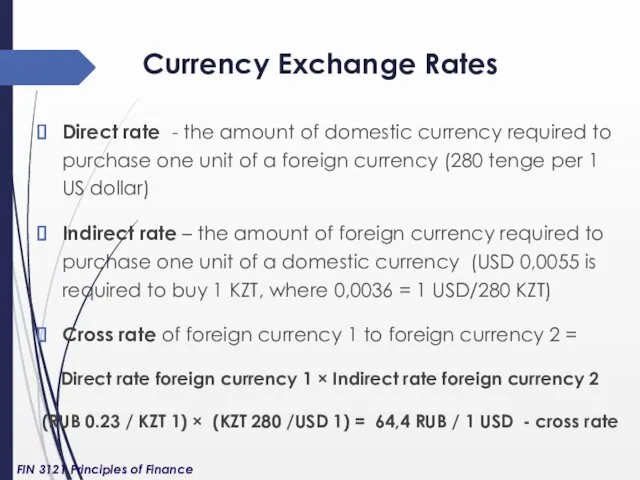

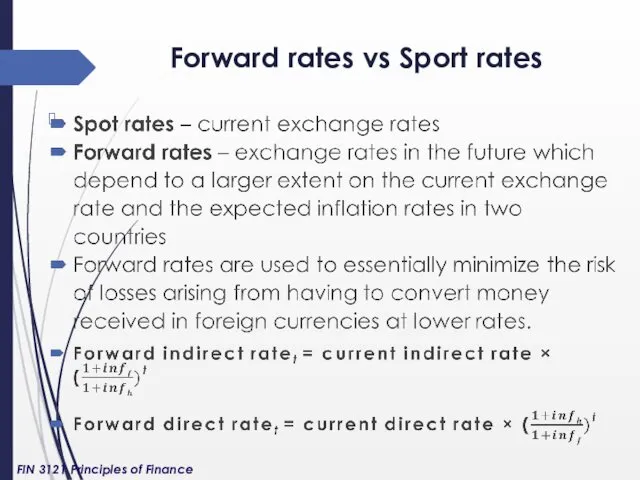

Currency Exchange Rates

Direct rate - the amount of domestic currency required

to purchase one unit of a foreign currency (280 tenge per 1 US dollar)

Indirect rate – the amount of foreign currency required to purchase one unit of a domestic currency (USD 0,0055 is required to buy 1 KZT, where 0,0036 = 1 USD/280 KZT)

Cross rate of foreign currency 1 to foreign currency 2 =

Direct rate foreign currency 1 × Indirect rate foreign currency 2

(RUB 0.23 / KZT 1) × (KZT 280 /USD 1) = 64,4 RUB / 1 USD - cross rate

FIN 3121 Principles of Finance

С Альфа-банком ваш зарплатный проект может быть лучше

С Альфа-банком ваш зарплатный проект может быть лучше Учет фактора риска при финансовом оздоровлении предприятия. Тема № 9

Учет фактора риска при финансовом оздоровлении предприятия. Тема № 9 Финансовая среда предпринимательства и предпринимательские риски. Лекция 1

Финансовая среда предпринимательства и предпринимательские риски. Лекция 1 Финансовые рынки. Инструменты и институты

Финансовые рынки. Инструменты и институты Новации в порядке формирования бюджетной (бухгалтерской) отчетности за 2019 год

Новации в порядке формирования бюджетной (бухгалтерской) отчетности за 2019 год Ипотечные продукты Банка ГПБ (АО)

Ипотечные продукты Банка ГПБ (АО) Нормативная база ценообразования в строительстве

Нормативная база ценообразования в строительстве Финансовое состояние предприятия

Финансовое состояние предприятия Нарощування потенціалу громади міста Маріуполя для підтримки внутрішньо переміщених осіб і потерпілих місцевих жителів

Нарощування потенціалу громади міста Маріуполя для підтримки внутрішньо переміщених осіб і потерпілих місцевих жителів Методы диагностики банкротства

Методы диагностики банкротства Понятие и виды издержек производства

Понятие и виды издержек производства Риск и доходность на финансовых рынках

Риск и доходность на финансовых рынках Статистика эффективности использования производственных и трудовых ресурсов

Статистика эффективности использования производственных и трудовых ресурсов Принципы оценочной деятельности

Принципы оценочной деятельности Оценка кредитоспособности клиентов коммерческого банка (ОАО Морской Банк)

Оценка кредитоспособности клиентов коммерческого банка (ОАО Морской Банк) Современная цифровая инфраструктура финансовой сферы

Современная цифровая инфраструктура финансовой сферы Проект по финансовой грамотности Оптимизация семейного бюджета

Проект по финансовой грамотности Оптимизация семейного бюджета Қызметтің негізгі түрлерінің тәуекелін жүйелік жіктеу

Қызметтің негізгі түрлерінің тәуекелін жүйелік жіктеу Управление проектами. Прединвестиционная фаза

Управление проектами. Прединвестиционная фаза Тема 3_. Управление стоимостью инновационного проекта

Тема 3_. Управление стоимостью инновационного проекта Казначейское сопровождение средств в соответствии с распоряжением правительства Российской Федерации

Казначейское сопровождение средств в соответствии с распоряжением правительства Российской Федерации Денсаулық сақтауды қаржыландыру

Денсаулық сақтауды қаржыландыру Деньги. История возникновения денег

Деньги. История возникновения денег Финансовая модель X5 Retail Group (Х5)

Финансовая модель X5 Retail Group (Х5) Получение аудиторских доказательств в конкретных случаях

Получение аудиторских доказательств в конкретных случаях Кредитные каникулы 2020. Межрегиональный проект онлайн обучений #онлайнУнивер24

Кредитные каникулы 2020. Межрегиональный проект онлайн обучений #онлайнУнивер24 Простой и переводной вексель. Расчеты векселями. Учет ценных бумаг

Простой и переводной вексель. Расчеты векселями. Учет ценных бумаг Инвестиции, снабжение, производство: организация и планирование

Инвестиции, снабжение, производство: организация и планирование