Содержание

- 2. After studying Chapter 13, you should be able to: Understand the payback period (PBP) method of

- 3. Capital Budgeting Techniques Project Evaluation and Selection Potential Difficulties Capital Rationing Project Monitoring Post-Completion Audit

- 4. Project Evaluation: Alternative Methods Payback Period (PBP) Internal Rate of Return (IRR) Net Present Value (NPV)

- 5. Proposed Project Data Julie Miller is evaluating a new project for her firm, (BMW). She has

- 6. Independent Project Independent -- A project whose acceptance (or rejection) does not prevent the acceptance of

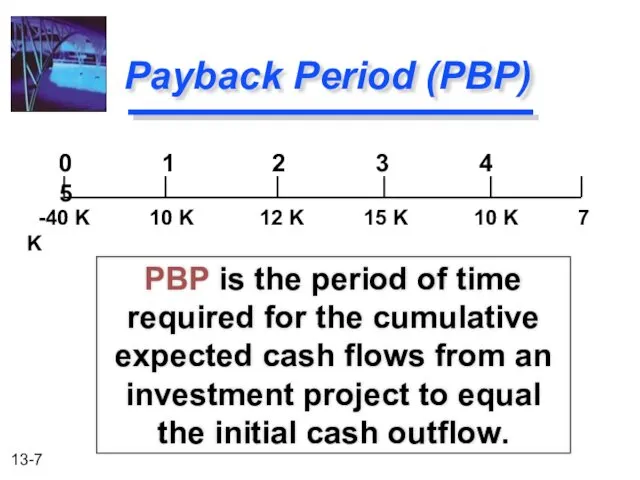

- 7. Payback Period (PBP) PBP is the period of time required for the cumulative expected cash flows

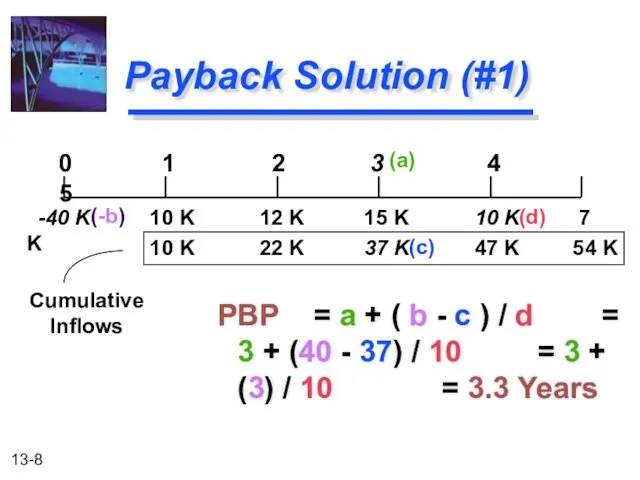

- 8. (c) 10 K 22 K 37 K 47 K 54 K Payback Solution (#1) PBP =

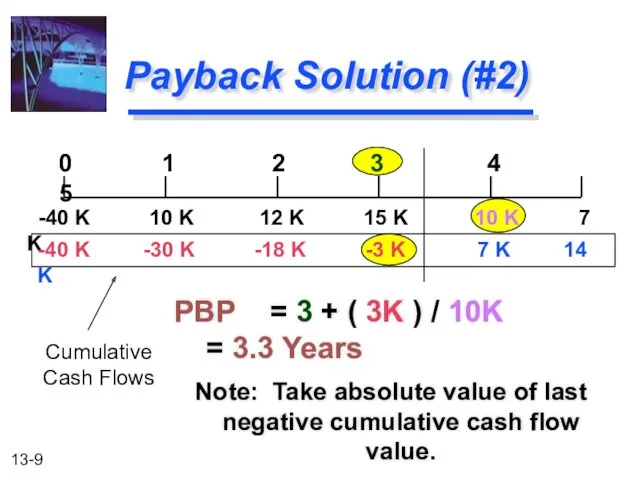

- 9. Payback Solution (#2) PBP = 3 + ( 3K ) / 10K = 3.3 Years Note:

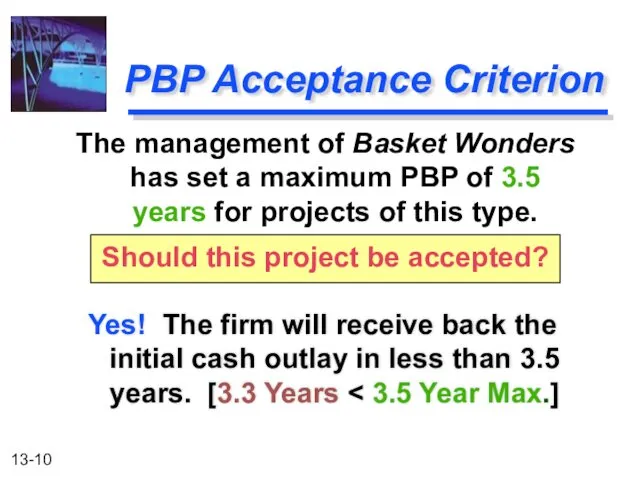

- 10. PBP Acceptance Criterion Yes! The firm will receive back the initial cash outlay in less than

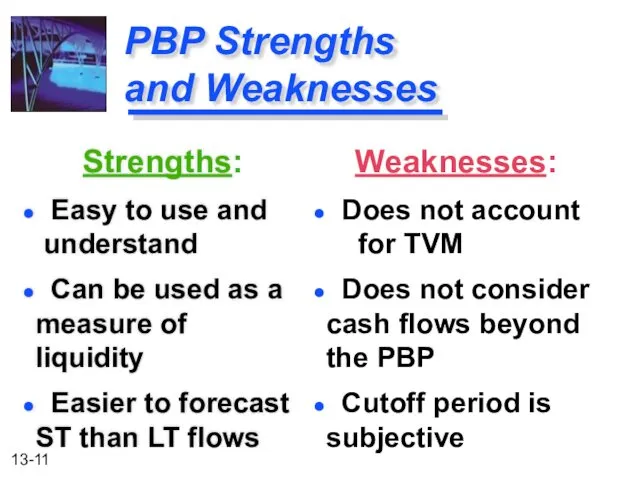

- 11. PBP Strengths and Weaknesses Strengths: Easy to use and understand Can be used as a measure

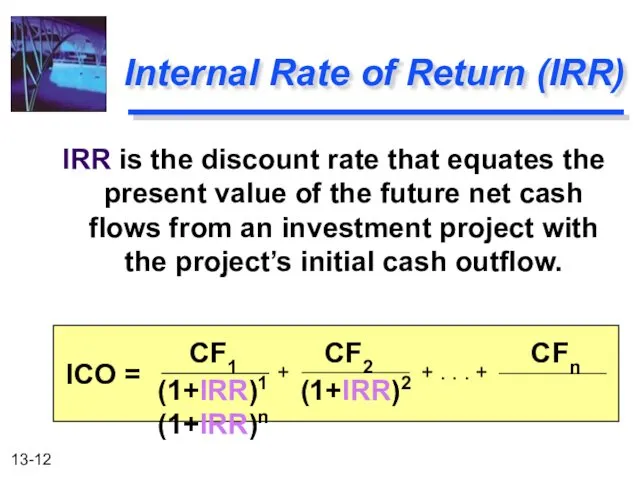

- 12. Internal Rate of Return (IRR) IRR is the discount rate that equates the present value of

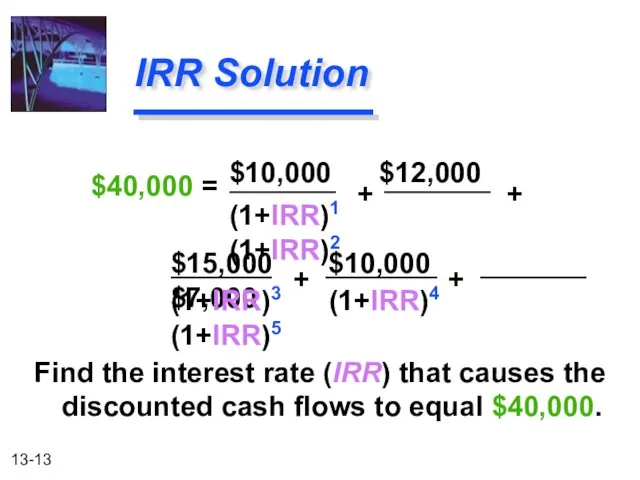

- 13. $15,000 $10,000 $7,000 IRR Solution $10,000 $12,000 (1+IRR)1 (1+IRR)2 Find the interest rate (IRR) that causes

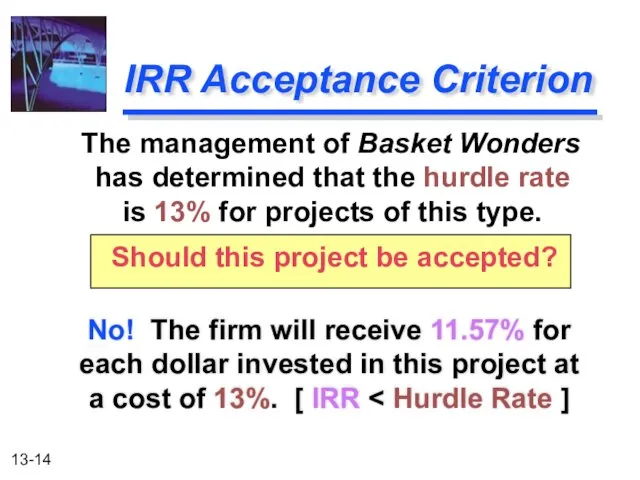

- 14. IRR Acceptance Criterion No! The firm will receive 11.57% for each dollar invested in this project

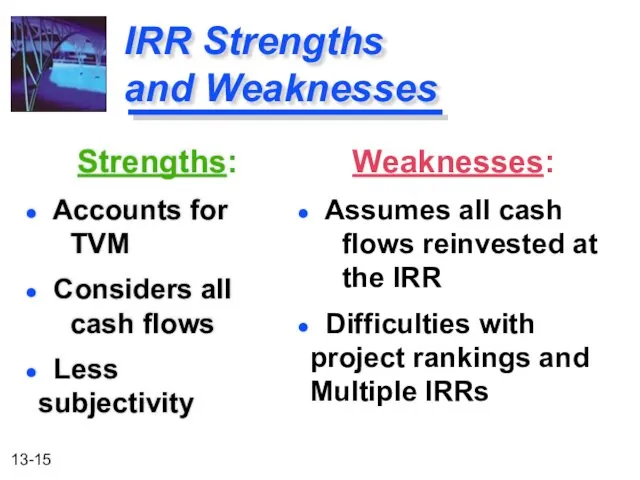

- 15. IRR Strengths and Weaknesses Strengths: Accounts for TVM Considers all cash flows Less subjectivity Weaknesses: Assumes

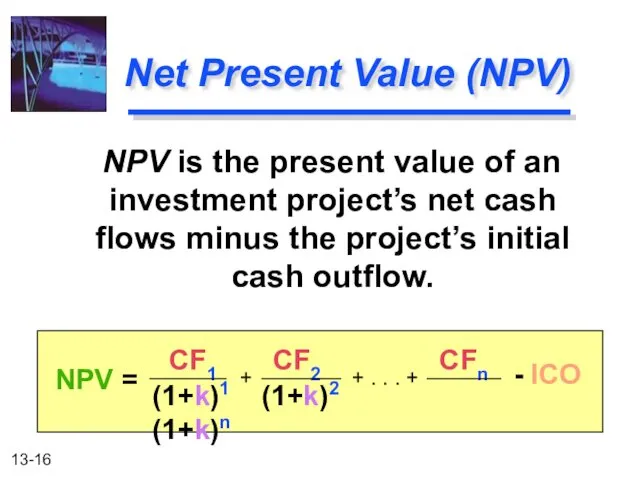

- 16. Net Present Value (NPV) NPV is the present value of an investment project’s net cash flows

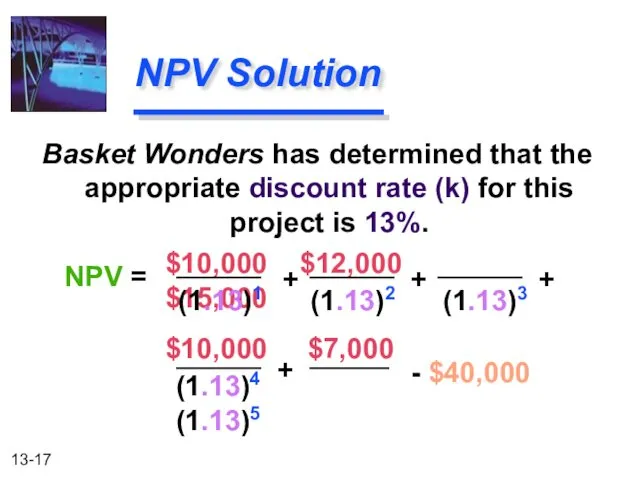

- 17. Basket Wonders has determined that the appropriate discount rate (k) for this project is 13%. $10,000

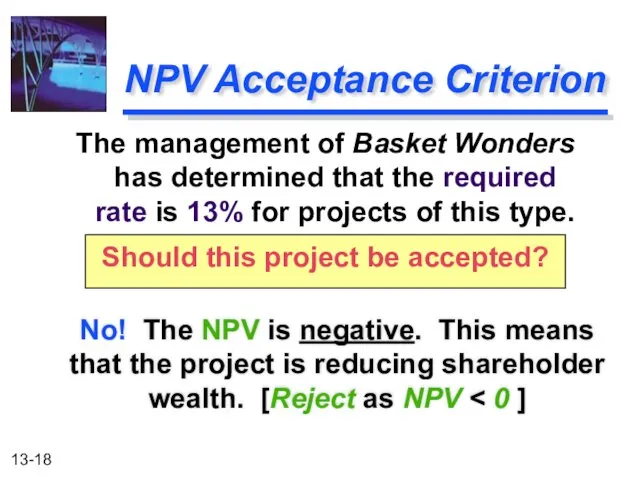

- 18. NPV Acceptance Criterion No! The NPV is negative. This means that the project is reducing shareholder

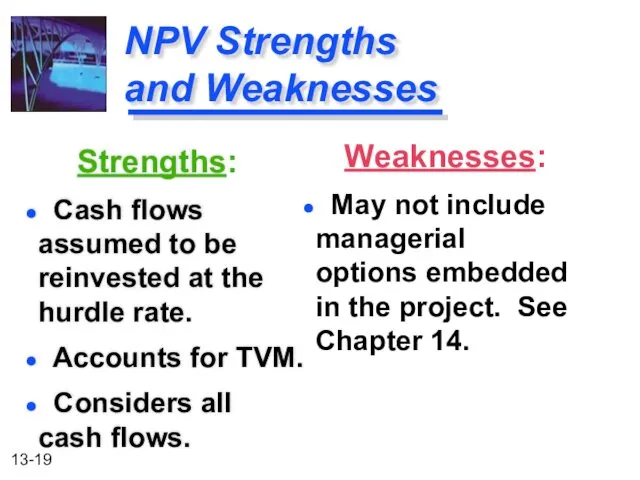

- 19. NPV Strengths and Weaknesses Strengths: Cash flows assumed to be reinvested at the hurdle rate. Accounts

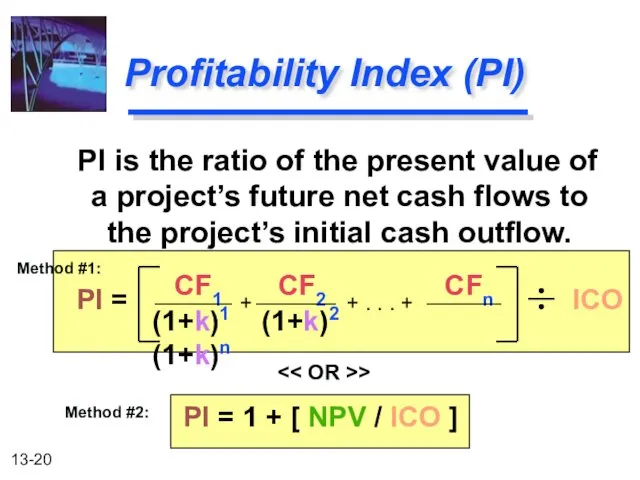

- 20. Profitability Index (PI) PI is the ratio of the present value of a project’s future net

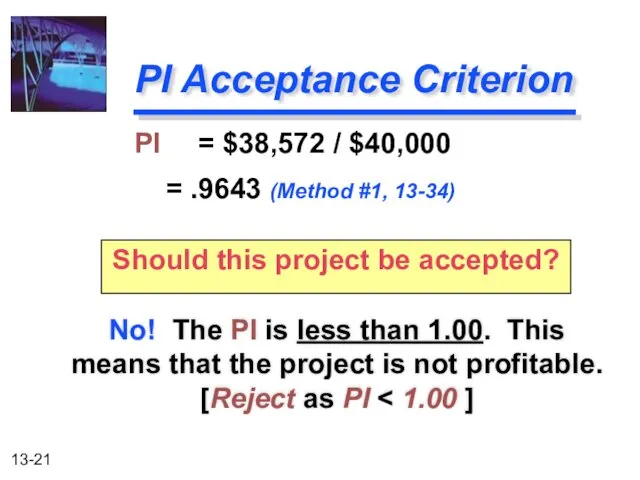

- 21. PI Acceptance Criterion No! The PI is less than 1.00. This means that the project is

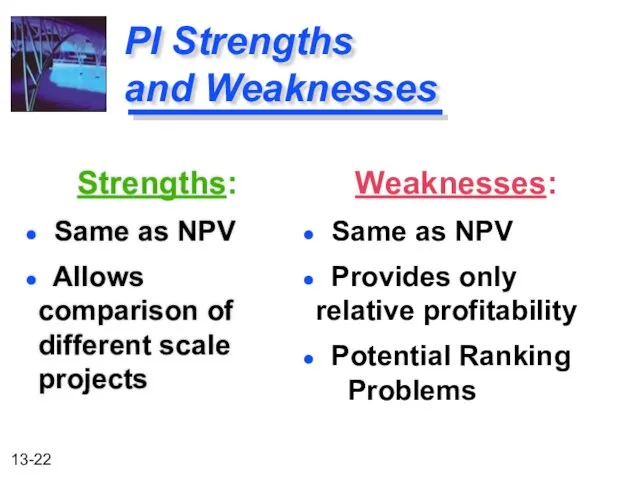

- 22. PI Strengths and Weaknesses Strengths: Same as NPV Allows comparison of different scale projects Weaknesses: Same

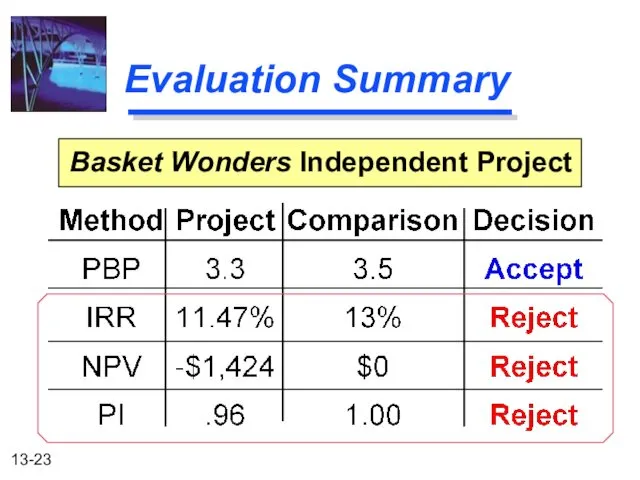

- 23. Evaluation Summary Basket Wonders Independent Project

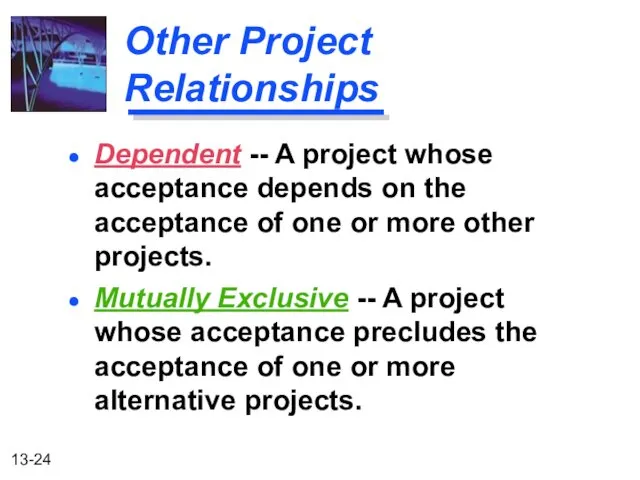

- 24. Other Project Relationships Mutually Exclusive -- A project whose acceptance precludes the acceptance of one or

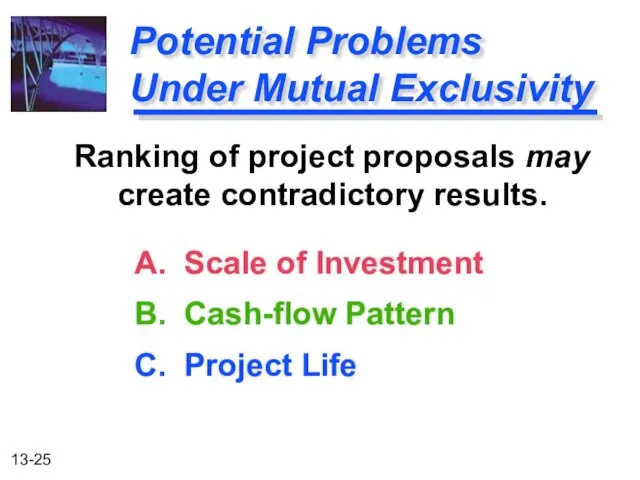

- 25. Potential Problems Under Mutual Exclusivity A. Scale of Investment B. Cash-flow Pattern C. Project Life Ranking

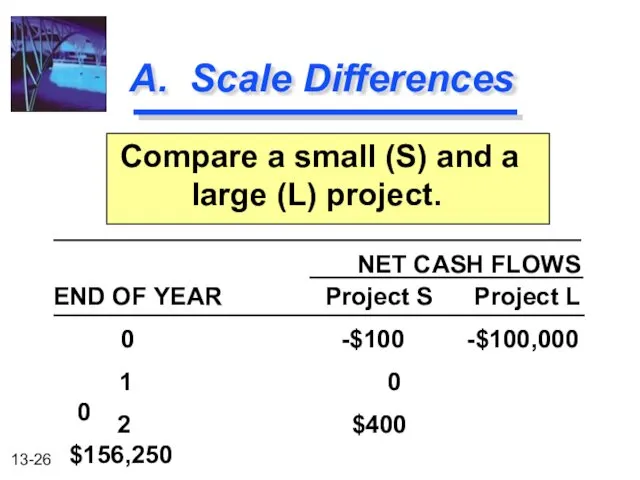

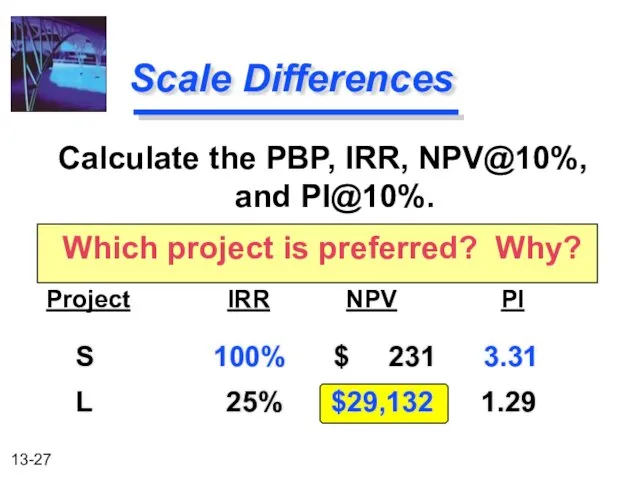

- 26. A. Scale Differences Compare a small (S) and a large (L) project. NET CASH FLOWS Project

- 27. Scale Differences Calculate the PBP, IRR, NPV@10%, and PI@10%. Which project is preferred? Why? Project IRR

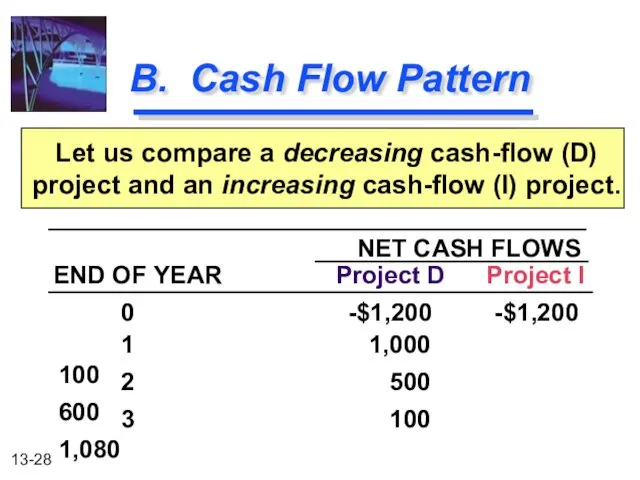

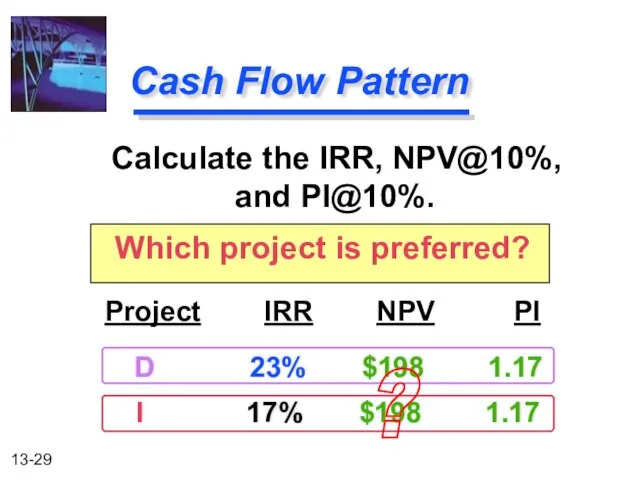

- 28. B. Cash Flow Pattern Let us compare a decreasing cash-flow (D) project and an increasing cash-flow

- 29. D 23% $198 1.17 I 17% $198 1.17 Cash Flow Pattern Calculate the IRR, NPV@10%, and

- 30. Capital Rationing Capital Rationing occurs when a constraint (or budget ceiling) is placed on the total

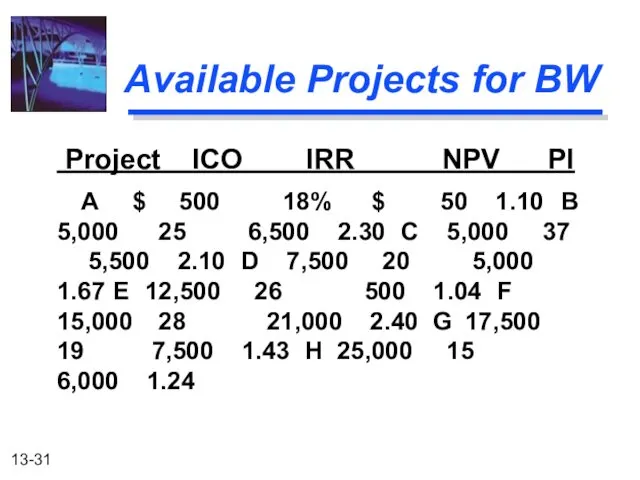

- 31. Available Projects for BW Project ICO IRR NPV PI A $ 500 18% $ 50 1.10

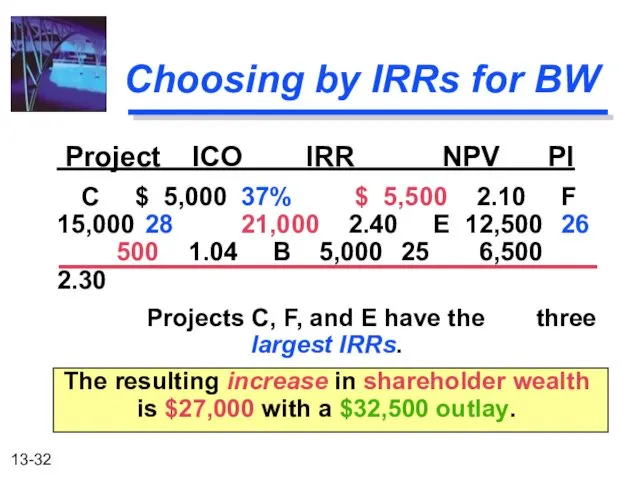

- 32. Choosing by IRRs for BW Project ICO IRR NPV PI C $ 5,000 37% $ 5,500

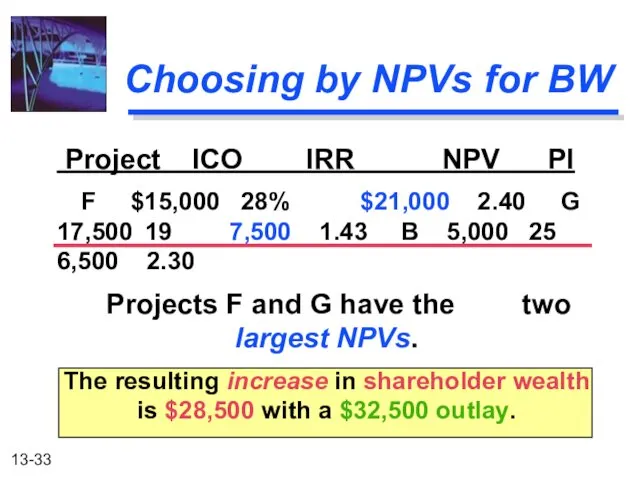

- 33. Choosing by NPVs for BW Project ICO IRR NPV PI F $15,000 28% $21,000 2.40 G

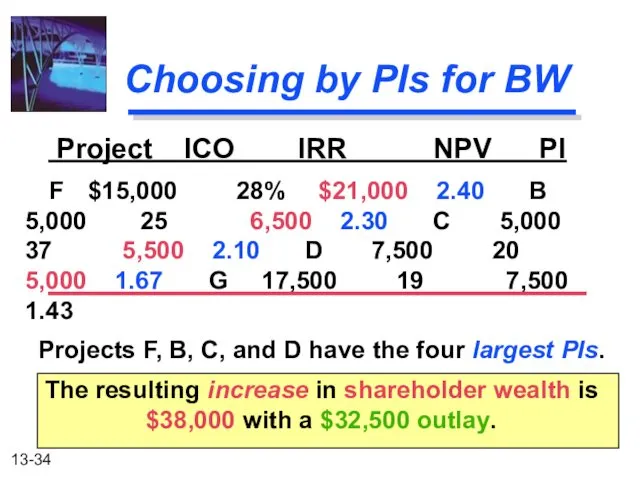

- 34. Choosing by PIs for BW Project ICO IRR NPV PI F $15,000 28% $21,000 2.40 B

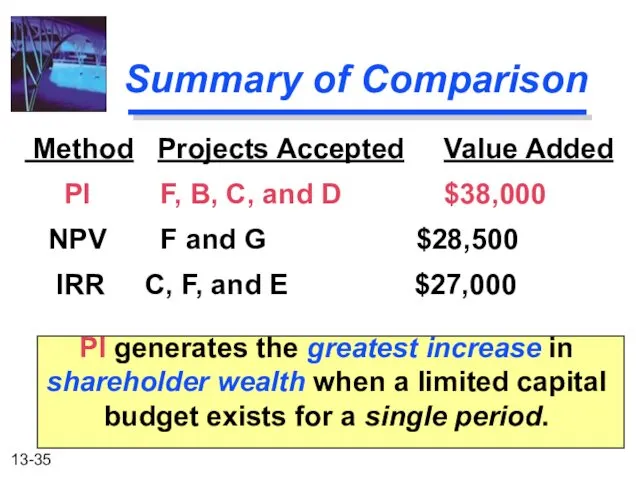

- 35. Summary of Comparison Method Projects Accepted Value Added PI F, B, C, and D $38,000 NPV

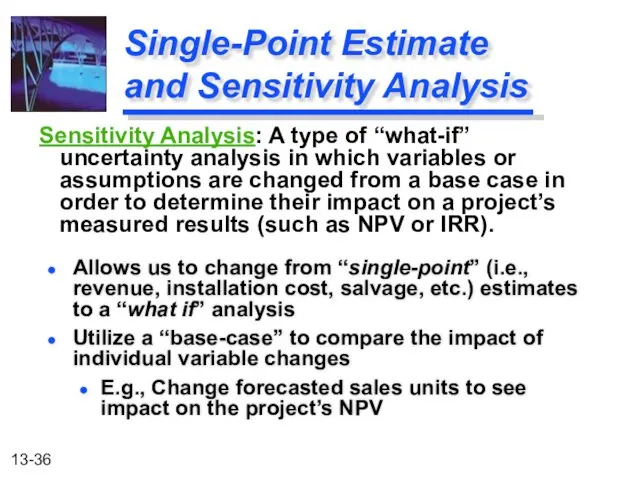

- 36. Single-Point Estimate and Sensitivity Analysis Allows us to change from “single-point” (i.e., revenue, installation cost, salvage,

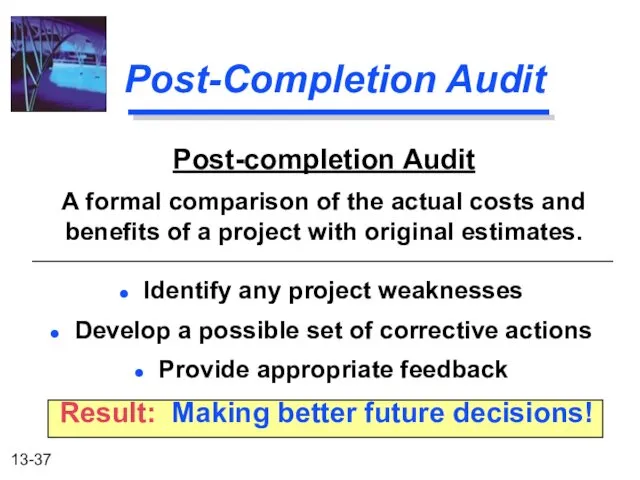

- 37. Post-Completion Audit Post-completion Audit A formal comparison of the actual costs and benefits of a project

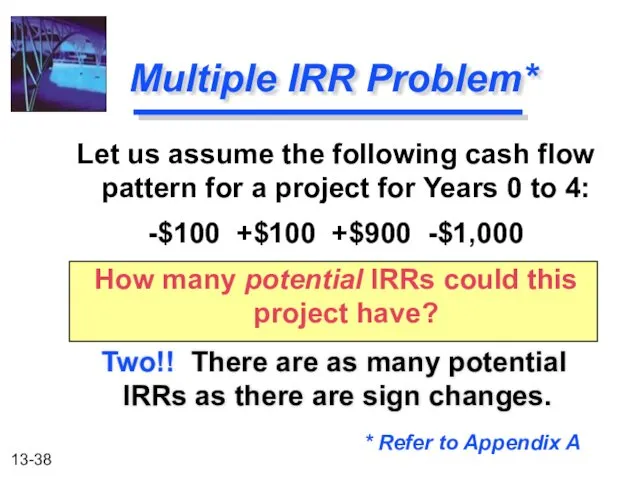

- 38. Multiple IRR Problem* Two!! There are as many potential IRRs as there are sign changes. Let

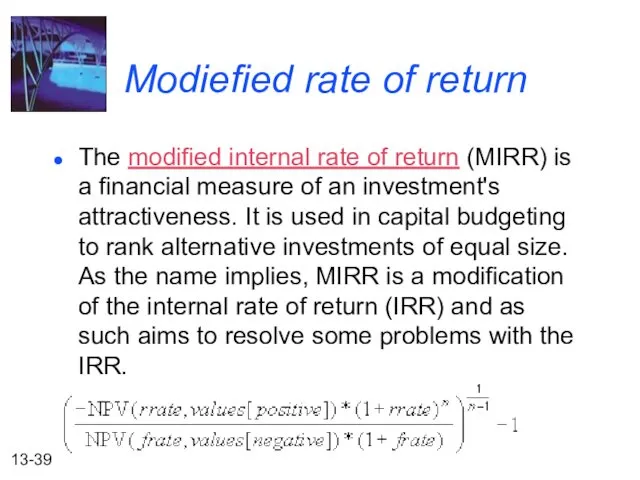

- 39. Modiefied rate of return The modified internal rate of return (MIRR) is a financial measure of

- 41. Скачать презентацию

Банковские гарантии

Банковские гарантии Выбор аудиторской компании клиентами

Выбор аудиторской компании клиентами Страхування відповідальності та його види

Страхування відповідальності та його види План финансово-хозяйственной деятельности, отчеты по исполнению ПФХД

План финансово-хозяйственной деятельности, отчеты по исполнению ПФХД Банківське право України. Поняття, предмет регулювання, джерела і система

Банківське право України. Поняття, предмет регулювання, джерела і система Финансовый рынок

Финансовый рынок Направления улучшения использования основных средств предприятия (на примере ООО АГРОФИРА Тысячный, Краснодарский край)

Направления улучшения использования основных средств предприятия (на примере ООО АГРОФИРА Тысячный, Краснодарский край) Фундаментальный анализ финансовых рынков

Фундаментальный анализ финансовых рынков Функции международного финансового рынка, его структура и участники

Функции международного финансового рынка, его структура и участники Налог на добавленную стоимость

Налог на добавленную стоимость Джерела фінансової інформації та оцінка фінансово-майнового стану фірми

Джерела фінансової інформації та оцінка фінансово-майнового стану фірми Қаржы тұрақтылығын талдау

Қаржы тұрақтылығын талдау Денежные реформы

Денежные реформы Некоторые вопросы по ГК, б/у и н/о

Некоторые вопросы по ГК, б/у и н/о Производственные возможности. Кривая производственных возможностей

Производственные возможности. Кривая производственных возможностей Программа страхования детей Дети

Программа страхования детей Дети O’zbekistonda lizing xizmatlari

O’zbekistonda lizing xizmatlari Анализ современных тенденций деятельности бюро кредитных историй

Анализ современных тенденций деятельности бюро кредитных историй Оценка недвижимости. Практический семинар

Оценка недвижимости. Практический семинар Реализация Стратегии повышения финансовой грамотности в Новгородской области

Реализация Стратегии повышения финансовой грамотности в Новгородской области Підвищення пенсійних виплат з 1 травня 2017 року

Підвищення пенсійних виплат з 1 травня 2017 року Фундаментальный анализ

Фундаментальный анализ Социальное страхование

Социальное страхование Кәсіпорынның табыстылығын диверсификациялау мәселелері

Кәсіпорынның табыстылығын диверсификациялау мәселелері Сервисы

Сервисы The bank and the banking system

The bank and the banking system Javne finansije. Lekcija 7

Javne finansije. Lekcija 7 Страхование в России

Страхование в России