Слайд 2

©2015 LnL Publishing. All rights reserved.

Here’s Where I Live

Слайд 3

©2015 LnL Publishing. All rights reserved.

Here’s Where I Live

Слайд 4

THE GOOD NEWS

MOST ANYONE CAN LEARN TO TRADE SUCCESSFULLY!!

Слайд 5

©2015 LnL Publishing. All rights reserved.

53 Years of Trading

The fact

I have made millions, my students have made millions only tells us my approach works and has for a long, long time. We are not one hit wonders!

Слайд 6

Just last week…

2015-11-13 19:18:00.522 GMT

By Lu Wang (Bloomberg) –

Larry

Williams, a trader whose market-timing tool ranks best among almost two

dozen strategies in 2015, said

U.S. stocks will resume their advance in coming weeks, lifting

the Standard & Poor’s 500 Index above its May record by year-end

Слайд 7

Fridays Headline

U.S. Stocks have

Best Week of 2015 as Interest

Concerns Fade

Слайд 8

Слайд 9

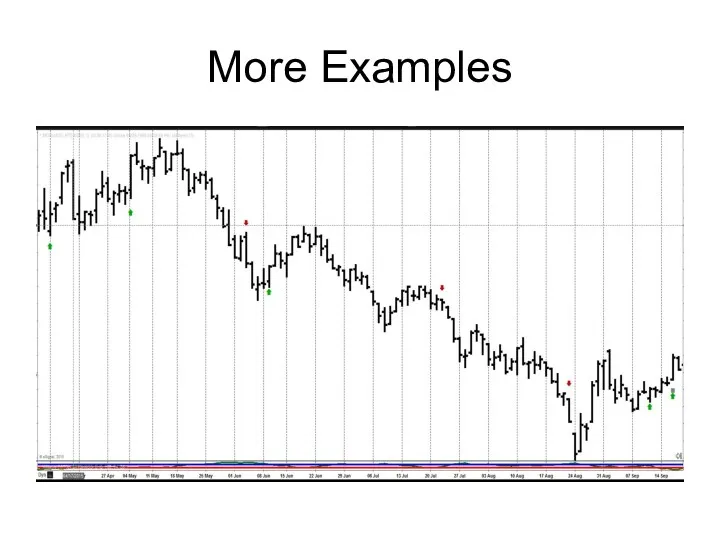

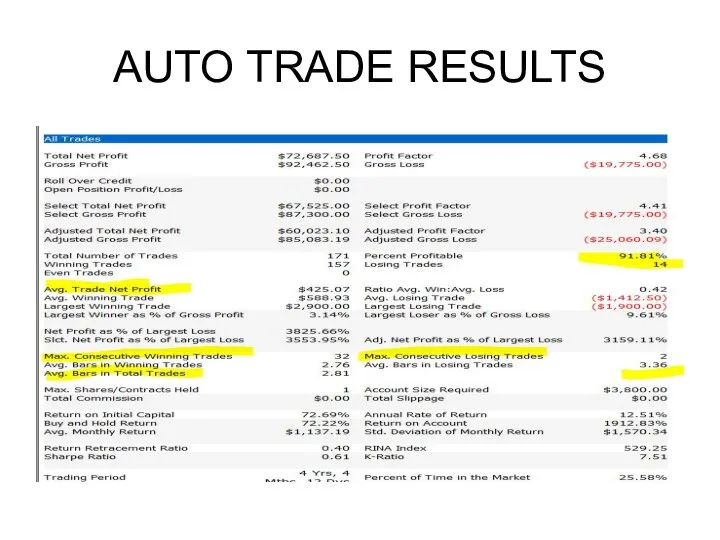

HOW I HAVE MADE MILLIONS

MY TRADING SUCCESS HAS COME

FROM ONE OF

TWO APPROACHES

Слайд 10

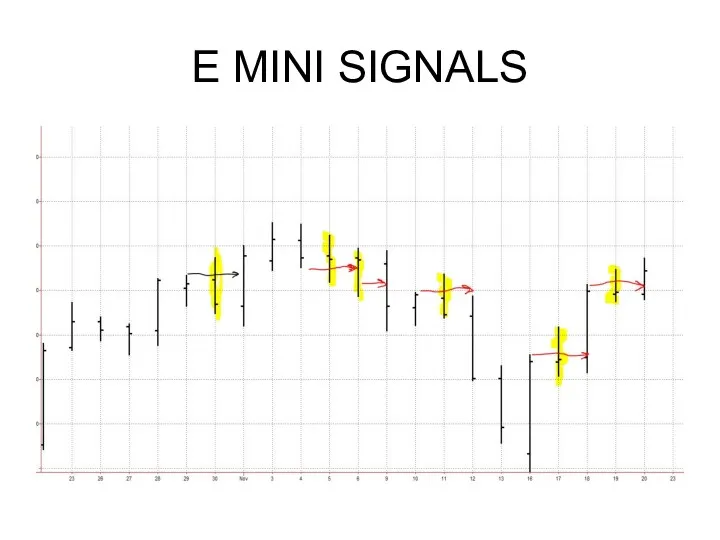

HOW I HAVE MADE MILLIONS

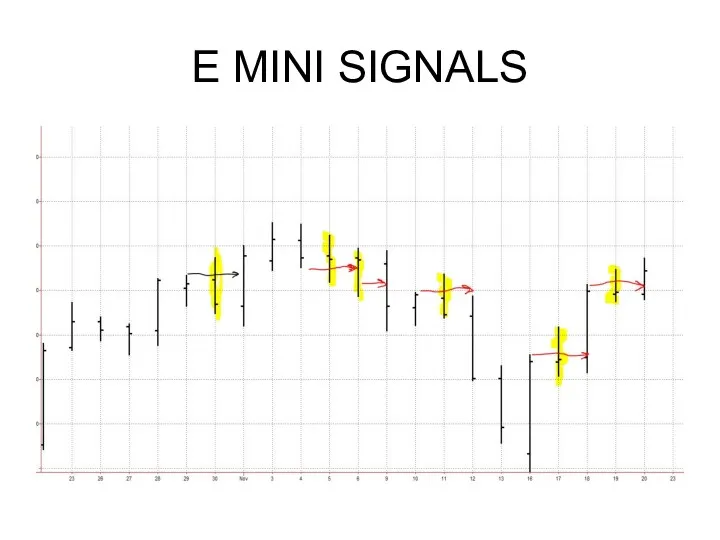

SHORT TERM TRADING WITH LOTS

OF TRADES IN

MOST ACTIVE MARKETS; GOLD, BONDS, E MINI

Patterns, Momentum, Influences

Слайд 11

HOW I HAVE MADE MILLIONS

2) Longer term “Fundamentally Set Up” trades.

Specific set up markets

Smart Money, Accumulation, Fade Public

Слайд 12

FIDELITY STUDY

1) The shorter you hold a stock, the more likely

you are to lose money

2) Accounts that had done the best were the accounts of people who forgot they had an account at Fidelity

Слайд 13

HOW I HAVE MADE MILLIONS

EXPONENTAIL WEALTH

COMES FROM

BEING A

GOOD TO DECENT TRADER

USING AGGRESSIVE MONEY MANAGEMENT

Слайд 14

Слайд 15

Слайд 16

HOW I HAVE MADE MILLIONS

MONEY MANAGEMENT IS THE KEY TO

THE KINGDOM

OF WEALTH

BUT IS ALSO OPENS THE

DOOR TO DISASTER

Слайд 17

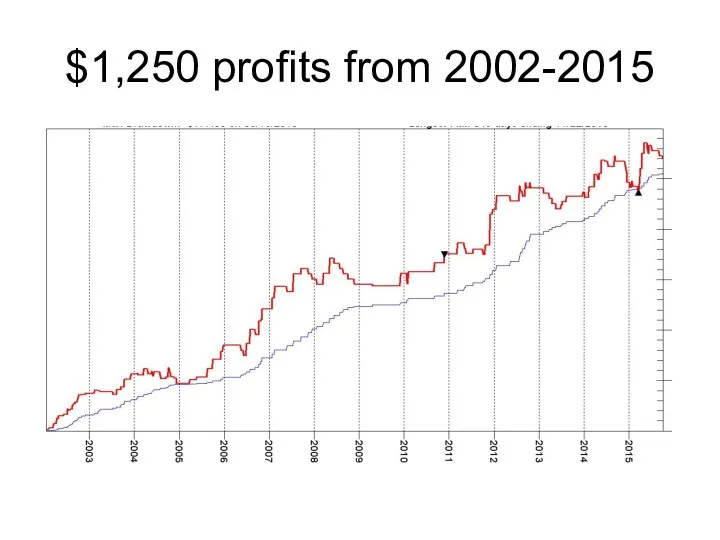

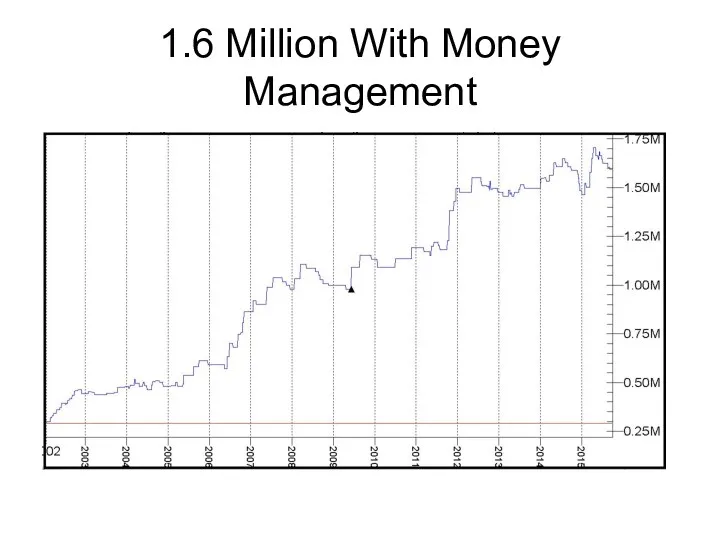

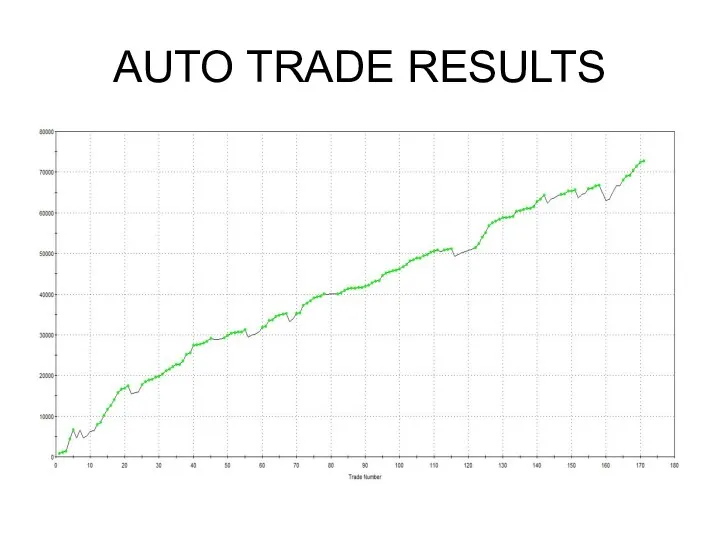

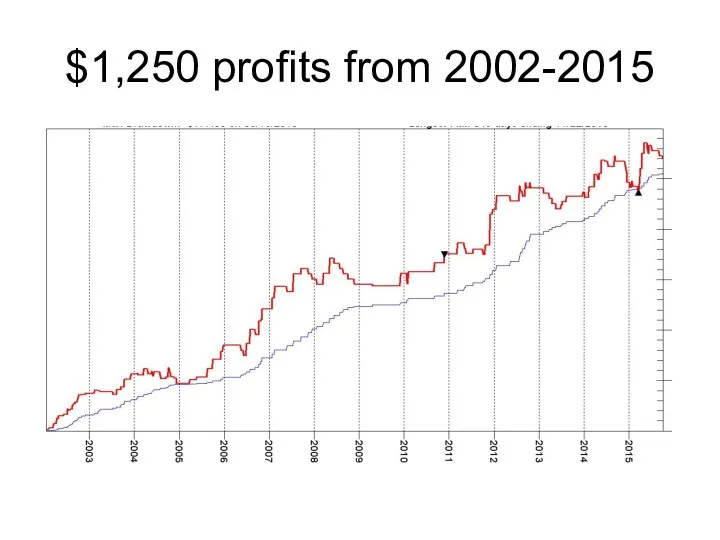

$1,250 profits from 2002-2015

Слайд 18

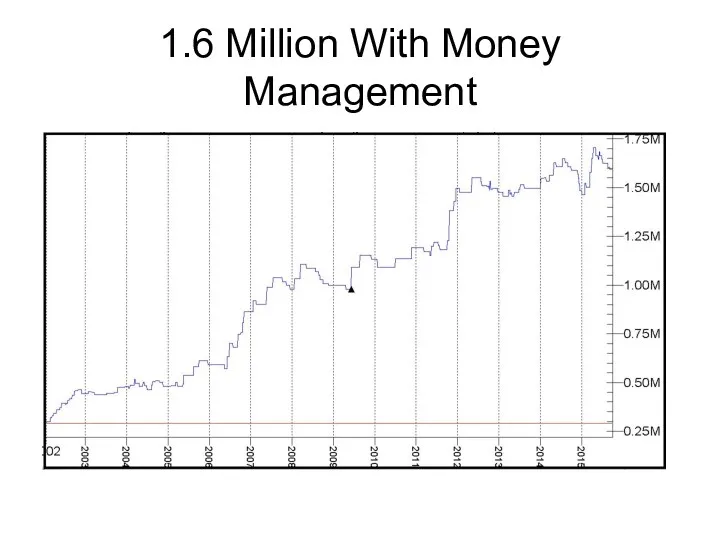

1.6 Million With Money Management

Слайд 19

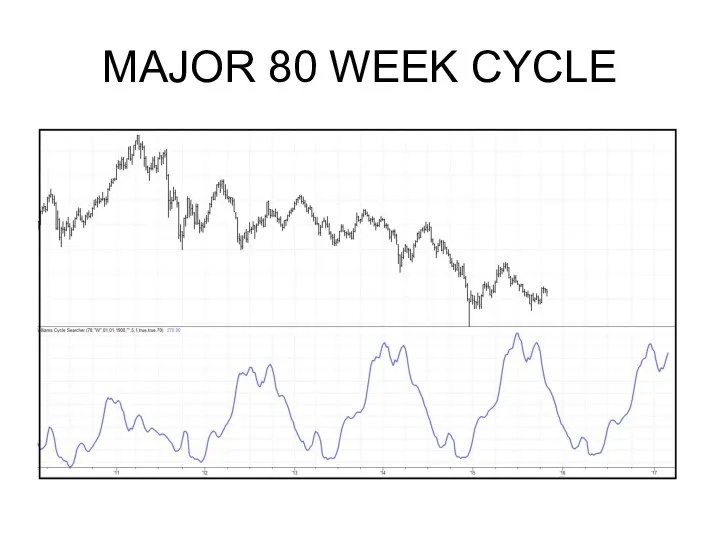

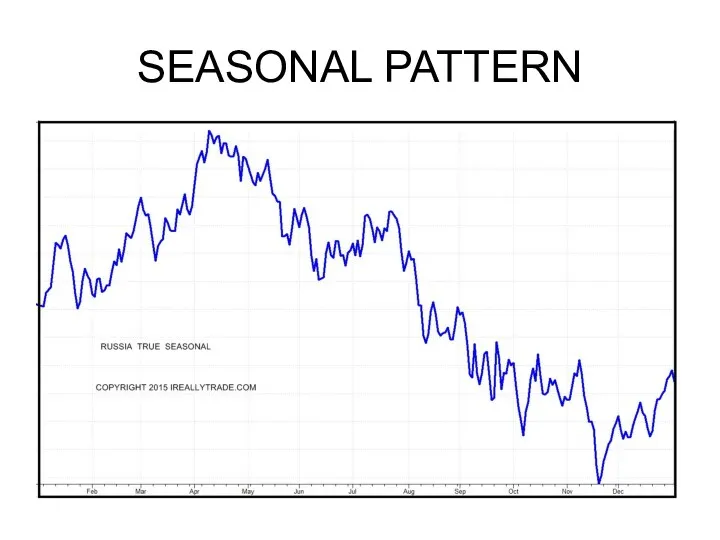

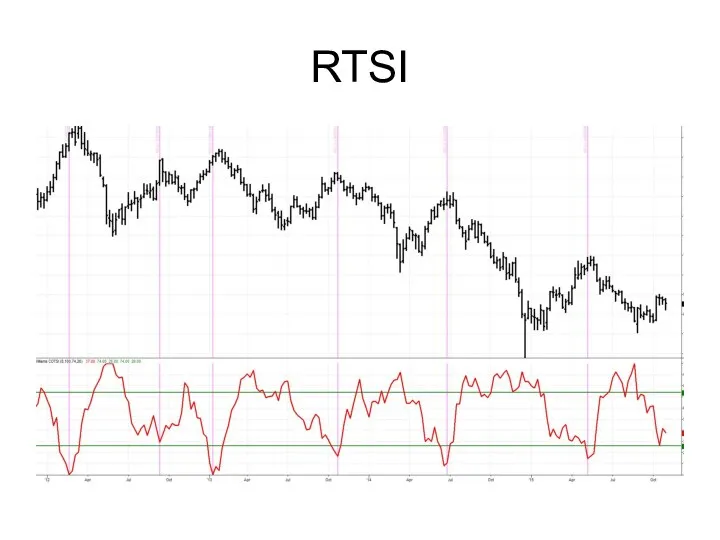

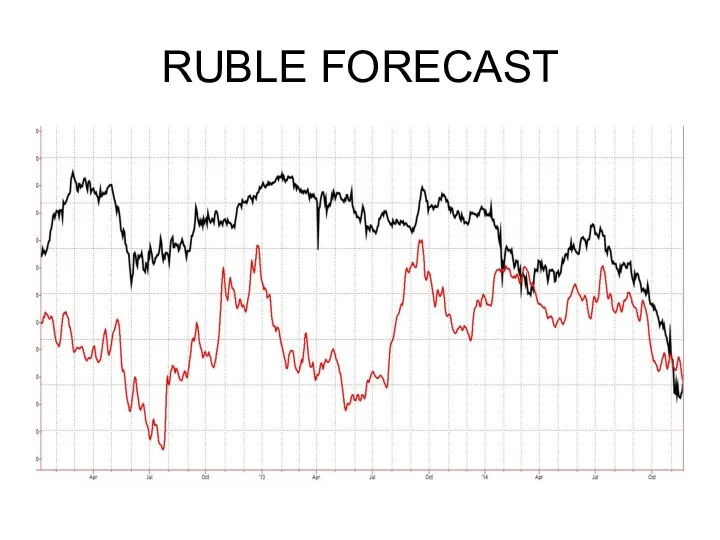

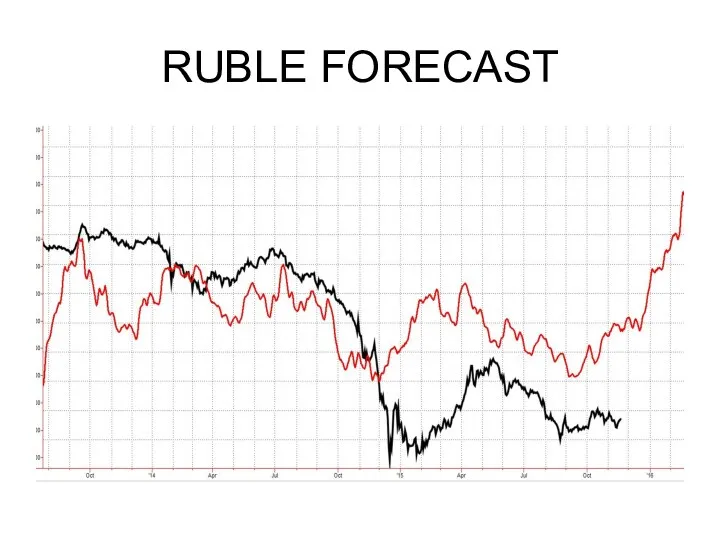

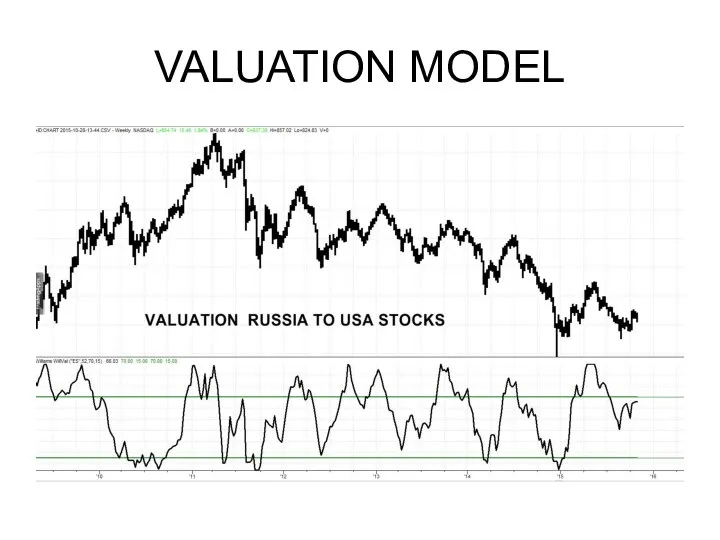

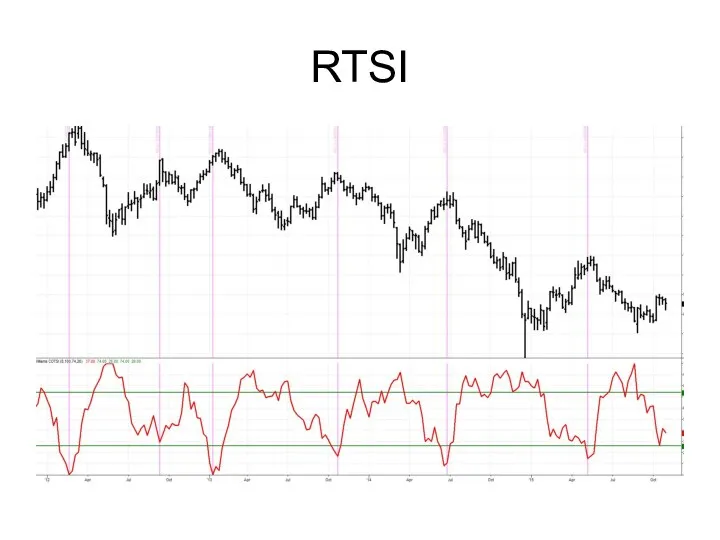

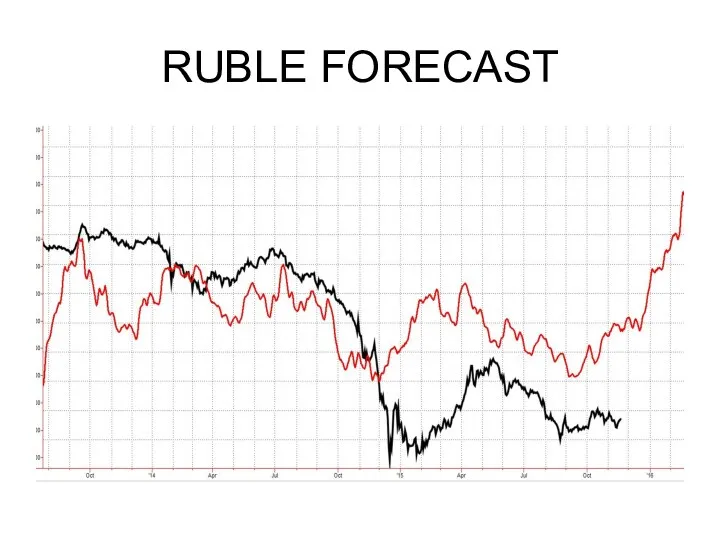

Secrets of Trading in Russia

Russian Stocks are predictable

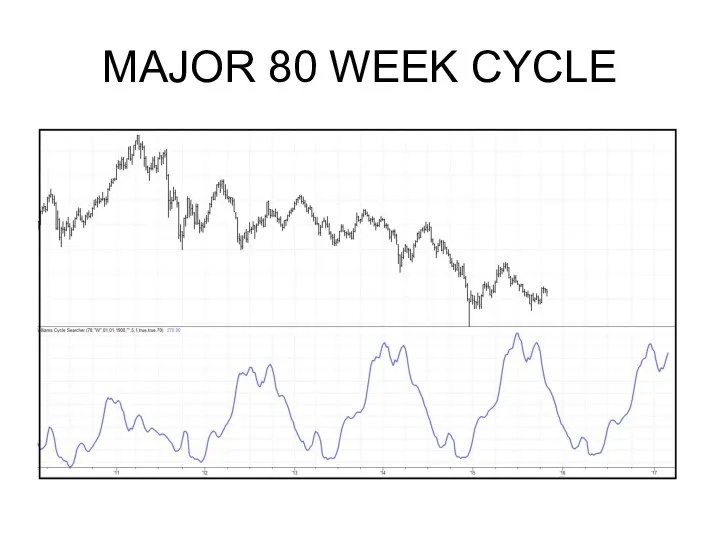

Cycles

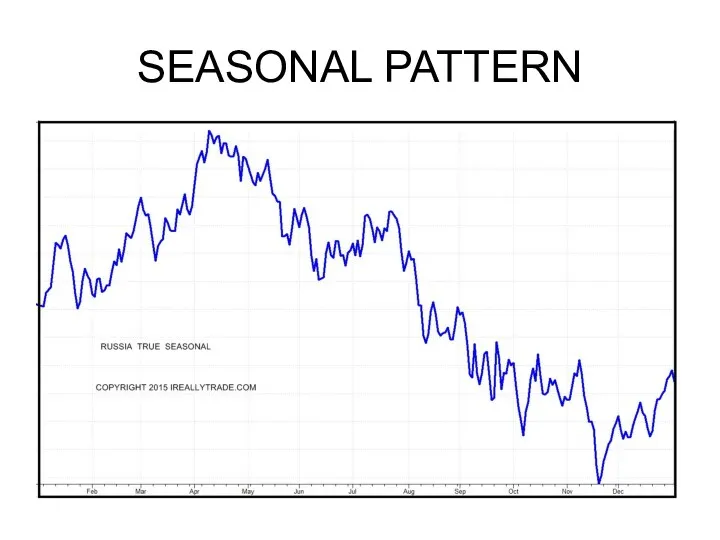

Seasonals

Mutual Fund influences.

Professional Accumulation

Слайд 20

Слайд 21

Слайд 22

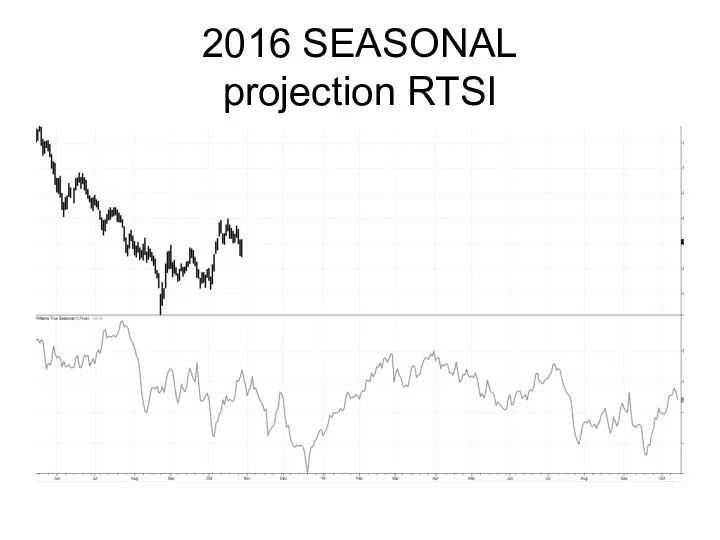

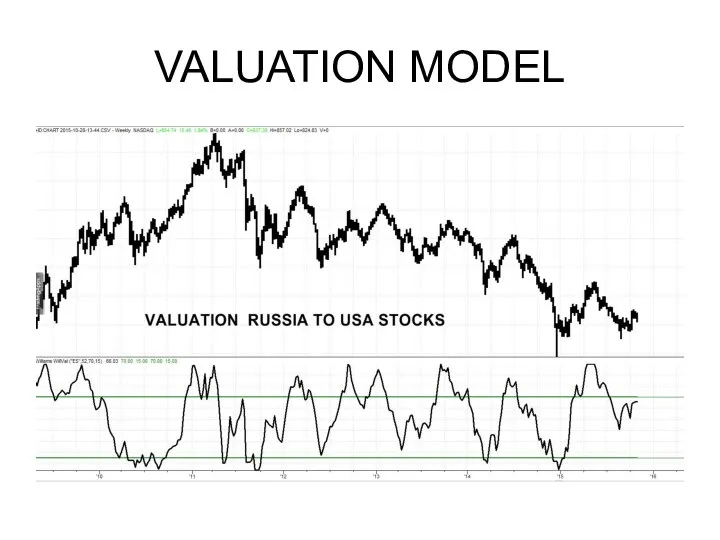

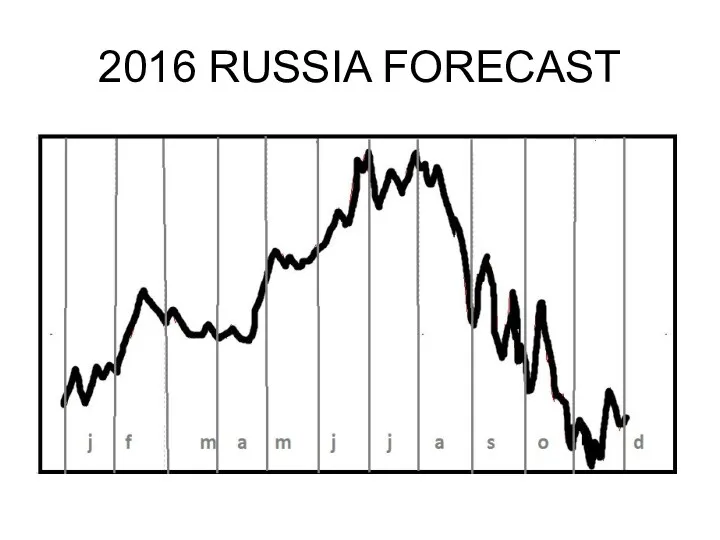

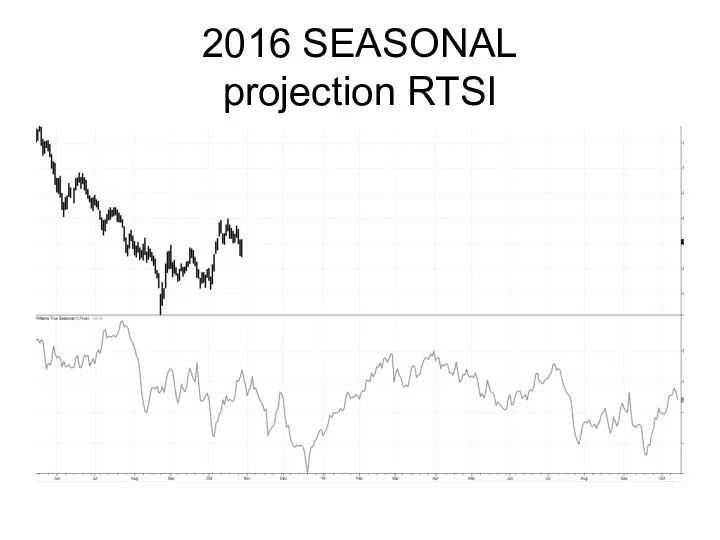

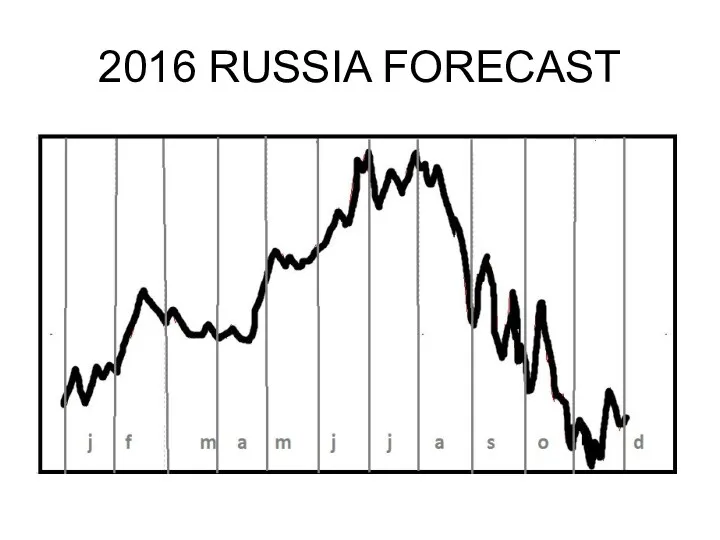

2016 SEASONAL

projection RTSI

Слайд 23

Слайд 24

Secrets of Trading in Russia

World wide stocks rally at the end

of

The month and Russia is no exception

Слайд 25

Secrets of Trading in Russia

RULE

Buy on the opening of the

2nd to last day of the month, hold for 2 days and exit

60% winners

Слайд 26

Secrets of Trading in Russia

Слайд 27

Secrets of Trading in Russia

QUESTIONS TO ASK

ARE SOME MONTHS

BETTER THAN OTHERS?

DOES TREND MATTER?

Слайд 28

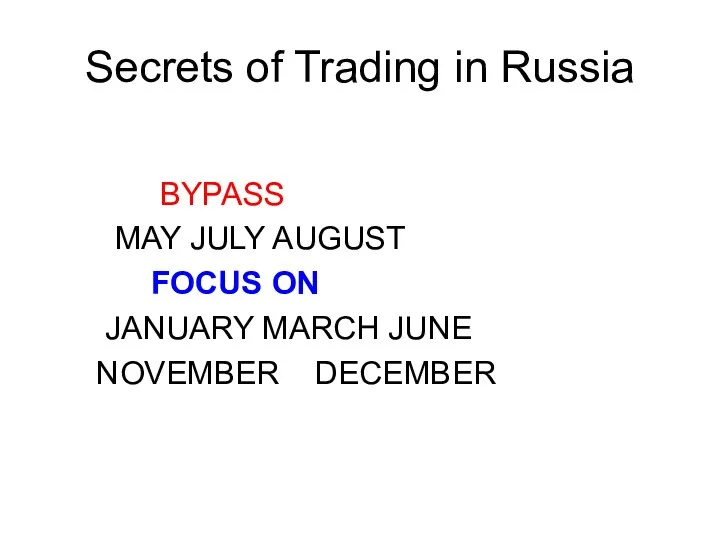

Secrets of Trading in Russia

Слайд 29

Secrets of Trading in Russia

BYPASS

MAY JULY AUGUST

FOCUS ON

JANUARY MARCH

JUNE

NOVEMBER DECEMBER

Слайд 30

Secrets of Trading in Russia

Monday has not been a great

day

For this strategy

Helps if trend is up; close > close

40 days ago

Слайд 31

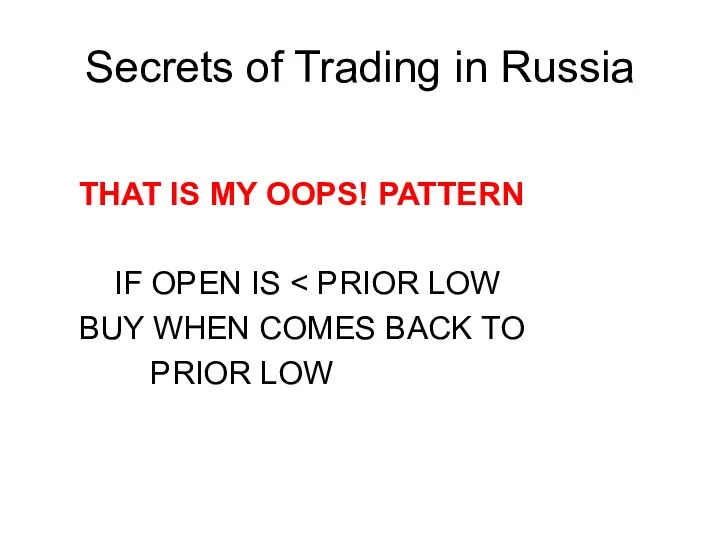

Secrets of Trading in Russia

Слайд 32

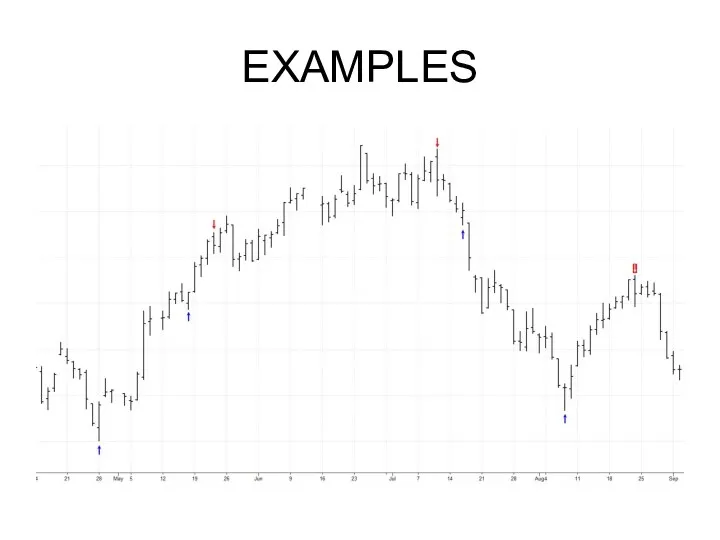

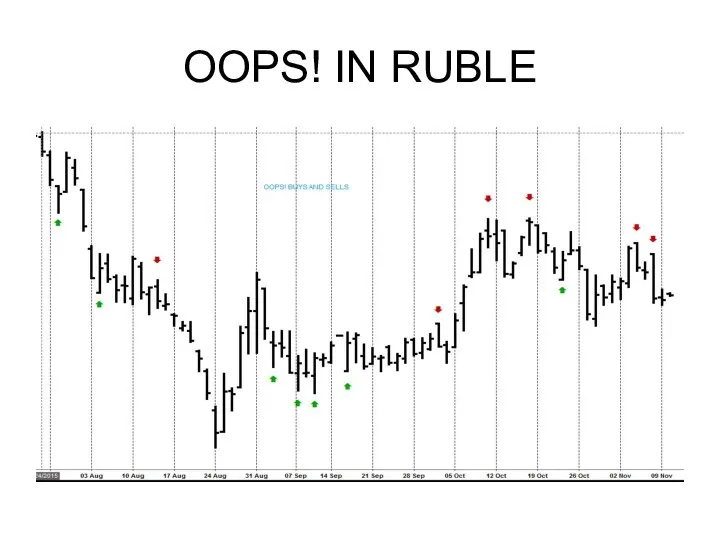

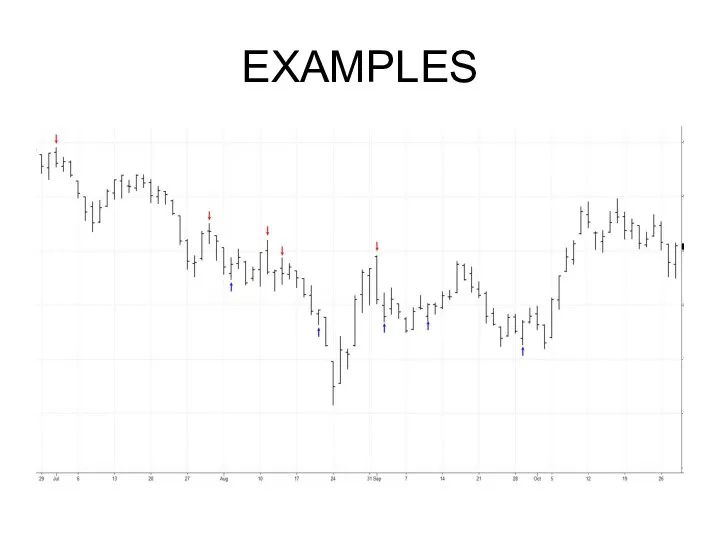

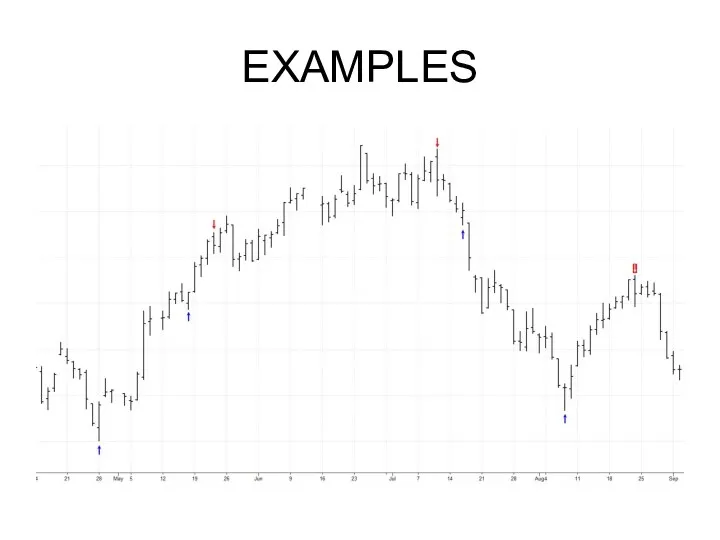

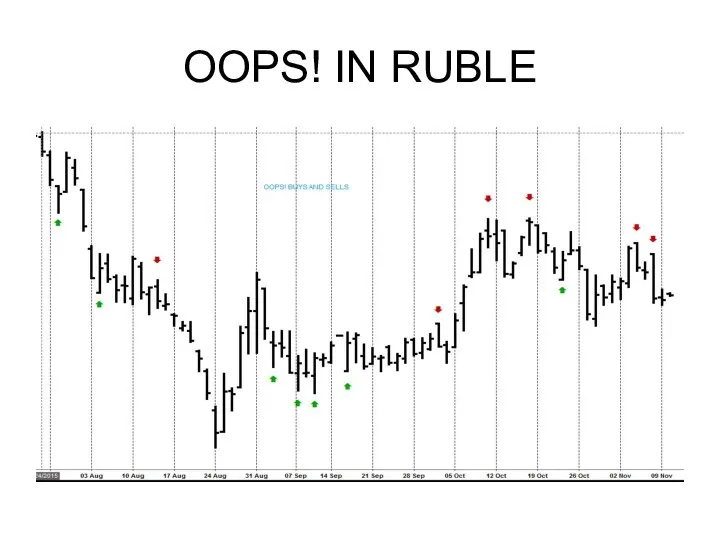

Secrets of Trading in Russia

THAT IS MY OOPS! PATTERN

IF

OPEN IS < PRIOR LOW

BUY WHEN COMES BACK TO

PRIOR LOW

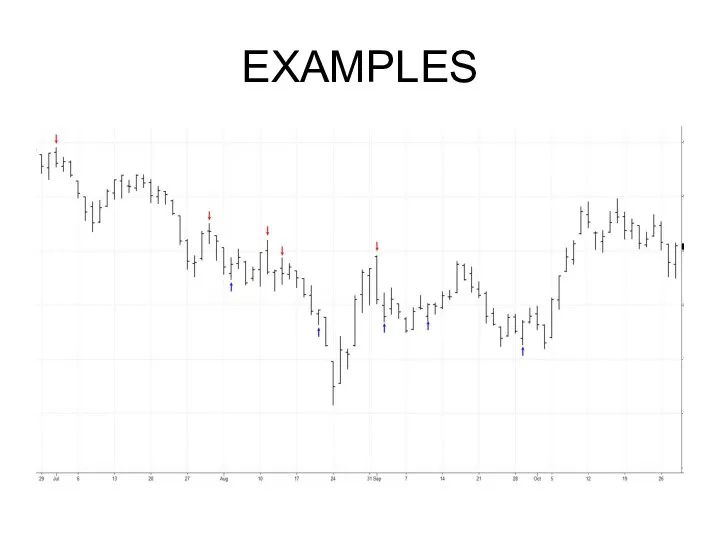

Слайд 33

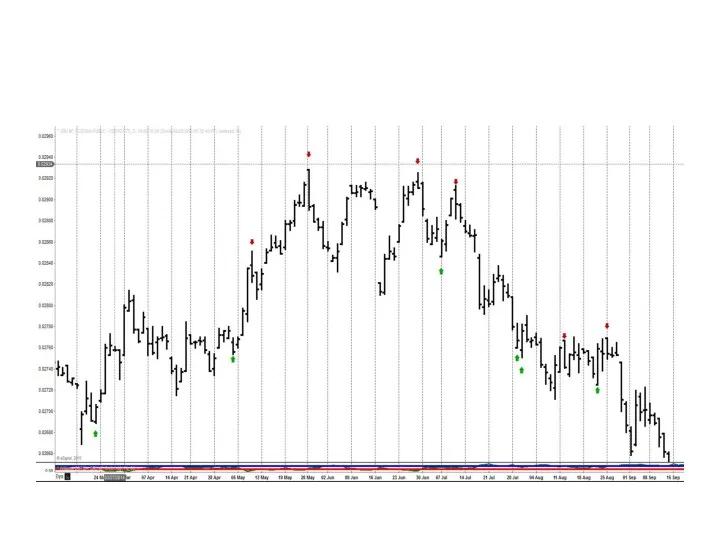

Secrets of Trading in Russia

Слайд 34

Secrets of Trading in Russia

Слайд 35

Слайд 36

Слайд 37

Слайд 38

Слайд 39

Secrets of Trading in Russia

RUSSIANS LIKE TO FOLLOW STRENGTH

WHEN TUESDAY HAS

BEEN STRONG

Слайд 40

Secrets of Trading in Russia

Слайд 41

Secrets of Trading in Russia

WHAT IS THE BEST DAY TO

BUY ??

WHAT IS THE BEST DAY TO SELL??

Слайд 42

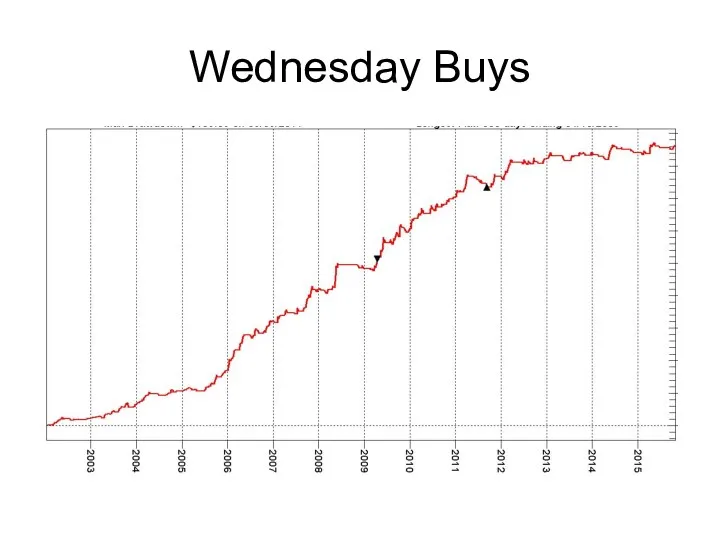

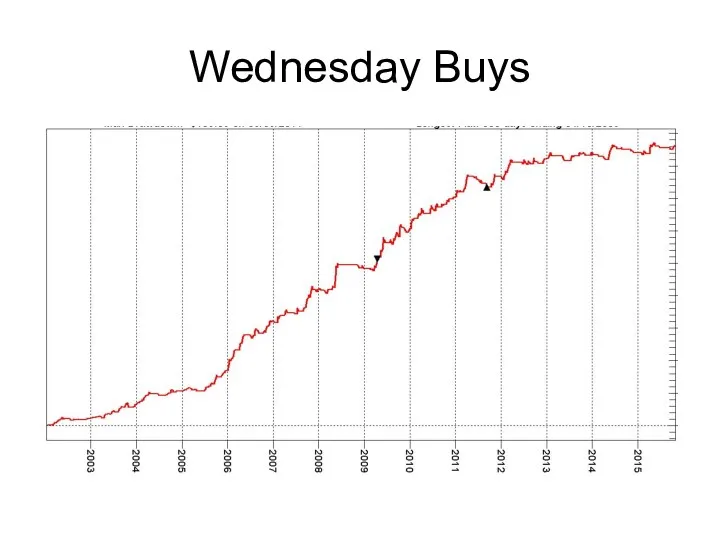

Secrets of Trading in Russia

BEST BUY DAY IS

WEDNESDAY

Слайд 43

Слайд 44

Secrets of Trading in Russia

BEST SELL DAY

TUESDAY

Слайд 45

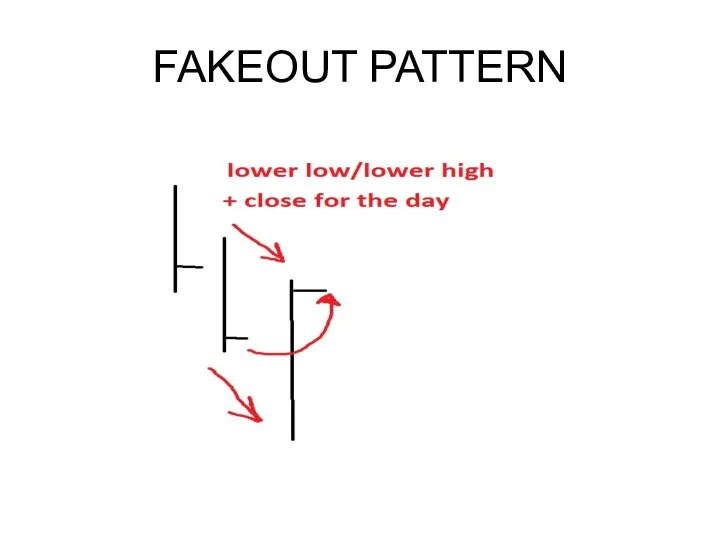

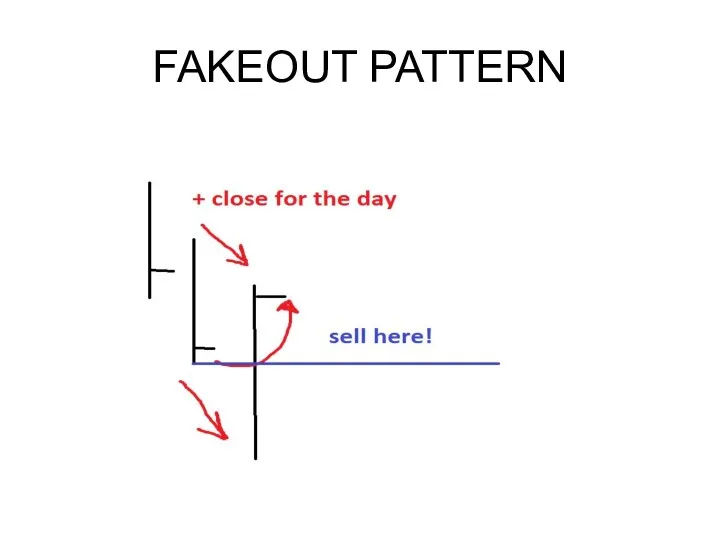

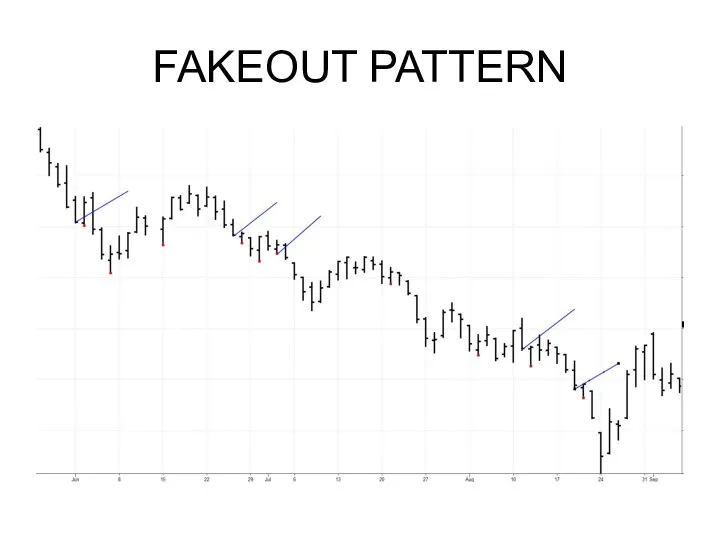

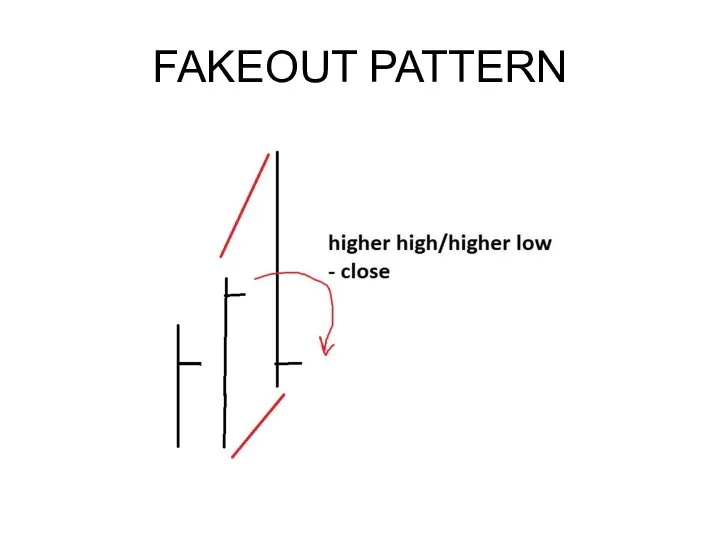

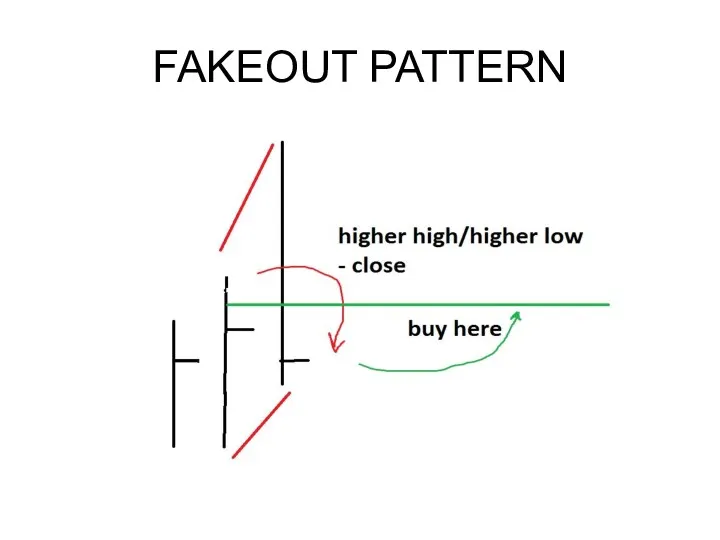

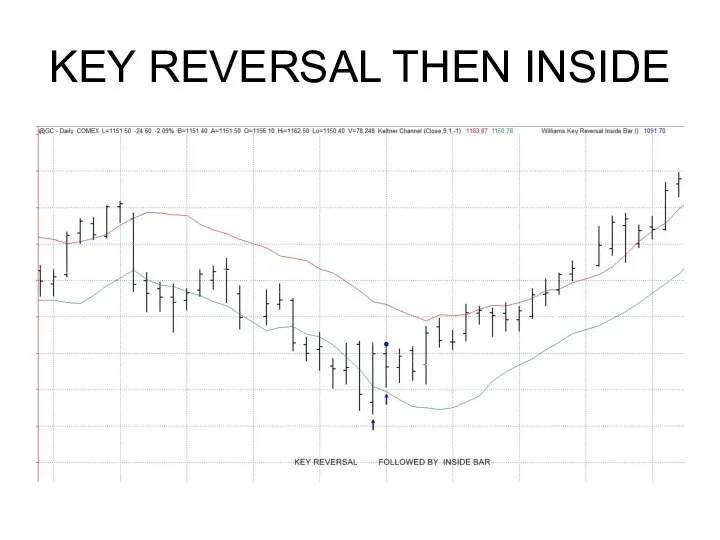

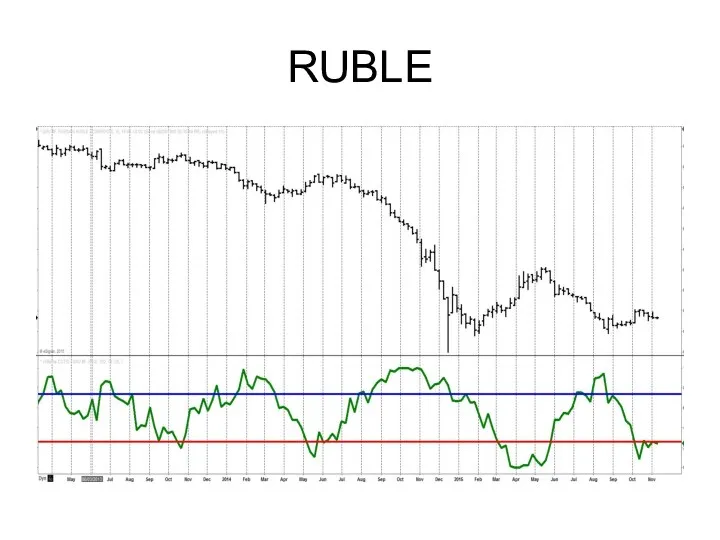

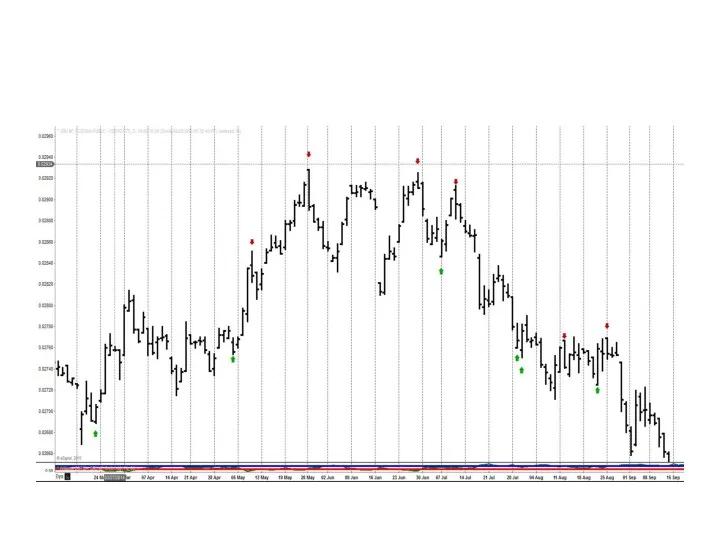

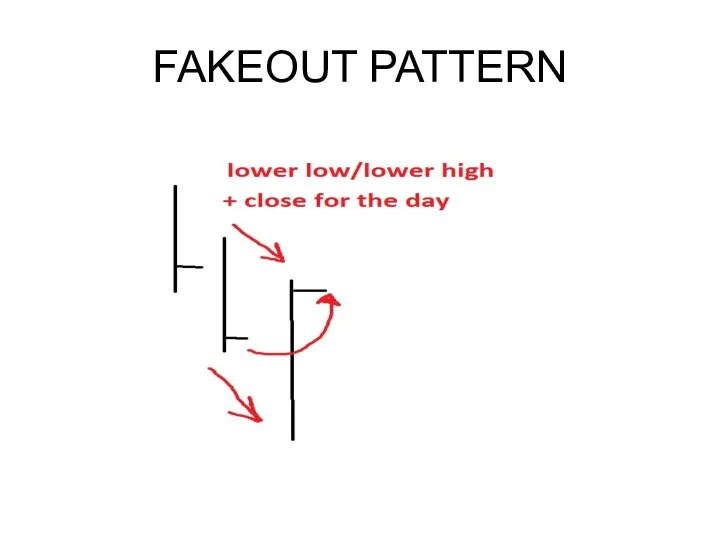

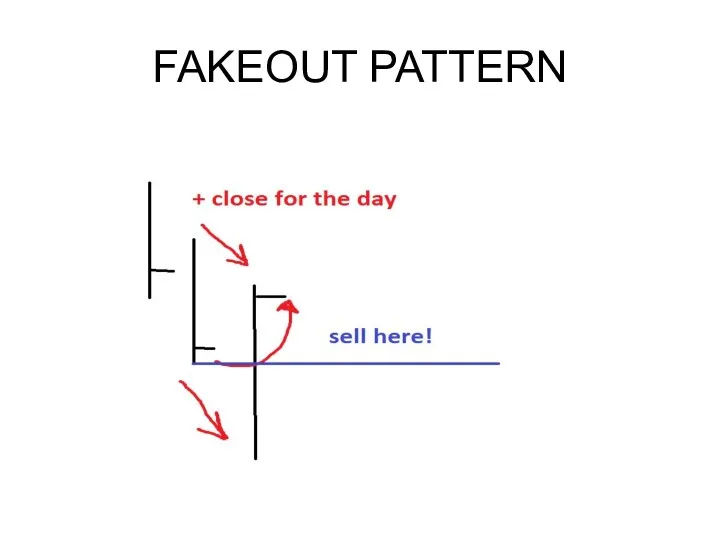

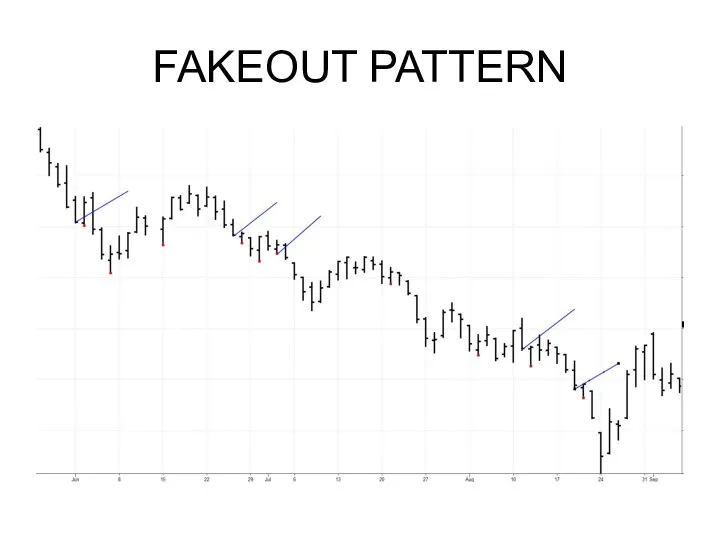

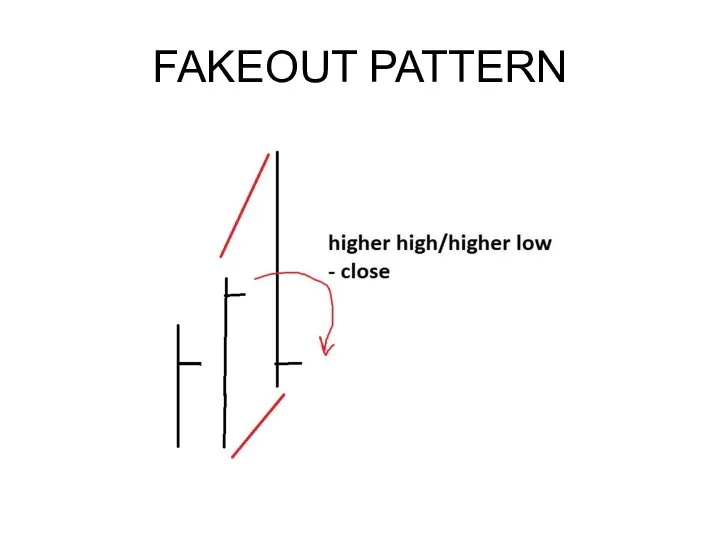

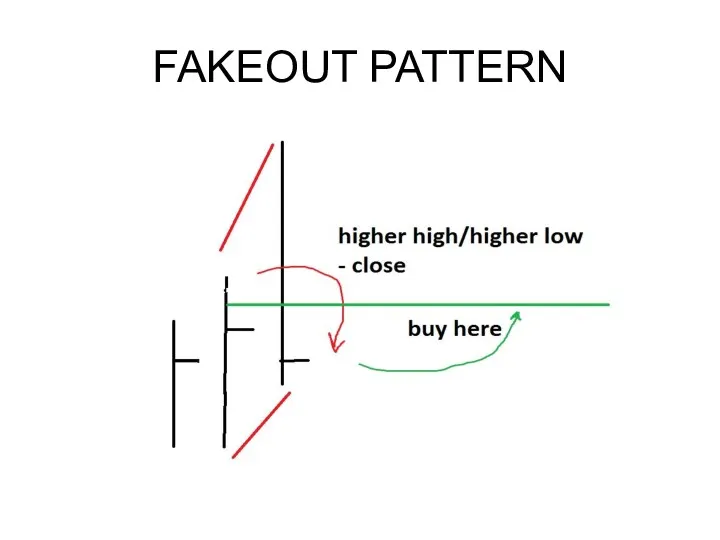

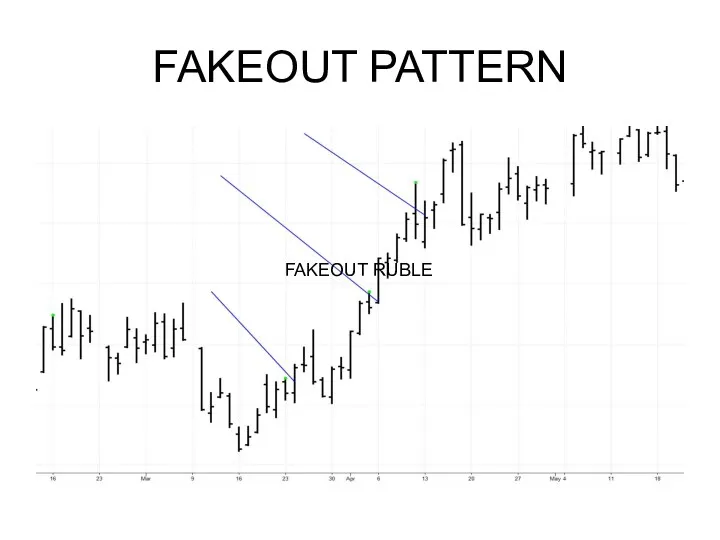

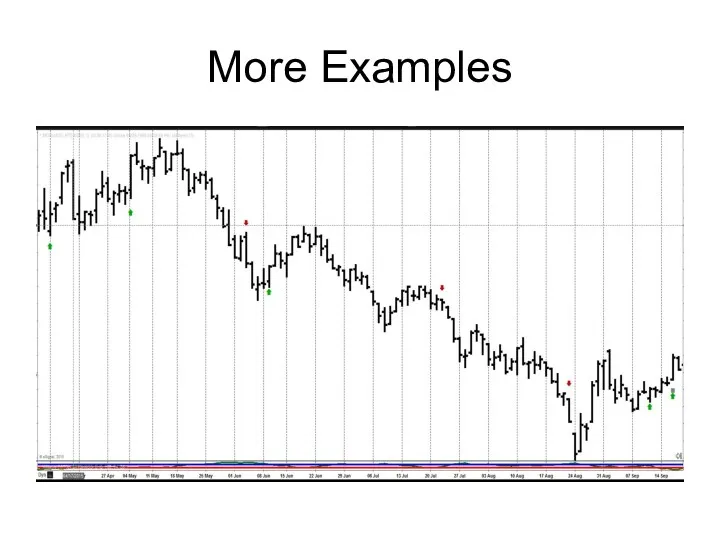

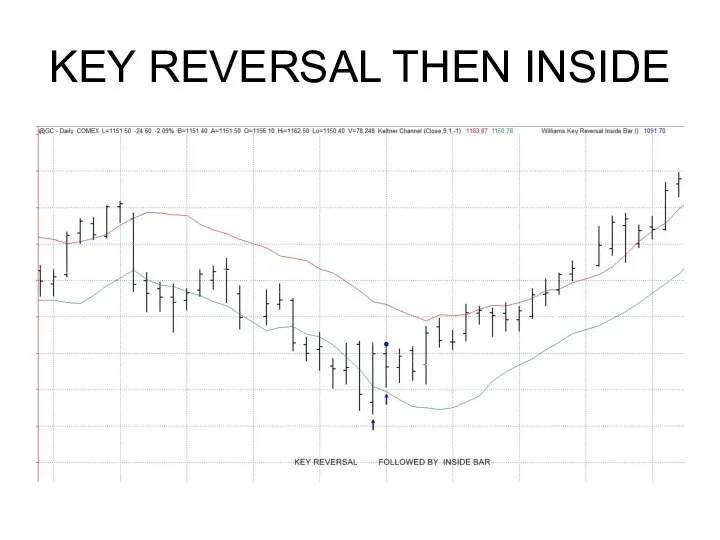

FAKEOUT PATTERN

KEY REVERSALS

ARE NOT

REAL REVERSALS

Слайд 46

Слайд 47

Слайд 48

Слайд 49

Слайд 50

Слайд 51

Слайд 52

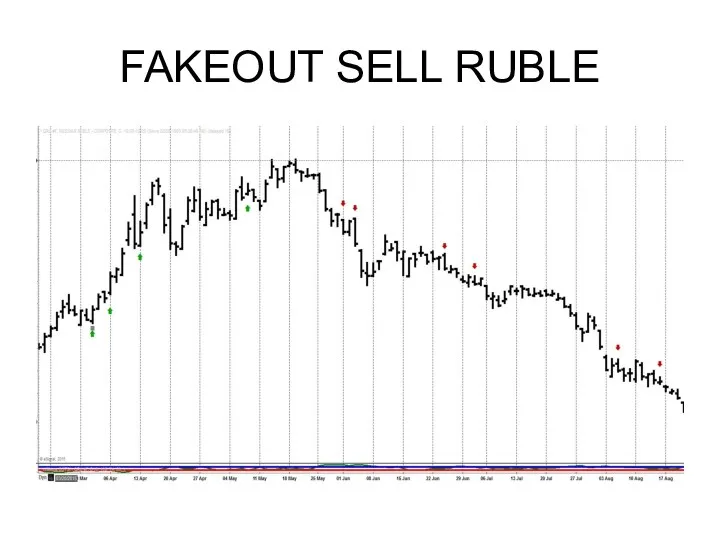

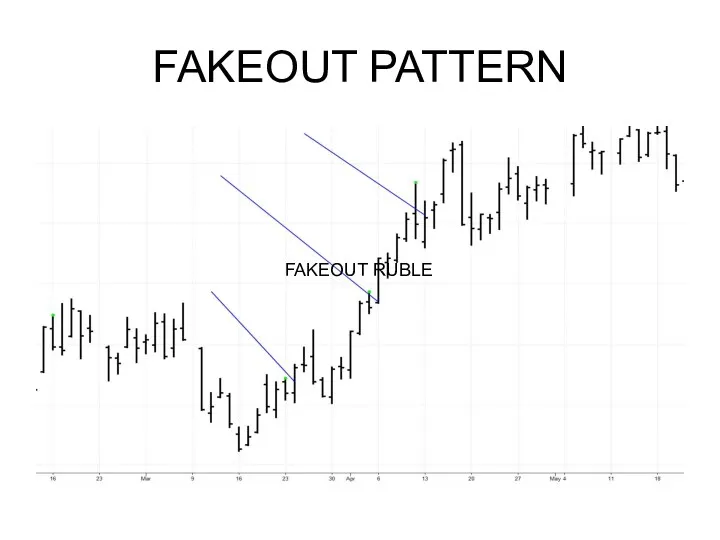

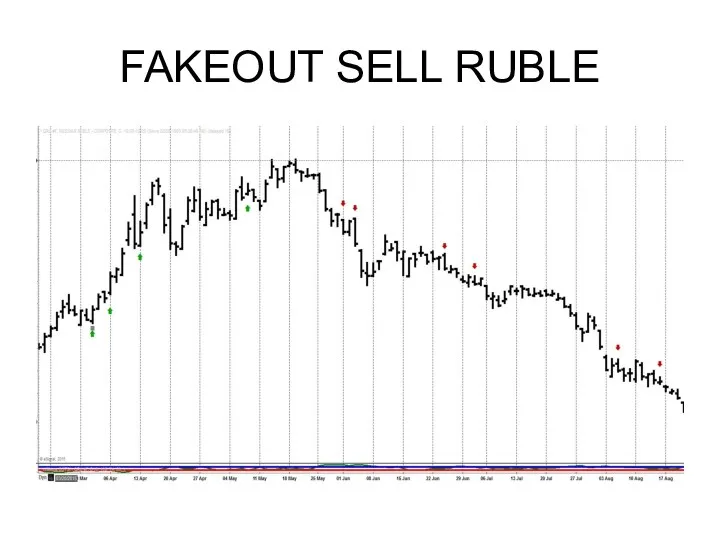

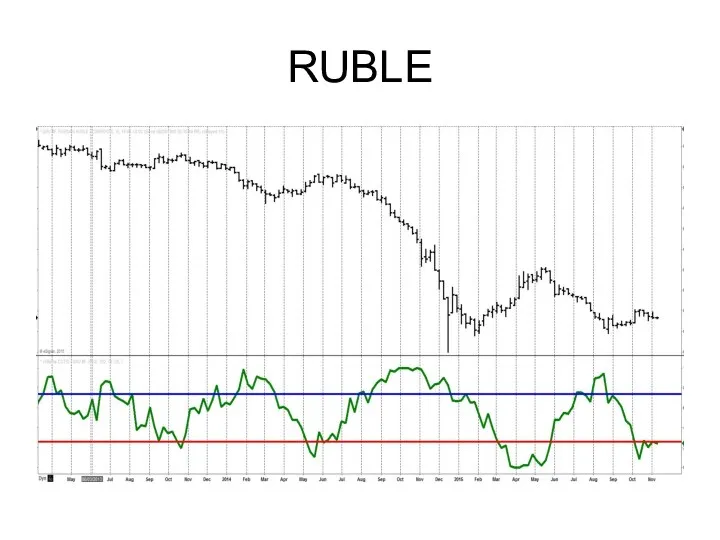

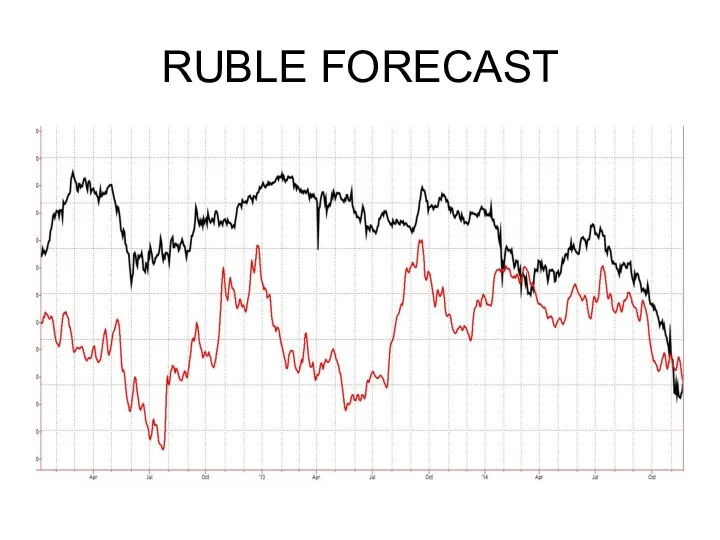

FAKEOUT PATTERN

FAKEOUT RUBLE

Слайд 53

Слайд 54

Слайд 55

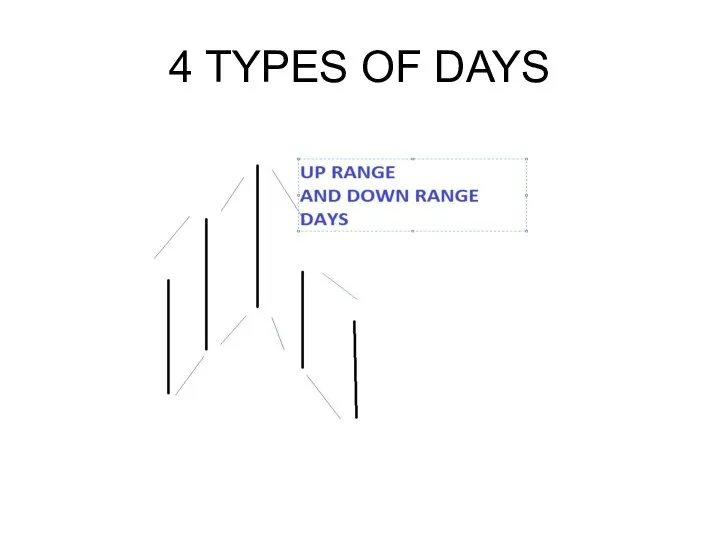

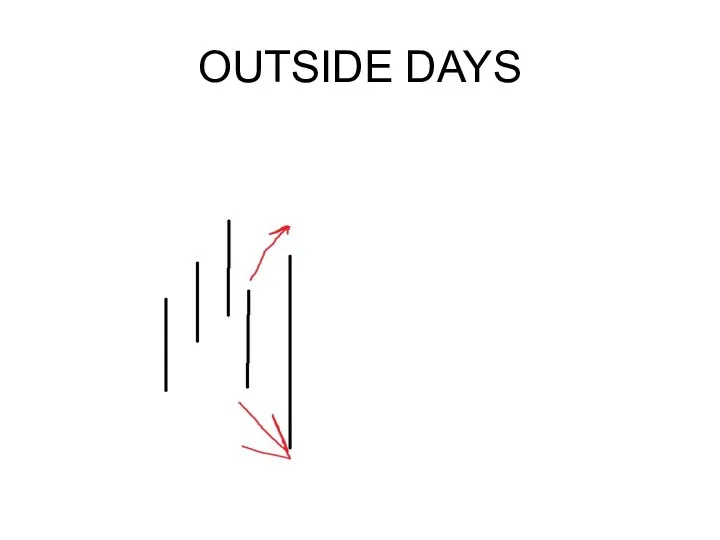

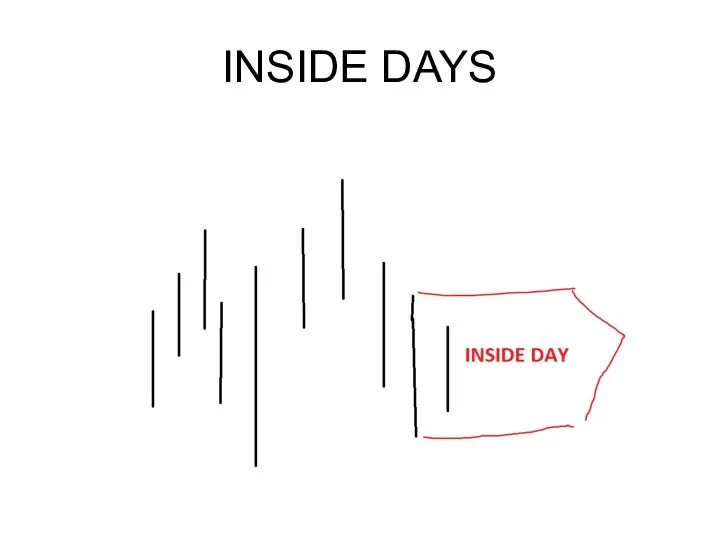

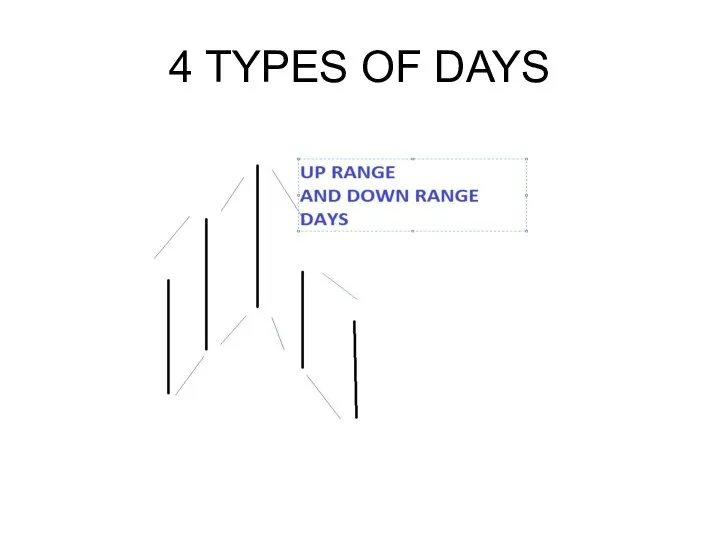

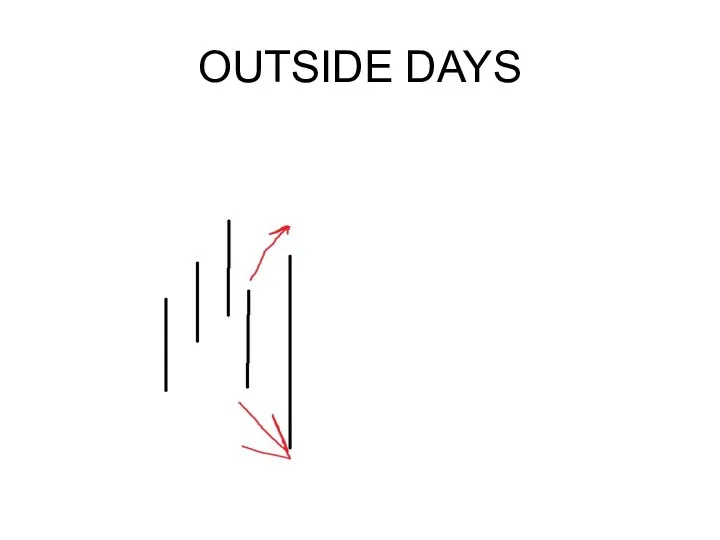

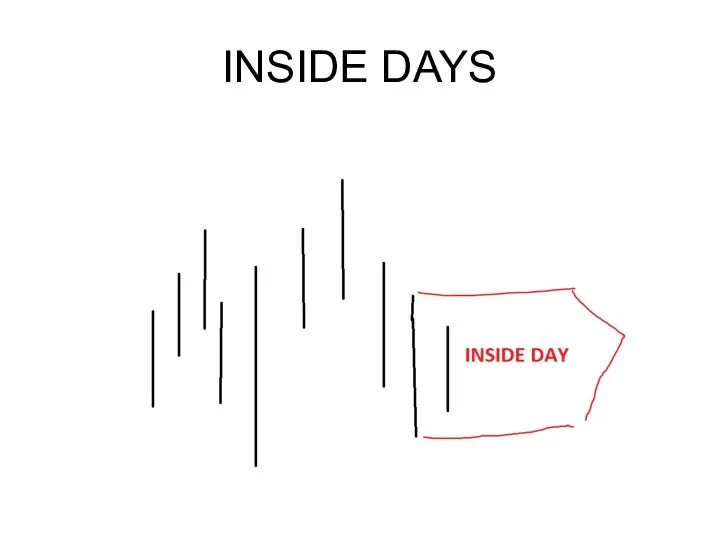

4 TYPES OF DAYS

ONLY 4 TYPES OF DAYS

1. UP RANGE

2. DOWN

RANGE

3. OUTSIDE RANGE

4. INSIDE RANGE

Слайд 56

Слайд 57

Слайд 58

Слайд 59

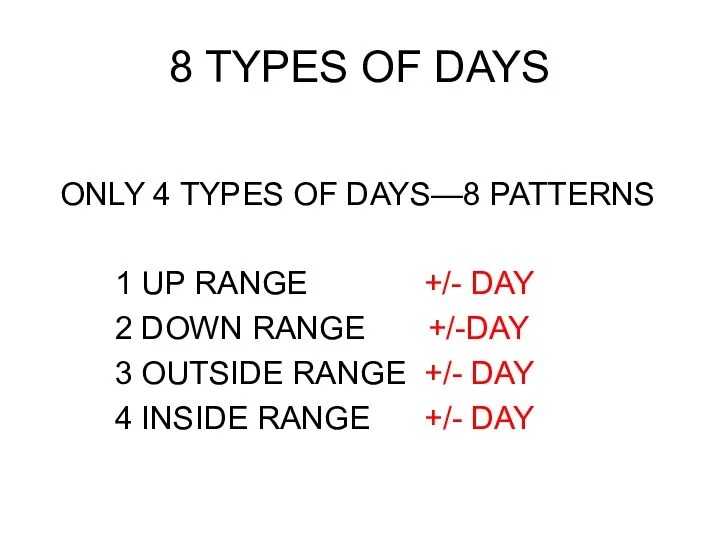

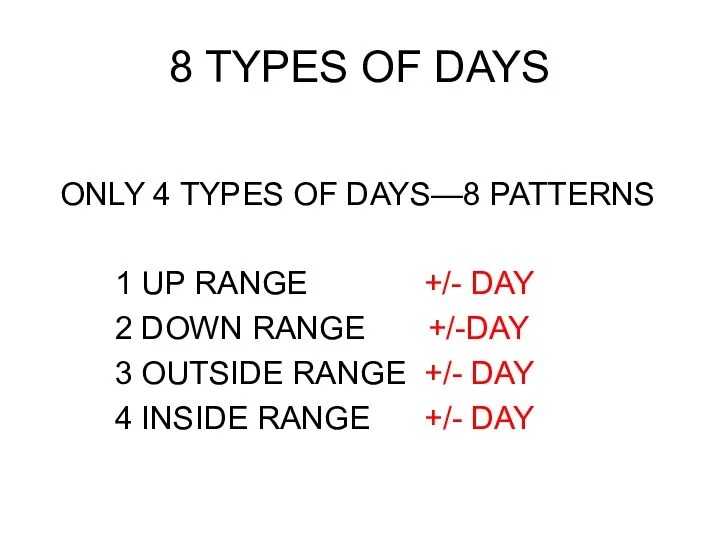

8 TYPES OF DAYS

ONLY 4 TYPES OF DAYS—8 PATTERNS

1 UP

RANGE +/- DAY

2 DOWN RANGE +/-DAY

3 OUTSIDE RANGE +/- DAY

4 INSIDE RANGE +/- DAY

Слайд 60

Слайд 61

Слайд 62

Слайд 63

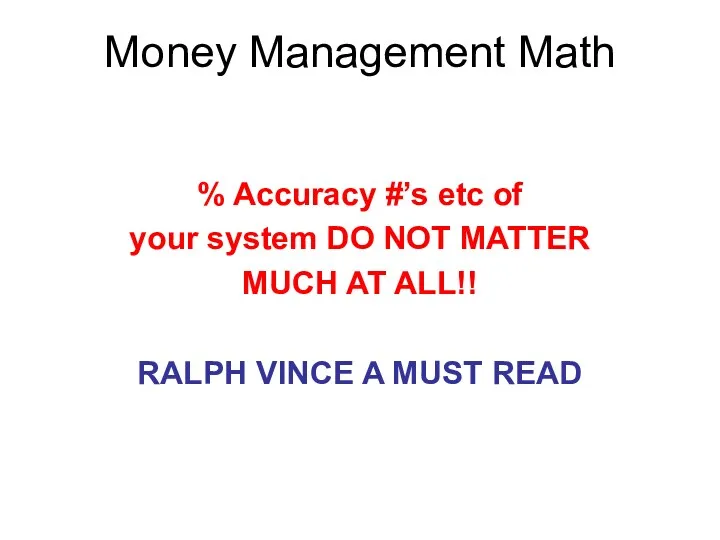

Money Management Math

% Accuracy #’s etc of

your system DO NOT

MATTER

MUCH AT ALL!!

RALPH VINCE A MUST READ

Слайд 64

Слайд 65

Martingale

DOUBLE UP AFTER EVERY

LOSSS OR SOME VERSION

OF THAT

STRATEGY

Слайд 66

DIFFERENT FORMULA

KELLY RATIO

OPTIMAL F

RYAN JONES

LATANTE

WILLIAMS % RISK

Слайд 67

Money Management Math

YOU MUST INCREASE BET SIZE

AS PROFITS INCREASE

YOU MUST DECREASE BET SIZE AS

AS PROFITS DECREASE

Слайд 68

Money Management Math

YOU MUST COMMIT A FIXED %

OF ACCOUNT

SO RISK

IS EQUALL

ON EACH TRADE/WAGER

Слайд 69

Слайд 70

Money Management Math

IT ONLY TAKES ONE LOSING TRADE

TO WIPE OUT

A TRADER…ONLY ONE

That’s Like Russian Roulette

Слайд 71

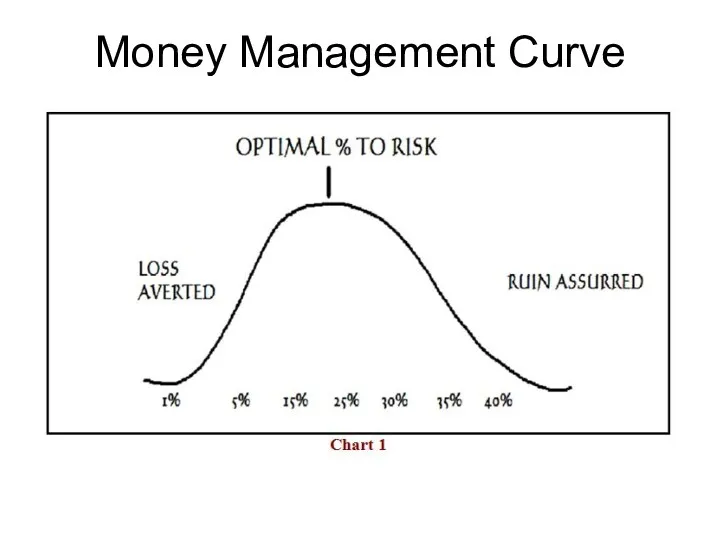

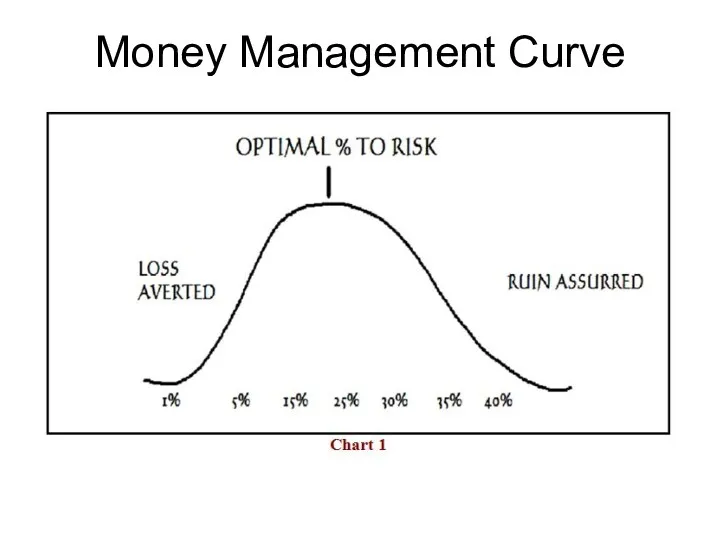

Money Management Math

THE MORE YOU RISK

THE MORE YOU

CAN GAIN

AND THE MORE YOU RISK

THE MORE YOU CAN LOSE

IS THE PROBLEM

Слайд 72

Money Management Math

ONE TRADE, ONE BULLET KILLS YOU

I HAVE

SEEN THE MARKETS DESTROY MANY PEOPLE

MUST ALWAYS BE DILLIGENT

Слайд 73

Money Management Math

IF YOU BET BIG

YOU WILL LOSE

BIG

Слайд 74

Money Management Math

IF YOU BET SMALL

YOU CAN ONLY

LOSE

SMALL

Слайд 75

Money Management Math

PROFITS ARE A FUNCTION OF TREND

NO TREND

NO PROFITS

Слайд 76

Money Management Math

TREND IS A FUNCTION OF TIME

THE MORE

TIME

THE BIGGER THE TREND

Слайд 77

Money Management Math

THE ONLY WAY DAYTRADERS

CAN WIN BIG

IS TO BET BIG

AS THEY CANNOT CATCH

LARGE TREND MOVES

---NO TIME---

Слайд 78

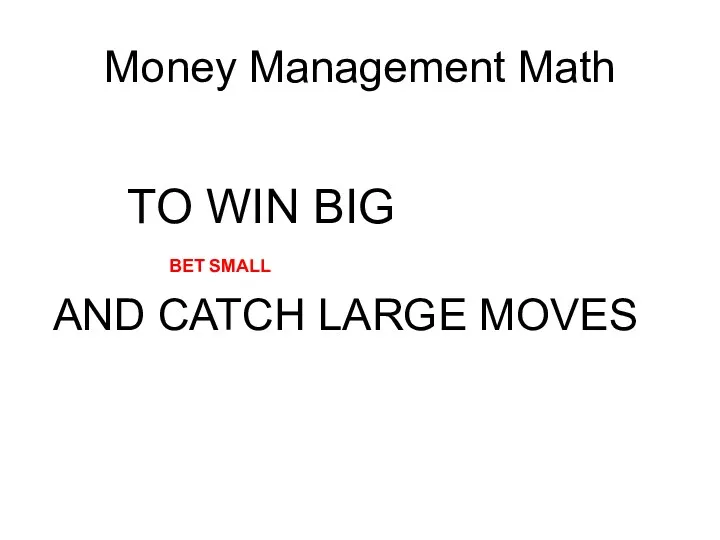

Money Management Math

TO WIN BIG

BET SMALL

AND CATCH LARGE

MOVES

Слайд 79

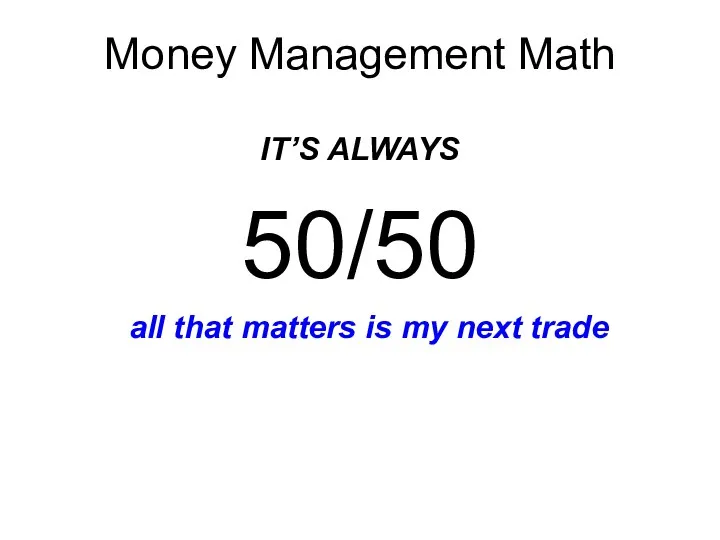

Money Management Math

IT’S ALWAYS

50/50

all that matters is my next

trade

Слайд 80

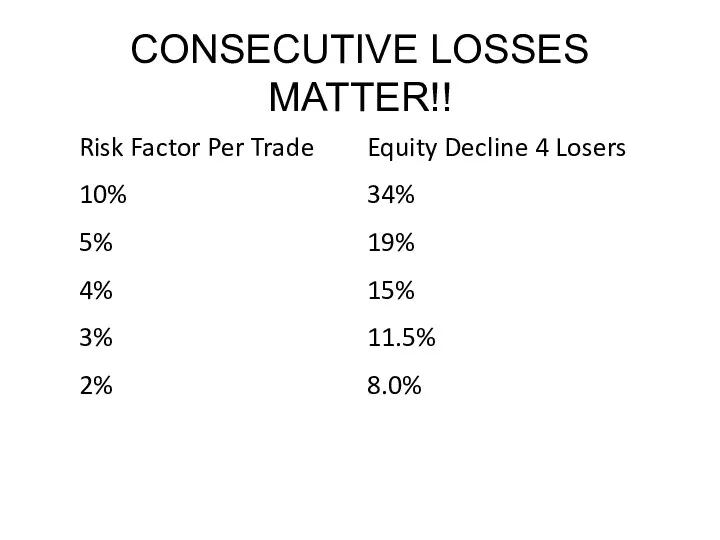

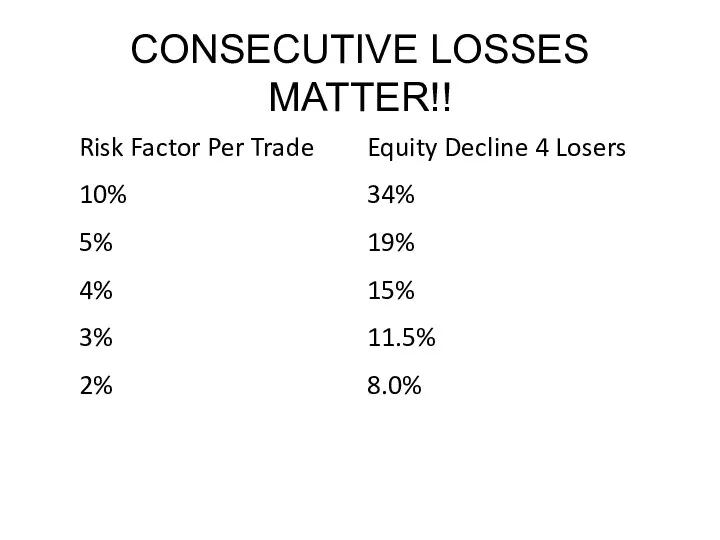

CONSECUTIVE LOSSES MATTER!!

Risk Factor Per Trade

10%

5%

4%

3%

2%

Equity Decline 4 Losers

34%

19%

15%

11.5%

8.0%

Слайд 81

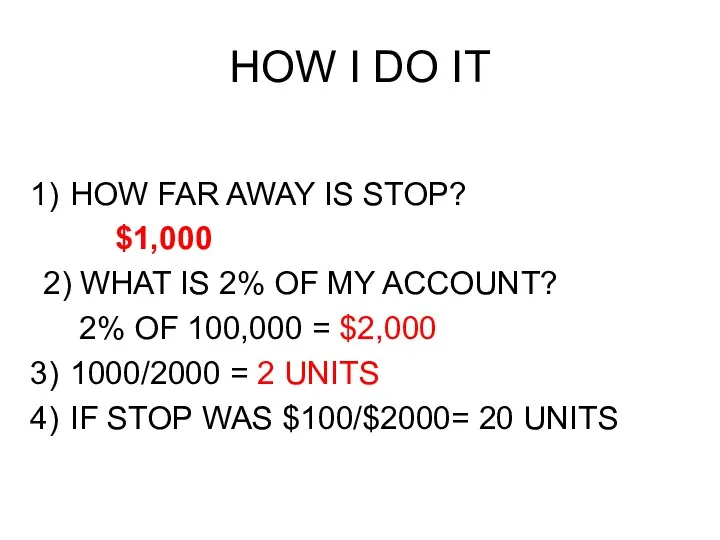

HOW I DO IT

2% RISK ON EACH TRADE

Слайд 82

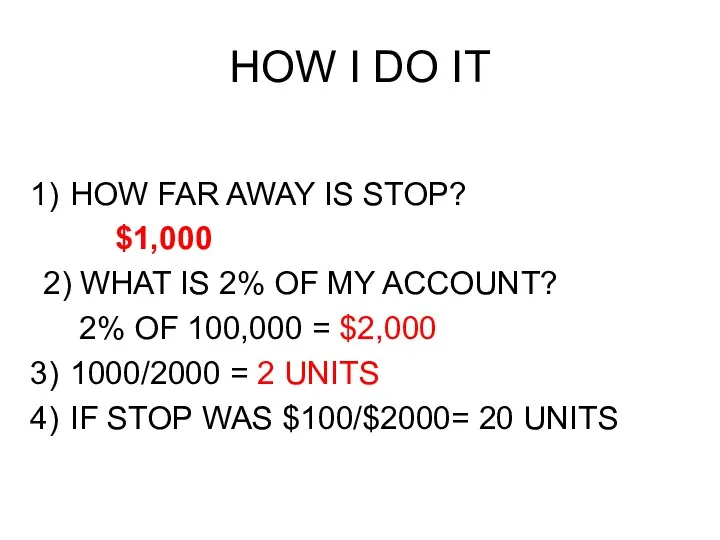

HOW I DO IT

HOW FAR AWAY IS STOP?

$1,000

2) WHAT IS 2%

OF MY ACCOUNT?

2% OF 100,000 = $2,000

1000/2000 = 2 UNITS

IF STOP WAS $100/$2000= 20 UNITS

Слайд 83

Money Management

It’s all about you… E=mc2

Слайд 84

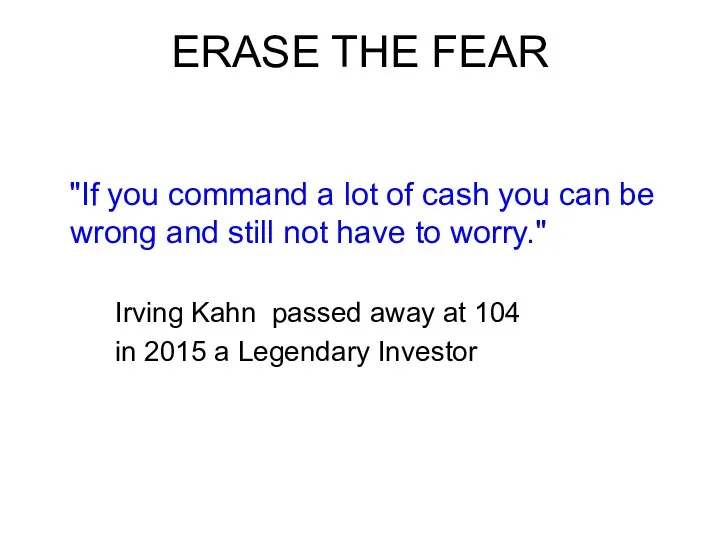

ERASE THE FEAR

"If you command a lot of cash you

can be wrong and still not have to worry."

Irving Kahn passed away at 104

in 2015 a Legendary Investor

Слайд 85

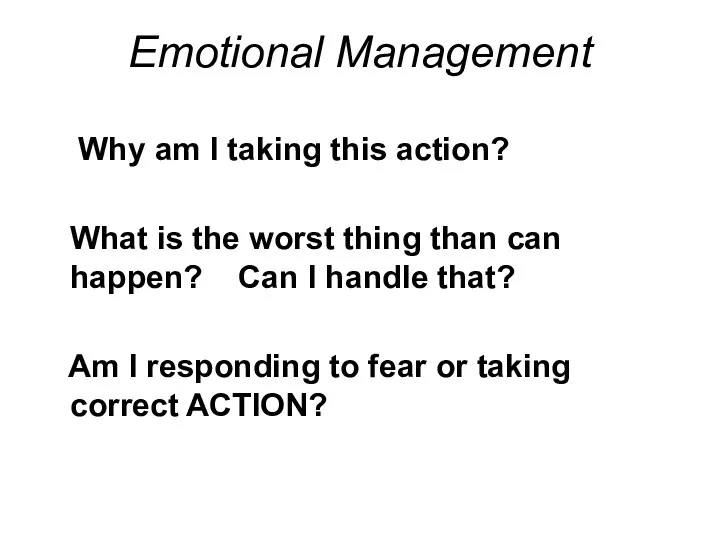

Emotional Management

Why am I taking this action?

What is the worst

thing than can happen? Can I handle that?

Am I responding to fear or taking correct ACTION?

Слайд 86

3 Traits of Winning Traders

1. They are not easily flustered, so

they don’t make emotional decisions

2. They are not over confident of their abilities

They are good with details

Dr. Jason Williams “The mental edge in trading”

Слайд 87

Wisdom from a Chess Master

The player who hesitates is often saved

All the right moves are there on the board, waiting to be made. Your job is to find them

Слайд 88

Слайд 89

Слайд 90

Слайд 91

Слайд 92

Слайд 93

Слайд 94

Слайд 95

Слайд 96

Слайд 97

Слайд 98

Слайд 99

Слайд 100

Слайд 101

Слайд 102

Слайд 103

Слайд 104

Слайд 105

Слайд 106

Слайд 107

Слайд 108

Слайд 109

Слайд 110

Слайд 111

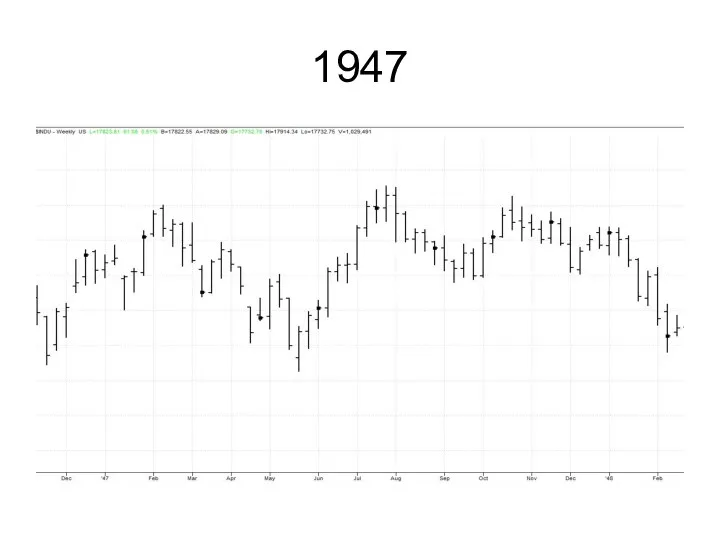

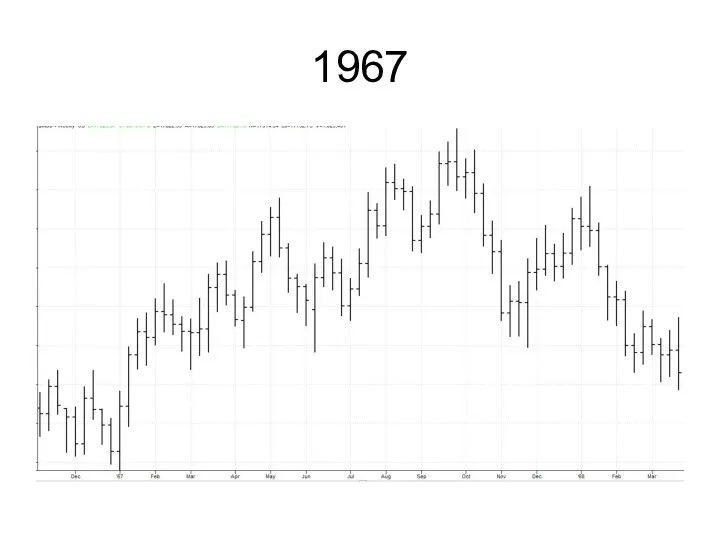

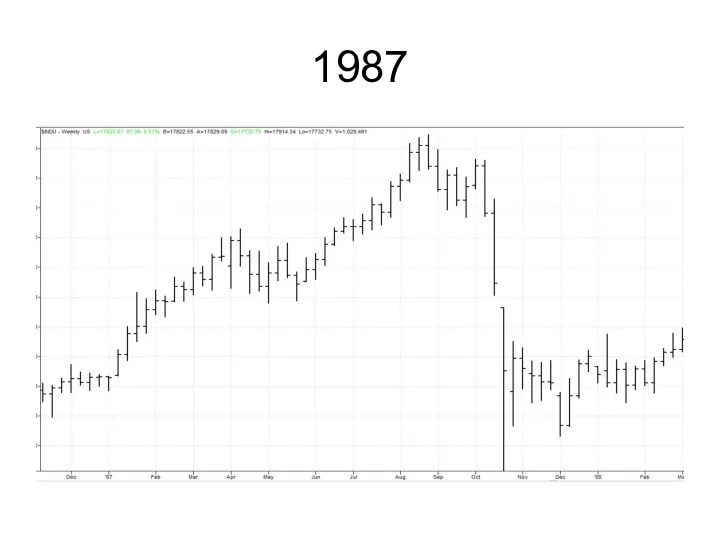

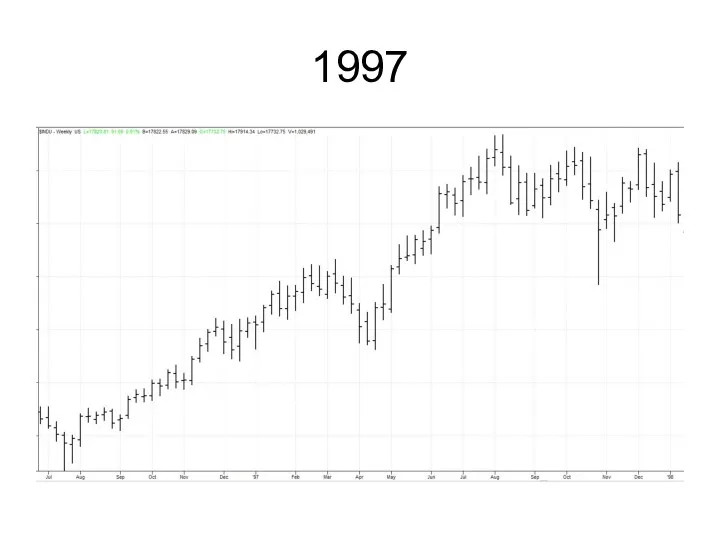

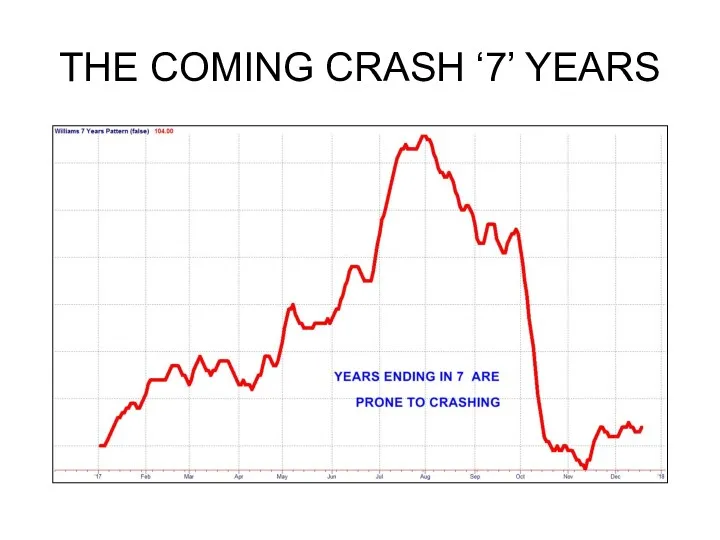

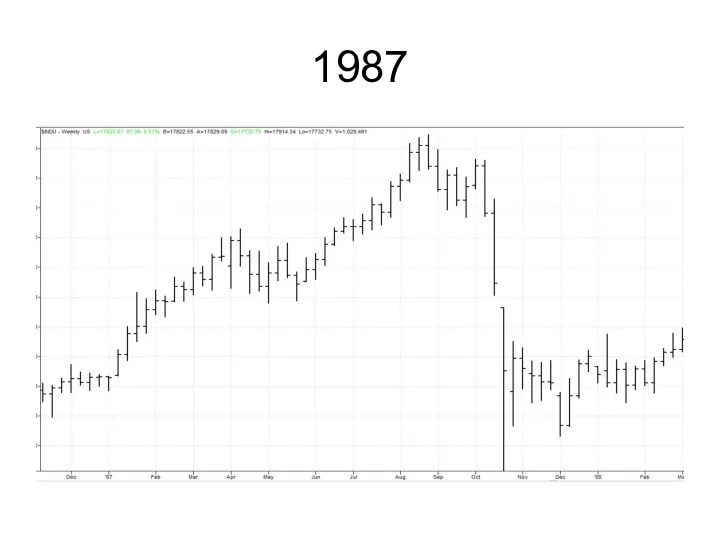

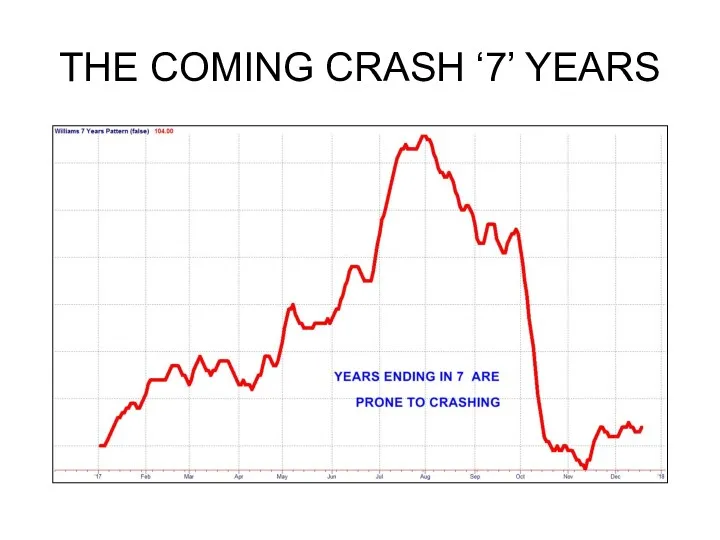

THE COMING CRASH ‘7’ YEARS

Слайд 112

Слайд 113

Слайд 114

Слайд 115

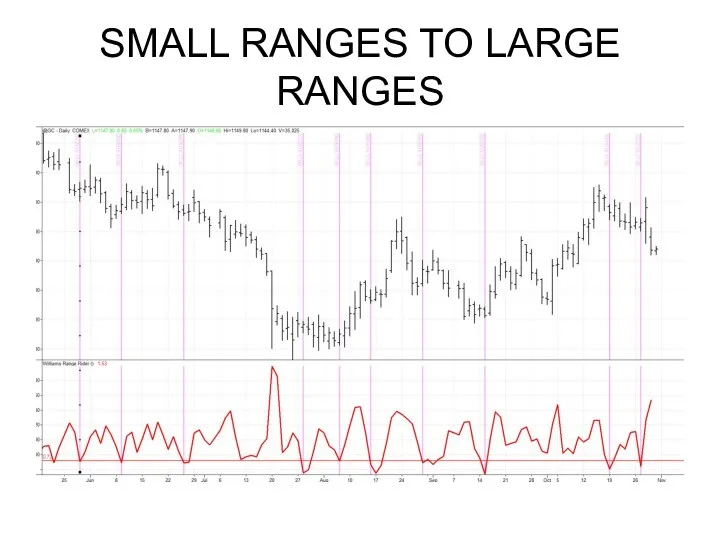

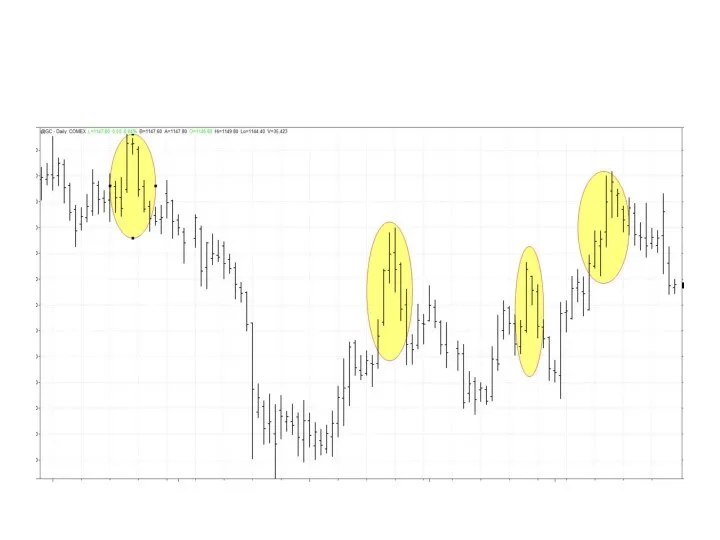

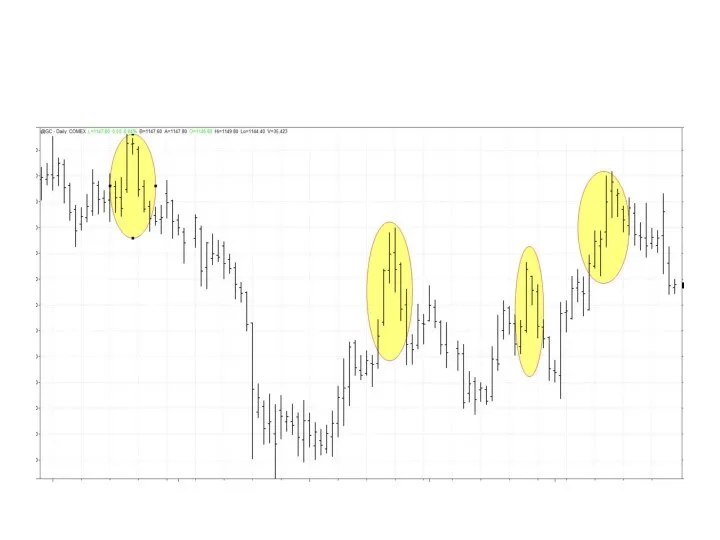

HOW MARKETS MOVE

SMALL RANGES TO LARGE RANGES

TOPS WITH LARGE CLOSE- LOW

BOTTOMS

SMALL CLOSE- LOW

Слайд 116

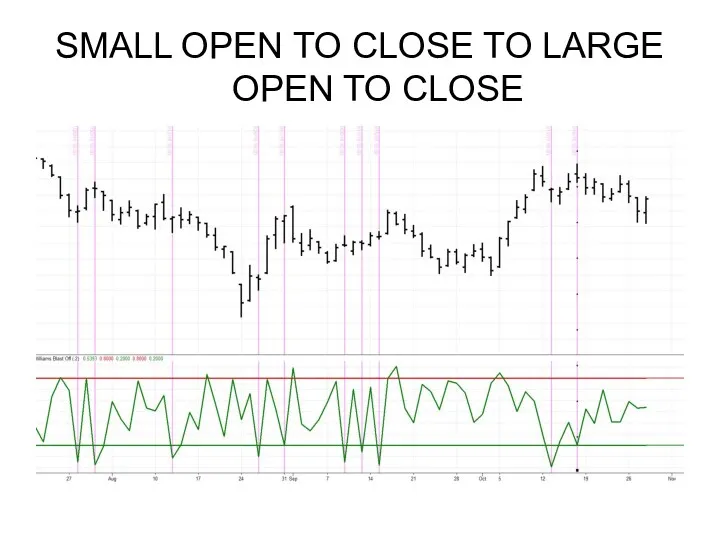

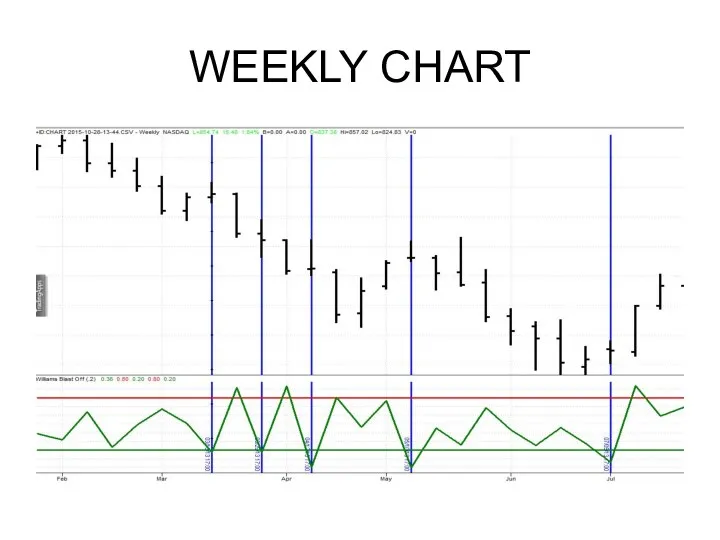

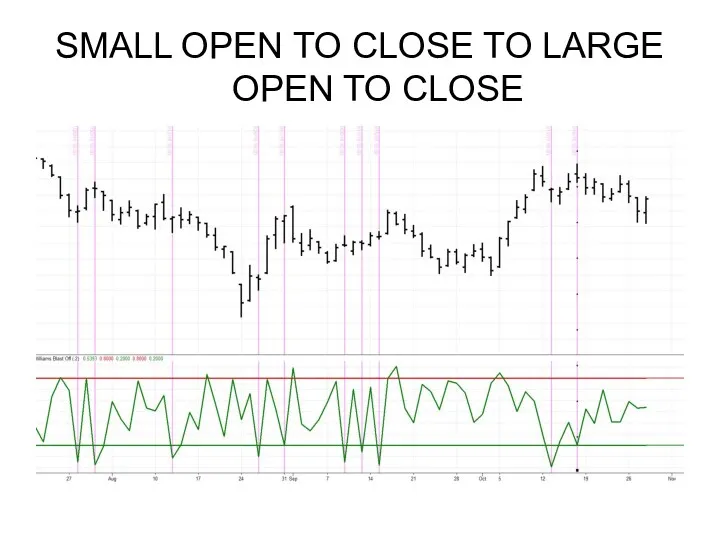

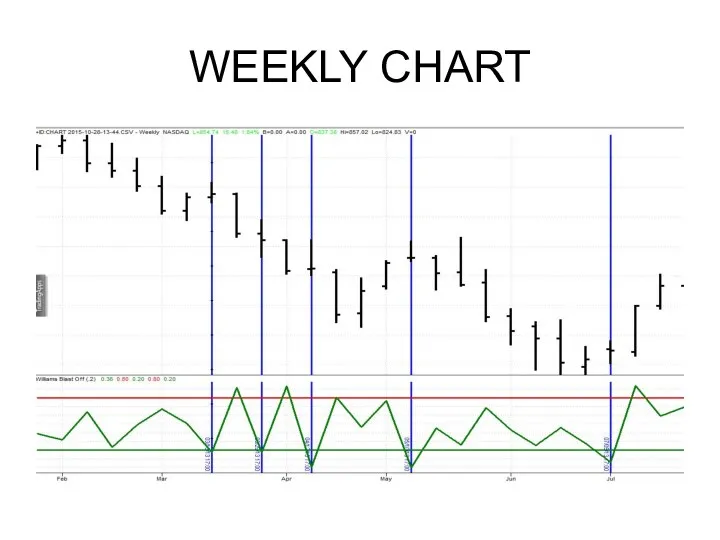

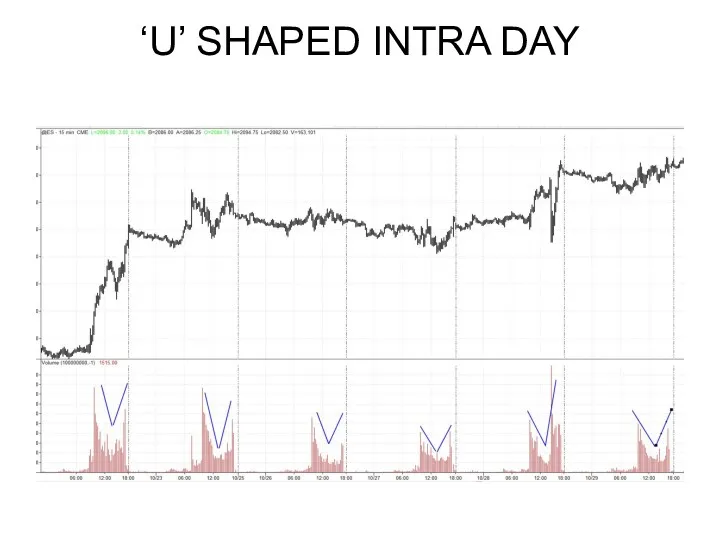

HOW MARKETS MOVE

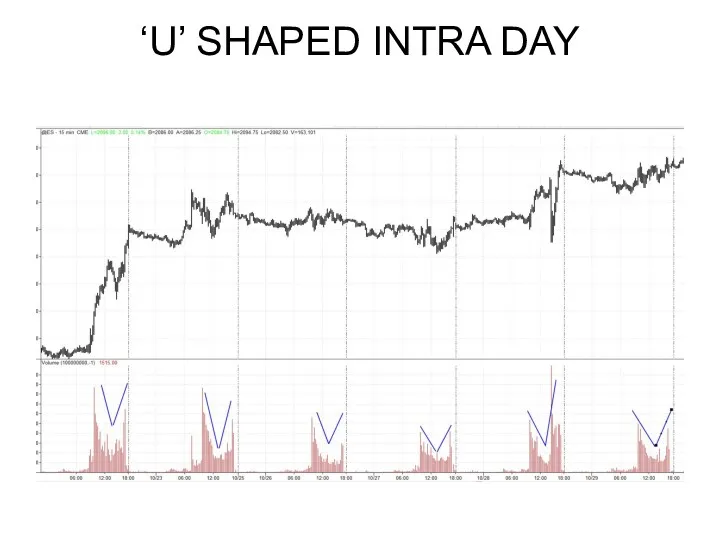

CONGESTION TO CREATION

SMALL OPEN TO CLOSE TO LARGE

OPEN TO

CLOSE

6. ‘U’ SHAPED INTRA DAY

Слайд 117

HOW MARKETS MOVE

CRITICAL POINT FOR

SHORT TERM TRADERS

LARGE RANGE DAYS

(WHERE THE MONEY IS)

CLOSE ON THEIR EXTREMES

Слайд 118

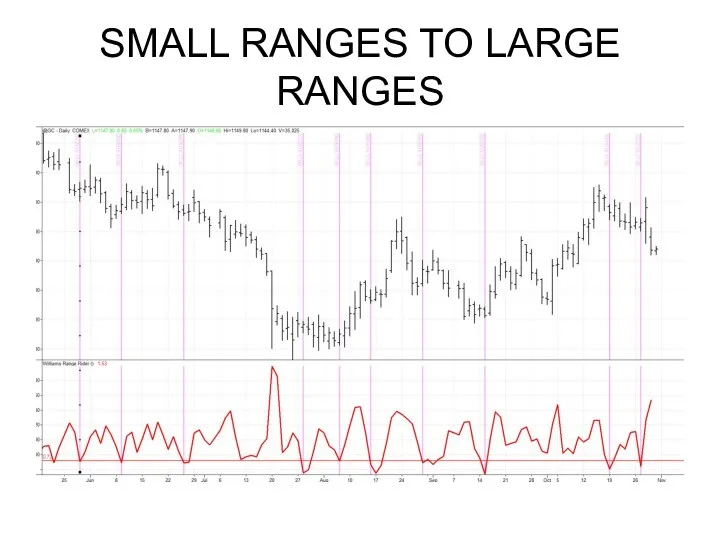

SMALL RANGES TO LARGE RANGES

Слайд 119

Слайд 120

Слайд 121

SMALL OPEN TO CLOSE TO LARGE

OPEN TO CLOSE

Слайд 122

Слайд 123

Слайд 124

Слайд 125

Слайд 126

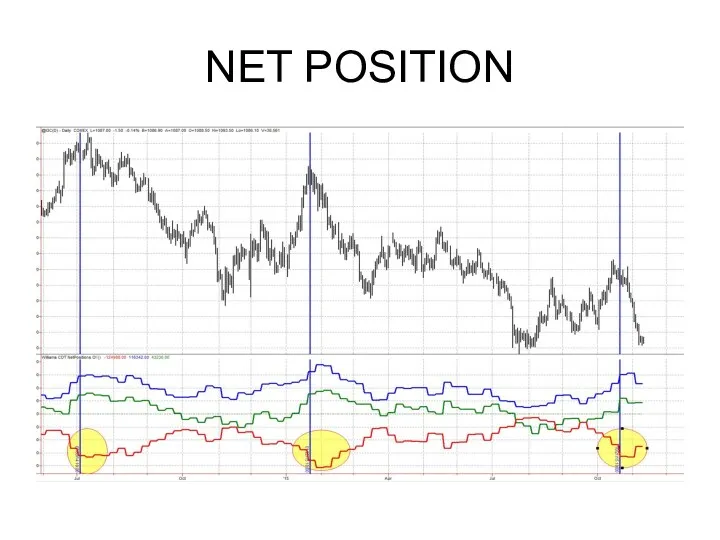

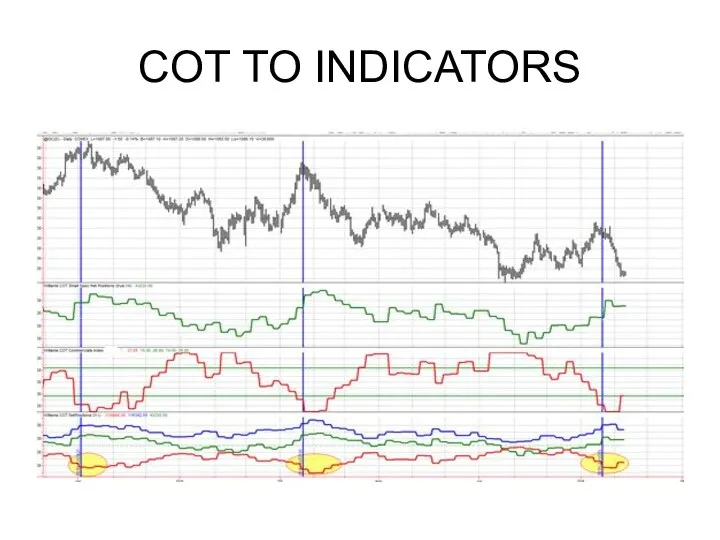

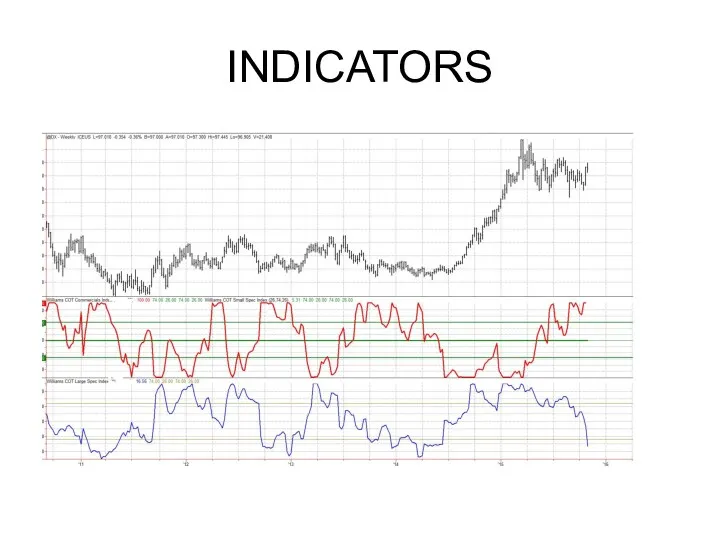

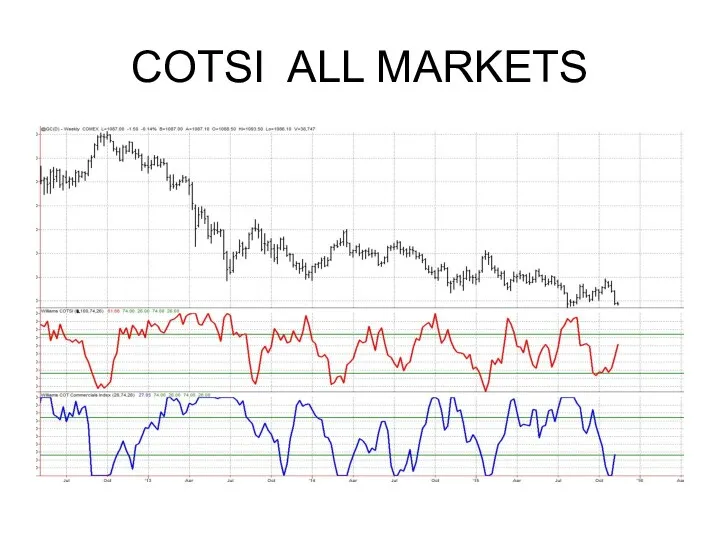

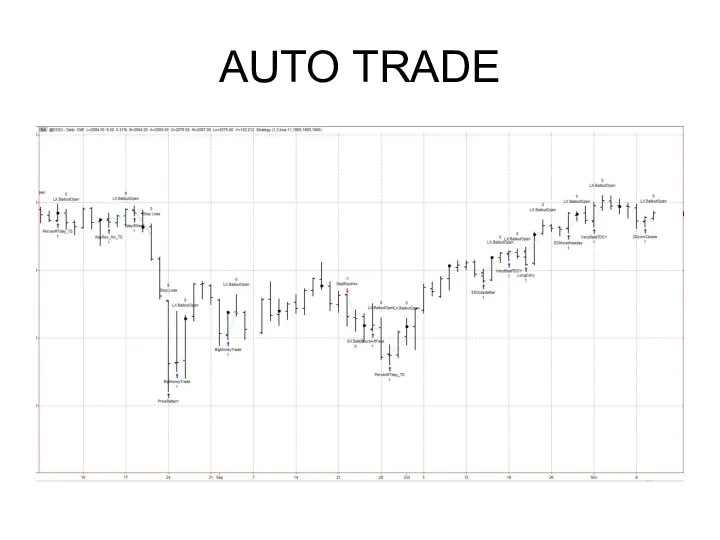

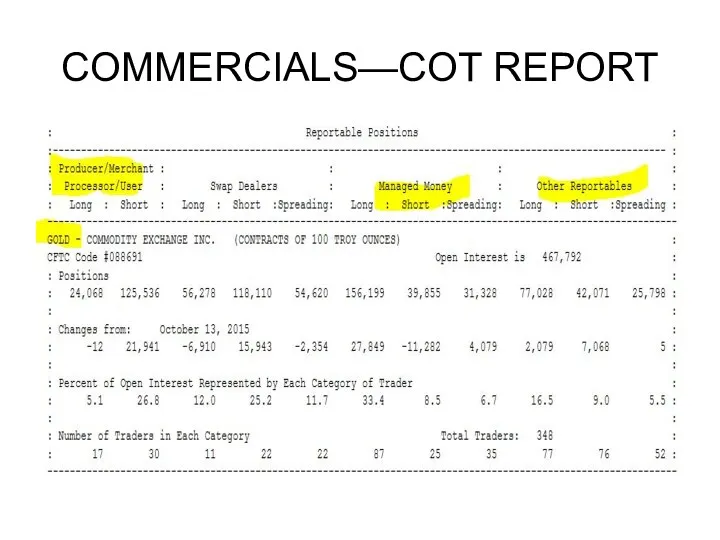

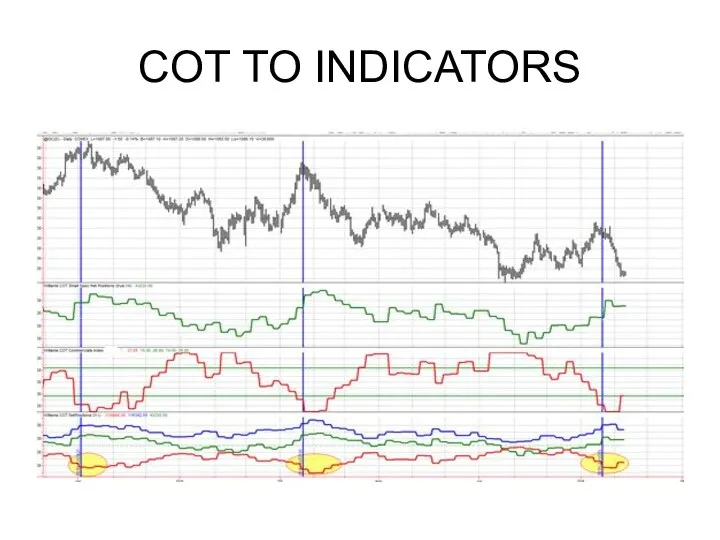

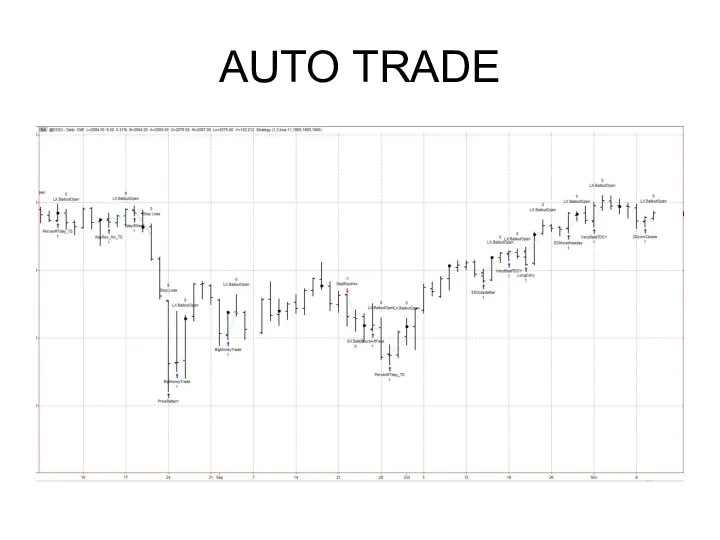

Set up trades

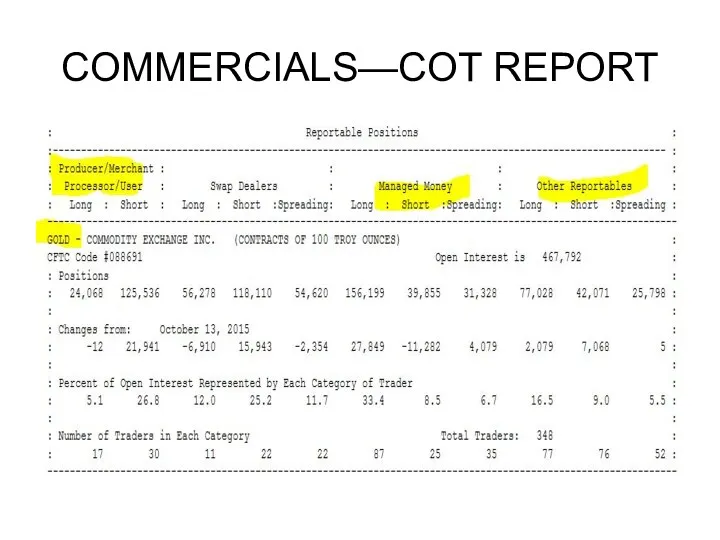

COMMERCIALS—COT REPORT

SEASONALS

CYCLES

ADVISORS

PAUNCH

Слайд 127

Слайд 128

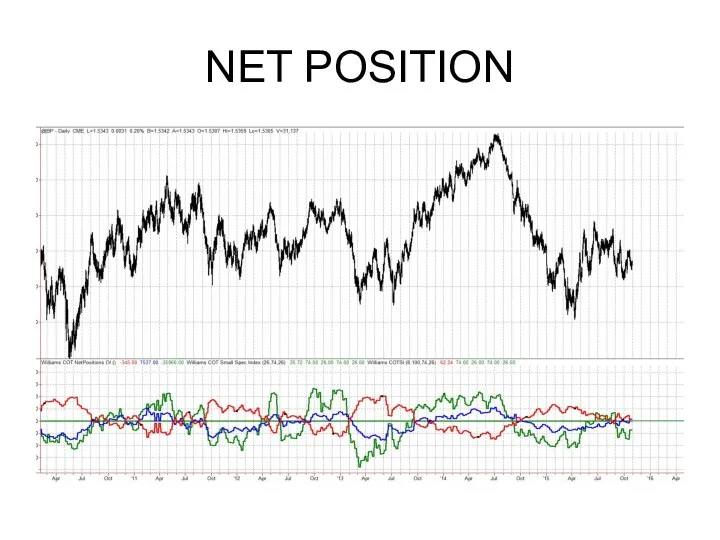

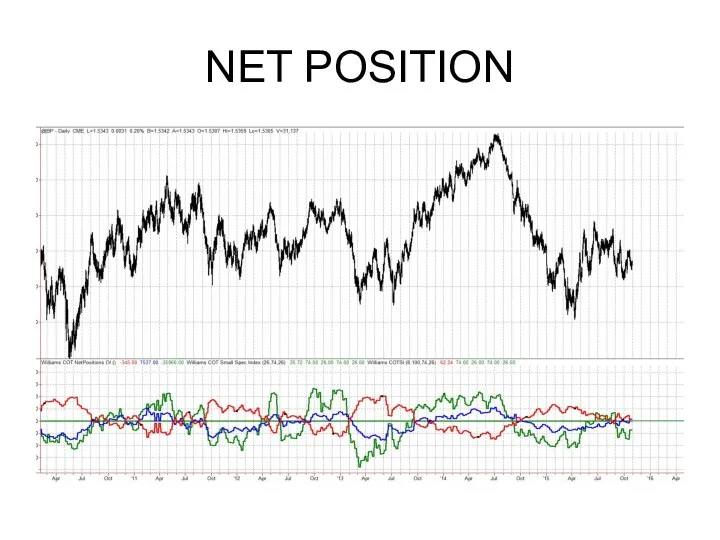

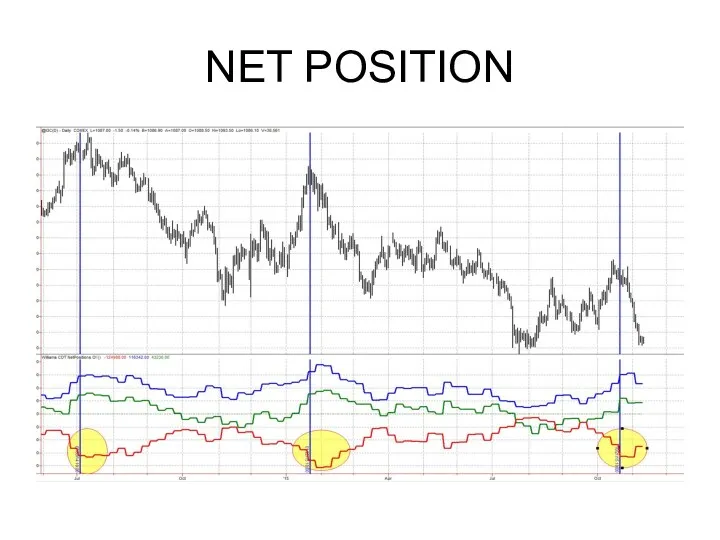

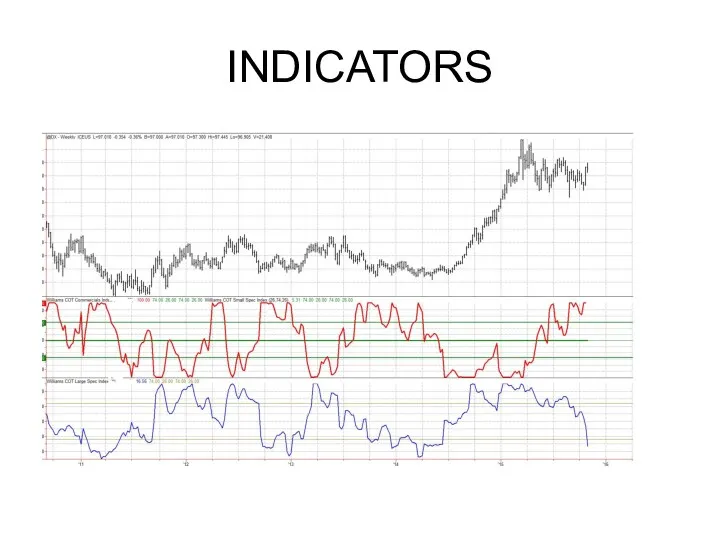

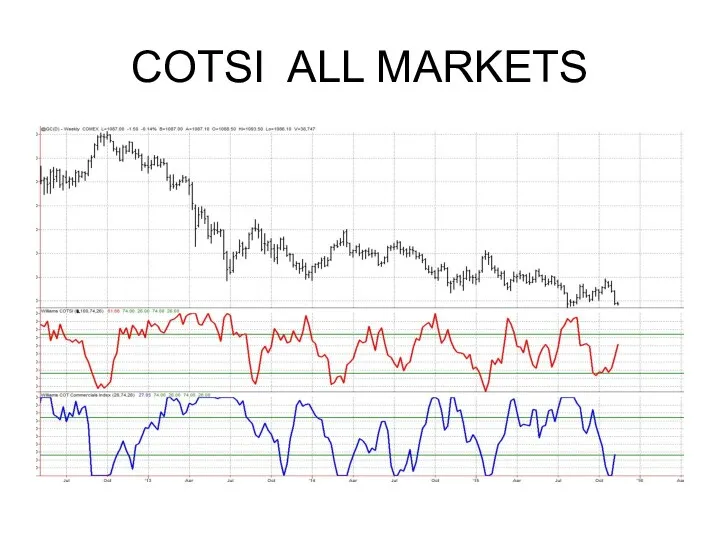

COT REPORT

COMMERCIALS ARE HEDGERS, USERS AND PRODUCERS

LARGE TRADERS ARE FUNDS

SMALL TRADERS

ARE THE PUBLIC

Слайд 129

COMMERCIALS

THEY DO NOT MAKE MONEY TRADING

THEY BUY WEAKNESS

THEY SELL STRENGTH

Слайд 130

LARGE TRADERS

SPECUALTORS

THEY BUY STRENGTH/SELL WEAKNESS

CRITICAL---THEY ADD TO POSITIONS

Слайд 131

SMALL TRADERS

THE PUBLIC

REACT TO PRICE

WITH NO MONEY MANAGEMENT

Слайд 132

Слайд 133

Слайд 134

Слайд 135

Слайд 136

Слайд 137

Слайд 138

Слайд 139

Слайд 140

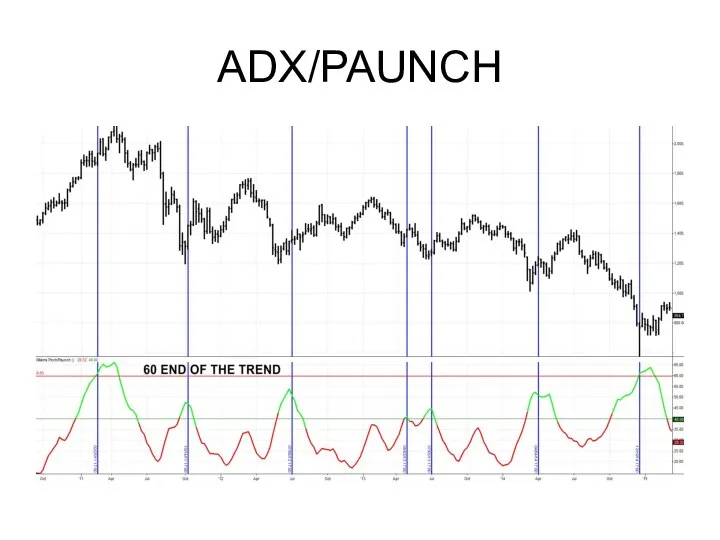

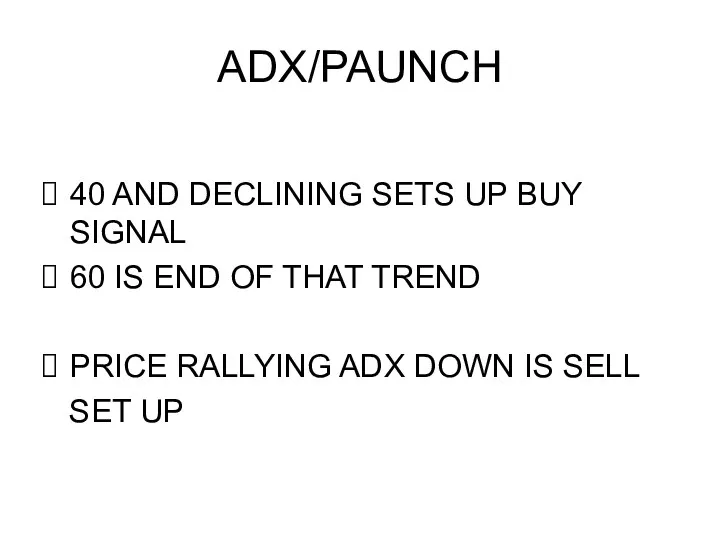

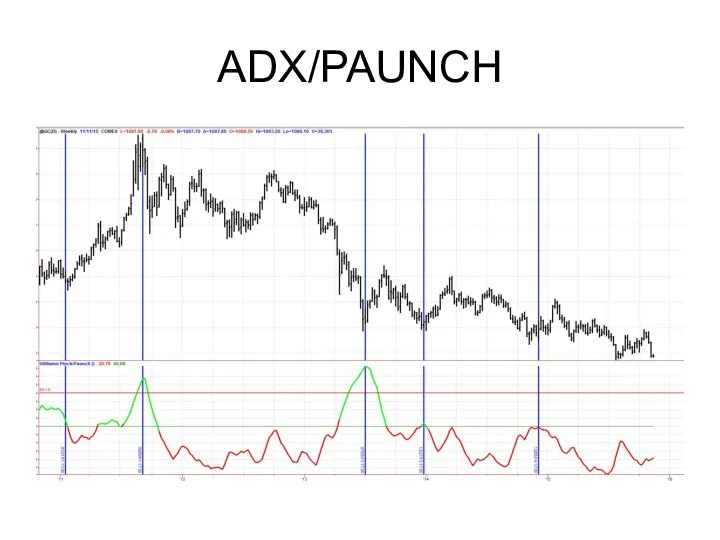

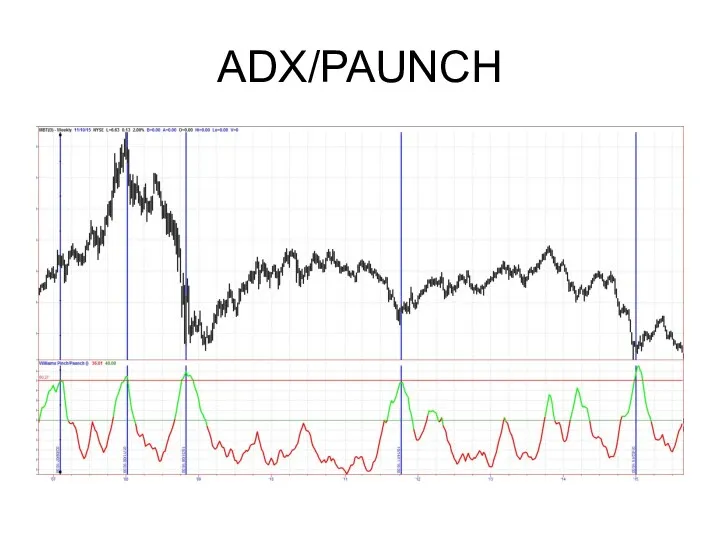

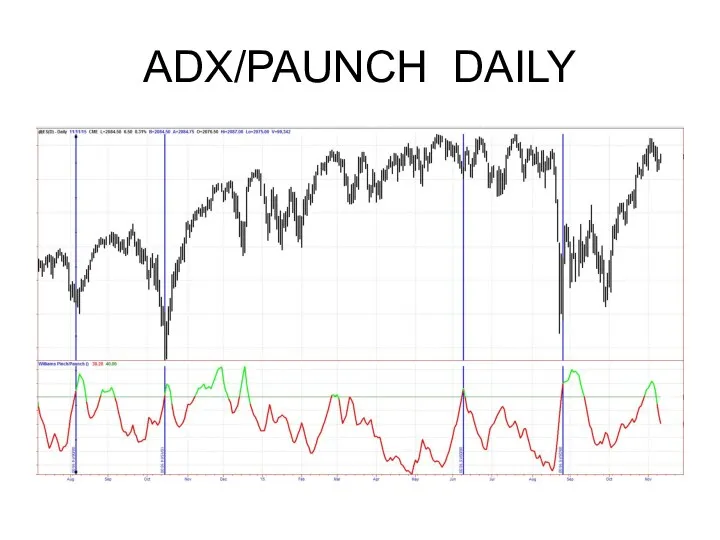

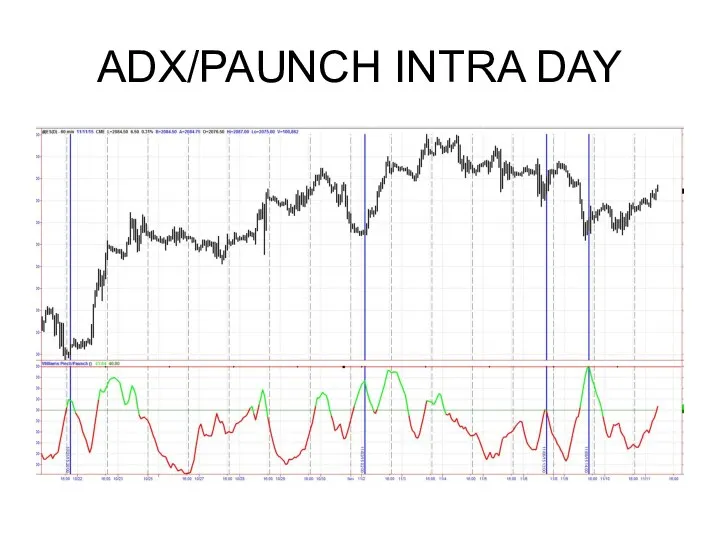

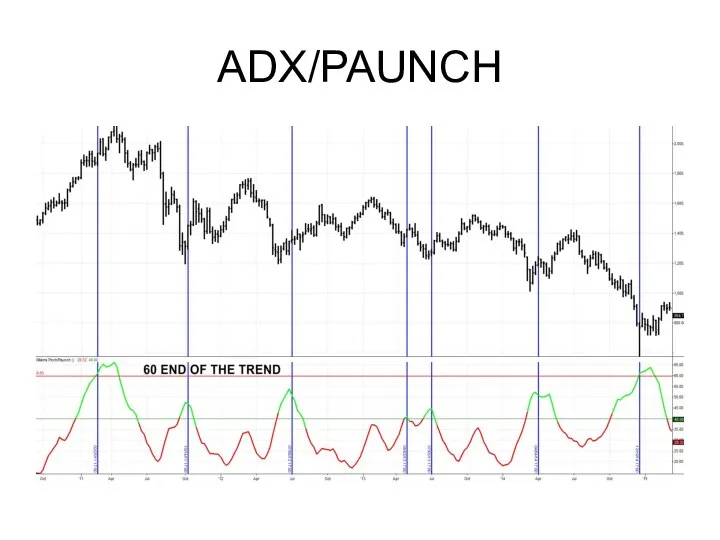

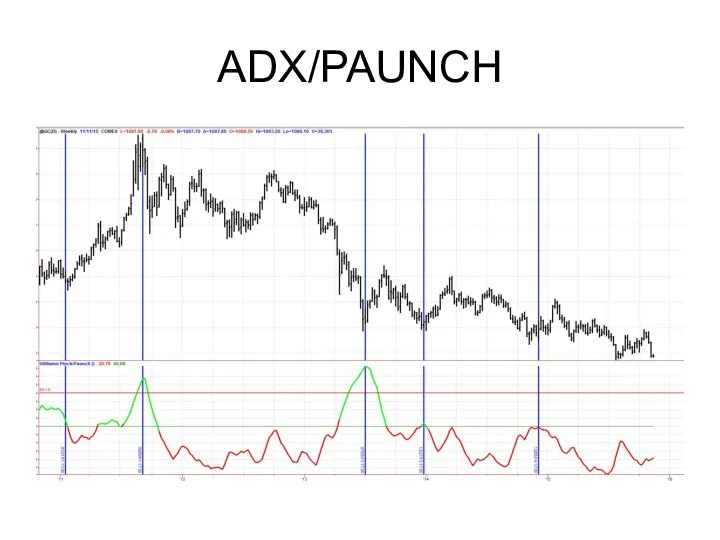

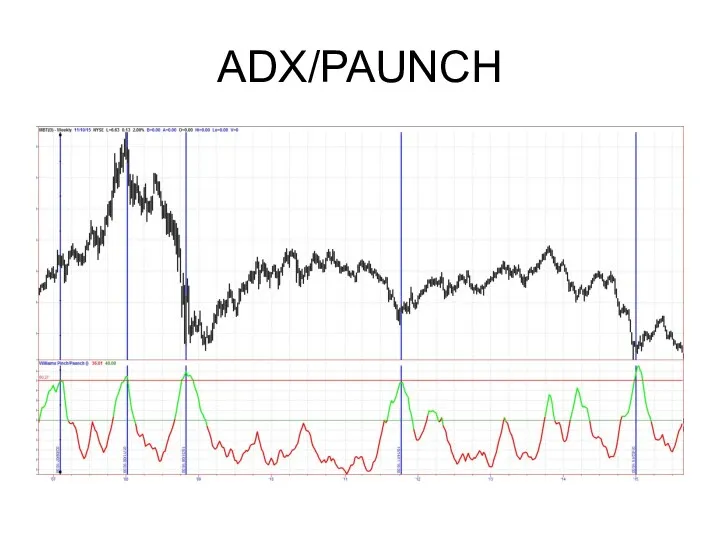

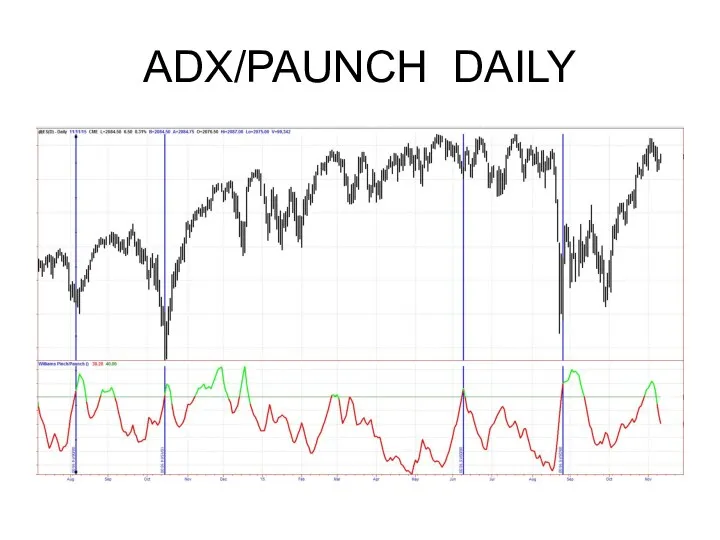

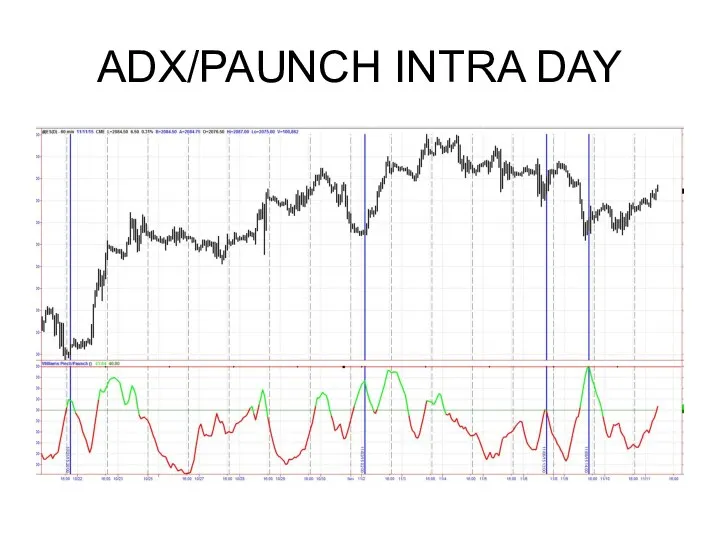

ADX/PAUNCH

40 AND DECLINING SETS UP BUY SIGNAL

60 IS END OF THAT

TREND

PRICE RALLYING ADX DOWN IS SELL

SET UP

Слайд 141

Слайд 142

Слайд 143

Слайд 144

Слайд 145

Слайд 146

Слайд 147

Слайд 148

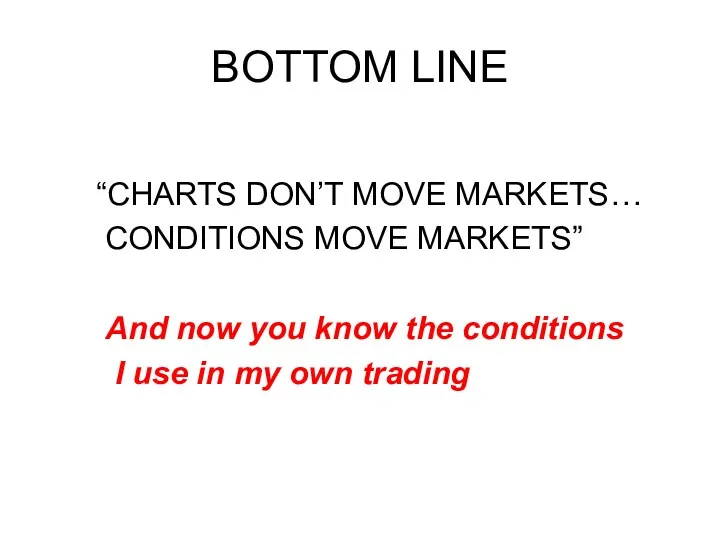

BOTTOM LINE

“CHARTS DON’T MOVE MARKETS…

CONDITIONS MOVE MARKETS”

And now

you know the conditions

I use in my own trading

Слайд 149

Слайд 150

Слайд 151

Стипендиальное обеспечение в науке и учёбе

Стипендиальное обеспечение в науке и учёбе Облік процесу виробництва продукції, виконання робіт та послуг

Облік процесу виробництва продукції, виконання робіт та послуг Понятие коммерческого банка, основные функции и операции коммерческих банков

Понятие коммерческого банка, основные функции и операции коммерческих банков Управление личными финансами. Доходы семьи

Управление личными финансами. Доходы семьи Управление личными финансами. Сбережения и инвестиции семьи

Управление личными финансами. Сбережения и инвестиции семьи Финансовая грамотность. 10 класс

Финансовая грамотность. 10 класс Финансовое состояние предприятия

Финансовое состояние предприятия Управление дебиторской и кредиторской задолженностью организации АО Компания Росинка, г. Липецк

Управление дебиторской и кредиторской задолженностью организации АО Компания Росинка, г. Липецк Казначейское сопровождение как элемент государственного финансового контроля

Казначейское сопровождение как элемент государственного финансового контроля Оценка кредитоспособности ПАО Аэрофлот

Оценка кредитоспособности ПАО Аэрофлот Анализ эффективности деятельности организации на основании данных бухгалтерской (финансовой) отчетности ООО РусснабгруппНН

Анализ эффективности деятельности организации на основании данных бухгалтерской (финансовой) отчетности ООО РусснабгруппНН Оздоровление и отдых членов профсоюза

Оздоровление и отдых членов профсоюза Недвижимость в Ивановской области по программе сельская ипотека

Недвижимость в Ивановской области по программе сельская ипотека Задачи по корпоративным финансам

Задачи по корпоративным финансам Анализ финансового состояния предприятия

Анализ финансового состояния предприятия Суть, мета і завдання управлінського обліку (тема 1)

Суть, мета і завдання управлінського обліку (тема 1) Охрана труда. Финансирование

Охрана труда. Финансирование Banking

Banking Российский сельскохозяйственный банк АО Россельхозбанк

Российский сельскохозяйственный банк АО Россельхозбанк Фонд по содействию кредитованию субъектов малого и среднего предпринимательства Республики Карелия

Фонд по содействию кредитованию субъектов малого и среднего предпринимательства Республики Карелия Ключевые направления деятельности ФНС России по созданию благоприятной налоговой среды

Ключевые направления деятельности ФНС России по созданию благоприятной налоговой среды Понятие финансового права. Предмет и метод финансового права. Место финансового права в единой системе российского права

Понятие финансового права. Предмет и метод финансового права. Место финансового права в единой системе российского права Финансовые и денежно-кредитные методы регулирования экономики

Финансовые и денежно-кредитные методы регулирования экономики Деньги. Денежная масса. Натуральный обмен

Деньги. Денежная масса. Натуральный обмен Раздел 4. Ревизия бухгалтерского учёта. Тема 4.4. Ревизия денежных средств

Раздел 4. Ревизия бухгалтерского учёта. Тема 4.4. Ревизия денежных средств Тест по бухгалтерскому учету

Тест по бухгалтерскому учету Ценовая политика

Ценовая политика Виды ценных бумаг. Их особенности и различия, права владельцев акций и облигаций

Виды ценных бумаг. Их особенности и различия, права владельцев акций и облигаций