Содержание

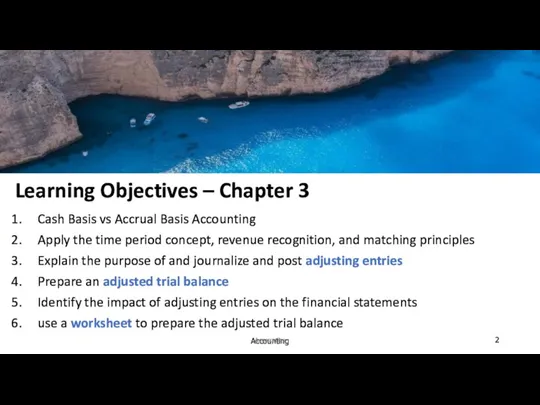

- 2. Learning Objectives – Chapter 3 Cash Basis vs Accrual Basis Accounting Apply the time period concept,

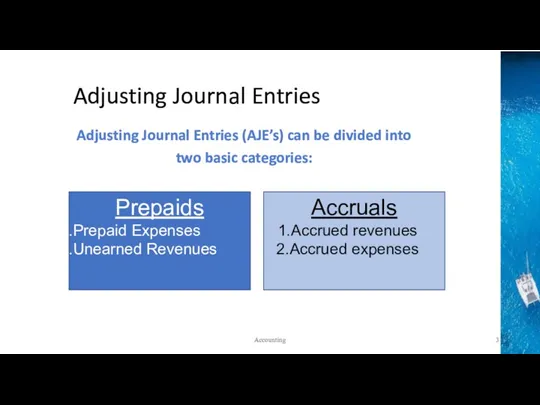

- 3. Adjusting Journal Entries Adjusting Journal Entries (AJE’s) can be divided into two basic categories: Prepaids Prepaid

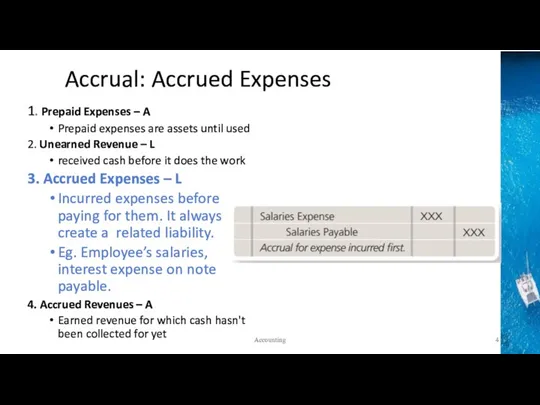

- 4. Accrual: Accrued Expenses 1. Prepaid Expenses – A Prepaid expenses are assets until used 2. Unearned

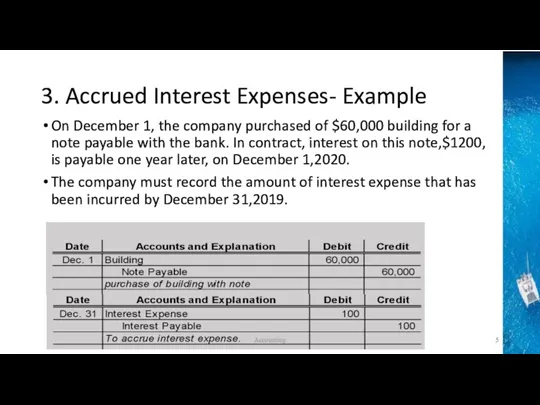

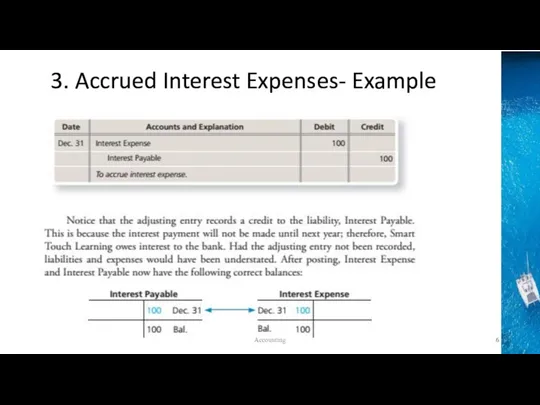

- 5. 3. Accrued Interest Expenses- Example On December 1, the company purchased of $60,000 building for a

- 6. 3. Accrued Interest Expenses- Example Accounting

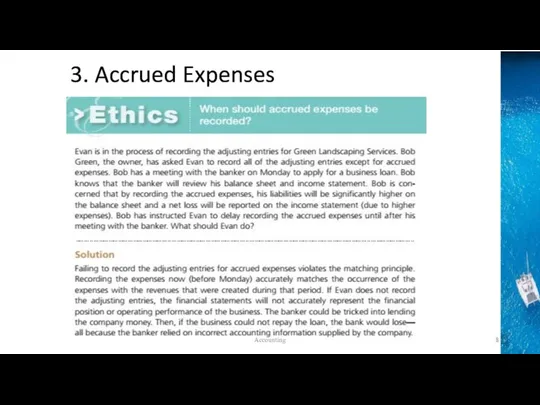

- 7. 3. Accrued Expenses Accounting

- 8. 3. Accrued Expenses Accounting

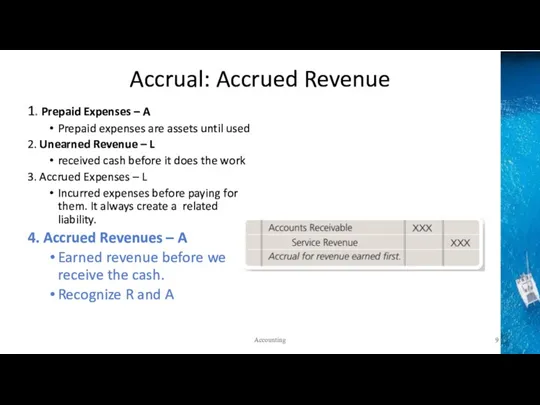

- 9. Accrual: Accrued Revenue 1. Prepaid Expenses – A Prepaid expenses are assets until used 2. Unearned

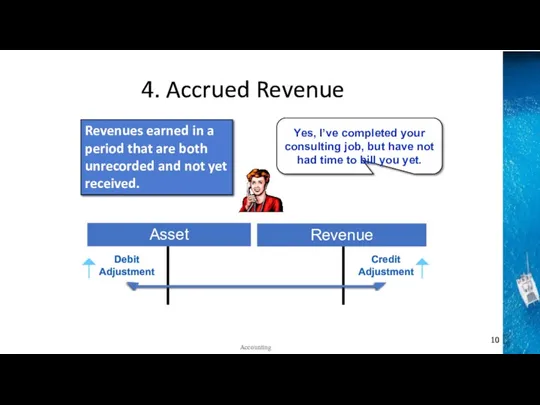

- 10. Yes, I’ve completed your consulting job, but have not had time to bill you yet. 4.

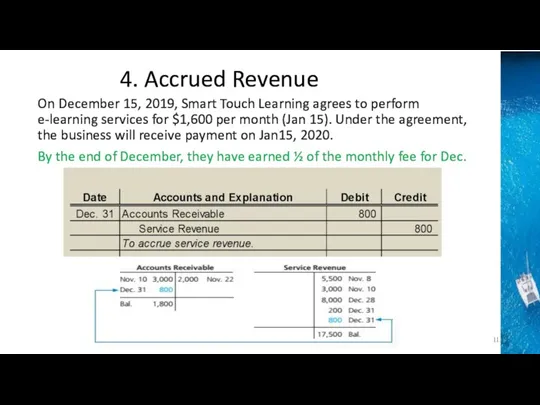

- 11. 4. Accrued Revenue On December 15, 2019, Smart Touch Learning agrees to perform e-learning services for

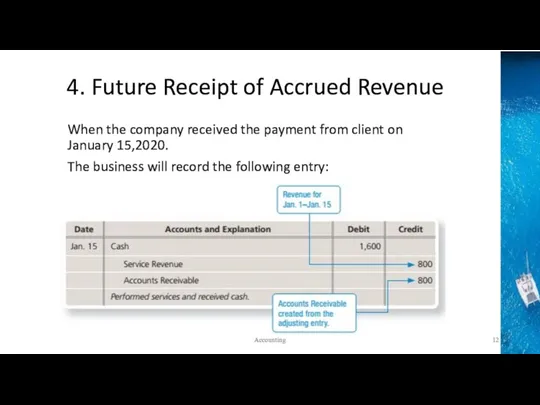

- 12. 4. Future Receipt of Accrued Revenue When the company received the payment from client on January

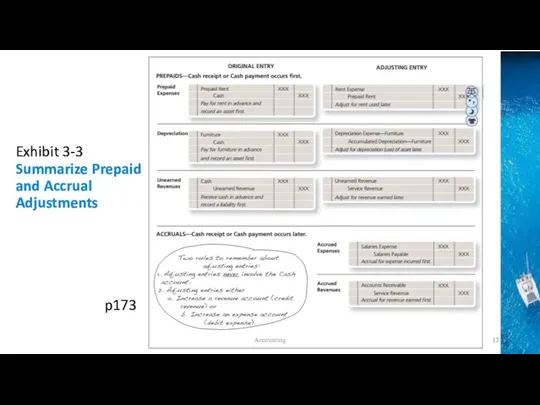

- 13. Exhibit 3-3 Summarize Prepaid and Accrual Adjustments p173 Accounting

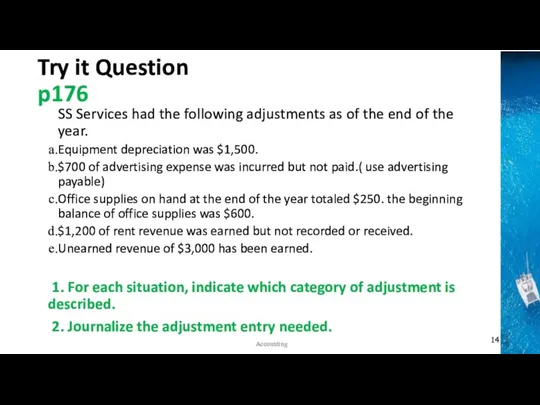

- 14. Try it Question p176 SS Services had the following adjustments as of the end of the

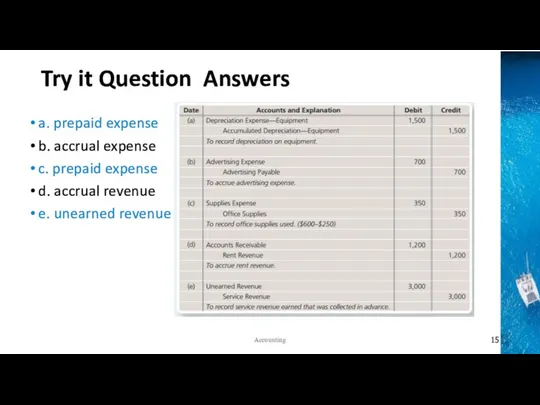

- 15. Try it Question Answers a. prepaid expense b. accrual expense c. prepaid expense d. accrual revenue

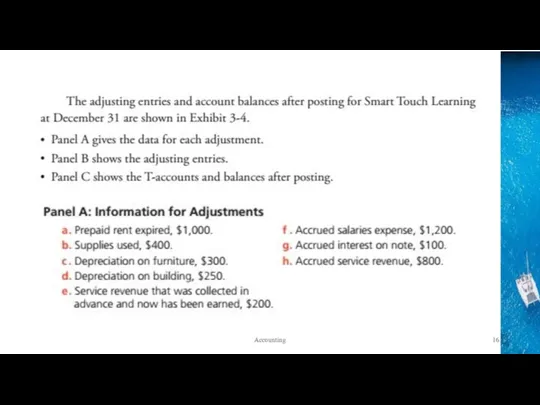

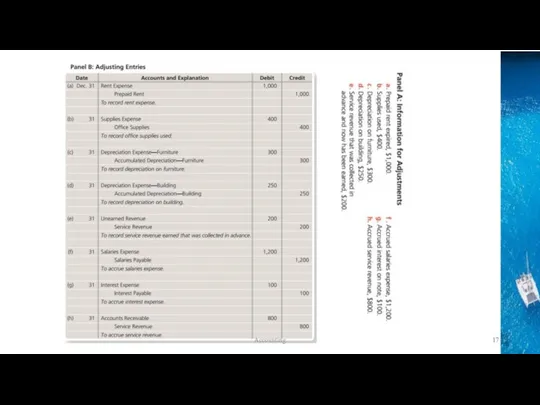

- 16. Accounting

- 17. Accounting

- 18. 截图p175C Accounting

- 19. Learning Objective 4 Explain the purpose of and prepare an adjusted trial balance Accounting 19

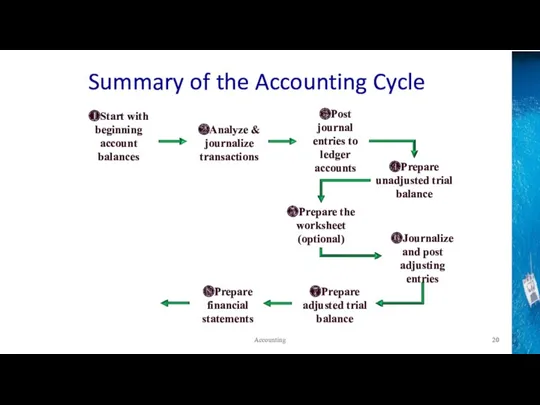

- 20. Summary of the Accounting Cycle ❷Analyze & journalize transactions ❸Post journal entries to ledger accounts ❹Prepare

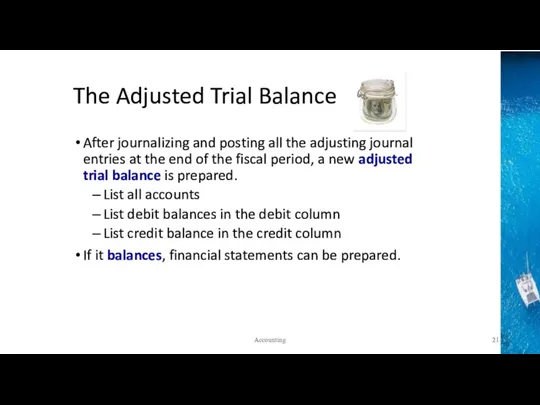

- 21. The Adjusted Trial Balance After journalizing and posting all the adjusting journal entries at the end

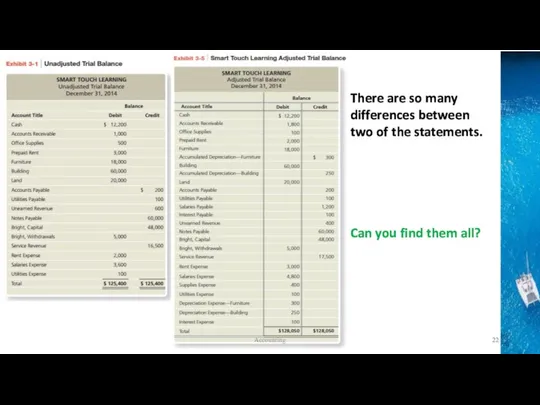

- 22. There are so many differences between two of the statements. Can you find them all? Accounting

- 23. Learning Objective 5 Identify the impact of adjusting entries on the financial statements Accounting

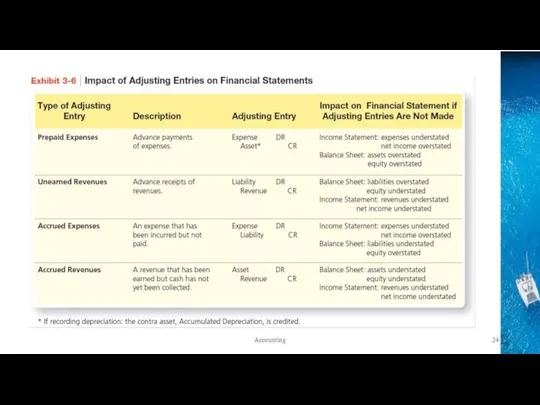

- 24. Accounting

- 25. Try it Question p179 Identify the impact on the income statement and balance sheet if following

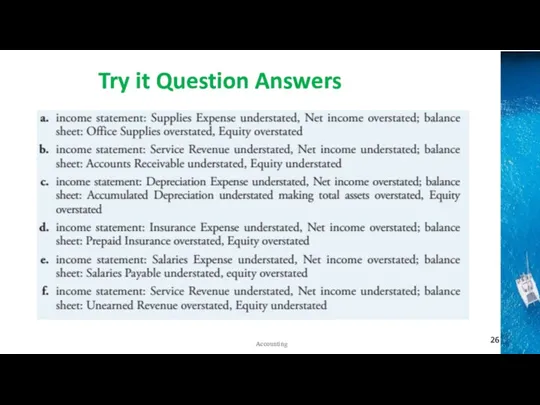

- 26. Try it Question Answers Accounting

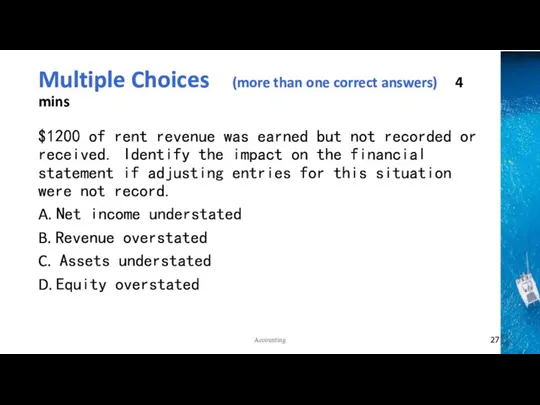

- 27. Multiple Choices (more than one correct answers) 4 mins $1200 of rent revenue was earned but

- 28. Learning Objective 6 Explain the worksheet and use it to prepare adjusting entries and the adjusted

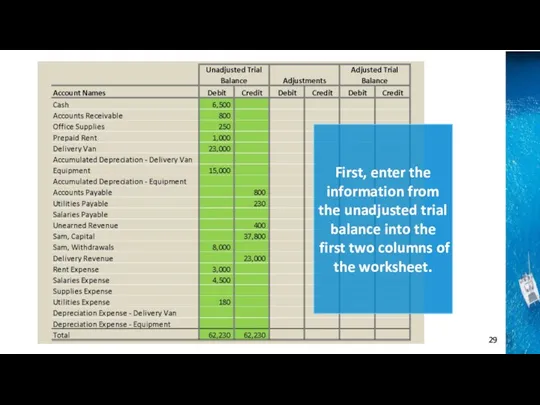

- 29. 3- Accounting First, enter the information from the unadjusted trial balance into the first two columns

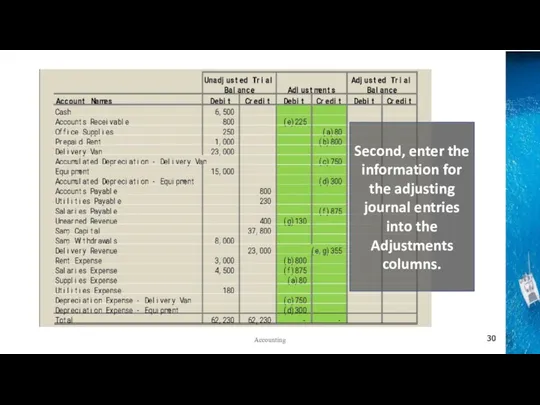

- 30. Accounting Second, enter the information for the adjusting journal entries into the Adjustments columns.

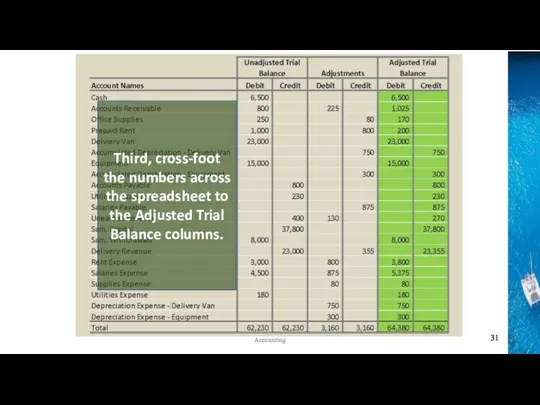

- 31. Accounting Third, cross-foot the numbers across the spreadsheet to the Adjusted Trial Balance columns.

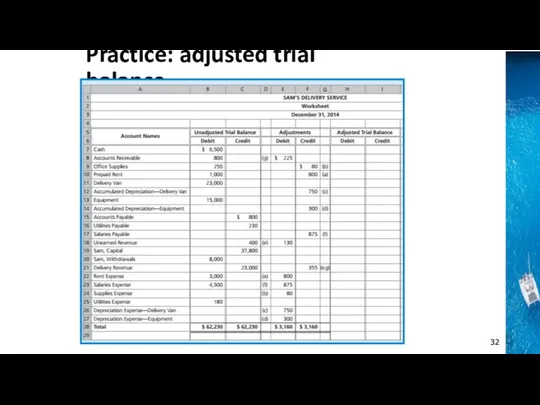

- 32. Practice: adjusted trial balance Accounting

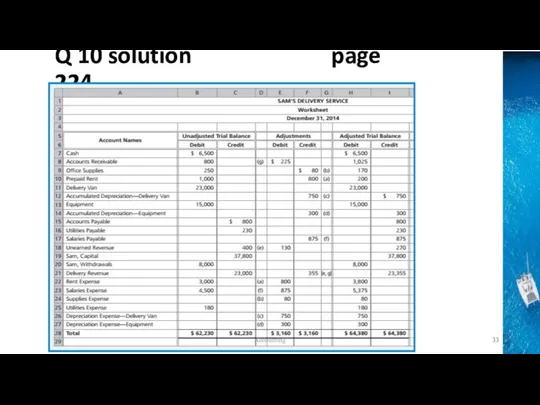

- 33. Q 10 solution page 224 Accounting

- 34. An internal document that helps summarize data for the preparation of financial statements is called a:

- 35. An internal document that helps summarize data for the preparation of financial statements is called a:

- 36. The adjusted trial balance shows: amounts that are out of balance and ways to rectify them.

- 37. The adjusted trial balance shows: amounts that are out of balance and ways to rectify them.

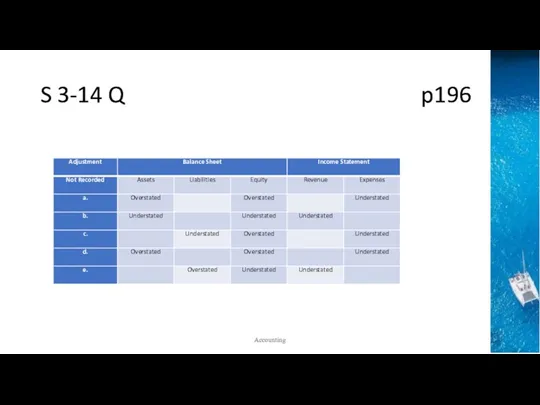

- 38. S 3-14 Q p196 Accounting

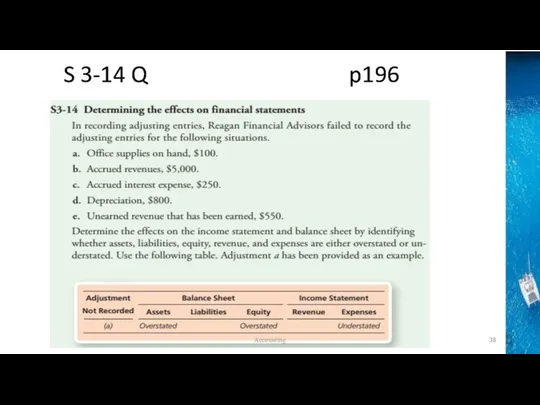

- 39. S 3-14 Q p196 Accounting

- 40. Unit Assessment Task Homework 30% - three times, each time account for 10% Final Individual Assignment

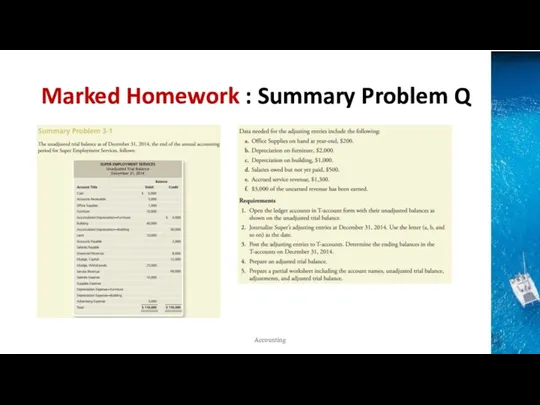

- 41. Marked Homework : Summary Problem Q Accounting

- 43. Скачать презентацию

ЭКВАЙРИНГ Новый инструмент управления продажами

ЭКВАЙРИНГ Новый инструмент управления продажами Изменение мотивационной программы кредитных экспертов ПОС и специалистов по сопровождению продаж АВТО

Изменение мотивационной программы кредитных экспертов ПОС и специалистов по сопровождению продаж АВТО Основные звенья государственных финансов, и их роль в финансовой системе РФ

Основные звенья государственных финансов, и их роль в финансовой системе РФ Основы анализа финансовой отчетности

Основы анализа финансовой отчетности Текущие и капитальные расходы бюджета

Текущие и капитальные расходы бюджета Понятия бюджетного устройства и бюджетной системы

Понятия бюджетного устройства и бюджетной системы Понятие и функции финансов. Тема 1

Понятие и функции финансов. Тема 1 Англо-американская система бухгалтерского учета

Англо-американская система бухгалтерского учета Liquidated damages in Russian contract law

Liquidated damages in Russian contract law Электрические сети и передача электрической энергии. Государственное регулирование в сфере электроэнергетики. Лекция 7-8

Электрические сети и передача электрической энергии. Государственное регулирование в сфере электроэнергетики. Лекция 7-8 Участники страховых отношений

Участники страховых отношений 20230320_modul_1.2._kak_sberech_dengi_s_pomoshchyu_depozita

20230320_modul_1.2._kak_sberech_dengi_s_pomoshchyu_depozita Привлечение банком средств предприятий

Привлечение банком средств предприятий Кредит наличными. Преимущества оформления кредитов в Альфа-Банке

Кредит наличными. Преимущества оформления кредитов в Альфа-Банке Концептуальні основи оподаткування

Концептуальні основи оподаткування Основы экономики. Задачи государства. Государственный бюджет

Основы экономики. Задачи государства. Государственный бюджет Учет денежных средств в аптеках

Учет денежных средств в аптеках Изменения в бухгалтерском учете учреждений бюджетной сферы вступающие в силу с 2023 года (сентябрь 2023 г.)

Изменения в бухгалтерском учете учреждений бюджетной сферы вступающие в силу с 2023 года (сентябрь 2023 г.) Органы, осуществляющие финансовую деятельность в РФ

Органы, осуществляющие финансовую деятельность в РФ Выбор платежного сервис-провайдера для интернет-магазина

Выбор платежного сервис-провайдера для интернет-магазина Гранты

Гранты ТСущность, функции и основные задачи инвестиционного анализа

ТСущность, функции и основные задачи инвестиционного анализа Группа всемирного банка

Группа всемирного банка Какие вклады являются застрахованными

Какие вклады являются застрахованными Қазақстанның қазіргі уақытта сыртқы қарызы қанша

Қазақстанның қазіргі уақытта сыртқы қарызы қанша Модели и методы оценки облигаций

Модели и методы оценки облигаций Соціальний і правовий захист військовослужбовців та членів їх сімей. Грошове забезпечення в 2016 році

Соціальний і правовий захист військовослужбовців та членів їх сімей. Грошове забезпечення в 2016 році Цели, функции, основные направления и процедуры внутреннего аудита цикла затрат

Цели, функции, основные направления и процедуры внутреннего аудита цикла затрат