Содержание

- 2. Learning Objectives Understand the changing nature of retirement planning. Set up a retirement plan. Contribute to

- 3. Financing Social Security When paying Social Security, you are purchasing mandatory insurance for you and your

- 4. Financing Social Security FICA taxes paid today are providing benefits for today’s retirees. The money you

- 5. Eligibility 95% of Americans are covered by Social Security. Receive Social Security credits as you pay

- 6. Retirement Benefits Retirement Benefits – size is determined by: Number of earnings years Average level of

- 7. Defined-Benefit Plans You receive a promised or “defined” payout at retirement. Usually noncontributory retirement plans, where

- 8. Defined-Benefit Plans Employer bears investment risk – you’re guaranteed the same amount regardless of how the

- 9. Cash Balance Plans Workers are credited with a percentage of their pay each year, plus a

- 10. Pay Now, Retire Later Step 1: Set Goals Figure out what you want to do when

- 11. Pay Now, Retire Later Step 2: Estimate How Much You Will Need Turn your goals into

- 12. Pay Now, Retire Later Step 3: Estimate Income at Retirement Once you know how much you

- 13. Pay Now, Retire Later Step 4: Calculate the Inflation-Adjusted Shortfall Compare the retirement income needed with

- 14. Pay Now, Retire Later Step 5: Calculate How Much You Need to Cover This Shortfall Know

- 15. Pay Now, Retire Later Step 6: Determine How Much You Must Save Annually Between Now and

- 16. Pay Now, Retire Later What Plan Is Best For You? Many options are available. Most plans

- 17. Defined-Contribution Plan Your employer alone, or in conjunction with you, contributes directly to an individual account

- 18. Defined-Contribution Plan Profit-Sharing Plans – employer contributions vary based on firm’s performance and employee’s salary. Money

- 19. Defined-Contribution Plan Employee Stock Ownership Plan – company’s contribution is made in stock. This is the

- 20. Retirement Plan for the Self-Employed and Small Business Employees Keogh Plans were introduced in 1962 to

- 21. Simplified Employee Pension Plan Used by small business owners with no or few employees. Works like

- 22. Savings Incentive Match Plan for Employees A SIMPLE plan can be established by small employers. May

- 23. Individual Retirement Arrangements (IRAs) There are 3 types of IRAs to choose from: Traditional IRA Roth

- 24. Traditional IRAs Personal savings plans, providing tax advantages for saving for retirement. Contributions may be tax

- 25. The Roth IRA Contributions are not tax deductible. Distributions are distributed on an after-tax basis. To

- 26. Traditional Versus Roth IRA: Which is Best for You? You end up with the same amount

- 27. Saving for College: The Cloverdell Education Savings Accounts (ESA) Works like a Roth IRA, except contributions

- 28. Saving for College: 529 Plans Tax-advantaged savings plan used for college and graduate school. Contribute up

- 29. Facing Retirement – The Payout Your distribution or payout decision affects: How much you receive How

- 30. An Annuity or Lifetime Payments Single Life Annuity – receive a set monthly payment for your

- 31. An Annuity or Lifetime Payments Joint and Survivor Annuity – provides payments over the lives of

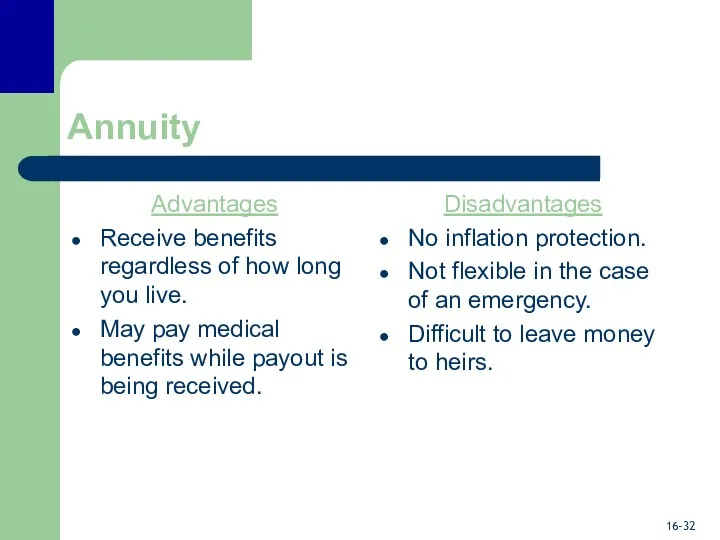

- 32. Annuity Advantages Receive benefits regardless of how long you live. May pay medical benefits while payout

- 33. A Lump-Sum Payment Receive benefits in one single payment. You must make the money last for

- 34. Tax Treatment of Distributions Annuity payouts are generally taxed as normal income. Can have the distribution

- 35. Putting a Plan Together and Monitoring It Most individuals will not have a single source of

- 37. Скачать презентацию

Семейный бюджет

Семейный бюджет Аудит

Аудит Основные группы функции Банка России

Основные группы функции Банка России Бюджетная система РФ

Бюджетная система РФ Страховые услуги

Страховые услуги Нормативно-правовая база, регламентирующая административно-территориальное устройство и повседневную деятельность ГУ

Нормативно-правовая база, регламентирующая административно-территориальное устройство и повседневную деятельность ГУ Нормативно-правовое регулирование аудиторской деятельности

Нормативно-правовое регулирование аудиторской деятельности Теоретичні основи інвестиційного проекту та інвестиційного консалтингу. (Тема 1)

Теоретичні основи інвестиційного проекту та інвестиційного консалтингу. (Тема 1) Подготовка 6-НДФЛ с учетом последних изменений

Подготовка 6-НДФЛ с учетом последних изменений Семинар для клиентов малого и микро бизнеса приуроченный презентации нового продукта ЭВОТОР – СМАРТ-КАССА

Семинар для клиентов малого и микро бизнеса приуроченный презентации нового продукта ЭВОТОР – СМАРТ-КАССА Экономический анализ эффективности использования оборотных активов организации

Экономический анализ эффективности использования оборотных активов организации What are costs?

What are costs? Система обязательного медицинского страхования в РФ

Система обязательного медицинского страхования в РФ Неделя финансовой грамотности для детей и молодежи. Неделя сбережений для взрослого населения, в рамках Проекта Минфина России

Неделя финансовой грамотности для детей и молодежи. Неделя сбережений для взрослого населения, в рамках Проекта Минфина России Обязательства компании: структура и методы управления

Обязательства компании: структура и методы управления Финансовые основы страховой деятельности

Финансовые основы страховой деятельности Задачи органов власти и местного самоуправления по реализации ППМИ в субъекте РФ

Задачи органов власти и местного самоуправления по реализации ППМИ в субъекте РФ Фінансова звітність, аналіз і прогнозування основних показників будівельного підприємства

Фінансова звітність, аналіз і прогнозування основних показників будівельного підприємства Бюро кредитных историй и их роль в деятельности банков

Бюро кредитных историй и их роль в деятельности банков Единый сельскохозяйственный налог (ЕСХН)

Единый сельскохозяйственный налог (ЕСХН) Теоретические аспекты бухгалтерского учета

Теоретические аспекты бухгалтерского учета Продукт для заемщика потребительского кредита Финансовый резерв

Продукт для заемщика потребительского кредита Финансовый резерв Получение аудиторских доказательств в конкретных случаях

Получение аудиторских доказательств в конкретных случаях Государственный бюджет зарубежных стран. Франция

Государственный бюджет зарубежных стран. Франция Программы регионального финансирования субъектов малого и среднего предпринимательства

Программы регионального финансирования субъектов малого и среднего предпринимательства Материальная помощь и стипендии, про которые никто не слышал

Материальная помощь и стипендии, про которые никто не слышал Банковские технологии анализа кредитоспособности заемщика. (Тема 8)

Банковские технологии анализа кредитоспособности заемщика. (Тема 8) История страхования. Лекция 1

История страхования. Лекция 1