Содержание

- 2. Profitability Margins and return ratios provide information on the profitability of a company and the efficiency

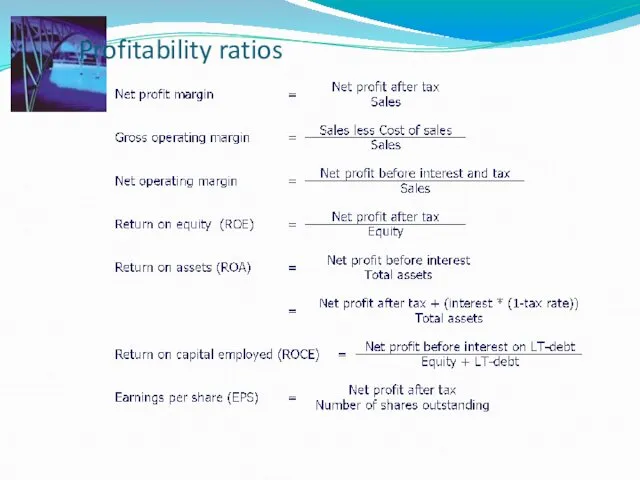

- 3. Profitability ratios

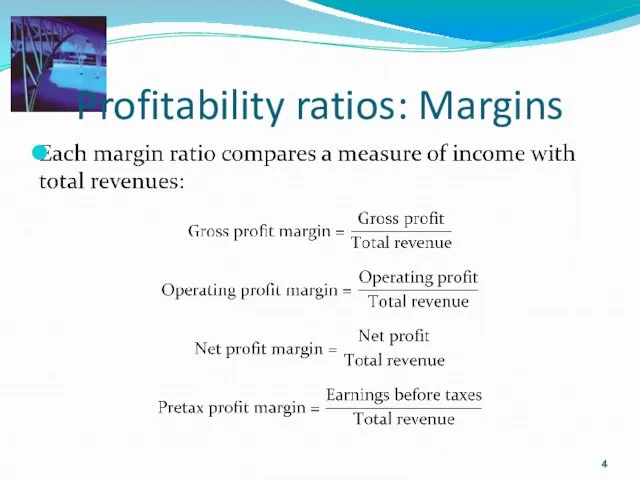

- 4. Profitability ratios: Margins

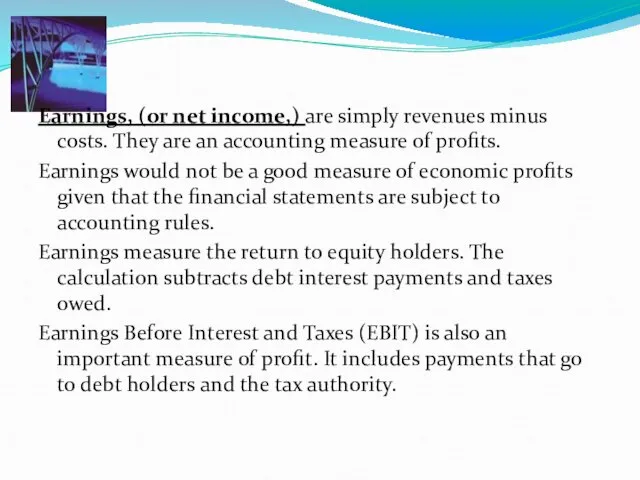

- 5. Earnings, (or net income,) are simply revenues minus costs. They are an accounting measure of profits.

- 6. Retained earnings Retained earnings are the earnings re-invested into the firm: Retained earnings = earnings -

- 7. Measuring profit Return on equity (ROE) uses accounting values: earnings divided by book value of equity.

- 8. Return on assets Return on assets (ROA) is another important measure of portability. Again, ROA uses

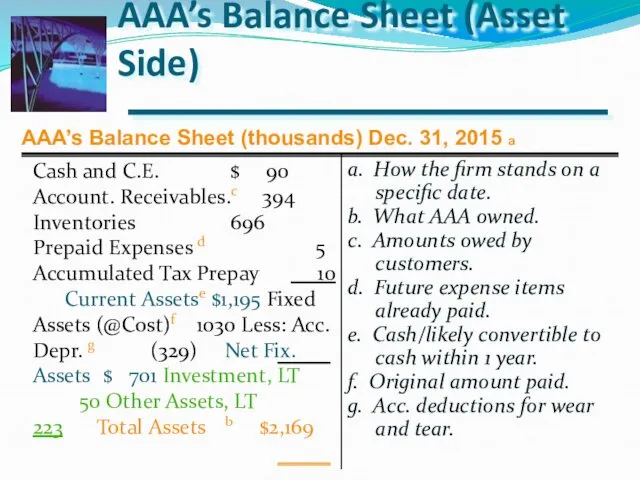

- 9. AAA’s Balance Sheet (Asset Side) a. How the firm stands on a specific date. b. What

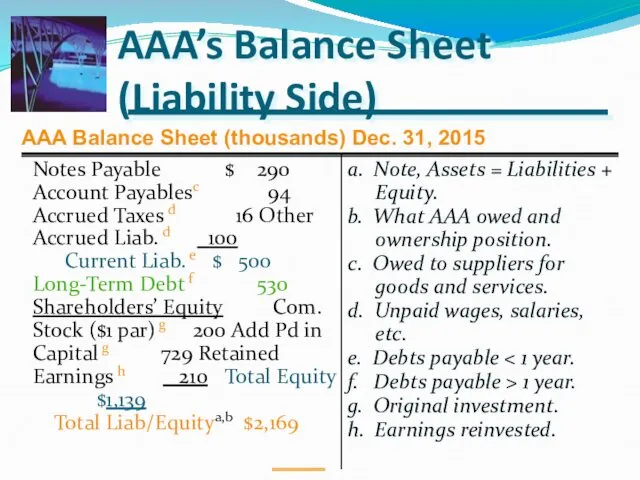

- 10. AAA’s Balance Sheet (Liability Side) a. Note, Assets = Liabilities + Equity. b. What AAA owed

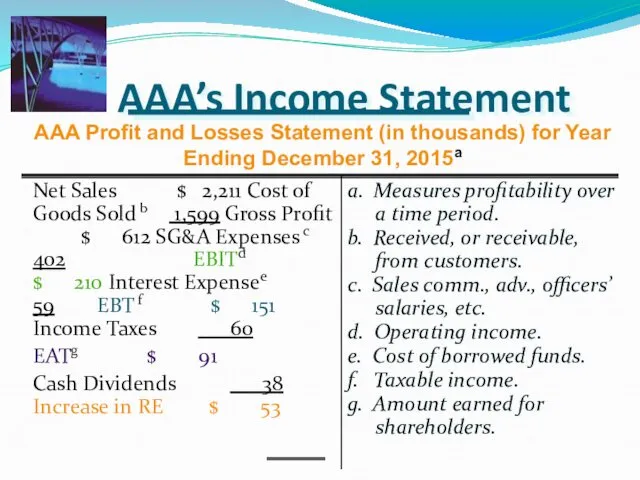

- 11. AAA’s Income Statement a. Measures profitability over a time period. b. Received, or receivable, from customers.

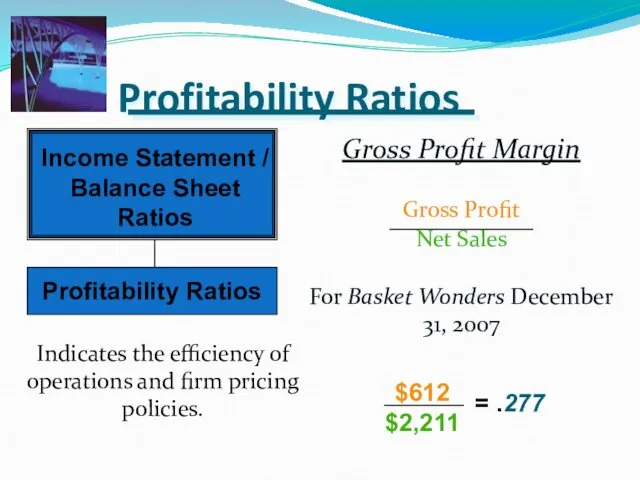

- 12. Profitability Ratios Gross Profit Margin Gross Profit Net Sales For Basket Wonders December 31, 2007 Indicates

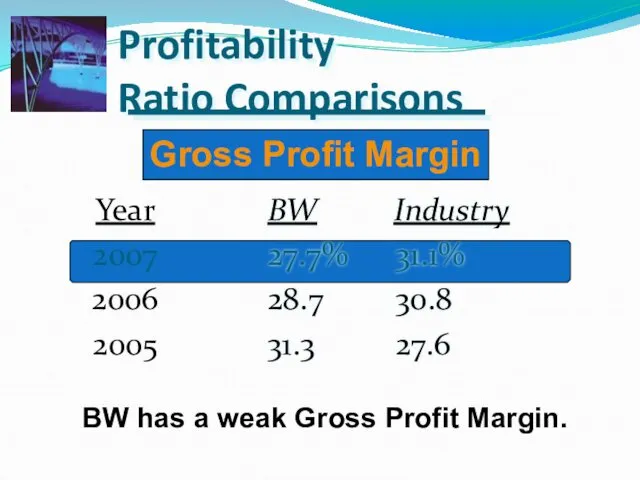

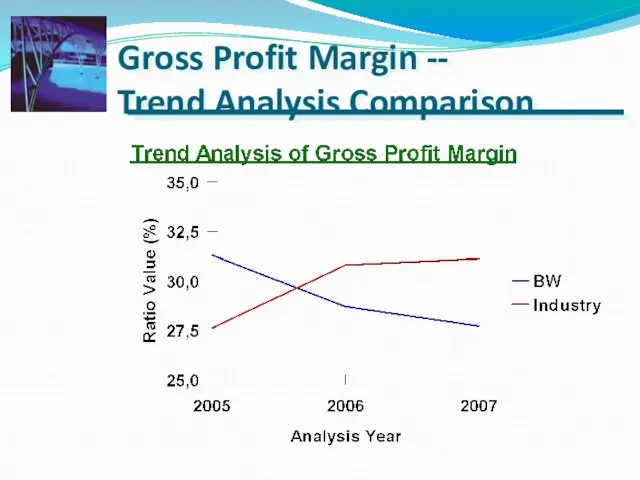

- 13. Profitability Ratio Comparisons BW Industry 27.7% 31.1% 28.7 30.8 31.3 27.6 Year 2007 2006 2005 Gross

- 14. Gross Profit Margin -- Trend Analysis Comparison

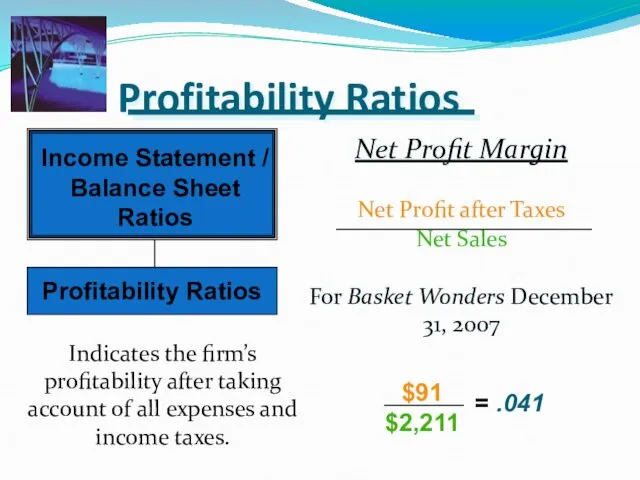

- 15. Profitability Ratios Net Profit Margin Net Profit after Taxes Net Sales For Basket Wonders December 31,

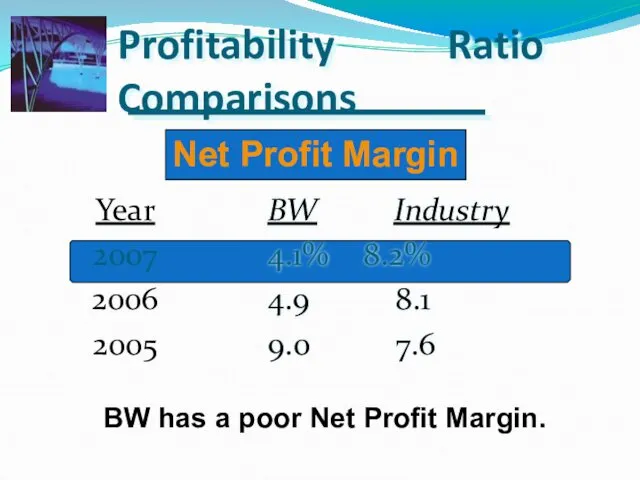

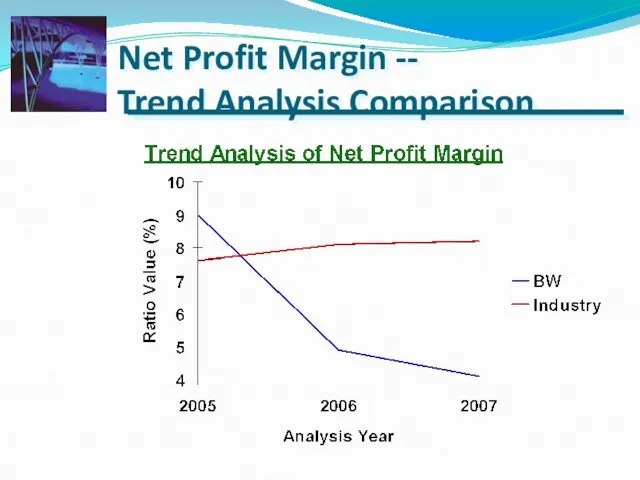

- 16. Profitability Ratio Comparisons BW Industry 4.1% 8.2% 4.9 8.1 9.0 7.6 Year 2007 2006 2005 Net

- 17. Net Profit Margin -- Trend Analysis Comparison

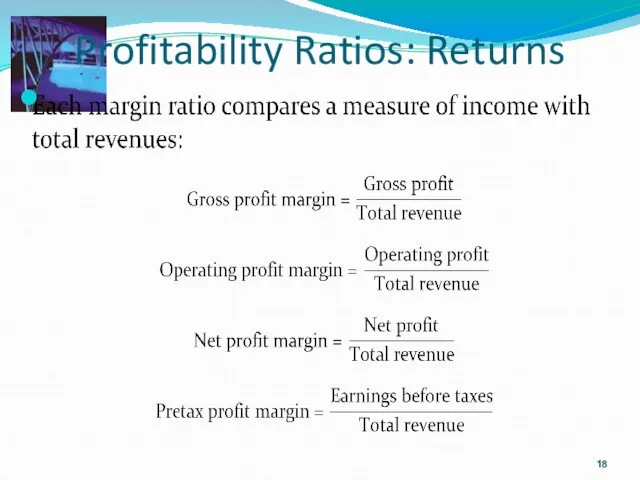

- 18. Profitability Ratios: Returns

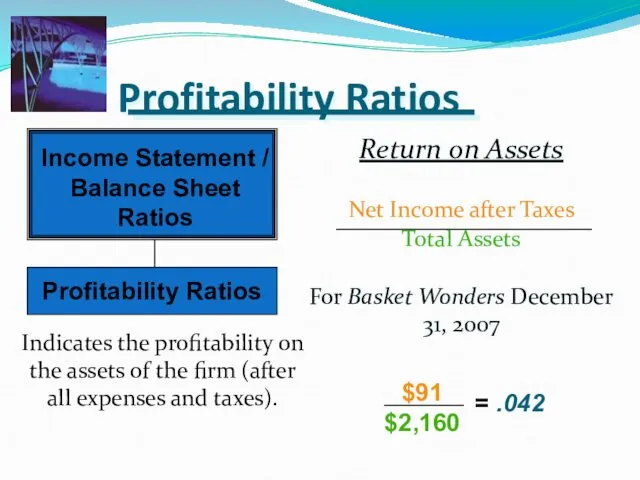

- 19. Profitability Ratios Return on Assets Net Income after Taxes Total Assets For Basket Wonders December 31,

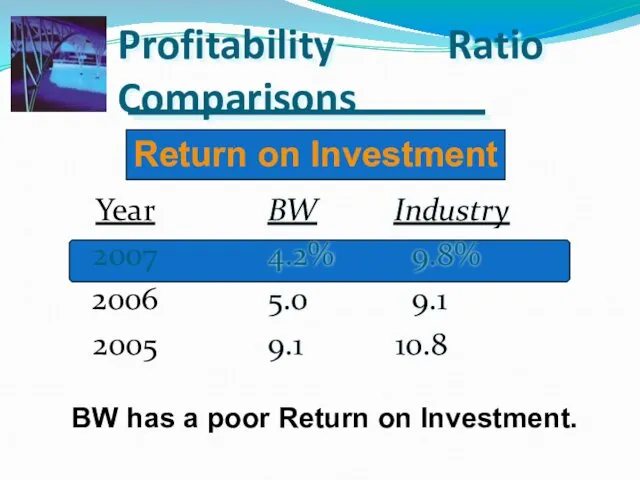

- 20. Profitability Ratio Comparisons BW Industry 4.2% 9.8% 5.0 9.1 9.1 10.8 Year 2007 2006 2005 Return

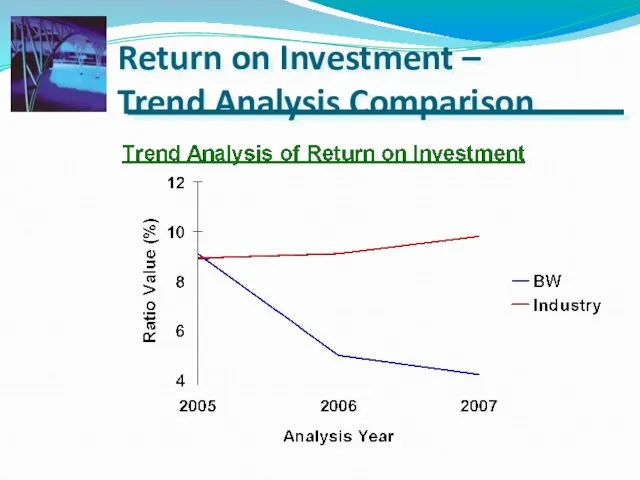

- 21. Return on Investment – Trend Analysis Comparison

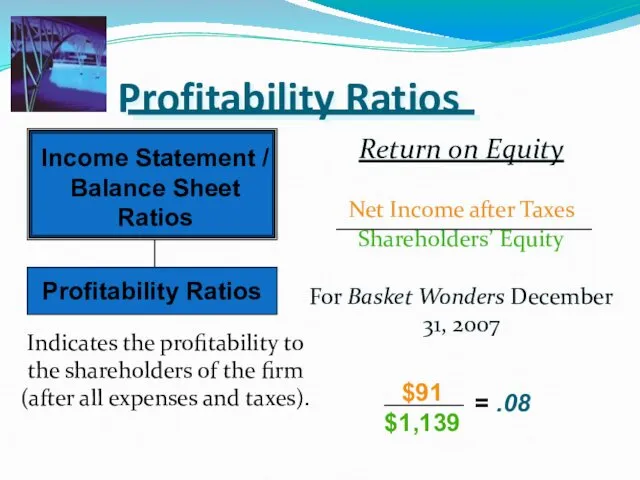

- 22. Profitability Ratios Return on Equity Net Income after Taxes Shareholders’ Equity For Basket Wonders December 31,

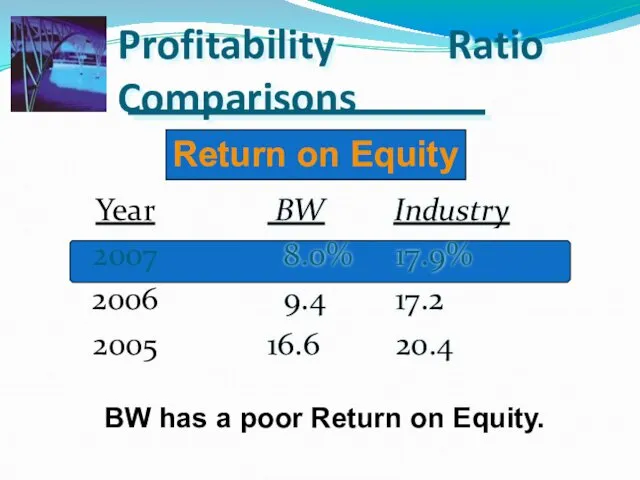

- 23. Profitability Ratio Comparisons BW Industry 8.0% 17.9% 9.4 17.2 16.6 20.4 Year 2007 2006 2005 Return

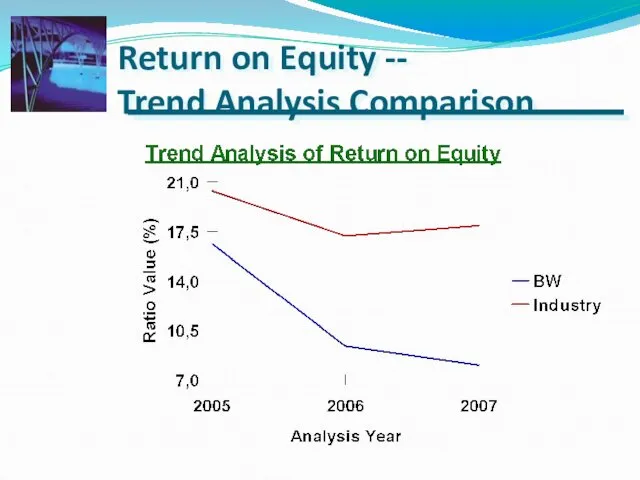

- 24. Return on Equity -- Trend Analysis Comparison

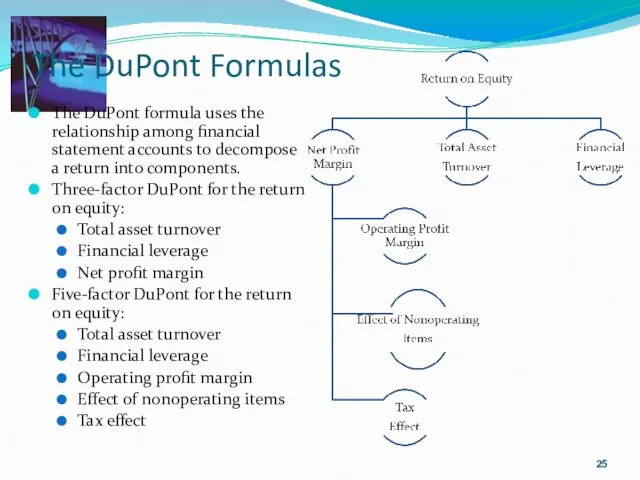

- 25. The DuPont Formulas The DuPont formula uses the relationship among financial statement accounts to decompose a

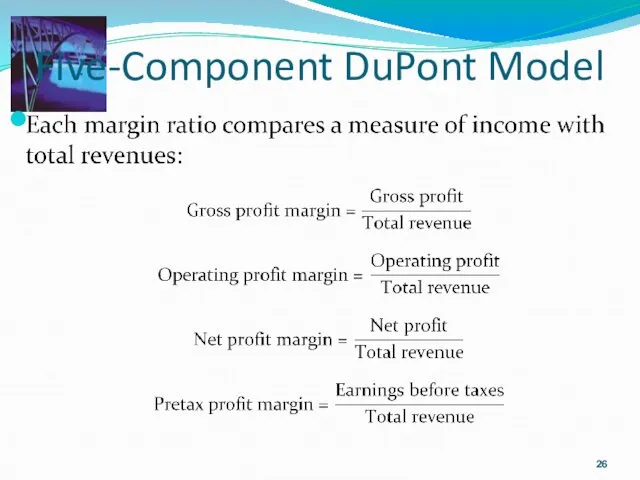

- 26. Five-Component DuPont Model

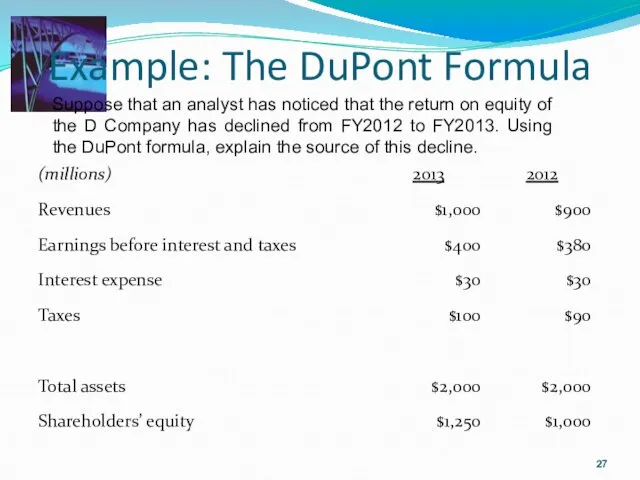

- 27. Example: The DuPont Formula Suppose that an analyst has noticed that the return on equity of

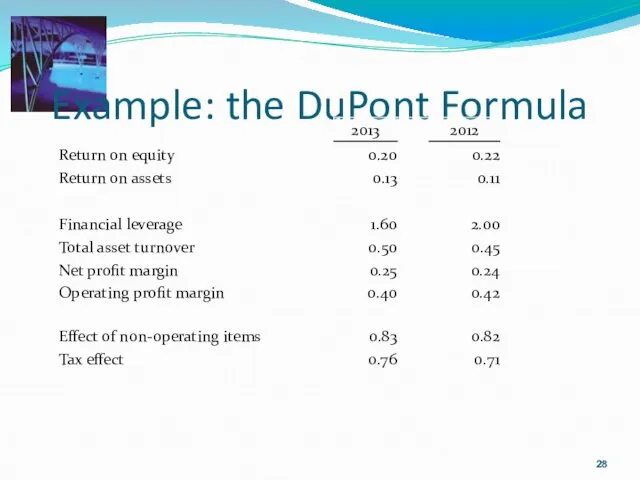

- 28. Example: the DuPont Formula

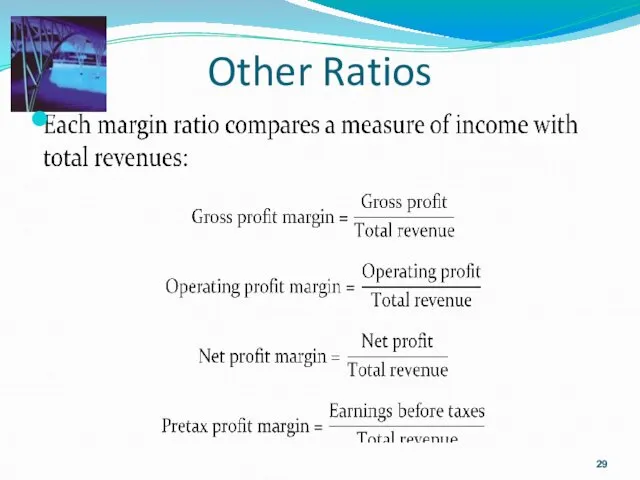

- 29. Other Ratios

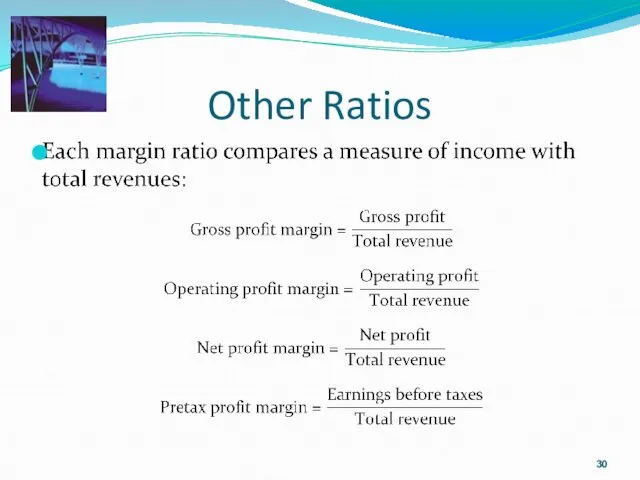

- 30. Other Ratios

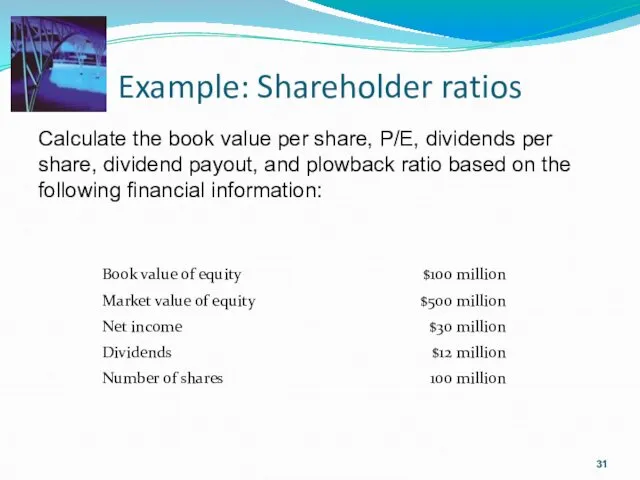

- 31. Example: Shareholder ratios Calculate the book value per share, P/E, dividends per share, dividend payout, and

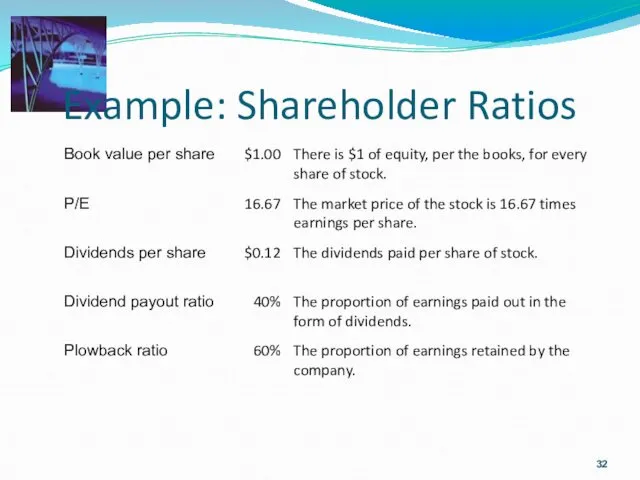

- 32. Example: Shareholder Ratios

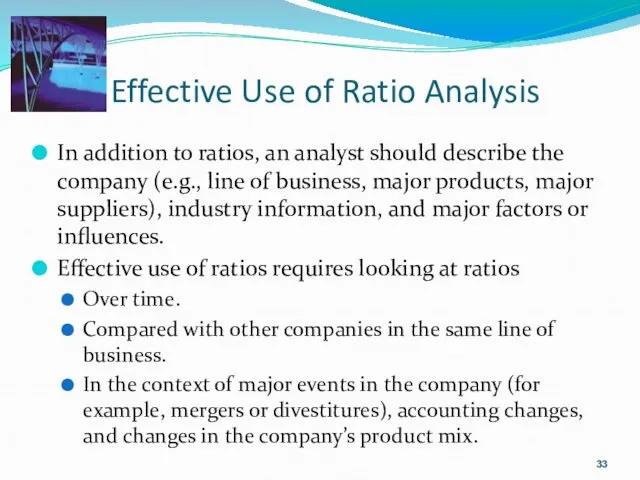

- 33. Effective Use of Ratio Analysis In addition to ratios, an analyst should describe the company (e.g.,

- 35. Скачать презентацию

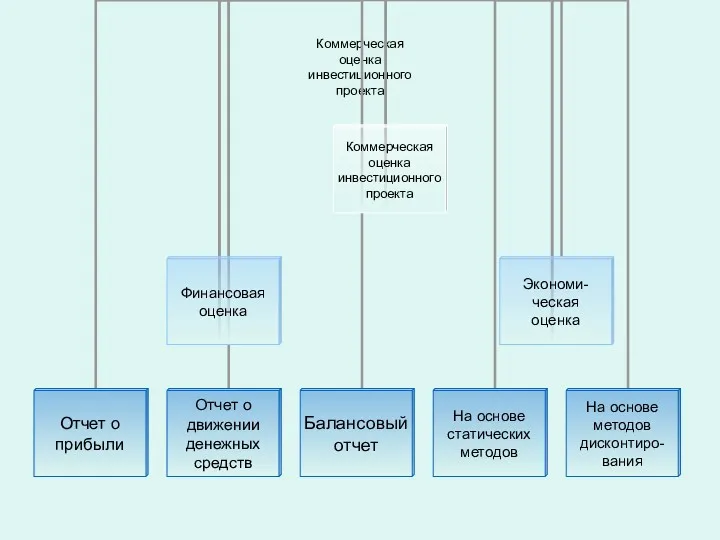

Оценка инвестиционного проекта

Оценка инвестиционного проекта Повышение заработной платы классным руководителям и молодым специалистам общеобразовательных организаций с 01.09. 2018 года

Повышение заработной платы классным руководителям и молодым специалистам общеобразовательных организаций с 01.09. 2018 года Спрос на деньги (классическая и кейнсианская концепции). Модель предложения денег. Равновесие на денежном рынке

Спрос на деньги (классическая и кейнсианская концепции). Модель предложения денег. Равновесие на денежном рынке Продукт Доктор Ресо. Екатеринбург. Добровольное медицинское страхование физических лиц

Продукт Доктор Ресо. Екатеринбург. Добровольное медицинское страхование физических лиц Валюта_2023_УЧЕБНАЯ

Валюта_2023_УЧЕБНАЯ Андеррайтинговые операции банков

Андеррайтинговые операции банков Правове регулювання ринку цінних паперів

Правове регулювання ринку цінних паперів Внесення змін до стипендійного забезпечення студентів

Внесення змін до стипендійного забезпечення студентів Формирование и анализ финансовой отчетности

Формирование и анализ финансовой отчетности Учет кассовых операций. Презентации и их роль в образовательном процессе

Учет кассовых операций. Презентации и их роль в образовательном процессе Коммерческое предложение по кредитованию и банковской гарантии

Коммерческое предложение по кредитованию и банковской гарантии Оказание поддержки субъектам малого и среднего предпринимательства Корпорацией МСП в период 2015-2018 годов

Оказание поддержки субъектам малого и среднего предпринимательства Корпорацией МСП в период 2015-2018 годов Операции на международном валютном рынке

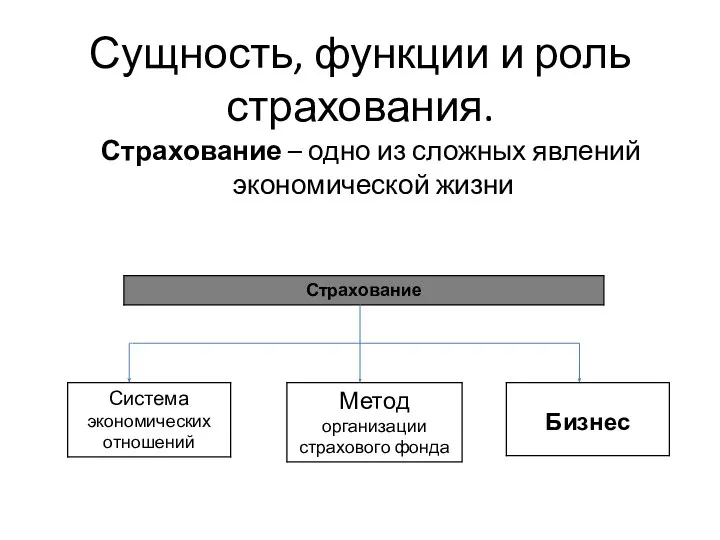

Операции на международном валютном рынке Сущность, функции и роль страхования

Сущность, функции и роль страхования Тарифная политика в страховании

Тарифная политика в страховании Роль грошей у ринковій економіці

Роль грошей у ринковій економіці Банковские услуги и отношения людей с банками

Банковские услуги и отношения людей с банками Дробление бизнеса

Дробление бизнеса Правовое регулирование рынка ценных бумаг

Правовое регулирование рынка ценных бумаг Единый налог на вменённый доход для отдельных видов деятельности (ЕНВД)

Единый налог на вменённый доход для отдельных видов деятельности (ЕНВД) Зарубіжний досвід забезпечення безпеки банківської діяльності

Зарубіжний досвід забезпечення безпеки банківської діяльності Российская компания “Сonsulting club”

Российская компания “Сonsulting club” Коммерческие предложения. Продажа объектов недвижимости

Коммерческие предложения. Продажа объектов недвижимости Історія виникнення та розвитку аудиту

Історія виникнення та розвитку аудиту Этика оценщиков

Этика оценщиков Инициативное предложение члена бюджетной комиссии Ефимовой Ольги Александровны в рамках проекта Народный бюджет

Инициативное предложение члена бюджетной комиссии Ефимовой Ольги Александровны в рамках проекта Народный бюджет Учет поступления и расходования денежных средств (на примере НИИЦ (г. Курск) ФГУП 18 ЦНИИ МО РФ)

Учет поступления и расходования денежных средств (на примере НИИЦ (г. Курск) ФГУП 18 ЦНИИ МО РФ) Учет операций по привлечению денежных средств по договорам займа и кредитным договорам. Глава 6

Учет операций по привлечению денежных средств по договорам займа и кредитным договорам. Глава 6