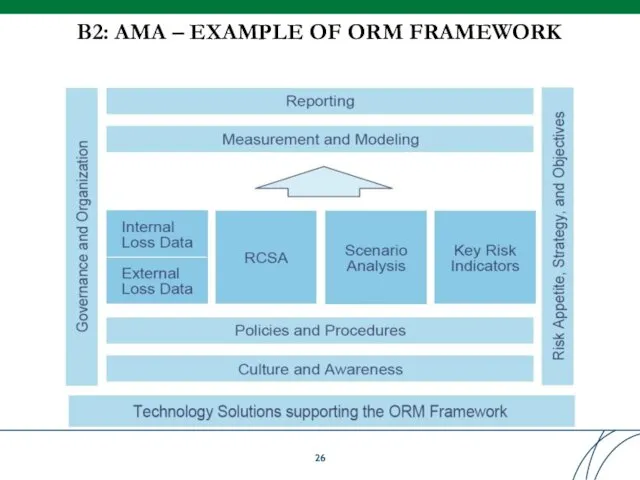

- 26. B2: AMA – EXAMPLE OF ORM FRAMEWORK

- 27. MANAGING OpRisk THROUGH FRAMEWORK OR has been managed already before it has been „labelled― so: „4-eyes―-principle,

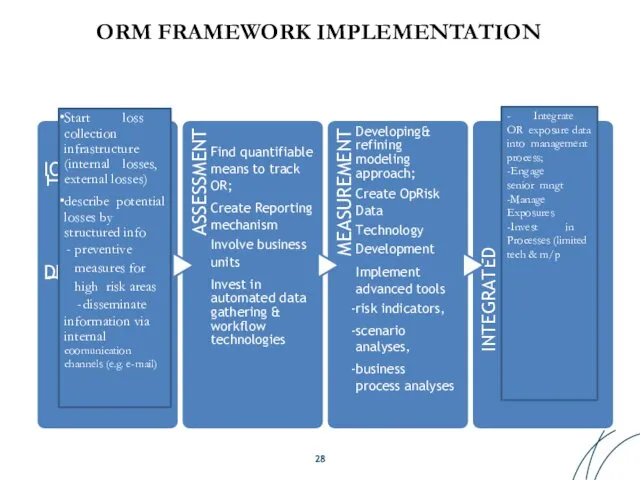

- 28. ORM FRAMEWORK IMPLEMENTATION I T ION DENTIFICA ASSESSMENT Find quantifiable means to track OR; Create Reporting

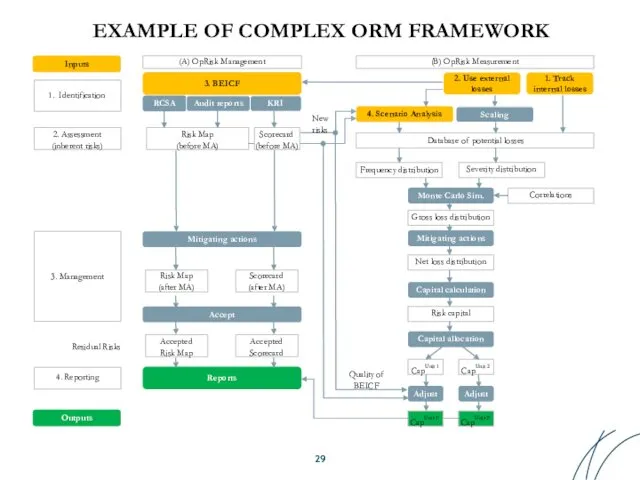

- 29. EXAMPLE OF COMPLEX ORM FRAMEWORK Mitigating actions Mitigating actions Net loss distribution Risk capital Capital allocation

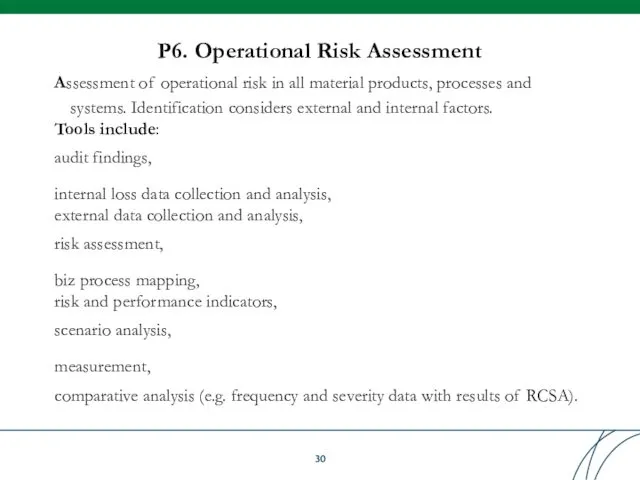

- 30. P6. Operational Risk Assessment Assessment of operational risk in all material products, processes and systems. Identification

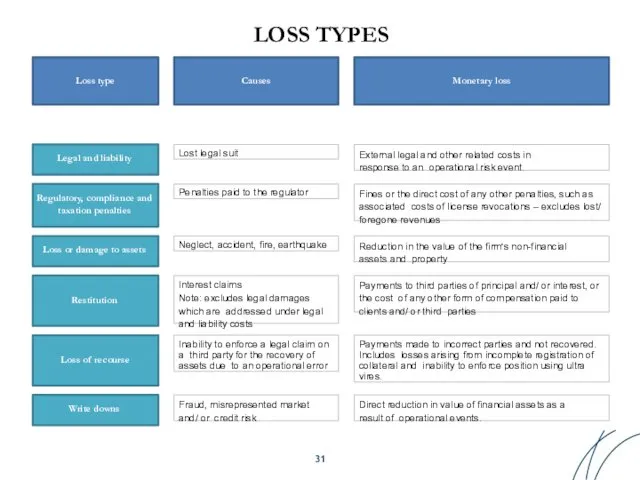

- 31. LOSS TYPES Loss type Causes Monetary loss Legal and liability Lost legal suit External legal and

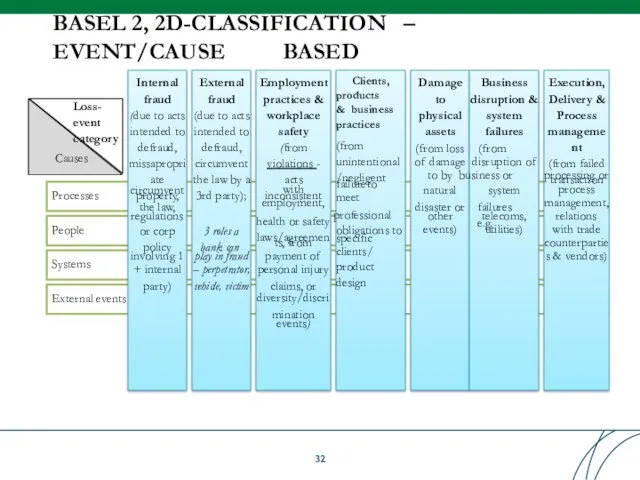

- 32. Processes People Systems External events BASEL 2, 2D-CLASSIFICATION – EVENT/CAUSE BASED Internal fraud (due to acts

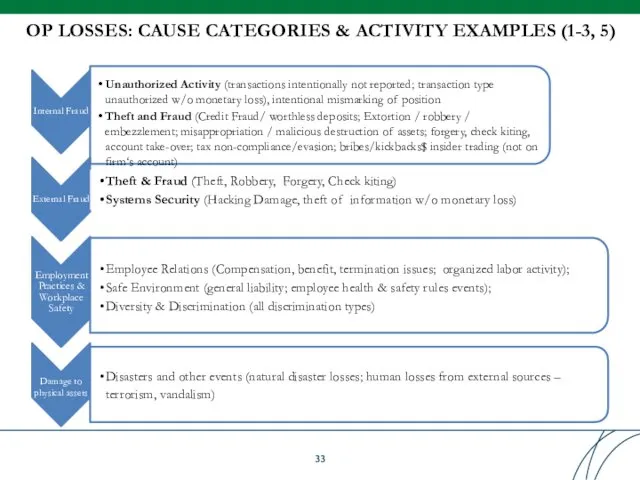

- 33. Internal Fraud Unauthorized Activity (transactions intentionally not reported; transaction type unauthorized w/o monetary loss), intentional mismarking

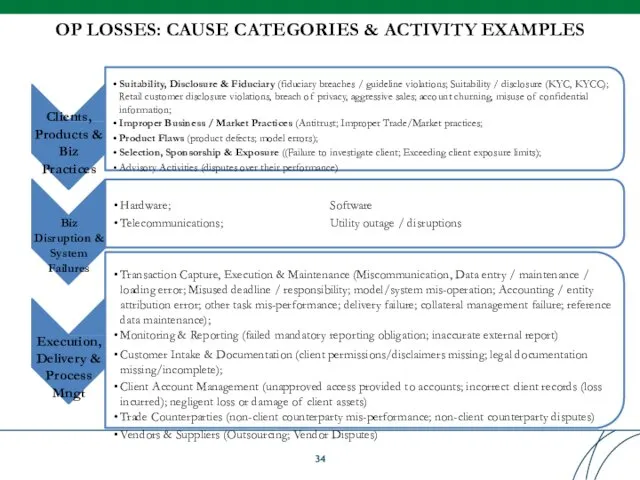

- 34. OP LOSSES: CAUSE CATEGORIES & ACTIVITY EXAMPLES Clients, Products & Biz Practices Suitability, Disclosure & Fiduciary

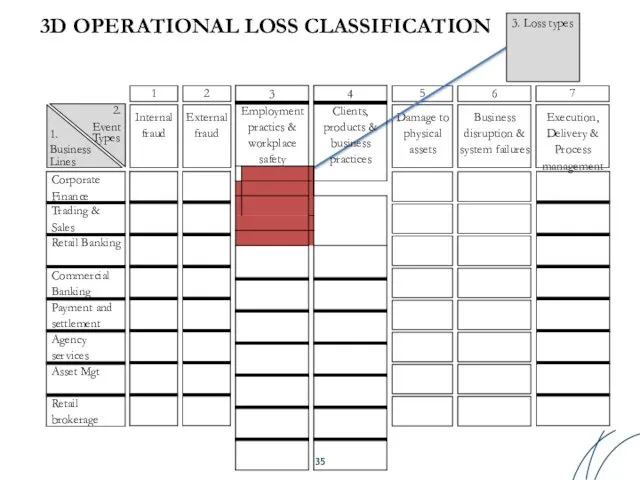

- 35. 3D OPERATIONAL LOSS CLASSIFICATION Internal fraud External fraud Damage to physical assets Business disruption & system

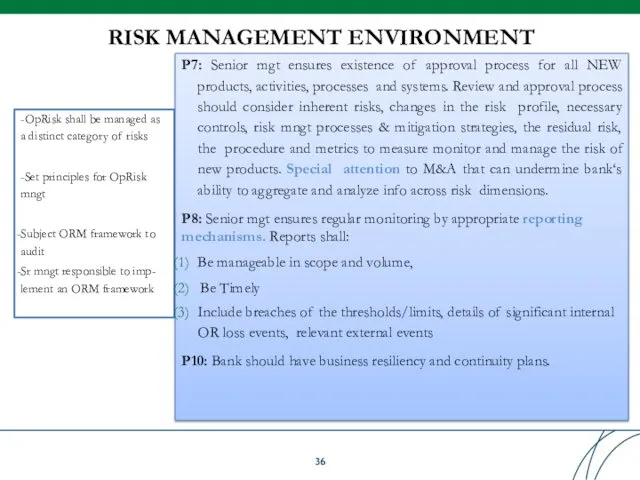

- 36. RISK MANAGEMENT ENVIRONMENT -OpRisk shall be managed as a distinct category of risks -Set principles for

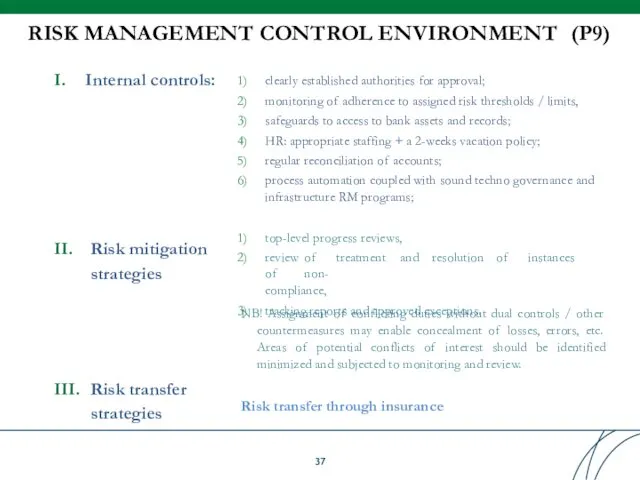

- 37. RISK MANAGEMENT CONTROL ENVIRONMENT (P9) I. Internal controls: II. Risk mitigation strategies III. Risk transfer strategies

- 38. Table of Contents

- 39. Table of Contents

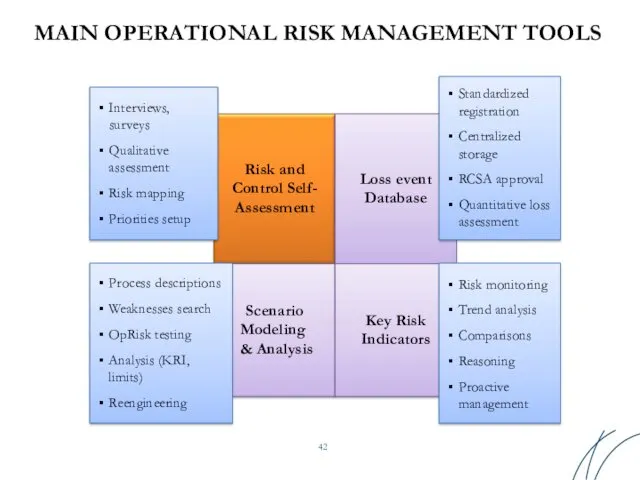

- 40. MAIN OPERATIONAL RISK MANAGEMENT TOOLS Risk and Control Self- Assessment Loss event Database Scenario Modeling &

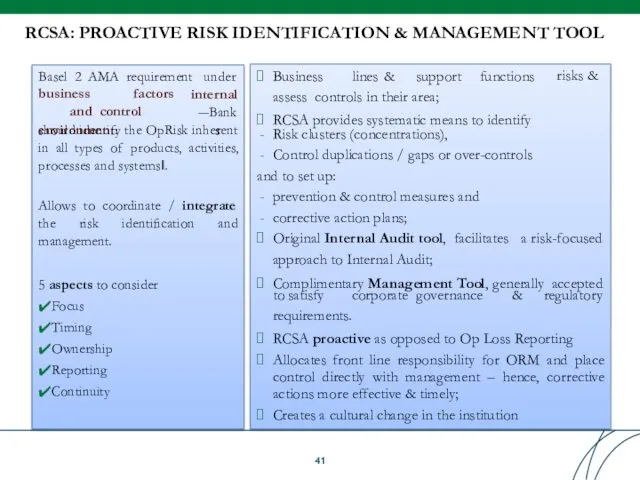

- 41. RCSA: PROACTIVE RISK IDENTIFICATION & MANAGEMENT TOOL risks & Business lines & support functions assess controls

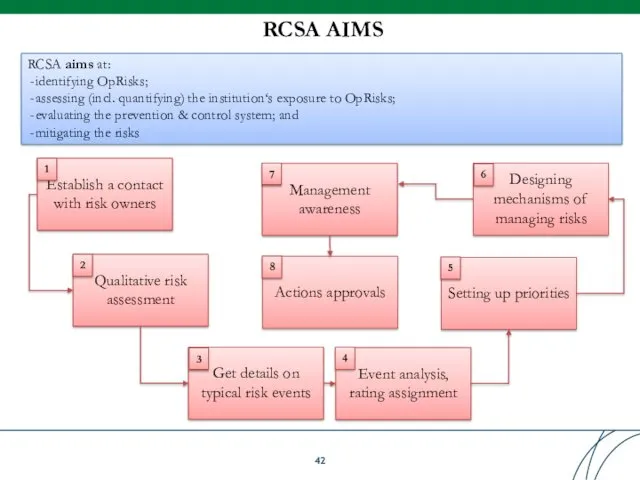

- 42. RCSA AIMS Establish a contact with risk owners Qualitative risk assessment Get details on typical risk

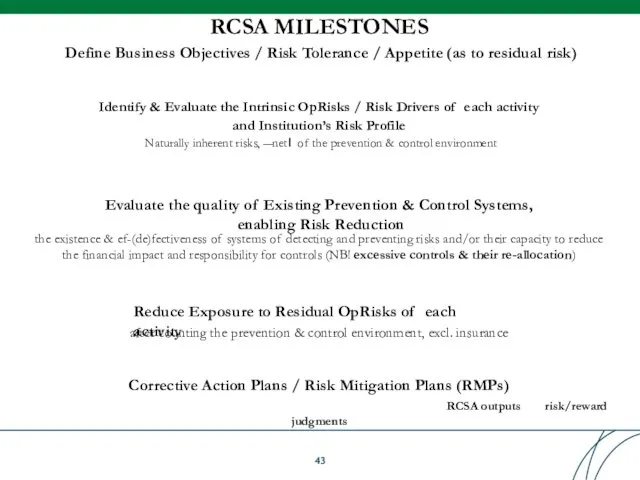

- 43. RCSA MILESTONES Corrective Action Plans / Risk Mitigation Plans (RMPs) Exterminate weak areas in prevention &

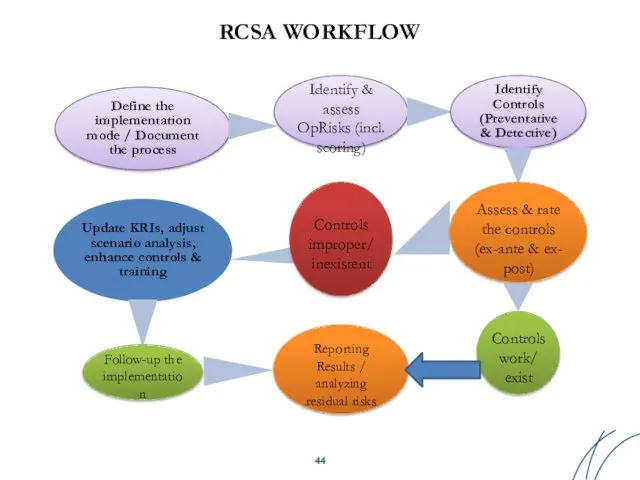

- 44. RCSA WORKFLOW Define the implementation mode / Document the process Update KRIs, adjust scenario analysis, enhance

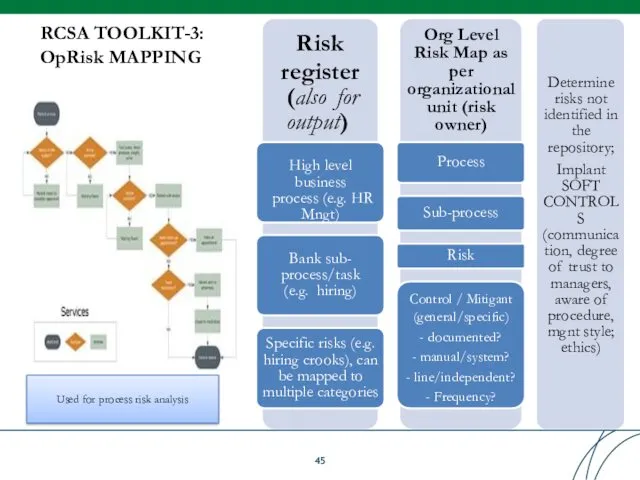

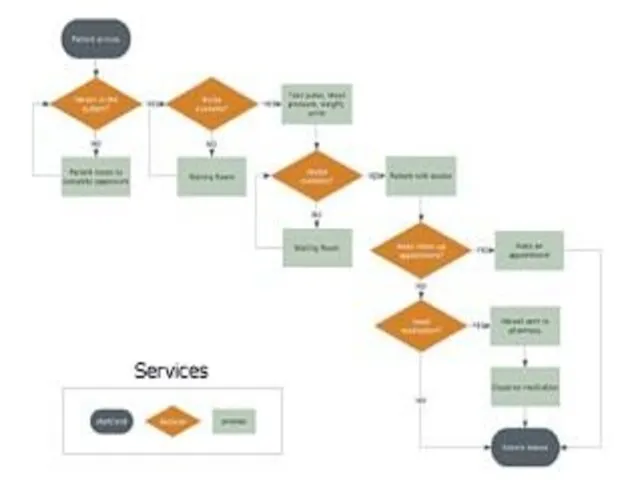

- 45. RCSA TOOLKIT-3: OpRisk MAPPING Risk register (also for output) High level business process (e.g. HR Mngt)

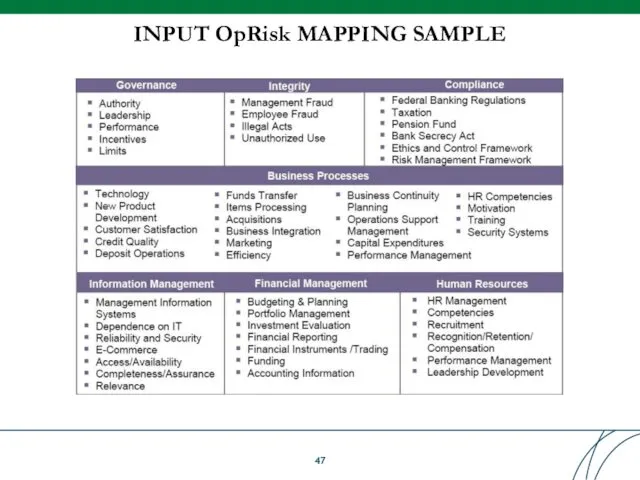

- 47. INPUT OpRisk MAPPING SAMPLE

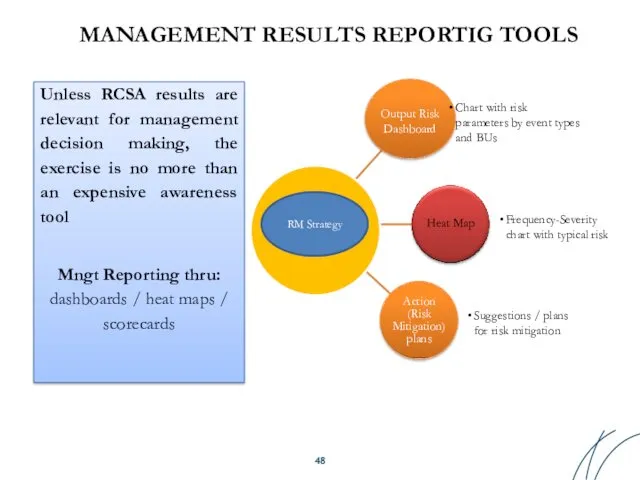

- 48. MANAGEMENT RESULTS REPORTIG TOOLS Unless RCSA results are relevant for management decision making, the exercise is

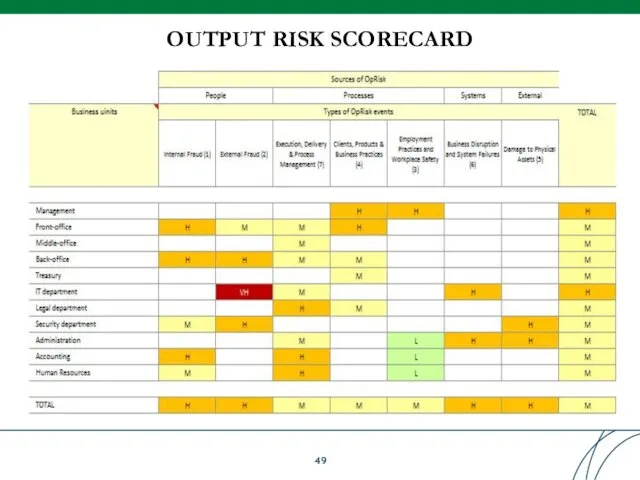

- 49. OUTPUT RISK SCORECARD

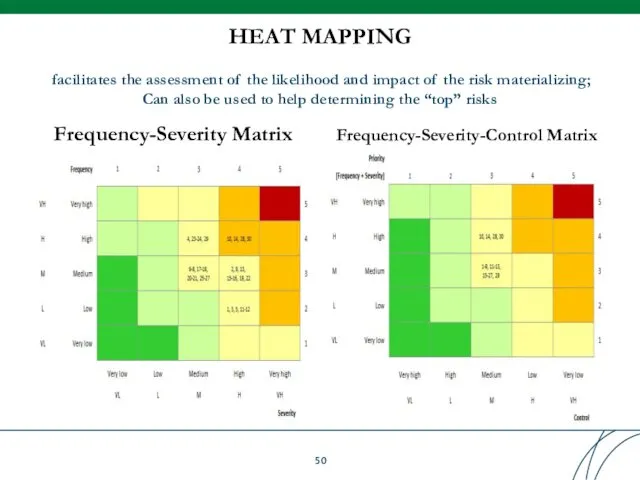

- 50. HEAT MAPPING facilitates the assessment of the likelihood and impact of the risk materializing; Can also

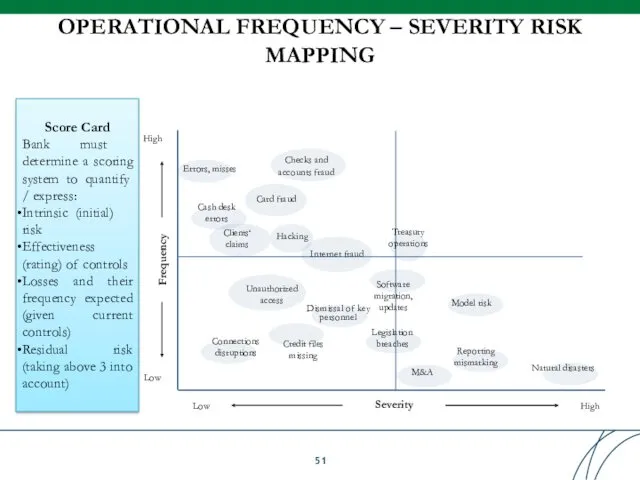

- 51. OPERATIONAL FREQUENCY – SEVERITY RISK MAPPING Card fraud Frequency Severity High Low Low High Unauthorized access

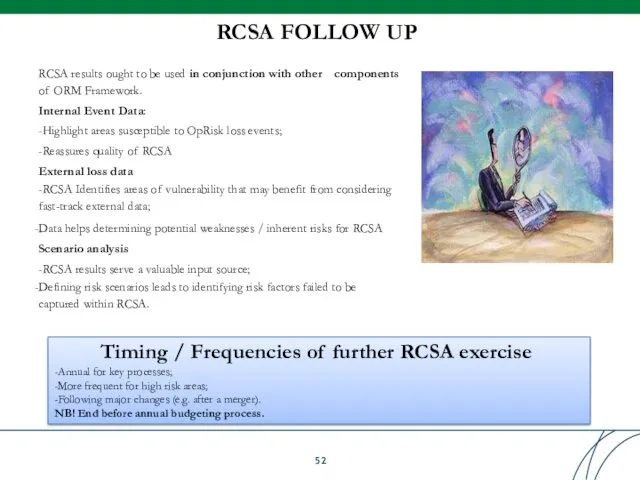

- 52. RCSA FOLLOW UP RCSA results ought to be used in conjunction with other components of ORM

- 53. Table of Contents

- 54. Basel Committee on Banking Supervision Principles for the Sound Management of Operational Risk, June 2011 Indicators

- 55. Indicators Approach allows to track operational risk profile and monitor risk exposure with series of quantitative

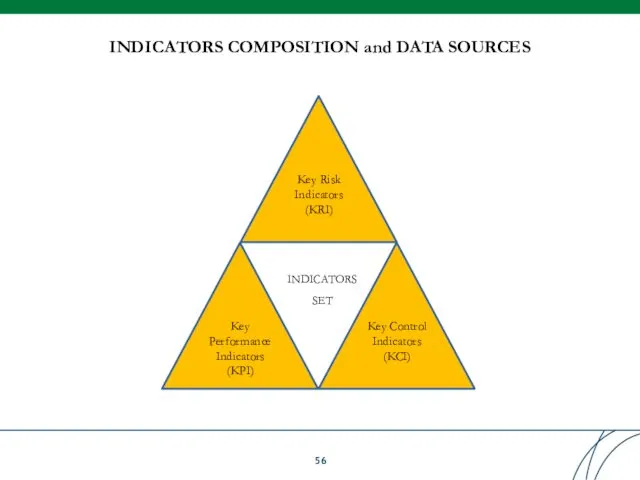

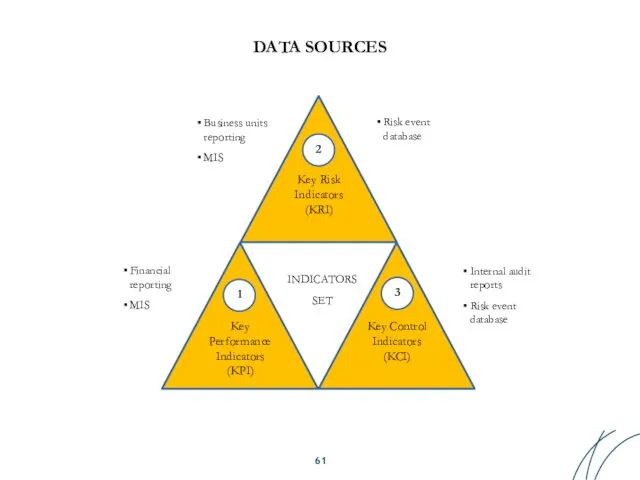

- 56. INDICATORS COMPOSITION and DATA SOURCES Key Risk Indicators (KRI) Key Performance Indicators (KPI) Key Control Indicators

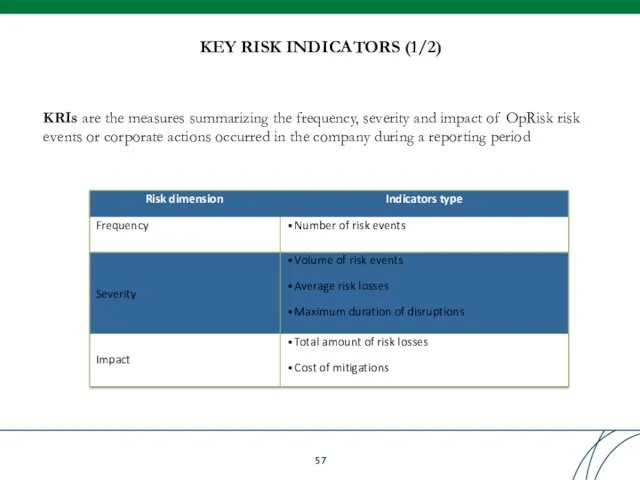

- 57. KRIs are the measures summarizing the frequency, severity and impact of OpRisk risk events or corporate

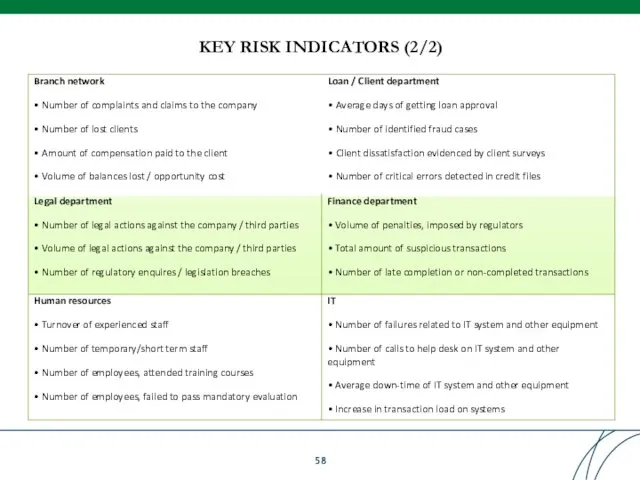

- 58. KEY RISK INDICATORS (2/2)

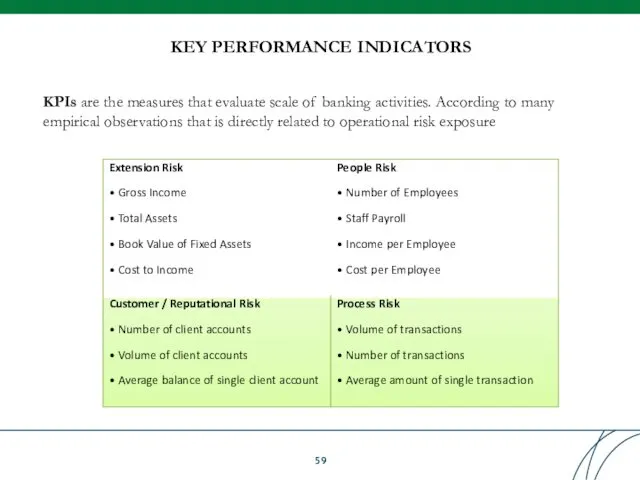

- 59. KPIs are the measures that evaluate scale of banking activities. According to many empirical observations that

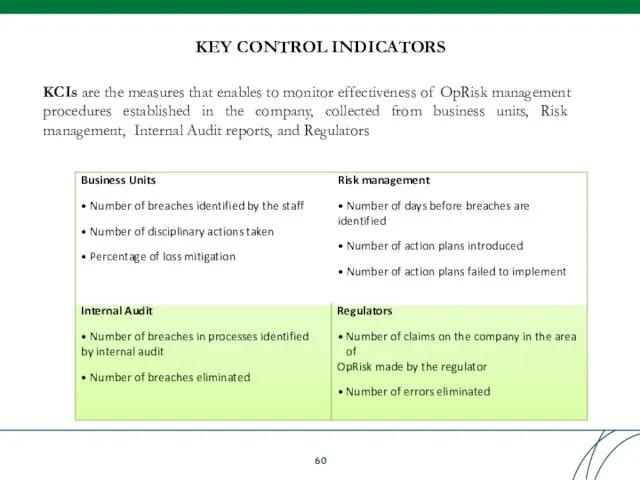

- 60. KCIs are the measures that enables to monitor effectiveness of OpRisk management procedures established in the

- 61. DATA SOURCES Key Risk Indicators (KRI) Key Performance Indicators (KPI) Key Control Indicators (KCI) INDICATORS SET

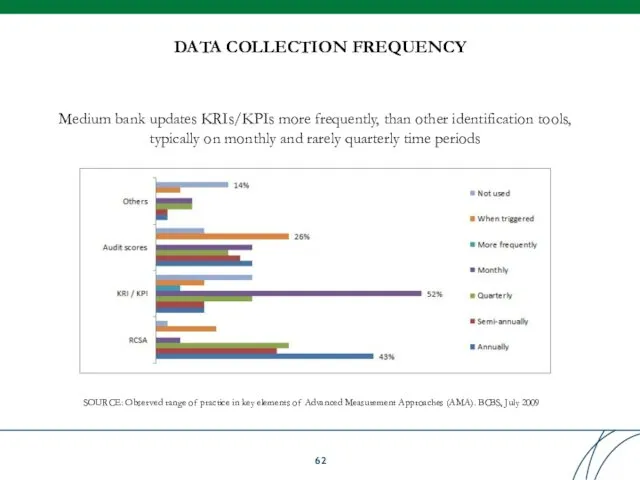

- 62. DATA COLLECTION FREQUENCY SOURCE: Observed range of practice in key elements of Advanced Measurement Approaches (AMA).

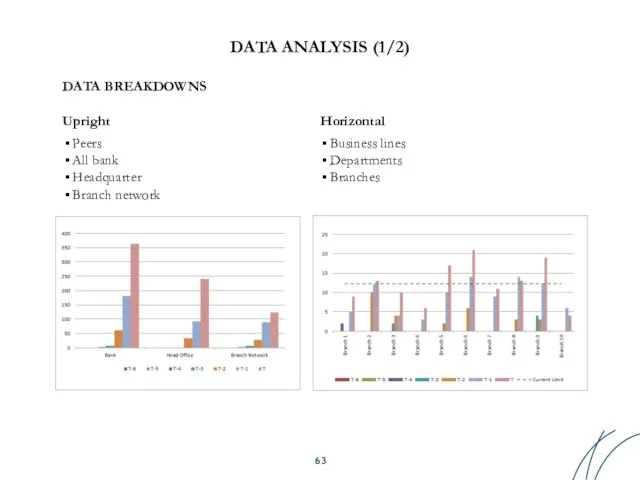

- 63. DATA BREAKDOWNS Upright Peers All bank Headquarter Branch network DATA ANALYSIS (1/2) Horizontal Business lines Departments

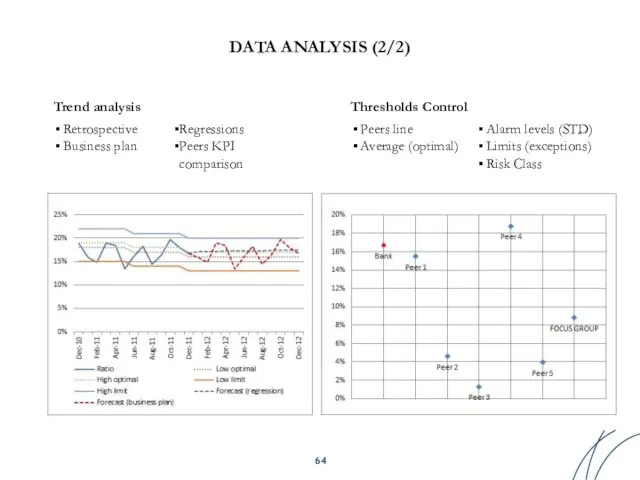

- 64. DATA ANALYSIS (2/2) Trend analysis Retrospective Business plan Regressions Peers KPI comparison Thresholds Control Peers line

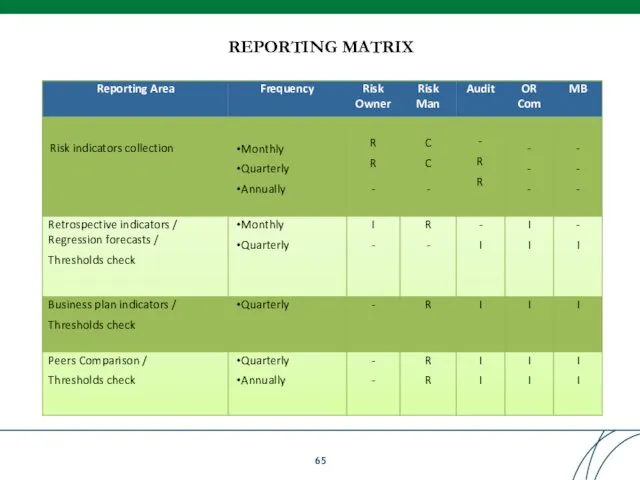

- 65. REPORTING MATRIX

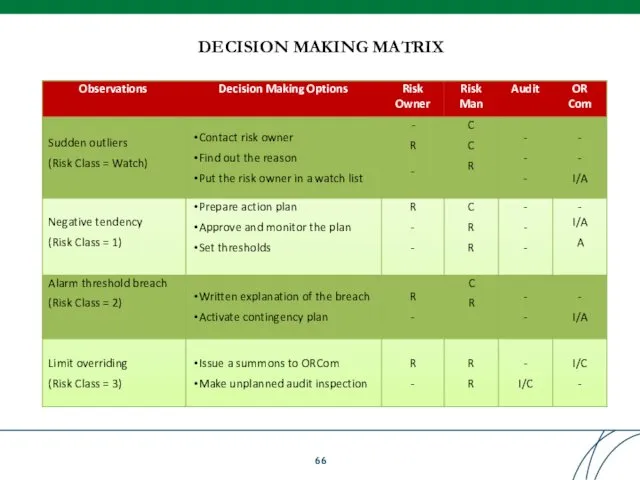

- 66. DECISION MAKING MATRIX

- 67. Table of Contents

- 68. Basel Committee on Banking Supervision Principles for the Sound Management of Operational Risk, June 2011 Business

- 69. The review and approval process should consider: inherent risks in the new product, service, or activity

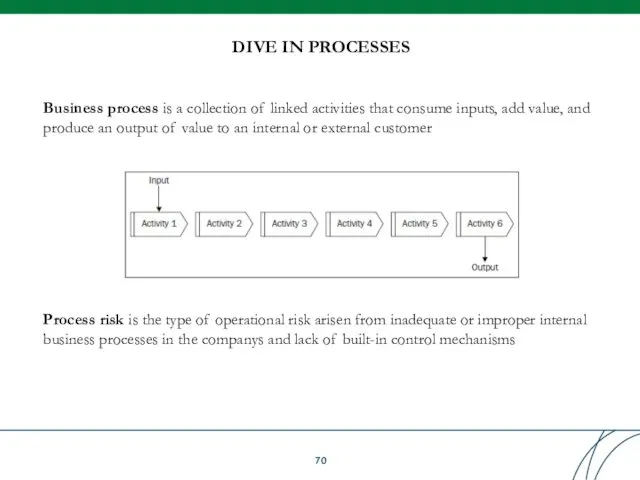

- 70. Business process is a collection of linked activities that consume inputs, add value, and produce an

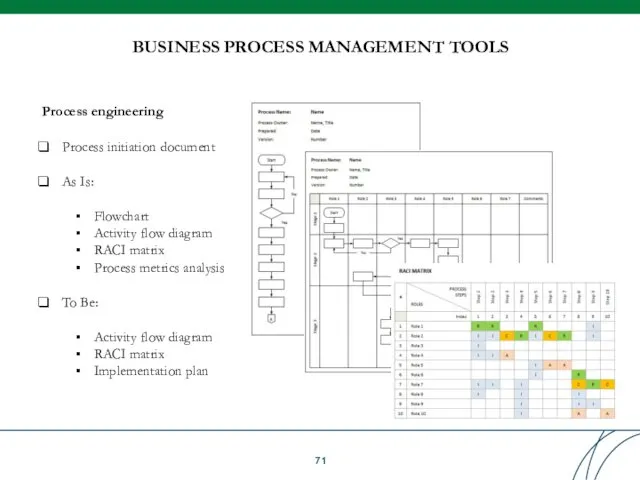

- 71. BUSINESS PROCESS MANAGEMENT TOOLS Process engineering Process initiation document As Is: Flowchart Activity flow diagram RACI

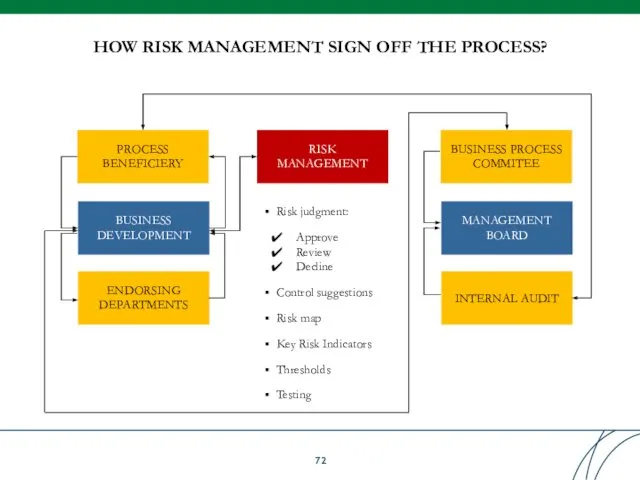

- 72. HOW RISK MANAGEMENT SIGN OFF THE PROCESS? PROCESS BENEFICIERY BUSINESS DEVELOPMENT ENDORSING DEPARTMENTS RISK MANAGEMENT Risk

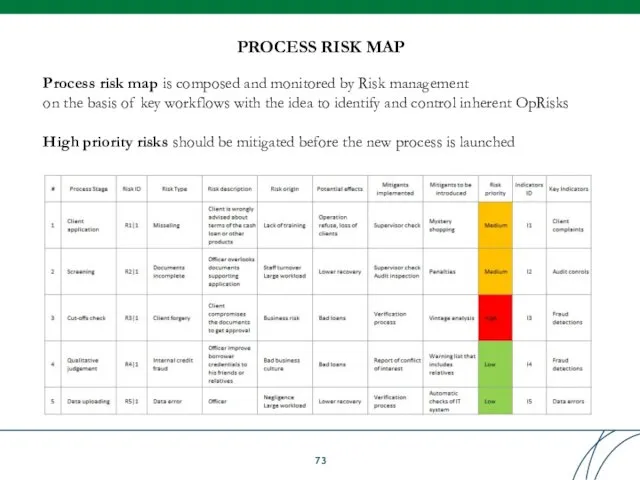

- 73. Process risk map is composed and monitored by Risk management on the basis of key workflows

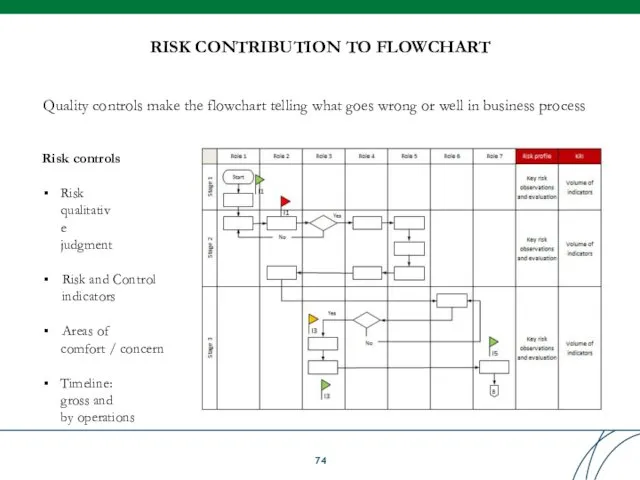

- 74. RISK CONTRIBUTION TO FLOWCHART Quality controls make the flowchart telling what goes wrong or well in

- 75. Table of Contents

- 76. Table of Contents

- 77. Basel Committee on Banking Supervision Principles for the Sound Management of Operational Risk, June 2011 Loss

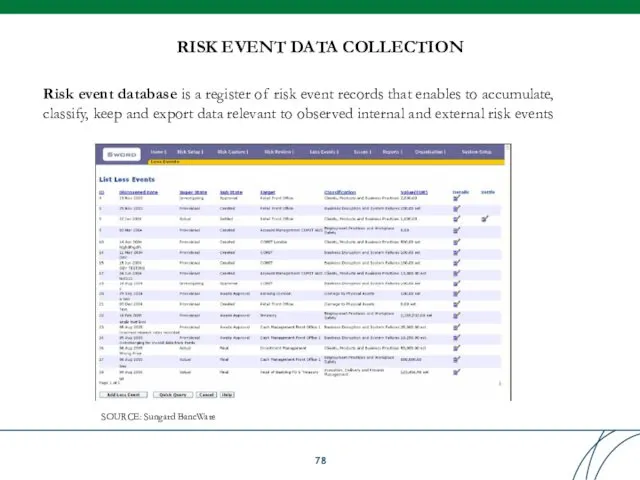

- 78. Risk event database is a register of risk event records that enables to accumulate, classify, keep

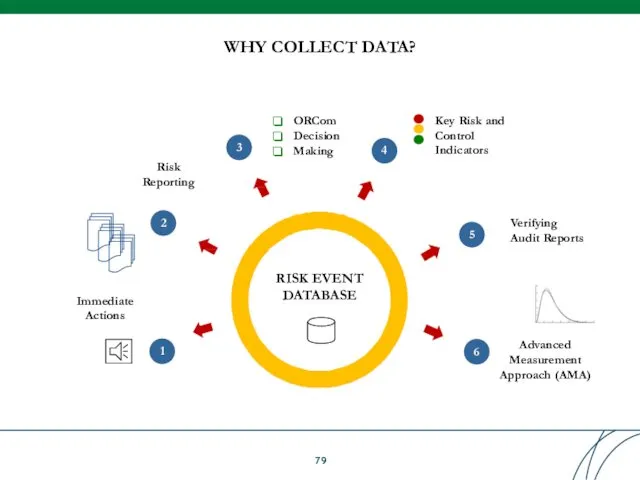

- 79. WHY COLLECT DATA? RISK EVENT DATABASE Immediate Actions Advanced Measurement Approach (AMA) 1 2 Risk Reporting

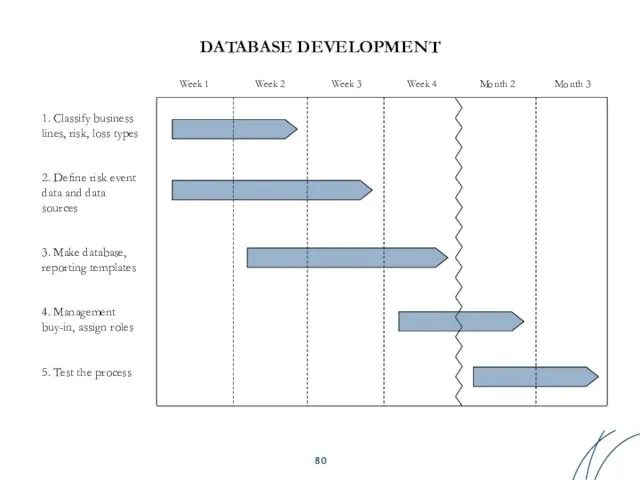

- 80. DATABASE DEVELOPMENT 1. Classify business lines, risk, loss types 2. Define risk event data and data

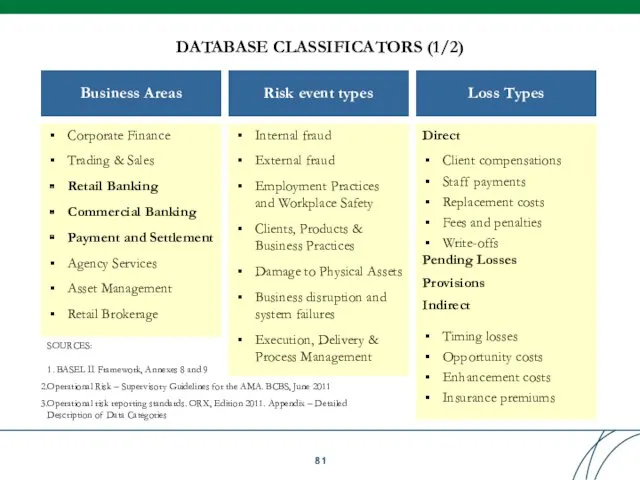

- 81. DATABASE CLASSIFICATORS (1/2) Business Areas Corporate Finance Trading & Sales Retail Banking Commercial Banking Payment and

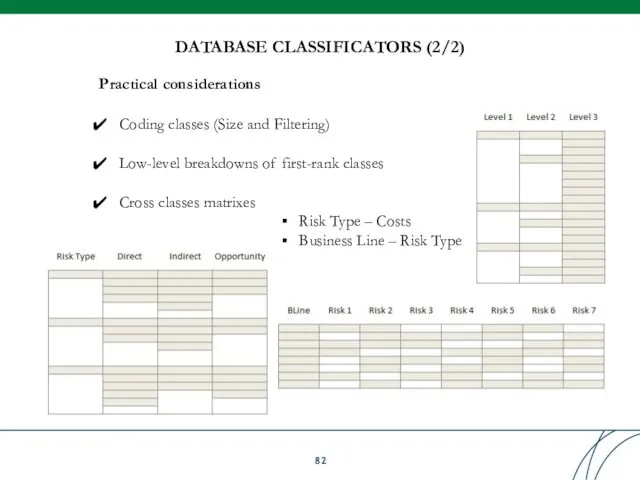

- 82. DATABASE CLASSIFICATORS (2/2) Practical considerations Coding classes (Size and Filtering) Low-level breakdowns of first-rank classes Cross

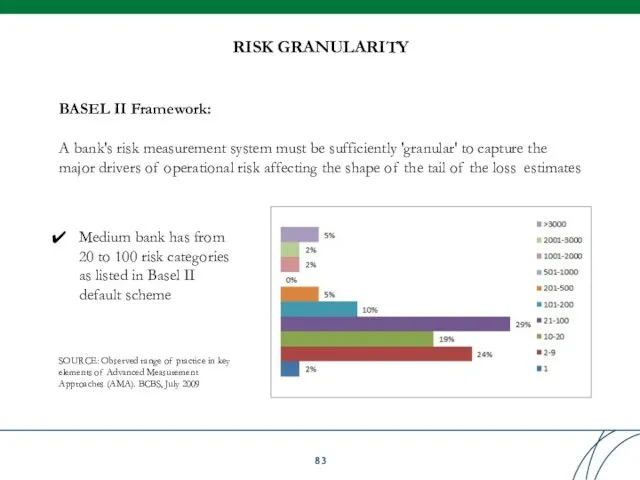

- 83. RISK GRANULARITY BASEL II Framework: A bank's risk measurement system must be sufficiently 'granular' to capture

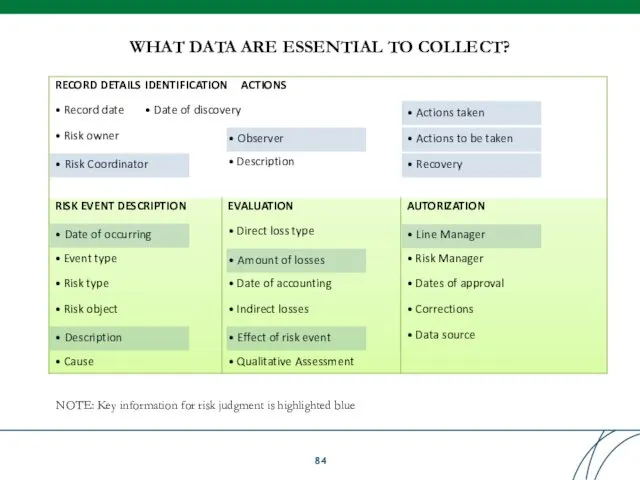

- 84. WHAT DATA ARE ESSENTIAL TO COLLECT? • Risk Coordinator • Observer • Actions taken • Actions

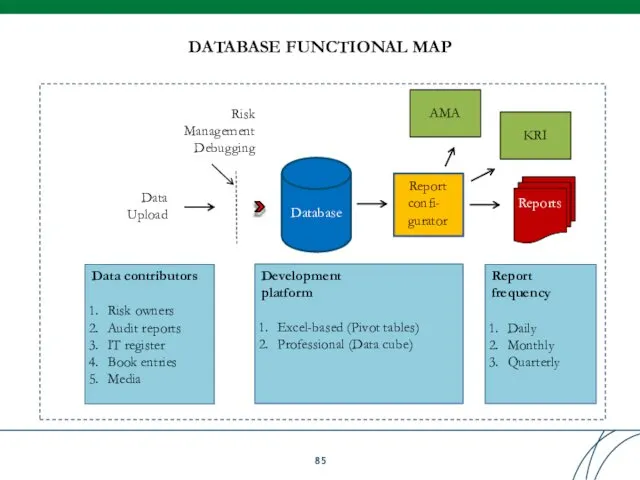

- 85. DATABASE FUNCTIONAL MAP Data Upload Database Report confi- gurator Reports Data contributors Risk owners Audit reports

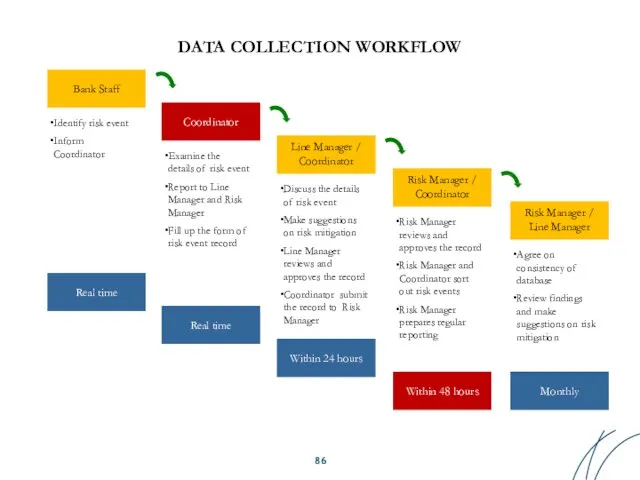

- 86. Bank Staff Coordinator Identify risk event Inform Coordinator Examine the details of risk event Report to

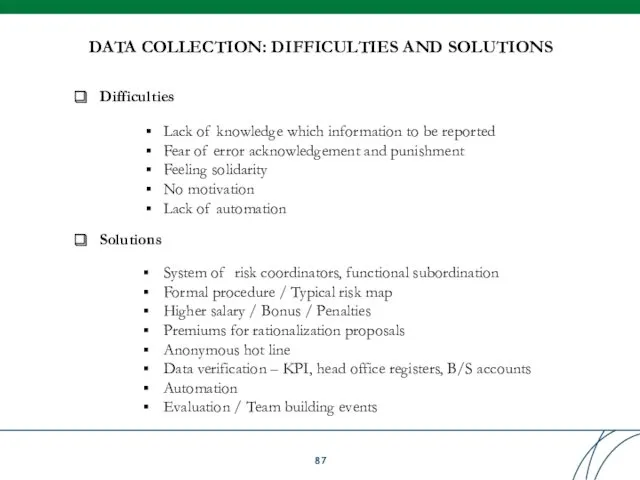

- 87. DATA COLLECTION: DIFFICULTIES AND SOLUTIONS Difficulties Lack of knowledge which information to be reported Fear of

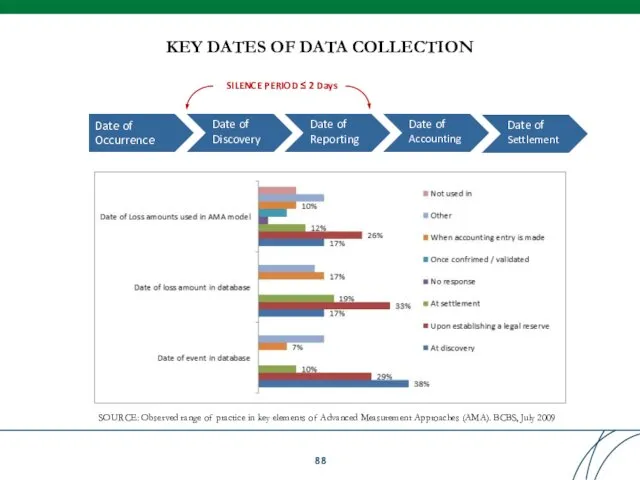

- 88. KEY DATES OF DATA COLLECTION SOURCE: Observed range of practice in key elements of Advanced Measurement

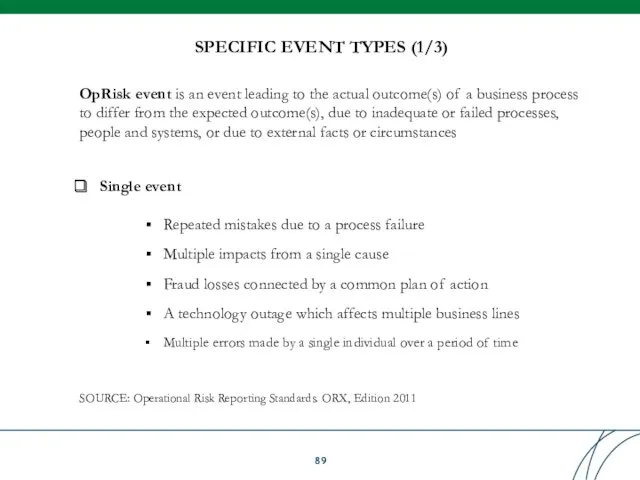

- 89. SPECIFIC EVENT TYPES (1/3) SOURCE: Operational Risk Reporting Standards. ORX, Edition 2011 OpRisk event is an

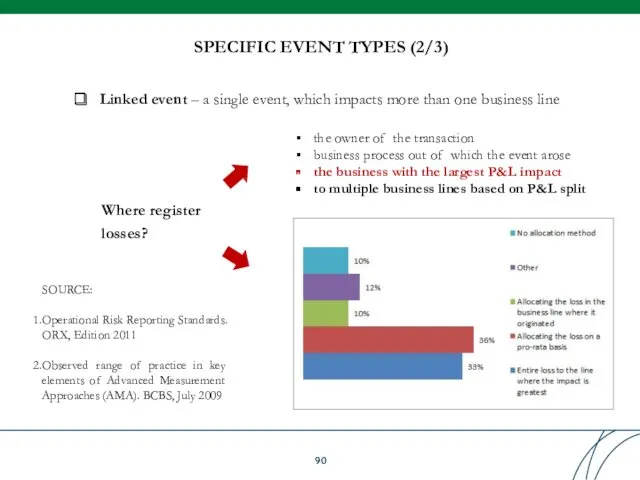

- 90. SPECIFIC EVENT TYPES (2/3) SOURCE: Operational Risk Reporting Standards. ORX, Edition 2011 Observed range of practice

- 91. SPECIFIC EVENT TYPES (3/3) Near-misses – operational risk events that did not lead to a loss,

- 92. SPECIFIC LOSS TYPES (1/2) SOURCE: Operational Risk Reporting Standards. ORX, Edition 2011 OpRisk loss – a

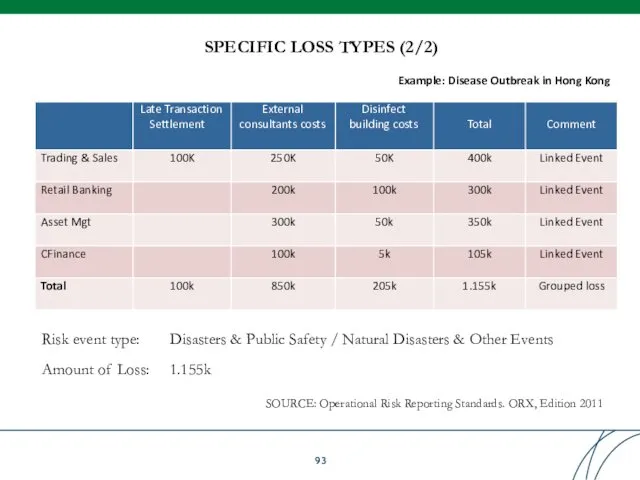

- 93. SPECIFIC LOSS TYPES (2/2) SOURCE: Operational Risk Reporting Standards. ORX, Edition 2011 Risk event type: Amount

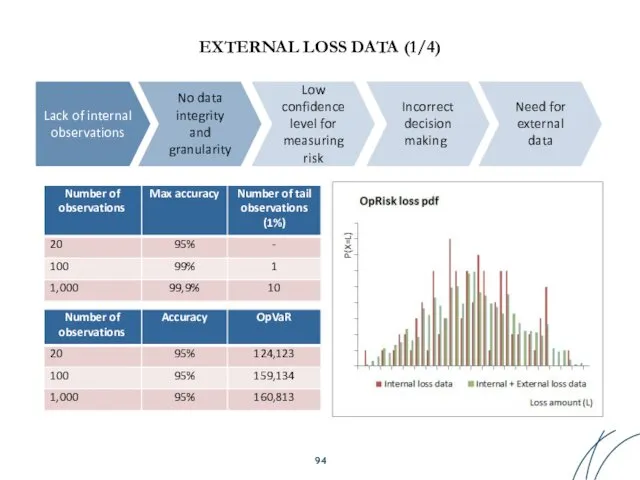

- 94. EXTERNAL LOSS DATA (1/4) Lack of internal observations No data integrity and granularity Low confidence level

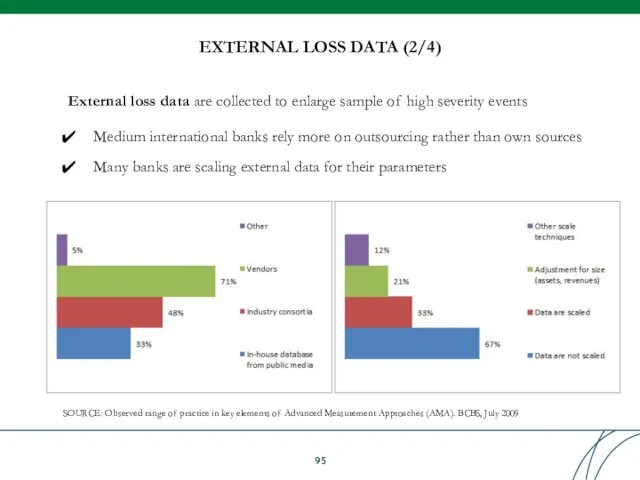

- 95. EXTERNAL LOSS DATA (2/4) SOURCE: Observed range of practice in key elements of Advanced Measurement Approaches

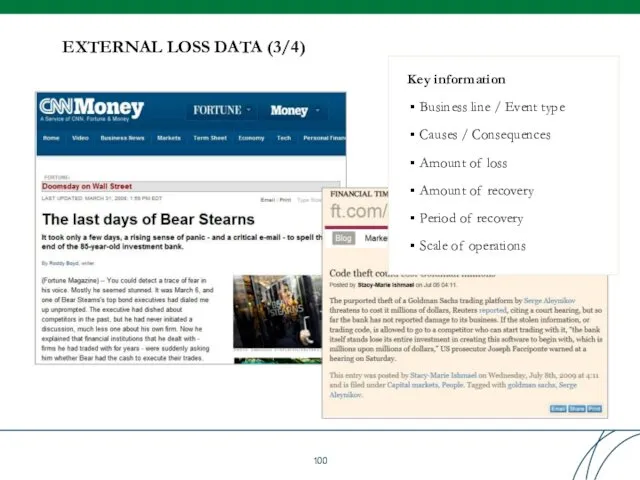

- 96. EXTERNAL LOSS DATA (3/4) Key information Business line / Event type Causes / Consequences Amount of

- 97. QUIZ: EXTERNAL LOSS DATA – local examples Internal fraud External fraud Reputational risk Products and processes

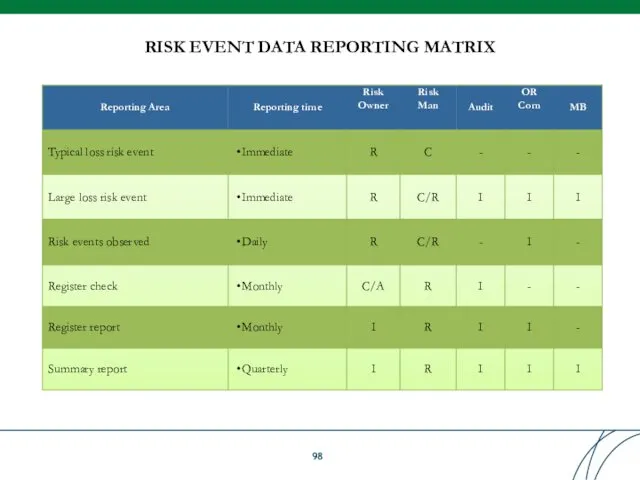

- 98. RISK EVENT DATA REPORTING MATRIX

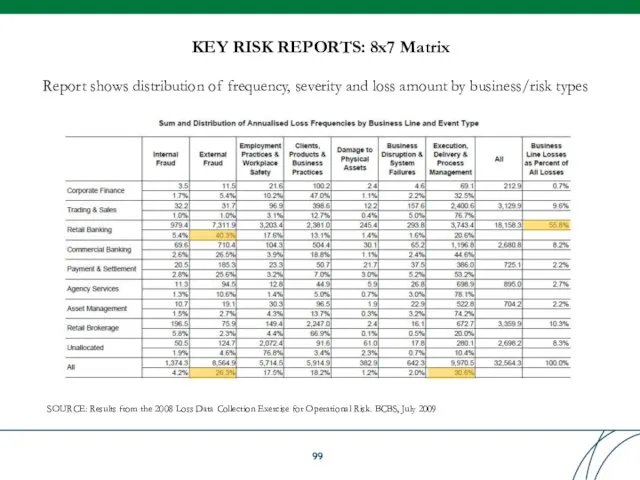

- 99. KEY RISK REPORTS: 8x7 Matrix SOURCE: Results from the 2008 Loss Data Collection Exercise for Operational

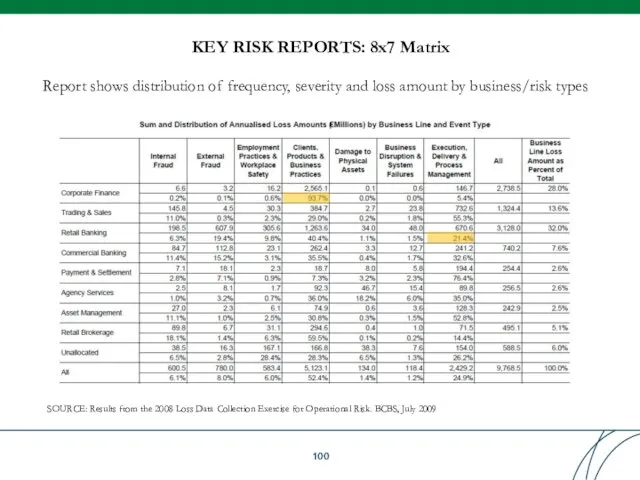

- 100. KEY RISK REPORTS: 8x7 Matrix SOURCE: Results from the 2008 Loss Data Collection Exercise for Operational

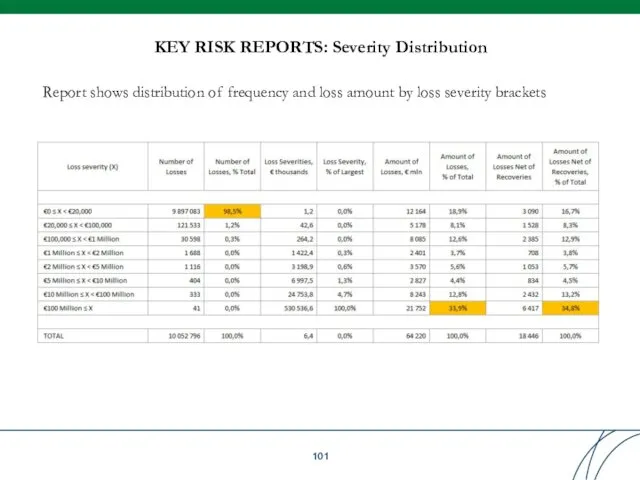

- 101. KEY RISK REPORTS: Severity Distribution Report shows distribution of frequency and loss amount by loss severity

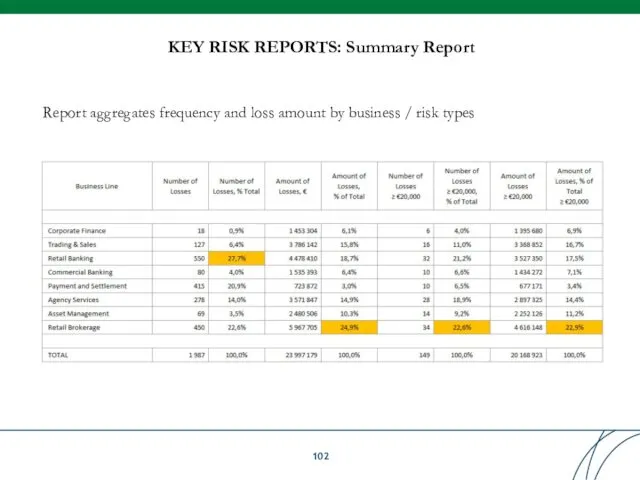

- 102. KEY RISK REPORTS: Summary Report Report aggregates frequency and loss amount by business / risk types

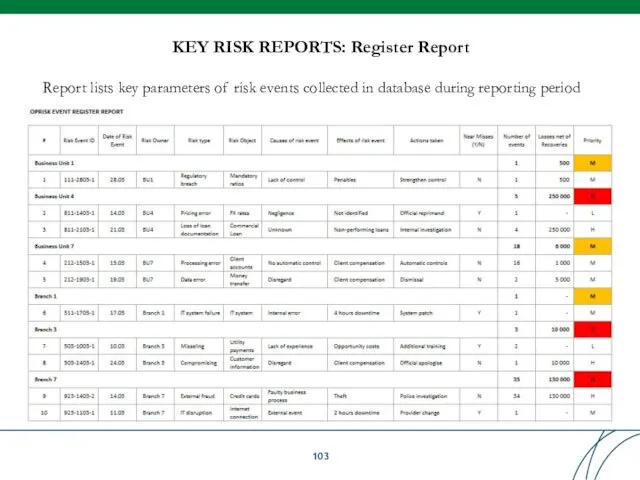

- 103. KEY RISK REPORTS: Register Report Report lists key parameters of risk events collected in database during

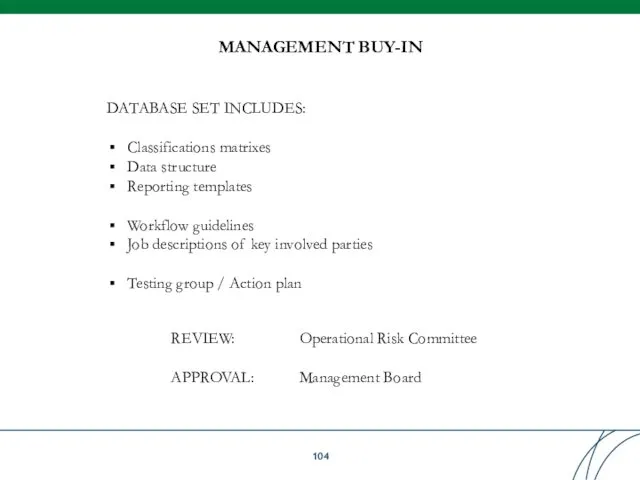

- 104. DATABASE SET INCLUDES: Classifications matrixes Data structure Reporting templates Workflow guidelines Job descriptions of key involved

- 105. Table of Contents

- 106. Basel Committee on Banking Supervision Principles for the Sound Management of Operational Risk, June 2011 ―

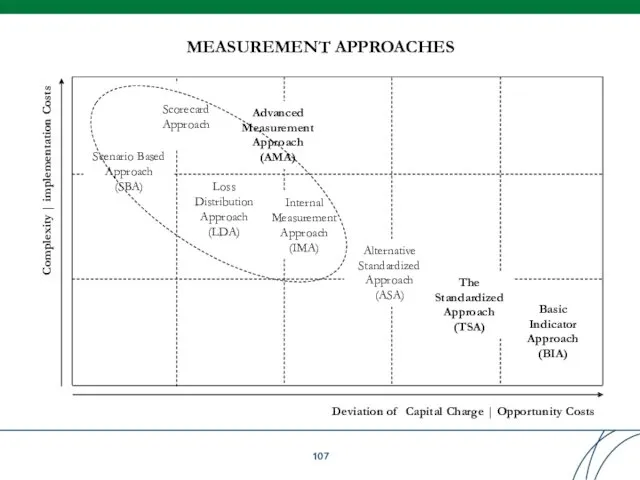

- 107. MEASUREMENT APPROACHES Deviation of Capital Charge | Opportunity Costs Complexity | implementation Costs Basic Indicator Approach

- 108. SELECTION CRITERIA Complexity or intensity of banking operations Meeting qualitative standards Partial use Restriction to revert

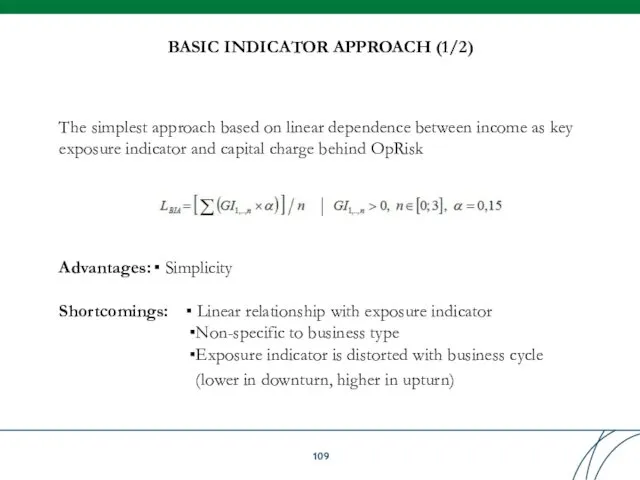

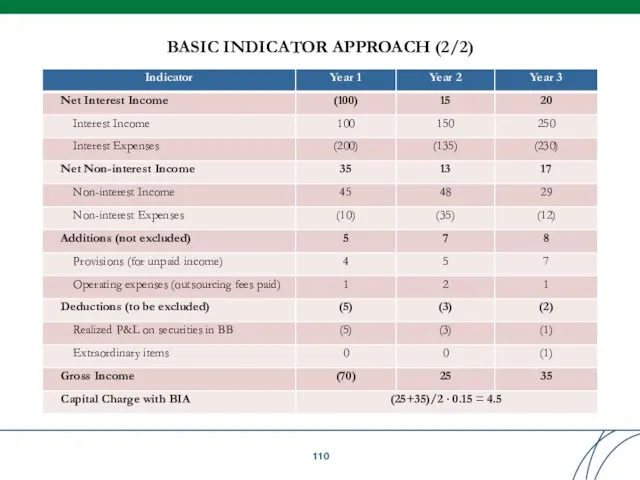

- 109. BASIC INDICATOR APPROACH (1/2) The simplest approach based on linear dependence between income as key exposure

- 110. BASIC INDICATOR APPROACH (2/2)

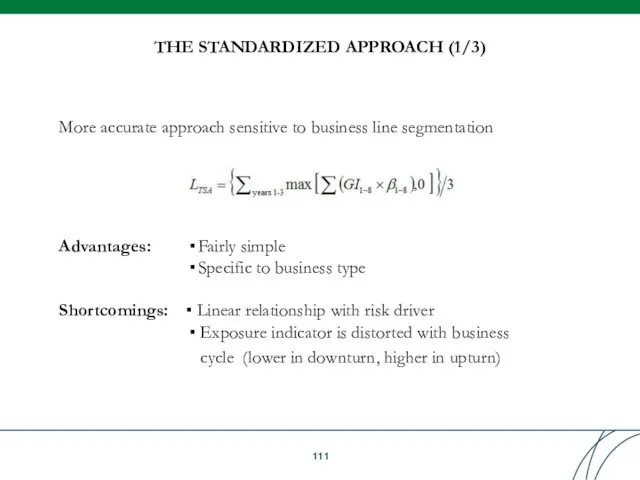

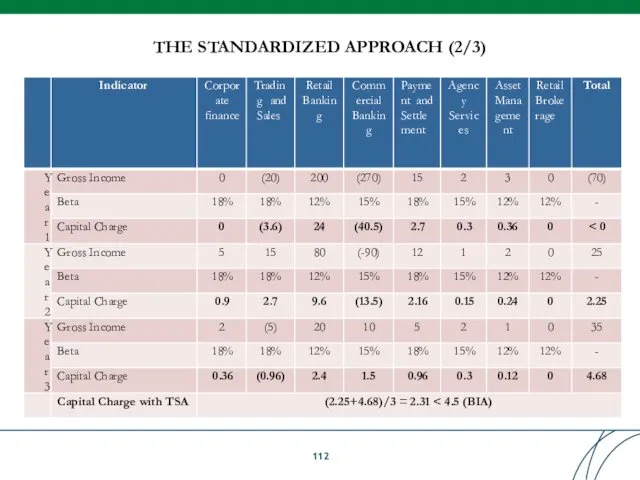

- 111. THE STANDARDIZED APPROACH (1/3) More accurate approach sensitive to business line segmentation Advantages: Fairly simple Specific

- 112. THE STANDARDIZED APPROACH (2/3)

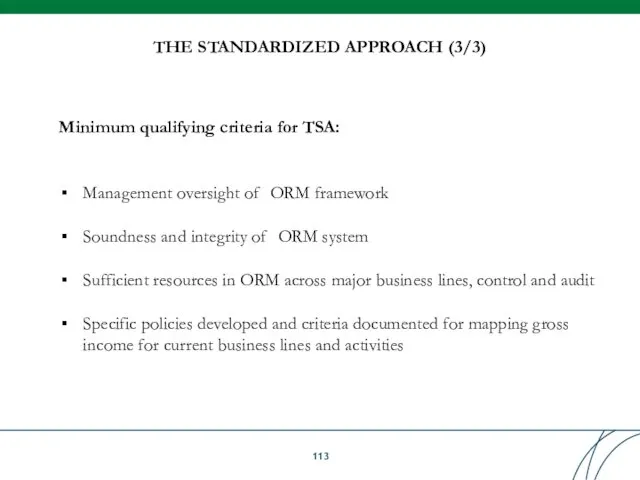

- 113. THE STANDARDIZED APPROACH (3/3) Minimum qualifying criteria for TSA: Management oversight of ORM framework Soundness and

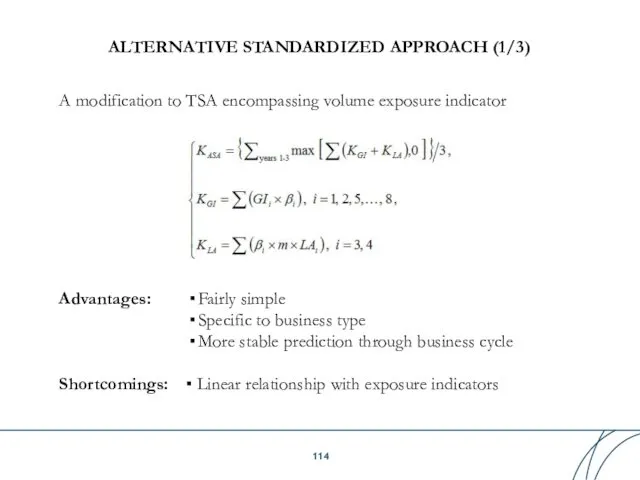

- 114. ALTERNATIVE STANDARDIZED APPROACH (1/3) A modification to TSA encompassing volume exposure indicator Advantages: Fairly simple Specific

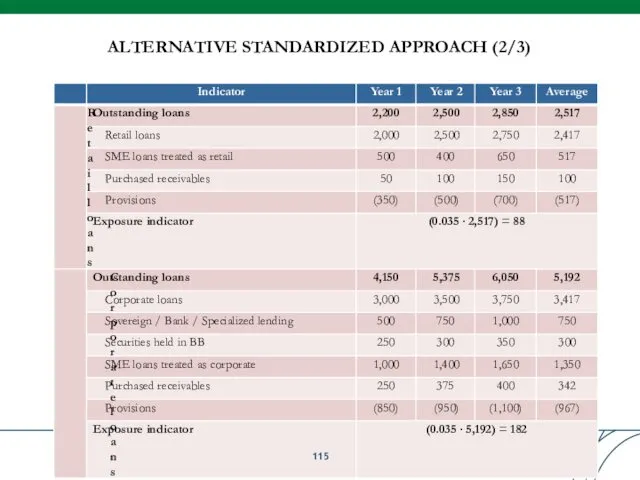

- 115. ALTERNATIVE STANDARDIZED APPROACH (2/3)

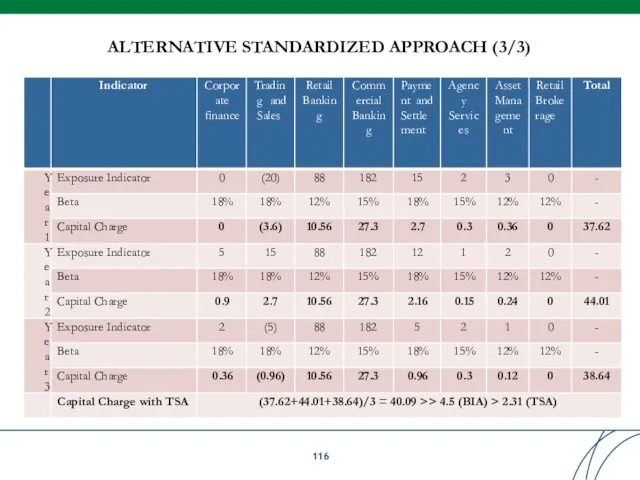

- 116. ALTERNATIVE STANDARDIZED APPROACH (3/3)

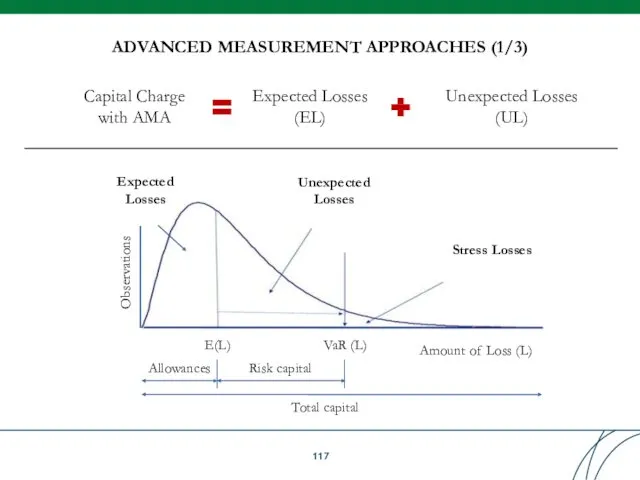

- 117. ADVANCED MEASUREMENT APPROACHES (1/3) Capital Charge with AMA Stress Losses VaR (L) E(L) Allowances Risk capital

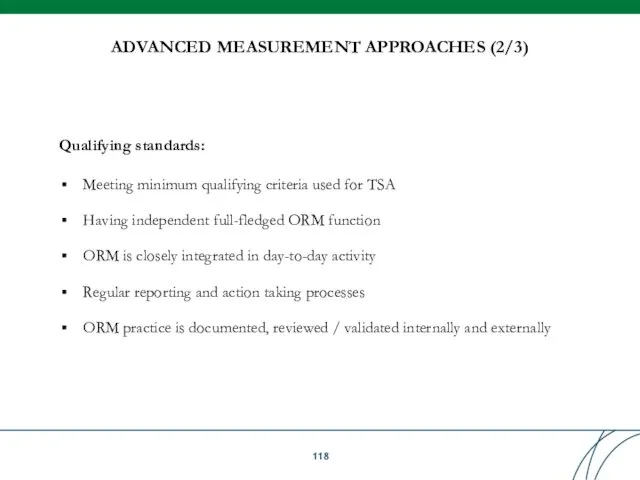

- 118. Qualifying standards: Meeting minimum qualifying criteria used for TSA Having independent full-fledged ORM function ORM is

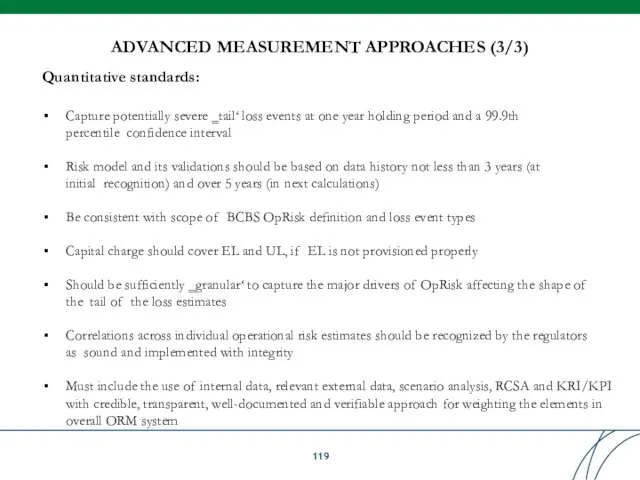

- 119. Quantitative standards: Capture potentially severe ‗tail‘ loss events at one year holding period and a 99.9th

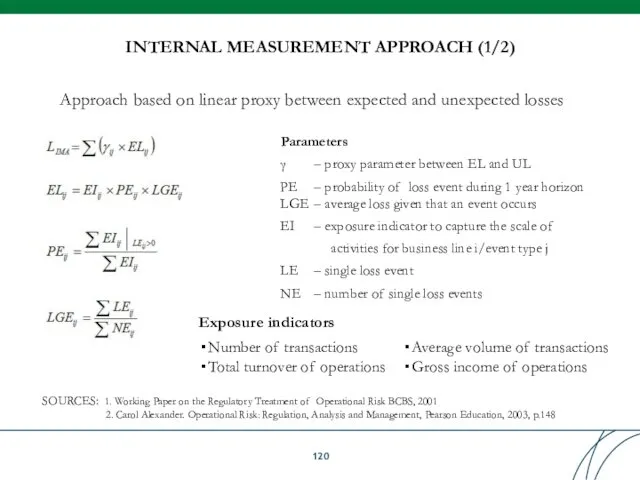

- 120. INTERNAL MEASUREMENT APPROACH (1/2) Approach based on linear proxy between expected and unexpected losses Parameters γ

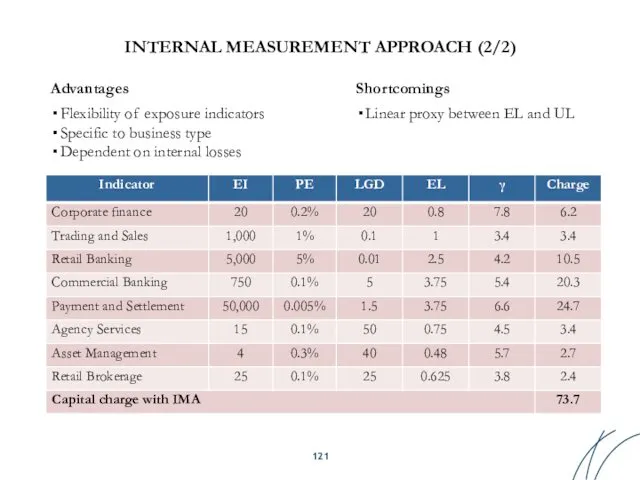

- 121. INTERNAL MEASUREMENT APPROACH (2/2) Advantages Flexibility of exposure indicators Specific to business type Dependent on internal

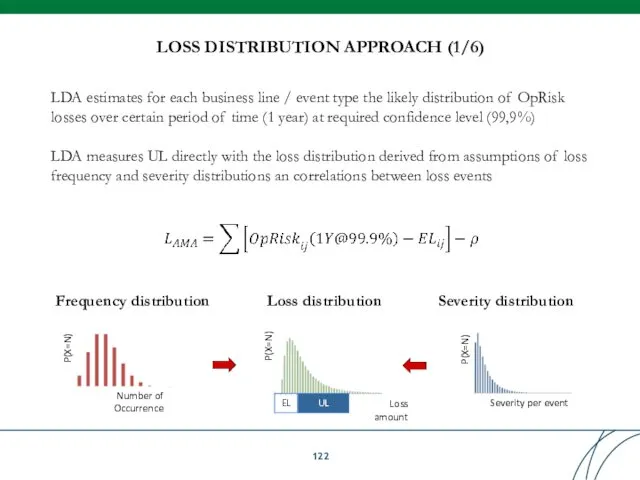

- 122. LOSS DISTRIBUTION APPROACH (1/6) LDA estimates for each business line / event type the likely distribution

- 123. LOSS DISTRIBUTION APPROACH (2/6) OpRisk Loss Simulation Algorithm: Collect statistics on loss events no. per day

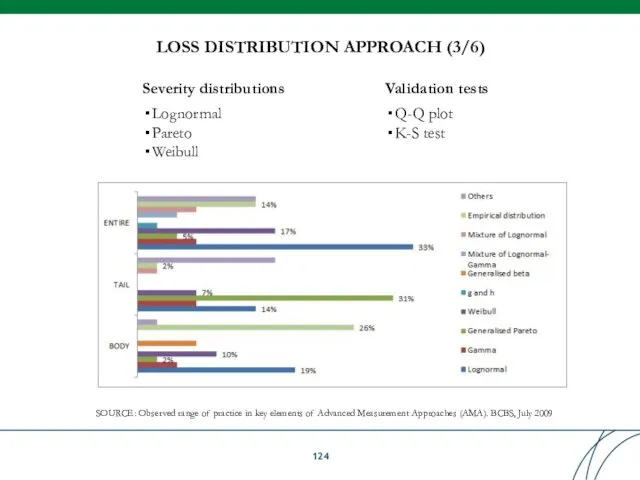

- 124. LOSS DISTRIBUTION APPROACH (3/6) Severity distributions Lognormal Pareto Weibull Validation tests Q-Q plot K-S test SOURCE:

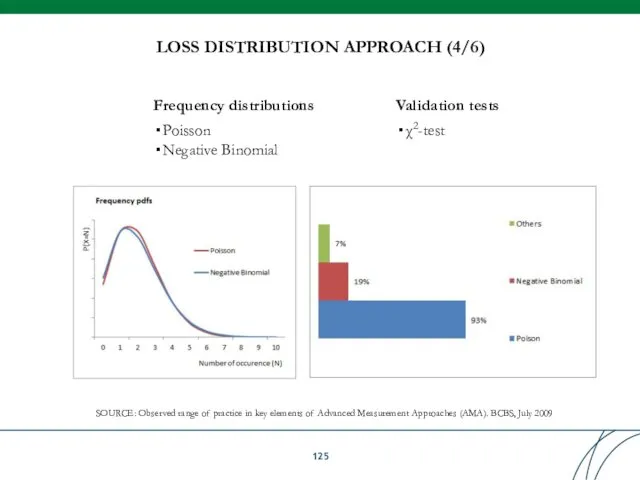

- 125. LOSS DISTRIBUTION APPROACH (4/6) Frequency distributions Poisson Negative Binomial Validation tests χ2-test SOURCE: Observed range of

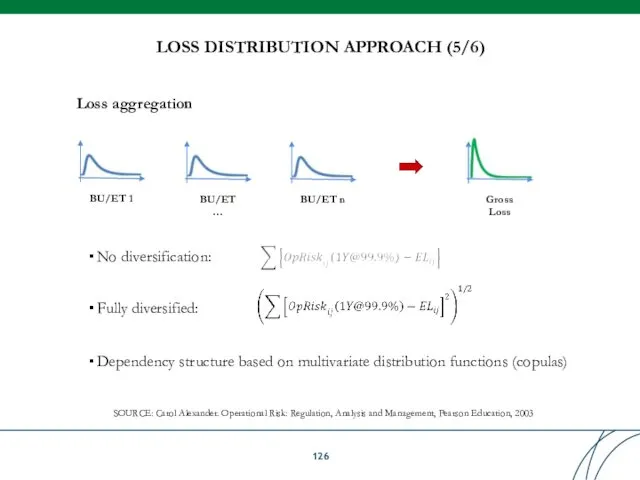

- 126. LOSS DISTRIBUTION APPROACH (5/6) Loss aggregation BU/ET 1 BU/ET n BU/ET … Gross Loss SOURCE: Carol

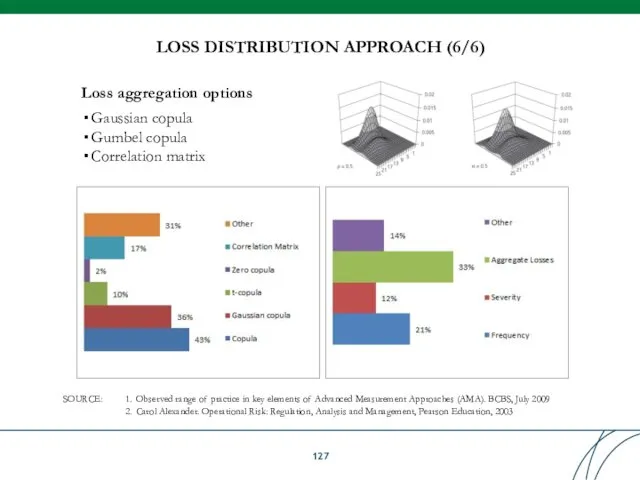

- 127. LOSS DISTRIBUTION APPROACH (6/6) SOURCE: Observed range of practice in key elements of Advanced Measurement Approaches

- 128. Table of Contents

- 129. Basel Committee on Banking Supervision > Principles for the Sound Management of Operational Risk, June 2011

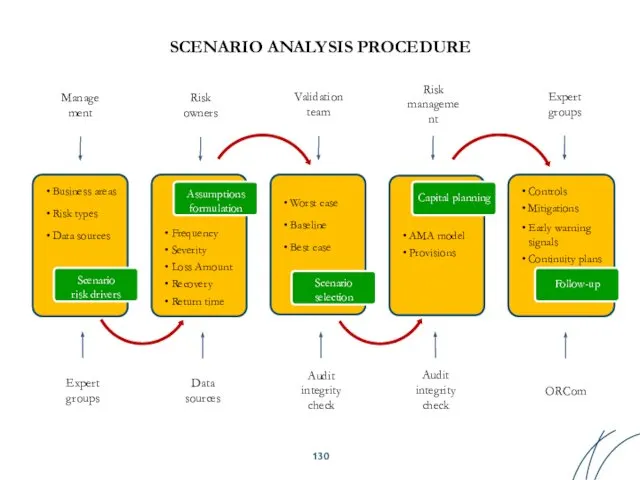

- 130. Business areas Risk types Data sources Scenario risk drivers Frequency Severity Loss Amount Recovery Return time

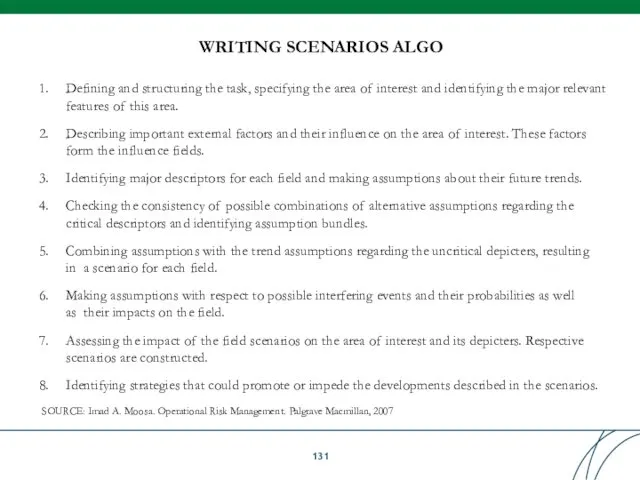

- 131. WRITING SCENARIOS ALGO Defining and structuring the task, specifying the area of interest and identifying the

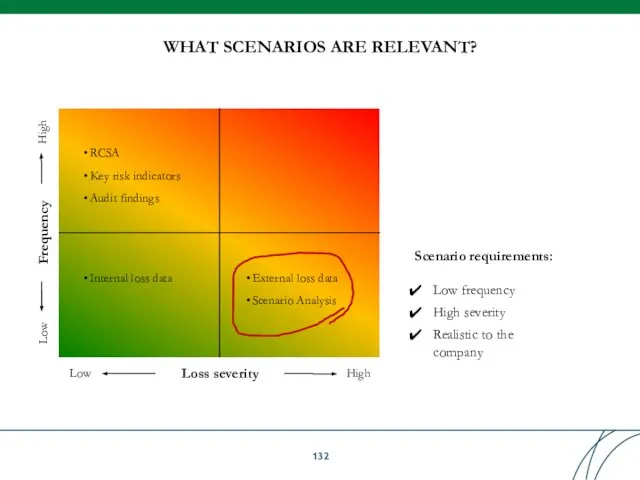

- 132. WHAT SCENARIOS ARE RELEVANT? Frequency Loss severity High Low High Low RCSA Key risk indicators Audit

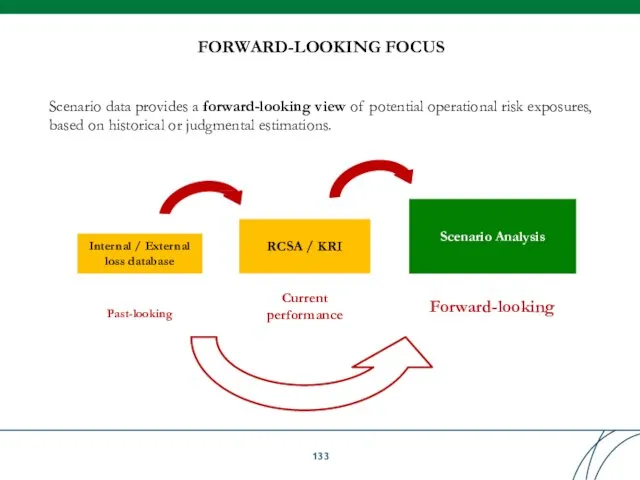

- 133. FORWARD-LOOKING FOCUS Internal / External loss database Past-looking RCSA / KRI Current performance Scenario Analysis Forward-looking

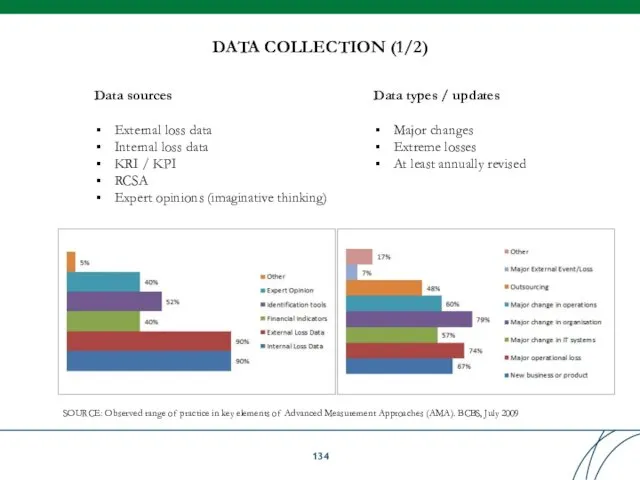

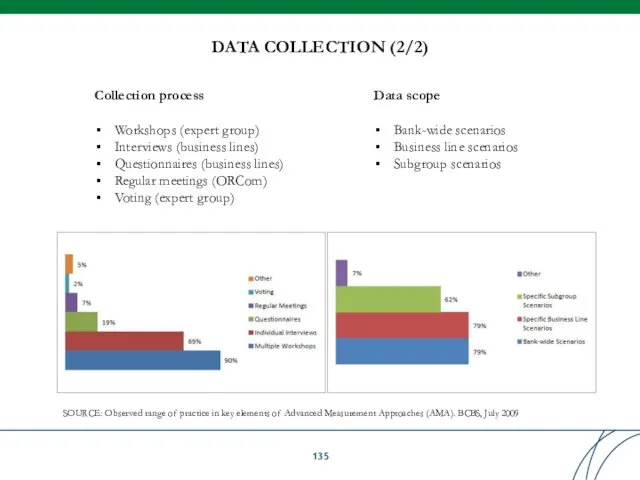

- 134. SOURCE: Observed range of practice in key elements of Advanced Measurement Approaches (AMA). BCBS, July 2009

- 135. SOURCE: Observed range of practice in key elements of Advanced Measurement Approaches (AMA). BCBS, July 2009

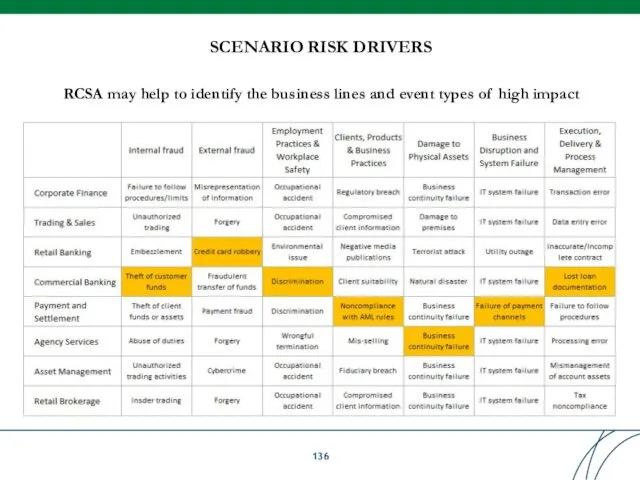

- 136. SCENARIO RISK DRIVERS RCSA may help to identify the business lines and event types of high

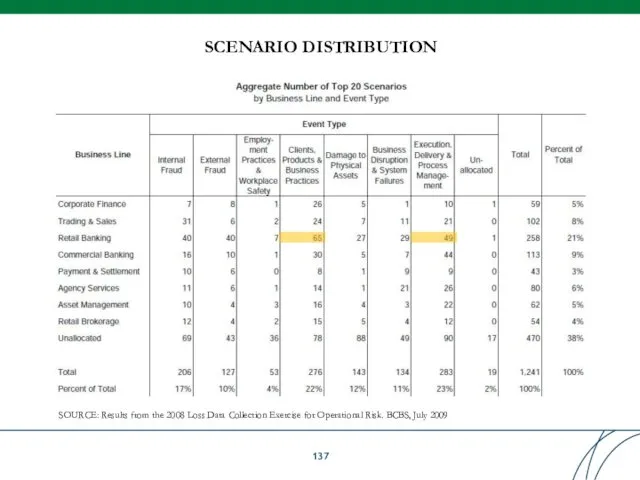

- 137. SCENARIO DISTRIBUTION SOURCE: Results from the 2008 Loss Data Collection Exercise for Operational Risk. BCBS, July

- 138. HIGH SEVERITY SCENARIO EXAMPLES Large loan or card fraud (internal / external) High-scale unauthorized trading Legislation

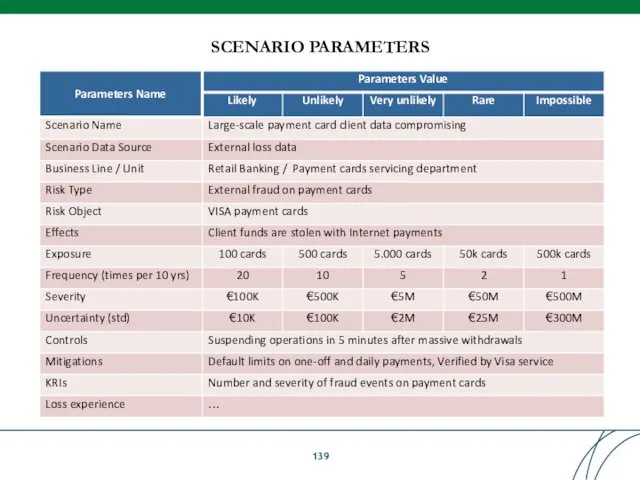

- 139. SCENARIO PARAMETERS

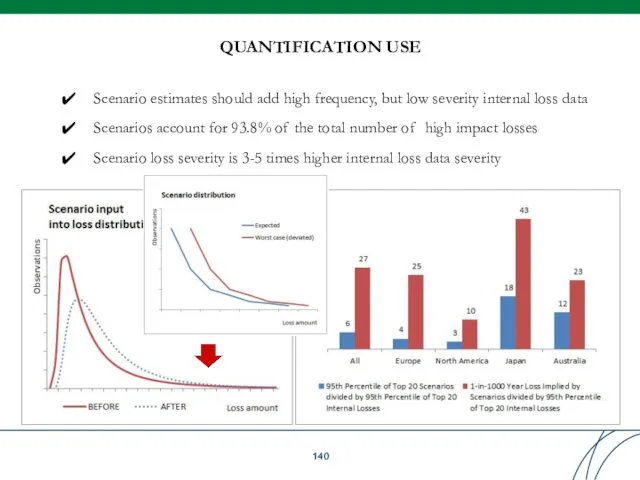

- 140. QUANTIFICATION USE Scenario estimates should add high frequency, but low severity internal loss data Scenarios account

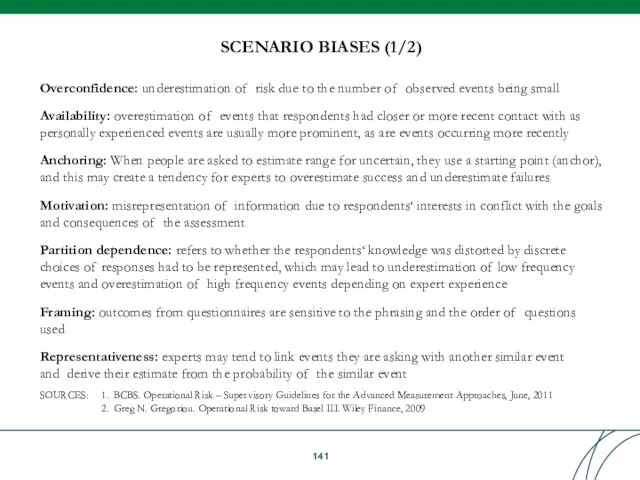

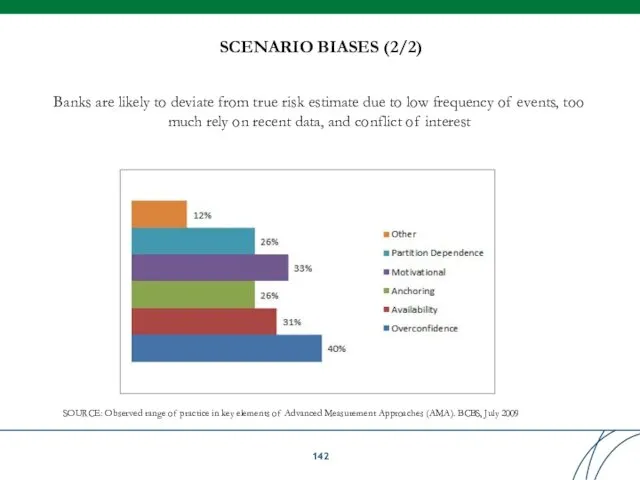

- 141. Overconfidence: underestimation of risk due to the number of observed events being small Availability: overestimation of

- 142. Banks are likely to deviate from true risk estimate due to low frequency of events, too

- 143. Established scenario framework should ensure the integrity and consistency of the estimates produced with the following

- 144. Table of Contents

- 145. Table of Contents

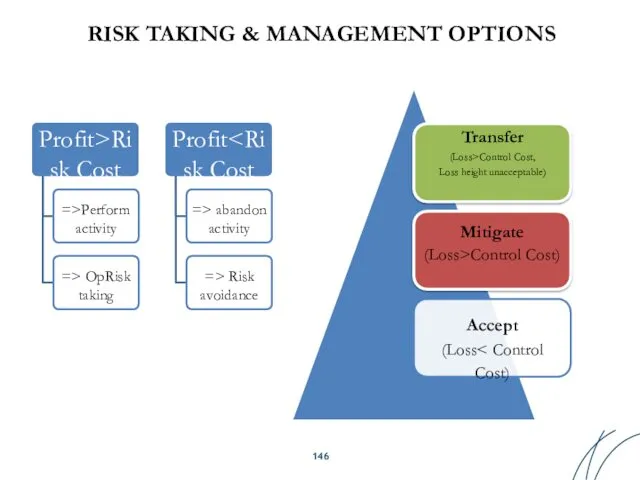

- 146. RISK TAKING & MANAGEMENT OPTIONS Profit>Ri sk Cost =>Perform activity => OpRisk taking Profit => abandon

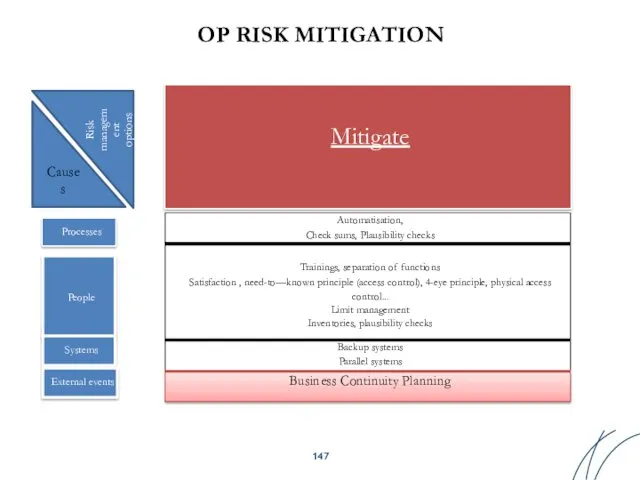

- 147. Processes People Systems External events OP RISK MITIGATION Mitigate Cause s Risk managem ent options

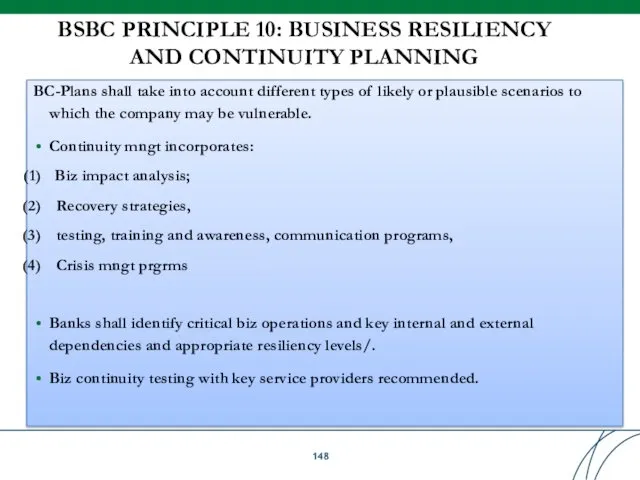

- 148. BSBC PRINCIPLE 10: BUSINESS RESILIENCY AND CONTINUITY PLANNING BC-Plans shall take into account different types of

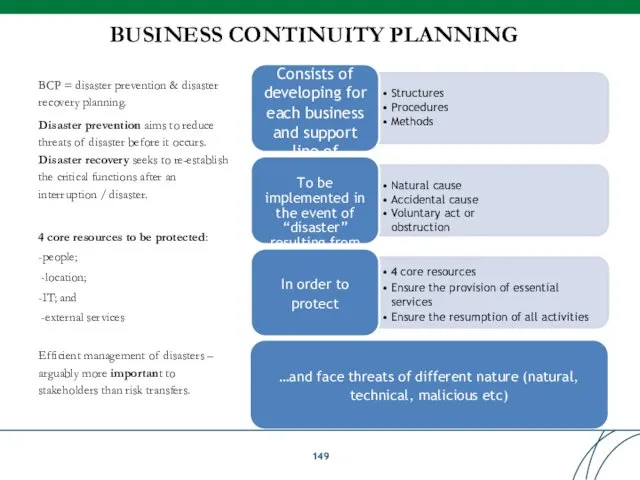

- 149. BUSINESS CONTINUITY PLANNING BCP = disaster prevention & disaster recovery planning. Disaster prevention aims to reduce

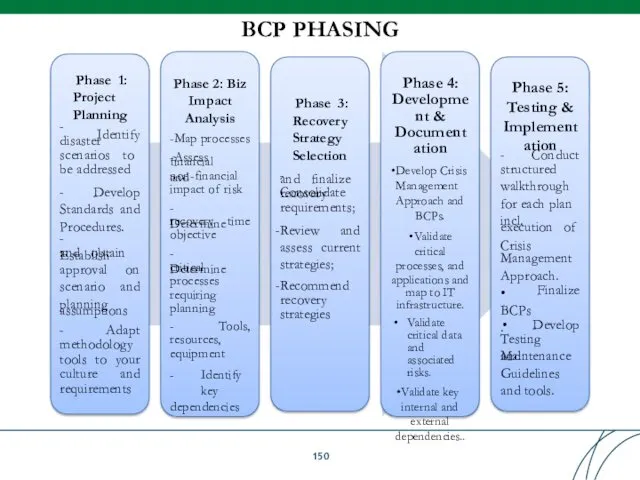

- 150. BCP PHASING - Phase 1: Project Planning Identify disaster scenarios to be addressed - Develop Standards

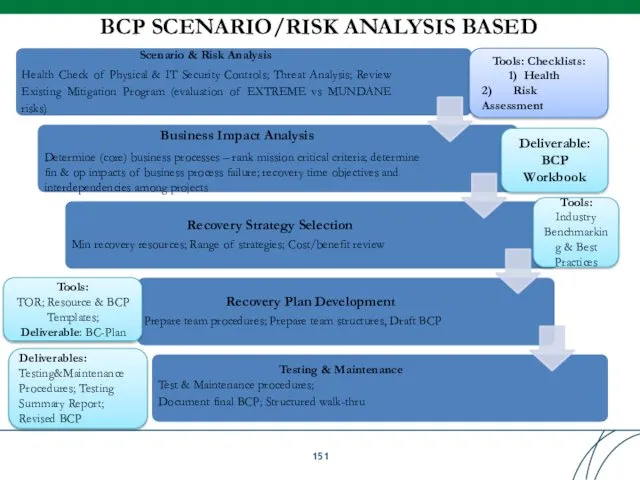

- 151. BCP SCENARIO/RISK ANALYSIS BASED Scenario & Risk Analysis Health Check of Physical & IT Security Controls;

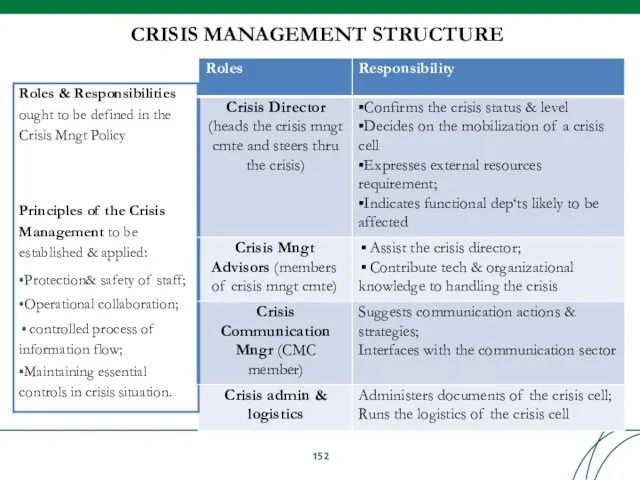

- 152. CRISIS MANAGEMENT STRUCTURE

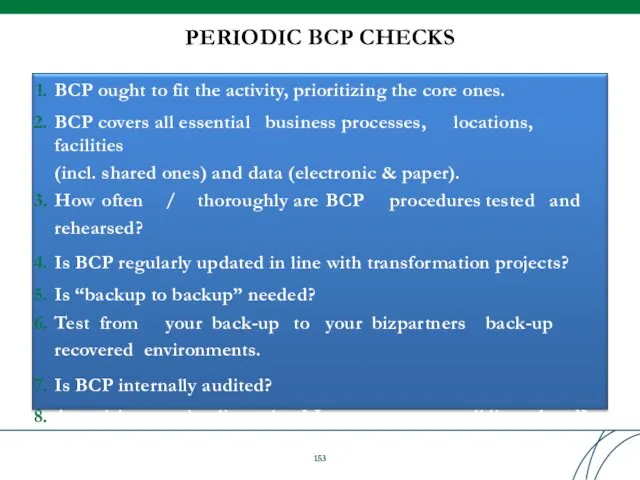

- 153. PERIODIC BCP CHECKS BCP ought to fit the activity, prioritizing the core ones. BCP covers all

- 154. BCP TIPS Simple preventive measures – geographic dispersion of intellectual capital; Implement alternative IT solutions for

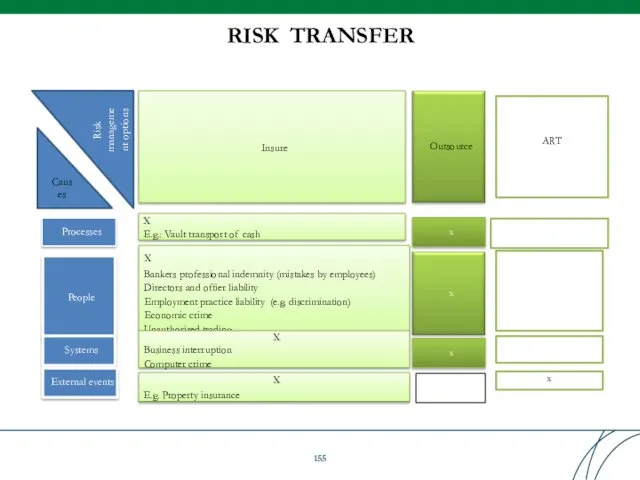

- 155. Processes People Systems External events Insure X E.g.: Vault transport of cash X Bankers professional indemnity

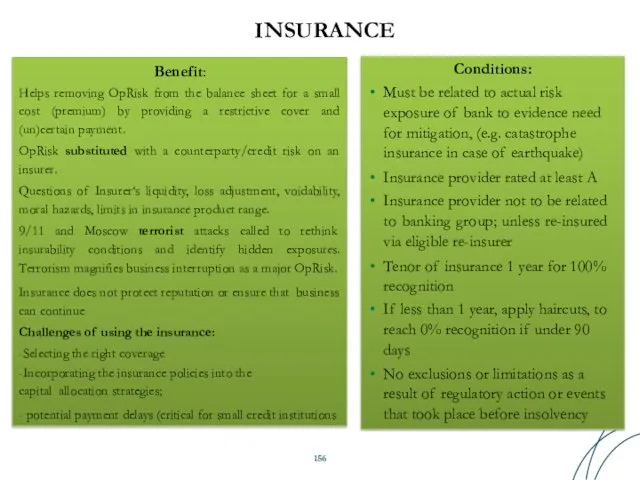

- 156. INSURANCE Conditions: Must be related to actual risk exposure of bank to evidence need for mitigation,

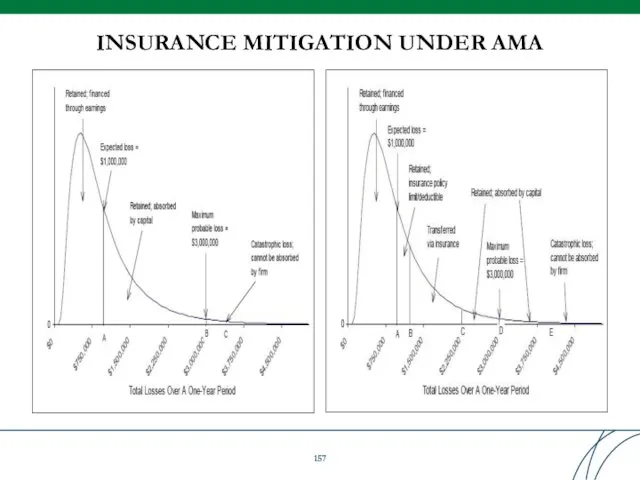

- 157. INSURANCE MITIGATION UNDER AMA

- 158. OUTSOURCING RISKS Op Risk Outsourcing drivers Cost reduction Higher process quality Risk sharing/ transfer Benefits from

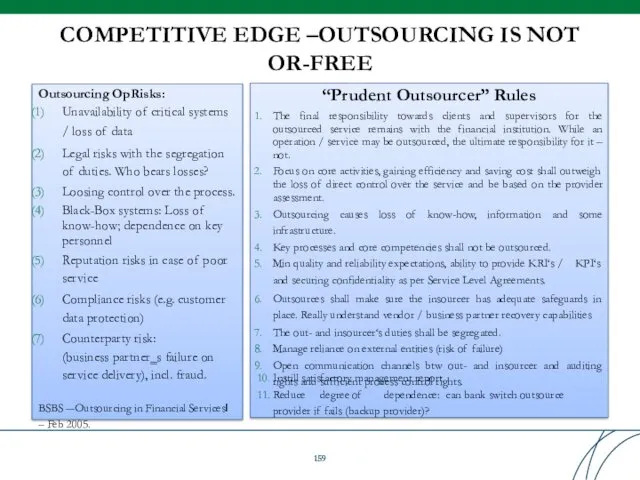

- 159. COMPETITIVE EDGE –OUTSOURCING IS NOT OR-FREE “Prudent Outsourcer” Rules The final responsibility towards clients and supervisors

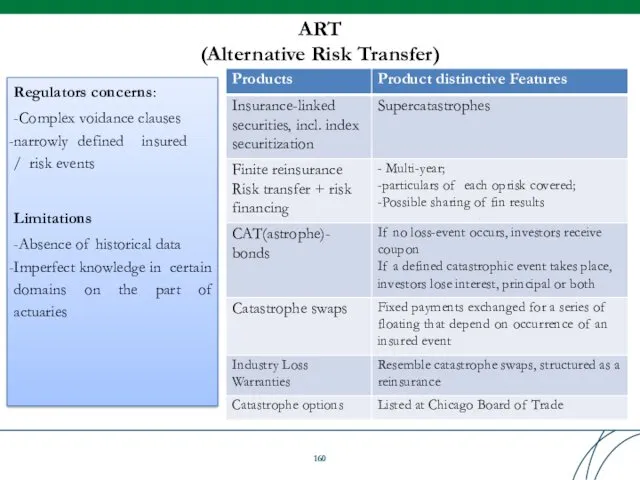

- 160. ART (Alternative Risk Transfer) Regulators concerns: -Complex voidance clauses narrowly defined insured / risk events Limitations

- 161. Table of Contents

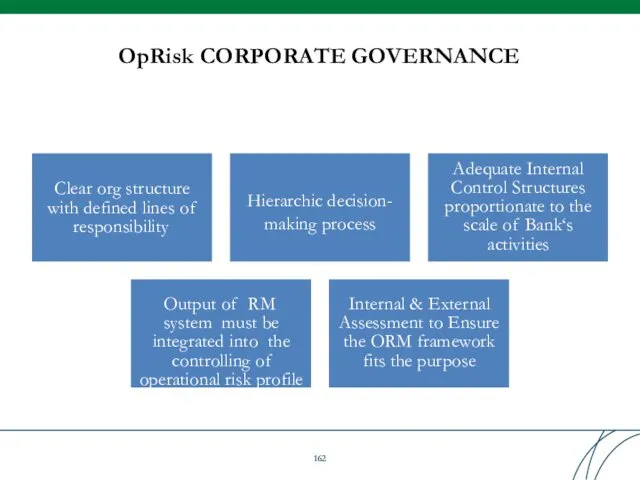

- 162. OpRisk CORPORATE GOVERNANCE Clear org structure with defined lines of responsibility Hierarchic decision- making process Adequate

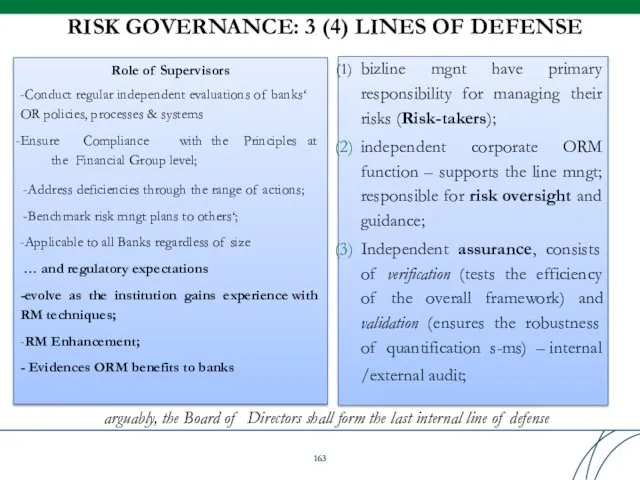

- 163. RISK GOVERNANCE: 3 (4) LINES OF DEFENSE Role of Supervisors -Conduct regular independent evaluations of banks‘

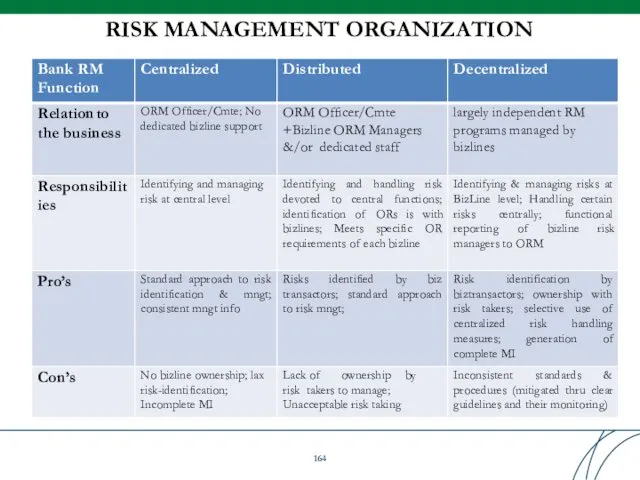

- 164. RISK MANAGEMENT ORGANIZATION

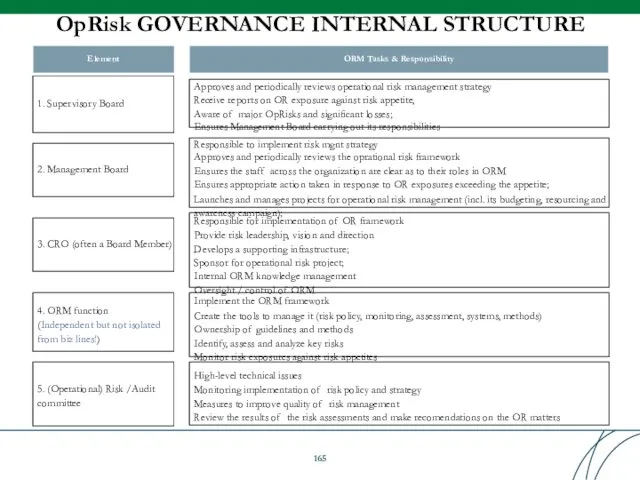

- 165. OpRisk GOVERNANCE INTERNAL STRUCTURE 1. Supervisory Board Responsible to implement risk mgnt strategy Approves and periodically

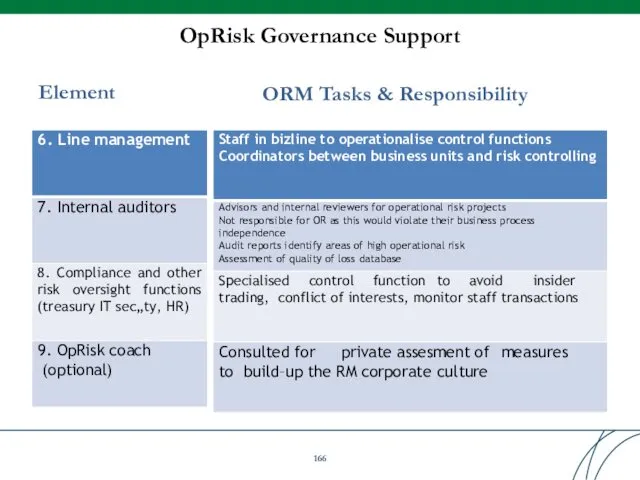

- 166. OpRisk Governance Support Element ORM Tasks & Responsibility

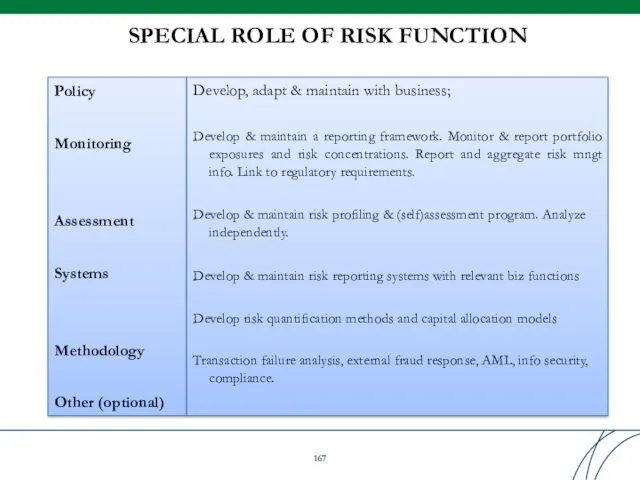

- 167. SPECIAL ROLE OF RISK FUNCTION Policy Monitoring Assessment Systems Methodology Other (optional) Develop, adapt & maintain

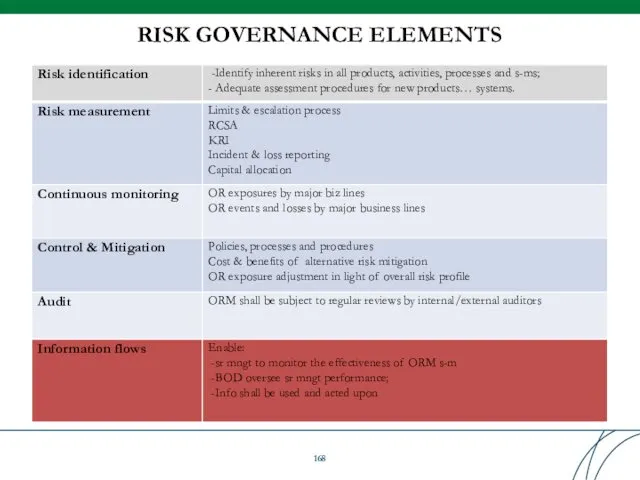

- 168. RISK GOVERNANCE ELEMENTS

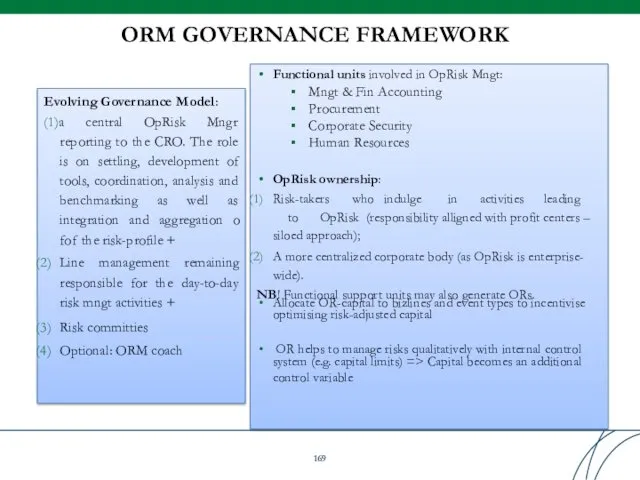

- 169. ORM GOVERNANCE FRAMEWORK Evolving Governance Model: (1)a central OpRisk Mngr reporting to the CRO. The role

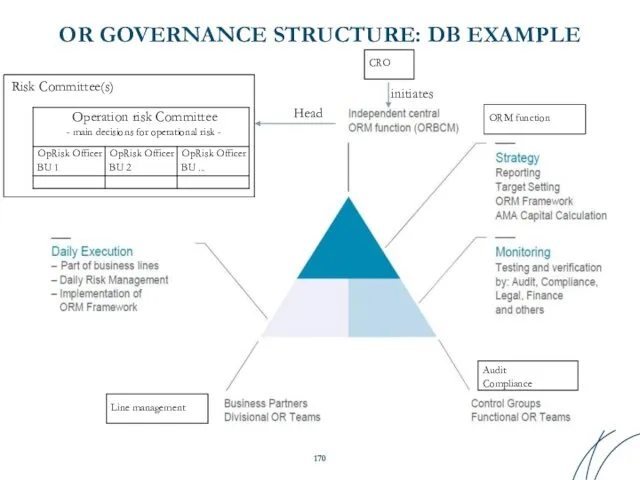

- 170. OR GOVERNANCE STRUCTURE: DB EXAMPLE Head Risk Committee(s) initiates Line management ORM function Audit Compliance CRO

- 171. DISCLOSURE TO EXTERNAL STAKEHOLDERS -Meet rating agency expectations (ORM assessment form part of their overall firm‘s

- 172. RULES OF STAKEHOLDER ENGAGEMENT ❑Do internal (“machine room”) and external (context) intelligence; ❑Communication team composition: Experts

- 173. - Who are your stakeholders? -What’s your Symbol (Brand, Reputation)? - Is it worth protecting?

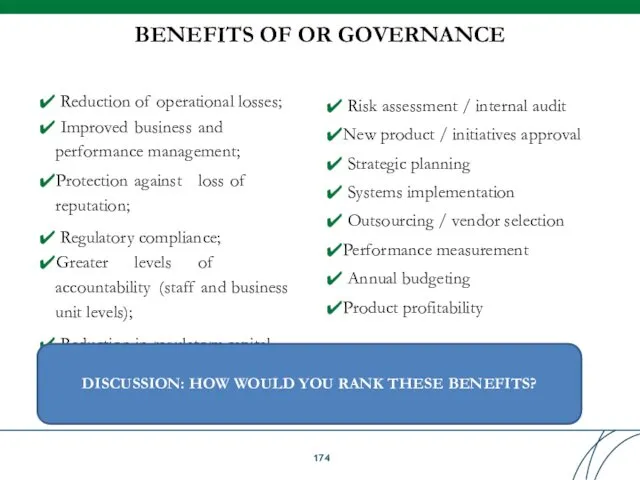

- 174. BENEFITS OF OR GOVERNANCE ✔ Reduction of operational losses; ✔ Improved business and performance management; ✔Protection

- 175. ORM IS SIMPLY GOOD CORPORATE GOVERNANCE Good ORM Fewer Surprises Increased shareholder value

- 176. Table of Contents

- 177. Contact information INTERNATIONAL FINANCE CORPORATION (IFC) Bank Advisory Program Central Asia and Eastern Europe Yevgeni Prokopenko,

- 179. Скачать презентацию

Стратегический менеджмент в образовании: формирование стратегического плана школы

Стратегический менеджмент в образовании: формирование стратегического плана школы Трудовые ресурсы предприятия. (Тема 8)

Трудовые ресурсы предприятия. (Тема 8) Менеджмент качества образования в высшей школе

Менеджмент качества образования в высшей школе Методы и формы управления в гостиничном бизнесе

Методы и формы управления в гостиничном бизнесе Мировые управленческие концепции. Американская, европейская, японская и российская модели менеджмента

Мировые управленческие концепции. Американская, европейская, японская и российская модели менеджмента How managers can make a decision in an uncertainty environment?

How managers can make a decision in an uncertainty environment? Time management. How to do everything

Time management. How to do everything Система внутреннего контроля современного предприятия

Система внутреннего контроля современного предприятия Оценка использования трудовых ресурсов и обоснование путей их улучшения ОАО Витебские ковры

Оценка использования трудовых ресурсов и обоснование путей их улучшения ОАО Витебские ковры Основы управления качеством и оценки соответствия

Основы управления качеством и оценки соответствия Организационный план. Персонал

Организационный план. Персонал Анализ кадровой политики ОАО РУСАЛ-ИркАЗ

Анализ кадровой политики ОАО РУСАЛ-ИркАЗ Совершенствование процесса адаптации персонала на предприятии на примере строительной организации ООО Застройщик

Совершенствование процесса адаптации персонала на предприятии на примере строительной организации ООО Застройщик Обще́ственное пита́ние

Обще́ственное пита́ние Теория поведения человека в организации

Теория поведения человека в организации Практическое задание по менеджменту

Практическое задание по менеджменту Вероятностные модели управления запасами

Вероятностные модели управления запасами Етапи процесу прийняття рішення

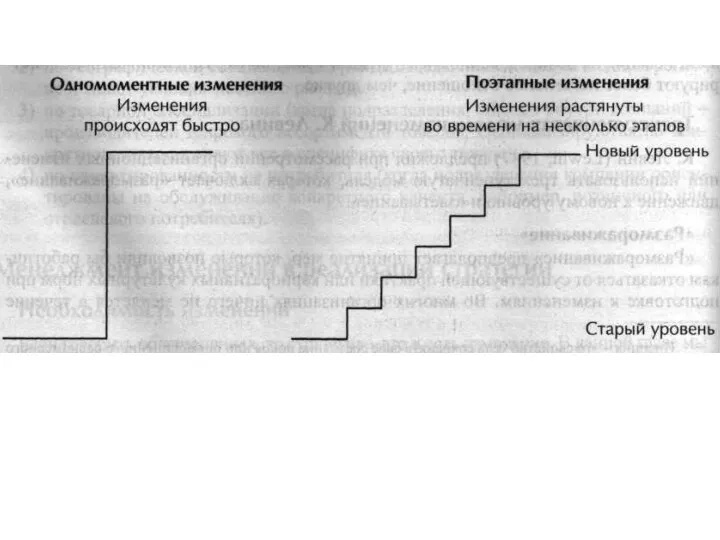

Етапи процесу прийняття рішення Изменения в организации и расходование ресурсов

Изменения в организации и расходование ресурсов Проект тайный ангел

Проект тайный ангел Экспертные методы оценки рисков

Экспертные методы оценки рисков Стратегический менеджмент

Стратегический менеджмент Школа менеджеров

Школа менеджеров Реинжиниринг бизнес-процессов. Основные концепции улучшения бизнес-процессов. (Тема 1)

Реинжиниринг бизнес-процессов. Основные концепции улучшения бизнес-процессов. (Тема 1) Понятие стратегического менеджмента

Понятие стратегического менеджмента Управление научными исследованиями и разработками. Разработки новых продуктов и технологий

Управление научными исследованиями и разработками. Разработки новых продуктов и технологий Оценка персонала компании

Оценка персонала компании Види туроперейтингу

Види туроперейтингу